Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Hosted at http://www.allbest.ru/

Specialty 080105.65 (060400) "Finance and Credit"

Course work

on the topic: "Financial stability of the insurance company"

Introduction

1. The concept and guarantees of financial stability and solvency of an insurance company

2. Analysis of the financial stability of an insurance company on the example of OSAO "RESO-Garantiya"

3. Measures to strengthen the financial stability of the insurance company

Conclusion

List of sources used

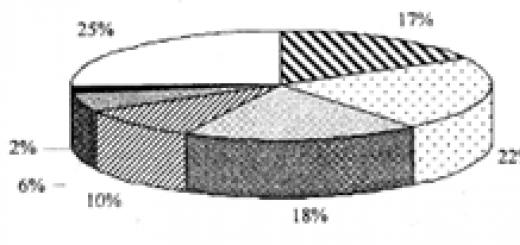

Annex A - Structure of the investment portfolio "RESO-Garantia"

Annex B - Horizontal analysis of the assets of OSAO "RESO-Garantiya"

Appendix B - Capital Adequacy Analysis

Annex D - Analysis of the effectiveness of "RESO-Garantiya"

Appendix D - Indicators characterizing business activity

Annex E - Analysis of the investment activity of "RESO-Garantiya"

Appendix G - Calculation of other performance indicators of "RESO-Garantia"

Appendix H - Normative values of indicators

insurance property condition financial stability

Introduction

The purpose of this work is to consider the concept of the financial stability of an insurance company: to reveal the essence of the phenomenon, the influencing factors and the possibilities of managing them, as well as the methodology for monitoring the solvency and financial stability of the insurer. The insurance market is an important area of the country's financial and credit system. The specifics of the insurance business and its socio-economic significance requires increased attention to the organization of the work of insurers, their stability and solvency, and the ability to meet their obligations. This problem is especially acute in times of crisis.

The first chapter discusses the factors affecting the financial stability of an insurance company, as well as guarantees of its solvency, taking into account the requirements of Russian legislation.

The second chapter provides an example of an analysis of the financial stability of an insurance company, explains the significance of indicators and their interpretation, and draws general conclusions about the state of OSAO "RESO-Garantia".

In the third chapter, the possibilities of influencing the financial performance of an insurance company are considered, measures are proposed to improve and improve their activities.

The appendices provide a methodology for calculating indicators of the financial stability of an insurance company based on reporting: balance sheet (form 1) and profit and loss statement (form 2).

When writing the work, textbooks were used as sources of theoretical knowledge, legal documents Russian Federation. Research publications and Internet resources were used to determine the methodology for assessing the financial stability of insurers.

1 . The concept and guarantees of financial stability and paymentaboutproperty of the insurance company

The insurance business is different from other types of entrepreneurial activity in many ways. First of all, this is a high responsibility that lies with the insurer: due to one manager’s mistake, due to one incorrectly calculated step, not only the activities of the insurer will be endangered, but also damage will be caused to a large circle of insurers. Meanwhile insurance activity aimed at protecting the property interests of individuals and legal entities upon the occurrence of certain events at the expense of monetary funds formed from the insurance premiums paid by the insured. Thus, the financial collapse of the insurer affects the interests of a significant number of people.

In order to prevent the insolvency and bankruptcy of insurance companies, it is necessary to identify insurers whose financial condition causes concern at an early stage.

In the insurance business, the financial mechanism is a mechanism for solving complex, usually unstructured problems with a high degree of uncertainty.

The financial stability of the insurer is the preservation of the optimal qualitative and quantitative state of assets and liabilities, allowing the insurance company to ensure the uninterrupted implementation of its activities and its development. This stability is manifested in the constant balance or excess of the insurer's income over its expenses.

In practice, it is customary to distinguish between financial stability and liquidity. Financial stability is defined as the potential (balance sheet) ability of a company to pay off its obligations and is associated with an analysis of the structure of the company's sources of funds. Liquidity (solvency) is the ability to cover assumed liabilities with assets in a specific period of time.

Factors affecting the financial stability of the insurer can be divided into two groups - external and internal. External factors do not depend on the effectiveness of the insurance company, they include economic, political factors, the legislative framework.

Among the internal factors affecting the financial condition of the insurance company, we can distinguish the following:

Policy in the field of setting tariff rates;

Sufficiency of insurance reserves in relation to the assumed obligations under insurance contracts (otherwise, losses and loss of solvency are possible);

Liquidity of own funds, placed mainly in real estate, and sufficient authorized capital;

The effectiveness of the investment policy, excluding the withdrawal from profitable turnover or the loss of part of the funds of insurance reserves and equity;

Balanced insurance portfolio that combines increased risks (up to notorious losses) with modern insurance products.

The policy in the field of establishing tariff rates is reduced to ensuring that the amount of insurance tariffs corresponds to the degree of insurance risk under the contract being concluded. The amount of income of the insurance organization largely depends on the size of insurance tariffs. If the insurer, in order to attract policyholders, regularly underestimates the amount of tariff rates, this will lead to the fact that the amount of collected insurance premiums will be lower than the amount of insurance payments that the insurer will have to make in connection with insured events, which will entail losses from insurance activities. . On the other hand, if the tariff rates are too high, the insurer may lose some of the clients who insure themselves in other insurance organizations.

Financial management in an insurance organization plays a special role in making decisions on the organization of the structure of financial turnover, while minimizing all the risks of the insurer's activities. Its task is to ensure the stability of the financial position of the insurance organization, to develop measures for the effective management of the financial flows of the insurer. This is done through the use of financial analysis as the basis for optimizing the activities of the insurance organization. Its main financial indicators are:

Gross income (receipt of income from insurance and non-insurance activities);

Expenses ( insurance payments and general expenses)

Financial results (profit or loss);

Profitability.

An insurance organization may have income from insurance activities, investments, risk management, consultations, personnel training, from property lease, profit from the sale of fixed assets, material values and other assets. Income from insurance operations is formed on the basis of insurance payments. They include:

insurance premiums;

The amount of reduction of insurance reserves;

Remuneration and bonuses under co-insurance and reinsurance contracts;

Amounts of reimbursement by reinsurers of the share of insurance payments on risks transferred to reinsurance;

The amount of interest on the deposit of premiums on risks accepted for reinsurance;

Service fees insurance agent, broker and other income received in the course of insurance activities.

Income from the investment activities of insurance companies is divided into income received from the placement of insurance reserves, and income received from the investment of compulsory insurance reserves.

The insurer's expenses are formed in the process of distribution of the insurance fund. The composition and structure of expenditures are determined by two interrelated economic process: repayment of obligations to policyholders and financing the activities of an insurance organization. In connection with these insurance business The following classification of expenses has been adopted:

Expenses for the payment of insurance compensation;

Contributions to reserves;

Expenses for doing business: organizational, acquisition, collection, liquidation, management.

Organizational costs are associated with the establishment of an insurance company. They belong to the assets of the insurer, as they are investments.

Acquisition costs are related to attracting new insurers and concluding new insurance contracts through insurance agents.

Collection expenses - expenses associated with servicing the cash flow of receipts of insurance payments. These include the costs of preparing receipt forms for receiving insurance payments and accounting registers.

Liquidation expenses are made after the occurrence insured event and related to the elimination of damage from it.

Management expenses include administrative and managerial staff salaries, administrative and maintenance expenses, and expenses for the development of insurance. In financial management, it is believed that in the absence of an “infusion” of funds, a corporation may go bankrupt if the profitability of its operations is below the profitability threshold. I.e Insurance Company can afford to reduce competitive insurance premium to the extent (to cross the threshold of profitability in insurance operations) as far as real profits in other activities allow it to do so.

According to Art. 25 of the Law of the Russian Federation of November 27, 1992 No. 4015-1 (as amended on November 29, 2007) “On the Organization of the Insurance Business in the Russian Federation”, the guarantees for ensuring the financial stability of the insurer are:

Economically justified insurance rates;

Insurance reserves sufficient to fulfill obligations under insurance, co-insurance, reinsurance, mutual insurance;

Own funds;

Reinsurance.

Insurance reserves are a set Money special-purpose, formed at the expense of insurance premiums received by the insurer and used by him to ensure the insurance obligations assumed. Insurance reserves are formed by the insurer for each type of insurance and in the currency in which insurance is carried out. The insurance organization calculates the amount of insurance reserves when determining financial results from carrying out insurance activities as of each reporting date. The insurer forms the following reserves:

1 insurance reserves for types of insurance other than life insurance, which include:

Unearned premium reserve (URP);

Reserve for reported but unsettled losses (RZU);

Reserve for occurred but unreported losses (IBNR);

Stabilization reserve (SR);

Reserve for compensation of expenses for the implementation of insurance payments and direct compensation for losses under compulsory insurance civil liability vehicle owners in subsequent periods;

Other insurance reserves.

2 life insurance reserve.

The unearned premium reserve represents the basic insurance premium received under insurance contracts in force in the reporting period and relating to the period of validity of the insurance contract beyond the reporting period. To calculate RNP, types of insurance activities are divided into three accounting groups, each has its own calculation option.

The reserve for reported but unsettled losses is formed by the insurer to ensure the fulfillment of its obligations under insurance contracts that arose in connection with insured events that occurred before the reporting date and the fact of the occurrence of which was declared to the insurance company before the end of the reporting period, but insurance payments for which reporting date were not made.

The reserve for occurred but undeclared losses is intended to ensure that the insurer fulfills its obligations under insurance contracts that arose in connection with insured events that occurred during the reporting period, the occurrence of which was not declared to the insurance company in accordance with the procedure established by law or the insurance contract as of the reporting date.

The stabilization reserve is an assessment of the insurer's obligations related to the implementation of future insurance payments in the event of a negative financial result from insurance operations as a result of factors beyond the control of the insurer, or in the event that the incurred loss ratio exceeds its average value.

The completed loss ratio is calculated as the ratio of the amount of insurance payments made in the reporting period for insured events that occurred in this period, the reserve for reported but unsettled losses and the reserve for incurred but undeclared losses calculated for losses that occurred in this reporting period, to the amount of insurance earned awards for the same period.

The stabilization reserve for compulsory insurance of civil liability of vehicle owners is formed to compensate the insurer's expenses for making insurance payments and direct compensation for losses in subsequent periods when making compulsory insurance civil liability of vehicle owners. It is an assessment of the insurer's obligations related to the implementation of future insurance payments in the event of a negative financial result from the compulsory civil liability insurance of vehicle owners as a result of factors beyond the control of the insurer.

The optimality of insurance reserves is understood as the adequacy of their structure and size to the obligations assumed by the insurer under insurance contracts. Evaluate insurance reserves in terms of their sufficiency should be based on the nature of the operations carried out by the insurer. At the same time, the establishment of any standards is quite problematic. Although, if a number of insurance organizations carry out similar insurance operations and the volumes of these operations are comparable, then the size of the insurance reserves formed by them should be commensurate, which means that we can talk about the possibility of establishing uniform criteria. With regard to companies dealing with insurance of rare risks, it is unlikely that any indicator can be introduced here. The insurer's own funds include: authorized capital, additional capital, reserve capital, retained earnings. They are formed at the expense of contributions of the founders and at the expense of the profit received as a result of the activities of the insurer. According to the legislation of the Russian Federation, the minimum size of the authorized capital of an insurer is determined on the basis of the basic size of its authorized capital, equal to 30 million rubles, and coefficients from 1 to 4, depending on the specialization of the insurance company.

In order to ensure their solvency, insurers are obliged to comply with the normative ratio between assets and insurance liabilities assumed by them (normative solvency margin) established by the insurance supervisory authority. Insurers are required to calculate the solvency margin on a quarterly basis.

Insurers that have assumed obligations in volumes exceeding the ability to fulfill them at the expense of their own funds and insurance reserves can insure the risk of fulfilling the corresponding obligations with reinsurers.

The presence of sufficient equity capital is an additional measure designed to ensure the ability of the insurer to meet its obligations. The formation of only insurance reserves does not fully ensure the financial stability of the insurer for the following reasons:

Technical reserves may turn out to be insufficient both due to subjective reasons (insufficient qualification of personnel, weak information base, costs in organizing accounting, deliberate underestimation of them in order to maximize profits), and due to objective circumstances (general deterioration of the situation on the insurance market, manifestation of negative view of unprofitability of factors);

Possible inadequacy of tariff rates to assumed obligations;

The real value of insurance reserves may turn out to be much lower than the value shown in the balance sheet due to a decrease in the value of assets covering insurance reserves;

The insurer may need to expand the range of its operations. The obligations arising from this at the first time cannot be covered by insurance reserves, therefore, their function at this time is performed by free reserves.

Investment activity is another source of income for insurance organizations, which in some cases even compensates for the losses that insurers may have from directly carrying out insurance activities. The risks associated with these operations force insurers to pursue a rather cautious investment policy. The main requirements that it must meet are reliability and profitability. The principles that should guide insurers in the implementation of investment activities are diversification, repayment, profitability and liquidity.

The principle of repayment implies the most reliable placement of assets, ensuring their return in full. The principle of liquidity implies that the general structure of investments should be such that at any time there are liquid funds or capital investments that are easily converted into them. According to the principle of diversification, the predominance of any type of investment over others should not be allowed. The principle of return on investment states: assets must be placed while ensuring these principles, taking into account the situation on the investment market, and at the same time bring a constant and sufficiently high income.

Of fundamental importance in the implementation of investment activities is the assessment of the risk of loss of funds due to the insolvency of organizations in which the funds of insurers are invested. The types of assets in which insurance reserves can be placed are established by Order of the RF Ministry of Finance No. 100-n “On Approval of the Rules for Placement of Insurance Reserve Funds by Insurers”. As a rule, the foundation of the investment portfolio of insurers is made up of such long-term and liquid investments, such as real estate, which, on the one hand, have a high level of reliability and can bring significant income, but, on the other hand, their sale can be associated with significant costs. . At the same time, such medium- and short-term investments with high liquidity as shares, government securities, funds in bank accounts, must meet the urgent and sudden needs of insurance companies in cash.

The financial condition of an economic entity is a characteristic of its financial competitiveness, that is, solvency, availability, placement and use of financial resources and capital, fulfillment of obligations to the state and other economic entities. The financial condition is the result of the financial policy of the insurer and is determined by the totality of financial and economic factors of the insurance company.

A sufficient amount of own funds or free reserves of the insurer guarantees its solvency under two circumstances - the presence of reasonable insurance reserves and the correct investment policy. At the same time, it is necessary that the insurer's portfolio consists of a very large number of approximately equal risks, or a small number of risks commensurate with the size of the insurer's own funds, which can be achieved through the reinsurance system. Failure to comply with this condition may lead to the fact that in the event of even one insured event, the insurer will become bankrupt.

Since the financial stability of insurers depends on a large number of different factors, the analysis of their financial condition can only be carried out on the basis of a study of a group of indicators that allow one to get an idea of the various aspects of the activities of an insurance organization.

2 . Analysis of the financial stability of an insurance company on theandmeasure OSAO "RESO-Garantiya"

Open Joint Stock Insurance Company "RESO-Garantiya" was established in 1991, has a license for 102 types of insurance services and reinsurance activities. The branch network includes more than 900 branches and sales offices in all regions of Russia. Priority directions activities are motor insurance (CASCO and OSAGO), voluntary health insurance, property insurance of individuals and legal entities, mortgage insurance, travel insurance, accident insurance, etc. Life insurance is offered by the subsidiary company Life Insurance Society RESO-Garantiya.

The analysis of the financial activity of the company is carried out on the basis of financial statements for 2006-2009 (balance sheet and income statement). Consideration of the financial performance of the organization in this period allows us to determine its resistance to the effects of the external environment, that is, in a steadily developing economy and at the time of the crisis.

Figure 1 - Dynamics of financial results of "RESO-Garantia"

According to the reporting as of December 31 of the years under review, the company ended the financial year with a net profit (Figure 1). However, comparing the relative change in this indicator over the years, in 2008 there is a significant decrease (by 68%), which is logical to link with the crisis Russian economy peaked in mid-2008. However, the measures taken and the stabilization of the external environment returned the net profit indicator to the pre-crisis level, that is, as of December 31, 2007,

Table 1 shows that there is no stable profit in various areas of accounting. Thus, the results from life insurance operations were maximum in 2006, but already in the following year there was a loss. Low rates for this type of insurance coincide with the general trend in Russia, since it is not in great demand among the population. The decrease in the volume of insurance premiums amounted to more than 40% in 2007, more than 25% in 2008 (compared to the previous years of 2006 and 2007, respectively). In 2009, this figure increased by 3% compared to the previous period. However, the volume of insurance payments in 2009 increased by 113%. The continuation of this trend in the future may lead to negative consequences and affect the solvency and financial stability of the company.

Table 1 - Results of activities of OSAO "RESO-Garantia", ths. rub.

As of December 31, 2009, the results from operations of other types of insurance also turned out to be unsatisfactory, the loss amounted to more than 500 million rubles. This is explained by the reduction of insurance premiums by 2% compared to the previous year, while payments under insurance contracts increased by 19%, expenses for insurance operations - by 5.5%.

Thus, the company's financial results in 2009 turned out to be positive to a greater extent due to the results on other expenses and income, in particular, due to income received from investment activities and other operating and non-operating income less expenses. Obviously, the measures taken to reduce the risks of investments in a situation of instability in the financial market allowed the company to save money. However, the increase in investment income by 95% in 2009 compared to the previous year is associated not only with the successful investments of the company's specialists, but also with the recovery of prices and quotations in the financial market in general, which is typical for the period of overcoming the crisis.

An effective investment policy that meets the external conditions and interests of the company is evidenced by a structural analysis of the investment portfolio of RESO-Garantiya OSJSC (Appendix A). The largest share is occupied by investments in debt securities of other organizations, deposits, and also before the onset of the crisis - in shares of other companies. At the same time, the portfolio structure changes in order to ensure minimal risk while maintaining high returns, depending on the state of the financial market. Of particular note are investments in buildings, the fluctuations of which are insignificant over four years, their share is 3-4% in the total.

The authorized capital of OSAO "RESO-Garantiya" exceeds the minimum established by the legislation of the Russian Federation and amounts to 3.1 billion rubles. The share of retained earnings increased from 4% in 2006 to 52% in 2009. (table 2). Its growth in 2007 by more than 1500% (Table 3) testifies to the effective activity of the company in this period and to the increase in concluded insurance contracts, with the exception of life insurance.

The reserve capital is formed in accordance with the norms established by the legislation of Russia, in 2009 it amounted to 9% of the total amount of the Company's own funds.

Table 2 - Structure of own funds of OSAO "RESO-Garantiya"

The share of additional capital in 2008 - 9%, in 2009 - 7%. The data in Table 3 show that in 2008 the growth of this capital item amounted to more than 250%, in 2009 there was a slight decrease in the indicator (less than 1%). However, according to the balance sheet data, it is impossible to judge what caused the decrease in the volume of additional capital, we can only assume that this is due to the revaluation of non-current assets.

Table 3 - Increase in own funds of RESO-Garantia

Structural analysis of the balance sheet shows that most of the organization's assets are investments, their share fluctuates around 50-60% of the total assets (table 4). Cash on the accounts of the organization at the end of the financial year during the study period does not exceed 10%, which is acceptable for the stability of the company.

The horizontal analysis (study of each indicator for the analyzed period) revealed a decrease in the growth of investments made by the company for the entire period (Appendix B). However, the largest decrease - by 30 p.p. in December 2009 compared to December of the previous one, it was offset by additional income on invested funds (an increase of 95%). To increase the stability of the company, the share of reinsurers in insurance reserves was increased, as evidenced by the growth of this indicator by more than 250% in 2009. Additional measures taken by the company to counteract external factors can be judged by the same increase in cash in bank accounts. For investing funds, preference was given to deposits as the most risk-free. Thus, the company maintained its financial stability and solvency by increasing the share of the most liquid assets and concluding additional reinsurance agreements.

Table 4 - Structure of assets of OSAO "RESO-Garantia", in percent

|

Specific gravity |

|||||

|

Investments |

|||||

|

Accounts receivable from insurance, co-insurance operations |

|||||

|

Cash |

|||||

|

fixed assets |

|||||

|

Other receivables for which payments are expected more than 12 months after the reporting date |

|||||

|

Share of reinsurers in insurance reserves |

|||||

|

Other receivables for which payments are expected within 12 months after the reporting date |

|||||

|

Receivables from reinsurance operations |

|||||

|

Construction in progress |

|||||

|

Other assets |

|||||

|

Deferred tax assets |

The share of fixed assets in the total assets for 4 years remained unchanged (7%), except for 2007. OSAO "RESO-Garantiya" annually increases the volume of fixed assets, which is associated with the opening of new branches in the regions of Russia (Appendix B).

The amount of insurance reserves formed by the company corresponds to its obligations (table 5). At the same time, in the crisis year of 2008, other insurance reserves, including stabilization reserves, were increased by 150%.

Table 5 - Insurance reserves of OSAO "RESO-Garantia", thousand rubles.

|

Name of indicator |

|||||

|

Life insurance reserves |

|||||

|

Unearned premium reserve |

|||||

|

Loss reserves |

|||||

|

Other insurance reserves |

|||||

|

Insurance reserves, total |

Table 6 shows that the dynamics of insurance premiums collected by OSAO "RESO-Garantia" in 2009 is somewhat different from the average indicators for the insurance market. So, according to Federal Service on insurance supervision for 62% of insurers, the dynamics of fees for the first three quarters turned out to be negative. At the same time, in 80 companies, the volume of collected premiums decreased by two or more times, and in 10% of market participants, their decline ranged from 50% to 75%. 39% of insurers reduced their sales by 25% or more.

Table 6 - Dynamics of collected insurance premiums "RESO-Garantiya"

|

Name of indicator |

Change, % |

Change, % |

Change, % |

|||||

|

I. Life insurance: |

||||||||

|

II. Insurance other than life insurance: |

||||||||

|

insurance premiums - net reinsurance |

||||||||

|

Volume of insurance premiums |

Thus, OSAO "RESO-Garantia" is quite successful, holds a stable position in the Russian insurance market, and is quite resistant to negative changes in the external environment.

However, vertical and horizontal analysis of the summary financial reporting insurance company does not allow to fully judge its stability and financial stability. The financial analysis also includes the development of a system of analytical indicators, that is, a set of interrelated parameters, and consideration of their trends. Their analysis is focused on obtaining a detailed and comprehensive description of the financial and economic activities of the enterprise.

All indicators can be divided into two main groups depending on the direction of analysis: coefficients measuring equity capital adequacy, and performance indicators of the insurance company. Depending on the parameters included in the calculation, they characterize the solvency, the sufficiency of insurance reserves, the liquidity of assets and the dependence of the insurer on reinsurance. When evaluating the values of indicators, one should consider not only their change over time, but also focus on the minimum established standard. The recommendations developed by CJSC Bank VTB 24, which comply with the recommendations of the Federal Antimonopoly Service of the Russian Federation, are adopted as standards in this work.

The level of capital adequacy of an insurance company is assessed on the basis of three indicators: the ratio of the insurance company's own funds to the amount of insurance reserves, the level of debt burden of the insurance company, the share of equity in liabilities.

The first indicator is also called the reliability factor (table B.1). Insurance reserves for its calculation are taken into account without the share of reinsurers in them (net insurance reserves). The reliability ratio reflects the level of stability of the insurer in terms of the ability to cover the company's obligations under insurance contracts at its own expense. It must be at least 0.3. As can be seen from the calculation, in OSAO "RESO-Garantia" this indicator increases every year, if in 2006 it was 0.28, then in 2009 - 0.41, which indicates the financial strengthening of the company.

Since insurance activities are not characterized by a significant amount of borrowed funds, the level of debt burden on the insurance company should not exceed 25 percent. OSJSC "RESO-Garantia" seeks to reduce the amount of borrowed funds: in 2006, the debt burden was 12.9%, in 2009 - 6.12%, every year it decreases by 1-2% (Table B.2). This suggests that the insurance company carries out its activities and covers its obligations at the expense of its own funds and formed reserves.

The overall level of financial stability of the insurance company determines the share of equity in liabilities. The minimum level, according to the assessment of VTB 24 Bank, is 19 percent. According to the calculation (Table B.3), the financial stability of OSAO RESO-Garantia is increasing, despite the crisis in the country's economy: the growth rate is 2-3% annually, in 2009, 26 kopecks accounted for one ruble of the company's liabilities and capital own funds.

An analysis of the effectiveness of an insurance company involves an assessment of the main sources of growth in the company's income and includes several indicators.

The loss ratio takes into account the amount of insurance payments per 1 ruble of insurance premiums. It should be in the range of 20 to 75%. At the same time, the calculation for OSAO "RESO-Garantiya" was made both by the total volume of insurance payments and contributions, and by types of insurance (Table D.1). The company has a negative trend in increasing this indicator. If in 2007 it was 37% (a decrease of 16% compared to December 2006), then in 2008 it rose to 52%, in 2009 - to 63%. Such a trend requires an adjustment of the policy of the insurance company, otherwise it is likely to approach the critical value of 75% in the next 1-2 years. At the same time, for life insurance, the loss ratio increases throughout the period under review, which requires the adoption of special measures to increase insurance premiums of this type. The indicator of the level of expenses (table B.2) reflects the share of expenses for doing business in the total amount of income, it should not be more than 50%. However, it was only in 2006 and 2007 that RESO-Garantiya managed to enter this limit (49% and 41%, respectively). In 2008, the indicator increased by 12%, in 2009 - by another 2% (that is, it amounted to 55%). Perhaps this trend is related to the instability of the economy, which led to the need for additional expenditures to maintain other indicators at the required level. However, the dynamics for 2 years indicates the inefficiency of the company.

One of the main performance indicators for any enterprise is the return on capital (Table D.1). For insurance companies, Bank VTB 24 determined the value of this coefficient to be at least 0.03. OSAO "RESO-Garantiya" complies with this requirement, despite the decline in profitability in 2008 and 2009. So, in 2007, 1 ruble of own funds accounted for 52 kopecks of profit, in 2009 - 17 kopecks. Since, according to the previously calculated indicators, the volume of the company's own funds is optimal, the volume of profit received is insufficient, and this trend is observed over the next two years.

The profitability of the insurance and financial and economic activities of the company is determined without taking into account life insurance and should be more than 0.03. However, according to the calculations made by OSAO "RESO-Garantiya" in 2006, the profitability was 0.003, in 2007 the indicator has a maximum value for 4 observed years - 0.01, but by 2009 it decreased to 0.04, approaching the minimum value (table D 2).

Thus, RESO-Garantia's business activity indicators have a negative trend, which requires urgent measures to change the situation and return to the pre-crisis level of 2007.

The effectiveness of investment activity can be assessed by means of the investment ratio and the level of coverage of net insurance reserves by investment assets (Appendix E). The investment ratio shows how successful the investment investments companies. Taking into account the change in profits and income from investments, we can conclude that 2009 was the most successful year - the value of the indicator was 0.49. That is, income from investment activities accounted for half of the final financial result. The level of coverage of insurance reserves by investment assets determines the degree of placement of funds at the expense of which liabilities are covered in investment assets and in the idea of cash on the bank accounts of the insurance company and on hand. This indicator should be at least 85%. OSAO "RESO-Garantiya" meets this requirement - in 2008 and 2009 the level of coverage was 95 and 106%, respectively. Consequently, the volume of the company's liquid assets sufficiently covers the assumed liabilities.

The share of reinsurers in insurance reserves determines the degree of dependence of the insurance company on reinsurers as of the reporting date. According to the requirements of VTB 24 Bank, this indicator should be in the range from 0.1 to 0.45. However, the share of reinsurers in OSAO "RESO-Garantiya" is much lower, in 2009 it amounted to 0.04 (Table G.1). On the one hand, this is explained by the sufficiency of own funds for the formation of reserves, on the other hand, an increase in the share of reinsurers will reduce the company's risks. It seems expedient for the Company to revise its policy in the field of reinsurance.

Sufficiency of the inflow of funds in the form of insurance premium receipts to cover running costs for insurance payments, current expenses for doing business, management, operating and non-operating expenses characterizes the indicator of current solvency, which should be at least 85 percent. The calculations in Table G.2 show that the solvency of OSAO RESO-Garantiya in 2009 decreased below the norm and amounted to 84%. Moreover, a significant decrease in the company's solvency was also noted in 2008 (by 46% compared to the same period in 2007).

The main sign of liquidity is the formal excess of the insurer's current assets over short-term liabilities. The current liquidity ratio reflects the adequacy of the working capital of the insurance company, which can be used in the event of claims being made against it for all existing liabilities, including in the event of insured events. It must be at least 0.5. In 2008 and 2009 the indicator of current liquidity of OSAO "RESO-Garantia" corresponds to the specified standard - 0.51 and 0.69, respectively (Table G.3). That is, the company has taken additional measures to increase the coefficient by increasing the volume of investment in deposits.

In 2007, the company was assigned an individual reliability rating by the "National Rating Agency" "ААА" - the maximum level of reliability". In November 2008, RESO-Garantia entered the top 40 of the "The Best Russian Brands 2008" list.

Thus, the insurance company OSAO "RESO-Garantiya" is one of the largest in the Russian insurance market and is distinguished by a high level of financial stability. It has one of the largest among Russian insurers authorized capital- 3.1 billion rubles, which makes it resistant to negative external influences. Equity adequacy ratios indicate that the company's equity capital corresponds to the volume of assumed liabilities and sufficiently covers the formed volume of insurance reserves, while the volume of borrowed funds is low.

However, loss ratios show that the insurance company's expenses for doing business, as well as the volume of insurance payments, increase disproportionately to the increase in insurance premiums. As a result, the company's loss ratio has been increasing in the last two years. Profitability indicators in this period also have a negative trend. Thus, the indicator of profitability of insurance and financial and economic activities indicates that the profit before tax of the company is declining in relation to its income. That is, the company's expenses increased in 2008 and 2009 disproportionately to the change in income received. Accordingly, the current solvency of the company also decreased.

However, the successful investment activity of the company allowed it to complete the financial year 2009 with a positive result and generally maintain financial stability at the achieved level in the conditions of stable economic development.

3 . Measures to strengthen financial stability fearabouthowling organization

As practice has shown, the financial stability of an insurance organization becomes a matter of its survival, since in today's unstable market conditions, bankruptcy can act as a likely result of the economic and financial activities of the insurer. Under these conditions, the role and importance of the analysis of the financial condition of insurance organizations and, above all, that part of it, which is based on balance sheet and report data, significantly increases. Such an analysis is of great interest to policyholders, to commercial partners of an insurance organization, to banks whose clients are insurance organizations, as well as to self-assessment of insurance organizations themselves and analysis of their subsidiaries and branches.

The boundaries of the financial stability of a market entity are critical points, at which quantitative changes in financial resources give rise to a qualitative leap, which changes, in particular, not only the quality of financial resources, but also financial stability.

The lower limit of financial stability is the one beyond which the financial condition loses the quality required by the market environment, which manifests itself in the loss of signs of financial stability (solvency and ability to develop), leading to a change in the status of an economic entity. For example, with quantitative changes that lead to a drop in the volume of financial resources below the critical one, the enterprise loses not only solvency and the ability to self-reproduce, but also financial independence. This, in turn, may also mean the loss of economic and legal independence.

Quantitative changes in the financial condition with a "plus" sign can also eventually lead to a change in quality; for example, a small entrepreneur becomes a large one with a corresponding change in the economic and financial mechanism, including taxation, legal status, etc. However, in the case when quantitative changes prepared the transition to another status, but such a transition does not occur, a situation may be observed when the discrepancy between quality and quantity (the amount of financial opportunities for the quality of their implementation) leads to a loss of incentive for development.

The transition from one qualitative state to another occurs in the form of a jump or overcoming a threshold, hence the stability assessment indicators should basically have a "threshold" character.

The insurance risk underlying insurance operations objectively causes an increase in the requirements for the quality of the financial resources of an insurance company. These requirements allow, along with solvency and the ability to develop, to single out a specific sign of financial stability, inherent only to an insurance company: the correspondence of the quantity and quality of resources to the size and structure of the accepted insurance risk, which primarily means the possibility of fulfilling the obligations of the insurer to policyholders.

The state of stability (instability) of an insurance company is formed under the influence of factors of different nature (economic, political, geographical, etc.) and the degree of influence. To study the influence of factors on the stability of an insurance organization, they must first be classified.

In foreign insurance management, the classification of factors is actively used according to the possibility of managing them. From these positions, the factors of sustainability can be manageable and unmanageable. At the same time, it is customary to single out the so-called "core" of controllable factors, other controllable factors and market (partially controllable and uncontrollable) factors.

The "core" includes: an insurance product, a system for organizing sales and generating demand, a flexible system of tariffs and the insurer's own infrastructure. Other manageable factors include the material, financial and labor resources of the insurance company. Together, all these factors are interconnected, and changes in one of them affect all others. Partially controlled market factors include market demand, competition, infrastructure of the insurance company, know-how in insurance services. Uncontrollable market factors include the state structure and political system, the social and ethical environment, the conjuncture of the world insurance market.

Such a classification meets the real practical needs of insurance managers who are developing a strategy for the company's behavior in the market, including in order to increase financial stability. The goals and key results set for the company can be divided into those that relate to the financial side of the activities of the insurance company, and those that relate to the indicators of the strategic activities of the insurer. Achieving acceptable financial performance is the basis and source of maintaining and improving the company's position in the market in the long term. Strategic goals should be focused on competition and on creating a strong competitive position in the chosen field of activity. Strategic and financial goals are closely intertwined, but we will try to distinguish between some of them.

Strategic goals: increasing market share, occupying a dominant position, improving the quality of insurance services offered to the insured; cost reduction compared to other competitors; expanding the range of offered insurance services; strengthening the company's reputation among customers; opening of new sales channels.

Financial goals: increasing the growth rate of insurance premiums; increase in profitability; increasing the profitability of certain types of insurance; increase in profitability from the placement of insurance reserves. Although strategic and financial goals are closely intertwined, in some cases managers may find themselves in a difficult position when it comes to choosing between the possibility of improving short-term financial performance and actions to strengthen the position of the insurance company in the long term. The choice in this case will depend on each specific situation, but it must be remembered that if the company has achieved good financial results and is not in danger of a crisis if they decline, the importance of solving the tasks of strengthening the competitive position of the insurer in the long term exceeds the need to improve current financial performance.

Clearly formulated long-term goals allow us to solve two important tasks:

1) planning key indicators for several years ahead, which allows you to determine what measures need to be taken now to ensure the achievement of these indicators;

2) managers have the opportunity to evaluate their current activities in terms of long-term prospects.

Modern foreign management actively uses the research method of "testing the strength of a company by a crisis." The technique is based on the assertion that during a crisis, the impact of factors on financial stability is more pronounced and more pronounced. It is believed that economic crises play the role of a kind of exams that any enterprise must pass. The difficulties experienced by the enterprise during crises are a model of the problems that confront it in a difficult environment. In a crisis situation, the role of one factor or another in ensuring the "survivability" and stability of the company is most clearly visible. The methodology of "crisis as an exam" is used by "Standard and Poor" when determining the rating of an insurance company. To do this, we analyze the crisis scenario (the ability of an insurance company to cope with a crisis), as well as six key concepts: management, capital, insurance, reinsurance, insurance policy, income.

The assessment of the financial stability of the insurer is hampered by the lack of a sufficiently developed and substantiated methodology for its calculation. There is no consensus about the weight (significance) of a particular indicator, as well as standard values that would serve as a guide. Difficulties in developing a sufficient methodological base are associated with the heterogeneity of the insurance market; standard values of indicators should be developed for certain groups of insurers that differ in common characteristics.

Western economists believe that financial and operational indicators are indicators of the most painful places in the activities of insurance organizations that need a more detailed analysis. This analysis, in turn, may not confirm the preliminary negative assessment due to the calculation of one or another coefficient.

So, in a number of cases, one or another value of the coefficient does not correspond to the generally accepted standard norm due to the specificity of specific conditions and business practices of a particular insurance company; comparison with average coefficients is not always justified due to, for example, the specialization of the activities of many insurance companies; the level actually achieved in previous years could not be optimal for the needs of the insurance company that existed in those years, or it could be optimal for previous years, but not at all meet the requirements of the current period.

Similar Documents

Theoretical foundations of the analysis of the financial condition of the organization, guarantees of solvency and conditions for ensuring the financial stability of the insurer. The specifics of assessing the financial condition of an insurance company on the example of OSAO "RESO-Garantiya".

thesis, added 03/08/2013

The essence and concept of assessing the financial condition. The specifics of assessing the state of the insurance company. Analysis of liquidity and solvency, business activity and financial stability on the example of OSAO "RESO-Garantiya". Assessment of the probability of its bankruptcy.

thesis, added 03/02/2013

Organization of financial activities and finances of the insurance company. Optimization of the capital structure and its impact on the market value of an insurance company. Analysis of the Russian insurance market. Analysis of the finances of an insurance company on the example of OSAO "Ingosstrakh".

term paper, added 12/06/2013

Economic content and purpose of the finance of the insurance company. Methodology for assessing the financial stability of an insurance company. Determination of the solvency of the enterprise according to the insurance reporting on the company's activities. The concept of reinsurance.

thesis, added 05/24/2014

Essence and functions of insurance activity. Organizational and economic characteristics of OJSC "Military Insurance Company". Analysis of liquidity, profitability and indicators of the financial stability of the enterprise. Ways to strengthen his financial condition.

term paper, added 11/14/2011

Obligation of the insurer. The management structure of the insurance company and the services provided, analysis of the liquidity of the balance sheet and financial stability. Financial stability as a factor in the reliability of the insurance business in Russia.

term paper, added 11/14/2013

The concept and types of financial stability of the enterprise. The essence of financial analysis, absolute and relative indicators of financial stability. Comprehensive assessment of liquidity and solvency of ARS LLC. Measures to strengthen the financial stability of the company.

term paper, added 03/01/2015

Ensuring the financial stability of insurance organizations in the conditions of the insurance market. Budgeting as a system of intra-company management. Budget model of an insurance company. Operating budgets of an insurance company. financial responsibility centers.

term paper, added 02/20/2009

The concept and role of financial analysis, features and stages of its implementation for an insurance company, assets and liabilities of the balance sheet. General theoretical aspects of business valuation, comparative and cost approaches. Assessment of the position of the insurance company.

thesis, added 12/25/2013

Methodology for analyzing the financial condition of an enterprise. Features of the analysis of the financial condition of the insurance company. Dynamics and structure of the company's profit, profitability indicators. Characteristics of the financial competitiveness of the enterprise.

Open Joint Stock Insurance Company "RESO-Garantia" was founded on November 18, 1991. This is a universal insurance company with licenses of the Federal Insurance Supervision Service C No. 1209 77 for 104 types of insurance and P No. 1209 77 for reinsurance. Life insurance license - C No. 4008 77 dated March 13, 2007 - issued to a subsidiary of OSZH RESO-Garantia LLC.

RESO-Garantia occupies a leading position in the Russian insurance market, is one of the leading domestic players in the insurance industry in terms of collected premiums, and is one of the leaders in retail insurance. At the same time, auto insurance (both CASCO and OSAGO), voluntary medical insurance, as well as insurance of property of individuals and legal entities are priority areas. RESO-Garantia also provides services for accident insurance, mortgage insurance, travel and other types of insurance.

According to the data of the Federal Insurance Supervision Service, following the results of 2009 OSAO "RESO-Garantia" took the 4th place in insurance premium collection. For success in work and high quality of customer service, the company was awarded a number of high awards and prizes. In particular, the "Financial Olympus" award and the annual award awarded by the "Finance" magazine. At the end of 2009, the company for the second time received the prestigious title of "People's Brand / Brand No. 1 in Russia" (an analogue of the Soviet "Quality Mark").

OSJSC "RESO-Garantia" has the highest possible reliability rating for domestic companies today A ++ rating agency "Expert RA", which corresponds to "an exceptionally high level of reliability." In addition, at the beginning of 2009, the National Rating Agency (NRA), which a year earlier assigned an individual reliability rating of "AAA" - the maximum level of reliability, "confirmed the company's previous high rating. (See Appendix 1)

In 2009 OSAO "RESO-Garantiya" took 157th place in the most authoritative domestic ranked list of the largest Russian companies "Expert-400".

The professionalism of RESO-Garantia employees is recognized by the entire insurance community of Russia: the company is an active member of most of the country's professional insurance associations, including the All-Russian Union of Insurers and the Russian Union of Motor Insurers. The company became one of the Russian companies that received the right to issue Russian Green Card policies.

The company was registered by the Moscow Registration Chamber on September 22, 1993 under No. 005.537. TIN 7710045520. Entered in the unified state register of legal entities under the number 1027700042413 on July 19, 2002.

The company has one of the most developed agent networks with over 20,000 insurance agents. The focus on improving and expanding the agency sales channel is the company's advantage and difference from most domestic insurers. Even in the conditions of the economic crisis, the retail channel for promoting insurance services maintains stable (and in many cases growing) volumes of fees.

All RESO agents are certified in accordance with strict internal rules and standards for the provision of insurance services, undergo annual re-certification in agencies and branches, in addition, the company has an effective system of remote training and testing of insurance representatives of the company.

Analysis of the solvency and financial position of the issuer based on economic analysis dynamics of indicators is presented in this table.

|

Name of indicator |

|||

|

Issuer's net asset value |

|||

|

The ratio of the amount of attracted funds to capital and reserves, % |

|||

|

The ratio of the amount of short-term liabilities to capital and reserves, % |

|||

|

Coverage of debt service payments, % |

|||

|

Level of overdue debt, % |

|||

|

Accounts receivable turnover, times |

|||

|

Share of dividends in profit, % |

|||

|

Labor productivity, thousand rubles/person |

|||

|

Depreciation to revenue, % |

Profits and losses of the enterprise RESO - Guarantee

|

Name of indicator |

|||

|

Gross profit |

|||

|

Net income (retained earnings (uncovered loss) |

|||

|

Return on equity, % |

|||

|

Return on assets, % |

|||

|

Net profit ratio, % |

|||

|

Profitability of products (sales), % |

|||

|

Capital turnover |

|||

|

Amount of uncovered loss at the reporting date |

|||

|

The ratio of uncovered loss at the reporting date and the balance sheet currency |

An economic analysis of the issuer's profitability/loss ratio based on the dynamics of the above indicators allows us to draw the following conclusions:

- - The share of individual types of insurance in the total portfolio of insurance services has not changed much, with the exception of life insurance. This is mainly due to the fact that in accordance with the Law "On the organization of insurance business in Russia" from 01.01.2007 a strict specialization of insurance organizations is introduced. Continues to hold the largest share attributable to property types of insurance and compulsory insurance of car owners of vehicles.

- - increased competition among large companies leads to the creation of new insurance products, stimulates the main market participants to reduce costs and improve the quality of management.

When carrying out insurance activities, the main cost item is the payment of insurance compensation. Since a significant part of the portfolio is concentrated in the segment of automobile and voluntary medical insurance, the growth of insurance indemnity payments is subject, in particular, to the factor of inflation in prices for car repairs and services of medical institutions. The increase in the cost of these works and services is taken into account in the tariff policy of the company.

The total volume of insurance payments for 2009 amounted to 18,686,371 thousand rubles, which is more than the level of 2008 by 2,963,371 thousand rubles. The largest share in the total volume of insurance payments falls on property insurance and compulsory insurance. To overcome the main factors that negatively affect the company's activities, the following methods are used to evaluate statistical data, reinsurance, restrictions on the amount and number of insurance contracts concluded, procedures for approving transactions, pricing strategies and constant monitoring of the emergence of new risks.

In pursuance of the Reinsurance Strategy, RESO - Guarantee uses facultative reinsurance and excess of loss reinsurance in order to reduce insurance payments under each contract. The Company constantly monitors the financial stability of reinsurers and periodically updates its reinsurance contracts. Takes appropriate measures to ensure that seasonal increases in the level of payments (for example, payments for different types contracts relating to vehicle insurance and liability to third parties in connection with the onset of the winter months with their difficult weather conditions) did not cause significant damage.

To determine the liquidity and solvency of the enterprise, let's turn to the main indicators that reflect this dynamics (Table 3)

RESO capital liquidity - Guarantee

Based on the above indicators, here are the main conclusions about the state of the company:

- 1) The current liquidity ratio shows the extent to which current assets cover current liabilities, and gives an overall assessment of liquidity. In other words, it shows how many rubles of working capital (current assets) account for one ruble of current short-term debt (current liabilities).

- 2) The excess of current assets over short-term financial liabilities provides a reserve to compensate for losses that an enterprise may incur during the placement and liquidation of all current assets, except for cash. The greater the value of this reserve, the greater the confidence of creditors that the debts will be repaid. Satisfies usually coefficient > 2.

In its semantic meaning, the quick liquidity indicator is similar to the current liquidity ratio, however, it is calculated for a narrower range of current assets, when inventories are excluded from the calculation, as a less liquid part of current assets. A ratio of 0.6-1 usually satisfies. However, it may not be sufficient if a large proportion of liquid funds is accounts receivable, some of which is difficult to collect in a timely manner. In such cases, a larger ratio is required. If a significant share of current assets is occupied by cash and cash equivalents (securities), then this ratio may be smaller.

3) Correspondence of current and quick liquidity ratios indicates the predominance of liquid assets in the composition of the issuer's working capital, which indicates the issuer's ability to cover its obligations in a short time.

Fluctuations in liquidity ratios due to a significant change in the volume of current assets.

In 2009, the growth of investments as part of current assets led to an increase in liquidity ratios.

The dynamics of the given liquidity and solvency indicators of the company testifies to the ability to fulfill short-term obligations and cover current operating expenses.

In order to manage liquidity risk within the framework of the general risk management policy, the company has an established limit on a credit line in one of the Russian banks as a reserve source of working capital. There are currently no significant factors that may lead to changes in the working capital financing policy; the insurance premium income at the moment significantly exceeds the company's need for cash to carry out current activities.

The structure and amount of the issuer's working capital in accordance with the financial statements

Company RESO - Guarantee does not use borrowed sources to finance working capital. The main sources of financing for current activities are cash receipts from the insurance premium collected by the issuer.

Title: Assessment of the solvency and financial stability of an enterprise (on the example of OSAO "RESO-Garantia")

Date of writing: 2011

Number of pages: 83

Price: 3000 rub.

Description:

Total amount of work - 83 pages

Margins are maintained: left - 30 mm, right - 10 mm, top 20 mm, bottom - 20 mm.

Font - Times New Roman

Text typed in Microsoft Word

Font size - 14

Interval - 1.5

Number of tables - 14

Number of drawings - 5

The work contains footnotes, on the basis of which, and compiled a list of references

List of used literature - 55 sources

For more information about our work, please contact us:

icq: 610 863 614

or by leaving a request on the site

Introduction

1 Theoretical foundations for analyzing the financial stability and solvency of an insurance company

1.1 The concept of financial stability and solvency

1.2 Methodology for determining the financial stability of an insurance company

1.3 Features of the methodology for assessing the solvency of an insurance company

2 Analysis of the solvency and financial stability of an insurance company on the example of OSAO "RESO-Garantiya"

2.1 Organizational and economic characteristics of OSAO "RESO-Garantiya"

2.2 Analysis of the solvency of the company "RESO-Garantia" based on the liquidity of the balance sheet

2.3 Analysis of solvency and financial stability based on financial ratios

3 Ways to improve the solvency and financial stability of OSAO RESO-Garantiya

3.1 Develop a financial recovery plan

3.2 Investment activities of an insurance company as a way to strengthen financial stability

3.3 Reinsurance as a way to strengthen financial stability

Conclusion

List of used literature

Applications

INTRODUCTION

The relevance of the presented final qualification work is determined by the fact that at present the state of financial markets and companies in the financial sector is of concern to both consumers and the state. The global financial crisis had a negative impact on the financial condition of Russian financial companies, including insurance companies, causing a decrease in the cost of corporate insurance and individuals and, consequently, a decrease in the growth rate of collections of insurance premiums or a decrease in their volumes.

In the current situation, none of the interested parties of the insurance market considers the situation in the insurance market comfortable. Consumers are not satisfied with the quality of services and are concerned about the decrease in the solvency and financial stability of insurance companies, insurers are concerned about the decrease in effective demand, the state is not satisfied with the quality of assets of insurance organizations and their level of financial stability, investors would like to receive the desired level of profitability, which insurers cannot provide in a crisis . Such a state does not contribute to the development and increase in the capitalization of the Russian insurance market.

The special importance of the solvency and financial stability of insurance organizations for the economy as a whole is due to a number of reasons.

First, the development of the insurance sector in the system of financial relations at the macro level contributes to the stabilization of the economy, as well as ensuring the social stability of society. Entering into financial relations with various market entities (insurers, contractors, the state, etc.) and fulfilling their contractual and other obligations, insurance organizations thereby affect the efficiency of the entire chain of economic relationships in society.

Secondly, insurance organizations have a significant impact on the investment market, since they are a reliable source of financial capital formation. An objective prerequisite for this is that the receipt of insurance premiums precedes the provision of insurance services. The resulting time lag between receipts of insurance premiums and payments allows insurance organizations to accumulate significant amounts of funds that are placed in various financial instruments and non-financial investment assets. The provision of insurance services, during which the funds received from policyholders are converted into significant insurance funds, stimulate the circulation of funds in the capital market. Life insurance operations also activate the financial market, because they help turn household savings into long-term investment resources.

Thirdly, strengthening the solvency and financial stability of insurance companies has a positive effect on macroeconomic market relations in general. At the same time, insurance organizations can act as market stabilizers only if they have the ability to fulfill their obligations during the insurance period, having for this purpose the resource potential to adapt to the requirements of an ever-changing competitive environment.

The purpose of the final qualification work is to formulate, on the basis of the study, measures to improve the solvency and financial stability of OSAO RESO-Garantiya.

The goal of the work involves the solution of a complex of interrelated tasks:

1. Disclosure of the concept of solvency and financial stability, determining their place in the system of financial analysis;

2. Consideration of methodological approaches to the analysis of the financial stability of an insurance company;

3. Presentation of methodological approaches for assessing the solvency of an insurance company;

4. Conducting an analysis of the solvency and financial stability of an insurance company by analyzing absolute indicators, calculating financial ratios and other types of analysis;

5. Development of a financial recovery plan for OSAO RESO-Garantia.

6. Identification of ways to strengthen the solvency and increase the financial stability of OSAO "RESO-Garantiya".

The methodological basis for writing the final qualification work was the works of domestic economists: Savitskaya G.V., Sheremet A.D., Gilyarovskaya L.T. and other authors, including Rodionova M.A. and Fedotova V.M., Kreinina M.N., Abryutina M.S., materials of periodicals.

At the same time, a number of organizational and methodological issues of the analysis of the solvency and financial stability of insurance companies are still unresolved. First of all, we are talking about the systematization of the database for analyzing the organization of its implementation in insurance companies, determining the system of indicators of solvency and financial stability, including taking into account the specifics of the insurance market.

The subject of the study of this work is the financial relations of an economic entity, which determine its financial condition and the stability of the enterprise's finances.

The object of the study is to assess the solvency of the financial stability and solvency of the insurance company OSAO "RESO-Garantiya".

The formulated goal, objectives, subject and object of the final qualifying work, as well as the logic of the study determined the structure of the work. It consists of an introduction, three chapters, a conclusion, a bibliography and appendices.

The first chapter deals with theoretical basis analysis of solvency and financial stability: the economic content of solvency and financial stability and its place in the financial analysis of the enterprise, the information base for the analysis of financial stability, the methodology for calculating indicators.

In the second chapter, the analysis and assessment of the financial condition, solvency and financial stability of OSAO "RESO-Garantiya" are made.

The third chapter discusses ways to increase the solvency and financial stability of the enterprise through the management of the structure of property and capital, the formation of a balanced policy for attracting borrowed funds.

The practical significance of the work is determined by the generalization of methods for analyzing the solvency and financial stability of various authors and, on this basis, by conducting an analytical assessment of the financial condition of a particular enterprise of OSAO RESO-Garantiya. This technique can be useful not only for this enterprise, but also for other enterprises whose main activity is insurance.

In the context of a decrease in insurance volumes and financial difficulties, the issue of restoring financial stability, increasing solvency in order to ensure a stable position in the market, continuing operations, providing an opportunity to develop production potential and increase its own sources of financing is especially relevant for RESO-Garantia.

courseworkAs of December 31, 2009, the results from operations of other types of insurance turned out to be unsatisfactory, the loss amounted to more than 500 million rubles. This is explained by a 2% decrease in insurance premiums compared to the previous year, while payments under insurance contracts increased by 19%, insurance transaction costs - by 5.5%. Thus, the company's financial results in 2009...

Financial stability of the insurance company (abstract, term paper, diploma, control)

Specialty 80 105.65 (60 400) "Finance and Credit"

Course work

on the topic: "Financial stability of the insurance company"

1. The concept and guarantees of financial stability and solvency of an insurance company

2. Analysis of the financial stability of an insurance company on the example of OSAO "RESO-Garantiya"

3. Measures to strengthen the financial stability of the insurance company Conclusion List of sources used

Annex B - Horizontal analysis of the assets of OSAO "RESO-Garantia"

Appendix C — Equity Capital Adequacy Analysis Appendix D — Performance Analysis of RESO-Garantia

Appendix D - Indicators characterizing business activity Appendix E - Analysis of the investment activity of RESO-Garantia

Appendix G - Calculation of other performance indicators of "RESO-Garantia"

Annex H - Normative values of indicators insurance property condition financial stability

The purpose of this work is to consider the concept of the financial stability of an insurance company: to reveal the essence of the phenomenon, the influencing factors and the possibilities of managing them, as well as the methodology for monitoring the solvency and financial stability of the insurer. The insurance market is an important area of the country's financial and credit system. The specifics of the insurance business and its socio-economic significance requires increased attention to the organization of the work of insurers, their stability and solvency, and the ability to meet their obligations. This problem is especially acute in times of crisis.

The first chapter discusses the factors affecting the financial stability of an insurance company, as well as guarantees of its solvency, taking into account the requirements of Russian legislation.

The second chapter provides an example of an analysis of the financial stability of an insurance company, explains the significance of indicators and their interpretation, and draws general conclusions about the state of OSAO RESO-Garantia.

In the third chapter, the possibilities of influencing the financial performance of an insurance company are considered, measures are proposed to improve and improve their activities.

The appendices provide a methodology for calculating indicators of the financial stability of an insurance company based on reporting: balance sheet (form 1) and profit and loss statement (form 2).

When writing the work, textbooks were used as sources of theoretical knowledge, legal documents of the Russian Federation. Research publications and Internet resources were used to determine the methodology for assessing the financial stability of insurers.

1 . The concept and guarantees of financial stability and paymentaboutproperty of the insurance company

The insurance business is different from other types of entrepreneurial activity in many ways. First of all, this is a high responsibility that lies with the insurer: due to one manager’s mistake, due to one incorrectly calculated step, not only the activities of the insurer will be endangered, but also damage will be caused to a large circle of insurers. Meanwhile, insurance activities are aimed at protecting the property interests of individuals and legal entities in the event of the occurrence of certain events at the expense of monetary funds formed from insurance premiums paid by policyholders. Thus, the financial collapse of the insurer affects the interests of a significant number of people.

In order to prevent the insolvency and bankruptcy of insurance companies, it is necessary to identify insurers whose financial condition causes concern at an early stage.

In the insurance industry, the financial mechanism is a mechanism for solving complex, usually unstructured problems with a high degree of uncertainty.

The financial stability of the insurer is the preservation of the optimal qualitative and quantitative state of assets and liabilities, allowing the insurance company to ensure the uninterrupted implementation of its activities and its development. This stability is manifested in the constant balance or excess of the insurer's income over its expenses.

In practice, it is customary to distinguish between financial stability and liquidity. Financial stability is defined as the potential (balance sheet) ability of a company to pay off its obligations and is associated with an analysis of the structure of the company's sources of funds. Liquidity (solvency) is the ability to cover assumed liabilities with assets in a specific period of time.

Factors affecting the financial stability of the insurer can be divided into two groups - external and internal. External factors do not depend on the effectiveness of the insurance company, they include economic, political factors, the legislative framework.

Among the internal factors affecting the financial condition of the insurance company, we can distinguish the following:

— policy in the field of setting tariff rates;

- sufficiency of insurance reserves in relation to the obligations assumed under insurance contracts (otherwise, losses and loss of solvency are possible);

— liquidity of own funds, placed mainly in real estate, and sufficient authorized capital;

- the effectiveness of the investment policy, excluding the withdrawal from profitable turnover or the loss of part of the funds of insurance reserves and equity;

— a balanced insurance portfolio that combines increased risks (up to notorious losses) with modern insurance products.

The policy in the field of establishing tariff rates is reduced to ensuring that the amount of insurance tariffs corresponds to the degree of insurance risk under the contract being concluded. The amount of income of the insurance organization largely depends on the size of insurance tariffs. If the insurer, in order to attract policyholders, regularly underestimates the amount of tariff rates, this will lead to the fact that the amount of collected insurance premiums will be lower than the amount of insurance payments that the insurer will have to make in connection with insured events, which will entail losses from insurance activities. . On the other hand, if the tariff rates are too high, the insurer may lose some of the clients who insure themselves in other insurance organizations.