The geostrategic position of Russia in the period after the collapse of the USSR allowed and encouraged the country's leadership to carry out further development of the state by reviving its power and achieving the goal of becoming one of the leading powers in the multipolar world, confidently overcoming the opposition of traditional and newly appeared competitors and gaining reliable and numerous allies. To what extent has Russia succeeded in solving the pressing problems of the first decade?

In one of his pre-election articles, Vladimir Putin writes: “Today, in terms of the main parameters of economic and social development, Russia has emerged from a deep recession ... we have reached and overcome the living standards of the most prosperous years of the USSR” (Putin V.V. “Russia is concentrating - challenges, to which we must respond).

Results of the first decade

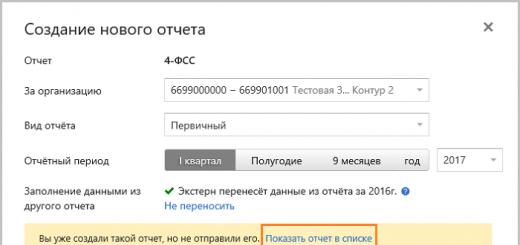

This peppy conclusion, on the one hand, is pleasant, but on the other hand, it means that more than 20 years of our history have actually been lost. Over these decades, the rest of the world has gone far ahead, and we are glad that we managed to return to the level from which the fall began. Which is more - joy or sadness. And what do statistics and other authorities say about this? Let's look at tables 1 and 2.

Table 1

As you can see, the available opportunities were not implemented in the best way. Particularly depressing are the indicators that characterize the main wealth - the savings of the population and the quality of life, the growth of GDP is insignificant and the raw material structure of the economy is still archaic, which slows down its development and the ability to counter the growing threats to the security of the country and each of its citizens.

table 2

Of course, the losses of the last decade of the last century, associated with the dishonest privatization of public property and the incompetent to criminal conversion of military production, which caused great harm in all spheres of society, were too heavy. But there was also no proper activity and creativity, especially on the part of those in whose hands the fragmented wealth of the country turned out to be. They responded sluggishly to the Russian president's call for a doubling of GDP within ten years, preferring not to invest in the real economy, but to export their income abroad. At the same time, the Ministry of Finance was skeptical about this call, basing its forecasts on lower GDP growth rates and diligently transferring huge income from commodity exports to the Stabilization Fund and its replacement funds. Real GDP growth often exceeded forecasts. By the end of the period, it slowed down, which was facilitated, firstly, by the withdrawal of very significant amounts from the economy into the “airbag” stored abroad, and secondly, by the global economic crisis.

“We need technology. It is short-sighted to hope that oil and gas will pull us out, - said Mikhail Eskindarov, rector of the Financial University under the Government of the Russian Federation. “And money that doesn’t work doesn’t do any good.” In 2008, state budget expenditures amounted to 7.57 trillion rubles, while 7.6 trillion rubles lay idle in the Reserve Fund and the National Welfare Fund. If they worked in domestic economy, in its real sectors, then the doubling of GDP proposed by the president would have been achieved earlier, and investing in the real economy instead of a “safety cushion” would have given it a second doubling. But there was no second doubling, no re-industrialization, and the crisis hit our economy much deeper than the economies of the US and Europe.

Note that the situation has not changed: when discussing the state budget for 2013 in the State Duma, the opposition parties noted the desire of the Ministry of Finance to underestimate real incomes, artificially show a deficit, and direct the additional funds received from oil and gas exports to the Reserve Fund, and not for investments, social needs , national defense and national security.

Define economic model

Ten years ago, when assessing the geopolitical position of the country, generalized indicators of the economic, military and military-economic power of Russia and largest countries peace. Their analysis showed that the Russian Federation only surpasses Germany, France, England, Japan in terms of economic potential, and also the indicators of China and the United States in terms of the size of the territory. However, the degree of realization of the economic potential of our state turned out to be significantly lower than those of these countries, therefore, in terms of general indicators of economic power, Russia was weaker than the states shown in the table. The intra-system indicators of the military-economic security of our country were also disappointing, and the systems for providing structures for military counteraction to threats to national security, due to the extremely limited economic capabilities of the state, are inadequate to the military-economic needs of the forces confronting real and potential military threats.

Nevertheless, at that time we believed that the Russian Federation had, although reduced, but still colossal economic potential. The revival of its power and return to the ranks of the most developed and powerful powers in the world was possible, but only with a comprehensive consideration of the main lesson of history - the consolidation of society around basic social values and the tasks of confronting internal and external threats faced by our state. It is especially necessary to emphasize the urgency of this task today, since the threats to national security have increased significantly, and there has been no noticeable shift in the balance of power in favor of Russia.

Now Russia is focusing on adequately responding to the foreseeable challenges that the whole world is facing: a systemic crisis, a tectonic process of global transformation - a transition to a new cultural, economic, technological, geopolitical era. While we were trying to leave socialism and become "like everyone else", these "everyone" came more and more to the conviction that capitalism had exhausted itself. It is impossible to enumerate all the obstacles and tasks; let us name those that have already been clearly identified.

In general, it is necessary to “complete the creation in Russia of such a political system, such a structure of social guarantees and protection of citizens, such a model of the economy, which together will constitute a single, living, constantly developing and at the same time stable and stable, healthy state organism” (V. V. Putin "Russia is focusing - challenges we must meet"). Such an organism guarantees the sovereignty of Russia and the prosperity of its citizens. Vladimir Putin also mentions words about justice, dignity, truth and trust. And what is “such” organism specifically?

Let us touch on some aspects of concretization of only one of these problems - the model of the economy.

First, we need to get off the raw material needle and switch to innovative development of industry, Agriculture and other sectors of the real economy. Without this, it is useless to talk about solving the problems of the economy and other spheres of life. And here the main difficulty is that in the economy that we are building, you can’t give orders. Other methods are needed. Private traders should be interested, and government officials should be selected politically and economically literate, professionally competent, creative and disciplined.

Secondly, it is necessary to destroy and eliminate the possibility of merging business with officials, to overcome corruption to the root (since it is recognized as treason), but at the same time not pushing the state out of the economy under the pretext of its alleged inefficiency, but expelling ignoramuses from the state apparatus, replacing them with honest ones. , economically literate people, only then the economy will become smart, efficient. Here we need a lot of creative work of lawyers and legislators in the field of improving economic law and colossal organizational work.

Thirdly, like air, it is necessary to achieve social unity in the country. It cannot be achieved without changing the decile coefficient several times, which is 1:15 in Russia as a whole, and in Moscow 1:50, while in European countries it is 1:7. Such a gap already threatens with a senseless and merciless revolt. Social cohesion cannot be achieved either without a progressive scale of taxation, without a substantial compensation contribution from the dealers in dishonest privatization and renationalization of that part of the property, the nature of which, as experience has shown, requires its withdrawal from private hands, and also without the liquidation of offshore companies. Many exemptions and innovations are required, but all this requires a strong political will, and not peppy pre-election calls and promises.

Thinking about the desired model of the economy, especially in terms of the defense industry, I suddenly stumbled upon the newly adopted federal law "On the Advanced Research Fund." We read: “The Foundation has the right to carry out income-generating activities only insofar as it serves the achievement of the purpose for which it was created and corresponds to this purpose.” We also read: “Federal government bodies have no right to interfere in the activities of the fund and its officials.” I think that this law would be very suitable for the entire economy, it is aimed at neutralizing the main flaw of the market economy, which focuses its subjects not on a functional effect (result), but on profit. On the other hand, we see a desire to eliminate bureaucratic obstacles, often created by incompetent actions of government agencies.

I am convinced that in an extremely contradictory socially oriented market economy it is very important not to imitate either under capitalist competition or under planned socialism, but in everything to see and observe the measure that determines the transition of phenomena to a new quality, even in its opposite.

Looking ahead 30-50 years

On the issue of restructuring and modernizing the economy, we often simplistically understand the relationship between the economy and national security, including national defense, repeating the wise statements of the authorities of the distant past that finance is the arteries of war, that three things are needed for war - money, money and money again. But since then, when it was said so, there have been major changes in the economy and military affairs.

The military development of the 20th century showed that with the industrialization of the economy, it is very difficult for money to turn into military power, that the issues of the structure of the economy, early economic mobilization and conversion in the processes of mutual transitions of economic and military power as elements of the system of power acquire a decisive role. The Soviet Union vividly demonstrated these processes on the eve of the Great Patriotic War and during the conversion of military production in the 1990s. Chains of objective functional and temporal interconnections between sectors of the economy predetermine these processes, and colossal success and shameful defeat, the possibility of "cutting the corner" and failing another SAP depend on understanding and taking into account these ties in military-economic policy.

Ignoring these interrelations during the years of conversion of military production made inevitable the rapid and such a deep collapse not only of the defense industry, but of the entire Russian economy in the 90s. This is also the reason for the extremely weak, unstable process of economic revival in the first decade of the 21st century. This is the mystery of the failures of Russia's neoliberal military-economic policy.

Military power in modern conditions presupposes such armaments and military equipment, the production of which is possible only if the structure of the real economy contains the most modern branches of production using high technologies. We are in a hurry to attend to the problems of the post-industrial economy, but in fact we have slipped into the pre-industrial economy, having lost mechanical engineering, the electronics industry, high technologies and highly qualified scientific personnel. The connection of other structures that ensure national security with the economy and its structure is similar. This connection should not be overlooked when talking about "smart" defense and protection from new threats, about the need to look beyond the horizon of 30-50 years ahead, allocating 23 trillion rubles for the development programs of the Armed Forces and the modernization of the defense industry, but putting up with the dominance of a raw material orientation economic policy and the outflow of brains and capital abroad.

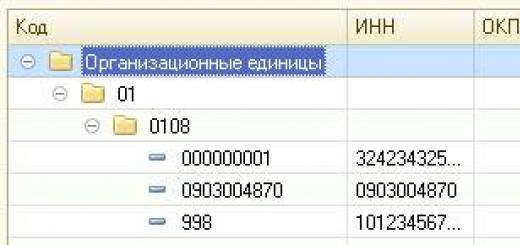

What are the indicators related to national defense and national security in the past decade and in the future? The data in Table 3 shed light on this question.

Table 3

As we can see, spending on national defense in the first decade of this century did not rise above 2.84 percent in GDP and 18.63 percent in state budget spending and tended to decrease, while spending on national security, respectively, 2.41 and 11.1 percent. . The indicators of the first years of the new decade do not indicate their growth.

Financial speculation is trading in financial assets for the purpose of making a profit as a result of taking market risk. It has become one of the main financial activities along with investing, hedging, insurance, etc. financial policy.

What is the underfunding of the defense industry? This may be a forced measure, a consequence of the extremely limited resources. But it can also be a way used by corrupt officials to enrich themselves under the guise of serving defense spending. In such a situation, military financiers have to take out loans from private banks at fabulous rates. The state pays for them by enriching the oligarchs and corrupt officials. How it was necessary to deal with financial fraud in the field of underfunding defense spending in the 90s of the last century is convincingly shown in the monograph of the former head of the Main FEU of the Ministry of Defense, Colonel-General V.V. security of Russia: problems and solutions”, St. Petersburg, 2003).

This is especially important to understand in the context of the country's transition to a socially oriented market economy with pluralism of forms of ownership. Since it is happening, it is necessary to gain knowledge and ability to work in market conditions, without losing the colossal opportunities for systematic regulation economic processes. Nearly a decade of the existence of the defense industry in conditions of underfunding and fragmentation in the interests of the privatization of its enterprises, the loss of much of what is necessary to ensure its adequacy to threats and reliable competitiveness, also led to the failure of the first three state weapons programs in the past decade. This makes us rethink our attitude to financial and economic technologies, understand their enormous destructive and creative power and skillfully use it for creation.

We are talking about the role and place of the military-financial component in the system of determining factors and how to prevent its separation from military, economic and military-economic policy, how to ensure the fulfillment of their functional purpose. The main thing is to achieve the adequacy of military-financial and military-economic interests, to exclude the exaggerated influence of narrow departmental and private interests. It is necessary to ensure a combination of functional goals and economic interests in the system of contracts of subjects of military-economic relations, having developed in economic law the rules of the game acceptable to the parties, and creating an acceptable coercion mechanism for them in the form of economic sanctions, norms of legal responsibility, introducing new forms of economic relations, institutional innovations, modern market technologies.

One of the most effective means and ways to the goal is the creation, and in fact the revival of large integrated structures in the defense industry destroyed by privatization and conversion of military production.

At all times, the international situation has had a significant impact on the development of the economy of any country. In the coming century, at least in its first decades, this influence will be determined mainly by its following features.

Multipolarity. Already in the late 1980s and early 1990s, the framework of a multipolar world began to take shape, which in the near future will become stronger and more perfect. The era of superpower domination, and today only the United States is one of them, will finally come to an end. Indeed, America has always set its own favorable system (including the economy, finances, human rights, etc.) as the world standard and imposed it on other countries. However, the time when it implemented its rules in organizations such as the IMF, the World Bank, the WTO, and even the UN, and thanks to this, actually ruled the rest of the world, is irrevocably gone.

The poles of the new structure of the world will most likely be the United States, the European Union, China, Russia and Japan, and it is they who will play the leading role in resolving international issues until at least the middle of the century. Achieving a balance between the poles and, consequently, prosperity in the world is possible due to their mutual coordination. The key points are peaceful coexistence, interdependence, mutual benefit and mutual benefit. This will greatly reduce the likelihood of friction and disagreement.

Strengthening the role of the economy. Her place in international relations will become more noticeable. There will be an intertwining of economics and politics, which will find expression in attempts to achieve political goals through the use of economic levers, as well as in the pursuit of even greater economic efficiency through the use of political tactics. Ultimately, however, each pole will defend its own strategic interests.

Under these conditions, mutual trust in the international arena must be built on the basis of mutual favor and mutual benefit in the economy and trade. Without this, it is difficult to continue political relations. If there is no trust in politics, it is not easy to develop trade and economic ties. That is why in the XXI century. so important is the normalization of foreign trade, economic and political relations.

This is especially true within the pair of the USA, the largest debtor state (external debt is about $1 trillion), and Japan, the world's largest creditor state (foreign capital is also about $1 trillion). In the coming years, we can expect a long and bitter confrontation between the American and Japanese models of economics, trade and financial policy. The struggle for strategic economic interests between the TNCs of America, Japan and Europe and the regional political contradictions or military conflicts initiated by them - all this fully confirmed that the economy and finance are inseparable in international relations.

Globalization. Thanks to the international division of labor and scientific and technological progress, economic and financial globalization is continuously deepening and developing. But this process is also fraught with negative consequences. Of course, the financial market as a phenomenon will exist in the next century. However, the huge free capital (daily turnover is more than 2 trillion dollars), being an important part of it, serves only to stimulate the "chase for income" and has nothing to do with trade and ordinary capital investments. This will inevitably serve as a factor in the instability of the entire economic system, a catalyst for large and small financial shocks or crises.

By the mid-1980s, the rapid development of TNCs led to changes in the world economic system and international trade: the market economy achieved unprecedented success, and its scope of operation expanded. The WTO has raised the degree of internationalization of trade, investment and services to a qualitatively new level. New stage scientific and technological revolution, which is based on Information Technology, improved the efficiency of market transformations and accelerated globalization. Thanks to the advent of fiber optic networks, the means of communication made a dramatic leap, and "electronic commerce" arose. Its effectiveness is a force that cannot be stopped, so "e-commerce" will reach new heights.

Whether we like it or not, the processes of globalization penetrate deeply into the life of all countries. It seems that in the coming years, despite the establishment of a number of restrictive laws, they will only intensify. An important role in this will be played by TNCs, which in this situation, due to flexible integration mechanisms, serve as additional bridges between national economies. In general, the globalization of the economy stimulates the development of society, but at the same time leads to injustice and inequality.

Currency bipolarity. Together with the beginning of the circulation of the euro (January 1, 1999), two poles formed in the international monetary system. The euro has become the world's second most important currency after the dollar. In terms of the level of real power (purchasing power), the degree of linkage with foreign economic activity and trade, and advancement in the financial market, these monetary units are very close. Therefore, they will play equally important roles and will have a huge impact on the development of the entire world economy. Indeed, the countries where the euro is used have outstripped the United States in terms of their share in world trade. Moreover, they have an active, and not passive, as it was for a long time in America, balance. Some experts predict that in the next 10 years Europe will catch up with America in terms of technological development.

However, financial unification does not at all mean unification in the economy, much less political unity in everything. In particular, among the countries that have adopted the euro, there are still some unresolved problems. Moreover, one of the leading EU states - Great Britain - has not yet joined them. In general, the contradictions between Europe, America and Japan in the areas of finance, economy and trade cannot disappear without a trace. Therefore, in most Western transnational economic organizations, there will be a situation of mutual confrontation between these three forces.

Of course, the global financial system is deeply ingrained and difficult to change. And yet it seems that in the XXI century. the international monetary system will be restructured, new laws will replace the old ones. All this will affect the structure and composition of foreign exchange reserves, the placement of funds in foreign trade and the amount of investment.

Further internationalization of trade. The formation of the WTO was largely due to the interests of transnational companies. Another reason is the need to promote internationalization in the areas of trade, investment and services to a qualitatively new level. At present, the system of provisions and laws of the WTO is being developed very rapidly. Their number is great; they meet the economic and trade interests of all countries included in this structure.

Ecology. In the 21st century the exports of many other countries will face various kinds of restrictions contained in international treaties, which will complicate the conditions for the functioning of the economy. This is largely due to the fact that it is necessary not only to meet the needs of the era, but also to think about how not to harm future generations, to give humanity the opportunity for further development. Hence the increased attention to ecology, rational use of natural resources.

The situation with the environment puts forward more and more stringent requirements for production and trade, making it mandatory to take measures to protect it. For example, when the international treaty for the protection of the ozone layer of the atmosphere was approved, developed countries agreed to stop the relevant production and reduce the shelf life of many materials, completing all the necessary activities in 1994-1996. The completion of most restrictive programs is scheduled for 2010. They will affect the production of various types of foam materials, solvents, cleaning products and other products.

The conditions of life and development of mankind have become a subject of special attention and a problem that in the new century they are trying to solve everywhere. In the future, environmentally friendly food and industrial products, environmentally friendly production and equipment and other issues will become the main content of international cooperation in the economy, trade and technology exchange. If now environmentally friendly products account for 8% of world trade, in the near future their share should reach 100%. Therefore, development plans and plans for environmental protection provide an excellent opportunity for world trade to materialize.

The geostrategic position of Russia in the period after the collapse of the USSR allowed and encouraged the country's leadership to carry out further development of the state by reviving its power and achieving the goal of becoming one of the leading powers in the multipolar world, confidently overcoming the opposition of traditional and newly appeared competitors and gaining reliable and numerous allies. To what extent has Russia succeeded in solving the pressing problems of the first decade?

In one of his pre-election articles, Vladimir Putin writes: “Today, in terms of the main parameters of economic and social development, Russia has emerged from a deep recession ... we have reached and overcome the living standards of the most prosperous years of the USSR” (Putin V.V. “Russia is concentrating - challenges, to which we must respond).

Results of the first decade

This peppy conclusion, on the one hand, is pleasant, but on the other hand, it means that more than 20 years of ours have actually been lost. Over these decades, the rest of the world has gone far ahead, and we are glad that we managed to return to the level from which the fall began. Which is more - joy or sadness. And what do statistics and other authorities say about this? Let's look at tables 1 and 2.

Table 1

As you can see, the available opportunities were not implemented in the best way. Particularly depressing are the indicators that characterize the main wealth - the savings of the population and the quality of life, the growth of GDP is insignificant and the raw material structure of the economy is still archaic, which slows down its development and the ability to counter the growing threats to the security of the country and each of its citizens.

table 2

Of course, the losses of the last decade of the last century, associated with the dishonest privatization of public property and the incompetent to criminal conversion of military production, which caused great harm in all spheres of society, were too heavy. But there was also no proper activity and creativity, especially on the part of those in whose hands the fragmented wealth of the country turned out to be. They responded sluggishly to the Russian president's call for a doubling of GDP within ten years, preferring not to invest in the real economy, but to export their income abroad. At the same time, the Ministry of Finance was skeptical about this call, basing its forecasts on lower GDP growth rates and diligently transferring huge income from commodity exports to the Stabilization Fund and its replacement funds. Real GDP growth often exceeded forecasts. By the end of the period, it slowed down, which was facilitated, firstly, by the withdrawal of very significant amounts from the economy into the “airbag” stored abroad, and secondly, by the global economic crisis.

“We need technology. It is short-sighted to hope that oil and gas will pull us out, - said Mikhail Eskindarov, rector of the Financial University under the Government of the Russian Federation. “And money that doesn’t work doesn’t do any good.” In 2008, state budget expenditures amounted to 7.57 trillion rubles, while 7.6 trillion rubles lay idle in the Reserve Fund and the National Welfare Fund. If they worked in the domestic economy, in its real sectors, then the doubling of GDP proposed by the president would have been achieved earlier, and investing in the real economy instead of a “safety cushion” would have given it a second doubling. But there was no second doubling, no re-industrialization, and the crisis hit our economy much deeper than the economies of the US and Europe.

Note that the situation has not changed: when discussing the state budget for 2013 in the State Duma, the opposition parties noted the desire of the Ministry of Finance to underestimate real incomes, artificially show a deficit, and direct the additional funds received from oil and gas exports to the Reserve Fund, and not for investments, social needs , national defense and national security.

Define economic model

Ten years ago, when evaluating the geopolitical position of the country, generalized indicators of the economic, military and military-economic power of Russia and the largest countries of the world were given. Their analysis showed that the Russian Federation only surpasses Germany, France, England, Japan in terms of economic potential, and also the indicators of China and the United States in terms of the size of the territory. However, the degree of realization of the economic potential of our state turned out to be significantly lower than those of these countries, therefore, in terms of general indicators of economic power, Russia was weaker than the states shown in the table. The intra-system indicators of the military-economic security of our country were also disappointing, and the systems for providing structures for military counteraction to threats to national security, due to the extremely limited economic capabilities of the state, are inadequate to the military-economic needs of the forces confronting real and potential military threats.

Nevertheless, at that time we believed that the Russian Federation had, although reduced, but still colossal economic potential. The revival of its power and return to the ranks of the most developed and powerful powers in the world was possible, but only with a comprehensive consideration of the main lesson of history - the consolidation of society around basic social values and the tasks of confronting internal and external threats faced by our state. It is especially necessary to emphasize the urgency of this task today, since the threats to national security have increased significantly, and there has been no noticeable shift in the balance of power in favor of Russia.

Now Russia is focusing on adequately responding to the foreseeable challenges that the whole world is facing: a systemic crisis, a tectonic process of global transformation - a transition to a new cultural, economic, technological, geopolitical era. While we were trying to leave socialism and become "like everyone else", these "everyone" came more and more to the conviction that capitalism had exhausted itself. It is impossible to enumerate all the obstacles and tasks; let us name those that have already been clearly identified.

In general, it is necessary to “complete the creation in Russia of such a political system, such a structure of social guarantees and protection of citizens, such a model of the economy, which together will constitute a single, living, constantly developing and at the same time stable and stable, healthy state organism” (V. V. Putin "Russia is focusing - challenges we must meet"). Such an organism guarantees the sovereignty of Russia and the prosperity of its citizens. Vladimir Putin also mentions words about justice, dignity, truth and trust. And what is “such” organism specifically?

Let us touch on some aspects of concretization of only one of these problems - the model of the economy.

First, we need to get off the raw material needle and move on to the innovative development of industry, agriculture and other sectors of the real economy. Without this, it is useless to talk about solving the problems of the economy and other spheres of life. And here the main difficulty is that in the economy that we are building, you can’t give orders. Other methods are needed. Private traders should be interested, and government officials should be selected politically and economically literate, professionally competent, creative and disciplined.

Secondly, it is necessary to destroy and eliminate the possibility of merging business with officials, to overcome corruption to the root (since it is recognized as treason), but at the same time not pushing the state out of the economy under the pretext of its alleged inefficiency, but expelling ignoramuses from the state apparatus, replacing them with honest ones. , economically literate people, only then the economy will become smart, efficient. Here we need a lot of creative work of lawyers and legislators in the field of improving economic law and colossal organizational work.

Thirdly, like air, it is necessary to achieve social unity in the country. It cannot be achieved without changing the decile coefficient several times, which is 1:15 in Russia as a whole, and in Moscow 1:50, while in European countries it is 1:7. Such a gap already threatens with a senseless and merciless revolt. Social cohesion cannot be achieved either without a progressive scale of taxation, without a substantial compensation contribution from the dealers in dishonest privatization and renationalization of that part of the property, the nature of which, as experience has shown, requires its withdrawal from private hands, and also without the liquidation of offshore companies. Many exemptions and innovations are required, but all this requires a strong political will, and not peppy pre-election calls and promises.

Thinking about the desired model of the economy, especially in terms of the defense industry, I suddenly stumbled upon the newly adopted federal law "On the Advanced Research Fund." We read: “The Foundation has the right to carry out income-generating activities only insofar as it serves the achievement of the purpose for which it was created and corresponds to this purpose.” We also read: “Federal government bodies have no right to interfere in the activities of the fund and its officials.” I think that this law would be very suitable for the entire economy, it is aimed at neutralizing the main flaw of the market economy, which focuses its subjects not on a functional effect (result), but on profit. On the other hand, we see a desire to eliminate bureaucratic obstacles, often created by incompetent actions of government agencies.

I am convinced that in an extremely contradictory socially oriented market economy it is very important not to imitate either under capitalist competition or under planned socialism, but in everything to see and observe the measure that determines the transition of phenomena to a new quality, even in its opposite.

Looking ahead 30-50 years

On the issue of restructuring and modernizing the economy, we often simplistically understand the relationship between the economy and national security, including national defense, repeating the wise statements of the authorities of the distant past that finance is the arteries of war, that three things are needed for war - money, money and money again. But since then, when it was said so, there have been major changes in the economy and military affairs.

The military development of the 20th century showed that with the industrialization of the economy, it is very difficult for money to turn into military power, that the issues of the structure of the economy, early economic mobilization and conversion in the processes of mutual transitions of economic and military power as elements of the system of power acquire a decisive role. The Soviet Union vividly demonstrated these processes on the eve of the Great Patriotic War and during the conversion of military production in the 1990s. Chains of objective functional and temporal interconnections between sectors of the economy predetermine these processes, and colossal success and shameful defeat, the possibility of "cutting the corner" and failing another SAP depend on understanding and taking into account these ties in military-economic policy.

Ignoring these interrelations during the years of conversion of military production made inevitable the rapid and such a deep collapse not only of the defense industry, but of the entire Russian economy in the 90s. This is also the reason for the extremely weak, unstable process of economic revival in the first decade of the 21st century. This is the mystery of the failures of Russia's neoliberal military-economic policy.

Military power in modern conditions presupposes such armaments and military equipment, the production of which is possible only if the structure of the real economy contains the most modern branches of production using high technologies. We are in a hurry to attend to the problems of the post-industrial economy, but in fact we have slipped into the pre-industrial economy, having lost mechanical engineering, the electronics industry, high technologies and highly qualified scientific personnel. The connection of other structures that ensure national security with the economy and its structure is similar. This connection should not be overlooked when talking about "smart" defense and protection from new threats, about the need to look beyond the horizon of 30-50 years ahead, allocating 23 trillion rubles for the development programs of the Armed Forces and the modernization of the defense industry, but putting up with the dominance of a raw material orientation economic policy and the outflow of brains and capital abroad.

What are the indicators related to national defense and national security in the past decade and in the future? The data in Table 3 shed light on this question.

Table 3

As we can see, spending on national defense in the first decade of this century did not rise above 2.84 percent in GDP and 18.63 percent in state budget spending and tended to decrease, while spending on national security, respectively, 2.41 and 11.1 percent. . The indicators of the first years of the new decade do not indicate their growth.

Financial speculation is trading in financial assets for the purpose of making a profit as a result of taking market risk. This has become one of the main forms of financial activity, along with investing, hedging, insurance, etc. Since both investment and speculation achieve financial growth, there is some clouding of thinking and degeneration of financial policy.

What is the underfunding of the defense industry? This may be a forced measure, a consequence of the extremely limited resources. But it can also be a way used by corrupt officials to enrich themselves under the guise of serving defense spending. In such a situation, military financiers have to take out loans from private banks at fabulous rates. The state pays for them by enriching the oligarchs and corrupt officials. How it was necessary to deal with financial fraud in the field of underfunding defense spending in the 90s of the last century is convincingly shown in the monograph of the former head of the Main FEU of the Ministry of Defense, Colonel-General V.V. security of Russia: problems and solutions”, St. Petersburg, 2003).

This is especially important to understand in the context of the country's transition to a socially oriented market economy with pluralism of forms of ownership. Since it is taking place, it is necessary to gain knowledge and the ability to work in market conditions without losing the colossal possibilities for the systematic regulation of economic processes. Nearly a decade of the existence of the defense industry in conditions of underfunding and fragmentation in the interests of the privatization of its enterprises, the loss of much of what is necessary to ensure its adequacy to threats and reliable competitiveness, also led to the failure of the first three state weapons programs in the past decade. This makes us rethink our attitude to financial and economic technologies, understand their enormous destructive and creative power and skillfully use it for creation.

We are talking about the role and place of the military-financial component in the system of determining factors and how to prevent its separation from military, economic and military-economic policy, how to ensure the fulfillment of their functional purpose. The main thing is to achieve the adequacy of military-financial and military-economic interests, to exclude the exaggerated influence of narrow departmental and private interests. It is necessary to ensure a combination of functional goals and economic interests in the system of contracts of subjects of military-economic relations, having developed in economic law the rules of the game acceptable to the parties, and creating an acceptable coercion mechanism for them in the form of economic sanctions, norms of legal responsibility, introducing new forms of economic relations, institutional innovations, modern market technologies.

One of the most effective means and ways to the goal is the creation, and in fact the revival of large integrated structures in the defense industry destroyed by privatization and conversion of military production.

Over the past 25 years, the state of the Russian economy and the relationship between economic factors and political decisions have been the subject of much speculation and superficial judgment. This “war of delusions” was one of the reasons why Russia not only missed 25 years and several unique opportunities for an economic and technological breakthrough, but also returned a hundred years ago in its political and economic structure. The wave of delusions and superstitions has led to the ultimate simplification of the view of the Russian economy, society and the origins of political decisions both within the country and abroad. The real picture is much more complex, and can be seen only by understanding the basic aspects of the Russian economic situation.

Features of the Russian economy over the past 25 years

- By the end of the 80s of the 20th century, the economy of the USSR finally lost control - due to internal imbalance and inflexibility of planned methods of management under the conditions of the socialist property system.

- The system of functioning of the economy changed in the 1990s, but democratic institutions and a competitive environment were not formed.

- In the 21st century, Russia has experienced the classic "Dutch disease", exacerbated by the centralization of power and property and the absence of democratic institutions. However, in the time that hydrocarbon prices have been high, Russia has managed to accumulate enough reserves that today's drop in oil prices and the country's relative international isolation did not cause an immediate economic collapse.

- All the main economic factors and even the available management resources today either negatively affect the economy or cannot ensure its growth.

- Foreign policy factors, primarily sanctions, are secondary, insignificant and do not have a significant negative impact on the economy, despite the fact that the authorities in Russia actively use them as an excuse for economic problems.

Key Findings and Forecasts

- The Russian economy is not unique - the Dutch disease experienced by it has quite typical symptoms and consequences. Russia is still far from economic collapse, but is slowly moving towards it. At the same time, there are points of catastrophic risk in the economy. The most likely development will be an increase in the tax burden and restrictions on the economy until 2018, with a transition to large-scale emission, tight regulation of the economy and the closure of capital markets after 2018. At the same time, the country's indicators will slowly decline, but a collapse is unlikely in the foreseeable future.

- In 2016 and, most likely, in 2017, one should not expect significant surprises from the Russian economy, both negative and positive. In the base scenario, neither catastrophic economic nor radical social processes are visible.

- The weakest link in the coming years will be the Russian banking sector.

- There are other “weak spots” where catastrophic changes may occur, but sooner rather than later.

- The Russian government decided to respond to economic challenges not by attempting to reform the economy, but by maintaining the level of budget revenues in the short term, including through the long term. The measures are mainly aimed at increasing the tax burden and inflationary reduction of budget liabilities. This strategy is only at the beginning of its natural course of development, 2016 and 2017 are likely to be marked by massive tax increases and fees and financial restrictions.

- It is very likely that the government will gradually go on a broad emission program, followed by the closure of the cross-border movement of capital, the restriction of foreign exchange transactions and price controls. However, this is unlikely to take on a large-scale character before the 2018 presidential election.

What happened to the Russian economy in the 21st century?

Over the past 15-16 years, the Russian economy has experienced a classic resource cycle and Dutch disease - phenomena that are banal and well studied. The increase in oil prices at the beginning of the century created the effect of rapid growth in budget revenues and allowed the authorities to refuse to stimulate the process of expanding the tax base. Moreover, thanks to the ability to control oil flows, the authorities consolidated indirect control over the hydrocarbon industry, the banking business, and through them - over the entire economic and political life of the country. This had a negative impact on the development of any non-oil business and on the effectiveness of economic and budgetary decisions.

In fact, by 2008, 65–70% of the Russian budget consisted (directly or indirectly) of income from the export of hydrocarbons, and the correlation of GDP growth rates, federal budget revenues, and the size of reserves with changes in oil prices reached 90–95% 1. Against this background, The ruble, due to the massive influx of petrodollars, turned out to be significantly overvalued - in 2006–2007, its market rate exceeded the calculated inflation rate by 35%. Thus, three negative factors influenced the economic development of Russia:

- The authorities, in their desire to control financial flows, deliberately worsened the investment climate, refusing to protect the rights of investors and entrepreneurs and even discriminating against them. This led to a reduction in the flow of investments, a rise in the cost of money, a decrease in entrepreneurial activity and an ever-growing loss of financial and human capital - more than $ 1 trillion was withdrawn from Russia, the best businessmen and professionals left the country.

- The sterilization of additional profits into reserves increased the value of money, as a result, the attractiveness of investment decreased, and the development of capital-intensive or slowly developing areas became impossible.

- The overvalued ruble and populist government measures aimed at unreasonable wage increases, together with high taxes, sharply inflated the cost of production, making domestic production unprofitable.

Against the background of a general increase in income due to the export of hydrocarbons and even outstripping growth in consumption, Russia has degraded in almost all areas of the economy, without creating a competitive productive sphere. In Russian GDP, up to 20% was occupied by hydrocarbon production, up to 30% (twice as much as the average for developed countries) - sharply hypertrophied due to huge import flows (at the expense of petrodollars) trade, about 15% - the domestic energy market and infrastructure, another 15% accounted for government projects, 9% was the share of the banking sector. And finally, no more than 10% of GDP belongs to the sphere of independent services and non-resource production 2.

An unreasonable social policy was superimposed on this: the growth of household incomes outpaced the growth of GDP, even taking into account the oil component; the budget became an employer for almost 30% of the able-bodied population directly and for almost 8%3 more indirectly, assuming an unreasonable burden; pension reform failed due to the indecision of the authorities. In addition, the budget was overburdened with ambitious inefficient projects and exaggerated spending on defense and security, and budget spending was greatly increased not only because the money was spent inefficiently, but also because of the high level of corruption.

Ultimately, after the fall in oil prices, Russia was left with an undiversified, quasi-monopolized economy that lacks both the factors and resources for growth.

Is it possible to say that Russia is suffering an economic collapse?

No, not yet. During the years of high oil prices, Russia has accumulated sufficient reserves 4: gold and foreign exchange reserves are three times higher than the expected volume of imports in 2016 5; enterprises have created a sufficient number of fixed assets; the population has accumulated more than $250 billion in banks and perhaps no less in cash, has accumulated a stock of durable goods, and the average living space per person has more than doubled. The fall in household incomes is certainly unprecedented, but even with oil at $35 a barrel it brings us back to the level of 2004-2005 - not rich times, but quite stable.

In general, per capita GDP in Russia in 2016 will be, according to pessimistic forecasts, about $7.5 thousand - in the list of countries this is the end of the 7th decade, next to Turkmenistan, slightly below China (and GDP according to PPP, apparently, is about $13 -14 thousand - in the list somewhere in the 9th ten, along with Algeria, the Dominican Republic, Thailand, Colombia, Serbia, South Africa). These indicators are modest, but still far from catastrophic (the zone of "color revolutions" begins at about $6,000 in nominal GDP per capita and $9,000-10,000 in PPP terms).

If the situation does not change (oil is not higher than $35 per barrel, no reforms are taking place), Russia may not fear a large-scale crisis in the economy for at least another three years - provided that the banking system withstands.

What factors influence the state of the Russian economy today?

Unfortunately, most of the factors affecting the Russian economy are currently not conducive to its development.

In the region of production resources Russia, which has historically underinvested in fixed capital, even today faces almost 85% capacity utilization. This is despite the fact that a significant part (according to some estimates - more than 40%) of the production capacity in Russia is technologically and physically outdated and cannot produce competitive products that are consumed by the market. For an adequate assessment, we can recall that in ten years the machine park in Russia has almost halved - and rarely can this reduction be explained by the retirement of old, low-power machines and the commissioning of new, higher power ones. So, in order to grow the economy, it is necessary to rapidly capitalize production and create new capacities. The state does not have the funds for this (the budget deficit will already exceed 3% of GDP, most likely it will be about 5% 7, state companies there are no free resources, private and foreign companies are not ready to invest in Russia today because of the crisis of confidence).

In the field of efficiency, Russia is far behind world competitors: we are talking about energy efficiency (we consume four times more energy per $ 1 of GDP than Japan), and about logistics efficiency - the cost of transporting goods, storage, customs clearance is significantly higher, than in developing countries and even than in many developed ones. Accordingly, the competitiveness of manufactured goods is decreasing, and this is a barrier to increasing production and sales markets.

In the field of productive forces, Russia is increasingly suffering from a shortage of labor resources - they are reduced due to natural demographic reasons by 0.5% per year 8. At the same time, most of the labor resources are involved in areas with zero or very low value added - in the civil service , in law enforcement agencies, in private security, in trade, in the extremely inefficient banking sector. The rest does not cover the needs of the state - there is a catastrophic lack, even at the current level of development of production and services, of engineering and technological personnel, skilled workers and, at the same time, effective managers and management specialists. The Russian municipal economy was actually based on the semi-legal exploitation of the labor of millions of migrants, including illegal ones. Until recently, remittances (money transfers "home") from Russia were an article state income No. 1 in Kyrgyzstan and No. 2 in Tajikistan, significant for Ukraine, Uzbekistan, Moldova, Belarus. Today, due to a sharp drop in both the value of the ruble and the purchasing power of the population, the number of labor migrants in Russia is sharply declining: both utilities and all businesses that employ a large number of unskilled workers, including network retailers.

Inconsistent and illogical policy in the field of lawmaking and law enforcement (especially in relation to property rights), as well as in the field of economics and entrepreneurship, demonstrated to the investment and business community, both inside and outside of Russia, that the government is unreliable, hostile towards entrepreneurs , maintains a high level of corruption, tends to prioritize state interests, programs and businesses to the detriment of private ones. The natural reaction was the refusal to invest in Russia - first in long-term, and then in any projects - and the departure of local entrepreneurs and investors. Over 16 years, the total capital outflow exceeded the total proceeds from the sale of hydrocarbons 9. The share of private business (excluding “quasi-” - those private companies that are actually controlled by the state) in GDP decreased to 30–35% 10. The volume of external debt fell to below 50% of GDP due to investment stagnation 11.

Private business in Russia today generates GDP in the amount of less than $3,000 per person per year - this is the level of those countries that are in the ranking at the beginning of the second hundred. The share of small and medium-sized businesses in GDP does not exceed 20-22% 12, while in developed countries this figure is at the level of 40-55%. Today, more than $1 trillion is made up of passive investments by Russian citizens in banks in Switzerland and other European countries, Hong Kong, and Singapore. About 20-30 thousand representatives of the professional and business classes of society leave Russia every year: in the USA there are at least 6 million first and second generation emigrants from Russia, of which at least 3 million people declare themselves as Russians, Israel - at least 1.5 million, the UK - several hundred thousand, in the rest of Europe - at least 1 million. This suggests that Russia has lost about 10 million people (about 7% of the population), who could become the basis of the middle class (today in Russia the middle class is no more than the same 10 million 13). This is, in fact, a total crisis of confidence of capital, entrepreneurs and professionals in the country. Thus, we can assume that the Russian economy lacks investment and entrepreneurial resources, at least until a radical change in the management paradigm takes place.

The devaluation resource is not too great in Russia either. Undoubtedly, the devaluation played a positive role in supporting exporters, the budget and smoothing out the problems of the “hard landing” of the economy. However, it is difficult to expect a positive effect from it in terms of GDP growth. First, the potential growth of GDP in Russia is tied almost entirely to domestic demand (export growth requires capital investments, which are not available, and technologies, which are also not available), that is, it is measured in rubles and practically does not grow. Secondly, almost 100% of Russian production is more or less dependent on the import of raw materials, components or equipment (this dependence varies from 15 to 70-80%), and due to the devaluation, the ruble cost of manufactured goods and even services is increasing much faster. growth of effective demand.

In 2000, the Ministry of Economic Development and Trade prepared an extensive document - "The main directions of the socio-economic development of the Russian Federation in the long term", which determined the strategic priorities of the state's economic policy for the period up to 2010. From the first days of the new millennium, the attention of the president and government, led during the first presidential term of V. V. Putin by Prime Minister M. M. Kasyanov, was focused on resolving a series of urgent issues.

Shortly after his election, the president proclaimed the need for "equidistance of the oligarchs" from power; elimination of unjustified privileges and, consequently, incomes that some entrepreneurs had due to “special” relations with bureaucracy and politicians. Public attention was drawn to this topic in 2003 during the investigation of the so-called "YUKOS case", when many accents were intensified regarding the responsibility of big business to the state and society. The authorities sought to create equal "rules of the game" for all participants in economic activity. Law of the Russian Federation "On combating money laundering". To implement this task, in November 2001, a new body was established under the Ministry of Finance - the Financial Monitoring Committee. Russia has joined the international financial intelligence community.

The improvement of the business climate was facilitated by the adoption at the end of 2000 of new Tax and Customs Codes, as well as additions to the Civil Code of the Russian Federation. The scale of taxes was reduced from 30 to 13% and became the lowest in Europe, which created the prerequisites for the exit of many sectors of the economy from the "shadow". Reduced customs import duties. These measures have already led to a noticeable replenishment of the treasury through taxes and customs duties in 2001. But ways of further optimization of the tax system are also being discussed.

In 2000-2003 important steps have been taken towards deepening market reforms in sectors that are called "natural monopolies". Already carried out and planned transformations in the management of the oil and gas industry, the electric power industry, in the system railway transport and the sphere of housing and communal services are aimed at creating a competitive environment, attracting investments, which should lead to a qualitative improvement in the situation in these areas. Many ministers of the economic block of the government proceeded from the fact that public administration is inefficient "by definition" and therefore the state should leave in its ownership only those objects that are necessary for the implementation of its functions. On this basis, further privatization of state-owned enterprises was carried out, which gradually covered new industries.

Of great economic and political significance was the adoption by the Duma in September 2001 of a new Land Code, which fixed the right of ownership of land and determined the mechanism for its purchase and sale. The document did not affect only agricultural land. However, already in June 2002, the parliament approved the law "On the turnover of agricultural land", which authorized the sale and purchase of this category of land. The adopted act was compared in value with the reform of Alexander II. Concessional lending to agricultural enterprises, an increase in the supply of equipment, and some protectionist measures are aimed at improving the situation in the agrarian sector.

In 2000-2004 The country's leadership has repeatedly expressed concern about the "raw material bias" in the development of Russian industry. As a strategic task, the task is to achieve progress in industries based on modern technologies and producing science-intensive products. It was pointed out that it is necessary to ensure a breakthrough in those areas where Russian science corresponds to the world level.

In this regard, the state began to pay more attention to the military-industrial complex (DIC), which traditionally has a colossal highly intellectual potential. Expansion of funding and started in the defense industry. transformations are aimed at solving problems of both a military and a civilian nature.

New economic policy initiatives have already had a positive effect. Over the past three years, the state budget has been running a surplus. This made it possible to raise the issue of preparing the country's transition to sustainable and more dynamic economic development.

Positive changes in the national economy made it possible to significantly strengthen the social orientation of the policy pursued. By the end of 2000, they managed to pay off most of the months-long arrears in wages, benefits and pensions. In 2001-2004 the salaries of various categories of workers in the public sector have been raised several times, and pensions have been increased. Gradually began to grow real incomes of citizens. New jobs appeared, which in 2001 alone led to a reduction in the number of unemployed by 700,000 people. A new Labor Code and a package of laws on pension reform have been adopted. The prospects for social development are beneficially affected by an increase in allocations to support institutions of science, culture and education. The government pays special attention to the modernization of secondary and higher schools.