Do not pay taxes - the dream, perhaps, of every citizen. And what can we say about individual entrepreneurs, for whom taxes are a real burden, significantly reducing their, sometimes so meager, profit. Let's figure it out, is not paying taxes on individual entrepreneurs a reality or a criminally punishable act?

More “soft” penalties for violations in this area are provided for in the Tax Code. Art. 122 of the Code establishes liability for non-payment (or partial payment) of tax due to the deliberate underestimation of the tax base by the taxpayer or incorrect calculation of tax. Penalty for this act: a fine of 20% of unpaid taxes.

What happens if you don't pay taxes? Liability for non-payment of taxes

- With foam. Citizens who are late in paying taxes will have to cover the penalty when paying. This measure has already been discussed. The amount of additional costs directly depends on how much the calculation was delayed.

- With fines set. The most common measure of responsibility, which is only found in Russia. The penalty for non-payment of taxes, according to the established rules, is set on an individual basis, but with some restrictions. Citizens pay 100-300 thousand rubles or lose their earnings for 12-24 months. It all depends on the decision of the court.

- With forced labor. Liability for non-payment of taxes in Russia by individuals is expressed (sometimes) in the form of forced labor. Its maximum duration is no more than a year.

- With imprisonment. The ultimate measure of responsibility that only a taxpayer can bear. Imprisonment is proposed for 1 year. Possible arrest for 6 months maximum.

But there is another scenario. What are the dangers of tax evasion? According to the established rules, if this act is committed by prior agreement or in large (especially large) amounts, the punishment is more severe. It is somewhat reminiscent of the responsibility of individuals for a similar act.

Non-payment of corporate taxes

Non-payment of corporate taxes

As practice shows, the option when an individual entrepreneur does not pay taxes for three or more years is the most common type of offense. When starting their own business, each founder is faced with the issue of paying taxes. At the same time, an economic entity has the right to choose the taxation system, which determines the amount, timing and procedure for payments.

Neither tax nor criminal liability for non-payment of taxes serves as a basis for getting rid of payment obligations. Persons who participate in business management or influence decisions made by the director or chief accountant are held liable. It is possible to hold accountable employees who deal with accounting and tax documents.

1734: I don't pay for SP what will happen to me for this

A Russian company has entered into an agreement with a foreign company for the provision of recruitment services abroad. A foreign company does not have a presence in the Russian Federation and is not registered with the tax authorities. How to determine the place of sale of these services for VAT purposes?

Good afternoon. Here's the question. There are martial arts trainings. Initially, the team was created from acquaintances, they trained themselves (there is the eldest and most experienced, he trains everyone) and they themselves performed. They chipped in to rent a gym and equipment for training. Now the rent has increased, they began to invite the guys to train with us (by means of advertising in groups, etc.), of course, on the same conditions as we do, we chip off on rent and on equipment! Initially, the charter was written, the meeting was collected.

Exemption from IP tax for 2 years

Tax holidays have been introduced in Russia for 6 years: from 2015 to 2020 inclusive. Intended: - for individual entrepreneurs - on the simplified tax system or patent - for the first 2 years from the date of registration Single tax rate for the simplified tax system - 0%, tax rate for the patent - 0% but only under certain conditions. Do you meet the criteria? 1. On the territory of the SUBJECT of the Russian Federation, where the IP is registered, THE LAW on tax holidays MUST BE ADOPTED. The right to introduce this law has existed since 01/01/2015, and in most regions the relevant laws have already been adopted, but there are exceptions. For example, in Tatarstan and the Republic of Karelia there is no law on tax holidays. A complete list of all regional laws is given in the appendix to this article. 2.

Also, an entrepreneur who is exempt from taxes must continue to pay mandatory insurance premiums for pension insurance, both personally for himself and for all employees without exception.

Who will be granted tax benefits According to the new law, the tax amnesty for individual entrepreneurs applies only to those representatives of small businesses who have chosen individual entrepreneurship.

They must also meet a number of requirements:

Opened an individual entrepreneur, but did not work, is it necessary to pay taxes

In other words, if the activity is not openly conducted, or there is an intention to suspend it for a while, one must be prepared for the fact that property tax will begin to be levied on real estate. That is, the reverse situation will arise when the official stop commercial work entails an increase in the tax burden.

If citizens are not individual entrepreneurs, this does not cancel the obligation of a citizen to timely and fully pay transport tax. On the contrary, entrepreneurs who use cars in business also have some resources to reduce the amount of payment. They can attribute all maintenance and repair costs to expenses and reduce the tax base, even fees for "Plato".

What happens if you don't pay taxes

- If you decide not to pay in large amounts, which is 1,800,000 rubles (like an apartment in some cities) with a tax debt of more than 10% in this amount, you will be punished in accordance with the Criminal Code.

- Huge troubles threaten you with especially large sums of 9 million rubles, or 3 million with a share tax debt more than a fifth.

- From the tax to get their money, that is, to compensate for the damage to the budget system.

- In administrative and criminal - to punish non-compliance with existing rules in the field of public relations and prevent further offenses. Simply: so that it would be disrespectful from now on.

Individual entrepreneur has not paid fixed contributions for more than 10 years

And what about the FIU, has it really not been trying to collect debts for so many years? As a reader of our forum said, every year enforcement proceedings were opened in his name, which the bailiffs closed from year to year without collecting a penny. Wore-IP was quite happy with this situation, but the amount of debt for 2014 was an unpleasant surprise for him.

What to do? Just come to the tax office, apply for the termination of activities as an individual entrepreneur and wait until the bailiffs stop again enforcement proceedings. Something tells me that the pr-in 140,000, and not as quickly stopped as Spanish. pr-va for amounts up to 30,000, which were all these years. Help!

— Dmitry812

Exemption of individual entrepreneurs from taxes

In this regard, the question of how and in what cases an individual entrepreneur is exempted from paying taxes is very relevant. In our article, we will try to consider in detail all possible scenarios of how to get exemption from the tax burden on business and stay within the legal framework.

In accordance with article 346.20 of the Tax Code of the Russian Federation, the duration of tax holidays is 2 tax period(2 years) from the moment the IP was opened. In case of obtaining the status of an individual entrepreneur in 2020, tax holidays will affect 2020-2020. Therefore, during this time the tax is not paid.

05 Aug 2018 1020Tax holidays have been introduced in Russia for 6 years: from 2015 to 2020 inclusive.

Intended:

- for individual entrepreneurs

- on USN or patent

- for the first 2 years from the date of registration

The single tax rate under the simplified tax system is 0%,

Patent tax rate - 0%

but only under certain conditions.

Do you meet the criteria ?

1. On the territory of the Subject of the Russian Federation, where IP is registered , THE LAW ON TAX HOLIDAYS SHOULD BE PASSED.

The right to introduce this law has existed since 01/01/2015, and in most regions the relevant laws have already been adopted, but there are exceptions. For example, in Tatarstan and the Republic of Karelia there is no law on tax holidays.

A complete list of all regional laws is given in the appendix to this article.

2. An individual entrepreneur must be registered for the FIRST TIME after the entry into force of the law:

For example, in Moscow - March 2015

In the Moscow region - April 2015

In St. Petersburg - January 2016

AT Sverdlovsk region– March 2015

AT Rostov region– July 2015

Full list of dates in the appendix.

Registration for the first time means that previously an individual has never been registered as an individual entrepreneur, and then not deregistered. You can check by TIN on the portal FOR HONEST BUSINESS.

From the moment of registration, an individual entrepreneur must apply either the simplified tax system or a patent.

3. Type of activity: production, domestic services, social and scientific sphere.

Specific activities are established in regional laws (see Attachment).

Revenue sharefrom sales in relation to this type of activity should be not less than 70%.

4. Also, regional laws may establish LIMITS on the average NUMBER of employees and the maximum INCOME.

For example, in Moscow there is a limit on the number of people up to 15 people, in the Republic of Buryatia - also 15 people, and income for the year should not exceed 6 million rubles.

Check the restrictions in the law of your region, details of all current regional laws can be found in the appendix to this article.

How to exercise your right to a 0% rate

If you meet the criteria, then:

- You can apply the 0% rate for 2 years.

- At the same time, entrepreneurs are not exempted from paying fixed payments to the pension and medical funds, as well as insurance premiums for employees.

For those on USN:

submit a declaration for 2017 indicating the rate of 0%, you do not need to pay advances on a single tax.

Note:There is no requirement in the Tax Code that you need to notify the IFTS about the application of the 0% rate, but no one forbids you to insure yourself and inform the inspection about your intentions and submit a letter in any form about the application tax rate 0% in the current year.

For those on PATENT:

in the application for a patent there is a field for indicating the tax rate of 0% and a reference to the norm of the law of the constituent entity of the Russian Federation, which provides for this rate.

For those who had the right, but did not take advantage of the benefit, it's not too late!

must be submitted to the tax office :

1. Application for return overpaid tax.

2. Documents confirming the right application of the 0% rate: an extract from the USRIP, a copy of the text of the regional law, the calculation of the share of income by type of activity for which tax holidays are provided, information on the average payroll number of employees.

3. For those who are on the simplified tax system , you need to submit an updated declaration at a rate of 0%:

for 2015- in the form approved by letter No. GD-4-3/ dated 05/20/15;

for 2016- in the form approved by order No. ММВ-7-3/ 26.02.16

There is no declaration for a patent.

federal law

Tax holidays adopted by Federal Law 477-FZ of December 29, 2014

For USN:tax code, article 346.20 point 4

For a patent:Tax Code, article 346.50, paragraph 3

Appendix: Regional legislation

Information on all regional laws regarding "tax holidays" as of 07/01/17 can be downloaded .

Pozdnyakova, Elena

accounting specialist

SC "Finver"

Editorial opinion may not reflect the views of the author.

Today we have to find out what will happen if we do not pay taxes. In fact, this question interests many citizens. Also, the answer may seem useful to organizations and individual entrepreneurs. After all, if you know about responsibility, everyone will be able to avoid negative consequences. This should be remembered. So what should the residents of Russia pay attention to? Is there any punishment for them, and if so, what exactly? All this will be discussed later. In fact, understanding the question is easier than it seems. Especially if you have knowledge of the Tax Code of the Russian Federation.

Is there any responsibility

The first thing you should pay attention to is the existence of liability for non-payment of taxes. Does it exist in Russia? If so, who exactly will carry it?

The answer is not so difficult. Responsibility for non-payment of taxes in Russia takes place. But the exact punishment will depend on many factors. For example:

- on the type of taxpayer;

- from the amount of non-payment;

- from the delay in payment.

Accordingly, it is not so easy to say exactly what taxpayers are afraid of. The only thing that people in Russia say with certainty is that non-payment of taxes necessarily entails a number of negative consequences. Which ones? They will be discussed further.

penalties

What happens if you don't pay taxes? The first problem that all taxpayers face is penalties. This is a monetary penalty that increases the tax paid by a certain amount. Charged daily. Accordingly, the longer a citizen or organization does not pay, the more they will eventually have to give to the state.

Penalties begin to accrue from the moment the debt is formed. That is, if the tax is not paid before the deadline, the next day the payment will increase. This measure applies to all taxpayers. Therefore, it is recommended not to delay with the studied payments.

Individuals

There are several types of taxpayers. They are subject to various penalties for non-payment of taxes. What are the options for the development of events?

The first large group of taxpayers is For them, as a rule, there are income taxes, as well as property, transport and land taxes. What to expect if ignored payment order from the tax office?

What happens if you don't pay taxes? There are several options for punishment. What exactly? The Tax Code of the Russian Federation will help answer. According to him, you may encounter:

- With foam. Citizens who are late in paying taxes will have to cover the penalty when paying. This measure has already been discussed. The amount of additional costs directly depends on how much the calculation was delayed.

- With fines set. The most common measure of responsibility, which is only found in Russia. The penalty for non-payment of taxes, according to the established rules, is set on an individual basis, but with some restrictions. Citizens pay 100-300 thousand rubles or lose their earnings for 12-24 months. It all depends on the decision of the court.

- With forced labor. Liability for non-payment of taxes in Russia by individuals is expressed (sometimes) in the form of forced labor. Its maximum duration is no more than a year.

- With imprisonment. The ultimate measure of responsibility that only a taxpayer can bear. Imprisonment is proposed for 1 year. Possible arrest for 6 months maximum.

All of the above punishments are the responsibility of individuals for non-payment of taxes due in accordance with established legislation. Similar measures are also provided for the preparation of false documents or for failure to submit a tax return by the due date.

Special sizes for individuals

Now it is clear what will happen if you do not pay taxes. Only all of these measures can not be called the only one of its kind. Responsibility is sometimes expressed in a slightly different way. What is this about?

On tax evasion on an especially large scale. Such a crime has harsher penalties for negligent taxpayers. What exactly?

The penalty for non-payment of taxes in such a situation will increase. Now, for the perfect deed, you will have to pay from 200 to 500 thousand. As an alternative punishment, a payment is made in the form of a citizen's profit for 1.5-3 years. Forced labor also takes place. If taxes are not paid on a particularly large scale, the court may impose 36 months of forced labor. Or imprisonment for a similar period. But the arrest is no longer taking place.

It is these measures that are provided for individuals, if Article 198 of the Criminal Code of the Russian Federation indicates such measures. But it has another interesting nuance. About him a little later. First you need to figure out what the non-payment of legal entities and individual entrepreneurs will result in.

Individuals and organizations

The difference is not too big in the established punishments. But for organizations and individual entrepreneurs, as a rule, the consequences of debts to tax authorities are more dangerous than it seems. In the course of such events, the company may cease its activities.

Tax evasion is punishable by:

- Fine. Like individuals, individual entrepreneurs and legal entities. persons pay from 100 to 300 thousand rubles. As an alternative amount, you can lose profits for a maximum of 2 years.

- Forced labor. A distinctive feature is that the organization is deprived of the right to conduct a particular activity. More precisely, the taboo is imposed on the violator. Most often - on the head of the organization. The maximum duration of punishment is 2 years for works and 3 for activity restrictions.

- Arrested for six months.

- Imprisonment. It is usually associated with a restriction in the conduct of a particular activity. The limits of punishment are exactly the same as with forced labor.

Everyone should know what will happen if they do not pay taxes. In addition to these penalties, organizations face penalties. Therefore, the increase in invoices still takes place.

Special cases

But there is another scenario. What are the dangers of tax evasion? According to the established rules, if this act is committed by prior agreement or in large (especially large) amounts, the punishment is more severe. It is somewhat reminiscent of the responsibility of individuals for a similar act.

Accordingly, you may encounter:

- Cash payments. Fines are set up to half a million. You can also lose income for 3 years.

- Forced labor for a maximum of 5 years. Additionally, the head of an organization or entrepreneur may be deprived of the opportunity to conduct a particular activity, as well as to hold specific positions. Such a measure lasts no more than 3 years.

- Imprisonment. Along with it, a taboo is imposed on activity. The duration of punishments is up to 36 months inclusive.

It follows that taxpayers face roughly the same consequences. But with a small caveat. Which one?

Disclaimer

The fact is that it is far from always necessary to think about what will happen if you do not pay taxes. In Russia, criminal punishment can sometimes be avoided. This feature applies to all taxpayers.

According to the established rules, if an individual entrepreneur, organization or just a citizen independently closed the debt and paid the penalties in full, you can not be afraid of responsibility. But such an indulgence applies only to cases when the violation is committed for the first time.

Results

From now on, it is clear what threatens non-payment of taxes. In practice, most often citizens are faced with penalties. But criminal responsibility does not occur so often. At least for individuals. And this is good news.

All citizens must pay taxes. In some cases bailiffs seize property for which they do not pay. Every taxpayer should remember this.

In 2017, a new measure of punishment for non-payment of taxes comes into force in Russia. Citizens who did not pay on time transport, property or land tax will be fined. The payment amount will be 20% of the invoiced tax.

At the age of 19, I started my own business without any help that the state owes me. I did everything myself.

Why do I pay dues? For your future pension or for the pension of your parents and grandparents? I cry for air - not otherwise. No help for small businesses - just words.

The tax inspector laughed when she saw that the expenses exceeded the income for the year. She asked: “And for what IP? Shut up and sew at home calmly - do not disgrace yourself!

I wrote a complaint against her and I want to know why I pay taxes.

Ekaterina, 22 years old, Mordovia

Indeed, it is infuriating to pay taxes and contributions to the state and not receive assistance from it if you do not know where your money is going. Let's figure it out.

Natalia Bogatyreva

What are the taxes that go to the budget spent on?

The state collects taxes from all citizens and spends them on general needs. Kindergartens, schools, universities work with this money, public transport, courts and police. The same money goes to social programs, support for the poor, payments to families with children, including maternity capital.

The state forms the budget not only at the expense of our taxes. The main source of formation of the federal budget is oil and gas revenues. It also receives income from the use and sale of state property, fines and more. Federal grants and subsidies for the implementation of targeted programs are directed to the lower budgets. But the key role in the replenishment of regional and municipal budgets is played by tax income.

Income taxes paid by individual entrepreneurs are credited specifically to the budgets of Russian regions and municipalities. They allow the city and the region in which you live to exist and develop. The laws on regional budgets describe in detail how much money and for what purposes the region needs to spend.

Let's look at an example

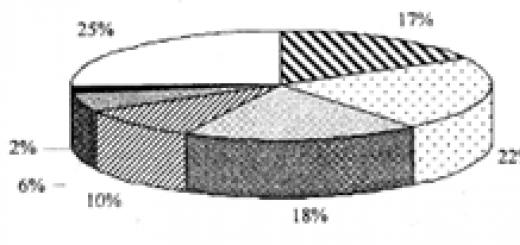

You write that you live in Mordovia. In 2017, the budget of the republic received 34.7 billion rubles of income. Of these, 21.5 billion rubles - due to taxes. This is almost twice as much as subsidies and other payments from the federal budget.

890 million rubles of tax was collected thanks to application of the USN. IP paid almost half of this amount. Individual entrepreneurs on the general taxation system and other persons engaged in private practice paid 28 million rubles in personal income tax.

For comparison, in Mordovia in 2017 they spent from the budget:

- For social security - 7.5 billion rubles.

- For preschool education - 2 billion rubles.

- For the salaries of deputies - 63 million rubles.

I often hear from acquaintances that deputies receive too much and it would be better if the state spent their salaries to cover citizens' taxes. As statistics show, these are incomparable categories: even if deputies agree to work for free, individual entrepreneurs will still have to pay taxes.

Suppose that all entrepreneurs in Mordovia do not pay taxes, then other items of expenditure will be underfunded: there will not be enough for teachers' salaries or for roads.

We pay taxes and in return we get free education, law enforcement and courts, emergency protection, product quality control.

Not everything works perfectly. It wouldn't work at all without taxes.

What do insurance premiums go to?

Insurance premiums are not taxes, but they are also obligatory to pay. Due to these contributions, free healthcare works and pensions are paid. Childcare benefits and sick leave are also paid through contributions, but their IPs are paid voluntarily.

Compulsory health insurance contributions. These contributions are paid by everyone who has an income. For those who do not work, contributions are paid by the state.

Contributions to CHI in 2017 throughout Russia

Insurance premiums for CHI

Who pays

1.7 trillion R

Contributions for the working population

Who pays

Employers

1 trillion R

With this money, you can get vaccinations, treat teeth, take tests and receive medicines. Almost all the money that the budget received in 2017 went to the Health Development program - in the amount of 1.6 trillion rubles.

I understand that at the age of 22, pension points are a dubious argument, while deductions to the treasury hurt your pocket. IP contributions are recorded on his personal account, albeit in the form of points. But they do not disappear without a trace, but go to the pensions being paid now. Whoever pays more gets more points.

Your resentment about pension contributions is understandable. The state is constantly changing the procedure for calculating pensions, recently raised the retirement age. By current rules It is difficult for an individual entrepreneur to save up for a decent pension only at the expense of assessed contributions. Because these fixed contributions Individual entrepreneurs are paid in such a way as if they only earn the minimum wage - about 11 thousand rubles a month. It is from such amounts that their future pension is formed. Want more - pay extra voluntarily. The Russian pension system is painful. But she works.

Due to your contributions, the funds for the payment of current pensions are replenished. The state pays them to the elderly, the disabled and those who have lost their breadwinner. To support these people is the duty not only of the state, but of the whole society. The contributions you pay now go to pay pensions for your grandparents, sick relatives and all those who have no one to take care of. This is an important element of the welfare state. If someone cannot work, the state will pay a pension from someone's future contributions.

Contributions are not the only source of funding for the pension fund. The pension contributions that go to his budget now are not enough to pay pensions to everyone. Therefore, the state has to pay a significant extra.

How to pay less

Become self-employed. Take a closer look There's no reporting at all low rates tax and do not have to pay mandatory insurance premiums. But you will have to save up for your pension on your own: the insurance experience of the self-employed is not taken into account and points are not awarded to them.

Close IP. Heed the advice of the inspector. Maybe she didn't mean to offend you. If you take one-time orders, it is not necessary to register as an individual entrepreneur. You can only pay personal income tax at a rate of 13% on each order. The tax can be significantly reduced by applying Insurance premiums do not need to be paid.

What assistance will an individual entrepreneur receive from the state

State and municipal assistance can be obtained if you know about it and apply for it in time. Information is published on the websites of regional ministries of economy, business support centers and employment centers. There is a special website for supporting and developing entrepreneurship - the SME Business Navigator portal. In Moscow, they consult at business service centers.

Money for business registration. The state helps the unemployed and the poor to organize an individual entrepreneur and start working. The unemployed must be registered with the employment service in order to receive information assistance in developing their business and financial assistance in paying the costs of registering an individual entrepreneur. The amount of financial assistance is determined by the subjects of the Russian Federation. In Moscow, it is limited to 10,200 rubles.

Development subsidies. The poor can receive financial assistance under the social contract. The state will give them money for the creation and development of individual entrepreneurs, but will monitor how the money is spent and what are the results. To receive such assistance, you need to have an official income below living wage. The amount is set by local law. For example, in Mordovia they give 10 thousand rubles. In Primorsky Krai - up to 50 thousand rubles.

Free consultations. The rest of the citizens of Russia can also get free advice on opening an IP in business support centers. They are created in each region. On the SME Business Navigator portal, you can create a business plan. You need to register, but it's free.

Discounted rent. In many regions, there are business centers where start-up entrepreneurs are given offices for rent at a reduced rate. For example, three times cheaper than the market price. In addition to the premises itself, you can get all the furniture, office equipment and even accounting services for free. Not everyone knows about this, but two floors in some business center in the very center of the city may turn out to be a business incubator with such conditions.

Grants and concessional loans. Financial assistance to IP includes targeted subsidies, concessional loans, loans and leasing. On the SME Business Navigator portal, you can choose from assistance options provided by SPs in your area.

Individual entrepreneurs can receive state support - this is not a myth. Find out what forms of support are available and apply. The state creates opportunities to support business, but the initiative is up to the entrepreneurs themselves. This is where your taxes go. But it is quite possible that they could be spent even more efficiently.

If you have a question about personal finances, expensive purchases, or family budget, write: [email protected] We will answer the most interesting questions in the magazine.

Opened an individual entrepreneur, but did not work, do I have to pay taxes? It all depends on what system of taxation the entrepreneur used before the circumstances arose. On the general regime and the "simplified" one can avoid settlements with the budget for income received, on UTII and a patent - no. You will have to pay insurance premiums for yourself to the FIU until the IP is removed from the register. The article provides options for resolving the situation.

How to suspend the activity of an individual entrepreneur legally

In business practice, there are circumstances when a citizen who conducts entrepreneurial activities without education legal entity, there was no need to do business, for example, during his vacation.

First of all, a businessman has a desire to officially suspend activities by writing a statement to tax authority. He hopes that if the individual entrepreneur does not operate, then the obligations for payments to the budget and to Pension Fund will not occur.

If the enterprise did not work, the tax legislation allows individual entrepreneurs not to pay taxes when using tax regimes, where the amount of tax depends on the amount of income. Insurance premiums that an individual pays for himself are mandatory for payment while registration is valid. We will cover this in more detail in the following chapters.

You can find an acceptable solution in two directions:

- Select OSNO or STS as the tax regime, if possible in the near future. The object of taxation (income or income minus expenses) does not matter here: the enterprise did not work, there was no revenue, and there is nothing to charge taxes for the reporting period - they can not be paid. In this case, the entrepreneur remains obliged to submit zero declarations and pay insurance premiums “for himself”. How to do it? Unfortunately, the transition to a "simplified" system from another system is possible only at the end of the calendar year, so you must either wait until January 1, or use the path described in the next paragraph.

- Close IP. The most convenient option. You will have to submit reports, pay taxes and insurance premiums in the amount corresponding to the period for which the IP did not work. The law does not prohibit arbitrarily often to close and re-register business. The main thing is to pay the accrued taxes and fees in a timely and correct manner.

To close, you must submit an application to the IFTS, where the IP was registered, and attach a receipt for payment of the state duty to it.

Social contributions

Regardless of whether the individual entrepreneur works in the chosen profile and which taxation system he preferred, contributions must be paid to the Pension Fund and the FSS. These fees are paid only for themselves if the employer did not have employees in reporting period. This is a significant difference from an organization that is not obliged to pay them if it does not work and does not maintain a staff.

- BASIC. When using the general regime, two types of taxes are calculated - VAT and personal income tax. The first one should be charged if there is a realization. In the absence of value added, this budgetary payment is no longer necessary. Income tax here it is calculated from the difference between income and expenses. When an individual entrepreneur does not conduct business, he does not receive income, and he has no expenses. That is, there is no object of taxation here. As a result, there are no obligations to transfer mandatory payments to the budget. However, at the end of the year, the businessman must file a declaration with zero indicators.

- USN. Here the situation is identical and the tax is calculated depending on income or on the difference between revenue and expenses. In both cases, due to lack of activity, there is also no object of taxation, that is, there is nothing to replenish the budget from. But it is necessary to report - once a year, according to the simplified tax system.

- ENVD. The essence of this regime is that reporting and paying taxes here do not depend on revenue. Budget payments are calculated from the estimated income, which is set regulations at the federal and regional levels. It is possible to avoid paying it if you write an application for deregistration as an "imputation" payer. If you do not choose another system instead, the taxpayer automatically switches to the OSNO and, without working, will pay only “his” insurance premiums (see item 1 of the list).

- PSN. This tax regime allows you to register the right to work in a certain area for a short period - from a month to a year. However, the expiration of a patent does not automatically mean that taxes do not have to be paid.

In case of non-renewal of the PSN, the entrepreneur will be required to report under the general system. The first paragraph of this list describes how the situation will develop in these circumstances.

Other taxes

In addition to budget payments directly related to commercial activities, there are a number of taxes that are indirectly related to business, but impose obligations on a businessman.

In addition to budget payments directly related to commercial activities, there are a number of taxes that are indirectly related to business, but impose obligations on a businessman.

Consider what individual entrepreneurs should do if they do not conduct activities, but the object of taxation is present.

A citizen who owns real estate in the territory of the Russian Federation is obliged to pay the corresponding tax. The inspection takes information about the number of objects in the property from the database of the cadastral chamber, calculates the budget payment and sends a notification to the address of the place of residence. The message contains the amounts to be paid and the deadlines for the transfer of money.

However, this procedure is provided only for those citizens who do not have a personal account on the website of the Federal Tax Service. If such a service is activated, then notifications are published in electronic form and are not sent to the home address.

But for an individual with the status of an individual entrepreneur, some features are provided. A citizen's property can be used in business. And then it is not taken from him. In order to achieve preferences, persons engaged in commercial activities must notify the tax authorities of this fact by attaching documentary evidence.

In other words, if the activity is not openly conducted, or there is an intention to suspend it for a while, one must be prepared for the fact that property tax will begin to be levied on real estate. That is, the opposite situation will arise, when the official stoppage of commercial work entails an increase in the tax burden.

pensioners tax on real estate do not pay, but this applies only to housing, outbuildings and garages. This exemption does not apply to businesses.

Possessed individual vehicles are taxed accordingly. The tax authorities calculate the budget payment themselves, then sending a notice to the home address with the amount payable and deadlines for payment. If a citizen has on the site tax service Personal Area, he receives a notice in electronic form, and not by mail, as before.

Possessed individual vehicles are taxed accordingly. The tax authorities calculate the budget payment themselves, then sending a notice to the home address with the amount payable and deadlines for payment. If a citizen has on the site tax service Personal Area, he receives a notice in electronic form, and not by mail, as before.

If citizens are not individual entrepreneurs, this does not cancel the obligation of a citizen to pay transport tax in a timely manner and in full. On the contrary, entrepreneurs who use cars in business also have some resources to reduce the amount of payment. They can attribute all maintenance and repair costs to expenses and thereby reduce the tax base, even fees for Platon.

If a vehicle was bought for commerce, with the suspension of activities, the best way out is to sell it.

Land tax

Individuals who own land plots are required to pay the appropriate tax. The size of this budget payment strongly depends not on the purpose for which it is used, but on the category in which the object is put by regional legislators. The value of the tax rate depends on this - the minimum for personal plots, agricultural land and the maximum for industrial or commercial areas.

In this area, a situation is created in which the amount of the final tax does not depend. If you want to suspend the activity of an individual entrepreneur and avoid the tax burden, the best way out is to sell commercial land or rent it out. However, in this case, an individual will have to file an annual 3-NDFL declaration, where they reflect the income received and still pay income tax.

As a result, the suspension of IP status is impossible. It is only possible to use tax regimes under which the absence of activity allows making settlements with the budget only for such taxes as property, transport and land taxes. But it is not exempt from the obligation to pay contributions. But the best way out would be to write an application to the Federal Tax Service with a request to remove it from the register. In the future, you can register again. The law does not limit the number of attempts.