AT payment order there is a field "21", which just indicates the order of payment. In this field, you must specify a number from 1 to 5. Each number has its own queue. We will tell you in the article how to correctly fill in the order of payment in the payment order in 2020.

Order of payment in a payment order: rules in 2020

If the current account of the organization or individual entrepreneur has a sufficient amount Money, then in this case the field "21" does not affect anything. The bank will make payments in the order in which they will come to it, that is, in a calendar queue.

But if there is not enough money on the current account to make all payments, then the bank must write off payments in the order in which it is established by law.

Thus, the order of payment will be taken into account or not taken into account by the bank when executing a payment order, depending on the situation:

- if there is money on the current account, it will not be taken into account;

- if there is no money on the account, it will be taken into account.

The order of payment specified in the payment order for payment is not changed by the bank. And if you specify the wrong order of payment, the bank may simply not accept such a payment. This means that any accountant needs to know which queue corresponds to which payment.

However, according to the latest clarifications, the bank is obliged to skip the payment, even if the company filled in field 21 with an error.

Order of payments in 2020

So, each type of payment has its own order: 1, 2, 3, 4 or 5.

|

Turn |

Payment type |

|---|---|

|

Payments providing for compensation for harm caused to life and health; Alimony claims. |

|

|

Payments under executive documents providing for the payment of severance pay and wages to employees (working and dismissed); |

|

|

Wages of employees (current); Payment of arrears on taxes and contributions (at the request of the tax). |

|

|

Fourth |

Payments under executive documents for other claims for payment. |

|

Other payments (in calendar order). |

Thus, it is important to understand:

- claims for the payment of taxes and contributions from regulatory authorities (collection orders) must be paid in the third place,

- and payments that the organization draws up for the payment of taxes or contributions on its own - in the fifth place.

Note! Write-offs of funds related to the same queue are made in the order of the calendar queue (that is, the document that first entered the bank will be executed first). Current payment orders for 2020 can be found in the article

The sequence of writing off penalties and fines

With regard to the order of writing off penalties and fines for tax requirements, accountants have questions. After all, payment of taxes on demand refers to the third stage, but the civil code does not say anything about penalties and fines. So how to be?

This question was answered by the Ministry of Finance. He explained that the execution of instructions from the tax authorities to pay penalties and fines to the budget of the Russian Federation is not provided for in the first or fourth priority.

Thus, it is easy to conclude that the payment of penalties and fines at the request of the tax authorities should be made in the fifth place.

Read

Payment order with decoding of fields

What order of payment to put down in the payment order

The order of debiting money from the current account in case of their insufficiency is established by Article 855 of the Civil Code of the Russian Federation. There are five lines in total:

first of all- payments under executive documents that provide for compensation for harm caused to life and health. As well as the payment of claims for the recovery of alimony;

second stage– Payments under executive documents that provide for the payment of severance pay and wages to former or current employees, as well as payment of remuneration to authors of intellectual activity;

third stage- the current salary of employees. Write-off of debt on and on behalf of Write-off of debt on the payment of contributions on behalf of the control services of state off-budget funds;

fourth turn- payments under executive documents for other monetary claims;

fifth turn- all other payments in the order of the calendar queue

But if there is enough money in the account to make all the declared payments, the bank will write off the funds in the order of the calendar turn.

What order of payment to write in the payment for the transfer of taxes and contributions

To list taxes and mandatory insurance premiums(penalties and fines on these payments) in field 21, you must enter the value 3 or 5. These values show in what order the bank will make payments if there is not enough money in the company's account.

The value 3 is indicated in payment documents issued by tax authorities or employees of funds in the event of forced collection of debts. Specify the value 5 in payments when voluntarily transferring current payments.

That is, the bank will execute the company's instructions for the transfer of current tax payments later than the requirements of the regulatory authorities for the repayment of arrears (clause 2 of article 855 of the Civil Code of the Republic of Russia, letter of the Ministry of Finance of Russia dated January 20, 2014 No. 02-03-11 / 1603).

What is the order of payment

Banks require that field 21 be filled in in all payments, with the exception of those related to the transfer of money to mandatory reserves or the return from these reserves (paragraph 2, clause 4.8 of Regulation No. 384-P dated June 29, 2012).

If there is enough money on the current account to make all the declared payments, the value of field 21 has little effect. Since the bank will execute payment orders in the order in which they arrive. But bank employees still require that field 21 be filled out in accordance with all the rules.

It turns out that, on the one hand, the order in which payments are debited matters only if there is not enough money in your account. On the other hand, banks are asked to redo an incorrectly executed payment order, regardless of the state of the current account.

The order in which payments are made will change.

The Ministry of Labor plans to change the order in which money is debited in the event of a company's bankruptcy (the bill to Federal Law No. 127-FZ of October 26, 2002 was published on the Single Portal).

At the stages of bankruptcy, the current payments of the bankrupt company on insurance premiums are written off in the fourth queue. Payments on contributions according to the requirements of creditors - in the third place (Article 134 of Law No. 127-FZ).

The Ministry of Labor proposes to transfer payments on contributions on demand to the second stage. Due to their high social significance, the growth of arrears in contributions from companies in bankruptcy proceedings. If the firm is in bankruptcy, contributions will be paid along with claims for severance pay and wages.

The order of payment in the payment order in 2020 is mandatory for any money transfers. The priority depends on which account the bank will make your payment. In our article, you will find out in which cases this or that priority is set, we will show the priority table and a sample payment order.

What is the order of payment in 2020

The order of payment (OP) is an important element of a payment order. It is put in field 21. It fits into the document in any situation, wherever your money is sent. In fact, this is an encryption to the bank, how urgent this transfer is. There are five sequences in total.

Based on this indicator, the bank withdraws money from the current account in one way or another. If there is 1 in field 21, this is a signal that this money needs to be sent to the address in the first place. What is it for:

- To send a payment to a financial institution, a day is given from the moment the order is received. In such a situation, it is necessary to streamline deductions so that they go one after another. But there are urgent translations, there are current ones. And the OP lets you put them in the right order;

- If there is a shortage of funds on the current account, money will be sent first of all for the most urgent payments (Article 855 of the Civil Code of the Russian Federation);

- As the money comes in, they will be distributed among current payments in a strictly defined sequence;

- And the most important! There are transfers that the bank is obliged to perform even without your instructions. These are alimony, compensation for grievous bodily harm, etc. They always come first.

Table of order of payments in 2020

In 2020, there will be only five queues. They depend on what the legal entity instructs the bank for the payment. A company or individual entrepreneur most often uses two: the third and fifth. Rest financial institution can carry out independently, since they are based on writ of execution.

|

Order of payment |

What funds need to be sent from the current account |

|---|---|

|

|

|

Transfers on writ of execution related to additional payment to employees (fired or employed) of their earnings or benefits upon dismissal |

|

|

|

|

Transfers on writ of execution, except for those mentioned above |

|

|

All other deductions |

Important! If several payments come to the bank at once with the same priority, then they will be executed as they arrive.

The order of payment for taxes, contributions, wages in the payment order 2020

Taxes, fees, penalties, fines, wage etc. have OP 3 or 5. As a rule, all fines, penalties, additional payments to employees go under the number 3 when the Federal Tax Service insists on their deduction. Everything else is number 5.

|

Payment |

Order and decoding |

|---|---|

|

Salary |

It is divided into current and delayed (underpayment).

|

|

Income tax |

Under the standard payment procedure, that is, they gave out a salary, transferred personal income tax - 5 If at the request of the Federal Tax Service - 3 |

|

Insurance premiums |

The employer is a conscientious payer and deducts contributions in a timely manner - 5; Tax obliged to pay additional contributions - 3 |

|

|

|

Material aid |

If it is not associated with writ of execution, and the employer allocates funds of his own free will - 5; In a situation where, through the fault of the employer, the employee was injured, and the court ordered the enterprise to compensate for the damage, which the latter does in the form of financial assistance - 1 |

|

Fine, penalties |

If the organization admits its guilt and voluntarily agrees to pay a fine or penalties - 5; Upon receipt of an appropriate commitment from a government agency - 4 |

|

State duty |

There will always be OP - 5 The logic here is simple - there is no duty, there is no service, so no one will oblige anyone to pay |

|

Dividends |

Put 5 |

How to prioritize payment in a payment order in 2020

For the requisite order of payment, field 21 of the payment order is intended. This procedure is prescribed in the Regulation of the Central Bank of the Russian Federation of June 19, 2012 No. 383-P.

It should be noted that in the absence of a shortage of funds in the account, an error with the OP will not become fatal. The next day after receiving the payment, the bank will fulfill your requirement for any. But he will do this in the order in which payment documents come to him.

OP plays a fatal role only in the absence of required amount. If the money is spent on transfers that can wait a little bit, then urgent deductions will remain unfulfilled. And it's already annoying.

How to fix the incorrect order of payment in a payment order in 2020

Even if you made a mistake with the OP in the payment, the bank will accept your order. To do otherwise, he has no right. But he will deduct money in a calendar order, that is, as orders arrive. However, two more scenarios are possible:

- The financial institution itself may ask you to correct the pay slip. This is likely because the review carefully monitors compliance with the OP;

- The bank itself will redraw the queue, in accordance with the rules for its observance. After all, the purpose of the payment is indicated in the order. And those transfers that, according to the law, must be carried out first, he will make the first.

In this case, if you have enough money to current account, no need to worry.

New KBK in 2020

In 2020, the Ministry of Finance decided to introduce a new CCC for payment orders. The experts of the magazine "Salary" told what will change.

Orders of payments - changes in filling in requisite 21

When opening a settlement or current account in a bank, about order of payments (the order in which funds are debited) no one thinks from the account - everyone is set to work without financial problems. Nevertheless, everyone gets acquainted with the concept of "priority of payments", and occurs at the first filling of a payment order or payment request. So what is the "priority of payment" and where is it affixed?

Priority of payment - definition

Order of payment- this is the sequence, fixed in the Civil Code of the Russian Federation, of debiting funds by the bank from the accounts of customers according to the received orders (settlement documents), the payment deadline for which has already come or is coming on the day they are received by the bank.The payment queue does not depend on the types of orders received by the bank (payment orders, payment requests, collection orders, ...) to the client's account, but depends on the availability of funds on this account and their sufficiency to pay for all received settlement (payment) documents.

Where and what designations indicate the order of payment

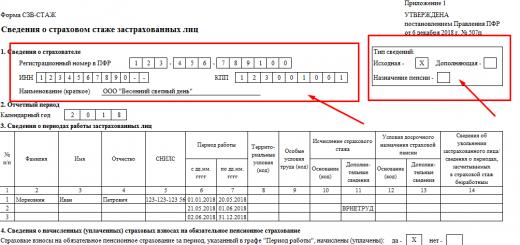

The order of payment is indicated in all types of customer orders. So, according to the Regulation of the Bank of Russia dated June 19, 2012 N 383-P "On the rules for transferring funds", the order of payment (21 details number) is indicated in the following types customer orders:

- In the payment order (See the form in Annexes No. 2 and No. 3 of the Regulation)

- In a collection order (See the form in Appendices No. 4 and No. 5 of the Regulation)

- In the payment request (See the form in Appendices No. 6 and No. 7 of the Regulation)

- In a payment order (See the form in Appendices No. 9 and No. 10 of the Regulation)

Since December 14, 2013, the order of payments has been established - 5(from the first to the fifth), and one of these five queues is always placed in the payment document - a change has been made to the Civil Code of the Russian Federation federal law dated December 2, 2013 N 345-FZ. The same federal law abolished 6 order of payment.

Payment documents are accepted by banks for execution with the obligatory filling in of all details, which include filling in 21 details, therefore, a payment document without this detail from the client is practically not accepted by the bank for execution.

The procedure for making payments and the existing types of order of payments

Article 855 of the Civil Code of the Russian Federation of January 26, 1996 N 14-FZ establishes two fundamental priorities for debiting funds from a client's account and describes the procedure for making payments:

- Calendar sequence of payments- if there are funds on the client's account, the amount of which is sufficient to satisfy all the requirements for the account, that is, banks debit funds from the account in the order in which the client's orders and other documents for debiting are received.

- Order of payments (in the sequence established by law)- if the funds on the account are insufficient to satisfy all the claims made against it, the order of debiting funds established by paragraph 2 of Article 855 of the Civil Code of the Russian Federation is applied.

Order of payment (in the sequence established by law)

In accordance with paragraph 2 of Article 855 of the Civil Code Russian Federation(as amended by the Federal Law of 02.12.2013 N 345-FZ) write-off of funds, if the funds in the account are insufficient to satisfy all the requirements presented to it, is carried out by banks in next order:

- First of all (priority of payment 1)- on executive documents providing for the transfer or issuance of funds from the account to satisfy claims for compensation for harm caused to life and health, as well as claims for the recovery of alimony;

- In the second turn (priority of payment 2)- according to executive documents providing for

transfer or issue of funds for settlements on the payment of severance pay and wages with persons working or working under an employment contract (contract), for the payment of remuneration to the authors of the results of intellectual activity; - In the third turn (priority of payment 3)- according to payment documents providing for the transfer or issuance of funds for settlements on wages with persons working under an employment contract (contract), instructions from tax authorities to write off and transfer debts for paying taxes and fees to budgets budget system the Russian Federation, as well as instructions from the bodies controlling the payment of insurance premiums to write off and transfer the amounts of insurance premiums to the budgets of state non-budgetary funds;

- In the fourth turn (priority of payment 4)- according to executive documents providing for the satisfaction of other monetary claims;

- In the fifth turn (priority of payments 5)- for other payment documents in the order of calendar priority.

If there are insufficient funds on the account, the account manager has only a limited opportunity to regulate the order of making those payments that were received on the same day and fell into the same queue.

In payment documents, the order of payment (in field 21) is always indicated, although from the foregoing it can be concluded that the calendar order of payments is applied in the following cases:

- when there are enough funds in the account for all payments;

- within each (one) order of payment, when there are not enough funds;

- when making all payments of the fifth order.

So, from December 14, 2013, the number of payment queues decreased from 6 to 5 in accordance with the amendments introduced by the Federal Law of December 2, 2013 N 345-FZ "On Amendments to Article 855 of Part Two of the Civil Code of the Russian Federation".

In line 21 of the payment order, you must fill in such details as "priority of payment". The order of payment in the payment order in 2017 must also be indicated when paying taxes. It is possible that companies have certain difficulties in understanding the procedure for filling in this field. Let's try to figure out what needs to be indicated in this field of the payment order.

What does the order of payment in a payment order mean?

The sequence of payments is determined by Art. 855 of the Civil Code of the Russian Federation. At the same time, from December 14, 2013, a new version of the article is in force, according to which the number of queues has decreased. Consequently, the organizations had enough time to familiarize themselves with the changes in legislation. There were no changes in 2016. At the same time, we recall the existing procedure, having considered the issues of the order of payment in the payment order in 2017.

The specified norm provides the procedure for writing off funds from the taxpayer's account, including in case of their insufficiency. If there are enough funds in the organization's account, the debit will take place in the order of calendar priority. That is, we note that the specified requisite is primarily necessary for the bank that will transfer funds - either in chronological order when receiving payments for payment (if funds are sufficient), or in the order established by law (if funds are insufficient).

Order of payment in a payment order

If there are not enough funds, in this case, payments are first made sequentially in the following order:

- settlements on the so-called requirements of a “personal nature” (compensation for harm, alimony);

- transfers to employees under executive documents (including former ones);

- remuneration of employees, as well as transfers on behalf of tax authorities for debts;

- other requirements that are not included in the first three groups listed, according to executive documents;

- other transfers according to payment documents.

Thus, as we see from the specified list, when filling out a payment order for the payment of tax, penalties, fines, an organization should understand the differences between the third and fifth stages of payment in the payment order.

What are the differences between the third and fifth lines

In the event that the company independently pays any payments to the budget (for example, advance payment for income tax), in column 21 she must indicate 5 (this will mean the fifth line). If we are talking about payment of a collection order tax authority, exhibited in connection with the presence of a particular tax debt, then in this case this payment will refer to the third stage (it is necessary to put down 3).

Thus, all voluntary tax payments paid by taxpayers on their own belong to the fifth priority. Accordingly, all transfers for collection - to the third. Knowing these differences in the order of payment in the payment order of 2017, the company will be able to correctly generate a document for payment.

Errors in the order of payment in the payment order

It is important to note that if the specified details are filled in incorrectly, the bank is still obliged to accept the payment order for execution. This should not be grounds for refusing to make a payment. At the same time, since it is the bank that will be required in case of non-compliance with the order of payments when they are written off, the organization is recommended to meet the requirements of the bank and correct the error in the details.