M.A. Kokurina, lawyer

There is a writ of execution - how to get your money

What can organizations do so that the money or property that has been awarded is received as soon as possible

When your company sued a debtor - an organization or a citizen - money or property, an accountant may remain face to face with a writ of execution. "What to do with such paper?" - a question to which you will find the answer in our article.

Carefully check the content of the executive document.

It must contain Part 1 Art. 13 of the Law of October 2, 2007 No. 229-FZ (hereinafter - the Law):

- the name and address of the court that issued the writ of execution, the surname and initials of the judge;

- the date of issue of the writ of execution, the name and number of the case on the basis of which it was issued;

- the date of adoption of the court decision and its entry into force or an indication of immediate execution;

- information about the debtor and the recoverer (for example, for an entrepreneur - full name, date and place of his state registration, TIN; for an organization - name, location, date of state registration, TIN);

- the resolutive part of a judicial act containing a demand for the payment of money to the recoverer or the transfer of property.

If any of these no details or details(for example, the signature of the judge is not visible on the writ of execution and Decree of the FAS VVO dated February 24, 2011 No. A43-8946 / 2007):

- <или> the bailiff may refuse to initiate enforcement proceedings and p. 4 h. 1 art. 31 Law, and the bank - not to accept the sheet for execution;

- <или> the debtor can challenge the performance on such a document in court.

In both cases, contact the court that issued the writ of execution as soon as possible with a written application for correcting errors or clarifying information so as not to miss the deadline for its presentation for execution. Clearly state in the application what kind of error you found.

From "Real Partner" LLC,

address: Moscow, st. Nametkina, 27,

phone: 287-15-46, fax: 287-15-47,

email mail: [email protected]

Statement

on the clarification of the information contained in the writ of execution

LLC Realny Partner requests that the missing information be entered into the writ of execution, series AS No. 001454647, issued by the Moscow Arbitration Court on July 14, 2012 in case No. A40-22630 / 07-48-175 in relation to LLC Imaginary Partner. The writ of execution does not indicate the date of entry into force of the court decision to recover from the debtor 141,000 (one hundred and forty one thousand) rubles. Also, in any form, make any statement in enforcement proceedings(for example, upon presentation of a writ of execution for execution - an application to initiate enforcement proceedings)

Applications:

1. A copy of the writ of execution, series AS No. 001454647, dated July 14, 2012

2. A copy of the decision of the Arbitration Court of Moscow dated July 14, 2012 No. A40-22630 / 07-48-175.

3. A copy of the decision of the participants of Realny Partner LLC dated January 15, 2010 on the election of A.E. Vyskalnikov to the position of General Director of Realny Partner LLC. Any Part 1 Art. 31, Art. 54 Laws:

<или>

leader

<или>

another representative

<или> leader companies. Then attach to the application a copy of the decision of the owners on the appointment of a particular person as a director of the company;

<или> another representative companies. In this case, attach a power of attorney. Copies of documents confirming the authority of the head, whose signature is on the power of attorney, should not be attached Decree of the FAS VVO dated December 14, 2011 No. A43-1213 / 2011

Do not forget that Writ of execution can be presented for execution:

- <или> for periodic payments - throughout the period for which such payments are awarded, and within 3 years after its expiration Part 4 Art. 21 Law;

- <или> for other payments - within 3 years from the date of entry into force of the court decision, pursuant to which the writ of execution was issued Part 1 Art. 21 Law.

Attention

The three years given to you to present the writ of execution for execution will not be extended for the period during which you receive the corrected writ or its duplicate. Art. 22 Laws.

These dates can be restored but this is quite problematic, since the court is far from ready to recognize every reason for the omission with respect Decrees of the FAS MO dated March 11, 2012 No. A41-K1-5572 / 06; FAS VSO dated May 16, 2012 No. A58-1537 / 07. If you have a writ of execution with a court ruling on the restoration of the term, then it can be presented for execution only within 3 months from the date the court issued such a ruling. Part 2 Art. 21 Law.

You can transfer a writ of execution for execution to a bailiff, to the debtor's bank or to his employer. In the application attached to the writ of execution when recovering money, be sure to indicate the details of your bank account to which the money should be transferred and Part 2 Art. 8 Laws. Documents can be sent by mail or handed over directly to the "performing" organization. If such an organization is geographically not very far from you, it is better not to send documents by mail, take them personally.

Present exactly what needs to be done original writ of execution.

Apply for a duplicate writ of execution You can Part 2 Art. 323 APK RF:

- <если>the original is lost before its transfer for execution - during the period of presentation of the executive document for execution;

- <если>the original was lost by the person who carried out the execution - within a month from the moment you learned about the loss of the writ of execution (for example, having received a certificate from the bailiff about the loss of the writ of execution).

If it is lost at the post office or, say, at the bailiff, it is you who will have to receive a duplicate t Part 1 Art. 21, paragraph 1, part 1, art. 22 Laws. For this:

- file an application for issuing a duplicate in any form to the court that issued the writ of execution;

- explain how the original writ of execution was lost. For example, you sent it by mail, but it did not go to the bailiff Decree of the FAS ZSO dated 05.03.2012 No. A75-1748 / 2010. There are cases when such important documents are lost during the reorganization of the bailiff's department or even burn there in a fire. Decrees of the FAS MO dated 07/09/2012 No. A40-37994 / 08-143-124, dated 05/18/2012 No. A40-56363 / 06-115-345. In case of such events, it is better to ask the bailiffs (in the FSSP) for written confirmation of what happened (for example, something like a certificate or any official response from the bailiff service in Order of the FSSP dated October 29, 2007 No. 570).

When you submit a writ of execution for execution, make an inventory of the attachment of all documents, and then:

- <или>send them by mail with acknowledgment of receipt;

- <или>deliver in person or by courier. Ask the secretariat of the "executing" organization (bailiff service, bank, debtor's employer) to put a stamp on your copy of the inventory.

So you can confirm that you did not lose the writ of execution. This will serve as a good reason for restoring the missed deadline for presenting the document for execution if such a deadline is missed due to its loss.

Immediately after submitting documents for execution, start to find out how the process is going. You can make inquiries about the progress of your case through public services website .

If the creditor acts through the bailiff

If you decide to collect your money or property through a bailiff, you need to proceed according to the following scheme.

1Part 1 Art. 31 Law

(1) Submit the application and writ of execution for execution:

- <если> do you know the specific address debtor (location of the organization / place of residence of an individual) - then to the bailiff service in this territory and Part 1, 2 Art. 33 Laws;

- <если> you do not know which branch of the FSSP documents must be submitted for execution, then:

- <или>send them to the chief bailiff of the subject of the Russian Federation, where the debtor is / lives Part 4 Art. 30 Law;

- <или>petition the court to send a writ of execution for execution Part 3 Art. 319 APC RF; Part 1 Art. 428 Code of Civil Procedure of the Russian Federation.

In the application, ask bailiff to install any restrictions on the debtor or his property(for example, on a temporary ban on a debtor - an individual to travel abroad or on the seizure of the accounts of an organization and Part 2 Art. 30, Art. 67 Law).

I ask you to seize the account of the debtor of Imaginary Partner LLC in Pole Chudesbank in order to fulfill the debtor's demand under the writ of execution dated July 14, 2012, series АС No. rub.

(2) Your main task is to timely submit the document for execution, everything else should be done by the bailiff. Despite this, “help” the busy bailiff not to forget about your case, take an interest in the progress of the process. Across public services website you can both request information about the progress of your execution and track the process of selling the seized property of the debtor.

(3) Discuss with the manager the issue of accepting the debtor's property. If the debtor does not / does not have enough money to pay off the debt, his property was put up for auction, but was not sold within 2 months, you offer this property at a price 25% below its market value and Part 10, 12 Art. 87 Law. You will have to look for a buyer if it is not useful to your company. If the property offered to you is worth more than the amount owed to you, you will have to pay extra for the property or refuse it. The writ of execution will be returned to you, and within the next 3 years you will be able to re-start enforcement proceedings on Part 2 Art. 22 Laws.

(4) If you were awarded property for which you fought in court, advise the manager to send a specialist to check its appearance, and most importantly, its serviceability. After all, bailiffs are not required to do this when seizing property for you. But if there are some minor defects, you'd better not refuse to accept it. Because the refusal in this case terminates the enforcement proceedings and the enforcement document cannot be re-submitted p. 3 h. 1 art. 43, part 5 of Art. 44, art. 88 Law. In other words, you won't get anything.

It is possible that the company will incur expenses in enforcement proceedings, for example, to search for a debtor by a private agency, to pay appraisers. Warn the people who will pay these expenses so that they bring you all the documents confirming such expenses. Such expenses must also be reimbursed to you from the debtor’s money available in bank accounts or in the deposit account of the bailiff’s unit after the sale of his property, first of all p. 1 h. 3 art. 110 Law.

If the claimant acts without bailiffs

You can start enforcement on your own by sending an application for recovery and a writ of execution for execution:

- <если> periodic payments or an amount not exceeding 25,000 rubles are collected from a citizen. - then to his employer or other person who pays him periodic payments (for example, a scholarship) Part 1 Art. 9 Law;

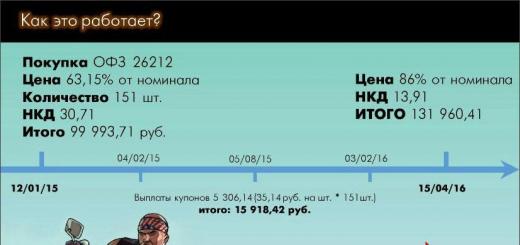

- <если> money is collected from the organization and Part 1 Art. 8 Laws - then to the bank where such accounts are opened. In this case, you should not indicate the numbers of the debtor's accounts, since the bank will draw up a collection order on its own clause 2.2 of the Regulations on the procedure for admission and execution, approved. Central Bank 10.04.2006 No. 285-P.

Names of banks with accounts of the debtor you can:

- <или>look in the contracts if the debtor is your counterparty;

- <или>find on the Internet, for example, on the website of the debtor company;

- <или>ask the tax office. Submit an application in any form to the inspection at the place of registration of the debtor with a request to provide information about the accounts and attach a notarized copy of the writ of execution. You should be answered within 7 days h. 8-10 art. 69 of the Law; Letter of the Federal Tax Service of June 11, 2009 No. MN-22-6 / [email protected] .

Upon receipt of documents for collection from you, the bank must part 5, 9 art. 70 Law:

- <если>there is money on the debtor's account - then immediately transfer it to your account and notify you of such an operation within 3 days;

- <если>there is money, but it is not enough to pay off the debt - immediately transfer the available amount, informing you about it, and then transfer the balance to you immediately upon receipt of money in the accounts;

- <если>no money - then notify you about the lack of money;

- <если>the debtor's account is closed - then notify you of this.

Accounting for recoverable debts

The penalties (penalties) awarded to you under the contract must be taken into account in non-operating income at the time the court decision comes into force. paragraph 3 of Art. 250, sub. 4 p. 4 art. 271 Tax Code of the Russian Federation. Of course, if these amounts were not previously included in income: for example, revenue should not be re-recorded in income.

If it turns out that the debtor has neither money nor property, or they could not be found, he debt becomes hopeless m paragraph 2 of Art. 266 of the Tax Code of the Russian Federation; Letter of the Ministry of Finance dated 03.08.2012 No. 03-03-06/1/383. Then its entire amount can be included in non-operating expenses after you receive resolution on the termination of enforcement proceedings a part 2, 3 art. 46 of the Law; Letter of the Ministry of Finance of October 22, 2010 No. 03-03-05/230. In addition, the adjunct will return your writ of execution, which you can resubmit for execution within 3 years Part 3 Art. 22, part 4 of Art. 46 Law.

Remember that when you start collecting on your own, without contacting the bailiffs, you can neither seize the debtor's property nor suspend operations on his accounts. Therefore, it is better to go directly to the bank with a writ of execution if you know for sure that there is money in the debtor's accounts or they should go there soon.

If you are collecting property or do not know for sure whether your debtor has money in his accounts, contact the bailiff.

Methods for collecting debts on a voluntary basis are very diverse. These include:

- telephone conversations;

Such methods are also relevant for debt collection from individuals and are officially enshrined in the new edition. federal law dated July 3, 2016 No. 230-FZ “On microfinance activities and microfinance organizations”;

Video: Receivables collection practices and tips for prompt identification and repayment

Recovery of debt from legal entities by force

The legal entity-creditor, if the debtor refuses to repay the debt, has the right to file a claim with the relevant judicial authorities. The creditor bases his claims before the court on Articles 309 and 310 of the Civil Code of the Russian Federation, according to which the obligations of the parties to the contract must be duly performed, and it is impossible to terminate the bilateral contract on the initiative of one party.

In general, enforcement through the judicial authorities is carried out in a certain sequence:

The requirements for the statement of claim are contained in the procedural rules. In fact, such a statement consists of several parts:

- Introductory. Contains data about the court to which it is addressed for consideration, and the installation data of the parties;

Sending an application to an arbitration or arbitration court. The arbitration court is a valid alternative to the arbitration court, which, as a general rule, considers and resolves business cases on a paid basis.

Applying to law enforcement agencies to persuade the debtor to fulfill its obligations is a more radical way and is used most often when the use of voluntary collection methods has not yielded results. In practice, it is implemented by sending requests to the prosecutor's office, the Economic Crime Department, and territorial internal affairs bodies to conduct verification activities in relation to the debtor on the fact of non-payment of the debt.

Collection methods after receiving a writ of execution

There are several ways to collect debt after a writ of execution has been received:

- recovery by collection;

Recovery by collection

The first method is characterized by independent execution of enforcement actions in accordance with the provisions of the Federal Law "On Enforcement Proceedings" dated 02.10.2007 No. 229-FZ. In fact, the creditor himself, upon receipt of the writ of execution, sends it to the bank where the debtor's accounts are opened. But this option is available only on the condition that its current current accounts are known.

In turn, the bank (credit institution), having received a writ of execution, is obliged to fulfill, on its basis, the requirement to recover funds from the debtor's account within three days.

Recovery through the bailiff service

The second method is the most common. This is due to the fact that bailiffs have much more resources for execution. To recover the debt, the creditor must apply with a writ of execution to the territorial bailiff service. In this case, it is required to write an application for the initiation of enforcement proceedings.

Bankruptcy

The third method is effective if the debtor is a large organization, the authority and business reputation of which can be undermined by the very application to the court with a petition to declare it bankrupt. Such a process can be initiated by applying to the arbitration court with an appropriate application. In this case, the claimant must have a writ of execution in his hands.

Sale of debt

The fourth option assumes that the existing debt is sold either to a collector or to another counterparty (legal entity or individual). This method is provided for by Article 382 of the Civil Code of the Russian Federation. The consent of the debtor does not matter.

How to get money under a writ of execution from a legal entity and individual entrepreneur

Collect debts in judicial order- It's not always easy. Few people know that the presence of a "winning" court decision does not guarantee the end of the story with the return of the debt, but is only its beginning. Many people have to get acquainted with the domestic post-judicial period, called "Executive proceedings", which consists in the activities of state bodies for the collection of debts, namely, the bailiff service.

Of course, there are cases when a conscientious defendant, having learned about the court decision, voluntarily repays the debt without enforcement. But the realities of reality are such that debtors repay debts only as a last resort, when they have nowhere else to go. In these cases, forced collection of debts will come in handy.

The debt collection procedure begins with the issuance of a writ of execution by the court. This document is the legal basis for starting the enforcement of debt collection.

A writ of execution is issued to the plaintiff or, at his request, is sent to the bailiff service.

Before submitting a writ of execution to bailiffs, it must be said that there are other options for collecting debt.

Thus, in the possession of reliable data on the debtor's bank account, the law allows the recoverer to independently send a writ of execution to the debtor's bank. In this case, you need to send an application to the bank, attaching a writ of execution to it. Subject to the correct execution of the application, indicating all the details in it, the bank will transfer the available funds of the debtor to your account.

If the details of the debtor's bank account are unknown, the recoverer, if he has a writ of execution, has the right to apply to the tax authority with an application for the provision of this information. This possibility is provided for by Part 8 of Article 69 of the Federal Law "On Enforcement Proceedings". That is, you can independently send an application to the inspectorate of the federal tax service, where the debtor is registered, and in response you will receive a list of the debtor's current accounts. Since, under the current legislation, banks are required to inform the tax inspectorate about the opening of accounts by legal entities and individual entrepreneurs, the tax inspectorate has up-to-date data. Find out which tax office You can submit a request in the Unified State Register of Legal Entities and Individual Entrepreneurs. Having received an extract from the Unified State Register of Legal Entities and IP, this information can be seen in the section "Information on accounting with the tax authority".

Having received a response to the request from the tax authority, you can issue an application for the presentation of a writ of execution to the bank and send it there. All that remains is to wait for the bank to transfer the money to you.

This method is the simplest and most relevant if the debtor conducts economic activities and money is received on his accounts. The situation may become more complicated if the debtor does not conduct operations on bank accounts. In such cases, the bailiff service is involved. Due to the load on the bailiff service, debt collection in this way can be lengthy - from several months to several years.

The lawyers of our company support the case at the stage of enforcement proceedings, sending various petitions to the bailiff service, and, if necessary, complaints against the bailiffs themselves.

To begin with, it must be said that an application with a writ of execution is submitted to the bailiff department at the place of registration of the debtor. After receiving the application and the writ of execution, the bailiff will issue a decision to initiate enforcement proceedings and perform a standard set of actions:

– will make requests to the tax office with the requirement to provide information about the place of work of the debtor,

- similar to Pension Fund,

- to the State Road Safety Inspectorate (on transport),

- to ROSREESTR and to banks (about existing real estate and funds).

At the same time, requests are usually sent not to all, but to the most famous banks, but you are not deprived of the right to apply for a request to a specific bank.

After some time (usually takes several months within a year), the bailiff will receive answers with the wording “No information available” and a year later he will issue a decision to complete the enforcement proceedings due to the inability to locate the debtor’s property. This does not deprive the right to file an application with a writ of execution again.

However, if you wait and do not take an active part in enforcement proceedings, then the situation described above will arise and you will never recover your debt. To collect a debt, you need to take an active part in enforcement proceedings - interact with the bailiff by filing petitions, complaints, providing transport to travel to enforcement actions. All these procedural appeals will help competently draw up the lawyers of our firm. You only need to provide all available information and scans of documents. We recommend that you state all available information about the debtor and his property in the application for initiating enforcement proceedings.

Each of the bailiffs has thousands of enforcement proceedings for which requests and enforcement actions are required.

So, for example, write a petition to travel to the location of the debtor in order to search for property. In any case, the best option is to contact a qualified lawyer who will help you interact with government agencies and understand how they work.

Legal advice in Yekaterinburg

Representation in court. Services of a lawyer, lawyer Drafting of documents

Bruskov Pavel Vitalievich

Forfeit on alimony - 2.6 million rubles were collected. This is a record

Alimony was transferred from equity to a fixed amount of 20,000 rubles

A record amount of debt on alimony - more than a million

It is forbidden to use a photo without the consent of a person

The debtor was evicted from the apartment, the enforcement proceedings were successfully completed

A penalty was collected in shared construction for the delay in renting an apartment

Alimony penalty awarded in one meeting

The penalty for late payment of alimony exceeded 1.5 million rubles.

43 million debt collection claims rejected

Fine and forfeit collected from the developer under the equity participation agreement (DDU)

Concealment of property from division by one of the spouses

The apartment in marriage was bought through the sale of a premarital apartment. We prove personal money

How is monetary compensation determined when dividing marital property?

Division of property of spouses in a "civil marriage"

Deprivation of parental rights or contesting paternity - what to choose?

How to collect alimony for three years in court?

Section of cars, machines, vehicles

Familiarization with the case materials in the Arbitration Court of the Sverdlovsk Region

Drawing up statements of claim for the recovery of debts on loans, receipts

Legal advice on debt collection (loans, receipts)

How to collect a debt if the debtor has no property?

How to collect a debt if the debtor has no property?

This issue is one of the first places in personal and virtual consultations.

Unfortunately, our Russian legislation is such that a debtor can often evade collection of money from him with impunity and successfully. There are no real sanctions for non-repayment of debt. Initially, debts are collected by the court, and so far everything is going well: the creditor (plaintiff) has evidence in his hands - this is either a receipt, or a loan agreement, or other documents. The court investigates them, the debtor (defendant) cannot oppose anything to this, and for his part, he has no evidence that he returned the finances. The court makes a decision and awards the debt to collect. A writ of execution is issued, which is transferred to the bailiffs. But then the situation is no longer so simple and rosy.

Our debtors are individuals (citizens) and legal entities (organizations).

Debt collection from the debtor faces

When submitting a writ of execution to the district department of the bailiff service, I advise you to immediately indicate in the application all the information that is known to the creditor about the debtor, and which can help in the search for his property.

The most ideal debtor is a person who works, with a large and official salary, who has worked in his place for a considerable time (preferably in the public service), who has gained experience, ranks or ranks, that is, who values his job, who, in order to pay off his debt, will not quit his job. work. In addition to this: a permanent place of residence, the presence of property, preferably a car, and bank accounts. Such a case, of course, is rare, and you should not rely on it. Still, such debtors themselves are aware of the likelihood and risks judicial recovery debts, and usually go towards creditors, not taking to extremes and to the level of bailiffs with their coercive actions.

The opposite of it (and this is much more common, which, in fact, is what the article is about) is a debtor who does not have official property. He does not have an apartment, land plots and other real estate, bank card or he does not use accounts, he often has a car, but it is registered in a different name (mother, wife, brother, etc.). Works unofficially, "in the black", usually in the service sector - for example, in a taxi, tire fitting, construction team, etc.; Fortunately, it is not so difficult to make employment documents, or not to have them at all. And here, when the debtor has no property, the issue of debt collection becomes hopeless. The law "On Enforcement Proceedings" indicates the measures that the bailiff can apply to the debtor; but no significant effect can be expected from them.

You have to fight for your money anyway. As practice and statistics show, with active and assertive actions, you can get your money back even from inveterate long-term debtors.

Having initiated enforcement proceedings for the recovery of a debt, after waiting for the deadline for voluntary payment of the debt and without waiting, the bailiff performs a standard set of actions:

- Sends a request to the Federal Tax Service Inspectorate (Inspectorate of the Federal Tax Service) for the tax office to give the bailiff information about the debtor's place of work. The tax service has such information, since each employer makes tax deductions from wages on behalf of the employee (at least he is required to).

- The same request is sent to the pension fund.

- A request to the traffic police about whether the debtor has a vehicle.

- Request to the regional chamber (Federal Service for State Registration, Cadastre and Cartography), which real estate objects are recorded in the name of the debtor, where he is the owner.

- Requests to banks about whether the debtor has open accounts or cards, whether they have cash balances. Here the question often arises - to which particular banks should requests be sent? There is no answer, since we have many banks, and the debtor has the right to open accounts in any banks. Therefore, they are usually limited to the largest ones (Sberbank, maybe VTB and Gazprombank, or others in a particular city).

Having sent requests, the bailiff waits for some time, receives answers from all the listed bodies. If any request from the list “fired”, that is, it contains information about the debtor’s property, the bailiff takes measures to seize and sell this property. If earnings are revealed, then 50% of it is withheld in favor of the creditor, until the debt is fully repaid. If money is found in bank accounts, they are completely arrested. The car is arrested and withdrawn for sale at auction, if it is not in kind, it is put on the wanted list. Real estate (with the exception of the only apartment, because it is impossible to evict and take away the apartment from the debtor, if it is one, it is impossible) is also arrested.

If all requests returned empty, that is, with one line like " We do not have information about whether the debtor has the full name of the property”, then the bailiff makes an exit to the debtor’s home at the place of residence, with the intention of picking up household utensils. It happens that this is beneficial, the bailiff can take away a TV, tape recorder or other property; but, as you yourself understand, its cost will be minimal, and even taking into account the use and depreciation that has taken place, and in the presence of a large debt, this is also not a panacea.

The next measure is a travel ban, established by the bailiff in relation to the debtor, outside Russia. In some cases, this matters, so you should not neglect it - you must use all possible measures to collect your debt. But if the debtor leads a marginal lifestyle and does not intend to travel abroad, then this coercive measure will not have any effect.

The last thing to use in the process of collecting debts from individuals is to find out if the debtor is married. To do this, let the bailiff send a corresponding request to the registry office. After all, if the debtor has a wife, for example, and registers all his property in her name, then the creditor has a chance to divide this property in court, allocate the share of the debtor spouse, and withdraw it on account of the debt. If there is a marriage, it becomes necessary to check the property of the spouse, often this is the only chance for repayment of the debt.

That's all the measures of state exacting-debt coercion. Here I do not mention the right of the bailiff to charge a performance fee of 7% of the collected debt, since if the debtor did not return the main debt, then these 7%, of course, for him are like pellets for an elephant. The creditor has the right to recover through the court also a penalty for the late repayment of the debt and indexation; but again, due to the non-return of the principal amount, this penalty loses its punitive (for the debtor) and enriching (for the creditor) properties.

Criminal punishment for debts is not established by our laws (with the exception of alimony debts, for which there is a separate article No. 157 in the Criminal Code), and the righteous anger of creditors in this vein will not be realized, unfortunately. Fraud, which all injured creditors are pressing on, cannot be initiated here - the police refuse to initiate it with reference to civil law (and not criminal) legal relations.

Yes, this, in fact, does not matter, because the punishment is secondary, the main thing for the creditor is to get his money back. What could really help here is forced labor for debtors, but our laws do not establish this. Labor is free, and this is written in the Constitution, which we all once adopted.

Rumors have been circulating on the sidelines of the legislature for more than a year about intentions to introduce the deprivation of a driver's license in relation to debtors. Personally, this seems to me to be a very effective and high-quality measure of state coercion, and I would like to see this item in our law on enforcement proceedings. But this bill has been stalling for a long time, and the prospect of its adoption is very vague.

So it turns out that the courts make decisions on debt collection, but in fact they are not always executed. If the bailiff took all the measures listed above, but nothing happened, he simply ends the enforcement proceedings. The writ of execution is sent back to the claimant.

The collector is entitled to present this sheet again, which I advise you to do - the debt is red, and let the debtors not relax, let them appear on the lists of debtors on the FSSP website and infringe on themselves all their lives, being restricted to travel abroad and registering property for other people, then there is a risk to them. It is possible to present a writ of execution in this way repeatedly, without limitation, that is, to pursue the debtor for life, and in the case of inheritance, also to bring the heirs of the deceased debtor to debt liability.

When the debtor reaches retirement age, you will be able to withhold 50% of his pension. And the debtor will not be able to evade this in any way, since the pension fund will transfer money to your account directly, without the participation of the debtor.

Advice to creditors-collectors: when submitting a writ of execution to bailiffs, take the initiative. Bailiffs are too heavily loaded with work, this is an objective reality. There are often accusations like " My bailiff does nothing», « Bailiffs are inactive”, but the circumstances are such that at present each bailiff has a lot of enforcement proceedings - up to two thousand or more per person, this is an enormous burden that a normal person simply cannot do. So the bailiff " doing nothing"not because of their laziness, but often due to objective circumstances. Therefore, it is recommended that the claimant not only hand over the writ of execution and wait passively, as it happens in nine cases out of ten, but actively connect: provide the bailiff with all the information about the debtor and his property, offer the bailiff to receive it in his hands and personally take requests to state bodies, receive them personally, return the completed requests to the bailiff, agree on the date and time of going to the debtor's home, if necessary, bring and take the bailiff, etc. This is not done to facilitate the work of the bailiff - no, after all, the bailiff receives his salary and must work it out. This is done only to speed up enforcement proceedings - this is the main goal. If the bailiff sends all requests by mail, he will receive answers to them in about a month or even two. During this time, the debtor, it is quite possible that he will have time to transfer his property to his brother-in-law, sell it, donate it, etc., that is, hide it from the creditor. Thus, helping the bailiff is the direct interest of the claimant.

Collection of debt from the debtor - jur. faces

Here things are much worse. In the overwhelming majority of cases, we are talking about the simplest organizational and legal form - LLC (limited liability company), which anyone can register without restrictions, as many times as they like. Accordingly, if you entered into consumer relations with an LLC, or simply gave the LLC a loan, then the LLC will be the debtor, and not the person with whom you communicated, not the director or founder. If the founder of an LLC sits in a beautifully furnished office, drives an expensive car, this does not mean at all that the LLC itself has sufficient property (or at least some) to pay off the debt to you. This is the misconception of most people who, in a conversation with a lawyer, say: Well, if there is no property and money in the LLC, then let the founder pay". This is an illegal requirement. The founder will not pay you anything, he does not have to. It should be the LLC, but there is no money in it - the current account is zero, there is no other property. Here again we get the end of the enforcement proceedings with the same reason - due to the impossibility of collecting the debt. After all, you can simply leave an LLC with all the accumulated debts, and immediately open a new one, even with exactly the same name, and at the same time the debt does not transfer to a new LLC.

Otherwise, all actions between the claimant and the bailiff are similar - initiating enforcement proceedings, sending out requests, leaving at the location of the LLC (legal address), etc. Unless the ban on traveling abroad does not apply here, because. it only exists for individuals.

In this regard, advice: when concluding an agreement or other legal relations, pay attention to who cooperates with you - an LLC or an individual entrepreneur. If there is an opportunity to choose - choose IP, individual entrepreneur. This is an individual who will pay off his debts to you with all his property.

Or, if there is only an LLC, pay attention to the moment whether it has a license, or whether the LLC is a member of self-regulatory organizations (SROs). This is a significant argument in favor of solvency: if an LLC has a license, then the likelihood of successful debt collection in the event of a dispute is much higher.

There is another important argument that you may not know about at the initial stage: this debts of counterparties to the debtor enterprise. This means, for example, that earlier the company that owes you money conducted activities, concluded contracts, received money, but not all buyers and customers paid it off. There are debtors. And so you filed a lawsuit, recovered your money, arrested the accounts of the legal entity. The bailiff did everything he could - zeros everywhere. And the enforcement proceedings hung. But time passes, some debtor settles accounts with the enterprise. The money goes to the account arrested by the bailiff, and transferred to you to pay off the debt. So there is always a chance.

Here is such a sad picture in places in terms of debt collection.

However, I repeat: you have to fight for your money. Life shows that sometimes you can return them even in hopeless cases, even from inveterate debtors, zero LLCs, etc. The more active your actions are, the greater the chances of success.

How to collect a debt under an executive document from a legal entity?

You have received a writ of execution. It can be presented to the bailiff service in a bank or the federal treasury of the Russian Federation. If, with the right diligence, this is done immediately, then you can save a lot of time, nerves and effort.

What is this about?

If your debtor entity, then immediately after receiving the writ of execution, it can be submitted to the search for open accounts with the tax office, where the debtor is a legal entity. All legal entities are required to open bank accounts in order to conduct their activities. All banks, on the basis of Art. 86 of the Tax Code of the Russian Federation, part 1 of July 31, 1998 N 146-FZ, report on opening accounts of legal entities to the tax office.

Why is it not worth submitting a writ of execution to the bailiff service immediately, after all, they can also freeze bank accounts?

The bailiffs will have to send a request to the tax office, receiving a response to such a request can take a long time, the debtor will “take away” all the money from his account. By the way, many debtors have many accounts that they use.

How to find out which tax authority to submit a writ of execution?

Each legal entity has a TIN. The tax office that serves the debtor and where he submits financial statements is determined by 1, 2, 3 and 4 digits of the debtor's TIN. Example: 770468987 - 1st and 2nd digits: 77 - this means that the debtor is serviced in Moscow (Moscow code); 3rd and 4th digits: 0 and 4 - this means that the debtor is served by the 4th tax office. Find out the address of the Moscow tax number 4 on the Internet.

In order for you to find out the debtor's account number, you need to: come to the tax office and apply for information about the debtor in accordance with the court decision. In Russia, different tax authorities have their own rules, so you may be asked for the original of the writ of execution, a certified copy of the court decision on the basis of which the writ of execution was issued or a copy of the writ of execution certified by a notary.

After some time, usually 7 days, you can get a tax statement on the debtor's open accounts. The extract indicates the numbers of the debtor's accounts, the name and addresses of the banks where they are opened.

Now you need to, as soon as possible, submit the original document of execution and an application for acceptance of the writ of execution for execution to the bank where the accounts of the debtor of the legal entity are opened, indicating your account where you need to transfer cash.

If the debtor's bank accounts are empty, and this can be recognized by the lack of money in your account within 14 working days from the date of filing the writ of execution with the bank, write an application to the bank to withdraw the writ of execution from execution. After receiving a writ of execution from the bank, present it to the bailiff service.

If the debtor is a state organization, then the executive document can be presented on purpose or by mail with an internal inventory of documents attached to the Federal Treasury of the Russian Federation. It is best to do this to the main department of the RF Criminal Code with a request to redirect the writ of execution to the required department of the RF Criminal Code. Or find out the necessary department of the RF Criminal Code and submit or send it there immediately.

Presentation of a writ of execution to the bailiff service.

If you received a writ of execution after the bank with a note about the absence of money in the accounts belonging to the debtor to the legal entity, then after that present the writ of execution to the bailiff service.

Write an application for acceptance for execution of a writ of execution and initiation of enforcement proceedings. An application template for initiating enforcement proceedings can be obtained from the bailiff service department. Be sure to attach your details where you need to transfer the money due to you or indicate them in the application (your bank account number, bank code, bank name).

After 7 working days, come to the department of the bailiff service and forgive a certified copy of the decision to initiate enforcement proceedings. If you had a refusal to initiate enforcement proceedings, try to obtain a writ of execution along with a decision to refuse to initiate enforcement proceedings immediately in order to eliminate the reason for the refusal. According to the law, in case of refusal to initiate enforcement proceedings, the decision to refuse to initiate enforcement proceedings, together with the executive document, is sent by mail the next day after it is issued by the bailiff.

If everything is fine and you have received a decision to initiate enforcement proceedings, ask the bailiff who initiated the enforcement proceedings to send a request for the provision of documents to the debtor legal entity, requests and orders to the registering authorities to obtain information about the debtor legal entity, before that, check the sending of the bailiff by the bailiff resolutions on initiating enforcement proceedings to the debtor legal entity (ask to show the postal register of sending and check whether the debtor legal entity received a letter with a resolution on initiating enforcement proceedings on the website of the Russian Post).

Require the bailiff-executor to send requests and orders to the authorities with data on the debtor legal entity.

Requests must be sent to:

Tax inspection, traffic police, Rosreestr. It is also necessary to immediately send resolutions:

1) to arrest open accounts and provide an extract on them for the last year from the date of receipt of the decision to seize the accounts of the debtor of the legal entity (this decision is approved by the senior bailiff), the accounts for which you need to do this are indicated in the response from the tax inspectorate.

If you want to receive what was awarded, then forgive the bailiff to issue all requests and orders to your hands, along with an instruction to present and receive answers to them.

After that, submit all requests and orders yourself to the addresses indicated in the documents (the bailiff will send them for a very long time, and then receive them for a long time). Be sure to require registration authorities and banks to put a mark on you with the incoming number, date of acceptance, position, full name and signature of the person who accepted the documents. After checking the box, find out when you can pick up responses to requests or orders. If you can’t pick up, find out the number of the postal register by which you can find out information about the letter with answers for bailiffs. On the Russian Post website, by the number that they tell you, you can determine where the letter with the answer is currently located.

Control the receipt of answers by the bailiff. If he gets them, forgive him to act on the answers (let him impose arrests and restrictions).

In case of difficulty, forgive all this to be done by the senior bailiff or his deputy (for example, if your bailiff is sick, the bailiff who replaces him is absent), inform the senior bailiff or his deputy that you have information about the fraudulent actions of the debtor to "withdraw » property, inform that, according to your information, the debtor is trying to sell his property in order not to execute the court decision and that you urgently need to make all requests and orders necessary for the execution of the court decision.

The bailiff or senior bailiff and his deputy can tell you that at the moment everything is working automatically electronically, do everything on paper, because practice shows that electronic requests are sent with errors, the answers to them come with errors and do not completely, the system is not yet perfect.

Let's analyze each of the above organizations that must provide information about the debtor to the legal entity:

1) the tax inspectorate will send an extract on the debtor's open accounts along with an extract from the Unified State Register of Legal Entities and a balance sheet for the last reporting period. This information can help the bailiff with the search for the debtor of a legal entity.

2) The traffic police will provide information on vehicles registered to the debtor of a legal entity.

3) Rosreestr will give an answer on the real estate of a legal entity registered to the debtor.

What to do if all the answers to the debtor of a legal entity turned out to be negative?

In such a situation, there is nothing left to do but check the general director, chief accountant and founders of the organization of the debtor of the legal entity.

It’s worth starting with the general director, and then moving on to the chief accountant, and then to the founders, if all explanations are negative, there is NO point in collecting debts as part of enforcement proceedings from a legal entity.

The general director of the debtor of a legal entity must be warned about criminal liability under Art. 315 of the Criminal Code of the Russian Federation. Let the general director of the debtor of the legal entity write an explanation for what reason the court decision is not executed. All the same must be done with the chief accountant of the debtor of a legal entity. Ask the bailiff to inform the general director and chief accountant that if the court decision is not enforced, then the claimant will apply to the prosecutor's office on the fact of fraud under Art. 159 of the Criminal Code of the Russian Federation.

After calling the general director and chief accountant of the debtor of the legal entity, you can call the founders of the legal entity. To take an explanation from them about the work of the legal entity and the obligations that it now has in connection with the court decision, ask the bailiff to inform the founders of the legal entity that if the court decision is not executed, then the claimant will contact the prosecutor's office on the fact of fraud Art. 159 of the Criminal Code of the Russian Federation.

If the explanations of the general director, chief accountant and founders are identical and do not arouse suspicion, ask the bailiff to make a decision to end the enforcement proceedings along with an act on the impossibility of collecting under paragraph 3 of part 1 of Art. 47, paragraph 3, part 1, art. 46 of the Federal Law No. 229 "On Enforcement Proceedings". Take your executive document in your hands, along with the resolution on termination and the act of impossibility of recovery.

Ask the bailiff to write everything that was done as part of the enforcement proceedings in an act of impossibility of recovery, in much the same way when he gives information to the recoverer about what was done as part of the enforcement proceedings or when responding to a complaint, let him indicate each action with a date.

Ask the bailiff-executor to send a resolution on the completion of enforcement proceedings to the debtor legal entity.

Write a statement on the initiation of a criminal case on the fact of fraud under Art. 159 of the Criminal Code of the Russian Federation to the prosecutor's office at the location of the debtor. Attach the resolution on the completion of the enforcement proceedings, the act of impossibility of recovery and copies of the materials of the enforcement proceedings to your application.

Do all of the above and the percentage of debt collection by you from the debtor of a legal entity, through the bailiff service will increase, if there is no desire to do all this, contact us, we will help you. Our services and prices.

How to collect a debt on a writ of execution: how to help a bailiff collect a debt

What measures are usually limited by the bailiff? How to freeze accounts ahead of time for voluntary payment? What actions of the company's lawyers will expedite the recovery?

In a case, much depends, unfortunately, not on the professionalism of a lawyer, but on circumstances. Will it be possible to find the property of the debtor, will the latter have time to take measures to hide it, etc. Of course, you can do the collection yourself. But bailiffs have much more authority to collect debt. Although many lawyers are skeptical about the prospect of applying to the bailiff service, active support from the recovering company, coupled with the powers of the bailiff, can give good results.

In business collection of the awarded debt Much depends, unfortunately, not on the professionalism of the lawyer, but on the circumstances. Will it be possible to find the property of the debtor, will the latter have time to take measures to hide it, etc. Of course, you can do the collection yourself. But bailiffs have much more authority to collect debt. Although many lawyers are skeptical about the prospect of contacting the bailiff service: it is no secret that the enforcement process can be very delayed, although by law it should not exceed two months, and often it does not bring any results. In fact, delays and failures are mainly due to the congestion of bailiffs and the high turnover of personnel in the FSSP, because of which a young and inexperienced specialist may end up as a bailiff. Meanwhile, at the stage of enforcement proceedings, there may be an objective opportunity to use non-standard obligations - for example, set-off or assignment. Therefore, in order to speed up the recovery procedure and increase the chances of obtaining a debt, it is sometimes enough to provide the bailiff with simple, purely practical and informational assistance. Active support from the creditor company, coupled with the powers of the bailiff, can give good results.

What does the standard debt collection process look like?

Having received a writ of execution and an application from the recoverer, the bailiff initiates enforcement proceedings and sets the deadline for voluntary execution for the debtor - no more than five days from the date the debtor receives the decision to initiate enforcement proceedings (part 12 of article 30 of the Federal Law of 02.10.07 No. 229-FZ "On Enforcement Proceedings").

At the end of this period, if the money has not been transferred, the bailiff takes measures to establish the location of the debtor company and its property. Article 64 of Law No. 229-FZ contains a rather extensive list of possible measures, but in practice, bailiffs are usually limited to official requests to government agencies and various organizations, as well as trips to the location of the debtor. First, the bailiff requests information about the debtor's accounts with the tax and banks, about real estate - from Rosregistration, about vehicles - from the traffic police (part 8 of article 69 of Law No. 229-FZ).

In a good scenario, if a valid account with sufficient funds can be found, the account will be seized and foreclosed upon. If the account is found, but there is not enough money on it, or a number of other requirements have already been presented to it, the bank places the bailiff's decision in the file of unpaid bills. Payments will go only if the account remains valid, that is, funds will be received on it and they will be enough to pay off the debt, taking into account the order of debiting (clause 1 of article 855 of the Civil Code of the Russian Federation).

If it was not possible to find a valid account or other property registered in the name of the debtor company using requests, the bailiff leaves for the legal address of the debtor company, as well as its branches and representative offices (part 2 of article 33 of Law No. 229 FZ) . The purpose of the departure is to find cash or movable property that can be foreclosed. It is clear that leaving will not give anything when the debtor does not act at his legal address, and the bailiff does not know the actual address. Then the bailiff draws up an act on the absence of the debtor and his property at the legal address. After two months from the date of initiation of enforcement proceedings, the bailiff has the right to return the writ of execution to the recoverer without execution (part 1 of article 36, paragraph 3 of part 1 of article 46 of Law No. 229 FZ).

True, having at least unverified information about any property of the debtor, the collector can apply for his search. Then the bailiff issues a resolution on the search, and then a special search group is engaged in the search as part of the territorial division of the FSSP (part 4 of article 65 of Law No. 229-FZ, clause 2.4 of the Administrative Regulations, approved by order of the Ministry of Justice of Russia dated September 21, 2007 No. 192). However, bailiffs working as part of a search group have the same rights as "ordinary" bailiffs. In fact, bailiffs-search officers only check the information received (most often from the same exactor) about the alleged location of the debtor's property. To do this, they send to the FSSP unit, which has jurisdiction over this territory, an orientation or a search task to verify this information. The verification is carried out by going to the indicated addresses and questioning citizens. But if the representatives of the claimant take an active part in the enforcement proceedings, they can adjust this standard procedure in their interests.

Non-standard methods of debt collection, not named in the law

The list of enforcement measures is open, which makes it possible to use methods that are not directly named in the law (clause 11, part 3, article 68 of Law No. 229-FZ). For example, when the debtor is a retail store or other organization that receives daily cash receipts, it makes sense to foreclose on this cash. According to part 1 of article 70 of Law No. 229-FZ, the bailiff can withdraw it on account of the execution of the court decision. But if the amount of debt is large, in order to cover it, you need to go every day (for example, a month or more) to the address of the store. Of course, the bailiff cannot afford to devote so much time to one production. However, the problem can be solved in one visit. It is necessary to withdraw the discovered cash, which will at least partially cover the debt, as well as by a resolution to oblige the debtor to transfer all cash incoming to the cash desk to the deposit account of the FSSP unit no later than the next day after they are received until the debt is fully repaid. Although this option is not named in the law, the Presidium of the Supreme Arbitration Court considers it legal (paragraph 17 of the letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 21, 2004 No. 77).

"Expedited" arrest of accounts and other property is possible

Upon presentation of a writ of execution to the bailiff, as in the case of delay in payment of traffic police fines, simultaneously with an application to initiate enforcement proceedings, you can immediately file a petition for imposing a security arrest on the debtor's bank accounts (part 2 of article 30 of Law No. 229-FZ). A security arrest will save time and give you more chances for real debt collection. After all, it is possible even before the expiration of the period for voluntary execution (part 1 of article 80 of Law No. 229-FZ).

If we act according to the standard scheme, then from the moment of initiation of enforcement proceedings until the moment the account is arrested, some time passes (five days for voluntary execution plus time for obtaining information about the debtor's accounts). This time is in the hands of the debtor: he can take various preventive measures. The provisional arrest will deprive him of this opportunity. Another plus: such an arrest is possible without observing the rules of priority for imposing a penalty on property (part 1 of article 80 of Law No. 229-FZ). This means that, as a security, you can arrest a foreign currency account if there is more money on it than on a ruble one.

Usually, data on the settlement account of the debtor company are available in the contract with it. But, of course, it is not a fact that by the time of collection this account is still valid and there are enough funds on it. If the recoverer has unconfirmed information about the debtor's accounts in any specific banks, then in the application you can ask the bailiff to check this information and, if it is confirmed, to freeze the accounts within the amount recovered.

When the account details are unknown, the bailiff has the right to send a special resolution to the bank - on the search for the debtor's accounts and their arrest within the amount of the debt (part 2 of article 81 of Law No. 229-FZ). Moreover, the bailiff can send such orders "fan", that is, to several banks at once. If, as a result, extra amounts are arrested, the bailiff will find out about this from bank messages and remove the arrest from these accounts (parts 3, 4 of article 81 of Law No. 229-FZ).

It is important that the bank must execute the decision on search-arrest immediately. And if you act through a two-stage scheme - a request to banks about accounts and balances on them, then an arrest, the bank will have an extra seven days from the date of receipt of the request (part 10 of article 69 of Law No. 229-FZ). If by the time the writ of execution is received, the recoverer does not have any data on the accounts, even before contacting the bailiff, he can request information about all the accounts of the debtor at the tax office, where he is registered (part 8 of article 69 of Law No. 229-FZ, p 2 of the Procedure for the provision of information by the tax authorities to the claimant, approved by order of the Ministry of Taxes of Russia dated January 23, 2003 No. BG-3-28/23). Note that a security lien can be imposed not only on accounts, but also on other property. It’s just that finding information about him by the time the writ of execution is handed over to the bailiff is more difficult than information about accounts.

What technical and organizational assistance will be useful to the bailiff when collecting a debt under a writ of execution

Delays in enforcement proceedings are often due to a simple human factor: the bailiff takes a long time to go to the debtor just because it is long or inconvenient to get there. Providing him with a transport with a driver, you can easily solve this problem.

With a number of actions necessary to discover the debtor's property (opening the premises, inspecting the property, arresting it), the presence of at least two witnesses is mandatory (Article 59 of Law No. 229-FZ). When leaving for the territory of the debtor, it may be difficult to find them, because the witnesses cannot be employees or other controlled persons of the debtor (as well as the recoverer). Therefore, if you plan to travel to the location of the debtor or his property, it is better to take with you two people who are not officially associated with the recovering company in any way.

Real address information will help

The property subject to registration is real estate and vehicles- the bailiff finds at the request of the relevant government agencies. But to detect unregistered movable property(office equipment, office furniture, design items, finished products or raw materials, etc.) he will be very useful data on the actual address of the debtor, its individual divisions. The claimant may have such information. For example, the address of the counterparty's office where the meeting took place when signing the contract, the address of the warehouse where the goods were shipped during the execution of the contract, etc. The claimant may apply to travel to the indicated addresses in order to locate the debtor's property (Article 50, paragraph 5 and 17, part 1, article 64 of Law No. 229-FZ). If during the trip to the indicated addresses some liquid property is found, it makes sense to immediately impose a security arrest on it (clause 1, part 3, article 80 of Law No. 229-FZ).

Ideally, of course, it is better to immediately receive from the persons in the room documents on the discovered property. After all, if it later turns out that it does not belong to the debtor, but to someone else, then this person has the right to file a claim for the exclusion of his property from the inventory. And this can suspend the entire process of enforcement proceedings (clause 1, part 1, article 39 of Law No. 229-FZ). But if there are no documents, for a start, written explanations of the persons present in the room are suitable - who their employer is, what function they perform in this place. Thus, you can make sure that the debtor company really conducts any activity at this address. For the same purpose, you can communicate with the owner of the premises in order to establish the existence of a lease relationship with the debtor. Stock up on more serious evidence of the property belonging to the debtor - data from his balance sheet and primary documents - you can already after the seizure.

Assistance in the preparation of requests and their transfer to addressees The real load on each bailiff, as a rule, is at least 100 productions that are being executed simultaneously. And for each of them you have to do a lot of paper work. Therefore, most likely, the bailiff will only be happy if the legal service of the recovering company takes over the preparation of requests for the case (to the tax office, banks, Rosregistration, etc.), so that the bailiff only needs to sign them.

By doing this, the legal service will not only speed up the process, but also make sure that there are no errors in the document, due to which the addressee may return them without execution or which may become a reason for appealing them. For example, it happens that banks, trying to "cover" profitable client, instead of statements on his bank accounts, empty replies are sent in response to the bailiff's request. Their meaning boils down to the fact that the bank allegedly cannot identify the person indicated in the request only because an inexperienced bailiff cited only the name of the debtor company without indicating its TIN and KPP. In addition, it would be useful to take on the function of delivering requests and arrest warrants to addressees.

In some regions, the Federal Bailiffs Service has put into effect a unified information system, which allows you to quickly receive bank information about debtors via electronic communication channels. But this is not yet widespread everywhere, therefore, in most cases, bailiffs send requests to any instances in the “old-fashioned” way - by mail. So, the answer will come at best not earlier than in a month. During that time, the debtor can, for example, transfer money to other accounts. In order to deliver requests and orders from bailiffs to addressees, persons who will be directly involved in this must receive an instruction from the bailiff authorizing them to take these actions (clause 1, article 24 of Law No. 229-FZ).

It is worth making sure that a written resolution of the senior bailiff is affixed to the bailiff's request to the bank about the debtor's accounts.

Otherwise, the bank may take time by refusing to respond to the request. The obligatory nature of such a resolution is provided for in Part 8 of Article 69 of Law No. 229-FZ, and its form is established in Appendix No. 43 to Order No. 126 of the Ministry of Justice of Russia dated June 25, 2008.

Collection can be applied to both the "receivable" and property rights. If the arrest of the account does not work, the collector's legal service can suggest the bailiff a more effective measure of collection and help in its technical implementation.

For example, foreclosure on the debtor's receivables (when the bailiff obliges the "debtor of the debtor" to transfer the debt not to the counterparty, but to the account of the FSSP, then the collector receives this money). It is also possible to foreclose on property rights, including the right to receive lease payments from the debtor's tenants and the right to receive payments in other enforcement proceedings in which the debtor company acts as a recoverer. Sometimes they can be more effective than foreclosing bank accounts. You can find the debtor's counterparties who owe him, in particular, using statements from his bank accounts (you can take, for example, a statement of operations for the last 12 months).

The claimant will not receive such extracts on his own, only the bailiff has the right to request them (paragraph 2 of article 26 of the Federal Law of December 2, 1990 No. 395-1 “On Banks and Banking Activities”). And the legal service of the claimant could take the trouble to analyze their content. Periodic payments from the same counterparties indicate the presence of a continuing contract with them, and therefore, possible payments in the future. You can prepare a list of counterparties sorted in this way, and the bailiff will ask them or the debtor himself for copies of contracts and acts on their execution in order to identify receivables (clause 2, part 1, article 64 of Law No. 229-FZ).

Practical advice from specialists in collecting debts under a writ of execution

Vasilina Serebryakova, Chief Legal Counsel of Center for the Execution of Court Decisions LLC:

It happens that it is difficult for the bailiff to get into the territory of the debtor company. At the entrance, the guard finds out the purpose of the visit, immediately contacts the management and plays for time. By the time the bailiff appears in the office, it turns out that all the documents of the company are in the safe, the accountant “left for the bank”, and the director is “on a business trip”. For the effect of surprise, the bailiff can order a pass for himself as a regular visitor. There were cases when the debtor had real estate, the rights to which he did not register. Then registration can be made on the basis of a bailiff's decision (Article 66 of Law No. 229-FZ) and then levy execution on this object.

Nikolai Ivanov, Deputy General Director for Development, Collection Agency YUSB Center:

It is worth checking whether the debtor is a member of another company. Bailiffs rarely figure it out themselves. But the penalty can be paid to its share in the authorized capital. When it becomes obvious that it will be necessary to collect the debt by foreclosing expensive property, it is better for the collector to find a buyer himself. Otherwise, the property may leave the auction "for a pittance" and will not cover the debt.

Thank you for participating in the preparation of the article of the specialists of the Office of the Federal Bailiffs Service in Moscow

After the Court has made a decision and awarded the desired amount in your favor, the case does not end there. Just don't get the money. We need a so-called writ of execution, according to which it is possible to receive money by a court decision. If you have sued a legal entity, for example, an insurance company, then after a court decision is presented, they will almost always require a writ of execution issued by the Court.

At this stage, it is necessary to write an application for the production of a writ of execution, after which it will be issued to you (or your lawyer - representative by proxy). The final stage of the case begins, during which the court decision will finally be materialized in the form of money received in your account. This is an executive production.

Judicial proceedings

Execution is the final stage court proceedings and enforcement of decisions of other bodies (officials), and is a set of actions of bodies and officials aimed at enforcement of decisions of courts and other bodies (officials), which are carried out on the grounds and within the limits of authority determined by the legislation of the Russian Federation.

Procedure for filing a writ of execution

- You can bring a writ of execution to insurance company. You may be required to provide original documents, so it is recommended that you make copies. However, on a voluntary basis, referring to the fact that you act in accordance with the procedure established by law. If they accept a writ of execution, then the money may not be paid for a long time. First one week, then another, another, and so on ad infinitum. Therefore, this method of obtaining your "hard money" is not the most successful and has a low probability of success. If the insurance company did not want to pay out for a long time, got involved in a legal battle, significantly delaying the payment terms, will it do it now? The question remains open.

- You can submit a writ of execution to the bailiff service, or ask the court to do it for you. But unfortunately, due to the heavy workload and catastrophic shortage of employees, bailiffs work very slowly. In practice, there are cases when enforcement actions were carried out by bailiffs for several years. Whether you want to play Russian roulette with bailiffs is up to you.

- You can send a writ of execution directly to a bank or other credit organization. According to Art. 8 of the Federal Law “On Enforcement Proceedings”, an enforcement document for the recovery of funds can be sent to a bank or other credit organization directly by the collector, of course, if the collector knows information about the debtor’s existing accounts, i.e. insurance company. However, often insurance companies hide exactly which banks their accounts are opened in, or they have accounts in several banks, only there is money on one account and not on the other.

There are situations when it is necessary to apply with a writ of execution to the bailiff service. For example, if the debtor is an individual. In this case, you need to decide on the unit of the bailiff service that is authorized to deal with this particular case, send a writ of execution there and start interacting with the bailiffs, seeking to take the necessary actions or even assisting them within the framework of the Law, which also contributes to the speedy actual execution of the Court's decision .

How to get money on a writ of execution quickly?

How not to get into a mess and get money as quickly as possible? The answer is simple - entrust this business to the Precedent company. Our specialists have been working in the field of auto insurance for many years, and during this time they have gained experience in collecting money from all insurance companies, we know in which banks they have accounts opened, and from which account the money will be transferred to you faster. If we are handling your case, we will organize the transfer of money under a writ of execution from the debtor's account to your account free of charge (this is included in the cost of conducting the case).

The cost of services of the law firm "Precedent"

- Comprehensive case management - from 5000 rubles.

Pre-trial settlement

- Filling out a notice of an accident (Europrotocol) - 500 rubles.

- Drawing up an application for payment when applying to the UK - 1000 rubles.

- Submission of documents to the UK * - 1500 rubles.

- Drawing up a claim in the UK - 1000 rubles.

- Drawing up an application to the UK for the payment of a penalty, a financial sanction - 1000 rubles.

- Obtaining copies of documents in the traffic police - from 2000 rubles.

- Drawing up an agreement on voluntary compensation for damage - from 1000 rubles.

*It is necessary to provide notarized copies of the passport of the owner of the vehicle, the rights of the driver of the vehicle (the one who was driving at the time of the accident), certificate of registration of the vehicle or title)

Expertise

- Departure of the expert to the place of inspection within the city of Yekaterinburg - 1000 rubles.

- Cost Conclusion refurbishment light car - 4000 rubles.

- Conclusion on the amount of loss of the commodity value of a light car - 2000 rubles.

- Conclusion on the cost of restoring a light-duty truck (for example, FordTransit, Gazelle, etc.) - from 5,000 rubles.

- Conclusion on the amount of loss of the commodity value of a light-duty truck (for example, FordTransit, Gazelle, etc.) - from 4,000 rubles.

- Conclusion on the cost of restoring a truck - from 10,000 rubles.

- Conclusion on the amount of loss of the commercial value of a truck - from 7,000 rubles.

Court proceedings

- Drawing up a statement of claim - from 2000 rubles.

- Drawing up procedural documents - from 1000 rubles

- Drawing up a complaint against a court decision - from 2000 rubles.

- Participation in a court session from 1000 rubles/session

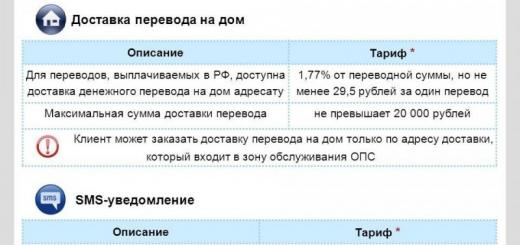

Enforcement proceedings

- Drawing up an application for a writ of execution to the bank - 500 rubles.

- Drawing up a request to the tax office to search for the debtor's funds - 500 rubles.

- Drawing up an application for a writ of execution to the bailiff service - 500 rubles.

- Drawing up an application for a writ of execution to an insurance company - 500 rubles.

- Preparation of claims to the register of creditors of insurance companies - 5,000 rubles.

What to do if the insurance company paid little for OSAGO?

If 20 days have passed since the date of filing an application for payment of insurance compensation, and the insurance company has paid little money, the amount paid is not enough to repair the car, then you need to make an independent examination, where the cost of restoration repairs will be determined damaged car.

If the car is running, then you can come to our expert, and he will make an approximate calculation of the cost of restoring your car for free. If the insurance company really underpaid you some amount, then we draw up an examination.

Then a claim is sent to the insurance company for additional payment of insurance compensation in the amount determined in your examination, and an application for payment of a penalty for late payment of insurance compensation, a financial sanction.

According to the OSAGO Law, in case of non-compliance with the term for making an insurance payment or compensation for damage in kind, the insurer for each day of delay pays the victim a penalty (penalty) in the amount of 1% of the amount of insurance payment determined in accordance with this Federal Law according to the type of damage caused to each to the victim. According to OSAGO, this is 400,000 rubles, respectively, the amount of the penalty for each day of delay is 4,000 rubles.