What is insurance? This is a way to protect health, property, transport, life. Probably, in our life it is possible to insure anything. It is worth remembering the stars of American cinema, who manage to insure even certain parts of the body from loss of elasticity.

Most of the readers probably chuckled when reading these lines. Meanwhile, insurance is a great way to protect yourself from all sorts of unpleasant surprises. But so that insurance of anything does not turn into a one-way game, you should responsibly approach the choice of an insurance company.

Over a period of time, you will insurance premiums, which means that there are risks of running into scammers hiding behind the name of an insurance company or concluding an agreement with a company that is on the verge of bankruptcy.

Types of insurance

Insurance can be personal or property. The first type includes all types of insurance, which, one way or another, are connected with a person, his health and life.

The second type is property insurance. There are a lot of options here: from home insurance by a private individual to financial risks legal entity. The range of services offered by insurance companies is quite large, everyone can choose insurance according to their needs and wallet.

Having concluded an insurance contract, an individual or legal entity pays premiums to the insurance company, which it manages in its own interests. Often insurance is combined with investment activities - profitable investment funds of insured persons.

In fact, an insurance company is a financial institution that, at the expense of the contributions of the insured persons, compensates for the insured events of the latter.

Loss of an insurance company's license

Since the insurance company is a financial organization, the control of activities is carried out by the Central Bank. In case of violations, the license from the insurance company may be revoked (temporarily or permanently). Reasons for license revocation:

- The Central Bank found that the information for obtaining a company license is unreliable;

- if reporting on the company's work is not submitted on time;

- if the organization carries out financial transactions not provided for by the license;

- the insurance company does not submit data on the authorized capital and cash flow to the Central Bank.

There are several other reasons for the revocation of a license, but all of them are associated either with violations of financial transactions, or with the concealment of the real state of affairs in the insurance company.

Before concluding an insurance contract, it is imperative to find out whether the insurance company owns a license, whether it has been revoked before. It will be useful to look for customer reviews about the work of the insurance company. By the way, the abundance of positive reviews should alert, people are reluctant to talk about their troubles, even if they are compensated.

Insurance companies whose license was revoked

2019 was not the best year for more than a dozen insurance companies. Here it is, a list of those who are deprived of the right to insurance activities in January:

- non-state Pension Fund Mosenergo OPS AO, license for pension insurance revoked;

- OOO Insurance Company"ASKO SKEL plus" license was revoked on January 14 of the current year;

- On January 26, 2018, Antares Insurance Company LLC lost the right to all types of insurance and reinsurance;

- Russian Insurance Society RODINA LLC revoked its license in January 2018;

- Russian Timber Reinsurance Company LLC On January 21, the license was revoked;

- Apogee Med Insurance Company LLC, PRIORITETNOE INSURANCE Insurance Company LLC, DOSTINOSTVO Life Insurance Company JSC, Podderzhka State Insurance Company OJSC, Regard Insurance LLC, Russian Alliance Insurance Company LLC – license revoked 14 January of this year;

- Insurance broker LLC "General Insurance (Reinsurance) Broker" - the license to provide intermediary services in insurance has been revoked.

In February, the list was expanded by the insurance companies Invest-Garant, AgroS and Capital Insurance and Reinsurance Center.

Since the Central Bank constantly checks the activity financial institutions, this list will expand. Unfortunately, the founders are in no hurry to comply with the requirements of the law, which leads to the revocation of the license for the right to operate. You can restore the license by fulfilling the conditions and requirements of the Central Bank.

Today, about 300 companies operate in the insurance market. All of them are included in the register of the Russian Insurance Association.

What to do if your insurance company's license is revoked

Revocation of the license means that the insurance company is not entitled to conclude new contracts and accept contributions under existing insurance contracts. Often, insurance companies "forget" to inform the insured person about the revocation of the license in time. The result is that an insured event occurs, and the insurance company can no longer (or does not want to) pay compensation.

What should the insured person do in this case? Unfortunately, there are no organizations for interaction between the insurance company and the insured person. The problem can only be solved by going to court.

First you need to send a letter to the address of the company with a notification of an insured event. The letter should include your details, number insurance policy and write a free-form description of the event to be compensated. Be sure to make a copy of the letter, and send the letter by registered mail with notification.

The letter must be sent within 72 hours of the incident. insured event otherwise the insurance company has the right to reject the payment. After that, you need to immediately go to court.

If the insured event has not occurred, but you wish to terminate the contract with the insurance company, a written application is also drawn up. Upon termination, you must return part of the insurance premium. If the company does not respond, and the address is not currently known, it remains to go to court.

For insurance companies that have had their license revoked, they have six months to transfer insurance contracts to another insurance company (taking into account the opinion of the client) or terminate them with the payment of a part of the insurance premium.

In order not to be a client of an insurance company that does not fulfill the requirements of work in its field, you need to conclude an agreement with an organization that has solid experience in the insurance market. The list of companies providing insurance services in various fields can be found in the Register of Insurance Organizations.

Find out how much an electronic OSAGO policy will cost for you and which insurance companies you can buy it in your region:

The official website of the PCA was registered in 2002 along with the creation of the Russian Union of Motor Insurers organization itself. The main activity of the PCA is the interaction of insurers, government agencies, car owners and other interested parties in ensuring the current legislation in the field of compulsory insurance auto civil liability (OSAGO).

The need to create the RSA and its main information resource, the official website, was due to the introduction from July 1, 2003 in the territory Russian Federation a law providing for mandatory motor third party liability insurance for all drivers. At the time of its foundation, RAMI included 48 insurance companies of the Russian Federation. In the process of doing business, this figure changed depending on the number of companies working in the field of OSAGO.

The official website of the PCA has become especially relevant since 2017, when insurance companies selling “auto-citizenship” were required to develop and implement on their official websites a toolkit that allows customers to remotely purchase e-OSAGO electronic policies online. From that moment on, the Russian Union of Motor Insurers took on the responsibility of guaranteeing the sale of e-OSAGO to any motorist. The systems that allow this to be done are called the Single Agent and E-Garant.

E-Garant on the official website of the PCA

As mentioned above, the E-Garant system was made to guarantee the implementation of compulsory auto insurance to all customers without exception. The reason for this was the fact that often insurance companies refused to sell an electronic policy to a client, explaining the situation with technical difficulties.

The introduction of the E-Garant system has solved most of the problems of Internet users who experience problems with purchasing insurance online. It is implemented as follows:

- The client visits the official website of a company or, which allows you to calculate the cost of the policy for all insurance companies.

- Enters all the information needed to calculate the cost of insurance.

- Further, the insurance company offers the client to buy e-OSAGO at the calculated cost, or, if for some reason it cannot sell the policy at the moment, displays a link to go to the E-Garant system.

- On the official website of the PCA, after entering the PTS number and the region of operation of the vehicle, E-Garant forcibly appoints an insurance company that will 100% sell the policy.

- At the bottom of the page there will be a button to go to the official website of the designated insurance company and apply for insurance.

More details about buying OSAGO in the E-guarantor system are written in.

Checking KBM online

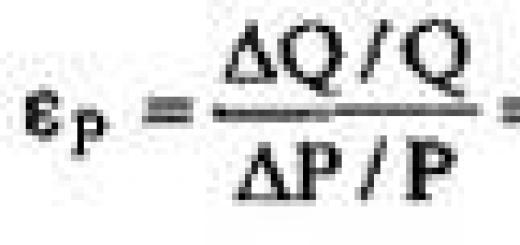

The bonus-malus ratio is perhaps the main adjustment indicator that affects the final cost of the policy. It is calculated individually for each driver based on the accident history of his driving. So, for a driver who has recently repeatedly got into an accident through his own fault, the cost of OSAGO will be much higher than for a more accurate car owner with an accident-free history. The calculation of KBM takes place according to a special and. Read more about the calculation of this coefficient in manual mode at the link above.

It is much easier to find out your current KBM on the official website of the PCA by making an online request to a constantly updated database:

- Go to page MSC checks— dkbm-web.autoins.ru/dkbm-web-1.0/kbm.htm.

- Fill in the required fields: last name, first name, patronymic, date of birth, as well as the series and number of the driver's license.

- After submitting the form, the specified data will be checked against the PCA database, after which the KBM will be displayed to you.

How to check the authenticity of the issued OSAGO policy on the PCA website

With the ubiquity of e-OSAGO electronic policies, cases of fake insurance have become more frequent. To exclude the possibility of falling into the hands of fraudsters, you must adhere to one simple rule - use the official websites of insurance companies for purchases. In addition, you can use sites - the so-called online calculators that calculate the cost of OSAGO for the same official companies. In the list of third-party reliable services, we can note:

All these sites operate under the secure https protocol and use a single principle: the user calculates the cost of OSAGO for all insurance companies at once, after which he can go to the official website of the insurance company and purchase e-OSAGO at the calculated price.

After the user has gone through all the stages of buying a policy, you can check its authenticity. This is where the PCA website comes in handy again.

OSAGO authentication by series and policy number

- Go to the page https://dkbm-web.autoins.ru/dkbm-web-1.0/bsostate.htm.

- Write the policy number (can only be numbers).

- Click the "Search" button.

If successful, the page will display information about the policy you are looking for. Otherwise, the service will issue an error indicating the reason.

How to check which car is included in the OSAGO policy

- Go to the PCA page https://dkbm-web.autoins.ru/dkbm-web-1.0/osagovehicle.htm.

- Specify the series of the form, for example, XXX, CCC, MMM, KKK, EEE or BBB.

- Enter the policy number (can only be numbers).

- Set the date for which you want to check the information.

- After submitting the form, the page will display information about the car that is included in the insurance, the series and number of which you have indicated.

Checking the availability of insurance by car number

- Follow the link https://dkbm-web.autoins.ru/dkbm-web-1.0/policy.htm.

- Enter the vehicle number.

- If possible, please provide the VIN and chassis number.

- Click the "Search" button.

- The result of the check will be a confirmation or refutation of the availability of insurance for a car with the specified state license plate.

The process of all the checks listed above is more detailed.

Calculation of the cost of spare parts for repairs under OSAGO on the PCA website

Another useful function of the official website of the PCA is the ability to calculate the cost of spare parts that are required for the insurance restoration of a car under OSAGO.

- Go to prices.autoins.ru/priceAutoParts/.

- Specify the date, region, brand name of the car and the article number of the required spare part.

- Next, enter the verification code and click the "Submit Request" button.

Contacts of the Russian Union of Motor Insurers

Among the insurance companies that have ceased their activities, there are both large and small insurers, companies with and without a license for OSAGO.

The largest insurance companies that were sanctioned in 2015 are:

ORANTA

The Oranta company was founded in 1995 and belonged to the Promsvyazcapital group. In September 2008, Oranta and Oranta-M were sold to the Dutch insurance group Eureko. The group announced its intention to invest €150 million in the development of Oranta by 2014. In September 2014, Achmea announced the sale of Oranta to the insurance group Kompanion insurance group. The reason for the sale of the company was the long-term unprofitability of business in Russia. In March 2015, Promsberbank CJSC acquired a 100% stake in the insurer's capital. On April 16, 2015, the company's license was suspended. In 2014, IC Oranta collected 2.06 billion rubles. bonuses and paid 2.1 billion rubles. reimbursement.

Russian Insurance Transport Company (RSTK)

OJSC Russian Insurance Transport Company (RSTK) was established on July 12, 1990 with the participation of the Ministry road transport RF. The company had a network of branches in the cities of Russia: Belgorod, Bryansk, Vladivostok, Voronezh, Yekaterinburg, Ivanovo, Kaliningrad, Kaluga, Novgorod, Orel, Pskov, Ryazan, Smolensk, Sochi, Tula, Khabarovsk, Cheboksary, Chelyabinsk, Yuzhno-Sakhalinsk, Yaroslavl and divisions in Vologda and Podolsk. On May 20, 2015, the company's license was suspended. In 2014, the company collected 4.34 billion rubles. premiums, including MTPL 2.53 billion rubles. Payments amounted to 0.98 billion rubles, of which 0.8 billion rubles for OSAGO.

Insurance Group "Companion"

At the end of 2013 Insurance group Companion was in the TOP-20 universal insurance companies in Russia, TOP-15 in Russia in terms of CASCO, accident and illness insurance. The company was a leader in collections in the Voronezh, Kirov, Nizhny Novgorod, Orenburg, Rostov, Samara, Sverdlovsk, Tambov, and Ulyanovsk regions. On June 03, 2015, the company's license was suspended

Companion SG fees in 2014 amounted to 7.2 billion rubles, payments - 3.1 billion rubles

northern treasury

IC "Severnaya Kazna" was established in 1992 under the name of IC "Center". In 1994, it was acquired by Severnaya Kazna Bank, after which its name was changed. In 2008, the bank withdrew from the founders of the company in connection with its liquidation. On March 05, 2015, the company's license was suspended

In 2014, the "Northern Treasury" collected 5.14 billion rubles. premiums. Payments amounted to 2.06 billion rubles.

Full list of insurance companies with revoked licenses

| Name of the insurance company | The address | License number (possibility of OSAGO) | No. and date of the FSSN order, No. and date of publication in the Financial Newspaper | Additional Information |

|---|---|---|---|---|

| Joint Stock Company "Insurance company "DAR"" | Protopopovsky lane, 19, building 13, Moscow, 129090 (temporary administration address: 109085, Moscow, Prospect Mira, 101B) | C No. 3741 77 There is OSAGO |

No. OD-3190 dated 11/16/2015 Bulletin of the Bank of Russia No. 105 dated November 19, 2015 |

|

| Limited Liability Company "Insurance Company TRUST" | st. Spartakovskaya, 25/28, building 1, Moscow, 105005 (temporary administration address: 129090, Moscow, PO box 88) | OS No. 2091-03 There is OSAGO |

No. OD-3014 dated 02.11.2015 Bulletin of the Bank of Russia No. 96 dated 05.11.2015 |

The decision to revoke the license was made due to the failure to eliminate the violations of the insurance legislation within the prescribed period, the violations were associated with non-compliance with the requirements for financial stability and solvency in terms of the formation of insurance reserves, the procedure and conditions for investing own funds and funds of insurance reserves. |

| Insurance Public Joint Stock Company "Russian Insurance Center" | st. Presnensky Val, 14/3, Moscow, 123557 | C No. 0159 77 There is OSAGO |

No. OD-2779 dated 10/15/2015 Bulletin of the Bank of Russia No. 91 of October 21, 2015 |

The decision to revoke the license was made due to the failure to eliminate violations of insurance legislation within the prescribed period, the violations were related to non-compliance with the requirements for financial stability and solvency in terms of the formation of insurance reserves, the procedure and conditions for investing own funds and insurance reserves. |

| Joint Stock Company "Zurich Reliable Insurance" | Paveletskaya Square, 2, building 2, Moscow, 115054 | C No. 0212 77 There is OSAGO |

No. OD-2209 of 20.08.2015 Bulletin of the Bank of Russia No. 71 dated 28.08.2015 |

On October 28, the Bank of Russia decided to issue a reinsurance license to JSC Zurich Reliable Insurance (Moscow). |

| Limited Liability Company "UMMC-Insurance" | st. March 8, 37, Yekaterinburg, 620014 | C No. 0248 66 There is OSAGO |

No. OD-1761 dated 07/23/2015 Bulletin of the Bank of Russia No. 63 dated July 29, 2015 |

|

| Limited Liability Company ""Insurance Group "Companion"" | Michurina st., 58, office 21, Samara, 443096 (postal address: Gagarina st., 141A, Samara, 443067; temporary administration address: 344000, Rostov-on-Don, Sokolova, house 63, PO box 8057) | C No. 3301 63 There is OSAGO |

No. OD-1693 of 07/16/2015 Bulletin of the Bank of Russia No. 60 dated July 22, 2015 |

The decision to revoke the license was made due to the failure to eliminate violations of insurance legislation within the prescribed period, the violations were related to non-compliance with the requirements for financial stability and solvency in terms of the formation of insurance reserves, the procedure and conditions for investing own funds and insurance reserves. |

| Joint Stock Company ""INSURANCE COMPANY ""SOYUZ"" | st. Myasnikova, 54/34/41, room 8A, Rostov-on-Don, 344019 | C No. 1145 61 There is OSAGO |

No. OD-1538 dated 02.07.2015 Bulletin of the Bank of Russia No. 57 of 07/08/2015 |

The decision to revoke the license was made due to the failure to eliminate violations of insurance legislation within the prescribed period, the violations were related to non-compliance with the requirements for financial stability and solvency in terms of the formation of insurance reserves, the procedure and conditions for investing own funds and insurance reserves. |

| Open Joint Stock Company Insurance Company "MRSK" | st. Bolshaya Yakimanka, 33/13, building 1, Moscow, 119049 | C No. 0776 77 There is OSAGO |

No. OD-1237 of 06/03/2015 Bulletin of the Bank of Russia No. 50 dated 06/10/2015 |

The decision to revoke the license was made due to the failure to eliminate violations of insurance legislation within the prescribed period, the violations were related to non-compliance with the requirements for financial stability and solvency in terms of the formation of insurance reserves, the procedure and conditions for investing own funds and insurance reserves. |

| Open Joint Stock Company "Russian Insurance Transport Company" | Engels St., 7/15, Khimki, Moscow Region, 141400 | C No. 1852 77 There is OSAGO |

No. OD-1117 dated 05/20/2015 Bulletin of the Bank of Russia No. 45 dated May 26, 2015 |

In the period from September 2014 to January 2015, the insurer illegally (by court decision) transferred to the account and issued in cash to representatives of Respect Insurance and Financial Consulting LLC (RSTC shareholder in the amount of 24.5% of shares) more than 166 million rubles, which negatively affected the financial stability of the company, and also led to the inability to fulfill the financial obligations of the insurer in the framework of direct loss settlement. |

| Closed joint-stock company "Insurance company "ASK-Petersburg"" | Ave. Yuri Gagarin, 1, St. Petersburg, 196105 | C No. 1709 78 There is OSAGO |

No. OD-957 of 04/29/2015 |

The decision to revoke the license was made due to the failure to eliminate violations of insurance legislation within the prescribed period, the violations were related to non-compliance with the requirements for financial stability and solvency in terms of the formation of insurance reserves, the procedure and conditions for investing own funds and insurance reserves. |

| Limited Liability Company "INSURANCE COMPANY "ORANTA"" | Preobrazhenskaya sq., 8, Moscow, 107061 | C No. 3028 77 There is OSAGO |

No. OD-958 of 04/29/2015 Bulletin of the Bank of Russia No. 40 dated 07.05.2015 |

The decision to revoke the license was made due to the failure to eliminate violations of insurance legislation within the prescribed period, the violations were related to non-compliance with the requirements for financial stability and solvency in terms of the formation of insurance reserves, the procedure and conditions for investing own funds and insurance reserves. |

| Limited Liability Company "Insurance Company "NORTH KAZNA" | st. Sony Morozova, 190, Yekaterinburg, 620026 | C No. 1155 66 There is OSAGO |

No. OD-876 dated 04/22/2015 Bulletin of the Bank of Russia No. 38 dated April 29, 2015 |

According to the Central Bank, the Investigative Department for the Sverdlovsk Region initiated a criminal case on the fact of falsifying reports in order to conceal the grounds for revoking a license, the statement also lists the facts of illegal sale of property on obviously unfavorable conditions, in order to create a situation in which the company will not be able to meet its obligations. |

| Closed Joint Stock Company "EUROSIB-INSURANCE" (since July 4, 2014 - Closed Joint Stock Company "ZASCHITA-INSURANCE"") | st. Bakuninskaya d. 69, building 1, Moscow, 105082 | C No. 2240 77 There is OSAGO |

No. OD-3259 dated 11/19/2014 Bulletin of the Bank of Russia No. 105 dated November 26, 2014 |

At the beginning of 2015, IC Zashchita Insurance (former Evrosib-Insurance) was declared bankrupt. A lawsuit demanding that the insurer be declared bankrupt was filed by Hedway Consulting LLC and the provisional administration of the company. The amount of the creditor's claims was 379.6 thousand rubles. By decision of the Moscow Arbitration Court on January 13, bankruptcy proceedings were opened against the debtor for a period of six months. |

| Open Joint-Stock Insurance Company "Rossiya" | Proezd Olminsky, 3 "" A "", Moscow, 129085 | C No. 0002 77 There is OSAGO |

No. 13-516/pz-i dated 11/14/2013 No. 13-516/pz-i dated 11/14/2013 |

In September 2013, one month before the suspension of the Insurer's license, securities owned by OSAO "Rossiya" in the amount of more than 6 billion rubles were replaced by promissory notes of the offshore shareholder of the company. At the beginning of 2014, the insurer's debt is 6.7 billion rubles, while the company's assets are not enough to cover this debt. You can pay off the company's debt if you manage to recover from the offshore shareholder of the company the promissory note debt and interest on it, which is approximately 7.5 billion rubles. |

| Limited Liability Company "Insurance Company "Metroton" | Bolshoi Karetny per., 8, building 1, Moscow, 127051 | C No. 3413 77 There is OSAGO |

No. 13-517/pz-i dated 11/14/2013 Supplement to the Bulletin of the Federal Financial Markets Service No. 87 dated November 20, 2013 |

On November 14, 2013, the insurance supervision revoked the company's license due to its refusal to carry out insurance and reinsurance activities and announced the introduction of a temporary administration in Metroton. On November 19, 2013, the Moscow Arbitration Court registered the insurer's application for its own bankruptcy. In February 2014, the CEO abandoned his earlier filing with the court to declare the company bankrupt, in his opinion, there are chances to restore the company's solvency. |

| Open Joint Stock Insurance Company "Protection-Nakhodka" | st. Ring, 68, Nakhodka, Primorsky Territory, 692900 | C No. 3174 25 There is OSAGO |

No. 13-898/pz-i dated 04/18/2013 Supplement to the Bulletin of the Federal Financial Markets Service No. 30 dated April 24, 2013 |

The company's license was revoked in April 2013, as the management of the largest insurance company in the Far East of the country at that time claimed, it was deliberately brought to bankruptcy, when in the summer of 2011 they were deprived of OSAGO forms for three months, resulting in company losses in the amount of approximately 50 million rubles . In 2010, the company held a quarter insurance market Primorye. |

| Open Joint Stock Company Insurance Company "" Aviation Fund Unified Insurance (AFES)"" | st. Shabolovka, 31. building 8, Moscow, 115162 | C No. 1273 77 There is OSAGO |

No. 12-364/pz-i dated February 14, 2013 Supplement to the Bulletin of the Federal Financial Markets Service No. 13 dated February 20, 2013 |

The licenses were revoked due to the refusal of the company to carry out the activities envisaged by the licenses. |

| Closed joint-stock company "International insurance company "AINI" | st. Clinical, d. 83 "" A "", Kaliningrad, 236016 | C No. 1714 39 There is OSAGO |

No. 12-3181/pz-i dated 12/20/2012 Supplement to the Bulletin of the Federal Financial Markets Service No. 100 dated December 26, 2012 |

In 2011, the company's license was revoked for the first time, but a year later the insurer secured the license back through the courts. In December 2012, the FFMS decided to revoke Ayni's license for "failure to ensure financial stability". In January 2013, by decision of the Kaliningrad Arbitration Court, the company was declared bankrupt, the insurer's debt is more than 178 million rubles. |

| Limited Liability Company Insurance Company "TIRUS" | st. Engels, 71 "A", Verkhnyaya Salda, Sverdlovsk region, 624760 | C No. 1168 66 There is OSAGO |

No. 12-3142/pz-i dated 12/18/2012 Supplement to the Bulletin of the Federal Financial Markets Service No. 99 of December 21, 2012 |

The company's license was revoked in December 2012, the temporary administration was appointed in November 2012 and withdrawn four months later at the request of the representative of the control body to remove the head of the temporary administration, Igor Koval, due to improper performance of duties. In March 2013, it was decided to reintroduce the temporary administration into the company, at the end of June 2013 the powers of the temporary administration expired, and in addition, she achieved the goals of her appointment and solved the tasks set. |

| Closed Joint Stock Company Joint Stock Insurance Company "ASTEK" | st. Karl Marx, 14, office No. 309, Khanty-Mansiysk, Khanty-Mansi Autonomous Okrug - Yugra, 628011 (mailing address: Komsomolskaya st., 1, apt. 51, Nadym, Yamalo-Nenets Autonomous county, 629730) | C No. 0244 86 There is OSAGO |

No. 12-2633/pz-i dated 10/23/2012 |

The license was revoked in connection with the refusal of insurance activities. |

| Open Joint Stock Insurance Company "ASTRO-Volga" | st. Matrosova, 10, Togliatti, 445012 | C No. 1892 63 There is OSAGO |

No. 12-2911/pz-i dated 11/22/2012 Supplement to the Bulletin of the Federal Financial Markets Service No. 97 dated 12/14/2012 |

The license was revoked due to reorganization in the form of a merger with IC "Samara" |

| Closed Joint Stock Company of Aviation and Space Insurance "AVIKOS" | st. Shabolovka, 31, building 8, Moscow, 115162 | From No. 1967 77 There is OSAGO |

No. 12-2634/pz-i dated 10/23/2012 Supplement to the Bulletin of the Federal Financial Markets Service No. 84 dated October 31, 2012 |

The licenses were revoked due to the refusal of the company to carry out the activities envisaged by the licenses. |

| Limited Liability Company Insurance Company "SOGAZ - Sheksna" | st. Lenina, 47, Cherepovets, Vologda region, 162602 | C No. 2115 35 There is OSAGO |

No. 12-2398/pz-i of 09/25/2012 Supplement to the Bulletin of the Federal Financial Markets Service No. 76 dated 03.10.2012 |

Licenses for insurance and reinsurance were revoked due to the company's merger with Insurance Company SOGAZ-Agro LLC |

| Open Joint Stock Company "Eastern Insurance and Reinsurance Company" | st. Letnikovskaya, 11/10, building 1, Moscow, 115114 | C No. 3905 77 There is OSAGO |

No. 12-2187/pz-i dated 08/23/2012 Supplement to the Bulletin of the Federal Financial Markets Service No. 66 dated 29.08.2012 |

At the beginning of 2011, Sputnik Insurance Center and S.P. Korolev's Experimental Engineering Plant of Rocket and Space Corporation Energia concluded an insurance contract for the Soyuz manned transport spacecraft. Sum insured exceeded 1 billion rubles. Risk in the amount of 150 million rubles. was reinsured with the help of a broker in Eastern Insurance and Reinsurance Company (VSPK). On January 22, 2012, an insured event occurred under the contract, according to which the direct insurer Sputnik Insurance Center paid compensation for more than 300 million rubles, and VSPK did not fulfill its obligations in its part of the contract, later the court recovered almost 48 million from VSPK reinsurance indemnity. |

| Limited Liability Company "Insurance Group" "Admiral"" | st. Old Believers, 46 "A", Moscow, 111024 | C No. 0046 61 There is OSAGO |

No. 12-1886/pz-i dated 07/24/2012 Supplement to the Bulletin of the Federal Financial Markets Service No. 58 dated 01.08.2012 |

More than 90% of the collections were accounted for by OSAGO, in September 2013, the PCA presented additional claims to the SG "Admiral" in the amount of 518 million rubles. and became the largest creditor of the insurer. |

| Open joint-stock company "Insurance company "Inkasstrakh" | Samara, PO Box 3394, 443008 | C No. 0113 63 There is OSAGO |

No. 12-1811/pz-i of 07/17/2012 Supplement to the Bulletin of the Federal Financial Markets Service No. 55 dated 20.07.2012 |

The license was revoked due to the refusal of insurance activities. |

| Open Joint Stock Insurance Company "Insurance Group "Regional Alliance" | Prospect of the Sixty Years of October, 9, building 2, Moscow, 117312 (mailing address: 426011, UR, Izhevsk, Mayskaya st., 29) | C No. 2923 77 There is OSAGO |

No. 12-1726/pz-i dated 10.07.2012 Annex to the Bulletin of the Federal Financial Markets Service No. 54 dated 18.07.2012 |

Insurance company "Regional Alliance" suddenly left the insurance market in early 2012, simply moving out of the rented office in an unknown direction. After leaving the insurance market, "Regional Alliance" left behind liabilities for OSAGO for 440 million rubles. At the request of VTB Bank, which was one of the creditors of Regional Alliance, an examination was carried out to identify signs of deliberate bankruptcy, which, in turn, revealed that between April 1, 2009 and March 31, 2012, the company entered into a number of transactions directly leading to a decrease in its assets by more than 70 million rubles. |

| Closed Joint Stock Company "Insurance Company of Law Enforcement Agencies of the Republic of Tatarstan" | 10, Lobachchego st., 2nd floor, office 30, Kazan, Republic of Tatarstan, 420111 (mailing address: 420111, Kazan, PO box 126) | C No. 3389 16 There is OSAGO |

No. 12-1032/pz-i dated 04/17/2012 Supplement to the Bulletin of the Federal Financial Markets Service No. 32 dated April 27, 2012 |

On May 31, 2012, the Presidium of the RAMI decided to exclude CJSC "Insurance Society of Law Enforcement Agencies" from the union, due to the revocation of the license and the withdrawal from the agreement on direct settlement of losses on OSAGO. In January 2012, the company began transferring the insurance portfolio to BSK Rezonans. |

| Closed Joint Stock Company Insurance Company "Russian Insurance Traditions" | Prospekt Mira, 69, building 1, Moscow, 129110 | C No. 2567 77 There is OSAGO |

No. 12-898/pz-i of 04/05/2012 |

In February 2013, the RAMI set a kind of record, the union managed to receive unpaid membership fees from CJSC Russian Insurance Traditions Insurance Company in the amount of 13 million rubles, which at that time was going through bankruptcy proceedings. This was the end of the union's luck, according to various expert estimates, payments from the RSA funds for IC RST should amount to about 1 billion rubles, and the company's assets amount to about 73 million rubles. |

| Closed Joint Stock Company "Insurance Company "NIKA Plus" | 18 Suschevsky Val St., Moscow, 127018 (mailing address: 18 Suschevsky Val St., PO Box 118, Moscow, 127018) | C No. 1560 77 There is OSAGO |

No. 12-897/pz-i dated 04/05/2012 Supplement to the Bulletin of the Federal Financial Markets Service No. 29 dated April 18, 2012 |

The Federal Financial Markets Service has revoked the licenses of CJSC Insurance Company Nika Plus for insurance and reinsurance. The reason is the failure to eliminate in time the violations of the insurance legislation, which were the basis for limiting the validity of the license. In November 2011, the Moscow Arbitration Court introduced surveillance in the company. The bankruptcy process was initiated by ProjectService LLC, to which the insurer owed about 125 thousand rubles. At the beginning of 2012, the court received a demand from the tax authorities about the debt of Nika Plus on mandatory payments in excess of 191 million rubles. |

| Open Joint Stock Company Insurance Company "Rostra" | Kolpachny per., 4, building 4, Moscow, 101000 | C No. 3647 77 There is OSAGO |

No. 11-3507/pz-i dated 12/22/2011 Supplement to the Bulletin of the Federal Financial Markets Service No. 99 of December 28, 2011 |

Before the revocation of the license, the company entered into agreements with the territorial bodies of the Ministry of Internal Affairs in 14 constituent entities of the Russian Federation, however, no payments were made due to the commencement of bankruptcy proceedings. In June 2015, the government decided to allocate 182 million rubles for payments to employees of the Ministry of Internal Affairs who were insured in 2010-11 in the bankrupt IC Rostra. |

Carefully study the black list of insurance companies before you buy a policy. Companies that are on the "stop list" perform their work poorly and receive a lot of complaints from insurers.

It should be borne in mind that after the license is suspended or revoked from the insurance company, some intermediaries continue to sell the policies of companies from the black list. Do not buy insurance if the company is on any of the lists provided. your policy will be invalid.

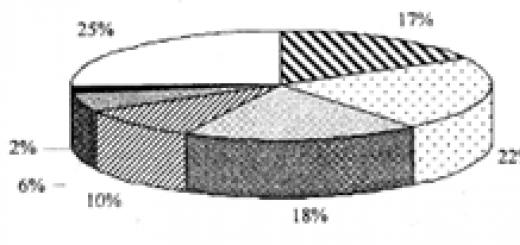

All problem companies can be divided into 3 groups:

Insurance companies with a suspended license

Initially, due to numerous complaints and violations, insurance licenses may be suspended or restricted. In this case, the insurance company does not disappear anywhere but does not have the right to sell and conclude new contracts. It is advisable at this stage to collect the unused part of the insurance premium.

Insurance companies with revoked license

If the insurance company does not eliminate violations in the previous step, then its license is revoked. At this stage it is still possible insurance payment if the company has money. At this stage, for OSAGO compensation, you can apply to the RSA (Russian Union of Motor Insurers)

Insurance companies are bankrupt

The last stage is bankrupt insurers. Nothing can be gained from them except compensation payment by OSAGO through PCA.

Limited licenses

The insurance company is now prohibited from entering into contracts for certain types insurance.

ALLIANCE (b yvsh. ROSNO) (Reg. No. 290) limited on December 16, 2014, in terms of OSAGO, by Order of the Bank of Russia dated December 12, 2014 No. OD-3500

ZHASK O (Reg. No. 1595) limited on November 26, 2014, by Order of the Bank of Russia dated November 19, 2014 No. OD-3258 (on limiting the validity of an insurance license)

Licenses suspended:

The insurance company is now prohibited from entering into contracts for all types of insurance.

RADON HEDGEHOG (registration No. 3118) was suspended on December 31, 2014, by order of the Bank of Russia dated December 26, 2014 No. OD-3670

svya TOGOR (reg. No. 3322) was suspended on October 24, 2013, by order of the SBRFR No. 13-318 / pz-i dated October 22, 2013

Licenses revoked:

An insurance company is forever prohibited from entering into contracts for all types of insurance. The company must fulfill its obligations and stop working.

- LLC "Insurance company "Avest" (Order of the Federal Tax Service No. 95 dated May 26, 2005)

- LLC "West Siberian Transport Insurance Company" (Order of the Federal Tax Service No. 95 dated May 26, 2005)

- CJSC "Joint-Stock Insurance Company "Doverie" (Order of the Federal Tax Service No. 129 dated 07.07.2005)

- Euro-Asian Insurance Company LLC (FSIS Order No. 148 dated 08.08.2005)

- OJSC "Insurance Company of the Commonwealth of Independent States" (Order of the Federal Insurance Service No. 159 of 09/02/2005)

- LLC "Insurance Company" Nasha Nadezhda "(Order of the Federal Tax Service No. 417 dated 02.12.2005)

- LLC "Insurance company" BORK "

- (former name - LLC Insurance Company Universal Policy)

- Fidelity-Reserve Insurance Company CJSC (FSIS Order No. 482 dated December 23, 2005)

- Rosmedstrakh JSC (FSSN Order No. 457 dated April 28, 2006)

- LLC "Insurance company" IC "Priroda" (Order of the Federal Tax Service No. 661 dated 16.06.2006)

- Insurance Company UNIKUM LLC (former name - Insurance Company Genstrakhovanie LLC) (FSIS Order No. 62 of 01/26/2007)

- LLC IC "Pyramid" (Order of the Federal Tax Service No. 1022 dated November 24, 2006)

- OJSC "General Insurance Company" (Order of the Federal Insurance Service No. 88 of 02.02.2007)

- CJSC "Interregional Insurance Agreement" (Order of the Federal Insurance Service No. 582 dated 08.06.2007)

- JSC "Joint-Stock Insurance Company "Investstrakh-Agro" (Order of the Federal Tax Service No. 1291 dated December 21, 2007)

- LLC "People's Insurance Company "Recon" (Order of the Federal Insurance Service No. 88 dated March 14, 2008)

- LLC Insurance Company Aibolit (Order of the Federal Tax Service No. 90 dated March 14, 2008)

- OOO Insurance Company Zenit (Order of the Federal Insurance Service No. 96 dated 03/20/2008)

- Industrial Insurance Alliance LLC (FSIS Order No. 320 of 08/01/2008)

- LLC "North-Western Insurance Company" (Order of the Federal Tax Service No. 459 dated 10.10.2008)

- LLC Insurance Company "Uralcoop-Policy" (Order of the Federal Tax Service No. 551 dated November 21, 2008)

- JSC "Joint-Stock Insurance Company "LEADER" (Order of the Federal Tax Service No. 629 dated 19.12.2008)

- General Insurance Alliance LLC (FSIS Order No. 33 dated January 30, 2009)

- SO ASTO Garantiya LLC (FSSN Order No. 35 dated January 30, 2009)

- Insurance Company GENERAL RESERVE LLC (FSIS Order No. 93 dated February 20, 2009)

- RussoBalt LLC (FSSN Order No. 114 dated March 5, 2009)

- Russian Insurance Company JSC (FSIS Order No. 164 dated April 16, 2009)

- JSC "Insurance company "GRANIT" (Order of the Federal Tax Service No. 167 dated April 16, 2009)

- JSC "Insurance company" ASOPO "(Order of the Federal Tax Service No. 168 of 16.04.2009)

- LLC "Insurance Group" Korona "(Order of the Federal Tax Service No. 169 dated April 16, 2009)

- CJSC "SAO" Metropolis "(Order of the Federal Tax Service No. 217 dated April 30, 2009)

- LLC "Insurance company "URALROS" (Order of the Federal Tax Service No. 275 dated May 28, 2009)

- CJSC "KONDA" (Order of the Federal Tax Service No. 307 dated 10.06.2009)

- LLC "Insurance company "SUPPORT - GARANT" (Order of the Federal Tax Service No. 362 of 07.07.2009)

- Finist-MK Insurance Company LLC (FSSN Order No. 363 dated July 7, 2009)

- OJSC "Russian Joint Stock Insurance Company "RASO" (Order of the Federal Insurance Service No. 468 dated 03.09.2009)

- CJSC "SO "LK-City" (Order of the Federal Tax Service No. 523 dated 02.10.2009)

- CJSC "IC" SVOD "(Order of the Federal Tax Service No. 525 dated 02.10.2009)

- Gorstrakh LLC (FSSN Order No. 670 dated 12/17/2009)

- IMPERIA Insurance LLC (FSIS Order No. 72 dated February 17, 2010)

- CJSC "RUKSO" (Order of the Federal Tax Service No. 103 dated 04.03.2010)

- SK Arbat LLC (FSSN Order No. 102 of 03/04/2010)

- OJSC IC "Russkiy Mir" (Order of the Federal Tax Service No. 200 dated April 16, 2010)

- OJSC Insurance Company "SKM" (Order of the Federal Insurance Service No. 222 dated April 29, 2010)

- JSC "IC "Ural AIL" (Order of the Federal Tax Service No. 306 dated 10.06.2010)

- OAO IC "Tsaritsa" (Order of the Federal Tax Service No. 337 dated 06/24/2010)

- CJSC SO "ASOL" (Order of the Federal Tax Service No. 399 of 07/23/2010)

- LLC IC "National Quality" (Order of the Federal Tax Service No. 426 dated 05.08.2010)

- SZAO "CONTINENTAL" (Order of the Federal Tax Service No. 425 dated 05.08.2010)

- OOO SF "West-Akras" (Order of the Federal Tax Service No. 524 dated 30.09.2010)

- CJSC "TPSO" (Order of the Federal Tax Service No. 543 dated 10/14/2010)

- OJSC "IC "Transgarant" (Order of the Federal Tax Service No. 544 dated October 14, 2010)

- CJSC "ZHASO-M" (Order of the Federal Tax Service No. 601 dated 11/12/2010)

- SO Sports Insurance LLC (FSSN Order No. 663 dated December 10, 2010)

- LLC IC "ROSINVEST" (Order of the Federal Tax Service No. 664 dated December 10, 2010)

- IC Sever Polis LLC (FSSN Order No. 665 dated December 10, 2010)

- LLC IC INNOGARANT (Order of the Federal Financial Markets Service No. 11-1239/pz-i dated May 24, 2011)

- OJSC IC GARMED

- OJSC ESKO (Order of the Federal Financial Markets Service No. 11-1839/pz-i dated July 21, 2011)

- OJSC Rosstrakh (Order of the Federal Financial Markets Service No. 11-2361/pz-i dated September 16, 2011)

- JSC IC "Rostra" (Order of the Federal Financial Markets Service No. 11-3507 / pz-i of December 22, 2011)

- SK KG LLC (FSFR No. 12-554/pz-i dated 03/06/2012)

- CJSC IC NIKA Plus (Order of the Federal Financial Markets Service No. 12-897/pz-i dated April 5, 2012)

- CJSC IC "RST" (Order of the Federal Financial Markets Service No. 12-898 / pz-i of 04/05/2012)

- CJSC SOPO RT

- JSC "SG "Regional Alliance" (Order of the Federal Financial Markets Service No. 12-1726 / pz-i dated 10.07.2012)

- OOO SG Admiral (Order of the Federal Financial Markets Service No. 12-1886/pz-i dated July 24, 2012)

- JSC "VSPK" (Order of the Federal Financial Markets Service No. 12-2187 / pz-i dated August 23, 2012)

- ERMAK (registration No. 3347) was withdrawn on December 31, 2014, by Order of the Bank of Russia dated December 30, 2014 No. OD-3747

- ARKADA (registration No. 3887) was withdrawn on December 10, 2014, by order of the Bank of Russia dated December 4, 2014 No. OD-3401

- EUROSIB-INSURANCE (registration No. 2240) was withdrawn on November 26, 2014 by Order of the Bank of Russia dated November 19, 2014 No. OD-3259

- ISLA (registration No. 3950) was withdrawn on 11/19/2014 by Order of the Bank of Russia dated 11/14/2014 No. OD-3200

- SDS-Medicina (formerly GSMK) (registration No. 3150) was withdrawn on 11/19/2014 by Order No. OD-3180 of the Bank of Russia dated 11/11/2014

- Confidence (former NKM-Confidence) (registration No. 3925) was withdrawn on November 7, 2014, by Order of the Bank of Russia dated October 29, 2014 No. OD-3077

- Zdravo Health Insurance Center (registration No. 4236) was withdrawn on November 7, 2014 by Order of the Bank of Russia No. OD-3076 dated October 29, 2014

- Instant Garant (former AMUR) (registration No. 3885) was withdrawn on October 22, 2014, by order of the Bank of Russia dated October 14, 2014 No. OD-2848

- Life insurance company Rossiya (registration No. 3979) was withdrawn on 10/01/2014 by order of the Bank of Russia dated 09/25/2014 No. OD-2611

- SOCIAL INSURANCE COMPANY (registration No. 3843) was withdrawn on 10/01/2014 by Order of the Bank of Russia dated 09/25/2014 No. OD-2613

- LITER-POLIS (registration No. 31) was withdrawn on September 17, 2014, by order of the Bank of Russia dated September 12, 2014 No. OD-2499

- ARKA-INSURANCE (registration No. 1057) was withdrawn on September 17, 2014, by order of the Bank of Russia dated September 12, 2014 No. OD-2498

- ASSCENT (registration No. 3709) withdrawn on August 27, 2014, by Order of the Bank of Russia dated August 21, 2014 No. OD-2182

- SOGAZ-AGRO (registration No. 3297) was withdrawn on July 23, 2014 by Order of the Bank of Russia dated July 17, 2014 No. OD-1827

- EVEREST (registration No. 3620) was withdrawn on June 20, 2014, by order of the Bank of Russia dated June 10, 2014 No. OD-1355

- SLAVYANSKAYA (former AVISTA-GARANT) (registration No. 1127) withdrawn on 06/05/2014, by order of the Bank of Russia dated 05/27/2014 No. OD-1175

- UNION SO (reg. No. 3738) was withdrawn on May 28, 2014, by order of the Central Bank of the Russian Federation of May 20, 2014 No. OD-1080

- THE INSURANCE COMPANY OF ST. ANDREY THE ONE-CALLED (registration No. 3432) was withdrawn on 05/08/2014, due to the refusal to operate by order of the Central Bank of the Russian Federation dated 04/30/2014 No. OD-885

- INFORMSTRAKH (registration No. 86) was withdrawn on 03/07/2014 by Order of the Bank of Russia No. 14-380/pz-i dated 02/27/2014

voluntary property insurance;

the type of insurance, the implementation of which is provided for by the federal law on a specific type of compulsory insurance;

reinsurance in the event of acceptance under the reinsurance agreement of obligations for insurance payment;

2) a reinsurance company for reinsurance;

3) to a mutual insurance company for the implementation of mutual insurance in the form voluntary insurance, and in cases where, in accordance with the federal law on a specific type of compulsory insurance, the company has the right to carry out compulsory insurance, in the form of compulsory insurance;

4) to an insurance broker to carry out intermediary activities as insurance broker.

3. To obtain a license to carry out insurance, reinsurance, the license applicant submits to the body insurance supervision:

1) an application for a license;

3) the articles of association of the license applicant;

4) decisions on approval of the charter of the license applicant, election or appointment of the management bodies of the license applicant, as well as on the formation of an audit commission or the election of the auditor of the license applicant;

6) documents confirming the payment of the authorized capital in full;

7) information about the persons specified in Article 32.1 of this Law, with the attachment of documents confirming the compliance of these persons with the qualification and other requirements established by this Law, Federal Law of November 2, 2013 N 293-FZ "On actuarial activities in the Russian Federation" and regulatory acts of the insurance supervisory body (information on persons appointed to the positions of deputy of the person exercising the functions of the sole executive body, member of the collegial executive body, member of the board of directors (supervisory board), deputy chief accountant of the insurance company, head and chief accountant of the branch of the insurance company, and information about the actuary of the insurance medical organization that carries out exclusively mandatory health insurance, are submitted in the presence of the indicated positions in the staff of the license applicant);

8) documents (according to the list established by the regulatory acts of the insurance supervisory authority) confirming the sources of origin of the property contributed by the founders (shareholders, participants) of the license applicant to the authorized capital;

9) provision on internal audit;

10) documents confirming the compliance of the license applicant with the requirements established by the legislation of the Russian Federation on state secrets (if this requirement is established by law);

11) documents confirming the compliance of the license applicant with the requirements established federal laws on specific types of compulsory insurance (in cases where federal laws contain additional requirements for insurers);

(see text in previous edition)

4. Applicants for licenses registered in the unified state register of insurance business entities should not submit to the insurance supervisory authority the documents specified in subparagraphs 3-11 of paragraph 3 of this article and are available to the insurance supervisory authority, if they have not been amended.

(see text in previous edition)

5. To obtain a license to carry out mutual insurance, the license applicant (non-profit organization) shall submit to the insurance supervisory authority:

2) documents confirming the payment of the state fee for granting a license;

3) the charter of the mutual insurance company;

4) decisions on approval of the charter of the license applicant, election or appointment of the management bodies of the license applicant, appointment of an internal auditor (head of the internal audit service);

5) information about the persons appointed (elected) to the positions of director of the company and members of the board, internal auditor (head of the internal audit service), chief accountant, as well as information about the actuary, with documents confirming that these persons meet the qualification and other requirements established by this Law, Federal Law No. 286-FZ of November 29, 2007 "On Mutual Insurance", Federal Law No. 293-FZ of November 2, 2013 "On Actuarial Activities in the Russian Federation" and regulatory acts of the insurance supervisory authority;

6) regulation on internal audit;

7) information about the members of the mutual insurance company, indicating their property interests, in order to protect which the mutual insurance company was created.

(see text in previous edition)

6. To obtain a license to carry out intermediary activities as an insurance broker, the license applicant submits to the insurance supervisory authority:

2) documents confirming the payment of the state fee for granting a license;

3) the charter of the license applicant - legal entity;

4) information about the persons appointed (elected) to the positions of managers (the person exercising the functions of the sole executive body, the head of the collegial executive body), members of the collegiate executive body of an insurance broker - a legal entity, information about an insurance broker - an individual entrepreneur, information about the chief accountant an insurance broker with documents confirming that these persons comply with the qualification and other requirements established by this Law and regulatory acts of the insurance supervisory authority;

5) a bank guarantee in the amount of at least three million rubles or documents confirming the availability of own funds in the amount of at least three million rubles, in accordance with paragraph six of clause 6 of Article 8 of this Law.

(see text in previous edition)

7. License applicants who are subsidiaries of a foreign investor or who have a share of foreign investors in their authorized capitals more than 49 percent, along with the documents specified in paragraph 3 of this article, submit the following documents to the insurance supervisory authority:

1) the decision of a legal entity - a foreign investor on its participation in the creation of an insurance organization in the territory of the Russian Federation;

2) an extract from the register of foreign legal entities of the respective country where the legal entity - a foreign investor is established, or other proof of the status of the foreign legal entity - founder (shareholder, participant) of equal legal force;

3) a written consent of the relevant control body of the country where the legal entity - a foreign investor is established, to its participation in the authorized capital of the insurance company on the territory of the Russian Federation or the conclusion of this control body or a person authorized to provide legal services in the country where the legal entity is established - a foreign investor that there is no need to obtain such consent in accordance with the legislation of that country;

4) a copy of the license (special permit) of the country where the legal entity is established - a foreign investor;

5) accounting (financial) statements of the legal entity - a foreign investor for the last five years of its activity, drawn up in accordance with the standards established by the personal law of the legal entity - a foreign investor, and confirming that the legal entity - a foreign investor carries out insurance activities in accordance with the law the country where it is established, with a copy of the auditor's report for the last reporting period (if any).

(see text in previous edition)

8. The regulatory act of the insurance supervision body establishes requirements for information, documents and (or) standard forms of documents in relation to the documents specified in subparagraphs 1, , , and 12 of paragraph 3, subparagraphs 1, , 7 of paragraph 5, subparagraphs 1, 4 of paragraph 6 of this article, as well as the procedure and methods for submitting to the insurance supervisory authority the documents provided for in paragraphs 3 - of this article.

The insurance supervision body, using a unified system of interdepartmental electronic interaction, requests from the federal executive body that carries out state registration of legal entities and individual entrepreneurs, information about the license applicant, its founders (shareholders, participants, members) contained in the unified state register of legal entities, the unified state register of individual entrepreneurs.

(see text in previous edition)

9. The lists of documents specified in this article submitted by applicants for licenses to obtain licenses are exhaustive, except in cases where federal laws on specific types of compulsory insurance provide for additional requirements for insurers. In order to verify the information received, the insurance supervisory authority has the right to send requests to organizations in writing for the provision (within their competence) of information relating to the documents submitted by the license applicant in accordance with the legislation of the Russian Federation.

10. In the event that an application for a license and other documents do not comply with the requirements established by this Law and (or) regulatory acts of the insurance supervisory authority, and (or) the license applicant submits the documents specified in this article, the insurance supervisory authority does not fully send the license applicant is notified in writing of the need to eliminate the identified violations, to draw up the documents properly with an exhaustive list of missing or incorrectly executed documents and to suspend the decision-making period for no more than thirty working days. If the license applicant fails to submit duly executed documents within the period specified in such notification, the application for a license granted earlier submitted by the license applicant and the documents attached to it shall be returned to the license applicant.

The decision to issue a license or to refuse to issue a license is made by the insurance supervisory authority within a period not exceeding thirty working days from the date of submission by the license applicant to the insurance supervisory authority of all the documents provided for by this article and duly executed.

The insurance supervisory authority notifies the license applicant of the decision to issue a license or to refuse to issue a license within five working days from the date of the relevant decision.

(see text in previous edition)

11. On changes made to the documents that served as the basis for obtaining a license in accordance with