Introduction

Conclusion

Bibliography

Applications

Introduction

The relevance of research. Accounts receivable and accounts payable are an objective inevitable consequence of the existing system of settlement relationships between an enterprise and counterparties, financial authorities, social security authorities, insurance organizations, employees, as well as other debtors and creditors. Both types of debt are the result of a gap in the time of payment and the moment of transfer of ownership of the goods, the presentation of payment documents and their payment.

Accounts receivable does not lead to negative results and a decrease in economic stability, if mutual debts are balanced, and the company manages to regulate it. Therefore, it is initially important for an enterprise to form an effective management system in the field of receivables, so that the enterprise's funds and its position in relation to consumers, partners and competitors are not irretrievably lost.

At the same time, you need to be very careful about settlements with creditors, repay their debts in a timely manner, otherwise the company may lose the trust of its suppliers, banks and other creditors, and will have penalties for settlements with counterparties.

Rational management of receivables and payables will allow the company to ensure a sufficient level of profitability and eliminate debt obligations. At the same time, the foregoing actualizes the problem of effective enterprise management, in particular, the problem of accounting, evaluation and management of receivables and payables in order to optimize its activities.

The purpose of the thesisis a study of the theoretical and methodological foundations for assessing receivables and payables to develop recommendations leading to an improvement in the economic performance of an enterprise.

In accordance with the goal, it was decided set of tasks:

explore the economic nature of receivables and payables, evaluate its role in the activities of the enterprise;

form the concept of managing receivables and payables;

explore the logical relationship between the policies for managing receivables and payables with the economic performance of the enterprise;

develop a methodology for enterprise management through optimization credit policy.

Subject of studyeconomic relations that arise in the process of improving the efficiency of enterprise management by optimizing the management of receivables and payables act.

Object of studyis the activity of the enterprise LLC "Kubaninterpraysis", which is engaged in wholesale and retail trade in branded clothing.

Methodological and informational basisstudies are the works of Russian and foreign economists, theorists and practitioners in the field of receivables and payables management.

Research considered in thesis problems are devoted to the works of such authors as H. Anderson, J. Bethge, R. Bradley, M. Brett, F. Brigham, H. Gernon, G. White, R. Campbell, R. Lewis, McCoinell, G. Muller, O Morgenstern, Toffler, M. Tracy, M. Friedman, J. Von Neumann, E. Hendriksen, R. Holt, M. Hirsch, W. Sharp, G. Schick, B. Edwards, and others. management of receivables and payables, issues of classification of receivables and payables, issues of economic modeling of the processes of managing receivables and payables within the framework of the enterprise management process.

The issues of managing receivables and payables were considered in their works by such Russian authors as M.Yu. Alekseev, A.S. Bakaev, M.P. Berezina, L.E. Basovsky, A.V. Bryzgalin, V.V. Bocharov, V.V. Burtsev, V.A. Bykov, O.B. Veretennikova, V.R. Zakharyin, V.P. Ivanitsky, V.B. Ivashkevich, A.V. Ignatieva, V.V. Kovalev, M.A. Komarov, A.I. Kovalev, A.M. Kovaleva, N.P. Kondrakov, M.M. Maksimtsov, A.N. Medvedev, V.M. Popova, V.P. Privalov, L.D. Revutsky, L.P. Khabarova, B.S. Khoreev, E.M. Chetyrkin, etc.

Research information baseincludes laws and regulations Russian Federation, data from periodicals on the problems of managing receivables and accounts payable, financial statements researched economic entity.

Work structure.The purpose and objectives of the thesis work predetermined the logic and structure of the work. The thesis consists of an introduction, three chapters of the main part, a conclusion, a list of references from 53 titles, 23 tables, 13 figures, 4 appendices, the volume of the thesis is 94 pages.

In the introductionthe relevance of the chosen topic is substantiated, the purpose of the work is formulated, the main tasks are set in accordance with it, the object and subject of research are determined.

In the first chapter -Theoretical and methodological aspects of assessing the receivables and payables of an enterprise" reveals the concept of receivables and payables, considers the classification of receivables and payables of an enterprise. The main approaches to the process of managing receivables and payables are determined. The need to manage accounts receivable and payables for the effective operation of an enterprise is substantiated.

In the second chapter -Evaluation of accounts receivable and accounts payable of an enterprise" an analysis of indicators characterizing the accounts receivable and accounts payable of an enterprise was carried out. The result of this analysis was the formation of a group of indicators that must be taken into account when conducting a qualitative and quantitative analysis of accounts receivable and payable. In accordance with the goals and objectives of the thesis, and as well as the results of the research, the concept of managing the receivables and payables of the enterprise is being formed.

In the third chapter -The main directions for improving the efficiency of managing accounts receivable and accounts payable of an enterprise" presents the developed methods for managing accounts receivable through the formation of a system of effective credit conditions, the development of standards for assessing buyers and differentiating the provision of credit was carried out, proposals for improving the organizational structure of the enterprise were identified.

In custodyconclusions are drawn and the main results of the study are presented.

accounts receivable credit

1. Theoretical and methodological aspects of assessing the accounts receivable and accounts payable of an enterprise

1.1 The concept and structure of receivables and payables

In the process of financial and economic activity, any enterprise enters into economic and financial relations with other enterprises, persons, etc. Thus, settlement relations arise. Calculations are divided into two groups:

on commodity transactions that are carried out by the enterprise if the enterprise is a supplier of finished products (works, services), a purveyor of inventory items, or a buyer;

on non-commodity transactions related to the repayment of debts to the bank, the budget, employees, extra-budgetary funds and other settlements.

In accounting, receivables are reflected as property of the organization, and accounts payable - as liabilities. However, both types of debt are inextricably linked and have a steady trend of transition from one to another. Therefore, these two types of debt must be considered in conjunction.

According to Yu.A. Babaev, accounts receivable are understood as the debt of organizations, employees and individuals this organization, which arises in the course of the economic activity of the organization, i.e. debts of buyers for purchased goods and services, accountable persons for the amounts of money issued to them under the report, etc.

Accounts receivable by their nature, depending on settlement relations, can be divided into normal, which is a consequence of the economic activity of the organization and overdue accounts receivable, which creates financial difficulties for the acquisition of inventories, payment of wages. Such accounts receivable should be the focus of attention and urgent operational action should be taken to eliminate them.

For the purposes of accounting and analysis, receivables are divided into current and long-term. Current debt must be collected within a year or a normal business cycle.

The production and commercial cycle includes: transfer of funds as an advance to suppliers, receipt and storage of goods and materials of production, storage and sale of finished products, and repayment of receivables.

The level of receivables is determined by many factors: the type of product, market capacity, the degree of saturation of the market with this product, the policy of settlements with customers adopted by the enterprise, and the last factor is especially important.

From the standpoint of financial management (according to authors such as Blank I.A., Brigham Yu.F.), accounts receivable have a dual nature. On the one hand, "normal" growth in receivables indicates an increase in potential income and increased liquidity. On the other hand, not every amount of receivables is acceptable for the enterprise, since the growth of unjustified receivables can also lead to a loss of liquidity.

In countries with developed market economy accounts receivable are carried in the balance sheet at net realizable value, i.е. proceeds from the amount of cash that is expected to be received when paying off this debt.

Net realizable value means that uncollectible receipts and various discounts are taken into account when registering receivables. Uncollectible receipts on receivables are losses or expenses due to the fact that part of the receivables is not paid by buyers. At the time of the sale of products, the company does not have information about which part of the invoices will not be paid. Therefore, when assessing receivables, a certain discount is charged for these receipts.

The discount for bad receipts is calculated on the basis of the amount of outstanding receivables for previous years, taking into account changes in economic conditions. Two methods are used to estimate bad earnings:

based on the percentage of outstanding receivables to net sales;

based on their percentage of unpaid invoices or bills of exchange in their total volume.

For a more visual representation of the structure of receivables, consider Figure 1.

Figure 1 - Classification of receivables

In conditions market system any company seeks to sell its goods and services as soon as possible in order to obtain cash. However, the growth in the volume of sales of goods and services on credit increases the timing of receipt of money on settlement accounts. The following factors contribute to the increase in sales on credit:

increased competition between producers in the market;

the desire to reduce the "laying" of goods and stocks, and hence storage costs;

increase in turnover and efficiency in the use of working capital.

When goods and services are sold on credit, accounts receivable are opened in the company's books. Before opening these accounts, the credit department analyzes the creditworthiness of customers and, based on the credit rating, compiles the company's classified loan portfolio by debtor companies. The practice of market management shows that companies with a period of work in business from several months to a year and from a year to two years should be especially careful, since it is precisely such companies that make up 50-70% of the total number of companies that have failed.

On the other hand, the company itself, when buying raw materials and materials, assumes monetary obligations, which it must fulfill within a specific time frame and in a specific amount. In addition, there are financial obligations of the company to the tax authorities and personnel for the timely payment of wages. Thus, there are problems of analysis and management of receivables and payables, which are reflected in the respective accounts.

A mirror reflection of work with accounts receivable is work with accounts payable, for which it is necessary to timely and promptly required amount make cash payments to other businesses. On the one hand, the delay and "spreading" of payments over time increases the company's income and liquidity, and on the other hand, it creates problems in relations with supplier enterprises, banks and other creditors, for example, in additional payments of legal costs. Sooner or later, the bad reputation of an untimely payer will force other suppliers not only to eliminate trade discounts, but also to increase prices for the supplied raw materials, materials and goods.

Long-term liabilities include:

long-term bank loans used for long-term capital investments: for the purchase of expensive equipment, construction of buildings, modernization of production;

long-term loans reflecting long-term loans (except for bank loans) and other attracted funds for a period of more than one year, including long-term bonds issued by the enterprise and long-term promissory notes issued.

Short-term liabilities include liabilities that are covered by working capital or repaid as a result of the formation of new short-term liabilities. These obligations are repaid over a relatively short period of time (usually within a year) .

Short-term liabilities are presented in the balance sheet either at their current price, which reflects the future costs of cash to pay off these liabilities, or at the price at the date of debt redemption.

Short-term liabilities include items such as invoices and bills payable arising from the provision of a loan to an enterprise, debt certificates of a short-term loan received by a company; tax arrears, which are essentially a form of credit provided by the state to this company; wage arrears; part of long-term liabilities due in the current period.

The state of accounts payable characterizes settlement relationships with suppliers, the budget, workers and employees. When checking the amounts related to suppliers, accepted settlement documents and uninvoiced deliveries, it should be borne in mind that their value largely depends on the uniformity and volume of deliveries at the end of the reporting period, the forms and procedures used for settlements, etc. .

Each enterprise, organization in their business activities conduct settlements with external and internal counterparties: suppliers and buyers, customers and contractors, with tax authorities, with founders (participants), banks and other credit organizations, with their employees, other debtors and creditors (Figure 2).

Figure 2 - Classification of the company's debt in relation to the counterparty

As part of the obligations of any enterprise, two types of debt can be conditionally distinguished:

"urgent" (obligations to the budget, to the bank on the loan received, to the social insurance and security authorities);

"calm" (advance payments received from buyers, to suppliers and contractors).

As a summary of this paragraph of the thesis, we note that the policy of managing receivables and payables is part of the general policy of managing current assets and the marketing policy of the enterprise, aimed at expanding the volume of sales of products and consisting in optimizing the total amount of this debt and ensuring its timely collection.

At the same time, it must be borne in mind that accounts receivable, as a real asset, plays a rather important role in the field of entrepreneurial activity.

Accounts payable to a certain extent is useful for the enterprise, tk. allows you to borrow cash owned by other organizations.

The state of receivables and payables, their size and quality have a strong impact on the financial condition of the organization.

In order to manage receivables and payables, it is necessary to analyze them.

1.2 Methodology for analyzing receivables and payables

Influence on the process of managing receivables is possible when the management of the enterprise and other officials have complete and reliable information about all business processes. The formation of such information occurs during the interaction of three functions of the management of settlements with debtors: accounting, analysis and control, which makes it possible to characterize the state of receivables and payables not only from a quantitative side, but also from other positions, as well as to make effective strategic and tactical decisions.

A sharp increase in accounts receivable and its share in current assets may indicate an imprudent credit policy of the enterprise in relation to buyers, or an increase in sales, or insolvency and bankruptcy of some buyers. On the other hand, the company can reduce the shipment of products, then the accounts receivable will decrease.

Of particular importance is the analysis of receivables and payables for banks, investment funds and companies that, before granting a loan or making financial investments, carefully analyze the financial statements of customers, including accounts receivable and payable.

Effective organization of analysis and management of receivables solves the following tasks facing the enterprise:

ensuring constant and effective control over the state of debt, timely receipt of reliable and complete information on the state and dynamics of debt, necessary for making management decisions;

compliance with the allowable amounts of receivables and payables and their optimal ratio;

ensuring timely receipt of funds on accounts receivable, excluding the possibility of applying penalties and causing losses;

identification of insolvent and dishonest payers;

determination of the company's policy in the field of settlements, in particular, the provision of commodity credit, discounts and other benefits to consumers of products, the receipt of commercial loans in settlements with suppliers.

Savitskaya G.V. believes that in the process of analyzing the preparation of calculations, it is necessary to study the dynamics, composition, causes and prescription of debt formation; for the analysis of receivables, data from section II of the balance sheet asset are used, and accounts payable - from section V of the balance sheet liability and data from primary and analytical accounting.

Blank I.A. proposes at the first stage of the analysis to also evaluate the level of receivables, i.e. determine the coefficient of diversion of current assets into accounts receivable, and the level of accounts payable, i.e. determine the coefficient of diversion of current (short-term) liabilities into accounts payable.

Bernstein L.A. proposes to assess the quality of debt on the following indicators:

share of doubtful receivables in the total amount of receivables;

share of overdue receivables in the total amount of receivables;

share of overdue accounts payable in the total amount of accounts payable;

the share of overdue loans and borrowings (loans and loans not repaid on time) in the total amount of loans.

To assess the composition and structure of debts for specific buyers. wherein Strazhev The.AND. recommends studying what percentage of non-recovery of receivables falls on one or more main debtors; whether the default of one of the main debtors will affect the financial position of the enterprise. According to Bernstein L.A., it is desirable to assess the composition and structure of debts by the terms of debt formation or the terms of their possible repayment. The most common classification provides for the following grouping of current debt: up to 30 days, from 1 - up to 3 months, from 3-6 months, from 6-12 months, more than 12 months.

The analysis of debtors involves, first of all, an analysis of their solvency in order to develop individual conditions for the provision of commercial loans and conditions for factoring agreements. The level and dynamics of liquidity ratios could lead the manager to the conclusion that it was expedient to sell products only on an advance payment basis, or, conversely, that it was possible to reduce interest on commercial loans, etc.

The analysis of accounts receivable and the assessment of its real value consists in analyzing the debt by the timing of its occurrence, in identifying bad debts and forming a reserve for doubtful debts for this amount. Of particular interest is the consideration of the dynamics of receivables by the timing of their occurrence and / or by the turnover period. Such an analysis allows you to make a forecast of the receipt of funds, identify debtors in respect of which additional efforts are needed to recover debts, and evaluate the effectiveness of receivables management.

The ratio of receivables and payables characterizes the financial stability of the company and the effectiveness of financial management.

In the practice of financial activities of Russian firms, a situation often arises when it becomes unprofitable to reduce accounts receivable without changing accounts payable. Reducing accounts receivable reduces the coverage ratio. The enterprise acquires signs of insolvency and becomes vulnerable to tax authorities and creditors. Therefore, financial managers are required to solve not only the problem of reducing accounts receivable, but also balancing it with accounts payable. In this case, it is important to study the terms of a commercial loan provided to the company by suppliers of raw materials and materials.

The analysis of receivables provides for the consideration of its absolute and relative values, the assessment of their changes according to the horizontal and vertical analyzes of the balance sheet. An increase in receivables is possible but for various reasons. It can be caused by the company's imprudent credit policy towards customers, indiscriminate choice of partners, insolvency and even bankruptcy of some consumers, too high sales growth rates, difficulties in selling products, etc.

It is advisable to analyze receivables by the terms of formation (up to 1 month, from 1 to 3 months, from 3 to 6 months, from 6 months to 1 year, over 1 year). In the balance sheet, receivables are divided into two types: debt, payments for which are expected in more than 12 months. after the reporting date, and debt, payments on which are expected within 12 months. after the reporting date. Obviously, accounting for the amount of debt passing through the accounts makes sense only as long as there is a possibility of receiving it. It is reasonable to assume that this probability depends on the length of the period of repayment of receivables.

Thus, the main tasks of the analysis of receivables are:

verification of the reality and legal validity of the amounts of accounts receivable on the balance sheet of the enterprise;

verification of compliance with the rules of settlement and financial discipline;

verification of the correctness of receipt of amounts for shipped material assets and the completeness of their write-off, the availability of supporting documents when making settlement transactions and the correctness of their execution;

verification of the timeliness and correctness of the execution and presentation of claims to debtors, as well as the organization of control over the movement of these cases and verification of the organization, recovery of damages and other debts arising from settlement relationships.

External analysis of the status of settlements with debtors is based on the data of Forms No. 1 and 5, which reflect long-term and short-term receivables by type. For internal analysis, data from the analytical accounting of accounts intended to summarize information on settlements with debtors are involved.

The analysis of the state of receivables begins with the general dynamics of its volume as a whole and by articles.

Regardless of the control measures on the part of the enterprise, in order to avoid the sale of products to insolvent buyers, the accounting department maintains an appropriate journal-order or record of settlements with buyers and customers. Based on the statement, the ranking of debts by the terms of payment of invoices is carried out, which helps the enterprise determine the policy in the field of managing receivables (assets) and settlement operations.

the payment deadline has not arrived;

A justified debt is a debt that has not yet matured or is less than one month old. Unjustified debts include arrears of buyers and customers. The longer the delay, the more likely it is that the invoice will not be paid. The diversion of funds into this debt creates a real threat to the insolvency of the enterprise and weakens the liquidity of its balance sheet.

Invoices that buyers have not paid are called doubtful (bad) debts. Bad debts mean that for every ruble invested in receivables, a certain part of the funds will not be returned. The presence of doubtful receivables indicates the inadequacy of the policy of granting a deferral in settlements with buyers. To identify the reality of the collection of debts of a dubious nature, it is necessary to check the availability of acts of reconciliation of settlements or letters in which debtors acknowledge their debt, as well as the statute of limitations. For debts that are not real for collection, a reserve for doubtful debts is formed in the prescribed manner. In the presence of supporting documents, bad debts are repaid by writing them off to the losses of the enterprise as receivables for which the limitation period has expired.

When analyzing the state of settlements according to analytical accounting, it is necessary to identify the volume of hidden receivables arising from the prepayment of materials to suppliers without their shipment to the enterprise.

With a decrease in the volume of receivables, it is necessary to establish whether it has been written off for losses, whether there are supporting documents.

The next step in the analysis of receivables is to determine the structure and dynamics of changes in each item of the receivables of the enterprise.

The analysis of other debtors reflects the timeliness of payments by workers and employees for goods purchased on credit. Arrears are usually allocated in the balance sheet as a separate item. In the liabilities side of the balance sheet, the source of coverage for such debts are bank loans received to pay for goods and materials sold on credit. If, due to untimely repayment by workers and employees of the loan, their debt to the enterprise exceeds the bank loan available to the enterprise, the excess amount is considered as a receivable.

An analysis of receivables should also show how calculations are made to compensate for material damage accrued by shortages and theft of valuables, including claims filed for recovery through the court, as well as amounts awarded by the court, but not recovered. The analysis reveals whether documents are presented to the judicial and investigative authorities in a timely manner to compensate for damage.

To assess the turnover of receivables, they use, first of all, the turnover ratio of funds in the calculations (turnovers).

An important indicator that characterizes the duration of repayment of receivables (in days).

The longer the repayment period, the higher the risk of its repayment.

Of interest for analysis is the share of receivables in the total volume of working capital. The higher this indicator, the less mobile the structure of the property of the enterprise.

Based on the results of the analysis, it is necessary to identify by how much the turnover period of receivables increases the duration of the production and commercial cycle of the enterprise.

The results of the analysis allow us to reasonably suggest which items of receivables can be considered in terms of the possibility of their reduction.

Consider the procedure for calculating the main groups of indicators that are calculated in the course of the analysis:

- Average accounts receivable:

where: DZ - accounts payable.

- Accounts receivable turnover:

where: ODZ- turnover of receivables;

ATR

WithDZ- Average accounts receivable.

- Receivables repayment period:

where: PPDZ- period of repayment of receivables.

It should be borne in mind that the longer the delay, the higher the risk of non-payment.

- Share of accounts receivable in total current assets:

where: DZAct- share of accounts receivable in current assets;

Ta- current assets.

- The share of doubtful receivables in the total volume of current assets:

where: DDZwith me- share of doubtful receivables

DZwith me- doubtful receivables

The last indicator characterizes the "quality" of receivables. The trend towards its growth indicates a decrease in liquidity.

- Average accounts payable:

KZ - accounts payable.

- Accounts payable turnover:

where: Okz- turnover of accounts payable;

ATR- Revenue from the sale of products;

Withkz- Average accounts payable.

- Payable period:

where: PPKZ- period of repayment of accounts payable.

The payables repayment period shows how many turnovers during the analyzed period the company needs to pay the invoices issued to it or how many days it takes.

As a summary of this paragraph, it should be noted that receivables and payables are natural components of the enterprise's balance sheet. They arise as a result of a discrepancy between the date of occurrence of obligations and the date of payment on them. The financial condition of the enterprise is influenced both by the size of the balance sheet of receivables and payables, and the turnover period of each of them.

At the same time, this may indicate a faster turnover of accounts payable compared to the turnover of receivables. In this case, over a certain period, the debts of debtors are converted into cash at longer time intervals than the intervals when the company needs cash to pay debts to creditors on time. Accordingly, there is a lack of cash in circulation, accompanied by the need to attract additional sources of financing.

1.3 Features of management of receivables and payables of the enterprise

Working with accounts receivable, that is, the process of managing it, is an important moment in the activity of any enterprise and requires close attention of managers and managers. Determining approaches to receivables management, stages and methods is a problem that does not have an unambiguous solution, depends on the specifics of the enterprise and the personal qualities of the management.

Since the management of receivables is a component of the enterprise management system, the process of managing it can be carried out in stages. In addition, receivables management occurs over time, and it is natural that it must be represented as a certain staged system.

According to I.A. Blank, the formation of receivables management algorithms is carried out in the following stages:

analysis of accounts receivable of the enterprise;

choice of the type of credit policy of the enterprise in relation to the buyers of products;

determination of the possible amount of working capital, which is directed to receivables for commercial and consumer loans;

formation of a system of credit conditions;

formation of standards for evaluating buyers and differentiating the conditions for granting a loan;

formation of a procedure for collection of receivables;

ensuring the use of modern forms of refinancing receivables at the enterprise;

building effective systems for monitoring the movement and timely collection of receivables.

G.G. came to almost the same conclusion. Kireytsev, but supplementing I.A. Blank, he identifies several more stages: control of the financial condition of debtors; in case of non-payment of the debt or part of it, the establishment of operational communication with the debtor for the purpose of recognizing the debt; appeal to the economic court with a claim for the recovery of overdue debts; compensation for losses from the bad debt fund.

Russian experts identify four main areas of work on receivables management:

planning the amount of receivables for the company as a whole;

management of buyers' credit limits;

control of receivables;

employee motivation.

To manage receivables, an enterprise needs information about debtors and their payments: data on invoices issued to debtors that have not been paid at the moment; time of delay in payment for each of the accounts; the amount of bad and doubtful receivables, estimated on the basis of the standards established by the company; credit history of the counterparty (average overdue period, average loan amount). As a rule, such information can be obtained in the study of the accounting system.

In general, the above stages of receivables management are based on the basic management functions. Based on the definition of management, which is given in the work of a team of authors led by V. Zarubinsky, management is a function of organized systems of various nature (biological, social, technical), which ensures the preservation of their specific structure, support for the mode of activity, implementation of their programs and goals.

It is proposed to single out such stages in the process of managing receivables.

The first stage of management - planning the amount of receivables - was, is and will be one of the most important. This is due to the fact that in the process of implementing work on planning the amount of receivables, it is necessary to take into account not only the parameters of receivables that characterize its state, but also a number of external factors that can significantly affect the final results of management.

In the process of accounting for receivables, information is collected on the financial position of debtors, on which the state of receivables depends. The main difficulty at this stage is to determine the minimum amount and nomenclature of data that allow the control subject to have a clear idea of the state of the control object. This circumstance is connected with two points. The first point is due to the fact that the collection and processing of accounting information requires funds, which are always limited. The second point is caused by the fact that information can be duplicated and late, and this does not contribute to making an informed decision.

The third stage of management is the control of the amount of receivables, which involves comparing actual accounting data with planned or budgeted ones. In the era of central planning, it was enough to develop planned indicators, but in market conditions, planned indicators should be formed when studying the market, which requires the development of business development plans and budgets. Due to the lack of a system of planned indicators of the enterprise, the control stage performs slightly different functions, in fact, control is reduced to comparing accounting data only for the past and current (planned) period. Therefore, an effective management process should be based on a common enterprise management system.

At the fourth stage - the analysis of receivables - the factors are investigated and highlighted, the influence of which led to the emergence of deviations in the actual parameters of the state of receivables from planned indicators.

The fifth stage is the stage of developing a number of alternative solutions or determining the optimal solution.

To form several possible solutions aimed at improving the situation in which the enterprise is located, it is enough information collected at the analysis stage. Based on this information, it is possible to create a system of restrictions regarding the corresponding objective function, as well as to rank the reasons that most affect the amount of receivables. The same cause can have multiple consequences, and the elimination of these causes is modeled to evaluate possible outcomes. Thus, several alternative solutions are developed or even an optimal solution is determined.

The sixth stage - the phase of implementation of one or more alternative solutions - at this stage, the implementation of the adopted optimal solution or several alternative solutions is carried out. At this stage, the necessary funds are determined, as well as the procedure for implementing the decision.

An important issue in the management of accounts receivable is its classification. Depending on what sign is the basis of its classification, you can use a variety of methods for managing receivables.

B.O. Zhnyakin and V.V. Krasnova offer the most complete classification of receivables on an urgent basis, namely: current, urgent, overdue, long-term and bad.

The classification of receivables can be based on the distribution of receivables depending on the target groups of debtors. At the same time, marketing approaches are used, which are based on the study of consumer behavior. Accounting for various reasons for non-payments and the real possibilities of citizens to pay the debts that have arisen is decided on the basis of accounting data on payments and debts.

One of these methods is the ABC analysis method. This method is based on the law discovered by the Italian economist V. Pareto, who says that a relatively small number of causes are responsible for most possible outcomes, at the moment this law is better known as the "20/80 rule".

This method in domestic practice and more widely abroad is used both to select objects from the general range of products that are produced by the enterprise, and within the same type of products. The ABC-analysis method is based on the distribution of a set of potential objects into groups according to the specific weight of one or another indicator. The literature provides examples of ABC analysis in terms of turnover, profit, labor intensity, material costs, and even parameters such as speed and consumer power. With regard to receivables, it can be formulated as follows: 80% of the amount of receivables can be attributed to 20% of debtors.

The number of groups during the ABC analysis can be any, but the division of the considered population into three groups (75: 20: 5) has become most widespread, which, obviously, is the reason for the name of the method, known abroad as ABC-Analysis. Group A - a small number of objects with a high level of specific gravity according to the selected indicator. Group B - the average number of objects with an average level of specific gravity for the selected indicator. Group C - a high number of objects with a small share of the selected indicator.

G.G. Kireytsev offers a ratio (75: 20: 5) to determine the degree of importance of buyers: A - buyers are those with whom the enterprise carries out approximately 75% of the turnover. This turnover is about 5% of buyers. B - buyers (20%) give, as a rule, 20% of the turnover. C - buyers (75%), turnover is approximately 5%.

This interpretation of the Pareto rule for receivables is also possible. Group A debtors are the most important debtors, those 20% that account for 80% of receivables, which deserve increased control, since the efforts will be justified here. Group B - debtors of medium importance, those that account for 15% of receivables in total and require attention only occasionally. Group C - unimportant debtors, those that account for 5% of the total receivables of the enterprise. You should not devote too much time and effort to managing debtors of this group.

The sequence of the analysis: firstly, calculate the total debt of all clients on the list; secondly - to calculate 80% of this amount; thirdly, by summing up the debts according to the list, starting from its part with the largest debts, that part of consumers who owe 80% of the total amount should be singled out. Their number is much less than the number of debtors. The selected group of citizens is the first and main target audience, given its relative small number and the main share of the debt (80%). Work with this category of debtors should be based on a personal approach. These efforts are justified by the amount of debt that will be returned. In a similar way, two more groups are distinguished: the first will be the smallest, the third will be the most numerous.

This method makes it possible to form target audiences of debtors, for whom the methods of debt collection applied will differ, which will allow choosing the most effective methods of collection for this particular category. In addition, the advantage can be attributed to the choice of a group of debtors who accumulate the largest amount and which need to be paid attention in the first place. When applying the ABC analysis method, certain difficulties arise, especially for utilities. They lie in the need to automate and computerize all relationships with debtors. At the same time, in communal enterprises, computerized accounting of payments should be kept not for houses or districts in general, as is always done, but for end consumers. The result of the analysis are lists of debtors with whom it is necessary to work.

The ABC analysis method is mainly used in the management of receivables that already exist. Credit limit management can be used to prevent the occurrence of unpredictable debt. It represents the maximum allowable amount of receivables both for the enterprise as a whole and for each counterparty, or is set for each of the commercial departments of the company, allocated according to the industry principle in proportion to the part of the proceeds for the previous period in the total sales of the enterprise and approved by the order of the general director. According to the same scheme, the limits are distributed among managers who work with buyers. Each of the managers, in turn, must distribute the credit limit received by him among the clients. As a rule, for new customers who work with the company for no more than six months, the credit limit is set in an amount that does not exceed the average monthly sales volume. For counterparties who have been working with the company for more than six months, the credit limit is set by the manager and must be approved by the management.

When calculating these indicators, the company primarily focuses on its strategy, increasing the market share requires a larger credit limit than maintaining its market share and accumulating free cash. At the same time, it is necessary to maintain sufficient liquidity of the enterprise and take into account credit risk (the risk of complete or partial loss of funds issued). In most cases, work with a new client begins on a prepaid basis. After the statistics of payments and deliveries for the counterparty has been accumulated, he can be granted a credit limit.

The use of credit limits gives advantages when working primarily with new customers - it helps to prevent the occurrence of uncontrolled receivables. Difficulties that arise in this case: mandatory automation of the process, knowledge of the counterparty, study of its credit capabilities and solvency, which involves close contact.

The considered material allows us to present the mechanism for managing receivables in the form of a diagram shown in Figure 3.

Figure 3 - Accounts receivable management system

Under the management of accounts payable is understood the use by the enterprise of the most acceptable forms and terms for it, as well as the volume of settlements with counterparties. Accounts payable management provides for a selective approach to the counterparties of the enterprise and makes it possible to:

?evaluate the benefit of the credit policy of counterparties, determine the cost of accounts payable, taking into account discounts, bonuses and deferrals, credit limits and obligations;

?make decisions on the effectiveness of work with counterparties both at the operational and strategic levels;

?increase the profitability of accounts payable and the enterprise as a whole;

?coordinate the management of accounts payable and receivable, which allows to increase the financial stability of the enterprise;

?quickly identify areas and eliminate the causes of inefficient accounts payable management;

?direct employees to solve problems of accounts payable management.

The process of control over the movement of accounts payable is carried out in stages.

The preliminary stage is the determination of the need to obtain a commercial loan or the choice of such a method of settlement with suppliers as advance payment.

Stage 1 - the conclusion of an agreement with the supplier on obtaining a commercial loan - the agreement on payment terms, discounts so that the size is maximum, and sanctions - minimum.

Stage 2 - receipt from the supplier of products to the warehouse, control of its quality and quantity. Complaints to the supplier.

Stage 3 - timely repayment of debts to the supplier.

Stage 4 - drawing up acts of mutual settlements with debtors and creditors. Conducting an inventory of receivables and payables.

Stage 5 - in case of violation of the terms of delivery, enter into operational communication with suppliers on the subject of: a) timeliness of shipment of products; b) compliance with its qualitative parameters; c) replacement with another brand or grade.

Stage 6 - in case of difficulties in paying for the purchase: a) choose the most effective form of payment; b) choose the best way to repay obligations.

Stage 7 - in the event of the disappearance of the creditor - to capitalize the unclaimed accounts payable as non-operating income.

The functions of control over the movement of accounts payable are mainly performed by the supplier, for whom, in turn, it is a receivable.

Accounts payable management can be carried out using two main options: accounts payable optimization and accounts payable minimization.

Optimization - search for new solutions, with the help of which accounts payable and its change can be applied to the enterprise

positive impact (increase in authorized capital, increase in reserve capital, etc.).

Minimization - a mechanism for managing accounts payable, in which the existing accounts payable is reduced to its reduction, up to full repayment.

Thus, in the first chapter of the thesis, the concept and structure of receivables and payables were considered, the significance and role of the analysis of these articles of financial statements were determined, and the main indicators used in the course of the analysis were considered.

2. Evaluation of receivables and payables of the enterprise

2.1 Organizational and economic characteristics of the enterprise

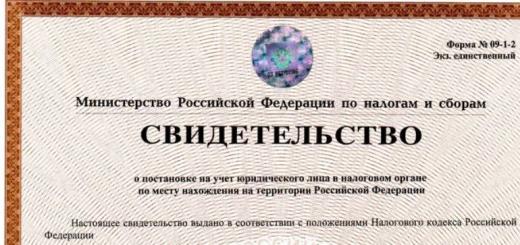

Kubaninterpraysis Limited Liability Company was established in accordance with the Civil Code of the Russian Federation and the Federal Law "On Limited Liability Companies".

Location of LLC "Kuban Interpraysis": Russia, Krasnodar Territory, Krasnodar, st. Sormovskaya, 1.

LLC "Kuban Interpraysis" is a full-fledged entity of economic activity and civil law, is recognized as a legal entity, owns separate property and is liable to them for its obligations.

LLC "Kuban Interpraysis" has an independent balance sheet, a round seal containing the full name in Russian, stamps, letterheads with its name, an emblem and other means of visual identification.

LLC "Kuban Interpraysis" has the right to open bank accounts on the territory of the Russian Federation and abroad, both in rubles and in foreign currency.

The Company is the owner of its property and funds and is liable for its obligations with its own property. Participants are liable for the obligations of the Company within the limits of their contributions to the authorized capital.

The Russian Federation, constituent entities of the Russian Federation and municipalities are not liable for the obligations of the Company, just as the Company is not liable for the obligations of the Russian Federation, constituent entities of the Russian Federation and municipalities.

The purpose of the Company's activities is to saturate the consumer market with goods and services and make a profit. The Company may carry out any types of activities that bring profit and are not prohibited by federal laws.

The profit of OOO "Kuban Interpraysis" is subject to taxation in the manner prescribed by the current legislation of the Russian Federation. The profit remaining after paying taxes and other payments to the budget goes to its full disposal and is used by the enterprise independently. The decision on the distribution of profits is made by the general meeting of participants.

LLC "Kuban Interpraysis" may be voluntarily reorganized in the manner prescribed by law. The reorganization of the Company may be carried out in the form of a merger, accession, division, separation and transformation.

When reorganizing, appropriate changes are made to the constituent documents of the company. The decision on the voluntary liquidation of the Company and the appointment of a liquidation commission is made by the Obidim meeting at the suggestion of the Board of Directors, the General Director or a member of the Company.

The company can also be liquidated by a court decision. The liquidation of the Company entails its termination without the transfer of rights and obligations by way of succession to other persons. The liquidation of the Company is carried out in accordance with the procedure established by the Civil Code of the Russian Federation, other legislative acts, subject to the provisions of this Charter. The General Meeting of Participants establishes, in accordance with the law, the procedure and terms for the liquidation of the Company and, in agreement with the registration authority legal entities, appoints a liquidation commission, the number of members of which, including the Chairman and the Secretary, cannot be less than three. The Company's property is sold by decision of the liquidation commission.

According to the Charter, LLC "Kuban Interpraysis" was established to carry out economic activities in order to meet public needs for its products, goods, works, services and the sale of the economic interests of participants and members of the labor collective of the company on the basis of the profit received.

To achieve the goals and objectives, Kuban Interpraysis LLC can carry out wholesale and retail trade in any kind of goods and products, including textiles, haberdashery, clothing and footwear.

The organizational structure of enterprise management is shown in Figure 4.

Figure 4 - Organizational structure of the management of LLC "Kuban Interpraysis"

Analyzing the organizational structure of the enterprise LLC "Kuban Interpraysis", we can say that its strengths are:

-high level of specialization;

-each head of his department is responsible for the quality of the work performed by him and his department, so they try to organize the work of their department so that all tasks are completed on time and with high quality;

-if necessary, the staff of functional departments is easily optimized, that is, the structure within the departments is flexible and receptive;

-existence of informal connections;

-any operational information about current indicators, conditions, etc. never lingers anywhere, i.e. any department and its employees directly provide the necessary information to the manager, as well as departments provide each other with the necessary information as quickly as possible.

Human resources are of great importance in the activities of the organization. The structure and dynamics of the number of personnel of the enterprise for 2009-2011 is shown in Figure 5.

Figure 5 - Dynamics of the average number of employees in LLC "Kuban Interpraysis"

Analyzing the data on the number of personnel, we can conclude that it remains constant during the analyzed period. In 2009-2011, the number of employees at the enterprise amounted to 20 people, of which:

people - administrative and managerial personnel;

human support workers (maintenance staff: cleaning lady, warehouse manager);

people are the main workers.

The size of the average salary at the enterprise also remains unchanged. For the purpose of material incentives for employees, a bonus system is applied for the quality of work performed, for the fulfillment and overfulfillment of production and financial plans.

For a more detailed consideration of the dynamics of the average wage, wage fund, we present the calculated data in Table 1.

Table 1 - Analysis of the dynamics of indicators characterizing the level of wages in OOO "Kuban Interpraysis" for 2009-2011

Indicator 200920102011Average number of employees, pers. 202020Average monthly salary, rub. 10812.510812.510812.5 Payroll fund, thousand rubles 2595.02595.02595.0 Labor productivity of one worker, thous./rub. 2822.553012.855628.45 Amount of work and services, thousand rubles 56451.060257.0112569.0

When analyzing the data in Table 1, it can be noted that there is a positive trend in terms of indicators characterizing the economic efficiency of labor resources, namely: the labor productivity of one employee increased by 2805.9 thousand rubles. and amounted to 5628.45 thousand rubles in 2011. in year.

Analysis of the efficiency of economic activity of Kuban Interpraysis LLC is based on the data of the enterprise's financial statements for 2009-2011 (Appendix 1-3).

Let's consider the indicators characterizing the efficiency of managing the current and non-current assets of the enterprise.

Fixed capital (non-current assets) is an investment of funds with long-term goals in real estate, bonds, stocks, mineral reserves, joint ventures, intangible assets, etc. The composition and dynamics of the fixed capital of the enterprise is presented in table 2.

Table 2 - Composition and dynamics of non-current assets of Kuban Interpraysis LLC for 2009-2011, (thousand rubles)

Funds of the enterprise200920102011Growth thousand. rub. share, %ths. rub. share, %ths. rub. share, %ths. rub. share, %2010/20092011/20102010/ 20092011/2010 Nemary assets 0000000 0 0-axle funds 36091003800100418610019138600 NEWS OF THE DOCTIONS 0000000000 OFFITIONS OF THE OF THE vent ocular venerates 360910038004100191386----------

From the data in table 2 it can be seen that the amount of non-current assets consists only of fixed assets. The cost of fixed capital in relation to 2009 in 2010 increased by 5.3%, respectively, in 2011 in relation to 2009 increased by 10.2%, which indicates the renewal of fixed assets.

To assess the structure of fixed assets, there is a division of them into an active part, indefinitely participating in the production process, and a passive part, with the help of which the normal functioning of active fixed assets is ensured. An increase in the share of the active part of fixed assets and, accordingly, a decrease in the share of the passive part are an important factor in the growth of the efficiency of production activities.

In an organization where 100% of the share in the structure of fixed capital is occupied by fixed assets, it is necessary to analyze their composition, structure and dynamics (table 3).

Table 3 - Availability, movement and structure of OPF LLC "Kuban Interpraysis" for 2009-2010 (thousand rubles)

ПоказателиНаличие на начало годаПоступилоВыбылоНаличие на конец года2009 годЗдания4952004952Сооружения480048Машины и оборудования83184642898493Транспортные средства879033846Производственный и хозяйственный инвентарь182713ИТОГО: 14215466329143522010 годЗдания4952004952Сооружения480048Машины и оборудования8493652739072Транспортные средства84641401260Производственный и хозяйственный инвентарь130013ИТОГО: 14352106673153452011 годЗдания4952004952Сооружения48000Машины и оборудования9072353189407Транспортные средства126039801658Производственный и хозяйственный инвентарь 13 0 0 13ИТОГО: 153457511816078

Analyzing the data on the dynamics and structure of fixed assets, we see that there were no changes in the structure of buildings (in 2009-2011 - 4952 thousand rubles). The composition of vehicles and machinery and equipment has grown significantly (the growth rate in 2011 compared to 2009 and 2010 was 48.9% and 6.8%, respectively).

For a generalizing characteristic of the efficiency of the use of fixed assets, indicators of capital productivity of fixed production assets, capital intensity, and relative savings of fixed assets are calculated. The dynamics of the performance indicators of the main production assets of LLC "Kuban Interpraysis" for 2009-2010 is presented in table 4.

Table 4 - Dynamics of performance indicators of the BPF of the enterprise LLC "Kuban Interpraysis" for 2009-2011 (thousand rubles)

Показатели2009 год2010 год2011 годИзменение2010/ 20092011/ 2010Выручка5917974302911081512316806Среднегодовая стоимость основных производственных фондов14283,514848,515711,5565863Фондоотдача4,145,05,80,860,8Фондоемкость0,240, 200,17-0,04-0,03Относительная экономия основных производственных фондов 2002,3 2339,1 4315 336.8 1975.9

From the results obtained in Table 4, it can be seen that the return on assets during the three analyzed years increases (from 4.14 in 2009 to 5.8 in 2011) due to an increase in the company's revenue. The capital intensity indicator is decreasing (from 0.24 in 2009 to 0.17 in 2011), which indicates an increase in the efficiency of the use of fixed production assets.

Based on the data in the table, we will build a graph that reflects the efficiency of using the fixed assets of the enterprise (Figure 6)

Figure 6 - Indicators of the efficiency of the use of fixed assets of LLC "Kuban Interpraysis" for 2009-2011

Current assets occupy a large share in the total balance sheet currency. This is the most mobile part of the capital, on the state and rational use of which the results of economic activity and the financial condition of the enterprise largely depend.

The main purpose of the analysis is the timely identification and elimination of shortcomings in working capital management and finding reserves to increase the intensity and efficiency of its use. Analyzing the structure of current assets, it should be borne in mind that the stability of the financial condition largely depends on the optimal allocation of funds through the stages of the circulation process.

In the process of analysis, first of all, it is necessary to study changes in the presence and structure of current assets (table 5). The structure of current assets of Kuban Interpraysis LLC for 2011 is also shown in Figure 7.

Table 5 - Analysis of the dynamics and structure of current assets of Kuban Interpraysis LLC for 2009-2011 (thousand rubles)

Type of current assets Availability of funds, thousand rubles Структура средств, %2009 год2010 год2011 год2009 год2010 год2011 год1234567Общая сумма оборотных активов104951347717181100100100Из них: Денежные средства 78 127 85 0,7 0,9 0,5Краткосрочные финансовые вложения000000Дебиторская задолженность8286113091454879,083,984,7Налоги по приобретенным ценностям4986184,70,040,02Запасы В том числе: сырье и materials deferred expenses1633 1470 1632023 1288 7352530 1859 67115.6 14.0 1.615.0 9.6 5.414.7 10.8 3.9 Participation in the operating process: in the sphere of production in the sphere of circulation1633 88622023 114542530 146.50115 .7 85.3

Figure 7 - The structure of current assets of OOO "Kuban Interpraysis" in 2011,%

As can be seen from the data in Table 5 and Figure 7, at Kuban Interpraysis LLC, the largest share in current assets is occupied by receivables. During the three analyzed years, the share of accounts receivable increases (in 2009 - 79.0%, in 2010 - 83.9% and, accordingly, in 2011 - 84.7%). The share of cash to decrease, which indicates the irregular work of the enterprise.

In connection with the reform of enterprises and the need to stabilize economic development, the importance of analyzing the liquidity and solvency of an enterprise is increasing. The liquidity of assets is defined as their ability to turn into cash, and solvency - as the ability to timely and fully pay off their obligations.

Analysis of the liquidity of the balance sheet consists in comparing the funds of the asset, grouped by the degree of their liquidity and arranged in descending order of liquidity, with the liabilities of the liability, grouped by their maturity and arranged in ascending order of maturity (Appendix 4).

To determine the liquidity of the balance sheet, the above groups should be compared. The balance is considered absolutely liquid if the following optimal ratios are met:

In the case when one or more inequalities of the system have the opposite sign compared to the optimal variant, the liquidity of the balance sheet differs from the absolute one. The liquidity assessment of the balance sheet of OOO Kuban Interpraysis for 2009 - 2011 is presented in Table 6.

Table 6 - Assessment of the liquidity of the balance sheet of OOO "Kuban Interpraysis" for 2009-2011

Analyzed period Actual ratio at the beginning of the analyzed period Actual ratio at the end of the analyzed period 2009 absolute liquidity conditions are not achieved2010 the condition of absolute liquidity is not achieved absolute liquidity conditions are not achieved2011 the condition of absolute liquidity is not achieved the condition of absolute liquidity is not achieved

According to Table 6, the assessment of the liquidity of the balance sheet for the three analyzed years showed that OOO "Kuban Interpraysis" did not reach the condition of absolute liquidity.

The analysis of the financial and economic activity of the enterprise LLC "Kuban Interpraysis" for 2009-2011 allows us to conclude that the company is in a stable financial position, but has insufficient liquidity of assets.

The management of the enterprise should take measures to prevent further deterioration of the financial condition and develop measures for more rational management of the capital of the enterprise in order to increase the efficiency of financial and economic activity.

2.2 Analysis of the receivables of the enterprise

In the current crisis conditions of management caused by the consequences of the global financial crisis of 2008-2009, in order to prevent a significant decrease in the volume of activities, Kuban Interpraysis LLC pursues an active policy of lending to its customers, which consists in providing a large number of products, payment for which can be made by bank transfer .

Regardless of the control measures on the part of the enterprise, in order to avoid the sale of products to insolvent buyers, the accounting department of Kuban Interpraysis LLC maintains a record of settlements with buyers and customers. Based on the statement, the ranking of debts by the terms of payment of invoices is carried out, which helps the company determine the credit policy.

All accounts receivable are classified into the following groups:

the payment deadline has not arrived;

delay from 1 to 30 days (up to 1 month);

delay from 31 to 90 days (from 1 to 3 months);

delay from 91 to 180 days (from 3 to 6 months);

delay from 181 to 360 days (from 6 months to 1 year);

delay of 360 days or more (more than 1 year).

According to the credit policy of the enterprise, the justified debt is the debt, the maturity of which has not come or is less than one month. Unjustified debts include arrears of buyers and customers. In order to determine the effectiveness of the credit policy of Kuban Interpraysis LLC, we will analyze the accounts receivable for the period under study.

To assess the composition and movement of receivables of Kuban Interpraysis LLC for 2009-2011, we will compile an analytical table 7.

The data given in table 7 show that for 2009-2011 the amount of receivables is increasing. In the structure of receivables, there is only short-term accounts payable, which accounts for 100% of the total debt. Its value for the analyzed period increased from 7516 thousand rubles. at the beginning of 2009 to 14548 thousand rubles. at the end of 2011.

In the total structure of receivables of Kuban Interpraysis LLC, overdue debts account for 43.3% on average over three years.

Over the analyzed period, overdue accounts receivable increased from 4125 thousand rubles. in 2009 to 6552 thousand rubles. in 2011. Consequently, the company failed to achieve the repayment of part of the overdue debts.

At the same time, it should be noted that the balance of receivables with a maturity of more than 3 months increased by 713 thousand rubles.

Table 7 - Assessment of the composition and movement of receivables

Indicators Movement of accounts receivableGrowth rate of the balance, %Balance at the beginning of the yearOccurredRepaidBalance at the end of the yearAmount, thousand rubles. Oud. weight,% amount, thousand rubles Oud. weight,% amount, thousand rubles Oud. weight,% amount, thousand rubles Oud. вес, %2009 годДебиторская задолженность, всего, в т. ч. 7516100611410053441008286100110,2Краткосрочная дебиторская задолженность7516100611410053441008286100110,2в том числе просроченная311241,4144523,64328,1412549,8132,6из нее длительностью свыше 3 месяцев112815,088514,578814,7122514,8108,62010 годДебиторская задолженность, всего, в т. ч.,5Краткосрочная дебиторская задолженность82861006445100342210011309100136,5в том числе просроченная322538,9244137,9155445,4411236,4127,5из нее длительностью свыше 3 месяцев145817,690814,12527,4211418,7145,02011 годДебиторская задолженность, всего, в т Part 8.6 Short-term accounts14548100128.6 including overdue accounts receivable554749.0258632.9158134.3655245.0118.1 of which the duration is more than 3 months322528.51874136.913425 The indicator of the quality of receivables determines the probability of receiving debt in full, which depends on the period of debt formation. Practice shows that the longer the term of receivables, the lower the probability of its receipt. Let's analyze the state of receivables by the terms of its formation (table 8).

Table 8 - Analysis of the structure and status of receivables of Kuban Interpraysis LLC for 2009-2011 (thousand rubles)

IndicatorsTotal at the end of the year weight, % including by terms of formation up to 1 month. from 1 to 3 months from 3 to 6 months 2009Дебиторская задолженность покупателей и заказчиков825699,64411629001225Прочие дебиторы300,363000Всего дебиторская задолженность8286100414629001225В процентах к общей сумме ДЗ, %100х50,0435,0014,782010Дебиторская задолженность покупателей и заказчиков1017789,99609719662114Прочие дебиторы113210,011100320Всего дебиторская задолженность11309100719719982114В процентах к общей сумме ДЗ, %100х63,6417,6718, 692011 Accounts receivable of buyers and customers1329091.35684930293412 Other debtors12588.6511471110

An analysis of the data in Table 8 shows that the main share of receivables falls on the debt of buyers and customers - in 2009 - 99.648%, or 8256 thousand rubles, in 2010 - 89.99% or 10177 thousand rubles, in 2011 - 91.35% or 13290 thousand rubles. The largest volume of receivables falls on debts with a maturity of up to 3 months. Including in 2011, 21.58% of total receivables (or 3,140 thousand rubles) are debts with a maturity of 1 to 3 months. At the same time, LLC "Kuban Interpraysis" as part of receivables in 2011 has a rather high amount of debt (3412 thousand rubles) with a long period of formation - more than 3 months, which is an overdue debt. Therefore, LLC "Kuban Interpraysis" must make every effort to collect overdue debts in the near future, since otherwise it is possible to write off overdue debts to reduce the financial results of the organization.

Depending on the specific conditions, other intervals for the occurrence of debt can be accepted. The availability of such information for a long period makes it possible to identify both general trends in settlement discipline and specific buyers, who most often fall into the number of unreliable payers. For a more detailed presentation of the calculated data, consider Figure 8.

Figure 8 - Dynamics of the structure of short-term receivables of Kuban Interpraysis LLC for 2009 - 2011 in %

The structure of receivables by terms of formation is shown in Figure 9.

Figure 9 - The structure of receivables in LLC "Kuban Interpraysis" by the terms of formation for 2009 - 2011, in%

The most important element of the analysis of accounts receivable is the assessment of its turnover. The trend of this indicator is often used in determining the validity of a discount for early payments. The higher the turnover rate, the less money invested in receivables.

The indicators of the turnover of receivables of Kuban Interpraysis LLC are presented in table 9.

Analysis of the data presented in Table 9 showed that:

the turnover ratio of funds in settlements (of all receivables) increases from 6.2 at the beginning of 2009 to 7.1 at the end of 2011. The diversion of enterprise funds into settlements and indirect lending by the enterprise (in the form of a commodity loan) to other enterprises are reduced;

there are no receivables for which payments are expected more than 12 months after the reporting date;

the turnover of accounts receivable, payments on which are expected within 12 months after the reporting date, increases. The enterprise incurs less losses from the depreciation of receivables;

accordingly, the turnover period of funds in the calculations of all accounts receivable decreases and amounts to 51.1 days at the end of 2011;

there are no accounts receivable with payments expected more than 12 months after the reporting date. Therefore, the turnover period for this type of debt is not determined;

the turnover period of accounts receivable, payments on which are expected within 12 months after the reporting date, is reduced;

the same value of indicators of coefficients and terms of turnover of funds in the calculations of all receivables and receivables, payments for which are expected within 12 months after the reporting date, are due to the fact that the analyzed enterprise has only one type of receivables.

Table 9 - Indicators of turnover of receivables of Kuban Interpraysis LLC for 2009-2011

Name of indicator 2009 2010 2011 at the beginning of the year at the end of the year change (+, -) at the beginning of the year at the end of the year change (+, -) at the beginning of the year at the end of the year change (+, -) 51.37.57.60.17.67.1-0.52. The turnover ratio of funds in the calculations (within 12 months) 6.27.51.37.57.60.17.67.1-0.53. Turnover period of funds in settlements (of all accounts receivable), days 58.148-10.14847.4-0.647.451.19.74. Accounts receivable turnover period (within 12 months), days 58.148-10.14847.4-0.647.451.19.7

Based on the data in the table, we will build a graph that reflects the turnover of the company's receivables (Figure 10)

Figure 10 - Indicators of turnover of receivables of LLC "Kuban Interpraysis" for 2009-2011

It is advisable to supplement the report on settlements with debtors with an aging register of receivables (table 10), which reflects the distribution of debt by maturity for each debtor, as well as the percentage attributable to each of the periods of delay in the context of customers and in general for the total amount of receivables. It is advisable to make this type of report at least once a month, as well as summarize the results for the quarter and for the year.

Table 10 - Register of aging receivables

ClientDistribution of debt by maturityTotal amount of debt, thousand rubles Share in the total volume, %Up to 30 days30-90 daysOver 90 daysths. rub. %ths. rub. %ths. rub. %2009КраснодарГУ893,0717614,372653,2РГОТУПС2175,271304,483474,2СГМА1143,9320116,413153,8ССХА1253,042177,4830624,986487,8ОАО "Октава"71417,3529810,28101212,3Прочие306074,34205270,7654244,24566968,7Итого411649,85290035,13122514 ,848256100%2010КраснодарГУ894,532099,892982,9РГОТУПС2203,611799,103993,9СГМА1186,0029413,914124,0ССХА1141,8723612,0036417,227147,0ОАО "Октава"61210,0464632,86125812,4Прочие515184,4869835,50124758,99709669,7Итого60971966211410177100%2011КраснодарГУ1143 ,762045,983182,4РГОТУПС1141,662989,844123,1СГМА943,1041712,225113,8ССХА2203,212367,7935510,408116,1ОАО "Октава"5477,9946815,4510157,6Прочие596887,14181960,05243671,401022376,9Итого68493029341213290100%

An analysis of the data in Table 10 allows us to conclude that the largest share in the structure of receivables among the analyzed debtors belongs to Oktava OJSC (in 2009 - 12.3%, in 2010 - 12.4%, in 2011 - 7.6 %).

2.3 Analysis of accounts payable of the enterprise

To analyze the company's accounts payable, the company's financial statements for 2009-2011, as well as analytical accounting data, are used as a source of information.

We will analyze the dynamics and structure of the company's accounts payable using table 11.

Table 11 - Analysis of the dynamics, structure of accounts payable of Kuban Interpraysis LLC for 2009-2011

Balance sheet items200920102011Deviation 2011 from 20092010ths. rub. beats weight, %ths. rub. beats weight, %ths. rub. beats weight, %ths. rub. thousand roubles. Кредиторская задолженность259461001206510015971100-99753906В том числе: поставщики и подрядчики2237386,231066288,371438890,09-79853726перед персоналом организации594,162,29326,962,71298,661,87-295,5-28,3задолженность по налогам и сборам744,652,87538,14 ,46656.414.11-88.24118.3other creditors2231.48.6538.14.46627.663.93-160489.56

When analyzing table 11, it can be noted that there is a downward trend in accounts payable, so in 2011 the amount of debt amounted to 15971 thousand rubles, which is lower than in 2009 by 9975 thousand rubles, but higher than in 2010 by 3906 thousand rubles

These changes occurred mainly due to a decrease in debt to suppliers and contractors, from 2009 to 2011 the decrease amounted to 7985 thousand rubles.

There is a decrease in the internal debt of the organization, namely, the debt to the personnel of the enterprise in 2011 amounted to 298.66 thousand rubles, which is lower than in 2009 by 295.5 thousand rubles.

There is also a decrease in debt to the budget and a decrease in the amount of debt to other creditors.

When considering the structure of accounts payable, it can be noted that the main share in the total amount of debt belongs to debts to suppliers and contractors (in 2009 - 86.23%, in 2010 - 88.37%, in 2011 - 90.09 %.

For a more detailed presentation of the data, we will use Figure 11.

Figure 11 - Dynamics and structure of accounts payable of LLC "Kuban Interpraysis" for 2009-2011

Next, we will analyze the turnover of accounts payable, since in order to make management decisions, the management of the enterprise needs to have at its disposal information how many turnovers during the analyzed period the company needs to pay the invoices issued to it or how many days it takes.

To assess the turnover of accounts payable, the following group of indicators is calculated:

Average accounts payable;

Accounts payable turnover;

The period of repayment of accounts payable.

For a more convenient consideration of the calculated indicators, we use table 12.

Table 12 - Analysis of accounts payable turnover of Kuban Interpraysis LLC for 2009-2011

Indicator 200920102011 Deviation of 2011 from 200920101. Average accounts payable2311419005.514018-9096-4987.52. Accounts payable turnover2,443,178,035,594,863. Accounts payable turnover period149.6115.145.4-104.2-69.7

When analyzing table 12, it can be noted that the amount of average accounts payable tends to decrease, so in 2011 accounts payable amounted to 14018 thousand rubles, which is lower than in 2009 by 9096 thousand rubles. These changes can be characterized positively, in addition, there is an increase in the number of turnovers made by accounts payable and, as a result, a decrease in the duration of one turnover.

The ability of an enterprise to make payments on time, finance its operations on an extended basis, withstand unforeseen shocks, and maintain its solvency in adverse circumstances is indicative of its sound financial condition, and vice versa.

If solvency is an external manifestation of the financial condition of an enterprise, then financial stability is its internal side, reflecting the balance of cash and commodity flows, income and expenses, means and sources of their formation.

A stable financial condition is achieved with equity capital adequacy, good asset quality, a sufficient level of profitability, stable income and borrowing. To provide financial stability enterprises must have a flexible capital structure, be able to organize its movements in such a way as to ensure a constant excess of income over expenses in order to maintain solvency and create conditions for self-financing.

The financial condition of the enterprise, its sustainability and stability depend on the results of its production, commercial and financial activities.

Using the grouping of asset and liability items given in Appendix 4, we will calculate the liquidity ratios of LLC KubanInterpraysis, the data are presented in table 13.

Table 13 - Financial and operational liquidity ratios of LLC "Kuban Interpraysis" for 2009-2011

Liquidity indicators 2009 2010 2011 at the beginning of the year at the end of the year change (+; -) at the beginning of the year at the end of the year change (+; -) at the beginning of the year at the end of the year change (+; -) .83-0.012. Absolute liquidity ratio (urgency) 0.040.01-0.030.010.020.010.020.01-0.013. The ratio of "critical evaluation" (or intermediate coverage) 1.701.51-0, 191.511.5101.511.5-0.014. Current liquidity ratio2.151.90-0.251.901.78-0.121.781.76-0.025. The coefficient of abstraction of the functioning of capital is 0.210, 20-0.10, 200.15-0.050.150.1506. Share of working capital in assets 0,720,740,020,740,780,040,780,80,027. The coefficient of provision with own working capital is 0.520.46-0.060.460.43-0.030.430.4308. The coefficient of restoration of the solvency of the enterprise0.880.860.88

The calculation of financial and operational liquidity ratios of Kuban Interpraysis LLC showed that:

in 2009-2011, the overall solvency of the enterprise is declining. It becomes a less reliable partner, the risk of economic and credit relations with the enterprise increases, but, despite the negative results, there is a tendency to improve;