Act of inventory of receivables and payables (sample)

Each domestic enterprise, at different intervals, must conduct an inventory of its fixed assets, inventory, receivables and payables. This obligation is provided for by the Law "On Accounting". The procedure for such a reconciliation is detailed in the instructions of the state bodies of Russia. One of the documents drawn up based on the results of the audit is form No. INV-17. A sample of its filling is not legally approved.

Debt inventory

The Ministry of Finance of Russia issued Order No. 49 of June 13, 1995, which not only approved the Guidelines for conducting an inventory, but also developed forms and forms of official documents.

It should be emphasized that the provisions of paragraph 1.1 of this regulatory act directly indicate the need to reconcile not only property, but also all financial obligations of organizations. To do this, an inventory list of settlements with buyers, suppliers, as well as the amount of debt is compiled.

In the process of checking such amounts, the inventory commission should establish the correctness of registration and the occurrence of obligations to creditors and debtors.

Among other documents, the Ministry of Finance Russian Federation approved the form INV-17 in its Order. The named form is used in cases of inventory calculations:

- with buyers;

- with sellers;

- receivables and payables.

However, it must be remembered that at present, by the Decree of the State Statistics Committee of the Russian Federation dated 18.08.98 N 88, the INV-17 form, which is still used today, has been developed and put into effect.

Blank form INV-17

When filling out any documents related to the reconciliation of the actual state and information reflected in the accounting records, all members of the inventory commission must certify the information contained in the forms used with their signatures. Ignoring this instruction may result in the recognition of the corresponding form as invalid.

Sample act of inventory of receivables and payables

The Goskomstat of the Russian Federation, in Decree N 88 of August 18, 1998, developed not only the form of the act itself used in the reconciliation of obligations, but also approved an annex to it. However, neither the State Statistics Committee of Russia, nor the Ministry of Finance of the Russian Federation, in their Methodological Recommendations, have developed an official sample for filling out INV-17.

Filling in the specified gap, it is necessary to indicate that the form of the main form consists of two parts:

- facial;

- negotiable.

The first page of the document contains general information about the enterprise, its division, and also indicates the start and end of the reconciliation, its basis, the number and date of the act itself. To comply with the procedure for filling out INV-17, the code of the type of activity of the enterprise should be reflected on the title page.

The form is filled out on a computer or with a black or blue pen.

After reflecting the specified data, information on accounts receivable.

The reverse side of the document form is intended to reflect information on relationships with creditors.

The data entered in the act of inventory of settlements with buyers, sellers, debtors and creditors are certified by members of the commission.

The basis for compiling the initial form is a certificate, which is an annex to form No. INV-17, without which the inventory act cannot be considered executed in accordance with the legislation of Russia.

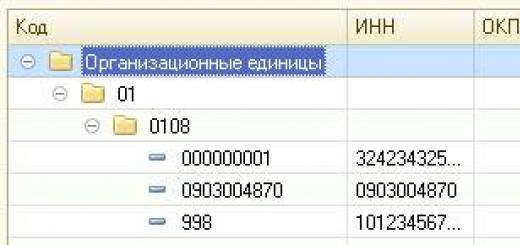

Information in the specified application is entered in accordance with the data of synthetic accounting accounts of the enterprise.

A sample of filling out the INV-17 form and its annexes

How to correctly issue the transfer of receivables and payables, which document in the following situation: Enterprise A has receivables: Enterprise P in the amount of 1,000,000 rubles. enterprise F in the amount of 500,000 rubles and also accounts payable: to enterprise D in the amount of 500,000 rubles. enterprise M in the amount of 500,000 rubles. enterprise A is closed and, by agreement, wants to transfer everything to another enterprise G.

In this situation, enterprise A can transfer receivables to enterprise D under an assignment agreement, in which enterprise A will be the assignor, and enterprise D will be the assignee.

The transfer of rights from the assignor to the assignee is formalized by an assignment agreement. The assignment agreement must be concluded in the same form as the original agreement (purchase and sale agreement, credit, etc.):

With regard to accounts payable:

Entity A can transfer her to Entity D by means of a debt transfer. To transfer an obligation, the original debtor and the organization to which the debt is transferred sign an appropriate agreement. And the creditor must put his mark on this agreement that he is not against the transfer. Or you can conclude a tripartite agreement. The signature of the creditor in it and will mean his consent

An example of the reflection of such a transaction for each of the parties is given in the text of the detailed answer.

How can the assignor formalize and reflect in accounting the assignment of the right to claim

When the right of claim is assigned, the creditor (assignor) transfers to another person (assignee) his right to claim from the debtor the performance of his obligations. For example, a creditor has the right to transfer its rights of claim when the debtor fails to repay its accounts payable on time.*

Grounds for assignment of the right to claim*

The creditor may transfer his rights to another person:

The cost of the right of claim, at which it is accounted for on the balance sheet of the assignor, reflect as part of other expenses in the debit of account 91 (clause and PBU 10/99). At the same time, on the date of signing the cession agreement, make the following entry in the accounting:

Debit 91-2 Credit 62 (76, 58)

– the value of the realized right of claim under the assignment agreement was written off from the balance sheet.

Upon receipt of payment from the assignee under the contract of assignment of the right to claim, make the entry:

Debit 51 (50) Credit 76 sub-account "Settlements under the contract of assignment of the right to claim"

– payment has been received from the assignee under the assignment agreement.

An example of the reflection in accounting of the assignment of the right to claim. Assignor account*

CJSC Alfa on March 16 sold goods in the amount of 165,200 rubles. (including VAT - 25,200 rubles). The cost of goods sold is 120,000 rubles.

On April 20, Alpha assigned the right to claim receivables to another organization for 160,000 rubles. This amount was transferred to Alfa's account on May 17.

Since the income from the assignment of the right to claim (160,000 rubles) does not exceed the amount of the claim itself (165,200 rubles), Alpha does not have a tax base for VAT.

The accountant of Alpha made the following entries in the accounting.

Debit 62 Credit 90-1

- 165,200 rubles. - reflected the proceeds from the sale of goods;

Debit 90-3 Credit 68 sub-account "VAT calculations"

- 25,200 rubles. - VAT is charged on the sale of goods;

Debit 90-2 Credit 41

- 120,000 rubles. - written off the cost of goods sold.

Debit 76 subaccount "Settlements under the contract of assignment of the right to claim" Credit 91-1

- 160,000 rubles. - the assignment of the right to claim is reflected;

Debit 91-2 Credit 62

- 165,200 rubles. - the value of the realized receivables under the contract of assignment of the right to claim is written off.

Debit 51 Credit 76 sub-account "Settlements under the contract of assignment of the right to claim"

- 160,000 rubles. - money was received from the assignee under the contract of assignment of the right to claim.

Taxes*

For information on how to account for income and expenses associated with the assignment of claims when calculating taxes, see How the assignor should account for the assignment of claims when taxing .

How to issue and reflect in accounting and taxation debt transfer

The organization can transfer obligations to the creditor to its counterparty. This can be any debt, such as repaying a loan, paying in advance for goods, or performing work. That is, the debtor changes, but the creditor remains the same. He only expresses his agreement or disagreement with such a translation.

How to arrange a debt transfer*

To transfer an obligation, the original debtor and the organization to which the debt is transferred sign an appropriate agreement. And the creditor must put his mark on this agreement that he is not against the transfer. Such consent is required by paragraph 1 of Article 391 of the Civil Code of the Russian Federation.*

Accounting: at the creditor*

For the creditor, the transfer of debt means only the replacement of the debtor in the obligation. Therefore, if your organization acts as a creditor, then in accounting reflect the transfer of debt by posting:

Debit 62 (58, 76...) "New debtor » Credit 62 (58, 76...) «Initial debtor »

- reflects the amount of debt transferred by the debtor to another person.

When payment is received from the new debtor (the obligation is extinguished), make a posting in the accounting:

Debit 50 (51, 60, 76...) Credit 62 (58, 76...) "New debtor »

- payment was received (set-off was made) in repayment of the debt under the contract from the new debtor.

This procedure follows from the Instructions for the chart of accounts (accounts,,,).

Accounting: at the original debtor*

On the date specified in the debt transfer agreement, the original debtor ceases to be obligated under the contract. At the same time, he has obligations to the counterparty, which has assumed the obligation to repay the debt. Therefore, if your organization is the original debtor, write off the amount of accounts payable in accounting by posting:

Debit 60 (66, 76...) Credit 76

- the amount of accounts payable transferred to the counterparty with the consent of the creditor is written off.

Reflect the repayment of the obligation to the new debtor by posting:

Debit 76 Credit 50 (51, 60, 62, 76)

– payment (offset) of obligations under the debt transfer agreement has been made.

This procedure follows from the Instructions for the chart of accounts (accounts,).

An example of the reflection of debt transfer operations in the accounting records of the original debtor*

In June LLC Torgovaya Firma Germes (creditor) sold materials to LLC Alpha (original debtor) in the amount of 590,000 rubles. (including VAT - 90,000 rubles) according to the supply agreement. The due date for payment is July 30th. On July 1, Alfa, with the consent of Hermes, transfers the debt to Master Production Company LLC (counterparty). Alfa and Master entered into an agreement that, in payment for the finished product received by Master from Alfa, Master assumes the obligation to repay Alfa's debt to Hermes.

In accounting for Alpha, the accountant made the following entries.

In June:

Debit 10 Credit 60

- 500,000 rubles. – materials were received from the “Trading company “Hermes””;

Debit 19 Credit 60

- 90,000 rubles. – reflected VAT for purchased materials;

Debit 68 Credit 19

- 90,000 rubles. - Accepted for deduction of input VAT on purchased materials.

At the time of shipment of goods to the "Master":

Debit 62 Credit 90-1

- 590,000 rubles. – recognized income from the sale of products to the "Master";

Debit 90-3 Credit 68

- 90,000 rubles. - VAT is charged on the cost of shipped products.

In July:

Debit 60 Credit 62

- 590,000 rubles. – debt transfer obligations are offset against payment for delivered products.

Accounting: with a new debtor*

When your organization assumes obligations from another organization and acts as a new debtor, reflect the recognition of debt to the creditor by posting:

Debit 60 (76) Credit 76

- reflects accounts payable to the original creditor and receivables from the former debtor.

This must be done on the effective date of the debt transfer agreement.

Pay off the debt to the creditor by posting:

Debit 76 Credit 50 (51, 60, 62, 76...)

- the debt to the creditor is repaid.

This procedure follows from the Instructions for the chart of accounts (accounts,).

An example of the reflection of debt transfer operations in the accounting of a new debtor *

In June LLC Torgovaya Firma Germes (creditor) sold materials to LLC Alpha (original debtor) in the amount of 590,000 rubles. (including VAT - 90,000 rubles) according to the supply agreement. The due date for payment is July 30th. On July 1, Alfa, with the consent of Hermes, transfers the debt to Master Production Company LLC (the new debtor). The "Master" has outstanding accounts payable to "Alpha" in the amount of 1,180,000 rubles. Alfa and Master entered into an agreement on the transfer of debt to offset Master's accounts payable to Alfa.

The accountant of the "Master" made the following postings.

In January:

Debit 10 Credit 60

- 1,000,000 rubles. - reflected the receipt of products from Alpha;

Debit 19 Credit 60

- 180,000 rubles. - input VAT on purchased products is reflected;

Debit 68 Credit 19

- 180,000 rubles. - Accepted for deduction of input VAT on purchased products.

In July:

Debit 76 sub-account “Settlements with OOO Alpha” Credit 76 sub-account “Settlements with OOO Trading Firm Germes”

- 590,000 rubles. – commitments to “Trading firm “Germes”” were accepted;

Debit 60 Credit 76 sub-account "Settlements with Alpha LLC"

- 590,000 rubles. – offset of accounts payable to Alfa;

Debit 76 sub-account “Settlements with OOO Trading Firm Germes” Credit 51

- 590,000 rubles. – the debt to the “Trading firm “Germes”” was repaid.

Question

Please tell me how to correctly draw up an act of acceptance of the transfer of receivables, to the contract for the sale of the right of claim between the LLC and the individual entrepreneur (receivables). If possible, please send a sample.

Answer

The form of the contract on the assignment of the right to claim (cession) must comply with the general standards applicable to the execution of contracts. It should be clear from the text of the contract who, to whom, to what extent and from what point in time transfers the rights of claim.

The contract must necessarily contain a reference to the contract that was concluded between the old creditor and the debtor. When transferring the right of claim, the old creditor is obliged to transfer to the new creditor all Required documents which he has under a deal with the debtor.

The assignment agreement must be concluded in the same form as the original agreement (contract of sale, credit, etc.). The assignor must attach documents certifying the right to demand the performance of certain obligations from the debtor to the assignment agreement. These can be contracts, invoices, invoices, acts of work performed (services rendered), etc.

The assignment agreement must specify:

- on the basis of which agreement this or that right arose;

- what is the obligation of the debtor;

- a list of documents and terms for the transfer of documents certifying the right to claim, which the assignor must transfer to the assignee;

- other information regarding the assigned rights.

This procedure is provided for by paragraph 3 of Article 385 of the Civil Code of the Russian Federation.

The law does not establish the form of the act of acceptance and transfer of receivables.

Related questions:

-

Good afternoon! I got the answer to my question, thank you very much for the clarification. There are two small questions left: If I have receivables in USD that arose before 01/01/2015, then in tax accounting ...... -

Acquisition of bad receivables. Debt 10,000, buy for 3,000. Are there any tax liabilities? Can the purchase price be included as an expense? What to do with the data... -

Good afternoon! Could you tell me how to draw up an urgent employment contract with a driver? The contract is supposed to be concluded for four months, due to the increase in the number of orders in the summer…... -

Good afternoon! IP worked without employees. In July, he wants to register one person for work. What is needed for this and what reports will need to be submitted after accepting an employee.

✒ Between…...

ACT N of acceptance and transfer of documents under the agreement on the transfer of debt d. » » d. According to the agreement on the transfer of debt N from » » d. O.) acting on the basis of, transfers, and (of the Charter, regulations), hereinafter referred to as the "Firm", (name of organization) in the person, acting on (position, full name) basis, accepts the following documents: 1. The original of the agreement N dated » » 2. Agreed with the Creditor, the calculation of the debt to. 3. . Organization: Firm: (signature) (signature) M.P.M.P. Save this document now. Come in handy. You found what you were looking for? * By clicking on one of these buttons, you help to form a document usefulness rating.

It should be emphasized that the provisions of clause 1.1 of this regulatory act directly indicate the need to reconcile not only property, but also all financial obligations of organizations.

To do this, an inventory list of settlements with buyers, suppliers, as well as the amount of debt is compiled.

In the process of checking such amounts, the inventory commission should establish the correctness of registration and the occurrence of obligations to creditors and debtors.

Among other documents, the Ministry of Finance of the Russian Federation in its Order approved the form INV-17.

How to write off accounts receivable if there are no primary documents

Cash deposit Money to the account on the basis of an extract from the personal (bank) account: debit of the corresponding accounts of analytical accounting of account 030405000 “Settlements on payments from the budget with the bodies organizing the execution of budgets”, accounts 020101510 “Receipts of funds of the institution to bank accounts”, 020102510 “Receipts of funds at the temporary disposal of the institution”; credit of account 020003660 “Decrease in accounts receivable on operations with cash funds of the recipient of budgetary funds”.

The list of documents on which the seal of the organization is obligatory (not obligatory) The need for operations of this kind arises when the creditor is not able to collect the required amount on his own.

By agreement, individuals share the obligations that have arisen, for example, in a divorce, or the company reorganizes.

The act of accepting the transfer of receivables

Important

The law does not regulate the format of a protocol for writing off debts; each company has the right to develop its own form, focusing on the rules of a business letter and its own routine.

Basically, all protocols are drawn up according to the same parameters (if this does not contradict the law).

So the following information should be reflected in the document:

- Name legal entity.

- The name of the business paper ("Protocol").

- Details of the document: number, date of writing, address of the commission.

- The structure of the meeting with the registration of attendees.

- Agenda for the hearing (amount of receivables to be written off, reasons).

- List of speakers and objects considered (what needs to be written off, motives, possible expert opinion, etc.)

Act of inventory of receivables and payables (sample)

A sample act for the inventory of receivables and payables of the Goskomstat of the Russian Federation in Decree N 88 of 18.08.98 developed not only the form of the act itself used in reconciling obligations, but also approved an annex to it.

However, neither the State Statistics Committee of Russia, nor the Ministry of Finance of the Russian Federation, in their Methodological Recommendations, have developed an official sample for filling out INV-17.

Filling in the specified gap, it is necessary to indicate that the form of the main form consists of two parts:

- facial;

- negotiable.

The first page of the document contains general information about the enterprise, its division, and also indicates the start and end of the reconciliation, its basis, the number and date of the act itself. To comply with the procedure for filling out INV-17, the code of the type of activity of the enterprise should be reflected on the title page.

K-yuristu.ru - catalog of lawyers, notaries, lawyers

There is an agreement "to enter the right of extortion", in your opinion, "assignment of the right to claim."

One of the participants in this triple action, a large state-owned enterprise, which is the "debtor".

That is, all participants comply with the requirements of the state enterprise in terms of paperwork.

Attention

Today the director brings me the documents, and among them is a template of a very strange document called "act of transfer of accounts payable."

My director is competent, knows the nuances of accounting and jurisprudence.

The document immediately embarrassed him, they laughed together. He says that they gave him a template in the debtor's accounting department with parting words to issue all this with signatures and seals.

It became lazy for me to type this “masterpiece” with my hands, and I decided to google it, especially since the director was told that they took the template in the League-law system, the unfortunate accountants, and why they had to defame the reputation of this system.

Act on the transfer of receivables

The claim can be sold or transferred free of charge, after which a notification of the conclusion of the contract will be sent to the subject bearing the obligation.

The civil law basis of the debt assignment agreement 391 and 392.

Intangible Assets In order to ensure the safety and ease of use, the cash register slip sheet is kept by the cashier separately for each month throughout the year.

At the end of the calendar year (or as necessary), the “Cash Book Insert Sheet” machine-grams are brochured in chronological order, the pages are numbered and sealed. Control over the correct maintenance of the cash book is entrusted to the organization’s chief accountant.

The act of acceptance and transfer of documents (annex to the agreement on the transfer of debt)

Sample documents I APPROVE (position) (Surname and signature) » » ACT of acceptance and transfer of cases dated » » In accordance with the order dated » »

N, a commission consisting of (position, initials, surname) accepted and transferred cases as of » » from, dismissed by order from (position, initials, surname) » »

N, k, (position, initials, surname) appointed by order dated » »

N, consisting of the following documents: I. Constituent documents with all applications, changes and additions. II. Staffing, personal files of employees, orders for core activities, orders and other documents drawn up in accordance with the nomenclature of cases) (application - certificates indicating the total number of cases and deadlines). III. Accounting documents (application - lists, inventories indicating the total number of cases and deadlines). IV. Cash: 1.

Let's take a look at some of the highlights of this document:

- the actual date of the meeting is always indicated;

- a separate protocol is drawn up for each type of problem;

- in addition to numerical values, letter values can also be assigned to the document number;

- when conducting joint hearings, numbers are written through "/";

- if there were 15 participants or more, then in the text of the document itself the entire list of persons can be omitted, it is enough to give a link to a separate list (it should be attached to the protocol);

- in case of inclusion in the composition of the commission of employees from different companies it is necessary to reflect their place of work and position;

- all items on the agenda are numbered and should be written like this: “About…” or “About…”;

- the main content of the document is written in the past tense (“offered”, “noted”, etc.).

The act of acceptance of the transfer of receivables and payables sample

A memo for the cancellation of receivables is needed to inform employees between departments of the organization about the decision made at the meeting of the commission.

Write this document in free form, but the following parameters should be included in the text of the letter:

- details of the addressee: full name, position, contacts;

- the name of the act ("Memorandum");

- document number and date of writing;

- a heading that reveals the subject of the letter (“On the write-off of receivables”);

- main content (description of the problem and solutions, the result of the protocol of the commission meeting);

- signature of an authorized employee with a transcript.

A well-written memorandum for writing off receivables (a sample can be viewed on our website) helps to quickly solve problems that have arisen and notify employees of the results of the commission meeting.

In case of receipt of cash by authorized persons, the latter daily hand over to the cash desk of the institution the funds drawn up by the Register of Delivery of Documents with receipts (copies) attached. order by persons from individuals without the use of cash registers.

Error 404: page not found Transactions on account 020104000 are recorded with the following accounting entries: Write-off of funds (based on the institution’s request for cash withdrawal) from the bank accounts of the treasury authority and from accounts opened with credit institutions: debit account 021003560 “Increase in receivables for transactions with cash funds of the recipient of budgetary funds”; credit of the relevant accounts of analytical accounting of account 030405000 “Settlements on payments from the budget with the bodies organizing the execution of budgets”, accounts 020101610 “Disposal of funds of an institution from bank accounts”, 020102610 “Disposal of funds of an institution received in temporary disposal”. A transaction of a legal entity in the status of a resident and a non-resident assignee, as well as other foreign exchange transactions, must be accompanied by a transaction passport.