Collecting a package of necessary documents is the first step in obtaining any loan. Depending on the chosen bank and their list may vary: some of them are required without fail, others - only when applying for a certain one. At the same time, the borrower's chances of obtaining a particular loan increase significantly if there are some certificates and references in the credit case. What documents you need to provide to obtain a loan, which of them are mandatory and which are not, and how the packages of documents differ in different banks are described below.

Standard set of documents

Regardless of the selected loan product, the manager will provide the borrower with a list of what documents are needed to obtain a loan. The client undertakes to provide the original passport and photocopies of all its pages, which can be certified by the borrower himself, as well as the signature of the bank manager accepting the documents, and the stamp of the credit institution. Additionally, filling out an application for a loan and a questionnaire is required. Some banks offer customers an application form that combines both forms.

List of standard documents for applying for a loan

Most banks give their customers lists of what documents are needed to obtain a consumer loan and which documents are required to obtain a mortgage. As a rule, you will need:

- A copy of the work book certified by the personnel department or any other document that confirms the employment of the client - a certificate from the employer, a contract, an extract from the work book. Such documents must indicate the place of work, position and length of service. Each page of the document must be certified. Seafarers are required to provide a passport, contracts for the last few years and their official translation into Russian.

- Income statement. It can be issued in the standard form 2-NDFL or in the form issued by the bank. It is certified by the seal of the employing organization and signed. It should contain information on the amount of income of the borrower for the last six months at least. If apart from wages the bank client has a third-party source of income (from renting out real estate, pensions, etc.), then documents confirming it are provided - such papers can significantly increase the chances of obtaining a loan.

- Documents that confirm the fact of the presence of a deferment from military service - a military ID, registration certificate and others. Required only if the borrower is under 27 years of age.

Many financial institutions, in addition to the documents listed above, may require additional ones. What documents are needed to obtain a loan additionally - described below.

Additional documents required by the bank

The documents listed below can be prepared not only at the request of a credit institution, but also on the personal initiative of the borrower. Most of these papers can not only confirm the social status of the borrower, but also positively affect the assessment of its solvency. Such documents can be provided to the bank when applying for both a consumer loan and any other loans and loans secured by property - real estate or a vehicle. What documents are needed to obtain a loan additionally?

- Vehicle registration certificate or driver's license.

- Insurance certificate of the pension fund.

- Passport - if available.

- Everything insurance policies- CASCO, OSAGO, OMS and others.

- Original certificate confirming that the borrower is the owner of the property, or a copy thereof.

- Bank statements, any documents confirming the existence of these accounts or securities.

- Photocopies of papers about the education received: certificates, diplomas, certificates, certificates.

- Account statements, copies of previously executed loan agreements, certificates from credit institutions confirming the absence of debts.

- Copies and originals of birth certificates of children, marriage or divorce.

When applying for a consumer loan aimed at purchasing goods - for example, household appliances - a credit institution may require the borrower to provide an invoice from the store; when applying for a loan for education - an agreement concluded with an educational institution, and a copy of its license certifying its right to conduct such activities.

Applying for a loan at Sberbank

To receive money on credit, a potential borrower can apply to one of the most popular banks - Sberbank. What documents are needed to get a loan in it?

If the borrower has never used the services of this credit institution before, then the requirements for it are much stricter than for other clients, and the verification of the received documentation will be carried out many times more carefully.

Required documents

The loan officer must receive the following papers from the borrower:

- An identity document is a passport.

- Employment book, contract with the employer or any document confirming the presence of a permanent place of work.

- The certificate and extract from the USRR are provided by individual entrepreneurs.

- Help 2-NDFL, tax returns with the stamps of the Federal Tax Service.

- Documents confirming an additional source of income - for example, from the rental of real estate or third-party part-time work. Notifying the bank about this will increase the chances of obtaining a loan.

- Men under the age of 27 must provide a military ID in order to prevent delays in loan payments due to military conscription.

- Persons acting as guarantors should not have any debts to credit institutions. In addition, they are required to provide a similar package of documents to the bank manager.

The borrower may, on his own initiative, present to the bank papers confirming his right to own real estate or any other property. Such certificates will confirm the solvency of the client and increase his chances of obtaining a loan.

Getting a loan from Rosselkhozbank

A standard set of papers required for obtaining a loan is available in each bank; Rosselkhozbank is no exception. What documents are required to obtain a loan from this financial institution?

The loan agreement is drawn up after the submission of the following documents:

- Each person involved in the design of a loan product fills out a questionnaire. The application form can either be taken at the institution or found on the official website of Rosselkhozbank.

- Identity document. In most cases, a passport is required.

- An employment contract or book is a paper confirming the employment of the borrower. Such documents are certified no later than one month before the date of application.

- Certificate 2-NDFL or a similar form issued by the bank and confirming the amount of the borrower's income. If the loan is issued for a pensioner, then it is necessary to present an extract on the accrual of a pension.

- Military ID.

Listed above are the documents required to obtain a loan. Providing a full package to Rosselkhozbank will help you get a loan and increase your chances of getting it.

Getting a loan from Sovcombank

One of the most successful banks today is Sovcombank. What documents are needed to get a loan in it?

- Passport of a citizen of the Russian Federation.

- The second document confirming the identity of the borrower. It can be any paper - a driver's license, a military ID, a medical policy.

- Tax certificate in the form of 2-NDFL or a special document issued by the bank.

- Employment contract or work book.

What documents are needed to get a loan for a pensioner?

A pensioner who receives his pension at Sberbank, for example, when applying for a loan, must provide only a passport, since all the necessary package of documents is already stored in a credit institution. If the pension is accrued by one bank, and the loan is issued in another, then it is necessary to take from pension fund certificate of the amount of the pension.

Drawing up a loan agreement at a bank requires the provision of a certain package of papers. What documents are needed to obtain a loan, and in which specific banks - is described above.

Hello, dear readers of the business magazine "site"! In this article, we will tell you how to get a loan for an individual entrepreneur to open and develop a business, including without collateral and guarantors in cash / non-cash money.

After reading the presented publication from beginning to end, you will learn:

- What types of loans for individual entrepreneurs are offered by banks;

- What stages will have to be overcome in order to take out an individual entrepreneur loan;

- Where can I get a loan for entrepreneurs without collateral and a guarantor.

At the end of the article, we traditionally provide answers to frequently asked questions.

The article will be useful not only to entrepreneurs themselves, but also to those who are just planning to become them. It is not necessary to already have plans for obtaining a loan, but it will be useful to study the publication and be prepared in this matter. So start reading right now - will definitely come in handy in the future!

About how to get a loan for individual entrepreneurs and where you can get a loan for an individual entrepreneur without collateral and a guarantor in cash - read in this issue

Individual entrepreneurs (IEs) in Russia have a special status:

- Firstly, they are ordinary individuals, therefore they have their rights and obligations;

- Secondly, individual entrepreneurs act as business owners, conduct entrepreneurial activities for the sake of generating income.

In different situations, such a dual status can be beneficial or create difficulties for the entrepreneur.

On the one side , when applying for a loan, individual entrepreneurs, as individuals, can count on the relevant programs. but , checking the solvency of entrepreneurs is carried out more strictly. Banks often refuse those individual entrepreneurs who have not been able to prove that their business is reliable.

It turns out that the issuance of IP loans is not easy and unpredictable lending area. It is difficult to figure out why lenders immediately refuse some entrepreneurs, while others issue loans for a large amount without any special effort.

Not everyone understands what banks' decisions on loan applications submitted by individual entrepreneurs are based on. That is why it is important to study what ways exist to increase the likelihood positive solutions .

One of the main requirements of banks for individual entrepreneurs in the process of considering an application is duration of business . Some lenders require experience to be at least a year, others have enough and several months. One requirement remains unchanged - the business must generate stable profits.

If a citizen has recently been employed or was unemployed, he will almost certainly be denied a loan for the purpose of doing business. In situations like this, it's much easier to get non-targeted loan for individuals.

However, it is worth considering, that the size of the non-purpose loan and the period for which it is issued will be minimal. Moreover, in this case, the entrepreneur is deprived of the opportunity to start a positive credit history as an individual entrepreneur. In this way, access to targeted lending for small businesses will be closed.

An individual entrepreneur should keep in mind that in order to apply for a loan for a large amount, you will have to provide security . It will become a confirmation of solvency for the bank.

Creditors accept the following property as collateral:

- vehicles;

- real estate;

- land;

- equipment;

- specialized equipment;

- inventories;

- securities.

After the entrepreneur submits an application for a loan, the bank conducts full analysis of financial and economic activities related to his business. If it is recognized as profitable and successful, the probability of approval of the application will increase.

Difficulties with obtaining a loan arise if the entrepreneur is only recently. In this case, the income cannot be shown. It is much better if the entrepreneur is able to document the fact of investing in the business, as well as provide a well-written business plan.

From a novice entrepreneur, the bank may require to provide:

- various payment documents (receipts, checks), confirming the acquisition of fixed and current assets - materials, equipment and others;

- certificate of ownership or real estate lease agreement, necessary for doing business;

- bank statements, confirming money transfers aimed at business development;

- guarantors with a stable income , who can be both employees of companies and successful individual entrepreneurs.

For lending to businesses, including individual entrepreneurs, The most commonly used types of loans:

- factoring;

- investment loan;

- letter of credit;

It is important to choose the right loan method. In the absence of sufficient financial knowledge, you can turn to professional credit brokers.

It is important to note, that individual entrepreneurs unlike ordinary individuals, do not attract banks as customers too much. This is due to the high risk that financial institution when issuing a loan.

On the one side, banks usually do not raise questions about the purpose of obtaining a loan by an individual. As a rule, this is a major purchase, home renovation, travel and others. Moreover, employees have a guaranteed income in the form of wages.

In the same time, the purposes of lending to individual entrepreneurs are not so obvious. Their profit is not secured by anything and there are no guarantees of its permanence.

Running your own business is always associated with risk. Many entrepreneurs face failure BEFORE payback moment. That is why banks require the provision of property as collateral or confirmation of the success of the business.

Major lenders often offer entrepreneurs specialized loan programs . The fact is that such services are an important line in the revenue part of the budget of credit institutions.

However, it should be borne in mind that entrepreneurs who have been successfully working in their field for several years have priority in approving loan applications.

For beginner entrepreneurs who want to get a loan, there are 2 options:

- get a personal loan or credit card as an individual;

- do not despair and continue to look for a program for self-employed entrepreneurs.

It turns out that it is not easy for an individual entrepreneur to get a loan. Therefore, experts recommend carefully studying all the nuances of such loans in advance.

Types of bank loans for individual entrepreneurs

2. What loans do banks offer for individual entrepreneurs - 4 main types 📋

Banks lend to individual entrepreneurs in several ways. Described below 4 most popular types of loans for individual entrepreneurs .

Type 1. Loan for replenishment of working capital

Such loans are used to replenish the working capital of the production process.

Reasons for such a loan are usually:

- intensive growth of production, for example in season;

- the desire to buy a significant batch of raw materials, materials or goods at a bargain price, but lack of funds for this.

Traditionally, the repayment period for loans of this type less than 2 years old . For its registration, the entrepreneur will have to confirm his solvency. To this end, banks are usually asked to provide activity report.

After signing the loan agreement, the entrepreneur is given repayment schedule. It is important to follow it exactly, make payments on time and in full.

At the same time, entrepreneurs are often given installment plan on the 3 month (especially for seasonal business). During this time, the receipt of funds to the current account of the IP usually begins.

Type 2. Overdraft

You can apply for this loan 1 time per year . After that, the funds can be used at any convenient time.

In most cases, an overdraft is offered by banks that maintain the entrepreneur's current account. If the turnover is high enough, no collateral is required to apply for such a loan.

You should carefully study the loan agreement. One of the most important parameters of an overdraft is repayment period. It can be one or more months.

When the debt is fully repaid, the money can be borrowed again. This principle is used throughout the year.

Type 3. Consumer loan for individual entrepreneurs

A feature of this type of loans is non-target nature. It turns out that the bank does not check the direction of use of funds. This approach greatly simplifies the processing and increases the likelihood of loan approval.

It should be borne in mind that a consumer loan is issued only individuals. However, due to the special status of individual entrepreneurs, some banks may refuse to issue such a loan to them.

In most cases, the amount of consumer credit less than 100 000 rubles. To increase the loan, you will need to attract a guarantor or co-borrower. This will allow you to get before 500 000 ruble th. If you need an even larger amount, you will have to provide a high-quality collateral.

Type 4. Targeted loan

This type of loan is issued for specific purposes - expansion of trade and production, purchase of a vehicle.

The bank will require you to confirm the direction of spending the funds. To do this, you can provide checks, payment orders, TCP and other documents.

Usually the amount of such a loan is about 1 million rubles , and the maturity is about 5 years.

We told about 4 -x main types of loans for individual entrepreneurs. Do not forget that each bank offers its own conditions.

Therefore, you should study the maximum of offers on the market, compare them. Only in this case it will be possible to choose the best option.

What factors affect the approval of a loan for an individual entrepreneur

3. What parameters do banks pay attention to when issuing a loan to individual entrepreneurs 💎

Each bank independently develops requirements for potential borrowers. However, there are a number of parameters that each financial institution takes into account when applying for a loan for an individual entrepreneur.

Parameter 1. Credit history

During the consideration of an application for a loan of individual entrepreneurs, the bank studies. This is due to the fact that the IP is an individual.

There will be no problems with obtaining a loan if the following conditions are met:

- there are no loan arrears;

- IP did not declare itself bankrupt;

- previously received loans are closed in a timely manner;

- there are no existing loans, or they are small;

- there are no claims from the tax inspectorate.

Should be considered, that the complete absence of a credit history (when loans were not previously issued) does not guarantee approval.

To create a positive reputation, you can issue quick loan through MFIs and close it on time. It is important that the company used for lending transmit information to the CBI ( credit history bureau).

Dimension 2: Compliance

When considering applications, the Bank always studies legal status of an entrepreneur. To do this, they will definitely check the presence of debts to the budget for the transfer of taxes, as well as debts to counterparties.

In addition, the bank takes into account the following points:

- timely payment of wages to employees of the entrepreneur;

- absence of administrative and criminal offenses;

- property belonging to the entrepreneur must not be arrested.

Parameter 3. Income

One of the main signs of solvency is traditionally considered income level. It is not difficult to confirm it for citizens who are employed - it is enough to request a relevant certificate from the employer's accounting department.

However, the entrepreneur cannot submit such a document, so he will have to familiarize the bank with accounting reports about their activities for at least 6 months.

Important! Solvency level potential borrowers is the most important requirement of credit institutions. Therefore, the entrepreneur will have to convince the bank that he is able to receive regular stable income.

However, high income today is no guarantee that a business will remain successful. Therefore, some banks consider financial statements an insufficient basis for approving a loan.

Additionally, the following proof of solvency may be required:

- primary documents;

- auditors' reports;

- indirect confirmation of the level of solvency ( for example documents for expensive liquid property - vehicles, real estate).

Dimension 4. Duration of business

If state registration individual entrepreneur was held shortly before the moment of applying for a loan, you should not wait for approval. The only chance to become a borrower in this case- attract surety or provide liquid pledge.

Banks have never been charities. It is important for them to return the funds issued on credit with interest without any problems.

Meanwhile, it is impossible to assess the probability of repayment of a loan issued to an entrepreneur who has been working recently. That is why the experience of doing business in most cases should be at least 6 months .

Banks obligatory demand guarantees of return of funds from potential borrowers. To receive a loan, entrepreneurs must confirm the level of solvency. The circumstances described above are necessary for this.

How to get an individual entrepreneur loan - a guide for a novice entrepreneur

4. How to get a loan for an individual entrepreneur from scratch - 5 main steps for obtaining a loan for a novice entrepreneur 📝

One of the conditions for obtaining loans by individual entrepreneurs is having a checking account. Without it, it is difficult to track the flow of funds.

However, it is not enough to conclude an account agreement. To get a loan, you will have to complete a number of actions. Below is instruction developed by experts.

Stage 1. Business registration

Any Russian citizen who has reached the age of majority has the right to register as an individual entrepreneur.

Also important conditions are that the future entrepreneur should not:

- be in the civil service;

- be declared bankrupt less 12 months ago.

To register a business, you must pay state duty, the size of which is 800 rubles .

If for some reason a citizen does not want to register a business on his own, he can contact a specialized company. Naturally, in this case, the costs will increase.

One of the documents required for registration is statement . Its form is legally established. It is important to fill out the application as carefully as possible - errors and typos are not allowed. It is important to study it in advance in order to know what data will have to be specified.

The entrepreneur must understand that the so-called activity codes.

Costs early decide what the entrepreneur will do. After that, it is important to study the legislative acts and select the appropriate codes.

Another important stage of registration is choice of taxation system . If the entrepreneur does not have sufficient knowledge about accounting, experts recommend him to consider using simplified taxation system.

It is not necessary for an individual entrepreneur to use printing in his activities. However, you can order it if you wish. The cost differs depending on the region, the manufacturer and the complexity of the design.

Stage 3. Choosing a credit institution and submitting an application

Many call the most responsible step in obtaining a loan bank selection . Today, a huge number of lenders offer programs designed for small businesses. The task of the entrepreneur at this stage is to choose the best option.

Ideally, preference should be given large reliable banks with an impeccable reputation. It is also important that the location of the offices is as convenient as possible.

There are other important criteria for choosing the best bank:

- period of activity in the Russian financial market;

- terms of lending programs for individual entrepreneurs;

- offered rates;

- reviews of entrepreneurs who have already applied for a loan in a particular bank.

Today, it is not necessary to visit a bank office to apply. Most major credit organizations offer to do this on their website. in online mode . This option allows doubting entrepreneurs to send an application to several banks at once.

The information provided is verified by staff. Security Services. After that, the bank issues a final verdict on the application. If approval is obtained, the entrepreneur must apply with necessary documents to the nearest bank branch.

Stage 4. Preparation of a package of documents for obtaining an IP loan

You should remember a simple rule- how more number of documents above chances for positive solution .

Most often, banks require from individual entrepreneurs:

- passport;

- certificate of tax registration (in a simple way, TIN);

- an extract from the USRIP must be fairly recent, usually received no more 1 months ago;

- an extract from the current account confirming all movements on it;

- tax return for the previous reporting period;

- primary documentation may also be required.

During the verification of the information provided, the bank often requests additional documents.

Worth considering! Get a loan without proof of incomealmost impossible for an entrepreneur.

Even if such a loan is issued, the rate on it will be at least 5% higher than traditional.

Stage 5. Obtaining borrowed money

It is unlikely that an individual entrepreneur will be able to get a cash loan. The money under the loan agreement will be transferred to checking account.

If the loan is targeted, the funds will be immediately transferred as payment for the purchased vehicles, real estate, equipment or raw materials.

If you strictly follow the instructions developed by professional financiers, you can get a loan much faster.

5. Where to get a loan for an individual entrepreneur to open and develop a business - TOP 3 best banks 🏦

When choosing a credit institution, an individual entrepreneur should not forget that he can use programs not only for individual entrepreneurs, but also for individuals.

In the face of a huge number of proposals, it is not easy to choose the best option. Can help overview of the best offers from banks compiled by experts.

1) Sberbank

Sberbank traditionally enjoys the greatest popularity among Russians. It provides loans to both individuals and legal entities, as well as individual entrepreneurs.

You can not ignore the program, which is called « Confidence" . It is intended for lending to small businesses and individual entrepreneurs.

The loan amount under the program under consideration can be from 30,000 to 3 million rubles . The maximum repayment period is 36 months. You do not need to provide collateral for a loan. The rate is from 16 % per annum.

Among the main requirements for the borrower are the following:

- age at least 23 and no more 60 years;

- the minimum period of activity as an individual entrepreneur - six months.

2) VTB Bank of Moscow

For those who are just planning to organize their own business, it is best to issue consumer credit. VTB Bank of Moscow offers many programs that differ in conditions and requirements. The funds obtained from such loans can be used for any needs.

In addition, several programs have been developed here for lending to individual entrepreneurs.

The most popular are - "Turnover", "Prospect for business", "Overdraft". The bet on them starts from 14 % per annum.

3) Alfa-Bank

Those entrepreneurs who need funds as soon as possible, experts recommend emphasize on credit cards this bank.

A fairly large one acts on them. Grace period. This means that if the debt is repaid within 100 days you don't have to pay interest. At the same time, the grace period is also valid in case of withdrawal from the card. cash .

An interesting offer is a map "Twins" . It combines a debit and credit card. The maximum credit limit is 500 000 rubles .

Alfa-Bank also offers specialized programs designed for lending to individual entrepreneurs. Regular customers of the bank can count on a more loyal attitude and the most favorable conditions.

For a more comfortable comparison of the presented banks, the main lending conditions are summarized in the table.

Table of banks with their conditions for lending to individual entrepreneurs:

6. What are the conditions for obtaining a cash loan for individual entrepreneurs

When applying for individual entrepreneurs, like any other borrowers, there are a number of requirements.

Despite the fact that each bank has the right to develop them independently, one can also name general mandatory conditions.

The main requirements for the borrower are:

- age from 21 years before 60 years;

- absence of debts on various deductions in favor of the state, including taxes;

- registration as an individual entrepreneur not less 12 months;

- business experience more than six months.

For a bank, issuing a loan to individual entrepreneurs is associated with a high degree of risk. That is why the terms of the loan become more stringent. Yes, the rate will be at least 17% per annum .

The size of the loan is affected by the presence of collateral:

- in its absence, in most cases, the maximum loan amount will be not more 1 million rubles.

- when secured in the form of liquid property, the amount of the loan will depend on its value.

The period during which it is necessary to repay the debt is, on average, equal to 3 -5 years old . The maximum it can reach 10 years.

In general, it should be borne in mind that the conditions for the provision of funds are most often set individually. It all depends on the characteristics of the borrower, as well as the availability of collateral, including collateral and guarantors.

Ways to obtain a loan for individual entrepreneurs without collateral and a guarantor

7. Where and how to get a loan for an individual entrepreneur without collateral and guarantors for a long time - an overview of the TOP-10 options 🗒

Not all entrepreneurs manage to get money from the bank. This process is lengthy and does not guarantee success. Meanwhile, there are other ways to get money on credit . All possible options are summarized below.

Option 1. Contacting a servicing bank

Contacting the bank that checking account IP or in which he has an open deposit, greatly increases the likelihood positive decision .

These credit institutions have information that can be used as proof of solvency.

Option 2. Applying for a consumer loan as an individual

Many banks offer consumer loans with a simplified procedure. Such loans allow you to use the funds received at your discretion.

However, it should be taken into account that such programs allow you to get a small amount of credit.

Option 3. Loan secured

One of the most realistic ways to get a loan for an individual entrepreneur is loan secured by property . Real estate, vehicles, securities and other property can be accepted as collateral.

Important, so that the property belongs to the borrower on the right of ownership and is highly liquid.

Option 4. Leasing

Leasing is also known as a finance lease.. It allows you to get equipment, vehicles for rent with subsequent redemption.

The chance to get a lease from an individual entrepreneur is quite large, because until the moment the debt is paid, the property is owned by the lessor.

Read more about for individuals and legal entities in a special issue.

Option 5. Investment funds

Quite rare, but still found specialized funds who direct their funds to the development of small businesses.

but in most cases, they invest in unique and high-tech activities.

Option 6. Help from loan brokers

Brokers are intermediaries between the lender and the borrower. With their help, you can choose the best option, as well as prepare an application for a loan.

Naturally, brokers take for their work commission. It is important not to make it until the result is obtained. Otherwise, you may lose money and not get a loan.

Option 7. Loan from loved ones

When looking for funds, it is important to explore all possible options. Do not hesitate to try to borrow money from friends, relatives and acquaintances.

In this case, you do not have to prove your solvency, prepare documents, wait for consideration. Today, however, not everyone will agree to lend money without interest.

Option 8. Private investors

Today, there are many people who agree to give their money for business development. You can find them at special Internet forums.

But keep in mind that this option is too different high rates.

Option 9. Overdraft

An individual entrepreneur can apply for an overdraft in 2 options:

- to the current account;

- to debit card open to an individual.

The convenience of an overdraft facility lies in its recurrence. It is enough to conclude an agreement 1 time, then to return and borrow money again.

In other words, the bank allows the entrepreneur to spend money in excess of the balance available on the account or card within the established limit, which depends on the cash turnover over the past six months.

Option 10. Getting subsidies from the state

The subsidy is a targeted government assistance to small businesses and individual entrepreneurs. Most often they are represented by municipal and federal programs, as well as business incubators.

Do not forget that soon after receiving the subsidy, you will have to submit documentary confirmation intended use funds .

If the amount is not spent in full, the rest will have to be returned to the state. For misappropriation, the entrepreneur faces criminal liability.

An individual entrepreneur should consider all possible options for obtaining funds in debt. This allows you to significantly increase the chance of a positive decision.

Useful tips on how to reduce the loan rate for a beginner individual entrepreneur

8. How to reduce the interest on a loan for an individual entrepreneur - TOP-3 tips for beginner individual entrepreneurs 💡

When applying for a loan, it is important to use all available ways to lower the rate. This is especially true for large loans for a long time. In this case, even a few percent can save several thousand rubles annually.

Below are expert advice how to get the interest rate down.

Guarantors are one of the types of security. They can serve as:

- individuals who are employed and have a stable income;

- successful individual entrepreneurs;

- legal entities.

The guarantor will also have to prepare documents in accordance with the list developed by the bank. The presence of property, deposits and other assets should be documented.

It should be remembered that if the borrower refuses to pay the loan, the guarantor is also responsible for repaying the debt and risks their credit history. Therefore, entrepreneurs should not let down the people who vouch for them.

Tip 2. Offer property as collateral to the bank

The pledge helps to convince the bank of solvency, as well as to confirm the intention to repay the debt on time.

Lenders easily accept as collateral real estate, vehicles, expensive equipment.

Tip 3. Use directed lending programs

If an individual entrepreneur plans to spend borrowed funds for specific purposes - the purchase of equipment, working capital, to expand the business, it is worth using target loan .

Such programs are rare, but the rate for them is usually lower by several percent.

If you use the tips presented here, you can significantly increase the likelihood of getting a better rate.

9. Answers to frequently asked questions from the site 💬

The scope of lending to individual entrepreneurs is quite wide. Therefore, it is impossible to cover it completely within the framework of one publication.

However, there are quite a few questions. To save our readers time, we provide answers to the most popular of them.

Question 1. Where can I get a loan for an individual entrepreneur secured by real estate?

The presence of collateral increases the likelihood of obtaining approval for a loan application.

Banks offer entrepreneurs several options for secured loans:

- Consumer loans for individuals. Their size depends on the value of the property provided as security. When buying real estate with received funds, the return period may exceed 20 years. However, some banks do not provide such loans to individual entrepreneurs.

- Express loans. Their advantage is the high speed of approval and issuance. However, they are also characterized by high interest rates and a small amount loan.

- Loans designed specifically for individual entrepreneurs. You will have to submit a fairly large package of documents, including, among other things, financial statements. Due to the high risk, the rates for such programs are quite high.

Bank loans are always the best. However, there is also other financial market participants who lend money:

- Pawnshop can lend money on bail. The features of this loan are high rate and undervalued property. If the loan is not repaid on time, the title to the mortgaged property will pass to the pawnshop.

- credit union - a cooperative that has the status of a non-profit organization. It is worth joining if regular needs for cash. Loans to members of the cooperative are issued at a reduced rate.

- Microfinance organizations they give out money quickly enough to almost everyone, without conducting a serious check. However, the stakes here are too high and can reach 1 % in a day.

- Private investors are individuals who lend their money on pre-agreed terms. However, in the field of private lending, there are quite a lot of scammers.

In the article, we have collected 20 largest banks lending to individual entrepreneurs for favorable conditions. The article also contains a list of documents that a bank may require to issue a loan.

Which bank to take a loan from

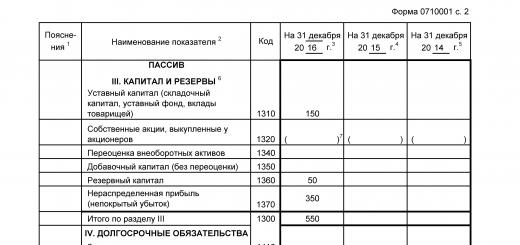

| Bank's name | Rate, per annum | Maximum amount, million rubles |

| 14,5 — 19,0% | 5 | |

| from 12.5% | 6 | |

| Promsvyazbank | 150 | |

| Rosselkhozbank | calculated individually, depending on the loan term | 10 |

| VTB 24 | from 10.9% | 30 |

| Tinkoff | from 15 to 21% | 2 |

| Opening | from 10% | 250 |

| Akbars bank | from 10% | 150 |

| OTP bank | from 12.5% | 1 |

| from 24.9% | 30 | |

| LOKO bank | from 9.25% | 150 |

| intesa | from 13% | 15 |

| Credit Europe Bank | from 14% | 200 |

| from 14.25% | 73 | |

| Primsotsbank | from 13.9% | installed individually |

| from 13.1% | 170 | |

| Post Bank | from 14.9% | 1 |

| Rosbank | from 12.2% | 150 |

| Renaissance | from 12.9% | 700 thousand rubles |

| Housing Finance Bank | from 13.99% | 8 |

Types of loans for individual entrepreneurs

Loans for small and medium-sized businesses can be divided into several types:

It has a distinctive feature: to get it, you need to prepare an extensive list of documentation. And if you expect to receive a large amount of funds, you need to provide security in the form of collateral or surety.

- Express lending

Designed for those entrepreneurs who have limited free time. In this case, you need to collect a minimum set of papers, but the interest on such a loan is higher than standard rates.

- Targeted lending for small business development

Programs can be state-owned, with the involvement of Entrepreneurship Support Funds, and so on. Funds in this case are issued only for specific purposes, entrepreneurs whose business is promising and has been operating for more than 3 months can count on them. We also note that some banking organizations offer businesses cash loans.

Loan for individual entrepreneurs in Sberbank

This banking organization provides an opportunity to issue a loan for an individual entrepreneur both without collateral and with collateral. The following tariff plans are available for customers:

Nuances: a loan under the "Trust" program is provided only to entrepreneurs whose annual revenue does not exceed 60 million rubles.

Lending for individual entrepreneurs in Alfa-Bank

A loan to an individual entrepreneur in this bank can be issued according to several tariff plans:

Important: an individual entrepreneur loan is issued only on the condition that you open a current account with a bank.

Credit for entrepreneurs in Promsvyazbank

First of all, we note right away that it will be possible for an individual entrepreneur to receive a loan if the period of his actual entrepreneurial activity exceeds 2 years.

As for the nuances, you must be registered for at least 1 year in the region where the office of this banking organization is present.

Loan for individual entrepreneurs in Rosselkhozbank

Several credit programs for which an individual entrepreneur can take out a loan. At the same time, we note that in order to receive funds, you need to open a current account with a banking organization before you sign a loan agreement.

Mostly loan products interest rate and the amount of the loan are calculated strictly individually.

Lending to entrepreneurs in VTB 24

In this credit institution, you can apply for a loan, as well as for any purpose, with or without security. As for tariff plans, there are several of them:

- Your passport (citizen of the Russian Federation);

- Questionnaire completed by you;

- The second document that will confirm your identity (SNILS, driver's license);

- Declaration on paid taxes;

- Extract from the USRIP;

- TIN certificate;

- Original of all licenses (if your activity is subject to licensing).

Most often, banking organizations require these documents, but you may be asked to provide additional documentation. If you involve a co-borrower or guarantor, he must collect similar documents. When it comes to collateral, you need to confirm ownership of it.

Who, besides banks, gives a loan to IP

It should not be hidden that not all banking organizations cooperate with individual entrepreneurs, especially in the field of lending. There are organizations in principle not lending to entrepreneurs. In this case, you can apply for a loan as a physical. person, or contact the MFI.

When applying to an MFI, keep in mind that the loan amount is not particularly large, the loan term is usually short, and the percentage is much higher than in a bank. Pay attention to this when you analyze where it is better to take a loan.

Reasons for refusal to apply for a personal loan

Typically, loan applications are handled by a dedicated loan department. You may be denied for the following reasons:

- Insufficient level of income;

- Availability of existing credit obligations;

- Short period of activity as an individual entrepreneur;

- Problematic credit history;

- Complete lack of credit history;

- Failure to meet age requirements;

- Providing knowingly false information about yourself;

- The presence of a criminal record that is not extinguished;

- The banking organization has facts about the violation of your mental health;

- You do not have a landline telephone;

- You have been to several banking institutions;

- Your refusal to change a non-purpose loan to a targeted one;

- Sloppy appearance;

- Suspicious, aggressive behavior.

In general, the documents that an individual entrepreneur must submit to obtain a loan are similar to the documents that are prepared by a legal entity (LLC, CJSC).

At the same time, there are some differences. Note that the matter is complicated by the fact that individual entrepreneurs usually do not keep accounts. Accordingly, not obtained from financial statements the bank needs to obtain information in a different way, from other documents.

List of documents for consideration of an application for a loan for individual entrepreneurs

As a rule, the entrepreneur is asked to prepare the following basic papers:

- Application on the internal form.

- Copy of the passport.

- Certificate of state registration.

- Certificate of registration with the tax authority.

- Extract from the EGRIP (Unified State Register).

- Certificate of registration in the social insurance fund and PF.

The papers listed above are almost always required - they confirm that such and such Ivanov Ivan Ivanovich is indeed an individual entrepreneur and a citizen of the Russian Federation.

The documents, related to business and turnover:

- Various contracts, waybills regulating the main activity.

- Licenses and permits for special activities (if any).

- Copies of tax returns. Usually, they need to be certified with a tax stamp.

- Copies of payment orders for which payments were made to the tax service.

- Copy of cash book.

If a deposit is required confirm the possession of collateral and provide information about its value. Options:

- Certificate of ownership of land, real estate.

- Contract for the purchase of special machinery and equipment.

- Technical passports, warranty cards.

- Invoices, invoices (if the collateral is the goods in circulation).

Information required for obtaining a loan:

- Certificate of the absence of encumbrance of collateral (insurance against the possible presentation of their rights to property by third parties).

- From the bank where the current account is maintained: a certificate of turnover (extract), on the maintenance of card index number 2 or its absence, on loan debt.

- From the tax: a certificate of the state of debt to the state and extra-budgetary funds and a certificate of open current accounts.

Please note that this is an indicative list. Some banks may require additional documents, while others, on the contrary, strive to simplify the procedure as much as possible and make the final package relatively small.

The good news is also the fact that banks do not always require all the papers at once. First, the borrower is checked for credit history, the very fact of doing business and the duration of the business (this is one part of the package) and only then the turnover and financial indicators are analyzed (this is the second part).

Accordingly, if you work with an adequate bank, there is no reason to fear "I will collect a bunch of pieces of paper, and then I will be refused, having spent a lot of time and effort."

Please note: some of the documents must be ordered from the tax service or other government agencies in advance. The term for preparing the certificate you need can be 2-3 weeks, so in order to speed up the consideration of your application at the bank, it will not be superfluous to take care of all the formalities as soon as possible.