Content

Buy residential real estate Loans made it easier. Banks offer various lending programs with the condition that the acquired square meters will be the subject of collateral. The appraisal of an apartment for a mortgage is prerequisite, and you need to order it from an independent appraiser or company even before going to the bank. The resulting report will allow you to determine the amount of the loan, because if necessary, the object can be sold at a real cost and repay the resulting debt.

Why do you need a real estate appraisal for a mortgage?

Appraisal of an apartment when buying a mortgage is necessary for both parties loan agreement. It is not only a guideline for issuing borrowed money, but also a certain insurance in case of force majeure. The fact is that the price set by the seller may be too high and not correspond to the real estate market. If the estimated cost turns out to be lower than the proposed one, and it is not possible to agree on a discount with the owner, the borrower can pay it out of his own funds or look for a new object for purchase.

Bank risks in mortgage lending

The lender is primarily interested in appraising an apartment. An independent analysis is carried out to prevent fraud on the part of the borrower, because he can request more money for selfish purposes and spend it for other purposes. By issuing a large amount to a borrower to purchase an apartment, the bank risks, since there is always a risk of default on the loan. To minimize the risk, firstly, the amount of the loan never amounts to the full amount of the purchase price, but ranges from 60-70%. Secondly, the acquired property necessarily acts as an object of collateral.

Protection of the interests of the borrower

Since financial and credit institutions are trying to underestimate the amount of borrowed funds, the buyer also needs an appraisal of an apartment for a mortgage. In this way, he can argue the requested amount of money. The larger the loan he receives from the bank, the less his own funds will have to be invested. After an independent examination, the borrower can see the real cost of the purchased housing, and not the one that suits the seller.

Who makes the assessment

Mortgage appraisal is carried out at the stage of preparing documents. All the nuances are spelled out in the law and the federal assessment standard, according to which only entities that have a license to do so can engage in activities. The borrower has the right to independently choose an organization or an individual, or can use appraisers who have been accredited by the bank where he is going to get a loan.

How much does it cost to appraise an apartment for a mortgage?

The exact cost of the service can be found out only after consultation with a specialist. Depending on the region, it can vary significantly. So, in Moscow, the price fluctuates on average from 5,000 to 10,000 rubles and depends on housing. It is clear that when analyzing elite housing, the cost will be higher than when experts prepare a report on Khrushchev outside the Moscow Ring Road. Very often, companies arrange promotions, and even today you can find offers starting from 2,500 rubles.

Who pays for the examination?

Conducting an examination is a troublesome and labor-intensive business. The cost of assessing an apartment for a mortgage depends not only on the collateral real estate itself, but also on the necessary package of papers, the urgency of the work. All these costs are borne by the potential buyer. The bank does not participate in this, because the report is one of the documents that the borrower needs to attach to the list of papers required for obtaining a mortgage.

Where to order an apartment appraisal

You can order a document only from those representatives who are licensed to carry out valuation activities - this is the law. To choose on your own or to resort to the recommended bank is already the business of the borrower. If credit organisation insists on choosing an appraiser only from a list accredited to it, it is necessary to request an official clarification of such a requirement from the bank, since such behavior is not authorized.

Independent firms

To date, finding a company that would make an objective assessment of an apartment for a mortgage is not difficult. When choosing a potential one, it is necessary to conduct a comparative description of not only the services offered and the speed of work, but also the cost. Here are just a few of them:

- LLC "Independent Assessment";

- LLC "Independent Expert Evaluation Bureau";

- Independent appraisal company "GLOBAL".

Accredited credit institution specialists

Mortgage appraisal can be carried out not only by independent firms, but also by companies accredited by the bank itself. Each banking institution on its Internet portal places information with the contact details of each entity. It is important to understand that lenders do not work with one or two professional appraisers. You can always choose - in Sberbank alone there are about two and a half hundred certified appraisers.

Private individuals

The law does not prohibit contacting individuals who have the right to conduct an assessment. They must be registered as individual entrepreneur and be sure to have an insurance policy civil liability in the amount of at least 300 thousand rubles. This will help to recover costs in case of an error due to the incompetence of the IP. When issuing a mortgage loan, it will not be superfluous to coordinate with the bank the candidacy of an independent expert.

How to choose the right appraiser

You can evaluate an apartment for a mortgage in any company, but this does not mean that each of them will perform the work efficiently and at a high level. When contacting a specific appraiser, it is important that the prepared package of documents does not contain errors, due to which you will have to apply for a service to a new expert. When re-paying for an assessment, the first thing to focus on is reviews. real people better friends who had direct contact with a representative of the organization.

Companies that have been operating for more than a year on the market, employing only highly qualified specialists - that's what you need to pay attention to. Do not chase cheap offers, because the work of an appraiser cannot cost a penny. When choosing a company, it is better to give preference to the one whose office is located in close proximity to the property - this will help reduce the cost.

If the bank insists on its person to carry out appraisal operations when buying an apartment, the borrower may refuse or accept the offer. The main advantage of cooperation with an accredited company is the quick decision making, since their reports are accepted with almost 100% approval. Such an approach may not be very beneficial for the borrower, since there is a risk of understating the real value of the acquired property. For comparison, you can order an additional independent examination.

How does a mortgage appraise an apartment?

First, you need to decide on the choice of an organization or individual who will carry out the assessment procedure. To do this, you need to discuss with the representative all the conditions for the performance of work and the cost of the service. If the chosen candidate is not included in the list of those accredited by the bank, it is necessary to agree on it in order to avoid problems in the future. After that, you can fill out an application and conclude a contract for the work.

Application for concluding an appraisal agreement

Before an expert evaluates an apartment for a mortgage, you need to fill out an application. As a rule, this can be done on the website of the company itself, while it is necessary to specify a minimum of data. These include the full name of the customer, the location of the object to be assessed and some information about it. After considering the application, the specialist will contact the client to set the time for signing the contract.

Signing an agreement

An agreement is concluded in the form of a company in two copies for each of the parties. If necessary, you can always make changes to the document if the customer wants to add some items. Be sure to indicate information about the customer, data about the appraiser, his qualifications and the presence of civil liability. In addition, information is given about the mortgaged housing object and the purpose of the assessment. The rights and obligations of each of the parties are indicated. The date, signatures are affixed and all this is sealed.

What documents are needed for real estate appraisal

To conclude an agreement and evaluate an apartment for a mortgage, you need to take a large amount of papers with you. The first thing you need is a passport. If a trusted representative acts on behalf of a citizen, a power of attorney for the right to carry out activities will be needed. In addition, the following documents must be attached:

- proof of ownership of the property.

- title documents (contract of donation, sale and purchase, privatization, etc.);

- technical plan;

- cadastral or technical passport;

- floor explication.

Methods for determining the cost of an apartment

An integrated approach in the work of valuation organizations includes several mandatory procedures, which indicates that this work is not easy. This includes the collection of documents, the process of inspecting the object and its analysis with the preparation of detailed reports. Different methods are used depending on the goal pursued. Profitable helps to determine what benefits can be obtained by renting out or reselling real estate. Many assumptions are made when using it, so it does not always accurately reflect the real state of affairs.

The cost method basically uses the actual condition of the appraised housing. The costs required for the construction of a similar object are taken into account. This requires an estimate, without which accurate information on the apartment is impossible. With the comparative method, a parallel is drawn between equal objects sold or offered for sale. There is a generalization of information, an assessment is made using various coefficients. The method gives the most accurate idea of the real value of the home.

Market price of the property

If to speak plain language, then the real market value of housing is the amount for which the buyer is ready to purchase an apartment, and the seller agrees to sell it. An analysis of the market price of an apartment is possible only by studying the existing offers on the market. Apartments of similar consumer qualities are taken into account. The more options presented for comparative characteristics, the more accurate the final figure will be.

liquid value

In addition to the market value of the apartment, the lender takes into account the liquidation value. This is the price at which real estate can be sold in as soon as possible with a minimum of effort. To obtain a mortgage loan, it is extremely important to accurately determine the market price of similar apartments, since the liquid price differs from it downwards and amounts to about 70–80%. The bank will issue a loan to the borrower based on the liquidation price.

What to do if there is a significant difference in the cost of an apartment

Estimated cost is much lower than offered on the market. You can cover the difference with your own money or request consumer credit, however, it will be issued at a higher percentage. You can provide additional collateral to the bank. This will help increase the settlement amount of the mortgage transaction. It is allowed to contact an independent expert for an additional assessment, because any nuances that affect the cost of housing could not be taken into account, for example, a new building from the developer, the presence of repairs in the premises, the location near the metro station.

Real estate appraisal report

As a result of the appraisal work, the main document is drawn up, which will guide the bank when determining the loan amount. This is a report that has legal force and meets the mandatory requirements of the customer. At its core, reporting is evidence, so to speak, justification of why the property has such a price. It is allowed to draw up a document by specialists who have permission from a self-regulatory organization and have insured their liability.

Design Requirements

Since the report is legally binding, it must be written correctly. Many banks may have their own additional documentation requirements, so you need to know about this in advance, as the document may not be accepted for consideration. All appraisers accredited by a certain bank are aware of the conditions put forward, therefore there are no complaints about the statements they have drawn up.

In addition, any completed report must comply with the requirements of the Association of Russian Banks (ARB) and the Association of Housing Mortgage Lending (AHML):

- be printed;

- data can be presented both in tabular and descriptive form;

- contain all the data necessary for calculating the loan;

- The number of pages must not exceed 30.

What information should be included in the report

Since the assessment of an apartment for a mortgage from a bank is made on the basis of a report compiled by an expert, the document must contain comprehensive data. Be sure to provide information about the customer and the contractor. Data about the object to be analyzed, tasks and methods of cost justification are included. An analysis of the location, development prospects is given. Photos of the house, entrance, the apartment itself or its share are given. The parameters of the apartment are described (floor, area, ceiling height, etc.)

All characteristics of the object are presented in comparison with similar dwellings, redevelopment is taken into account. The calculation of the cost per square meter in compared apartments is given with decreasing and increasing coefficients. The market and liquidation value of the apartment is determined. In addition to all this information, the report is completed with annexes, acts, copies of documents and other photographs of the object.

Time of preparation and submission of the report

Depending on the complexity and qualification of the expert, the preparation of the report may take different time. It can take two days to work, but it can be more, but as a rule, the average time for compiling does not exceed five working days. After the report is ready, the client receives a notification that the document can be picked up. If the report was prepared in a non-accredited company, it is necessary to check for copies of documents confirming the legality of the company's work.

Apartment appraisal period

Due to real estate may change in price, and its condition worsen, the period of validity of the report under the law is 6 months. This is done so that the client can apply to other credit institutions if he is denied a loan. After six months, if it was not possible to obtain a loan, a re-evaluation of the apartment for a mortgage is carried out.

Video

Did you find an error in the text? Select it, press Ctrl + Enter and we'll fix it!

Through real estate appraisal, a financial institution is able to:

- minimize risks in case of loan default;

- determine whether the estimated amount is sufficient to issue the requested mortgage amount.

According to the Federal Standard (clause 26 No. 3), the validity period of the final value of the property for the transaction is considered valid for 6 months, with the exception of property registered upon entering into an inheritance.

By whom and at whose expense is the procedure carried out?

An appraisal of an apartment with a mortgage is carried out by professional employees, who can be:

- accredited specialists of the financial institution;

- independent valuation firms;

- private persons.

It should be borne in mind that banks tend to underestimate the real cost of an apartment for their own safety, and borrowers tend to increase it in order to get the maximum loan.

This is why an independent appraisal of an apartment for a mortgage is important for both parties.

It has an official status, therefore it provides additional opportunities for the customer:

- used in court to deal with various cases, for example, determining compensation payments when dividing property;

- is an important argument in disputes with tax office on the size of the taxable base arising from the accrual property tax or personal income tax.

financial institution offers the borrower two options for finding a specialist in appraisal services:

- provide a list of trusted companies and recommend one of them;

- inform about the selection criteria (license, liability insurance policy of at least 300 thousand rubles, participation in SRO, etc.), with the help of which the client will be able to independently find an appraiser.

Formally, a credit institution does not have the right to limit the choice of a client or impose a certain company.

However, two factors must be taken into account:

- the decision of the borrower must be agreed with the financial institution;

- by choosing a specialist who is a trusted partner of the bank, the process of obtaining a mortgage is much easier and faster than with an independent search.

Many are interested in the question of who pays for the services of appraisers.

If you look at it, a document on the real value is more needed for a person who wants to get a loan.

The owner of real estate can sell it without submitting a report to the registration authorities. Therefore, payment for appraisal activities is one of the borrower's expenses.

How and when is the assessment done?

After confirming the selected specialist by the bank, the borrower pays a visit to the appraisal company.

He must provide at the disposal of photocopies of documents certified by the signature:

- plan of the apartment, including floor plans;

- cadastral passport from BTI;

- information about the type of floors (for residential buildings built before 1960);

- a document confirming the right to real estate (contract of sale, certificate of inheritance, etc.);

- a certificate stating that the property is not subject to demolition or reconstruction with resettlement (for buildings created before 1970);

- agreement on equity participation (when buying an apartment in a building under construction).

When visiting an appraisal company, the following steps are taken:

- a contract is concluded for the transaction (it specifies the terms and objectives of the event, the cost of services);

- the date and time of the visit by the specialist to the object of assessment is assigned (you need to choose daylight hours);

- are made cash in cash or non-cash form for the services provided.

The expert carefully analyzes all the documents for the apartment, after which he goes to the property appraisal for a mortgage.

This procedure takes place in several stages:

- The premises are inspected for compliance with the schemes from the BTI (takes 10-15 minutes, depending on the experience of the specialist).

- All residential and adjacent areas are photographed, possible defects are identified.

- The value of real estate is calculated using various methods.

- Value adjustment methods are used, taking into account the strengths and weaknesses of the property.

- Reporting documentation is being prepared.

During the inspection, the expert asks the customer and the seller of the apartment a number of questions. He finds out the approximate number of residents of the house, as well as positive and negative factors that can affect the market value.

The specialist must consider:

- condition and age of the property;

- availability of public transport;

- location of important infrastructures (schools, hospitals, pharmacies);

- apartment parameters (area, floor, ceiling height, presence of a loggia or balcony, etc.).

After inspection, the specialist monitors alternative proposals, explores the current database. Next comes the final report.

The term for real estate appraisal involving a mortgage loan can last up to 5 days.

Basic Methods for Determining Cost

There are different methods for determining the value of real estate.

The most common of them are the following:

- costly- based on the calculation of the costs required to restore the property, taking into account depreciation, inflation, reconstruction costs. It allows the buyer not to overpay money for the construction of property similar to the usefulness of the object in question.

- Comparative method- a common type of appraisal that involves an analysis of the value of similar types of property.

- Profitable- a method designed for the analysis of commercial real estate. It is based on the calculation of the cost, taking into account the possible profit and all the benefits from the active use of the object. The main advantage is the precise definition investment risk, disadvantage - the probability of making a mistake with the predicted income.

When evaluating residential real estate for the purposes of mortgage lending, experts use the comparative method.

What is included in a bank statement?

According to the appraisal legislation, the report must be in writing, as well as be laced, numbered and sealed.

It usually consists of 28-30 pages. You should familiarize yourself with the finished document immediately at the office of an independent company, since you can immediately resolve all issues.

The report consists of the following sections:

- General information about the appraiser and the customer.

- Information about evaluation methods.

- Information about the analyzed object.

- Real estate market research.

- Determination of market and salvage value.

- Applications (legal acts).

The real estate appraisal report for the bank includes:

- property documents;

- photographs taken during the inspection of the property;

- the market value of the property;

- the liquidation price at which the bank will be able to sell the apartment in the event that the borrower fails to fulfill financial obligations.

If the borrower independently searched for a specialist, he must attach to the report a document confirming the appraiser's membership in the SRO, a liability insurance policy, and a diploma of education in the field of appraisal.

What affects the appraised value, and what if it is below the market value?

The appraised value of the property affects the terms of the loan, which include:

- the amount of the mortgage issued to the borrower;

- the maximum loan term;

- percentage rate.

If the real value is equal to or greater than the amount that the borrower is going to issue, there will be no problems.

The bank will issue a mortgage because it has the ability to sell the property in default.

There are cases when the price of real estate is lower than the market price or agreed with the seller, then the person will not be able to receive the amount he was counting on.

The reasons for such a situation may be as follows:

- the appraiser did not take into account the state of the object;

- the specialist incorrectly selected similar types of real estate.

The borrower can do the following:

- Request a reassessment or use the services of another company (additional costs are needed) or accredited bank specialists.

- Provide financial organization additional security.

- Get a consumer loan for the missing amount.

In extreme cases, you will have to take out a smaller mortgage. In most cases, banks come to the conclusion that the re-examination reflects the real value of the apartment.

Price

The cost of real estate appraisal is formed individually, depending on the urgency of the work and the location of the apartment, since the appraiser will need to spend more time and money to travel to remote locations.

It is also influenced by the quality characteristics of the property.

The table shows the approximate prices of specialist services in some Russian cities.

Mortgage appraisal is a mandatory procedure that requires taking into account many nuances.

Choosing the right specialist saves time and guarantees the borrower a mortgage loan.

Video: Mortgage real estate appraisal

Before the bank accepts the issuance of a mortgage loan, the collateral for which is an apartment owned by the borrower, the bank must know the market value of the collateral. To do this, you need to evaluate the apartment by independent experts. Without assessing the collateral, the bank will not issue a mortgage loan. This is...

People who decide to purchase housing through a loan ask themselves the following questions: is an appraisal of an apartment necessary for a mortgage in a new building? Why is this procedure necessary? Who should determine the price of housing and at whose expense is this done? How to order an appraisal service and what should you pay attention to when choosing an expert appraiser? How not to run into "pitfalls" and not lose or overpay money? Let's try to answer all these questions.

Why evaluate an apartment in a new building with a mortgage?

Valuation means determining the value of housing on the market, which is carried out by a person who has a license for this activity. An appraisal will be required if there is an intention to apply for a mortgage loan in order to acquire square meters in a new home. Federal Law of July 16, 1998 N 102-FZ (as amended on December 31, 2017) “On Mortgage (Pledge of Real Estate)” obliges to determine the value of an object when registering a mortgage in connection with a mortgage.

Why evaluate an object? Before lending money, a financial institution must be sure that in a situation where the borrower cannot meet its debentures, the property can be sold and thus returned bank funds. A complete list of everything you need to buy an apartment in a new building.

The appraiser's report is also used under the following circumstances:

- To determine the amount of compensation payments, if there is a division of property.

- In case of disputes with the IFTS about the size of the tax base.

Who conducts the assessment?

So, ? Price determination can be carried out both by independent appraisers who have an appropriate license, and by a specialist of a credit institution.

The requirements for an expert are::

- Must insure activities for at least 12 months.

- Must be a member of an SRO (self-regulatory organization) and pay contributions on a regular basis.

- Have a civil defense policy with an insurance amount of 300,000 rubles.

- Not be related to the person who intends to sign mortgage obligations.

What should you pay special attention to when choosing an expert organization?

Attention should be paid to such points as:

- Reputation.

- How long has the company been in the market?

- The presence of positive or negative feedback.

It makes sense to make a request for forms of contracts, reports, in order to check whether they comply with the requirements of Art. Art. 10, 11 of the Federal Law "On Appraisal Activities".

It is important to know that the borrower has the right to seek services from firms that are not accredited by the bank. In circumstances where a financial institution imposes a ban, a waiver should be requested in writing, which will contain an explanation. If the refusal is justified, it is necessary to demand that the appraisers eliminate the shortcomings. If there was a refusal to eliminate the shortcomings, it is worth contacting an expert who is a member of the SRO.

In a situation where banking organization gives an unreasonable refusal, the borrower has the right to write statement of claim to the judicial authorities. The claim must contain a requirement to accept the conclusion and issue the necessary amount of money.

Which party is responsible for paying for the service?

The borrower is obligated to pay for the services of an expert. The cost of the procedure for assessing an object in a new building, if any mortgage credit lending, starts from 2,500 rubles. The amount may vary depending on the region. For example, in Moscow and Moscow Region you will have to pay 3,500-4,000 rubles, while in St. Petersburg - 3,000-3,500.

How to order an assessment?

First of all, you need to choose an expert. To speed up the process of obtaining mortgage funds and to be sure of the correctness of the assessment, it is preferable to choose a specialist who is in the register of a financial institution. The speed is explained by the fact that the security service does not have to spend time checking the credentials of an expert.

First of all, you need to choose an expert. To speed up the process of obtaining mortgage funds and to be sure of the correctness of the assessment, it is preferable to choose a specialist who is in the register of a financial institution. The speed is explained by the fact that the security service does not have to spend time checking the credentials of an expert.

At the same time, we must not forget that the bank does not have the right to force the client to work with a certain appraiser. The choice of a professional is the right of the borrower.

After the choice in favor of one or another expert is made, it is necessary to provide the following documents:

- Passport of the person acting as the borrower.

- New building plans and premises.

- Cadastral passport issued by BTI.

- Contract on equity participation (if executed in an unfinished building).

The borrower has the right to apply to appraisers who do not have bank accreditation.

The evaluation process is as follows:

- Conclusion of an agreement with an expert organization. The contract must specify the terms and objectives of the provision of services.

- Schedule a viewing date. In this case, it should be taken into account that the appraiser arrives only during daylight hours.

- A conclusion is issued within 3 days from the date of inspection.

How is the property inspected?

The inspection consists of several steps:

- Real inspection of the apartment. The average visit time is 15 minutes.

- Photographing the dwelling and the building in which it is located. The purpose of photographing is to identify defects or fix their absence.

- Production of calculations of the cost of the object.

- Drawing up a conclusion based on the data obtained and analysis of similar real estate. The conclusion is valid for six months. The report must include copies of housing documentation and photographs. The average volume of the report is 28-31 pages.

When determining the price, not only the constant characteristics of the apartment are taken into account, but also the living conditions in the area. Developed infrastructure will increase the appraised value.

What types of property appraisals are there?

There are the following options for determining the value of real estate:

- Market: analysis of transactions in the market, similar to the one that is planned to be made.

- costly: Calculates the costs that would be incurred in the case of the construction of a similar facility.

- Profitable: The prospects for an increase in market value are taken into account.

Currently, the vast majority of Russians do not have their own housing. According to the Analytical Center, about 25% of the country's population rent apartments, rooms and houses. Even more - 30% - are forced to live with their parents, as they are unable to pay for the rent of real estate.

However, everyone wants to have "their corner". Unfortunately, the modern economy is such that real estate prices are set quite high, and not everyone can afford to buy a home without using third-party funds. And since it will take too long to save up for the same apartment, almost 100% turn to banks for mortgages.

What is an appraisal of an apartment?

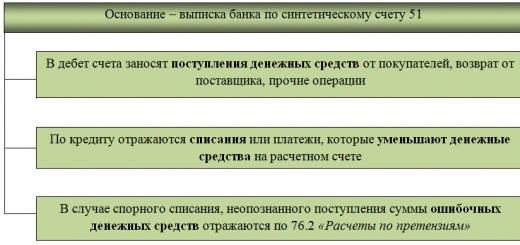

One of the many documents that must be submitted to the bank in order to receive funds for the purchase of housing is an apartment appraisal report. Only based on the price of housing, which will be indicated in the report, the bank will determine the amount that it will give you. And it doesn't matter how much you actually buy an apartment.

Apartment appraisal - this is the activity of a specialist aimed at determining the most probable value of this type of real estate on the free market.

Banks accept only those reports that are made by professional appraisers with the appropriate education and qualifications. As a rule, banks recommend appraisal companies and appraisers who are accredited by them, that is, they have undergone a thorough check of compliance with all the requirements for the report of the law “On Appraisal Activity” and the quality of the work performed.

How is the assessment done?

When you contact an appraiser, be sure to inform him about the purpose of the assessment and better specify which bank you will have a mortgage loan with. Appraisers who specialize specifically in real estate valuation, as a rule, are aware of the additional reporting requirements of a particular bank.

Pre stage:

Before proceeding with the report, the appraiser will ask you to collect the necessary documentation for the apartment. This list is small, so collecting documents will not be difficult for you. You can find a typical package on this page in the "Required Documents" section.

The next obligatory stage of the assessment is a site inspection visit. As a rule, appraisers carry it out independently or it is done by their assistants. An inspection is necessary to photograph the apartment, as well as to more accurately determine the general condition of the object and its compliance with the parameters stated in the documents. For example, many owners of an apartment being sold are trying to hide the presence of illegal redevelopment. And this greatly affects the decision of the bank regarding the approval of the mortgage.

Estimated stage:

After examining the apartment, the appraiser proceeds to study the real estate market and the economy in this area as a whole in the region. Similar objects are selected, the data of which will be taken into account in the calculations.

When making calculations, the appraiser determines not only the market value of the apartment, but also the liquidation value. The salvage value is the price at which the object can be sold in the shortest possible time, and it is usually lower than the market price.

Knowing the liquidation value allows the bank to determine the possibility of covering losses in case, for any reason, you stop paying the loan. Then the bank will be able to terminate the contract and sell this apartment, and you will not remain a debtor.

Interesting fact:

In ancient Greece, on the land of the debtor, the creditor installed a sign, which meant that in case of non-payment of the debt, the land would become the property of the creditor. This tablet was called - mortgage (hypothéke).

What does the client get?

The result of the appraiser's work is a report that you can provide to the bank to a loan officer.

Case from practice:

In April, a client contacted our company. He has a difficult situation. In order to receive the amount he needed from the bank, it was necessary to reach a certain cost of the apartment, but they could not do this in another company. To his luck, he called us, and our specialists once again showed their professionalism, having managed to calculate the required cost of the apartment. As a result, the client received the funds he expected.

The apartment appraisal report itself looks like a printed document, consisting of about 70-80 A4 sheets. The report must be numbered and bound. And also certified by the seal and signature of the appraiser.

A completed valuation report for a mortgage consists of sections:

- Information about the Appraiser and the Customer

- Characteristics of the object of assessment

- Overview and analysis of the real estate market

- Analysis of the liquidity of the object

- Justification of the assessment methodology

- Determination of market value

- Determination of salvage value

- Documents of the Appraiser: Diploma, Certificate of membership in the SRO, Extract from the register of the SRO, Policy compulsory insurance appraiser's responsibility

- Company documents: OGRN, TIN / KPP, Insurance policy

- Documents of the Customer: title and technical documentation for the apartment

- Photos of the apartment

Many buyers perceive the bank's approval of an application for a mortgage loan as a guarantee of the success of the upcoming transaction. The borrower's documents were thoroughly checked, as a result of which the bank agreed to lend him the required amount - it would seem that now it remains only to find suitable housing. In fact, the amount of a pre-approved loan is far from the final figure, and in the end it can turn out to be much more modest.

Initially, the bank calculates the loan amount based on the level of income and the degree of solvency of the borrower. However, the key factor in determining the actual size of the loan is the estimated value of the collateral. The figure appearing in the sale and purchase agreement has practically no meaning for the bank - it is important for it to have an opinion of an independent appraiser on the real market value of the object, at which it can be sold if the debtor fails to fulfill its obligations.

Not only the lender, but also the borrower is interested in an independent professional assessment of housing purchased on a mortgage: if he cannot repay the loan and will be forced to sell the property, the proceeds should be enough to full repayment debt. In this regard, the assessment of mortgaged housing is a prerequisite for obtaining a mortgage loan in accordance with federal law No. 102-FZ "On Mortgage (Pledge of Real Estate)".

So as soon as the borrower decides on the choice of an apartment, he will need to order its assessment. It is better not to postpone this procedure until a deal is reached: if the estimated cost of housing is significantly lower than the price set by the seller, then the buyer may not have enough funds for the purchase, since the bank will issue a loan only within the amount set by the appraiser.

The costs of the services of the appraisal company are borne by the client. If we are talking about a typical city apartment, then the cost of the assessment will be an average of 5-6 thousand rubles. Buyers of suburban real estate will have to pay an appraiser from 25 thousand rubles or more, depending on the type of object and its distance from the capital. Of course, these are average figures, and there are offers of various price categories on the evaluation market. However, when choosing a company, the borrower should not focus only on the cost of services. Dumping one-day firms often do not bear any responsibility for their activities. Therefore, before entering into an agreement with appraisal company, it is worth checking whether it is a member of one of the self-regulatory organizations of appraisers and whether it has a valid civil liability insurance policy. In addition, it would be useful to find out how many employees it has, whether they have specialized education and what their work experience is. However, each mortgage bank offers the client its own list of recommended appraisers who have already passed a thorough check, and the borrower, as a rule, can trust the choice of the lender. The list of appraisers proposed by the bank does not always suit the client: he may be confused by the affiliation of the appraisal company or the inflated price for services. In this case, the borrower has the right to apply to any other appraiser that meets the requirements of the lender. True, you need to be prepared for the fact that the procedure for agreeing with the bank on the candidacy of an “outside” appraiser will take a lot of time. In addition, not every appraisal company will be ready to spend its time and energy on providing an extensive package of documents at the request of the bank.

What, where, how much?

The evaluation process itself is quite fast. At the first stage, the client concludes an agreement with the appraiser and provides him Required documents: for example, for an apartment on the secondary market, these are copies of a certificate of state registration of ownership of the object and a cadastral or technical passport with explication and floor plan. If the housing is still under construction, then instead of a certificate of ownership, a contract is provided equity participation. Also, the client must give the appraiser a copy of his passport.After that, the appraiser or his representative personally inspects the housing, evaluating it according to a variety of parameters, photographs the property. Subsequently, these photographs are filed with the final report as a justification for the appraiser's conclusions.

Usually a report is prepared within 1-3 days, for suburban real estate - 4-5 days. If necessary, the client can use the express property assessment service within 24 hours, paying for the urgency one and a half to two times more expensive.

The appraisal report indicates the market and salvage value of the property. The second figure is often more important for the bank, since the liquidation value is the price at which this property can be sold as soon as possible in the format of a forced sale. Usually it is 10-20% below market value.

When preparing a report, the appraiser should be guided by the Federal Valuation Standards and AHML standards, as well as individual requirements specific bank. The lender always double-checks the content and form of the report and often sends it back for revision. The borrower, whose bank refused to accept the report for objective reasons, should apply to the appraisal company with a request to make the required corrections. In most cases, the appraiser redoes the report without objection, but it would not be superfluous to specify this condition at the stage of concluding an agreement with the appraisal company.

Appreciate

The most common method of assessing real estate in a mortgage is a comparative analysis of similar objects. To determine the average market price of real estate, “analogues are selected that are most similar to our object of appraisal. The main criteria by which analogues are selected are location and physical characteristics(total area, wall material, number of storeys, year of construction),” says the Head of the Residential Real Estate Appraisal Department of the OBIKS appraisal company * Victoria Larina. It is important to remember that the figure obtained remains relevant for a rather limited time period, since the appraiser cannot predict price changes in the real estate market under the influence of various factors in the medium and long term.When signing an agreement with an appraiser, you should not ask him to name him in advance approximate cost housing - he will not be able to do this before he analyzes the object according to a wide list of criteria, a number of which have a very significant effect on the final price. So, the main pricing characteristics of an apartment include its area, type and class of building, location and transport accessibility. Factors that increase the price of the object are isolated rooms in the apartment, windows facing different sides of the house, a spacious kitchen (9 meters or more), a separate bathroom, a glazed loggia or balcony. The appraiser also takes into account the quality of repairs in the apartment, the degree of improvement of the entrance and the adjacent territory.

The cost of an apartment can be significantly reduced by the location on the first or last floors of the house, a high degree of physical deterioration of the building, an unsightly view from the windows and an unfavorable environmental situation in the area. Lose in price and those apartments in which repairs are required, as well as objects with uncoordinated redevelopment.

After analyzing all the main and secondary characteristics of housing, the appraiser selects the closest analogues in the database of apartments for sale (usually at least six), calculates the average cost per square measure in the selected apartments, and, using certain coefficients, determines the price of the object in question.

It is much more difficult to determine the market value of suburban real estate, especially those not built according to a standard project. The cost per square meter is affected by the condition of the house and the year of construction, category land plot, availability of engineering communications, security level. Of key importance is the location of housing, remoteness from the city center, the quality of access roads. In addition, the price is affected by the type of settlement, the ecological situation in the area and the level of infrastructure development.

A specific task for the appraiser is to determine the market value of housing under construction, which very often becomes the subject of collateral for mortgage loans. How to evaluate an object that exists only on paper, and one cannot be completely sure that it will be built and put into operation at all? In practice, in this case, it is not ephemeral square meters that are assessed, but the cost of rights to the object being built. The price of future housing is determined based on the cost of ready-made properties with similar characteristics, which is then adjusted taking into account information about the developer's portfolio of projects, the stage of construction and various risks (delays in the task, bankruptcy of the developer, etc.). As a rule, housing under construction is valued cheaper than similar real estate in the secondary market.