January 2019

Get consumer credit- the task is not difficult. However, if the person who has made such a decision thinks about the consequences of his actions, then the situation no longer looks too simple. It is necessary to take into account a number of factors, for example, the choice of a bank that will give a loan. In addition, it is useful to first ask its employees on what conditions the necessary funds will be received, to what extent the content and subject matter of the loan agreement comply with legal standards, and how objectively it reflects the mutual rights and obligations of its participants.

What is a loan agreement?

A loan agreement is a written bilateral agreement, according to which financial institution, on the one hand, undertakes to issue for personal use a certain material amount (credit) to the client for special conditions specified in the document. And the person who received the funds, for his part, promises to return them in full and within the specified period, additionally taking upon himself the obligation to pay interest on the capital used.

This paper is one of the independent and autonomous versions of the loan agreement. This allows you to apply similar rules to it, unless otherwise stipulated by law, is not spelled out in the rules of consumer lending and does not contradict the very essence of the compiled paper. Unlike a standard loan, this method of lending is classified in legal practice as a consensual one, since it gains momentum only after its participants reach all the specified requirements and conditions. In addition, it falls under the category of reimbursable, since the repayment of the borrowed amount is carried out by the bank's client within the framework of the interest rates specified in the agreement.

The general conditions of the loan agreement are regulated by regulatory legal acts, and additional clauses of the main sections can be drawn up at the discretion of the participants in the transaction.

Civil Code

What article of the civil code regulates the loan agreement? Based on current legislation, this document classified as a civil law consumer agreement. This means that the bilateral obligations that develop between the organization that issued the loan and the person who received it have a private legal legal connotation. At the same time, the monetary relations of its participants are carried out in accordance with the rules and norms of the Civil Code of the Russian Federation. When making it, both parties are obliged to be guided by the fundamental principles of freedom and voluntariness in the process of the agreement being concluded, unless other actions are provided for by the legal and regulatory framework of the state. This is what the law says - in particular, Article 819 of the Civil Code of the Russian Federation.

The article not only gives a complete definition this action. However, it regulates in the most detailed way the practical application of the agreement, according to which the financial institution that issued the money on the terms of consumer lending assumes the obligation to act according to the conditions ascribed in the document, while observing both the size of the loan and the interest rates on it - without going out at the same time beyond the limits indicated in the text. The borrower, accordingly, undertakes the task of promptly reimbursing all funds and repaying interest overpayments. If no other actions of the participants are additionally agreed, then the document, according to Article 819, does not gain legal force upon its signing - the moment the loan agreement is concluded is the receipt by the interested person of the required amount from the lender.

Rights and obligations of the parties under the loan agreement

To conclude a loan agreement, it is required not only to comply with all the requirements that are imposed by law on its direct participants. It is equally important to understand the mutual rights and obligations that will have to be fulfilled after the signatures under the document are put. At the same time, it should be understood that not only banks and private financial companies can act as a creditor, but also foreign organizations, individuals or legal entities. Regardless of who gives the money, the agreement regulates both rights and obligations upon the transaction. As a rule, they are standard, but the parties can make their own adjustments.

Obligations of the creditor under the loan agreement:

- the need to give the client the required amount of money in the ways established by law;

- accept the repayment of debt obligations under the agreement and place them on the required current accounts;

- at the first request of the client who issued this loan, provide him with information about the remaining part of the debt, or the termination of credit obligations upon closing the entire amount (this information must be confirmed by a special certificate).

A person acting as a borrower under this document, in turn, is obliged to:

- Accept for personal use the requested funds in the amount he needs. Dispose of them in accordance with the goals prescribed in the agreement. If there is no item on the intended purpose, the borrower has the right to use them at his own discretion, without informing the bank about his actions.

- By the time the transaction is signed, the client must provide a true personal information and additional information about yourself that the lender requires. Reference! For deliberate distortion of data or the use of forged papers and certificates, criminal liability and a real term of imprisonment may be applied to the violator.

- Payments must be regular in nature - according to the established debt repayment schedule.

- If the contract contains insurance premiums they should be paid on time.

The Bank is entitled to:

- write off the amounts necessary for repayment from other accounts and sources of income of the borrower if he evades his direct obligations;

- since the subject of the loan agreement can be not only money, but also property values, the company may file a claim for their temporary confiscation;

- for objective reasons, terminate the contractual relationship ahead of schedule and initiate the fulfillment by the borrower of payment obligations in full before the period of time established by the agreement;

- apply all legal levers of influence on the non-payer and apply to the judicial authorities to protect their interests.

The bank customer is entitled to:

- partially make current payments ahead of schedule in order to fulfill their financial obligations as soon as possible;

- demand access to information about the status of their credit debt at any time convenient for him;

- familiarize yourself with the procedure for drawing up a loan agreement and put your signature under it only if you fully agree with all the points of the document;

- until receipt Money on hand to refuse bank services and terminate the contract ahead of schedule unilaterally.

Types of loan agreement

- Target - funds go to the purchase of a specific product.

- Non-targeted - the borrower is not obliged to give financial institution a report on exactly where he spent the borrowed money.

- Secured - means the presence of guarantors.

- Unsecured - without their presence.

- With or without recoverable limit funds - the loan is taken one-time and is no longer replenished.

- Investment - funds are used to develop their own business. Interest under such agreements is controlled by the state and cannot go beyond the established limits.

- With and without interest rates. In the latter case, all overpayments are compensated by the state. Example − mortgage credit lending within the framework of participation in various federal projects and programs.

- Restructuring and refinancing - is when there is a need to ensure the financial ability of the client to make payments on time and in full. In this situation, the procedure for drawing up a loan agreement is actually a transfer of debt to another banking institution, when the client repays his initial debt at the expense of the funds received.

The procedure for drawing up a loan agreement

Before making an agreement, the company requires the client to provide the documents necessary for consideration of the application. If the parties to the loan agreement are a bank and an individual, their list is standard. If foreign creditors or legal entities are involved in the transaction, this list can be expanded. Further, the management of the organization will consider the application and make a decision - to allow lending or to reject the transaction.

Before signing the main agreement, depending on the situation, accompanying documents can be signed - collateral, insurance, surety. This loan agreement must be concluded in the form regulated by law, in writing and in two copies.

Contract time

The loan agreement is considered concluded from the moment the loan is received and is valid for the period specified in the document. This period is determined individually. Usually, customer credit extends over several years - basically it is 2-3 years. When it comes to buying real estate or a car, these limits are more extended. From a legal point of view, the term of the contract is terminated upon the fact full repayment debt obligations.

Related videos

in a person acting on the basis of , hereinafter referred to as " Bank”, on the one hand, and in the person acting on the basis of , hereinafter referred to as “ Borrower”, on the other hand, hereinafter referred to as “ Parties”, have concluded this agreement, hereinafter referred to as the “Agreement”, as follows:

1. The Bank grants a loan to the Borrower for (the purpose of the loan).

2. The total amount of the loan - rubles rubles.

Credit is provided for payment.

3. The borrower undertakes to repay the loan before "" year.

Loan repayment is carried out by. If funds are not received to repay the loan within the specified period, the loan debt, including interest, is paid to the account of overdue loans and debited from account No. in the bank.

4. For the use of the loan, the Borrower pays a fee in the amount of % per annum.

Interest is accrued and collected by the Bank on a monthly basis after the day of each month in an indisputable manner by collection order from the current account of the Borrower.

The countdown of the interest accrual period starts from the date of disbursement of funds from the loan account and ends with the date of transfer of funds in repayment of the loan to the Borrower's loan account.

If the Bank's account does not receive funds to repay the interest due from the Borrower before the next month, the interest due from the Borrower on the loan shall be considered as untimely paid.

In case of violation of the loan repayment term and payment of interest, the Bank charges a penalty in the amount of % of the outstanding amount of the loan debt for each day of delay.

5. The borrower undertakes to fulfill the following obligations:

Submit the following documents to the Bank for registration and issuance of a loan, drawn up in accordance with the current banking practice:

Charter, balance sheet, certificate of state registration;

Term obligation for the amount and maturity of the loan;

A card with sample signatures and a seal imprint, duly certified;

Use the received loan for the purposes stipulated by the agreement, repay the received loan in a timely manner together with accrued interest, give the Bank the right to control intended use loan.

At misuse loan, as well as non-fulfillment of other terms of the agreement, the Bank has the right to present the loan for early recovery.

6. The Bank, guided by the subject of the agreement, undertakes to monthly accrue interest for the use of the loan and collect them from the current account of the Borrower by collection orders.

7. Disagreements arising in the process of fulfilling the terms of this agreement are preliminary considered by the parties in order to develop a mutually acceptable solution with the execution of a bilateral protocol of consideration.

If it is impossible to settle disputes and disagreements by means of a bilateral agreement, they are submitted for consideration to the bodies of an arbitration court or court.

8. Neither party has the right to transfer its rights and obligations under this agreement to third parties without the written consent of the other party.

9. This agreement is made in triplicate: the first and third are kept in the Bank, the second - with the Borrower.

This agreement comes into force from the moment of its signing and is valid until the termination of relations under it.

All appendices to the contract are its integral part.

Any changes and additions to this agreement will be valid only if they are made in writing and signed by both parties.

This agreement may be terminated unilaterally and upon prior notice to the Borrower, provided that he repays the loan in full, together with interest on it.

The party for which it has become impossible to fulfill obligations under the contract is obliged (no later than days from the moment of their occurrence) to notify the other party in writing in order to make an appropriate decision.

9. DETAILS AND SIGNATURES OF THE PARTIES

Bank

- Legal address:

- Mailing address:

- Phone fax:

- TIN/KPP:

- Checking account:

- Bank:

- Correspondent account:

- BIC:

- Signature:

Borrower

- Legal address:

- Mailing address:

- Phone fax:

- TIN/KPP:

- Checking account:

- Bank:

- Correspondent account:

- BIC:

- Signature:

Each person or organization that needs a loan from a bank must draw up a loan agreement with this institution. This procedure must be carried out competently and in accordance with certain requirements and conditions, therefore it is important to know which documents must be signed, what items they should consist of, and it is also necessary to remember about other important aspects this process.

How to draw up a loan agreement

Initially, you need to remember that there is no single document that would constitute a loan agreement, so it can vary significantly in different credit organizations. Some banks do not draw up a loan agreement in the generally accepted form with their customers when issuing a loan. However, in any case, this document must contain certain information and the most important points, since only then will it be considered official. At the same time, each client of the bank must be very careful in studying this document so as not to violate any of its clauses or skip hidden payments, leading to the fact that a person or company is forced to pay a lot of money for imaginary bank services.

Initially, it is important to know the terms of the loan agreement, which may be different. This document must contain information about who exactly acts as parties to this agreement, and at the same time this data must be truthful and accurate. If there are any inaccuracies, they can cause serious problems with the bank or the client in the future. The conditions additionally state what amount of money the client takes on credit, and it is also important to know how exactly you can get cash. It is important to carefully study all the points, as there should be no hidden fees or additional payments for opening an account or withdrawing money if the loan is issued by card. The terms and conditions should contain information about the interest rate used, which should not change over time.

The execution of a loan agreement must be accompanied by a calculation by the bank employee of the amount of interest for the entire loan period. It is important to remember that different borrowers may be offered different interest rate because it depends entirely on credit history client, as well as other factors. The loan agreement must contain data on monthly payments, which can be differentiated or annuity.

The procedure for compiling a document

The procedure for drawing up an agreement is considered quite simple, but the client should be very careful when studying the document for those items that are related to fines and sanctions in case of late payment on the loan. You also need to study the information on how you can pay off the debt ahead of schedule, and at the same time there should not be any payments for this. It is important to pay attention to the rules that will have to be followed if it becomes necessary to terminate the loan agreement.

When drawing up a document, it is important to take into account how the bank will act in case of non-payment, and here it may indicate the collateral that is placed at the disposal of the credit institution in the event that the borrower cannot meet its obligations.

Thus, a loan agreement is a complex and specific document that each potential borrower must study very carefully and scrupulously in order to know exactly how he can act in this or that unforeseen situation. Such an attitude towards this document can save the bank client from paying unnecessary interest or commissions, which are often very high. It also depends on the correct study of the contract how the interest and the main debt of the client will be paid, how he can repay his debt in part or in full ahead of schedule, and also how he should act in a situation where for some reason he cannot pay the debt. As a rule, such an attitude towards drawing up a loan agreement with a bank has a positive effect on all cooperation between the client and the credit institution.

Car loans

Legislation

Business ideas

Contents Urgent Stamp Making Who will act as buyers Where to start a business Equipment for doing business There are many types of businesses that can be started by people with entrepreneurial ability. Moreover, each option has its own unique features and parameters. Urgent production of seals and stamps The business idea of manufacturing seals and stamps is considered quite attractive in terms of..

Table of Contents Card Making Business Idea How to Start a Custom Card Making Business Employees Premises How to Sell Customized Cards various options to open. The business idea of making postcards is considered quite interesting, since postcards are such elements that are in demand.

Contents Choosing a Gym Premises What do you need to open a gym? The gym is becoming more and more popular in modern world as more and more people think about how to lead a healthy lifestyle that involves proper nutrition and exercise. Therefore, any businessman can open a gym, but to get good income, you need to think about it..

Contents Store Location Assortment of Products Vendors Bijouterie is a wardrobe essential for every woman who looks after herself and tries to look attractive and bright. Therefore, almost every entrepreneur who is aware of the possibility of making good profits wants to open his own jewelry store. To do this, it is necessary to study all available prospects, draw up a business plan and predict possible income in order to decide whether it will be..

After the commercial bank has considered the application potential borrower, demanded and received from him Required documents, conducted an analysis of financial statements For the creditworthiness and insolvency of a future client, made sure of a high-class reputation, etc., the bank decides on the conclusion of a loan agreement and the conditions under which it will be issued and returned.

At the same time, the reliability of the loan agreement is the higher, the better the basic conditions for the lending procedure are worked out and defined: urgency, payment, repayment and security.

A loan agreement is a written agreement between commercial bank and a borrower, for which the bank undertakes to provide a loan for an agreed amount for a specified period and for a specified fee (interest). The borrower undertakes to use and repay the loan issued by the bank, as well as to fulfill all the conditions of the agreement. The loan agreement includes the following main sections:

1. Preamble. It usually contains the names of the contracting parties and a description of the purpose of the loan.

2. The volume and terms of repayment of the loan. This section indicates the amount of the loan, the procedure for obtaining it, the loan interest, the term of the loan and the terms of its repayment.

Domestic commercial banks loans are issued in the following order.

Loans are issued by the credit department for specific repayment periods by order orders. In the event of a change in the conditions for the production and sale of products (carrying out works and rendering services) caused by objective reasons, the bank can satisfy the additional need of the borrower for a loan that has arisen in connection with this within the limits of available credit resources on the terms specified in the supplementary agreement. If, when lending to large target programs and objects, the creditor bank cannot satisfy loan application the borrower completely due to insufficient credit funds, and the refusal of a loan will jeopardize the activities planned by him or shake the reputation of the creditor bank, then the bank may issue a loan jointly with other commercial banks on the basis of a joint lending agreement.

The interest for using the loan is determined in such a way that the amount of interest received from the borrower covers the bank's expenses for raising funds necessary to provide the requested loan, with the addition of the so-called margin1. The amount of interest also depends on the period of use of the loan, the risk of insolvency of the borrower, the nature of the loan security, the content of the credited event, the rates of competing banks and other factors.

Interest rates for a loan can be fixed (fixed) and floating, which is also stipulated in the loan agreement. Fixed Rates remain unchanged throughout the life of the loan. Floating rates may be changed by the lending bank during the loan period with the obligatory notification of the borrower, depending on the development of market relations, changes in interest rates on deposits, emerging supply and demand for credit resources, as well as the state of the economy and finances of the borrower.

" Margin - the difference between the rate at which the bank charges interest on the amount of loans provided, and the rate at which the bank pays interest on borrowed funds.

It should be borne in mind that the bank can change the interest rate on the loan, including the fixed one, in accordance with the interest rate policy and the solution of other economic tasks of the state.

Credits for preferential terms(interest-free or with low interest rates) can be provided, as an exception, subject to the reimbursement of the bank for the costs of attracting resources from the state bodies that decide on the issuance of such loans for the implementation of the planned activity.

An example of the application of more low rates than operate in the loan capital market, can serve as the provision of loans to farms for their formation and development. The unreimbursed costs of banks for issuing such loans can be compensated centrally from the federal budget through the Bank of Russia.

In accordance with the requirements of the Bank of Russia on the procedure for the client-borrower to return the funds provided to him and pay interest on them, the repayment of funds placed by the bank and the payment of interest on them are made by:

Write-offs of loaned funds from the settlement (current), correspondent account of the borrower client on his payment order;

Write-offs of funds in the order of priority established by law, or in the order of direct initiative from the settlement (current), correspondent account of the borrower (served in another bank) on the basis of the payment request of the creditor bank "without acceptance", provided that the agreement provides for such an operation ;

Transfers of funds from the account of clients-borrowers of individuals on the basis of their written instructions for the transfer of funds of clients-borrowers of individuals through communication agencies or other credit organizations. Contribution of cash to the cash desk of the creditor bank on the basis of an incoming cash order. Withholding from the amounts due for wages to borrower clients who are employees of the creditor bank (at their request or under the terms of the contract).

Repayment (refund) of funds in foreign currency carried out only in cash.

On the day (date) established by the agreement of payment of interest on the placed funds and / or repayment (repayment) of the principal debt on them, the accounting officer responsible for maintaining the account of the borrower client, in accordance with the order signed by an authorized official of the bank, either executes accounting entries the fact of payment of interest on the placed funds and/or repayment of the principal debt on them, or in case of non-performance (improper performance) by the borrowing client of its obligations under the agreement, transfers the debt on accrued but not paid (overdue) interest and/or on the principal debt on placed funds to the relevant accounts for accounting for overdue principal debt and/or overdue interest.

The debt on the funds provided (placed) (uncollectible and/or recognized as uncollectible in accordance with the procedure established by the Bank of Russia) is written off from the balance sheet of the creditor bank at the expense of the created reserve for possible losses on loans, and in case of its deficiency, it is attributed to the losses of the reporting year.

The write-off of the outstanding debt on the presented (placed) funds, including interest, from the balance sheet of the creditor bank is not its cancellation, it is reflected in the balance sheet for at least five years from the date of its write-off to monitor the possibility of its collection.

In accordance with Art. 34 of the Law "On Banks and Banking Activity", the creditor bank is obliged to take all measures provided for by law to collect the debt (including from the client - the borrower of the debtor).

3. Report and guarantee. In this section of the contract, the borrowing company discloses the state of its affairs and vouches that the financial statements underlying the loan are true and accurately reflect the situation of the borrower.

This clause of the loan agreement certifies that the borrower:

Registered in the prescribed manner and has a good reputation;

It is empowered to conclude a loan agreement and fulfill its obligations to the creditor bank;

Has property that is not subject to retention and is free from any obligations, except for those stipulated by the loan agreement;

Does not participate in any legal actions or claims, other than those to be determined by the contract;

It has trademarks, a company name, a seal, a current account for conducting financial and industrial affairs;

Fulfilling contractual obligations under this loan, not

violates other obligations, does not suffer economic losses from the time of the audit and submission of financial statements; %

It has total amount tax arrears that do not exceed the amount indicated in the balance sheet.

Before the final execution and payment of monetary amounts on the loan, the draft agreement and its terms, confirmed by the relevant documents, must have a lawyer's opinion.

If the agreement provides for a revolving loan, the borrower is obliged to send a document to the bank before each disbursement of the loan, confirming that the previous reports and guarantees remain in force.

4. Description of the security. If a loan is provided against a certain type of security, this paragraph of the loan agreement contains its detailed description, supporting documents and indicates the procedure for handling and using it in appropriate situations.

In some cases, commercial banks may enter into an agreement with the borrower to provide a loan without collateral. Such a loan is usually issued to financially stable clients who have a reputation as a reliable payer and are considered by the lending bank as a first-class borrower.

5. The binding terms of the loan agreement impose certain obligations on the management of the borrowing enterprise. One of the most common conditions is the provision by the borrower at intervals established by the contract of financial reports, as well as other information requested by the bank.

In some cases, the loan agreement may oblige the borrower to maintain working capital above a specified level so that he has a stable level of solvency for the period of using the loan.

Banks in Western countries sometimes include in an agreement on a term loan the borrower's obligation to support the management of the company, which satisfies the creditor bank. This is an important condition, since its success depends on the management of the company. In addition, banks often demand insurance from the borrower's leading administrators of the firm, which is difficult to find a replacement.

6. Forbidding conditions. This section provides a list of actions that the borrower undertakes not to take during the entire period of using the loan without prior approval from the lender bank. The purpose of these conditions is to prevent the dispersion of capital and financially weaken the borrower.

A typical prohibition clause is the borrower's obligation not to pledge its assets as collateral for loans from other lenders.

In the practice of foreign banks, the agreement includes conditions that prohibit the borrower from merging and consolidating with other companies without the permission of the bank, selling or leasing assets, and issuing loans. Nor can he act as a guarantor, endorser or guarantor. Such a ban reduces the likelihood of financial difficulties for the borrower and increases the reliability of loan repayment and interest.

7. Limiting conditions - the terms of the agreement, in accordance with which the bank sets restrictions on the actions of the borrower. For example, to ensure stability financial position borrower, the creditor bank limits the amount of dividends, wages, bonuses and advances paid to employees of the borrowing enterprise. The purpose of the restrictions is to encourage (if not force) the borrower to rely less on borrowed funds and increase your capital. To prevent a weakening of the financial position of the borrower, the bank may also limit the amount of funds that can be invested in fixed assets, for example, industrial building and equipment, or funds allocated by the borrower for the purchase of its own shares and other securities.

8. In the section "Terms of the loan agreement" it is indicated under what conditions the loan agreement should be considered violated. Such conditions include non-payment to the creditor bank of the main part of the debt or loan interest by the due date, the inclusion of false information by the borrower in financial reports, etc.

In addition to the above sections, the loan agreement also contains sections “Responsibility of the parties”, “Term of the agreement”, “ Additional terms". In the final part of the contract, the legal addresses and payment details of the parties are indicated.

If you urgently need money, there are two options for obtaining it - contact the bank and borrow. To provide guarantees for the return of funds and written confirmation of obligations, the parties enter into an agreement. If the funds are provided by a banking institution, then such an agreement is called. In the case when money is borrowed by individuals or legal entities, a loan agreement is drawn up. The article contains detailed information about these documents.

Before comparing these 2 types of agreements, it is necessary to understand the definitions of these concepts.

A loan agreement is a written agreement to transfer to a borrower financial resources or valuables under the obligation to return them within the specified period. When making a deal, you must prescribe the conditions:

- the amount of funds provided or the number of items;

- return periods;

- the amount of the reward.

A loan agreement is a written obligation to provide funds. It is concluded between the borrower and the lender and contains the following information:

- amount;

- goal;

- return periods;

- guarantees (collateral, security).

Both agreements have a common essence - the funds provided are subject to return. However, the loan agreement implies the issuance of money for the sake of profit. In this case, the bank is an intermediary, since it provides money received from other customers. The loan agreement does not provide for mediation. Both parties independently stipulate the presence and amount of remuneration.

There are the following differences between a loan agreement and a loan:

- A way to regulate legal relations at the legislative level. If the principles for obtaining a loan are indicated in the civil code, then the terms of the loan are also determined by banking law.

- Subject of the contract. The loan agreement involves the issuance of financial resources. A loan can be either money or property.

- Design method. In the form of a document, a loan agreement is drawn up necessarily. A loan transaction, the amount of which is less than 10 minimum wages, is concluded in writing or orally, at the discretion of the parties. If the amount is more, you need to draw up on paper.

- Availability and method of accrual of remuneration. The amount of interest for using a loan is often higher than the refinancing rate, but is limited by law. The loan agreement most often does not provide for the accrual of interest or the amount of remuneration is negotiated by the participants in the transaction.

- Refund method. The amount of credit debt is paid in installments and includes additional commissions. Repayment of the loan is carried out at a time, unless the agreement provides for other conditions.

- The status of the participants in the transaction. Borrowers, borrowers and lenders can be both individuals and legal entities. However, only banking institutions act as lenders.

Loan agreement: sample

Types of bank loan agreements

Experts subdivide these documents into the following contracts:

- With security - in parallel with it, a property pledge or guarantee is issued. Agreement without collateral – civil legal means are not used as guarantees for the return of funds.

- Purpose - when drawing up an agreement, a specific purpose for using credit funds is indicated. The non-target contract does not provide for such strict restrictions.

- Consumer - implies the provision of financial resources to an individual to meet their own needs (credit card agreement).

- Investment - contains the conditions for investing in investment projects.

- Refinancing - designed to maintain the liquidity of the banking system, which is achieved by the influence of the Central Bank. Allows you to repay a loan issued earlier at the expense of a new one, taken on more favorable terms.

The credit department and the security service examine the documents you provide and check the status of your credit history. After carrying out work on risk optimization, a contract is concluded. Since the law does not regulate a single sample of such a document, each bank develops its own form of a loan agreement. It includes the following items.

- General provisions, where the names of the contracting parties are indicated and information is provided on the subject of the contract. The type and purpose of the loan, amount, rate, terms of issuance and return of funds are indicated.

- Rules for the provision of credit and its repayment. The list of documents on the basis of which a credit account was opened and its number are highlighted. The procedure for repaying the debt, specific dates and amounts, including at. The features of payments in case of a lack of funds from the borrower are discussed.

- The method of calculating interest for the use of credit funds and their payment. Here the cost of the loan is indicated, including the frequency of interest accruals, the billing period, the maturity of interest and the possibility of writing off their amount from other accounts.

- Obligations and rights of both parties, which are based on the current law. They depend on the situation financial market, features of the transaction and solvency of the borrower.

- Ensuring the return of credit funds. The number and date of the pledge agreement are indicated, bank guarantee or guarantees.

- Responsibility and rights of the lender and the borrower, possible sanctions.

- The procedure for amending the agreement and resolving disputes that have arisen.

- Details of the lender and borrower, their signatures and seals.

If between the client and credit institution an agreement is reached on all the points presented in the contract, the document is signed by both participants. After its signing, the deal comes into force.

Loan agreement: sample

Your attention is rearranged by an agreement concluded between individuals

Terms of the loan agreement

If the borrowed amount is not significant, the lender usually takes an IOU from the recipient when transferring money. It indicates the fact of receiving funds. If an amount exceeding 10 minimum wages is provided on credit, you should draw up a full contract or contact a notary.

When he lends money entity, a written agreement is required. To give the document legal force, it is necessary to correctly specify its conditions.

- Introduction, where the date and place of registration are prescribed.

- Loan amount and interest rate.

- Conditions for the transfer of funds.

- The term and method of return (in parts or in full).

- The amount of the penalty for delaying the repayment of debt.

- Place of repayment.

- The purpose of the loan.

At the end, the passport details of the participants in the transaction, the date, signatures and their transcripts are indicated.

Requirements for drawing up a loan agreement between individuals

You should carefully check the terms of the document, even if it is drawn up by a notary. If the necessary conditions are missing or incorrectly specified in the receipt or loan agreement, difficulties may arise in collecting the debt. By prescribing circumstances that are not mandatory, you will provide yourself with additional guarantees of a return.

When drawing up a loan agreement, pay attention to the following points:

When issuing a receipt, experts recommend including in it a handwritten confirmation of the borrower about understanding the legal consequences of the agreement. During the proceedings, the debtor may declare that he was not able to understand the consequences of the actions taken. When transferring money, a third person will come in handy. In the event of a trial, he will confirm the fact of receiving funds.

Make a smart contract. Not every receipt can recover the debt through the court in case of violation of its terms by the borrower. Include all the necessary conditions in the agreement, and certify the fact of the transfer of cash or things with a receipt. To exclude the recognition of the contract as invalid, provide it to a notary for verification and certification of signatures.

How is the loan agreement calculated?

At the time the debtor returns the money, the lender must personally write on the receipt that he accepted the amount in full and return it to the borrower.

If there is no IOU, a document certifying the receipt of funds by the lender should be drawn up. It is drawn up in an arbitrary written form and must contain:

If part of the funds is returned, then the receipt indicates the amount of the remaining amount. Experts recommend making two copies of receipts. One is for the borrower, the other is for the lender. When promissory note is issued by a notary, it is also necessary to pay in his presence and certify the fact of return on all copies of the contract.

There are situations when the debtor does not return the money. If there is a receipt or a loan agreement, you have legal grounds to enforce the collection of funds. You can repay your debt in the following ways:

- Write to the law enforcement services a statement about initiating a criminal case on the fact of fraud, illegal receipt of money or malicious evasion of its repayment.

- File a lawsuit under a loan agreement and a petition for the arrest of the borrower's property. After all, before the entry into force judgment, the debtor may take measures to conceal the property. In court, you will need to prove that the borrower received the funds.

- File an application with the court for a court order. If the amount of debt is less than 10 thousand rubles, then you need to contact a justice of the peace. If the amount is higher - to the district court.

If you win the debt collection process, the bailiffs will enforce the court's decision.

1. When drawing up a loan agreement in a bank for an individual, lawyers recommend paying attention to the following points:

- What costs does the creditor impose on the debtor (for example, in case of early).

- Under what conditions is early termination of the agreement possible, and in what case can the bank demand repayment of the debt ahead of the agreed date.

- Is it possible to recover a debt on the basis of an executive inscription issued by a notary.

2. Please note that if the loan agreement does not specify the amount of remuneration, and the amount provided is below 50 minimum wages, it is automatically recognized as interest-free. If the subject of the agreement exceeds the 50-fold limit, then the interest rate is calculated from the refinancing rate in force at the time of signing the transaction. This may not be profitable, so specify the amount of remuneration in advance.

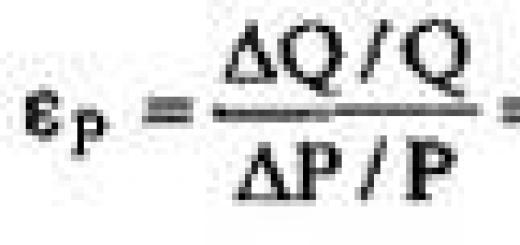

3. If you want to receive interest from a loan transaction, indicate in the contract their amount and method of payment. With the second party to the agreement, calculate the amount of accrued interest in advance using the formula below. For example:

- loan amount - 20,000 rubles;

- number of days - 90;

- the interest rate corresponds to the refinancing rate of 8.25%.

The calculation will look like this:

20,000 (rubles): 365 (days a year) x 8.25% (refinancing rate) x 90 (loan days) = 406 p. 85 kop. (percentage amount).

You can stipulate any procedure for paying interest (monthly, quarterly, at the end of the term). If the debtor has not paid off the loan within the prescribed period, interest continues to accrue on the residual amount up to the full amount.

4. Not only the lender, but also the debtor can apply to the court: for the restoration of violated rights. Illegal retention by the creditor of the debtor's property in order to pay increased fines is the basis for going to court. If the delay under the loan agreement occurred due to the fault of the lender, who deliberately hid in order to receive a penalty, this is a legitimate reason to apply to the judicial authorities.

5. Experts recommend when applying statement of claim on the basis of a loan agreement or a receipt, do not attach original documents to the case. Copies will be enough to consider the dispute. The originals can be examined, certified and returned back by the judicial authorities. So you protect yourself from the loss of documents and be able to provide them for examination for authenticity.