Mortgage life and health insurance makes it possible to reduce interest rate for a target loan, however, the condition is not included in the list of mandatory requirements for receiving funds. The client, approving the execution of the insurance contract, agrees to additional costs, since the mechanism of the procedure is based on covering a certain fee. Banking organizations recommend quite extensive lists of companies with which the borrower can enter into an agreement. The offers of insurers differ significantly in terms of the cost of the service.

What is the essence of health and life insurance on a mortgage

When drawing up an agreement for obtaining a loan for the purchase of housing, an employee of a financial institution will certainly offer the client to insure their own health and life. The service is included in the mortgage programs of almost every bank.

An uninformed citizen will begin to ask questions - what is insurance, is it really necessary, how much will the contract cost and what benefit will he get from it. Of course, the expert will immediately begin to talk about the benefits of the product and in every possible way convince the borrower to accept the offer and use the service. And this is where you need to figure it out.

First of all, it must be clarified that the registration of this type of insurance is not mandatory. In general, mortgage insurance is aimed at 3 objects:

- purchased property;

- health and life;

- title (ownership of the object).

No home insurance banking organization reject the application for a mortgage, but the client has the right to refuse other types of services.

Speaking about the essence of life and health insurance under mortgage lending, the meaning is to guarantee the receipt by the bank of funds provided to the borrower, if the borrower temporarily or permanently loses the ability to fulfill contractual obligations. In other words, he will not be able to deposit money, guided by the established schedule.

According to the terms of insurance, the reasons for providing the bank with the missing amount on the loan are:

- loss of legal capacity by the borrower for a period of more than 30 days (injury, serious illness, etc.);

- assignment of disability 1, 2 groups;

- the death of the borrower.

On the onset insured event, depending on the specific situation, the company undertakes to temporarily pay the mortgage or pay the entire amount remaining at the current moment.

When applying for insurance for the borrower, there is a certain benefit - in which case, the insurer will pay the loan, and the apartment will remain intact (it will not be confiscated for non-payment of the debt). In addition, mortgage health and life insurance can affect the interest rate on a loan. In most credit institutions, with the consent of a citizen for insurance, its value is reduced by 1%.

When applying for insurance for the borrower, there is a certain benefit - in which case, the insurer will pay the loan, and the apartment will remain intact (it will not be confiscated for non-payment of the debt). In addition, mortgage health and life insurance can affect the interest rate on a loan. In most credit institutions, with the consent of a citizen for insurance, its value is reduced by 1%.

However, for the bank, the benefit is also obvious - the financial structure protects its own interests and, in the event of unforeseen circumstances, one way or another, gets back the previously issued cash. That is why mortgage specialists often impose and force the borrower to insure the risks of non-payment of the loan for reasons related to the physical condition of the person.

Clients, in turn, should understand that insurance will require rather large contributions, which will significantly increase the burden on the borrower's budget. Payment will have to be made annually at the time of renewal of the contract for another 12 months, however, if desired, the client can refuse the procedure for another prolongation.

In addition, some organizations are more likely to refuse to issue a targeted loan if the applicant is categorically against additional services. At the same time, this factor will not be indicated as a justification, since the regulations of credit structures do not define life insurance as a mandatory requirement for a mortgage.

Evidence of high cost insurance contract regarding the life and health of the borrower is not in doubt. For a clearer understanding, clients should know what affects the final amount of insurance and how the amount is formed.

Evidence of high cost insurance contract regarding the life and health of the borrower is not in doubt. For a clearer understanding, clients should know what affects the final amount of insurance and how the amount is formed.

Most often, the cost of the policy is calculated at a standard rate and does not exceed 1% of the size of the target loan at a particular moment. Since the contribution is made annually, over time its value will decrease.

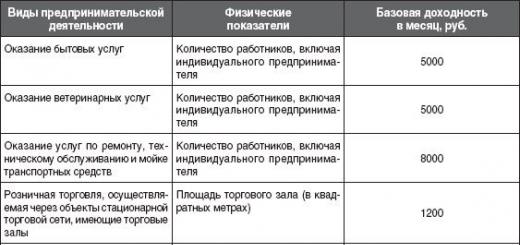

The following factors may affect the cost of insurance services:

- Age - the older the client, the higher the tariff rate.

- Gender identity. For female representatives, the insurance rate may be reduced. This is explained by the fact that men are many times more likely to work in hazardous industries. Their life expectancy is somewhat shorter than that of ladies, according to statistics.

- Weight category. For borrowers with increased weight indicators, increased rates on life insurance are provided. In some cases, they may even be provided with services. This is where the high risk of disability comes into play.

- Field of activity. Occupations with an increased risk factor will result in higher wage rates.

- Hobby. Passion for extreme sports will change the cost of the insurance contract in a big way.

- Health status. The presence of chronic diseases and other pathologies will play a role in increasing the total amount.

- The amount of the loan and the price of the property. The higher the figures, the higher the cost of insurance.

- The history of relationships with the insurer, for example, a bonus for switching from another office or personal discounts will help reduce the amount of insurance.

One way or another, the calculation of the total amount is carried out taking into account the specific situation. Therefore, it is quite difficult to accurately determine the cost of the agreement. In this case, we can only talk about approximate figures.

Offers of insurance companies

Credit organizations offer insurance services provided by both subsidiaries and other accredited offices. Citizens who want to get a targeted loan should be careful and examine all offers to find out which company is cheaper to draw up a contract. It is important to remember that the client has the right to independently choose an insurer from the list provided, without going beyond it.

The most popular insurance companies offer the following rates:

- SOGAZ. Here the rate is 0.17% of the total loan amount.

- Renaissance Insurance. It also offers favorable conditions at a rate of 0.18%.

- Sberbank Insurance. The company is part of the financial organization Sberbank. Here the cost of insurance is from 0.5 to 1% of total amount loan. In case of refusal, the loan rate increases by 1%. If the client wishes to change the insurer, the balance will be returned only after the full repayment of the mortgage. Otherwise, the money will not be returned.

- VTB Insurance. The organization offers clients a comprehensive insurance program, in other words, it will not work to draw up a contract only for health and life. The agreement also includes title and collateral insurance. The average rate is 1% of the loan amount. When changing the company, conditions similar to the requirements of Sberbank apply. The agreement is concluded for the entire period of the mortgage loan with annual renewal. For other financial institutions, the term of the policy is 1 year.

- Alpha Insurance. Insurance is issued either for 1 year or immediately for the entire period of the mortgage. The rate is from 0.8% to 1% depending on the specific situation.

- VSK Insurance House. The tariff for the cost of a life and health insurance policy is 0.55% of the total loan amount. The agreement is valid for 1 year, then renewal is required. If the client wishes to terminate the contract before the policy comes into force, it entails the return of the entire amount of insurance, but on condition that less than 5 days have passed from the moment of consent to the date of refusal.

- RESO-Guarantee. The company offers different rates depending on the bank that provided the loan. For Sberbank, the rate is 1% of the loan amount. For other credit institutions, only insurance is provided in the complex, where life and health are calculated at a rate of 1%, property - 0.18%, title - 0.25%.

- Alliance Rosno. When calculating the cost of a life insurance policy, a rate of 0.87% is applicable. At the moment, the organization does not cooperate with Sberbank.

- Rosgosstrakh. Here the tariff depends on gender. For men - 0.56%, but for women - 0.28%. For Sberbank: men - 0.6%, women - 0.3%. In case of early termination of the agreement, the remaining part of the insurance is paid only upon full repayment of the target loan.

- Ugoria. The company draws up a comprehensive insurance contract at a rate of 3%.

So, if we talk about where it is cheaper to insure life and health when applying for a mortgage, Renaissance Insurance and SOGAZ please with optimal conditions.

When choosing an office for mortgage life insurance, you need to carefully study all the offers that exist in this area. You should rely on the list of companies provided financial institution where the loan agreement is drawn up. According to the data, the most high stakes for insurance, Sberbank Insurance offers, but the lowest rates are from SOGAZ and Renaissance Credit.

Many borrowers have no idea why they need to insure their life and health when applying for mortgage loans.

What is it for? Is it possible to refuse? If I want to take out an insurance policy - how do I do it? Does it have any benefits? How to get insurance in the event of an insured event?

Let's consider all these questions in more detail.

Why take out life and health insurance?

Sberbank today is one of the major players in the provision of. When applying for a mortgage, this bank uses a system personal insurance.

Life insurance, which is required by many banks, including Sberbank, is primarily necessary in order to play it safe after the fact occurrence of various risks, namely:

Life insurance, which is required by many banks, including Sberbank, is primarily necessary in order to play it safe after the fact occurrence of various risks, namely:

- if the borrower dies for any reason (including as a result of an accident);

- due to incapacity for work and, as a result, the inability to continue to repay in the future mortgage;

- occurrence of various serious diseases.

By and large, in the event of any insured event, the lender will be able to return his money, and the borrower, in turn, will receive monetary compensation, which will remain after the loan is closed by insurers.

Obligation to take out an insurance policy

When applying for a mortgage loan, many citizens ask the same question - is it necessary to insure life and health?

In this regard, one feature must be taken into account: despite the fact that insurance is not prerequisite

, without the presence insurance policy The interest rate on the loan will be increased by approximately 1%.

In this regard, one feature must be taken into account: despite the fact that insurance is not prerequisite

, without the presence insurance policy The interest rate on the loan will be increased by approximately 1%.

Moreover, Sberbank itself does not force its potential customers to take out an insurance policy with any particular insurance company, here, as they say, the borrower chooses the company himself, which is ready to offer insurance on favorable terms for both parties.

However, in the process of insurance, it must be taken into account that not all insurance companies cooperate with certain banks. Sberbank has its own list of insurers, VTB 24 has its own insurers. For this reason, when applying for a mortgage, you need to be interested in which insurance companies cooperate with the bank.

Terms of Service

The very object of insurance when applying for a mortgage loan at Sberbank is considered to be the life and health of the borrower.

According to the terms of insurance, insured events may occur for the following reasons:

- in the event of the death of a potential borrower;

- in case of loss of legal capacity, in parallel with which 1 or 2 group is assigned.

According to the terms of the program voluntary insurance also provided for some restrictions, according to which it will be impossible to obtain insurance if necessary. In particular, we are talking about:

Get insurance impossible, if:

- the borrower's death was caused by alcohol;

- the death of the borrower is caused by diseases such as HIV or AIDS;

- death was due to professional sports (for example, death in the ring, and so on).

In the process of obtaining an insurance policy, it should be borne in mind that the size insurance compensation is 1% more than the amount of the mortgage loan itself. In the event that an insured event occurs, Insurance Company fully repays the mortgage loan, and the rest of the insurance pays the borrower himself.

Overview of company offers

If we talk about companies that cooperate with Sberbank, then their scroll as follows:

In turn, insurance in these companies for the life and health of the borrower will cost the following amount:

- IC "Sberbank" - about 1% of the sum insured;

- JSC "Sogaz" - about 1.17% of the sum insured;

- LLC insurance company VTB Insurance - about 1%;

- Renaissance Insurance Group LLC - about 0.321%.

If speak about insurance company VSK, then here the interest rate for life and health insurance is calculated on an individual basis and largely depends directly on the size of the mortgage loan. However, in any case, it is safe to say that Better conditions in this area is provided by Renaissance Insurance Group LLC.

The procedure for registration and the list of required documents

If we talk about how life and health insurance of the borrower is carried out, then algorithm has the following form:

- collection of all required documents;

- contacting an insurance company;

- writing an application;

- signing an agreement.

Where to go

Each borrower, when applying for a mortgage loan, must take out insurance for his life and health. To do this, you must contact directly the insurance company that cooperates with a particular banking institution.

At the same time, there can be many insurance companies, so it is better to take their list directly from the bank where the mortgage is issued.

List of documents

First of all, you will need to write statement. Each specific insurance company has its own form, so this document is always filled out in the presence of insurance agent.

In addition to the statement will need to provide:

- original and copy of the borrower's passport;

- the original medical report, which confirms the fact that the borrower has no serious illnesses.

After the entire package of documents is ready, including the application itself, the insurance agent draws up an agreement, which specifies:

- period of validity of the insurance policy;

- what is the sum insured;

- conditions under which an insured event occurs;

- what does not apply to the insured event;

- passport details and initials of the insured person;

- signatures of both parties.

Actions in the event of an insured event

First of all, it must be remembered that in the process of signing an agreement, you must always carefully study the conditions under which an insured event occurs.

At the moment when the insured event occurs, procedure is as follows:

At the same time, one nuance must be remembered: it is necessary to notify the insurance agent immediately after the insured event has occurred (this means notification on the same day and even in the first hours).

Benefits of Life and Health Insurance When Taking a Mortgage Loan

Without any doubt, there are both pluses and minuses in taking out a life and health insurance policy.

If to speak about shortcomings, then first of all we are talking about the cost of such a policy. This is due to the fact that insurance is carried out for the entire period of the mortgage loan, and given that it can be 20 or 30 years, the amount appears significant.

If to speak about shortcomings, then first of all we are talking about the cost of such a policy. This is due to the fact that insurance is carried out for the entire period of the mortgage loan, and given that it can be 20 or 30 years, the amount appears significant.

At the same time, it should be taken into account that under the terms of the insurance policy, the borrower is obliged to pay insurance premiums annually and it turns out that he overpays an impressive amount on the loan.

However, speaking of positive sides, then everything is much simpler here. Agree, few of us know what may come in a year or two. A mortgage loan must be repaid not for 5 years, but much more.

For this reason, having insured his life and health, the borrower fully guarantees himself and the bank that in any case the mortgage loan will be repaid in full.

Imagine a simple situation, the borrower did not take out an insurance policy and paid off a mortgage loan not at 15%, but at 17% (the interest was increased because there was no insurance). The loan was issued for 30 years, 10 of which he had no health problems, and he paid on time. But in the 11th year of paying off the loan, he developed a serious illness and died. His only son came into the inheritance, and thus the mortgage loan was transferred to his shoulders. If there was insurance, then the son would not have to pay the remaining 20 years of a mortgage loan.

As you can see, the advantages of an insurance policy are quite obvious, and therefore, according to statistics, 95% of borrowers always prefer to take out such a policy.

The benefits of taking out an insurance policy are described in the following video:

In the last decades of the last century, a life insurance policy was in almost every Soviet (Russian) family. But the collapse of the economy in 1991 turned contracts with Gosstrakh into pieces of paper and discouraged the population from giving money to insurers. The mass return of services to the financial market is associated with obligatory types insurance (insurance for credit cars or mortgages). However, by housing loans not everything is clear.

The Federal Law “On Mortgage (Pledge of Real Estate)” dated June 16, 1998 No. 102 obliges to insure only pledged property. The bank also requires additional life insurance for a mortgage, and in some situations, a policy in case of loss of ownership. Is it worth agreeing to the requirements and how much will they cost?

When is a mortgage insurance policy required for a borrower?

As a rule, insurance includes three types at once:

How much will the “triple” peace of mind cost the client?

Life and health insurance will cost 1%.

Property insurance - from 0.1 to 0.25% and Title insurance - from 0.5% to 5%.

If all three objects are insured, and not the mandatory minimum, the conclusion complex agreement one insurer will cost less than separate insurance documents for every kind.

The sum insured is equal to the loan amount increased by 10%. The premium payable to the insurer is calculated by multiplying the sum insured by the rate.

So, the title is needed only for the secondary market. Is life insurance worth it? Banks have come up with an "antidote" for those who want to save money on this procedure: they estimate the increase in their risks at 1-2%. The rate for unprotected borrowers rises from 11%-12% to 13%-14%.

What option will allow you not to overpay?

It can be seen from the table that there is no savings in case of refusal of insurance. Given that the policy provides financial protection, you should not refuse it. It is important to choose the right company and delve into all the details of the conditions.

Life insurance: what does the contract protect from?

The policy guarantees financial protection against one of the following events:

1. Death of the borrower from:

- accident

- an illness that was not known at the time of insurance.

2. Recognition as a disabled person with a complete loss of ability to work.

3. Temporary disability (for a period of more than 30 days).

It is important to immediately notify the lender and the insurer of the occurrence of one of the events and not stop paying off the mortgage until the documents necessary for payment are collected. In the first two situations, the insurer fully compensates the bank for the amount of the debt, and the encumbrance from the apartment will be removed. In the latter case, the indemnity is calculated as the product of the actual period of incapacity for work and the monthly payment divided by 30.

If the package of risks as a whole is the same for insurers, then the list of exceptions varies. This should be remembered when choosing an insurance company.

Before issuing a policy, you need not only to familiarize yourself with its basic conditions, but also to study the Rules of insurance.

Reimbursement may be denied if:

- disability or death occurred as a result of the Borrower's intentional actions aimed at causing grievous injury to himself.

- the cause of the event was the use of alcohol, drugs.

- the event was accompanied by criminal acts of the borrower falling under the jurisdiction of the Criminal Code.

- the cause of the event was drunk driving or “transferring the steering wheel” of your car to another drunk driver.

- there was a suicide (suicide attempt) of the borrower in the first two years.

These circumstances must be proven by the employees of the insurance company. The payout case will definitely “stall” for the duration of the criminal proceedings, if any.

It is theoretically possible to change the standard terms of the contract, but large insurers are unlikely to do this for the sake of one new insured. Therefore, a careful selection will have to be carried out by the client himself.

When choosing an insurance company, you need to pay attention to the reputation, the availability of a license for this type, real reviews about payments. Not the last factor will be the price of insurance services.

What affects the price of insurance

Perhaps before signing the contract, the client will not only be offered to fill out a detailed questionnaire about himself, but also asked to undergo a medical examination.

The results will certainly affect insurance rate, but in addition to medical nuances, there are accompanying circumstances that affect the price.

| Personal data | Related factors |

|---|---|

| Gender (price for men is higher) Age (the older the client, the higher the rate) chronic diseases Early death of close relatives due to illness Imperfect height/weight ratio Frequent sick leave lately Dangerous profession extreme hobby | Loan amount Intermediary commissions A small number of clients for this type of insurance in the company (the logic of accumulation of insurance reserves does not allow to reduce prices if this type is not massive for the company) Availability of other insurances in this company (loyal customers are rewarded with discounts) |

If you have CASCO, OSAGO, VHI, ask your agent if the company can provide special conditions for a life insurance policy for a regular customer.

Mortgage life and health insurance is for the entire period of lending. But fees are paid once a year. Before paying, you should ask the bank for information about the balance of the debt (sometimes the insurer does this) so that the agent makes a recalculation insurance premium. Despite the reduction in the sum insured (the "body" of the loan), a reduction in the financial burden should not be expected due to the increase in tariffs caused by the increase in the age of the borrower.

But if the client has lost weight or changed dangerous work to an office routine, the insurer should be informed about this. A recalculation will be made, a new schedule of insurance payments will be formalized as an additional agreement to the contract. It is not reasonable to mislead the insurer about the state of health in order to save several hundred rubles.

Such actions will lead to serious consequences if the deception is revealed. The companies employ a staff of lawyers, medical experts and a security service designed to prevent unreasonable payments.

Video. Mortgage insurance

Pitfalls of insurance payments

Surprises for the client (heirs) in the payment of insurance compensation include:

It can be a consolation that the loan agreement also provides for the release of the parties from obligations under the influence of force majeure circumstances.

How to draw up a contract and whether it can be terminated

To apply for insurance you will need:

- identification;

- a copy of the mortgage agreement and the loan agreement with the current balance of the debt;

- in some cases, the results of a medical examination and a certificate from a psychiatrist.

You can apply for a policy:

- with your agent

- at the insurance broker's office

- in an accredited insurance company

- with an affiliated insurer

The last method is the fastest, but the first will be the most economical. Tariffs of "pocket" insurance companies or official partners are the highest. They contain the bank's commission for providing a client, the costs of doing business (including wages) of a broker, an insurer. But if it was not possible to resist the onslaught of the loan officer, it is important to know that the client has the right to terminate the policy and conclude in the company where the price and conditions are more attractive. Bank refusal to accept this document will be illegal.

Important: for a year now there has been an opportunity to return money for imposed insurance in the first five days, if an insured event has not occurred (Instruction of the Central Bank of the Russian Federation of November 20, 2015 No. 3854-U) - the so-called "cooling period". The rule applies to mortgage insurance.

You can renew the contract with an alternative insurance company at any time. It is convenient to do this before paying the next installment, having decided in advance on the choice of a new insurer. It is impossible not to renew the policy at all: the contract with the bank provides for severe sanctions from raising the loan rate to the requirement to repay the debt in full as soon as possible. Results: you should not refuse voluntary life insurance with a mortgage.

The policy will not only save 10-20 thousand annually, but will also become financial protection for the borrower's family in the event of unforeseen circumstances. It is for this reason that one should choose reliable insurer and before signing, slowly study the terms of the contract.

Video. Mortgage insurance. We minimize costs

When taking a long-term loan, the bank will in any case insist on life insurance for the borrower, as well as some other insurances. It's all about the following risks:

- If the client dies, there will be no one to repay the loan.

- The client may become incapacitated and unable to repay the loan.

- Mortgaged real estate can be destroyed by accidental or intentional factors.

- The client can be deprived of the right of ownership of the acquired property through the court.

Of course, the main focus will be on . Such requirements are not surprising, because the bank will only be able to protect its interests in this way if it fails to obtain collateral for the loan.

Attention: the thing is that it is not at all necessary to satisfy this requirement from the bank. It will not be possible to prescribe this obligation in an agreement with a bank, therefore no one can strictly demand life insurance from a client.

But be that as it may, With life insurance, the borrower will have its own benefits. Having insured, he will receive a full guarantee that in the event of his death (or disability), none of his guarantors will have to pay his own mortgage. After all, in the event of an insured event, the insurance company will repay the loan.

Does the co-borrower need it?

Now about whether it is necessary to insure the life and health of a mortgage co-borrower. Per long time The co-borrower risks paying off the mortgage in the same way as the borrower himself.

If something happens to him from which the borrower is insured, then there can be no talk of any insurance payments, since the co-borrower is not registered in the insurance policy. And in the future, the borrower will have to make mortgage payments on their own.

Therefore, to avoid this, it is also desirable to insure the life of the co-borrower, although this is not a mandatory step in obtaining a mortgage.

Is it possible to do without it or not?

As mentioned earlier, despite the bank's insistent proposals for life insurance of the borrower, a mortgage can be taken without it. Of course, banks have their own methods of persuasion, which they are happy to use.

How to refuse?

You can always opt out of life insurance. However, this will be followed by the bank's actions aimed at reducing its own risks. This usually looks like a noticeable increase in the mortgage interest rate. By warning about this in advance, the bank will try to influence the client to change his mind.

Pros and cons of the solution

On the one hand, waiving this insurance allows you to avoid additional insurance costs. But the cons for some may seem more significant. After all, in addition to the increased rate, the borrower will also face their own risks described above.

And the bank can also “sweeten” the choice by reducing the interest rate when applying for an insurance policy. Moreover, he can reduce the percentage quite seriously, up to 0.5% -0.8%.

Reference: over the years, such a discount will allow significant savings, for example, by taking a loan of two million for 15 years at 1%, and receiving a discount of 0.5%, you can save about 200 thousand rubles.

How much does health insurance cost?

Of all mortgage insurances, life and health insurance is the most expensive. Indeed, the most expensive are precisely those policies that have the greatest chance of an insured event.

The risk, in turn, depends on the age of the borrower (the older he is, the greater the risk) and whether he has chronic diseases.

It is worth remembering that insurance premiums are made annually and until the end of the loan term. And at the same time, the amount of the contribution is constantly regulated, and each time it is recalculated depending on the residual amount of the debt.

Rates and tariffs

Consider how much it will cost to insure yourself. Typically, the average price for an insurance policy is about 1.5% per year of the cost of the loan. At the same time, the maximum cost of health and life insurance will not exceed 2%. It turns out that on average, with a loan of one million, the payment for the first year will be approximately 15,000 rubles and will be recalculated in the future.

How to calculate the cost?

The cost of insurance will directly depend on the balance of the debt at the time of calculation, as well as from the insurance company where the policy is purchased. To determine the choice of insurer, you can resort to online calculators to calculate the cost of insurance.

Important: for each client, the amount of contributions will be different, because insurers apply a large number of coefficients to the calculation, both increasing and decreasing.

For example, older people will have to contribute more than younger people because they have a higher risk of getting sick or dying.

Men can also raise the tariff compared to women, because according to statistics, women have a longer life expectancy. Also, people who work in hazardous conditions are more likely to get sick and die.

The exact tariff is calculated individually for each, however, insurers have their own specific base percentages, from which they make a start by applying increasing / decreasing coefficients.

You can find out more about how to determine where life and health insurance with a mortgage is cheaper.

Required documents

To successfully draw up an insurance contract, you must provide the following set of documents:

- Borrower's passport.

- Borrower application form. It is filled and printed right on the spot.

- Concluded mortgage agreement.

- Medical statement on the borrower's state of health (taken at the clinic). If it confirms the good health of the client, then the insurance premium may be reduced.

- In addition to a medical certificate, a certificate may be required that the borrower is not registered with a psychiatrist.

The policy will be issued after the first paid insurance premium.

Drawing up an agreement with the UK

The insurance contract should be treated very carefully. Especially attention should be paid to the following points:

- Term of insurance. The insurance contract must be valid throughout the entire loan period. However, payments must be made annually.

- Territory of insurance. The treaty must be valid throughout the world, without exception.

- Exceptions for which there will be no insurance payments. They need to be read and memorized carefully.

What needs to be included in the document?

There are several insured events in life and disability insurance, in which insurance companies undertake to pay out insurance funds. All cases must be specified in the insurance contract:

- Borrower's death.

- Receipt by the borrower I-th group disability (complete loss of ability to work).

- Receipt by the borrower of the II-group of disability (with partial disability).

Also, be aware of the exceptions. under which the insurer will be exempt from payments:

- Cases of harm to health and / or life due to the commission of illegal actions by the borrower, for example, driving while intoxicated.

- The insured event arose due to a suicide attempt, during military operations (including exposure to radiation).

- With solid evidence of intentional harm to health and / or life, in order to receive insurance payments.

What happens if the recipient of the loan dies?

All property of the borrower, including real estate, which was acquired by mortgage, is legally inherited.

- If the borrower was insured and the death was eligible, the insurance company will pay off the remaining mortgage debt. The heirs will be able to use the received property in full right.

- If the borrower was not insured, then the borrower's debt will also go to the heirs along with the property.

Important: if they refuse the inheritance, then the property will become the property of the bank, and will be sold. In this case, the heirs have absolutely nothing to rely on. All this speaks only in favor, and it is worth thinking about it.

Procedure

In order for the insurance claim process to proceed correctly, you will need to do the following:

- To begin with, the heirs should carefully study the details of the insurance policy.

- After determining all the nuances, and making sure that the death was suitable for an insured event, it is necessary to send a notification about what happened to the insurance company. The notice period is also specified in the contract, and it should not be violated, otherwise it will be almost impossible to get mortgage payments from the insurer.

- Further, the bank will initiate an investigation into this case.

- After that, you need to collect and provide the bank with the necessary documents.

- Then the insurer will come into play, but in no case should you stop making money on a mortgage. This must be done until the insurance company transfers its funds.

From the required documents, you need to collect the following (usually voiced by an insurance expert):

- Insurance contract, insurance policy.

- The passport.

- Application in the form of an insurance company.

- Documents to prove what happened. They can be a death certificate of the borrower, a police report, an act of an enterprise on an accident, etc.

- Information about the current amount of debt. Taken from the bank.

Life insurance when applying for a mortgage is not a mandatory step, but banks will strongly insist on it. But this is really worth thinking about, because such a long-term loan brings a lot of risks not only to the bank, but also to the borrower.

In case of refusal, the bank will play it safe and raise the interest on the loan. And if an insured event suddenly occurs, then his debt will also pass from the borrower to the heirs. Life insurance will avoid this: the debt will be paid by the insurance company, and the property will go into the possession of the heirs.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Banks, providing a loan for the purchase of real estate, not only issue a pledge for it, but also require mortgage insurance. Buying a property insurance policy is a prerequisite for any mortgage agreement. What about other types of insurance?

Understanding What Mortgage Insurance Is

Mortgage insurance is a set of types of insurance that are designed to protect the financial interests of each participant in mortgage lending.

The need to conclude such agreements is due to the need:

- bank - in obtaining guarantees of loan repayment, which allows to reduce the interest rate and increase the loan term in relation to consumer loans;

- client - in obtaining financial security for the possibility of fulfilling their obligations in the event of death, disability, a decrease in income, and so on.

The main purpose of mortgage insurance is to redistribute risks among insurers, borrowers and lenders in order to increase the reliability of the mortgage insurance system.

Types of mortgage insurance:

- mortgage property insurance, which, according to the agreement, was pledged against the risks of loss or damage;

- personal, which is life and disability insurance of the client (borrower or co-borrower);

- Title deeds are insurance against loss of title to collateral as a result of loss of ownership.

As an additional option, insurers offer to insure civil liability the owner of the premises before:

- third parties during the operation of the property (for example, from cases of flooding of the neighbors' apartment);

- creditor for non-fulfillment of accepted financial obligations (in the event of a delay, if it is impossible to make payments in the future).

Features of this type of insurance

Mortgage risk insurance differs in that the lender (bank) is indicated as the beneficiary under the contract. In the event of an insured event, it is in his favor that the insurer will make an insurance payment. Its amount cannot simultaneously exceed either the amount of outstanding debt or the amount of damage suffered.

There is a scheme of payment of the sum insured at a time - immediately - at the conclusion of the contract for the entire term of the loan. The most common scheme is the annual payment of the sum insured.

Do I need to insure an apartment every year with a mortgage? Yes. This is stated in the loan agreement.

Legality of requirements for the conclusion of insurance contracts

Mortgage property insurance: mandatory or not - disputes have been going on for a long time, but there is a law, and there is judicial practice.

According to Federal Law No. 102-FZ “On Mortgage”, mortgage borrowers are required to insure the collateral. Nothing is said about other types of insurance in the document.

Mortgage personal insurance Art. 935 of the Civil Code of the Russian Federation is defined as voluntary. However, banks strongly recommend that their customers take out such insurance. It is optional, but its absence will lead to an increase in the loan rate, at least 1%.

A similar situation exists with respect to title insurance. The client has the right to refuse, but the loan, as more risky, from the point of view of the lender, will be offered to him for other, less favorable conditions than those borrowers who agreed to comply with the requirements of the bank.

Judicial practice in relation to such disputes indicates that in most cases the requirement to conclude a life and health insurance contract is recognized as an abuse of freedom of contract, since they refused to issue a loan without insurance.

According to the Instructions of the Central Bank of the Russian Federation of November 20, 2015 No. 3854-U, the borrower has the right to refuse the insurance product imposed on him within 5 days from the date of signing the relevant documents. The amount paid by him must be returned in full.

However, the Central Bank of the Russian Federation explained that if the borrower refuses this service, the lender has the right to change the terms of the standard agreement and increase the interest rate.

This clause is already included in most mortgage agreements. Also, lenders widely use their right to unilaterally terminate the mortgage agreement due to non-compliance by the client with its conditions. This provision is also spelled out in the loan documentation. The bank sends a notice to the client with the requirement to either take out insurance, or he terminates the contract. The latter means that the borrower is obliged to repay the entire amount of the loan, or legal proceedings await him.

The appeal of citizens (more often during litigation) to the fact that the condition for the need for insurance violates their rights is not accepted: the agreement was concluded under certain circumstances, about which the client was warned in advance.

The signature under the documents means agreement with the fulfillment of the requirements established by them.

Typical insured events

Property insurance standardly assumes as an insured event:

- fire, including that which occurred outside the insured object;

- domestic gas explosion;

- disaster;

- flooding resulting from an accident in the water supply, sewerage or heating system, even if the water came from neighboring premises;

- illegal actions of third parties (hooliganism, robbery, vandalism);

- falling on real estate of aircraft (their parts);

- identification of structural defects in the structure, which were unknown to the insured at the time of the conclusion of the contract.

You need to be prepared for the fact that the minimum package offered by insurers provides for payments only when significant damage has been caused to the insured property.

For example, if the wallpaper was damaged as a result of the bay of the neighbors, there will be no payment, and if someone broke the window, then you can count on compensation for its value. The entire balance of the loan will be paid only when the object is completely destroyed. In the case of a private house, if the foundation remains, then only part of the debt will be repaid, because, from the point of view of the insurer, the rest of the building can still be used to build new housing.

To get more guarantees, more compensation, you should take out more extended insurance, but it will cost more.

The next type of mortgage insurance is life and health insurance of the borrower. Insured events under such an agreement are:

- the death of the insured due to an accident or illness that occurred during the term of the contract;

- disability as a result of illness or accident with the appointment of 1 or 2 disability groups.

What is title insurance for a mortgage is easier to understand from the list of insured events under such contracts:

- recognition of the sale and purchase as invalid (on the basis of paragraph 2 of Chapter 9 of the Civil Code of the Russian Federation);

- recovery from the buyer of housing (in whole or in part) by persons who have retained ownership of this object.

This type of insurance is designed to protect the rights of a bona fide purchaser. Confirmation of the occurrence of an insured event will be judgment. Payments under such agreements should compensate the financial costs of the borrower and guarantee the repayment of the loan to the lender.

In such cases, the insurance company has the right to provide full legal support, including representation of the client's interests in court.

The problem of receiving insurance payments

The insurer has the right to refuse to pay insurance compensation in a number of cases. All of them are written in the insurance contract.

Personal insurance for mortgage lending involves the establishment of the borrower of the 2nd or 1st disability groups or his death as an insured event. In this case, the payment is made in full one time. In the first case, the property remains in the ownership of the borrower, in the second it will be included in the estate and the heirs will receive it without any encumbrance (without collateral or obligation to repay the loan debt). But for example, compensation under a life insurance contract will be denied if the death occurred as a result of suicide or a car accident caused by the insured. Indemnification will not be paid in cases where the client initially knew about health problems, the confirmation of which the insurer finds in his medical documentation, but did not report this when concluding the contract.

There will also be problems with compensation for persons who have suffered from professional risks, as well as for those whose blood at the time of the insured event is found to contain alcohol or drugs, the intake of which was not prescribed by a doctor. According to the law, the insurer in such a situation is not obliged to repay the debt.

If life and health insurance was issued in respect of both spouses-co-borrowers, then in the event of the death of one of them, the debt to the bank will be repaid only by half, i.e. 50% of the loan balance. If the insurance was made taking into account certain proportions, then the payment will be made taking into account how it was written in the contract. For example, in the event of the death of one of the spouses, the compensation may be 70% of the balance, while in the event of the death of the other - 30%.

In cases where there is no firm confidence that the refusal of the insurance company is correct, it is worth contacting a lawyer specializing in this area.

Already at the first consultation, having studied all the documentation, the specialist will be able to confirm or refute the legality of the actions of the insurer and make an assumption about the advisability of protecting their interests in court.

How to save money on mortgage insurance

The insurance program offered by the lender's employees is, as a rule, a product that is unprofitable for borrowers. Most banks act as intermediaries between the true insured, the organization with which the contract is actually concluded, and which subsequently, if necessary, will make insurance payments, and the client. Accordingly, the lender most likely has a discount from the "supplier" and at the same time makes a surcharge to cover his own expenses.

As a result, an insurance contract concluded in a bank office may turn out to be 10-20% more expensive than an agreement drawn up on the same terms either with the insurer itself or with its other official partner.

If you decide to take out insurance directly from the insurer, check with the lender for a list of accredited companies. Although any restrictions on the choice of an insurance company are unacceptable according to the law, they can be established contrary to them. Therefore, it is wiser to check with the bank for a list of accredited insurers.

Considering that the sum insured is calculated based on the value of the loan balance plus interest that will be accrued over the next year, savings are possible due to early repayment of the loan.

The faster the mortgage debt is repaid, the less interest the borrower will pay, the less the sum insured.

You should also take into account the maturity date of the loan. Ideally, you need to adjust the term for the full repayment of the loan by the time the next insurance contract ends. If it didn’t work out, then by issuing an appropriate certificate from the creditor about the absence of debt, you can contact the insurer with a request to return part of the sum insured according to the actual time of existence of the credit obligation (debt to the bank).

How to properly insure yourself with a mortgage so as not to overpay. When determining the amount insured, insurers take into account:

- client's age. The policy will be cheaper for people who are 25-35 years old;

- the price of the property - the more expensive it is, the more you need to pay the insurer;

- with personal insurance, they may be asked to undergo a medical examination, as a result of which the cost of the policy will be determined. The fewer health problems a person has, the fewer bad habits he has, the greater the discount he will be given;

- The larger the loan amount, the more sum insured assigned for payment.

Summary

Mortgage insurance: mandatory or not? An insurance contract for mortgaged real estate is required. The rest - formally not, in fact, the bank indirectly (through worsening credit conditions or even refusing to conclude a mortgage agreement) forces customers to agree to this requirement.

From a financial point of view, sometimes it is a little more profitable to agree to an increase in the rate on a loan, but refuse additional insurance.

Interest is accrued regularly on the balance of the debt, which decreases as payments are received to repay the loan, i.e. monthly or even more frequently. When determining the sum insured, the amount fixed at the beginning of the year is taken into account.

A reasonable solution to this issue is to fulfill the requirement of the creditor, but conclude a mortgage insurance contract directly with the insurance company.

Borrower's benefit mortgage insurance is that in the event of an insured event, although the bank will receive the payment, the citizen will be released (partially or completely) from obligations to pay the mortgage.

In difficult times, which are indicated in insurance as insured events (loss of property, disability, etc.), this can be very helpful.

Given the above, we can say that a mortgage is a risky project for the borrower and the insurer. The bank in the presence of a full package of insurances and the subject of collateral risks less.