You will find out who and under what conditions can take a loan for development Agriculture which banks provide individuals with such financial assistance and whether it is even worth applying for a loan for private household plots.

My relative, who lives in one of the villages of the region, having retired, decided to turn the subsidiary farm into a stable source of income. On her plot, she always grew vegetables for the family, and sold part of the crop in the market.

Having extensive experience in growing greenhouse and field cucumbers and tomatoes, she wanted to monetize this advantage. The business idea required money for the construction of greenhouses, covering material, seedlings, and fertilizers.

Loan for agricultural development - if there is no money to start a business

Business begins with calculations. This rule is always valid, regardless of the choice of activity, scale and form of ownership.

If you decide to turn your personal subsidiary farm into a profitable business, start with, make a cost estimate for a startup. If you have your own savings for investment - great! After considering all the risks and opportunities, start working. If there is no start-up capital, but the idea looks promising, look for investors.

Options to borrow money from relatives and friends are not available to everyone. The search for investors on Internet sites is not yet developed enough in Russia to recommend it to farmers. The state will support subsidies only to large producers.

Therefore, the owners of part-time farms have only one way - to the bank. Read on to find out how a start-up farmer will be met there.

Why does the bank dislike private household plots

Bank - commercial structure aimed at making a profit. Here they evaluate the solvency of customers at the stage of negotiations and require a guarantee of the return of their money with interest.

So, what credit institutions do not like about private household plots:

- according to the law, personal subsidiary farming is a form of non-entrepreneurial activity. That is, the owner of private household plots does not need to register his enterprise as an LLC or himself as an individual entrepreneur. Everything that he produces in his household, he has the right to use, donate or sell. Selling is not considered business. And here lies the first pitfall for obtaining a loan: it is difficult for a bank to assess the profitability of this business, since there is no financial reporting. Can't be imagined balance sheet or an individual entrepreneur declaration, because according to the law such reports are not kept and are not submitted to the tax office;

- There are a number of high-risk industries for lenders. Agriculture is one of the areas where investors are in no hurry to invest. Seasonality, weather conditions, even landscape features of the site - all this matters in assessing the attractiveness of the project, and, accordingly, the willingness to lend money;

- banks don't like to fund start-ups in general. Well, they do not like to give money to novice businessmen "for an idea." Hence the increased requirements for collateral: the lender will want guarantors, collateral and insurance for everything that moves and does not move. And, of course, they will check the client's credit history.

Read on to learn how to overcome these barriers and get money to develop your private household plot.

Who can get such a loan

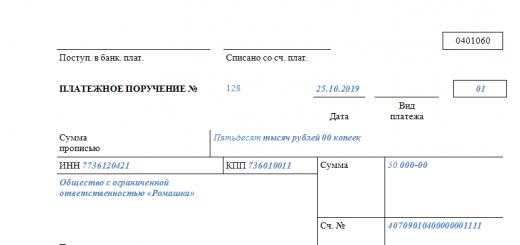

The business idea of my relatives required an investment of 250,000 rubles, and they decided to take out a loan. Having learned that the money was needed for the development of the economy, the bankers asked for documents and guarantees.

LPH is a legal way to do business without taxes

LPH is a legal way to do business without taxes What is required from the borrower:

- Copy of the passport. The money will be given to a citizen over the age of 23. Restriction for the term of crediting is considered to reach the age of 70 years. Similar requirements apply to guarantors, some lenders lower the bar for them to 60-65 years. For example, the situation of my relatives: applying for a five-year loan, the main borrower was the spouse, her age is 56 years. And the husband (60 years old) and his sister (54 years old) became the guarantors.

- Extract from the household register for household plots located within the bank's coverage area. It will not be difficult to issue a private household plot if all documents are ready for your own or rented plot. They are transferred to the local administration for entering data into the household book. An extract from this book will be required for consideration of the loan application. Attention! Under the terms of the lenders, entries in the registers of local governments must be made no later than 12 months before applying for a loan. In other words, the bank wants to make sure that the customer's experience in managing household plots is at least one year.

- Documents for the land(own or rented), with buildings. Here you will need a lease agreement or a certificate of ownership, a cadastral plan and a technical plan for buildings and communications.

- Documents for equipment and machines. For example, if the farm has a tractor or a truck, prepare a copy of the title.

- Income confirmation. If you have additional income (salary, pension), prepare certificates.

- Copies of documents of guarantors on work experience and income.

- Other references at the request of the bank.

“Other” documents deserve special attention. Each loan is issued on individual terms, so they may ask for any documents characterizing the financial situation.

For example, my relatives do not have agricultural equipment, and two cultivators were not interested in the lender. The problem was solved by a title deed for a passenger car and a registration certificate for a residential building: the total valuation of the property was several times higher than the loan amount.

About, how to apply for a LPH Read a separate post.

Terms of Service

It is impossible to assess the terms of lending to owners of household plots, focusing only on interest.

How much the loan and its subsequent maintenance will really cost you depends on several factors, primarily on solvency.

Percent

In 2018, interest rates on loans for household plots - from 11% per annum. It would seem that these are attractive tariffs compared to conventional consumer programs. But in practice, in order to get the minimum rates, you will need to meet the conditions for additional collateral.

Insurance

Registration insurance policy life and health of the main borrower and co-borrowers, whose income is taken into account when calculating the loan - one of the conditions of the lender. If you cancel the insurance, the interest rate will increase by 4-6 points.

Guarantee

In the example of my relative, a pensioner, two people acted as guarantors. This is due to the "age requirement": the bank considered the husband's age (60 years) critical, and demanded to attract another guarantor.

Pledge

If the lender considers the transaction risky, he will ask for collateral. In most cases, this applies to loans for 500 thousand rubles. and higher. The collateral is the purchased equipment, if a loan is taken for the purchase of equipment, or land, if the money is needed to buy the land into ownership.

A good collateral option is special equipment for which a loan is taken

A good collateral option is special equipment for which a loan is taken So, before going to the bank, you need to assess your chances and be prepared for additional expenses:

- the lender will offer to take out life and health insurance for borrowers. The cost of buying a policy will help you get a loan at competitive rates. Especially if the insurance is issued in a company “related” to the bank;

- guarantors are liable to repay the debt if the borrower fails to fulfill its obligations. If there are no guarantees of a return of money on time, there is a risk of spoiling relationships with loved ones and solving the problem in court;

- when transferring property as collateral, it will have to be insured against damage and loss. The insurance policy is renewed every year, until the full settlement with the creditor.

More information in a related article.

How to get a loan for the development of private household plots- step by step guide

So, you have a strong desire to make a profit from your personal farm, you have already drawn up a business plan, agreed with buyers and partners. It remains only to take a loan.

Here is a step by step guide on how to do it.

Step 1. Choose a bank and submit an application

The choice of a lender is limited by the number of banks offering targeted programs for household plots and the borrower's capabilities. We will not consider options for obtaining consumer loans, this is a topic for another article.

Preferential loans for the development of household plots are issued by clients whose income is directly related to the activities of a personal farm. And if there is no confirmation of other sources of income, then the loan is guaranteed to be given in the Russian Agricultural Bank and Sberbank.

In other structures, they are reluctant to consider applications from clients without IP status, so cooperation with them is possible on other conditions.

Step 2. We provide the necessary documents

We have already indicated the list of documents for obtaining a loan above.

At the stage of collecting papers, conduct a constant dialogue with the creditor: he has the right to require other confirmations of your solvency. For example, a certificate of family composition and spouse's income, etc.

Step 3. We receive funds and pay off the debt

When the deal is approved, do not rush to rejoice. Specify under what conditions they give you money, and how much it will cost. The final conditions (amount, tariff, insurance and collateral) are set by lenders after reviewing the borrower's file and assessing all risks.

Having accepted an application for 1 million rubles, bankers can approve a loan for 200 thousand rubles, considering the amount of income insufficient. Or they will be asked to pledge real estate, attract guarantors, etc.

After reading the loan agreement and finding out the amount of all transaction costs (insurance, etc.), re-evaluate your capabilities. Especially if you pledge real estate and transport: in case of non-payment of the debt, you risk being left without property.

By signing the contract, receive money and every month give part of your profits to the creditor. Do not forget to do it on time: the reputation of a reliable borrower will help you get your next loan faster and cheaper.

Which banks to contact

Loans for the development and management of agriculture can be issued in several structures, most work with legal entities and individual entrepreneurs leading peasant farms.

Borrowers - individuals who maintain personal subsidiary plots, are offered special programs by Rosselkhozbank and Sberbank.

Let's compare their conditions:

| Sberbank | Rosselkhozbank | |

| Interest | from 17% per annum | The minimum loan rate of 11% per annum for up to 12 months will be received by regular customers who have salary cards and meet all the requirements of the creditor. Other borrowers will be offered a rate of 13% per annum. |

| Timing | up to 60 months | up to 60 months |

| Sum | from 30,000 to 1.5 million rubles | up to 1 million rubles |

| Security | A guarantee of individuals or legal entities or a pledge of property is required. | |

| Insurance | Collateral property is insured. | They take out personal and property (for secured loans) insurance, without an insurance policy the base rate increases by 5%. |

| Initial payment | If money is needed to purchase equipment, machinery, inventory, you must have your own funds for the first payment. Under the terms of the lender, the minimum installment is 5%, but the larger it is, the more loyal the attitude towards the client. | |

| Redemption | Annuity payments (in equal installments) throughout the entire term. Early repayment without commissions. | Clients can repay the debt in differentiated payments during the first year (for loans issued up to 24 months) and during the first two years of lending (for loans up to 60 months). You can repay the loan early, in whole or in part, at any time, without commissions. |

| Clients | Citizens of the Russian Federation, from 21 years old. At the time of debt repayment, the client's age should not exceed 75 years. | Citizens of the Russian Federation, from 23 years. At the time of debt repayment, the client's age should not exceed 75 years. |

About subsidies

Is it worth taking a loan for the development of private household plots - expert opinion

To take or not to take, that is the question... Everyone makes a decision on lending independently, taking into account the situation and prospects for business development. Experienced farmers are not afraid of the risks of crop failure or EU sanctions if they have a stable base (established production, own equipment fleet, etc.).

What should owners of small household plots do who want to take their business to a higher level that brings tangible income?

For them, the advice of financial advisers:

- Make a business plan and evaluate the profitability of the project - if the expected income will allow you to pay all current costs, debts to the bank and receive a net profit of at least 20%, this is a reason to look for investors.

- Assess the current financial condition and the presence of a "safety cushion" - if you do not have your own funds to cover expenses in the event of a "force majeure" situation, postpone going to the bank.

- Avoid pledging residential real estate: if something goes wrong, you risk being left homeless - better attract a co-borrower, take less money, but do not give away the only house or apartment.

- Check with local authorities about subsidy programs and make the most of your rights to get help without going to creditors.

- Having received the money, pay in a timely manner, pay contributions and interest on time - and repay the debt ahead of schedule as soon as possible.

Watch the video about what the farmers who took the loan faced:

Conclusion

Every entrepreneur faced a lack of money for development. How to solve this problem and is it worth applying for a loan? There is no universal answer, just as there are no two identical projects.

Do not believe the stories about a certain Pupkin who borrowed a million rubles, owning nothing, and in two years created an agro-industrial holding from scratch. There are no miracles in credit relations with banks!

It is necessary to develop personal subsidiary plots (PSP), and free Money not for investment? It is not necessary to take “expensive” cash loans - there are bank lending options, moreover, designed specifically for owners of household plots.

The fact is that the state, through specialized banks, implements state support measures for this industry. In this article, we will talk about a special product of the Russian Agricultural Bank, which is called “Credit for the development of personal subsidiary plots”

Basic goals

A loan with state support can be obtained for up to two or up to five years - it all depends on the purpose of raising funds.

Loans for a period of up to two years are provided for the conduct of current activities, while the duration of the technological cycle of production of specific types of agricultural products is assessed without fail. The list of credited activities under this subprogram consists of 7 items, in which the options are listed in sufficient detail.

For instance:

Purchase of fuel and other materials for agricultural machinery, as well as spare parts, payment for current repairs;

Purchase of seeds, seedlings, fertilizers, young livestock;

Acquisition of agricultural equipment, containers;

Acquisition of materials for the construction, reconstruction and repair of fences and fences;

Current expenses of a seasonal nature.

Longer-term loans - for up to five years - are provided for investment purposes, the list of which is also described in sufficient detail in 24 paragraphs, including:

Acquisition of buildings, structures, as well as their overhaul;

Purchase of agricultural machinery and units with engine power from 100 horsepower (or weighing from 3.5 tons), including the cost of delivery, installation, adjustment, insurance;

Acquisition of gas equipment with payment for relevant design and connection services;

Other expenses that may be classified as capital expenditures.

Non-standard goals

It turns out that funds can be obtained not only for “purely” agricultural needs, but also for purposes not directly related to work on the ground. This includes the development of tourism and folk crafts, the organization of trade and cultural services for the inhabitants of agricultural areas.

If, nevertheless, your goals do not coincide with the above, then Rosselkhozbank offers to consider specialized loans "Gardener" and "Engineering Communications". The latter program allows you to receive money for the construction of water supply, gas pipelines, sewerage, telephone, Internet and other networks. The rate on such a loan is quite democratic - from 21% per annum.

For the development of the economy

The first notable feature of this loan is the opportunity to get the so-called vacation, that is, a deferment to repay the principal debt. For loans granted for two years, the first year you can pay only interest, and only then begin to pay the principal. For investment loans (for a period of up to five years), you can get a deferral of payment of the principal debt for up to two years.

The interest rate on the loan is subsidized by the state and starts from 14.9% per annum (for reliable clients) and from 16.5% in other cases, while the life and health of the borrower are necessarily insured. If you refuse this, then you will be set a rate, as for a simple cash loan.

If, when comparing loan terms, we focus only on the rate, then the program for the development of household plots in the Russian Agricultural Bank has one of the minimum rates on the market. So, the rates start from 15.5% per annum. In Sberbank, a simple demand without collateral is issued at a rate of 15.9% per annum, and with a guarantee of individuals - from 14.9% per annum. In VTB24, the rate for similar products is 17% per annum.

More or less similar to the product of Rosselkhozbank, a specialized loan is offered by Sberbank. We are talking about "Credit to individuals leading a personal subsidiary plot." The interest rate on it is clearly 21% per annum, but maximum amount loan is limited to 700,000 rubles.

The maximum loan amount is calculated individually for each borrower and is limited, in fact, only by the client's solvency and the security that he can provide. With a loan amount of up to 300,000 rubles, a guarantee of at least one individual is required. And with the desired loan from 300,000 to 700,000, a guarantee is already required by two people. Although the pledge of property of private household plots (equipment, structures, land plots, etc.) is also allowed.

Requirements for borrowers

A loan for the development of household plots from the Russian Agricultural Bank is provided to citizens of the Russian Federation under the age of 65 (at the time of the expiration of the contract). An additional "mitigation" of this requirement is the involvement of a co-borrower under the age of 60 years.

Second required condition- the loan is granted only to the owner of a personal subsidiary farm, which must be confirmed by relevant documents.

So, in order to receive the necessary funds, in addition to the passport, you need a certificate of ownership of the land, as well as an extract from the household book.

At present, agriculture is called upon to become one of the main directions public policy. In this regard, individuals, as well as organizations that are interested in its development, are provided with certain support measures. The article will tell you how to an individual get a loan for the development of agriculture.

Features of loans for the development of subsidiary farming

Obtaining and launching such loans has a number of features:

- Intended use of the loan. The specific list of purposes for loans for the development of household plots is quite wide. The main ones are:

- purchase of seeds, planting material, fertilizers or plant protection products;

- purchase of animals for agriculture;

- payment for electricity used for irrigation;

- acquisition or payment of rent for land, as well as premises that are used in the development of the economy;

- purchase of equipment used for processing agricultural products or for animal husbandry;

- development spending tourism business in the countryside;

- purchase of cars, tractors, fuels and lubricants, etc.

2. Choice of the period during which benefits for the repayment of the principal debt will be valid. This is due to the fact that many areas of agriculture have a pronounced seasonal character. This feature predetermines the receipt of the main profit from the development of the economy in future periods.

3. Payment of a smaller amount of own funds (compared to standard programs) when receiving a loan for the purchase of machinery or equipment.

4. State subsidization of a part interest rate. This support may be different, depending on the branches of agriculture, the direction of the use of funds and other factors. However, in any case, the state subsidy significantly reduces the cost of the loan.

In the event that physical a person intends to receive a loan for the development of the economy, the requirements for it will differ slightly from the standard conditions.

Firstly, most bank loan programs in this case provide for the provision of collateral. Most often, they are a guarantee of an individual / legal entity or a pledge of property. If the purpose of the loan is to purchase machinery or equipment, then they act as collateral for a loan for the development of production.

Secondly, when analyzing the financial condition, not only incomes received from the development of household plots are taken into account, but also all other income (at the place of work, which is the main one; from activities as an entrepreneur, etc.)

Thirdly, the presence of private household plots must be confirmed by an extract from the household book. As a rule, according to the requirements of banks, records must confirm the management of the economy for at least one year.

Fourthly, the borrower must confirm the availability of the necessary land and equipment.

Example: obtaining a loan from the Russian Agricultural Bank for the development of household plots

The leader in providing loans for agriculture is Rosselkhozbank. It currently provides two related physical lending programs. persons * - "For the development of personal subsidiary farming" and "For the development of personal subsidiary farming without security." Both programs are designed for loans for existing household plots. The main conditions for loans from Rosselkhozbank for business development are as follows:

The following documents are required to obtain a loan:

- General passport of the Russian Federation or other document confirming the identity of the borrower.

- Documents confirming the settled relationship with the recruiting authorities (for men not older than 27 years).

- Documents that confirm the employment of the client.

- Information showing the financial condition of the borrower.

- Documents on the selected provided security (for a program with security).

- Documents that confirm the right to use the land.

- An extract from the household book, which contains information about the personal subsidiary plot.

- Recommendations of regional offices of the Association of Peasant (Farmer) Households and Agricultural Cooperatives;

- Recommendations for agricultural needs. cooperatives, etc. organizations;

- Recommendations of the city or village administration;

- Certificate of registration with the tax authority.

- Since agricultural lending provides for the possibility of subsidizing the rate, it is advisable to determine eligibility in advance. For each direction and in each subject of the Russian Federation, the requirements may vary.

- Be sure to have up-to-date entries in the household book.

- Simultaneously with the request for an extract from the household book, it is also advisable to request the recommendations of the head of the local administration. This will confirm the value of the project for which the loan is being requested.

- It is advisable to consider the possibility of establishing grace period repayment of principal and (or) interest. This will ensure a low credit burden at the beginning of the project.

- After receiving a loan, it is highly desirable to confirm in a timely manner and in full intended use funds. This will avoid penalties and will not spoil relations with the bank.

*Date of data update – April 2015.

Starting a business related to agriculture is not easy. The first difficulty you may encounter is the lack of initial capital, because such a business requires considerable investments at the initial stage.

Loans for the development of agriculture will help to cope with this problem.

Today, banks create special credit programs for farmers, especially since the industry has a beneficial effect on the development of regions.

There are several types of loans for the development of agriculture. Loan for 1-2 years can be issued for certain seasonal works. For other needs, a long-term loan is issued (up to 5-8 years).

Loans for the development of agriculture are issued for the purchase of:

- animal feed

- fertilizer

- necessary units and machines

- fuels and lubricants

- livestock.

An investment loan can be obtained by novice farmers with a small initial budget for up to 5 years.

Main credit programs for the development of agriculture

The main types of loans for agriculture include:

- loans for the introduction of personal subsidiary plots

- loans secured by the next harvest

- loans for agricultural land

- loans secured by agricultural machinery.

Typically, credit programs involve making a down payment - 10-20%. Small and medium-sized businesses can act as borrowers.

Entrepreneurs to receive such a loan must have a separate office for the administration and experienced employees in the state. If a consumer cooperative applies for a loan, then it must include at least 5 people.

A private person who owns a subsidiary plot can get a loan to pay for land and warehouses, as well as to buy fertilizers, agricultural equipment, feed, and livestock. A private person's loan can be secured by real estate or movable property. As a rule, a guarantor is required to obtain a substantial amount.

Requirements for the borrower

- availability of liquid property and agriculture in the property

- stable income to be confirmed

- availability of all documents for doing business.

Where to get a loan for the development of agriculture

To date, loans for the development of agriculture are offered by banks.