Above, we have considered the historical process of changing various functional forms of money. However, each of them does not exist in the abstract, but within the framework of some monetary system. Throughout the history of mankind, not only the external appearance of money and its internal content have changed, but changes have constantly occurred in monetary systems as a whole. They have a long history and the main stages of their development are generally associated with a change in the forms of money.

Monetary system - this is a form of organization of money circulation in the country, which has developed historically and is enshrined in the current national legislation.

The monetary system consists of the following elements:

- o monetary unit;

- o price scale;

- o the type of money that has legal tender value;

- o the procedure for issuing and circulation of money;

- o the state apparatus that regulates money circulation.

Currency unit - this is a legally established banknote that serves to measure and express the price of all goods.

Price scale - the procedure for dividing a monetary unit into smaller multiples.

Under types of money legally valid means their forms circulating in the country, which are economically established and recognized by the legislator as legal tender.

Under the order of issue and circulation of money refers to the legally regulated processes of their provision, release, storage and withdrawal from circulation.

Under state apparatus that regulates money circulation, means the state body that is legally entrusted with monitoring and regulating the processes of issuing, securing, storing and withdrawing banknotes from circulation.

Types of monetary systems in the historical aspect can be distinguished depending on the nature of their various elements. Monetary unit as an element of the monetary system can be:

- o with legally fixed metal content;

- o without legally fixed metal content;

- o with indirectly fixed metal content.

Currency unit with a fixed metal content has a legally assigned weight amount of monetary metal. So, in 1895, 1 rub. corresponded to 7.518797 g, and in 1961 -0.987412 g of gold

To monetary units no fixed metal content refers to the modern Russian ruble. The official ratio between the ruble and gold or other precious metals is not established.

If there is a monetary unit in circulation with indirectly fixed metal content, this means that its metal content is determined by the exchange rate relative to the monetary unit, which has a fixed metal content. The Soviet ruble of the period 1937-1953 can be attributed to such a monetary unit, when its exchange rate against the dollar was fixed, which made it possible to determine the gold content of the ruble.

Currently in developed countries Oh monetary units with a fixed metal content does not exist. In 1971, the United States was the last to abolish the gold content of its currency.

Thus, depending on the adopted monetary unit, three types of monetary systems can be distinguished. Their evolution took place as follows: systems with a fixed metal content in the monetary unit - with an indirect - without a metal content.

The scale of prices is another element that can be used as the basis for the classification of the monetary system. According to monetary theory, there are three types of price scales:

- o archaic (eastern);

- o classical (Western European);

- o decimal.

Archaic price scale historically appeared first and was used in the monetary systems of the countries of the Ancient East. It had proportions of 1:60:360, which corresponded to the following names of monetary units: 1 talent weighing 30 kg contained 60 min and 360 shekels. Each mina weighing 0.5 kg consisted of 60 shekels. The weight of the shekel was determined as the weight of 180 grains of wheat and was 8.41 g.

Classic price scale began to dominate from the 9th century, and had a ratio of 1:20:240. In England, under Charlemagne (VIII century), a monetary system functioned, in which 1 pound of silver (409.3 g) contained 20 solidi and 240 denarii. In France, this scale existed until 1795. Then in 1 livre there were 20 sous and 240 deniers. In Great Britain until 1961, 1 pound contained 20 shillings and 240 pence.

Decimal price scale is currently used in all countries and has a ratio of 1:10:100.

Accordingly, three types of monetary systems are distinguished, which gradually replaced each other. At first, monetary systems with an archaic price scale dominated, then with a classical one, and at present, decimal monetary systems are dominant.

Finally, monetary systems are classified according to the type of money in circulation. As you know, there are good and bad money. In accordance with this, two types of monetary systems are distinguished: metal, in which, as a rule, full-fledged metallic money acts as a general equivalent, and based on defective and fiat money for metal.

In metallic monetary systems, coins were the dominant form of money. The first monetary monetary system is found in Babylon - the "Babylonian system". It was based on the weight value of metal banknotes, which had the form of stamped ingots. In any monetary system, there are two types of coins: main and auxiliary. The main coin is a full-fledged one, the rule of open coinage is usually applied to it.

Open minting is the minting of full-fledged precious metal coins in accordance with its content in the coin established by the state; it can be carried out by any economic agent.

An auxiliary coin is always defective and is issued according to the rules of closed coinage. It is a token, billon coin and with a forced exchange rate relative to the main one.

Closed coinage is a coinage in which the right to issue a coin belongs exclusively to the state.

Depending on what metal the main coin is minted from, they distinguish the following types metallic money systems based on:

- o on the copper standard, if the main coin is minted from copper;

- o on a silver standard, if silver is used to make the main coin;

- o on the gold standard.

AT financial practice in general, only these three metals were used, although according to historical documents in ancient Sparta, coins were minted from iron. The type of metal used to make coins was determined by the wealth of the people and the development of the means of production. Over time, some metals were replaced by others, less noble ones were replaced by more noble ones.

Depending on the number of main coins in metal systems, the latter are divided into two types: monometallic and bimetallic. AT monometallic money system there is only one main coin, which has unlimited payment power, and all other coins are recognized as auxiliary and are means of payment in a limited amount. The type of currency metal determines the type of monometallic monetary system.

AT bimetallic money system the main currency is based on two standards, i.e. two main coins function in it, having a ratio fixed by law between them. Coins minted from other metals are considered auxiliary. The bimetallic monetary system arose in the depths of feudalism and became widespread in the era of the primitive accumulation of capital (XVI-XVIII centuries). The use of two metals as a universal equivalent was contrary to the nature of money, causing a sharp fluctuation in prices, expressed simultaneously in gold and silver. The instability of bimetallism hindered the further development of the economy, which led to the transition to monometallism. The latter was legally enshrined in Great Britain in 1816, in Russia - in 1843-1852, in Holland - in 1847-1875.

A variation of the bimetallic monetary system is the so-called lame currency system, which is a combination of the two systems described above. In pei, silver coins become non-primary, i.e., while remaining legal tender, they are minted in a closed manner. Gold coins retain the status of major coins, are recognized as legal tender, and the rule of open coinage applies to them. Such a system was a transitional form from bimetallism to monometallism and later gave way to a monometallic monetary system based on the gold standard in its classical form.

There are three types of gold monometallism:

- o gold coin or classic;

- o gold bullion;

- o gold exchange.

Classic gold coin standard prevailed in the era of classical capitalism, i.e. free competition. It is characterized by the following:

- o the circulation of gold coins, to which the rule of free coinage was applied;

- o exchange of value signs (banknotes) for gold at face value;

- o fulfillment by gold of all functions of money;

- o free circulation of gold between persons and countries;

- o the transition of excess gold into treasures, which contributes to the automatic regulation of money circulation.

Gold bullion standard dominated the period of monopoly capitalism. Its main features are as follows:

- o gold coins remain in circulation, but the closed coinage rule applies to them;

- o banknotes are exchanged for bullion upon presentation of the amount established by law;

- o the process of demonetization of gold begins;

- o the free circulation of gold between countries is maintained.

Gold exchange standard characteristic of the system of state-monopoly capitalism. Its features include the following:

- o gold coins go out of circulation;

- o the exchange of banknotes for gold is carried out through their exchange for foreign currency convertible into gold.

All types of the gold standard ensured a fairly stable functioning of money circulation. However, each type of monetary system has its own historical boundaries. To replace metal systems after the crisis of 1920-1930. come systems of paper money circulation. The main reasons for the transition to the latter include the following:

- o monopolization of the economy;

- o containment of economic growth by the size of gold mining and the lack of the necessary elasticity of money circulation;

- o limited control and influence on the part of the state on monetary circulation.

Monetary systems based on the circulation of fiat money currently exist in the vast majority of countries. Obvious benefits such systems, connected primarily with the convenience and economy of circulating money, contributed to their widespread distribution. It should be noted that this type of monetary system is not a kind of frozen formation. It is constantly changing, new forms of money are emerging, their role is changing, other elements of the monetary system are being transformed.

Expansion of international exchange, formation of world and regional financial markets led to the emergence of special forms of money - international and regional, which act as a measure of value, a means of circulation and payment, accumulation in the world and regional markets. In other words, international and regional money perform the same functions as national money, but at the international (supranational) level.

monetary system is a form of government organization.

In the monetary system, i.e., the organization of the monetary economy, the following main elements Keywords: monetary unit, price scale, types of money, forms of issue of money. Depending on the historically specific content of the elements of the monetary system and determine its specific forms: a system of piece money, and, fiat paper and credit money.

The monetary system develops historically in each country.

Monetary systems based on handling defective and irreplaceable credit and paper money.

In this case, gold is pushed out of circulation and can no longer be considered as money. This type includes all modern monetary systems of all countries of the world. They have common features.

As a result, the elements of the monetary system are determined:

- the national monetary unit accepted as the scale of prices;

- types of banknotes (currency notes and coins), the procedure for their issuance into circulation (issue);

- methods of organizing circulation;

- order, restrictions and regulation of monetary circulation.

In circulation in all countries, substitutes for real money (banknotes) are devoid of their own value, but remain stable and perform the functions of a medium of circulation, a means of payment, a measure of value, a means of accumulation.

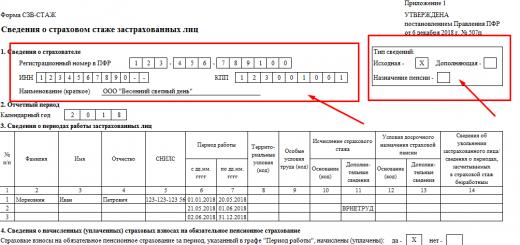

Elements of the monetary system

Modern monetary systems include the following elements (with some features).

Currency unit

Currency unit- a legally established banknote that serves to measure and express the prices of all goods and services.

National or international currency— the name of money in a country or group of countries.

Currency unit is the custom in the country money name(dollar, mark, ruble, yen, yuan, baht, tugrik, etc.) or the name of money used in the international monetary system (euro, SDR, etc.). All monetary units are divided into smaller parts: the ruble is equal to 100 kopecks, the dollar or euro is equal to 100 cents.

A monetary unit is a banknote (ruble / 100 kopecks), which is used to measure and express the prices of goods (1 dollar - 100 cents).

Most countries use the decimal division system. Within a particular economic system, it serves as a price scale.

Price Scale

Price Scale- means a measure of expression of value in the implementation or evaluation of any benefits in the monetary units of a given country.

Price scale - it's a way of measuring purchasing power or the value of commodities, in other words, through the scale of prices, the function of money as a measure of value is manifested.

Initially, the weight content of coins coincided with the scale of prices, but gradually it began to separate from the weight content of coins (this was due to damage to coins, their wear, and the transition to minting coins from cheaper metals). With the cessation of the exchange of credit money for gold, the official price scale lost its economic meaning. As a result of the Jamaican Agreement, the official price of gold and the gold content of monetary units were abolished. At present, the scale of prices is formed spontaneously and serves to measure the cost of goods through price.

Types of money and the procedure for their release into circulation

Types of money that are legal tender - this is primarily credit money (banknotes), small change, as well as paper money (treasury bills).

In economically developed countries, state paper money (treasury notes) is not issued or issued in limited quantities, while in underdeveloped countries they have a fairly wide circulation.

Types of money are the denominations of banknotes and coins that are in circulation. In the Russian Federation - banknotes issued. The decision to issue new types of tickets, banknotes and coins into circulation is made by the Board of Directors of the Central Bank of the Russian Federation. He also approves the denominations and samples of new banknotes. The description of banknotes is published. All banknotes are issued as legal tender.

The types of money currently existing are the result of historical development monetary systems in specific national conditions of a country or group of countries. In general, there are currently cash(paper, credit and change coins) and non-cash money(records on bank accounts) (Fig. 9).

The nature and types of money in national and monetary systems are determined by the degree of development of trade, economic and credit relations in a state or in a group of states. and seamlessly flow into each other. Cash is transferred to non-cash (to bank accounts), and non-cash - to cash (from bank accounts). In the modern monetary system, non-cash money reaches 80-95% of the total monetary economy.

Rice. 9 Types of money in modern system monetary circulationEmission system

Emission system- the legally established procedure for the issuance and circulation of banknotes. Issuance operations (operations for the issuance and withdrawal of money from circulation) are carried out: central bank(bank notes - banknotes), the treasury (state executive body), which issues small denominations of paper money.

AT Russian Federation the rules of the organization governing the circulation of money:

Order, restrictions and regulation of money circulation

Implemented state-credit apparatus(Central Bank of the Russian Federation, Ministry of Finance, Treasury, etc.).

In many countries, such a device is central banks, which, together with other government agencies, develop benchmarks for growth money supply in circulation and credit, which allows you to control inflationary processes.

The main task of the state in the regulation of monetary circulation is to ensure the stability of the monetary unit by:

- conducting an appropriate fiscal policy;

- control over the money supply and the rate of lending.

During the regulation of monetary circulation, economic instruments and methods of regulation are adopted.

National and international monetary systems

AT modern conditions the whole system of monetary circulation is organized in the so-called monetary system. Already on early stages appearance and development, there was an understanding objective necessity their organization in the monetary system. The functions of such an organizer were assumed by state, resulting in national monetary system, with the development of international trade and economic relations, a international monetary (monetary) system.

National monetary system is a form of organization of the monetary economy within the framework of one state.

international monetary system- this is a form of organization of the monetary economy within the framework of international economic relations of several states (for example, the euro system) or within the framework of the global global economy.

The monetary system in the course of historical development has undergone several organizational changes, each of which had a certain historical name, occupied a specific time space and was present in national and / or international systems farms (Fig. 8).

Rice. 8. Historical forms of development of monetary systems (national and international)

Liquidity of the monetary system

Cash liquidity- this is the ability to be used at any time to purchase goods, services, etc.

The degree of liquidity is different for different forms of money.

Despite the varying degree of liquidity, all forms of money form a kind of unity through which all economic ties are carried out and formed. In the conditions of everything economic relations act in monetary form, i.e. as multidirectional, which can be represented as follows (Fig. 11):

Rice. 11. Modern market economy and cash flows

Cash flow

Cash flow- this is the amount of economic benefits or monetary obligations moving from one economic entity to another (products, loans, repayment of debts ...).

Main characteristics of cash flow: amount, direction, time.

In addition to direction and amount, time is an important characteristic of cash flow. The flow can be determined for a year, a month, a week, etc. The longer the time interval, the greater the flow. In order for cash flows to function continuously, they need a certain amount of money. For example, the cash flow serving agricultural products (crop production) looks like this (Fig. 12):

Each subject of economic life and each consumer must always have at their disposal some amount of money, and this money together form cash reserve. Unlike cash flow, the cash reserve is not determined within a time interval, but on a specific date, at the moment. Usually, the cash reserve is determined at the beginning of the month or at the beginning of the year. It can also be determined at 12 o'clock on the set day (Fig. 13).

Formation and development of the monetary system of Russia

The formation and development of the first monetary system began in the process of monetary reform 1922-1924.

In the course of the reform, all elements of the monetary system were determined by law.

monetary unit was announced chervonets, or 10 rubles. The gold content of the chervonets was set at one spool - 78.24 shares of pure gold, which corresponded to the gold content of the pre-revolutionary ten-ruble gold coin.

By a decree of the Council of People's Commissars of the USSR of October 11, 1922, the monopoly right to issue chervonets as bank notes was granted to the State Bank of the USSR.

All the necessary conditions were created to maintain the stability of the chervonets.

The issue of chervonets was carried out State Bank in the process of short-term lending National economy. Loans were issued only for easily realizable inventory items.

To maintain sustainability chervonets in relation to gold the state allowed exchange of chervonets for gold in coins and bullion and for stable foreign currency. accepted chervonets at face value in payment public debt and payments levied by law in gold.

Bank notes were credit money not only in form but also in essence. Their issue was limited not only by the needs of economic turnover, but also by the values on the balance sheet of the State Bank. By law, chervonets put into circulation were backed by at least 25% of their amount with precious metals, stable foreign exchange at the rate of gold, and 75% - easily marketable goods, short-term bills.

By the beginning of 1924, the necessary prerequisites had been created in the country for the completion of the monetary reform and the formation of a new monetary system. The government has stopped using the printing press for coating. The depreciated money was exchanged for new treasury notes at the rate:

1 ruble of treasury notes was equal to 50 billion rubles of banknotes of all samples put into circulation before 1922.

Treasury notes were different from bank notes.

1. Until the middle of 1924 the issue of treasury notes was used by the NKF of the USSR to cover the budget deficit, since their release into circulation did not require bank collateral with gold, goods or credit obligations. However, for sustainability, a limit was placed on the issue right to issue treasury notes. In 1924, it was no more than half total amount issued bank notes. In 1928 the issue limit was increased to 75%, and in 1930 to 100% of the ticket price.

2. In 1925, in connection with the elimination of the budget deficit, the issue of treasury notes was completely transferred State Bank.

3. The treasury character of the issue was preserved only for the metal coin, the income from which was received in.

Thus, during the years 1922-1924. The State Bank carried out three monetary reforms: In 1922, the ruble was put into circulation, exchanged for 10,000 previously issued banknotes; in 1923 - a new ruble, exchanged for 100 rubles of the 1922 model. In January 1924, treasury notes were issued in denominations of 1, 3 and 5 rubles. Ten rubles were equal to one gold piece. The new ruble was exchanged for 50,000 rubles of the 1923 model within three months. Thus, in two years the State Bank reduced the money supply by 50 trillion. once.

PRICE SCALE - a way of expressing the value of goods in monetary units. Under the conditions of metallic circulation and the gold standard, M.ts. expresses the amount of money metal corresponding to one monetary unit.

Economics and law: a dictionary-reference book. - M.: University and school. L. P. Kurakov, V. L. Kurakov, A. L. Kurakov. 2004 .

See what "PRICE SCALE" is in other dictionaries:

The amount of gold or silver accepted in a country for a monetary unit and its multiples. Price scale is a means of expressing value in monetary units. See also: Commodity prices Money Financial Dictionary Finam ... Financial vocabulary

Weight quantity (mass) of metal assigned to a monetary unit. After the 2nd World War, by agreement between most industrialized countries, the official price of gold, set by the US Treasury in 1934 (35 ... Big Encyclopedic Dictionary

Method and means of measurement, expression of the value of goods in monetary units. Under the conditions of metal circulation and the gold standard, the scale of prices expresses the amount of metal, silver, gold, corresponding to one monetary unit. Raizberg B.A ... Economic dictionary

English price index; German Preisindex. The weight of gold and silver, accepted in a given country as a specific monetary unit, which serves to measure and express the prices of all goods. Antinazi. Encyclopedia of Sociology, 2009 ... Encyclopedia of Sociology

English scale price A. The amount of gold or silver accepted in the state for a monetary unit and its multiples. B. Expression of value in monetary units. Dictionary of business terms. Akademik.ru. 2001 ... Glossary of business terms

- (English scale of price) a characteristic of the country's monetary system, which determines the purchasing power of a unit of its currency in the domestic market. In the theory of money, a category associated with the function of money as a measure of value. For ... ... Wikipedia

Weight quantity (mass) of metal assigned to a monetary unit. After the 2nd World War, by agreement between most industrialized countries, the official price of gold, set by the US Treasury in 1934, served as the price scale ... ... encyclopedic Dictionary

price scale- method and means of measurement, expression of the value of goods in monetary units. Under the conditions of metal circulation and the gold standard, the price scale expresses the amount of metal, silver, gold, corresponding to one monetary unit ... Dictionary of economic terms

PRICE SCALE- (English measure of prices) - technical function of money; a means of expressing value in monetary units. M. c. wears a legal character, depends on the will of the state and serves to express not the value, but the price of the commodity. Through M. c. ideal, mentally ... ... Financial and Credit Encyclopedic Dictionary

PRICE SCALE- - the weight amount of metal, accepted in a given country for a monetary unit and used to measure the prices of goods. To compare the prices of different goods, it is necessary to express their prices in the same units, that is, to reduce them to the same scale. Application ... ... Economics from A to Z: Thematic guide

The weight of a metal (gold or silver) accepted in a given country as a monetary unit and its multiples. Used to measure and express the prices of all goods. Fixed by the state in the legislative order M. of c. not… … Great Soviet Encyclopedia

In accordance with the Decree of the President of the Russian Federation of August 4, 1997, from 01.01.98 a new price scale was introduced.

The price scale serves as a means of measuring and expressing the prices of goods and services with the help of a state legislative act that establishes a specific monetary unit. In Russia, such a monetary unit is 1 ruble, equal to 100 kopecks, in the USA - $1, equal to 100 cents.

In a number of countries, the names of monetary units have remained from the old days, when the weight content of gold or silver was the basis of the price scale, for example, in England, the pound sterling is still used on the world market at the present time: 1 ounce of gold or 1 gram of gold, 1 carat for precious stones . The state established the gold content of the monetary unit, and on its basis the exchange rate was determined in relation to the currencies of other countries.

Historically, in Russia and the Soviet Union there have been several price scale changes. First of all, it can be noted monetary reform 1897, conducted by S. V. Witte. The Russian ruble received a real gold backing. The gold content of the ruble was set at 0.774234 g of pure gold.

The free exchange of credit notes for gold coins ensured the stability of the Russian ruble and its firm exchange rate on the main world exchanges until 1914.

This experience was used after the Great October Socialist Revolution. By decree of the Council of People's Commissars of October 11, 1922, bank notes were issued in denominations of 1,3,5,10 and 25 chervonets with a gold content of chervonets of 7.74234 g of pure gold, and in 1924 gold treasury notes were issued in 1.3.5 rub. The gold content of the ruble was set at 0.774234 g, and Soviet signs began to be exchanged for a new currency at a ratio of 1 ruble. gold = 50,000 rubles. of banknotes of the sample of 1923. The initiator of this reform is the People's Commissar for Finance G. Ya. Sokolnikov.

On December 16, 1947, after the end of the Great Patriotic War, a monetary reform was carried out with the simultaneous abolition of the card system. The wages of workers and employees, the income of peasants from the sale of products for state purchases, as well as other labor incomes of the population, were kept at the same level in the new money. Cash banknotes of the population, enterprises and collective farms were exchanged at a ratio of 10 rubles. old for 1 rub. new. The change coin remained in circulation in the same denomination. The exchange of money was carried out from 16 to 22 December, and in some areas - until 29 December. The deposits of the population in Sberbank changed in the following ratio:

Up to 3000 rub. according to the ratio 1:1;

Up to 10000 rub. the first 3000 rubles. - 1:1, and the rest of the amount - 3:2;

Over 10,000 rubles. the first 10,000 rubles. - as noted above, and the rest of the amount - 2:1.

Cash in the accounts of cooperative enterprises and organizations, collective farms were recalculated according to the ratio 5: 4.

Bonds of the state 3% loan of the 1948 issue were exchanged for bonds of old conversion loans according to the ratio: by 1 rub. new loan 3 rubles. old.

Such a differentiated approach made it possible to carry out the monetary reform in the least painful way for both enterprises and the population. The economy began to develop, and the real incomes of the population increased.

On January 1, 1961, a new price scale was introduced by increasing the purchasing power of the ruble tenfold. New banknotes were exchanged for old ones at a ratio of 1:10. The exchange took 3 months. All old prices were recalculated to new prices at a ratio of 10:1, and a broad public and state control for such a recalculation. The gold content of the ruble was set at 0.987412 g of pure gold, and the ruble against the dollar was set at 0.90 kopecks. for $ 1. In connection with the devaluation of the dollar in 1977, the parity rate of the ruble against the dollar fell to 82.84 rubles. for $ 100. This rate was updated annually, and in June 1987 it was 63.87 rubles. for $100.

The liberalization of prices and foreign exchange transactions, which began in 1992, led to the fact that the exchange rate of the ruble and dollar began to be determined based not on their gold content, but on the basis of market factors, primarily the ratio of prices in the domestic market of Russia. The old price scale practically ceased to exist, the depreciation of the ruble led to the fact that, in terms of price levels, the new ruble could no longer fulfill its role of measuring the prices of other goods. Disappeared and kopecks from circulation, their purchasing power in the new conditions was virtually zero. For 1 rub. and even more so for 1 kopeck. nothing can be bought.

Inflation, which began in 1992, "ate" not only the savings and savings of the population and enterprises, but also the scale of prices. The ruble ceased to play the role of a monetary unit, and kopecks disappeared from circulation altogether. The purchasing power of the ruble has declined, and its authority in the money market has plummeted.

Since January 1, 1998, by a decree of the Government of the Russian Federation in accordance with the Decree of the President of the Russian Federation of August 4, 1997 No. 822, all wholesale and retail prices for goods and works, tariffs for services, purchase prices for agricultural products, as well as allowances, margins have been recalculated and discounts based on the new price scale - 1000 rubles. in old-style money for 1 rub. in new money.

The price scale is set by the state. This is a truly technical way of measuring prices, and for the population the new price scale will be both more convenient and familiar.

But prices for goods and services are set by private firms, the share of prices regulated by the state is small, and they do not have a decisive influence on the dynamics of new prices. Private firms, of course (by virtue of the laws market economy), try to round prices in their favor, and local authorities are unable to exercise control over each price for a particular product, which changes daily. Prices are rising both with the new price scale and due to other objective factors.

The surge of inflationary price growth in 1998-1999. occurred as a result of an increase in the money supply in circulation. The state, paying off debts for unpaid wages, increases the demand of the population, then prices naturally rise.

To the content of the book: Prices and pricing

See also:

it is a means of expressing value in monetary units, a technical function of money. During metal circulation, when the monetary commodity - metal - performed all the functions of money, the price scale was the weight of the monetary metal accepted in the country as a monetary unit or its multiples. States fixed the scale of prices by law.

Initially, the weight content of the coins coincided with the scale of prices, which was even reflected in the names of some monetary units (for example, the pound sterling was a pound of silver). However, in the course of historical development, the scale of prices gradually separated from the weight content of coins. This was due to the deterioration of coins (i.e., with a decrease in the weight or fineness of a coin while maintaining its former face value, which was undertaken by the state in the conditions of metal money circulation in order to generate income for the state treasury), their wear, the transition to minting coins from more cheap metals instead of expensive ones (copper instead of silver).

With the cessation of the exchange of credit money for gold, the official price scale lost its economic meaning. And, finally, as a result of the currency reform of 1976-1978. (based on the Jamaican Agreement) the official price of gold and the gold content of monetary units were abolished. At present, the scale of prices is formed spontaneously and serves to measure the cost of goods through price.

Types of banknotes. Currently, no country has a metal circulation system. The main types of banknotes are: credit bank notes (banknotes), as well as state paper money (treasury notes) and small change, which are legal tender in the country.

More on the subject of price scale:

- 3.3.4 Pumping with uncorrelated scaling components

- 3.4 Continuous wavelet transform in stochastic fluid dynamics 3.4.1 On the multiscale description of turbulence