Voluntary health insurance(VHI) is one of the types of insurance products offered by insurance medical organizations.

Unlike compulsory health insurance (CHI), it is additional and is concluded by a person voluntarily in a separate order. Both an individual and a legal entity can draw up a VHI agreement by purchasing a corporate package for their employees.

Dear reader! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant form on the right or call by phone.

It's fast and free!

What is VHI for employees?

Voluntary medical insurance for employees is a contract for the provision of a range of services for the organization and financing of medical care, concluded between the employer and the insurance company.

The volume and quality of assistance and other measures are prescribed in a special agreement, based on programs drawn up by mutual agreement of the insured (employer) and the insurer (insurance company) and provided to the insured (employees of the insured's enterprise and members of their families) in accordance with the contract.

Voluntary medical insurance programs are compiled taking into account funding and provide the right for the insured employee to apply to the medical institution specified in the contract to provide him with:

- consultations,

- diagnostics,

- treatment,

- rehabilitation,

- prevention,

- spa treatment.

The VHI policy allows the insured person to receive medical care in accordance with the specified list in the contract.

There are several types of VHI packages. The standard base includes:

- Medical reception and treatment in the clinic and at home.

- Call for an ambulance.

- Inpatient treatment in a planned or emergency order.

- Rehabilitation, including in sanatoriums.

- Dentist and family doctor services.

In addition, there is a complete, advanced and a package of the "constructor" type.

Advantages of a corporate insurance package

When applying for a corporate VHI package, each employee receives:

- Full insurance coverage for the costs of providing assistance in accordance with the list of prescribed services.

- Professional long-term maintenance from the moment of its appeal to the dispatching console of the insurance organization in the event of insured event. The insured person gets the opportunity to contact the company's consultant around the clock, who is an intermediary between the client and the medical institution and builds optimal interaction between them.

- In the absence of certain paid services in the VHI package, the insured person has the opportunity to receive this service at a certain discount if it is absolutely necessary.

- The possibility of conducting an examination on the conformity of the quality of services provided, as well as defending the rights and protecting the interests of the insured.

Also, there are pluses for the company or insured company:

- There is an effective "lever" to increase the motivation or retention of their working employees, reducing the "churn" of personnel.

- An additional social guarantee is being formed (as part of the social package) to attract more qualified workers in addition to the level wages.

- Preferential taxation is provided, since up to 6% of the salary of employees is deducted for insurance coverage and is not subject to personal income tax.

- Increases the level of competitiveness and reputation among similar companies.

- The level of corporate and legal culture is improving.

- Timely provision of assistance is ensured, which significantly reduces the duration of general disability and increases the efficiency of each insured person.

- The time spent on annual medical examinations and preventive measures (for example, vaccination) is minimized.

Minuses

However, in addition to the advantages, there are certain negative points for the employer:

- Relatively high cost of the VHI service package.

- The need for additional tax and accounting registration and accounting (increased workflow).

- In litigation with the insurance company, all costs are at the expense of the employer.

- The policyholder is also liable for dishonest behavior of the employee (transfer of the policy to another person).

There are certain disadvantages for the team itself:

- There may be territorial attachment to inconveniently and far located medical institutions.

- The untimely inclusion of an employee by the insurer in the lists of the insured will entail personal expenses of the sick person without the right to compensation.

- The exclusion list may include some chronic pathologies that an employee has. In this case, insurance premium will not return.

Careful study of the VHI contract and the choice of a reliable insurance company will significantly reduce the likelihood of these shortcomings.

Features of the conclusion of the contract

Before signing, you should pay attention to certain nuances:

- Careful study of all clauses of the contract is required. before its signing with the obligatory indication and reservation of those conditions that do not suit the insured. Moreover, it must be an officially certified document.

- The full list of exceptions to denial of care should be reviewed. according to the established regulation. It is also worth notifying your employees about this, including under their personal signature.

- When signing an agreement, it is important to pay attention to the term of the current license insurance company to provide these services. It may happen that it expires before the end of the proposed contract.

- In the event of disputes, the settlement of relations between the insured and the insurer is carried out using the rules established by the Civil Code of the Russian Federation (Chapter 48, Articles 927 - 970) and the specific provisions of the concluded VHI agreement.

- Mandatory registration of the VHI policy is carried out in case of employment of foreign citizens. The conclusion of contracts also applies to members of their families (spouse, children under 18 years of age and dependent children) from the date of their official entry into the territory of Russia. This clause is mandatory and is prescribed in the employment contract. The main condition is that the employee must be highly qualified, that is, experienced or having certain achievements in his field of activity.

For unskilled and skilled workers, this obligation does not apply.

How to apply for a VHI package (step by step instructions)

The contract with the insurer is usually concluded by the HR manager of the company. It has 2 main tasks:

- Stay within the budget allocated for this purpose.

- Choose the optimal program, taking into account the wishes of the majority of employees to maintain their motivation.

To do this, it is necessary to conduct a preliminary analysis of the needs of employees of the organization in a certain amount of medical care:

- By categories of formation of VMI programs (depending on length of service, position and risks).

- By filling the package, taking into account the necessary medical institutions (clinic, hospital, ambulance).

- By connecting a complex of additional services (treatment abroad, preventive measures, accident insurance, as well as the inclusion of close relatives in the program).

- An order is printed on the establishment of VHI at the enterprise (written in free form).

- Amendments are made to labor or collective agreements (who, in what order and to what extent can use the VHI package).

Only after the consistent fulfillment of all the above points is an agreement concluded with the selected medical insurance organization.

How to choose an insurer?

Each insurance organization has its own VHI programs with certain packages for the provision of medical care and other services.

Therefore, it is necessary to follow a certain algorithm of actions to select the optimal insurer:

The big name of the insurance company does not play a decisive role. In the first place should be the interests of their own employees. Only after evaluating all of the above points should you begin to develop and agree on an agreement with the selected insurer.

Where can I get VHI for employees?

VHI policy for employees can be issued in most insurance companies. Among them are such organizations as Rossgosstrakh, Sogaz, Alfa-insurance, Ingosstrakh, VSK, as well as Sberbank, VTB-Insurance, Uralsib, Alliance and others.

The cost of the corporate package

Covered risks with a full list of the volume and quality of medical care are determined only by the employer.

This affects the cost of the VHI policy for the employee, as well as the level and price category of the medical institution under the insurance program.

Depending on the options for filling programs for organizations and companies, the following approximate cost of a corporate VHI package in rubles is possible:

- Outpatient care (+ home care) - from 10,000 to 200,000.

- + dentistry - from 15,000 to 220,000.

- + ambulance and hospital - from 20,000 to 270,000.

- + emergency and planned assistance - from 30,000 to 310,000.

Medical insurance for relatives of employees

To increase motivation, some employers issue VMI policies not only to employees, but also to their loved ones - wife (husband) and children under 18 years old. Optionally, the list of insured persons can be expanded.

This is especially important for employees who care not only about their health. This leads to an increase in their productivity and a decrease in staff turnover.

So, we can conclude that VMI for employees, with the right choice of an insurance organization, only benefits the employer, increasing the prestige of the company and the corporate culture of the team. And employees provided with a high-quality social package are more efficient, which is also a positive moment for the functioning of the entire enterprise.

The voluntary medical insurance system is an integral part of the social package issued to an employee. Assumes expenses from the employer.

What is DMS?

VHI is one of the tools for expanding the list of medical services provided. In this case, the insured is the company in whose staff employees work. Money for insurance is accumulated from the profits of the company, which is stipulated in Article 17 of Law No. 1499. VHI is provided on the basis of an insurance program. The document includes a statement of all basic information: the insurance company, the amount of insurance, responsible persons, and so on.

How it works? In the event of an event provided for by insurance, an employee of the company can go to a medical institution prescribed in the contract and receive appropriate assistance for the amount provided. An insured event can be an injury, an acute illness. Not all cases of medical care are paid by the employer. For example, the list of insured events does not include:

- Preventive research carried out at the voluntary request of the employee.

- Treatment that is not urgently needed.

- Receiving assistance in a medical institution that is not prescribed in the insurance contract.

This is a general list. Extended is determined by the specific insurance program.

Benefits of VHI

The following benefits of insurance for a company can be distinguished:

- Increased motivation to work, employee loyalty.

- Increasing the company's competitiveness.

- Reducing the tax base.

- Increasing the prestige of the organization.

Consider the benefits of insurance for employees:

- Access to quality medical services.

- Prompt care for illnesses and injuries.

- In some cases, treatment in sanatorium and resort conditions.

- Getting dental services.

At the expense of the employer, the employee gets the opportunity to be treated in best conditions. As a rule, VHI is issued by large companies that value their specialists and care about their health. Insurance is rarely offered by organizations with high turnover. For example, VHI is almost never issued to sellers in chain stores, since the turnover of these employees is constant.

Flaws

At voluntary insurance there are also disadvantages. Minuses:

- Serious financial contributions of the company.

- Time-consuming registration, if new employees constantly come to the organization.

- The risk of receiving low-quality services.

Voluntary insurance is practically meaningless for young and healthy employees.

Design features

First, the employer must select an insurance company. Then you need to compose and send an appeal to this company. The obligatory registration of VHI should be included in the collective and labor agreements. The insurance agreement contains the following information:

- Information about the insurer (company), the insured (employer) and persons who can receive medical services under VHI (employees).

- Subject of insurance.

- Rights and obligations of all parties.

- Responsibility for non-compliance with the conditions specified in the agreement.

- The period of the agreement.

- The amount of insurance and the premium of the insurance company.

- Compensation payment procedure.

- The procedure for paying insurance premiums.

At the request of the employer, insurance can be extended not only to employees, but also to their family members.

Who offers VHI?

A lot of insurance companies offer corporate policies. Appropriate offers can be found at the following organizations:

- Alpha Insurance.

- Ingosstrakh.

- "Renaissance" and many others.

Individual insurance programs are provided by Sberbank.

How much is it?

The cost of services depends on what exactly is included in voluntary insurance:

- Treatment on an outpatient basis - from 10 to 200 thousand rubles.

- Treatment on an outpatient basis, dentistry - from 15 to 220 thousand rubles.

- Outpatient treatment, dentistry, calling an ambulance, inpatient treatment - from 20 to 270 thousand rubles.

- All the services listed above, as well as emergency and planned treatment in a hospital - from 30 to 310 thousand rubles.

IMPORTANT! VHI expenses are included in wages.

The list of medical services included in the insurance contract depends on the specifics of the company and the wishes of its management. It is possible to design various programs for ordinary employees and specialists. This will motivate employees for career growth.

NOTE! It is profitable for the company to draw up an insurance contract for long time. This option is less expensive.

Tax accounting for VHI

Money for VHI is taken from the profits of the enterprise. Accordingly, its taxable base is reduced. However, this benefit can only be used if the following conditions are met:

- The validity period of the insurance agreement is not less than one year.

- Money for the VHI program is included in tax-free expenses in the amount of not more than 6% of the amount of expenses that are directed to pay salaries. An exception is VHI for freelance specialists.

- When accounting for payments under the VHI program, either payments to the insurance company or compensation for employees' expenses for medical care under an insurance agreement are recorded.

Under these conditions, expenses are included in expenses. This rule is stipulated by Article 255 of the Tax Code of the Russian Federation.

The employer has the right to issue several insurance policies for one employee. However, according to the letter of the Ministry of Finance dated July 29, 2013 No. 03-03-06 / 1 / 30023, it is required to take into account the limit of spending on wages. The standard includes spending on salaries of all employees, not just insured persons. It also combines the remuneration of individual entrepreneurs who cooperate with the company under civil law contracts.

If the insurance agreement is valid for several periods, the base is calculated as follows:

- Increasing total from the effective date of the agreement to the end of the current period.

- From the next period until the end of the agreement.

These rules are established by the letter of the Federal Tax Service dated May 6, 2010. Insurance expenses will be taken into account not earlier than the reporting period in which the premium was transferred. They are distributed evenly throughout the term of the agreement. Money transferred under insurance contracts will not be subject to personal income tax. This rule is regulated by paragraph 3 of Article 213 of the Tax Code of the Russian Federation. Also, insurance premiums are not deducted from the payments. However, this is only relevant if the insurance contract is valid for at least a year.

Accounting

In accounting, expenses for VHI are included in the list of expenses during the period in which they are paid. This rule is established by a number of regulations. Insurance costs are recorded in the debit of the expense account. For example, it can be account 20, 26, 44. If the company transferred insurance premiums for employees who do not work for the company on the basis of an employment contract, then the resulting expenses are recognized as other. They are recorded in the debit of sub-account 91.02 "Other expenses".

In tax accounting, expenses must comply with the standards. In accounting, expenses are recorded without restrictions. If there is a difference between the two forms of accounting, the amount is reflected in accounting.

Today, in our country, voluntary medical insurance is the only way to receive medical care at the proper quality level. Numerous problems of district polyclinics, queues, rudeness, lack of motivation among employees, outdated clinical and laboratory facilities lead to the need to use the VMI insurance policy.

This service was introduced on October 1, 1992 and includes additional medical and other services in addition to the established programs of compulsory medical insurance.

You can become the owner of a VHI policy by concluding an appropriate agreement with an insurance company.

A voluntary medical insurance contract may include one or more medical services:

- Ambulatory polyclinic service. Primary and repeated examinations of doctors in the clinic. Therapeutic and diagnostic manipulations aimed at the relief and diagnosis of acute or exacerbation of a chronic disease. Instrumental and laboratory research methods. Treatment room services. Restorative manipulations. Preparation and issuance of medical documentation.

- Help at home. Departure of the doctor at home if the patient cannot visit the clinic for health reasons

- Emergency medical care. Performing the necessary emergency therapeutic and diagnostic measures, in accordance with the existing pathology.

- Stationary. Placement and treatment in the intensive care unit, carrying out resuscitation, surgical measures according to individual medical indications.

- Dentistry. Therapeutic and surgical dentistry.

An insurer can only be a legal entity that provides health insurance on the basis of a special state permit (license) for the right to engage in health insurance.

A voluntary medical insurance contract is an agreement between the insured and the insurance medical organization, according to which the latter undertakes to organize and finance the provision of medical care of a certain volume and quality or other services to the insured contingent under voluntary medical insurance programs.

The contract of voluntary medical insurance must contain:

- names of the parties;

- the duration of the contract;

- number of insured persons;

- the amount, terms and procedure for making insurance premiums;

- a list of medical services corresponding to voluntary medical insurance programs;

- rights, obligations, liability of the parties and other conditions that do not contradict the legislation of the Russian Federation.

The VHI contract begins with the submission by the insured of an application for insurance. The application can be drawn up for the insured himself, for his family members or, in case of collective insurance, for employees.

In the application, the insured provides the following information:

- age

- marital status

- profession

- place of residence

- state of health at the time of filling out the application

- the presence of chronic diseases, injuries, physical indicators, a list of past diseases.

In the case of contracts with high guarantees, the application may be asked to indicate the presence of hereditary diseases, the life expectancy of parents, the data of basic laboratory tests, a predisposition to certain diseases, and also require an additional medical examination or provide extracts from the medical history.

When concluding collective insurance agreements, no data on the health status of potential insured persons is required.

The VHI contract is considered concluded from the moment of payment of the first insurance premium unless otherwise provided by the terms of the contract.

During the validity period of the VHI agreement, if the court recognizes the insured as incapable or limited in capacity, his rights and obligations are transferred to the guardian or trustee acting in the interests of the insured.

Each citizen in respect of whom a contract of voluntary medical insurance has been concluded or who has concluded such an agreement on his own, receives an insurance medical policy. The health insurance policy is in the hands of the insured.

If the insurance contract is concluded with individual, then the insurance policy shall indicate:

- surname, name, patronymic of the insured (insured person);

- home address and telephone number of the policyholder (insured person);

- terms of insurance;

- a list of medical institutions to which the Insured has the right to apply for medical assistance or services;

- procedure and form of payment.

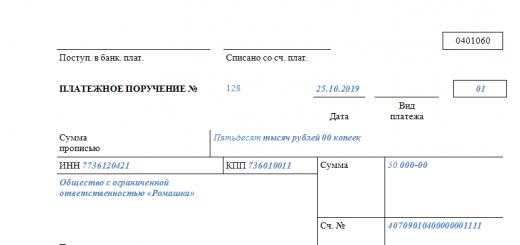

If the insurance contract is concluded with a legal entity, then the insurance policy shall indicate:

- name, legal address and bank account details of the insured;

- terms of insurance;

- health insurance program;

- a list of medical institutions that guarantee the provision of services to the insured;

- validity period of the insurance contract;

- the number of insured persons;

- the amount of the insurance premium payable under the insurance contract;

- procedure and form of payment.

The object of VHI is the insured risk associated with the costs of providing medical care in the event of an insured event.

An insured event is an insured person applying to a medical institution from among those provided for by the insurance contract in case of an acute illness, exacerbation of a chronic disease, injury, poisoning and other accidents for receiving advisory, preventive and other assistance requiring the provision of medical services within their list provided for by the insurance contract.

An insured event is the treatment of the insured person to a medical institution during the term of the insurance contract.

The sum insured is the maximum level of insurance coverage under the medical insurance contract, determined on the basis of the list and cost of medical services provided for in the medical insurance contract.

Insurance premiums paid by the insured under the insurance contract are established depending on the terms of insurance, the list of medical services chosen by the insured and the level of insurance coverage under the insurance contract, the insurance period and other conditions stipulated by the insurance contract.

Under a voluntary medical insurance contract, the insured is obliged to:

- timely and in full to pay the insurance premiums stipulated by the insurance contract;

- provide the insurer with the information necessary for concluding an insurance contract, as well as other necessary information related to the validity of the insurance contract;

- ensure the safety of documents under the insurance contract.

In this case, the insured is obliged:

- comply with the instructions of the attending physician received in the course of providing medical care, comply with the procedure established by the medical institution;

- take care of the safety of insurance documents and not transfer them to other persons in order to receive medical services.

The insurer under the insurance contract is obliged to:

- familiarize the insured with the rules of insurance;

- issue an insurance policy (contract) of the established form;

- upon the occurrence of an insured event, insurance payment in the manner prescribed in the insurance contract;

- ensure confidentiality in relations with the policyholder (insured person).

The validity of the insurance contract is terminated in the following cases:

- expiration of the period for which the contract was concluded;

- fulfillment by the insurer of obligations to the insured under the insurance contract in full;

- liquidation of the insured legal entity in the manner prescribed by law (death of the insured – natural person);

- liquidation of the insurer in the manner prescribed by the current legislation of the Russian Federation;

- in other cases stipulated by the current legislation of the Russian Federation.

Citizens, finding employment in new companies, see the condition of providing a policy as an advantage of a vacancy additional insurance as a social package. But what is VHI for employees and what opportunities does it open up?

VHI is voluntary health insurance.

The voluntary medical insurance program for employees is the provision of an extended social package that includes payment for diagnostics and treatment, including in specialized clinics.

What does it mean for an employee?

Voluntary health insurance is a policy under which you can compensate for the costs of treating employees.

An insured event is their appeal to a medical institution from the list provided for by the insurance contract.

The general list of services includes:

- outpatient care;

- visiting doctors at home;

- treatment at the dentist;

- rehabilitation programs at resorts and sanatoriums in Russia, as well as in specialized medical centers;

- registration of medical documentation;

- measures for immunoprophylaxis.

If an employer chooses a policy with limited coverage, then expensive dental services, spa treatments and emergency hospitalizations are excluded from it.

If an employer chooses a policy with limited coverage, then expensive dental services, spa treatments and emergency hospitalizations are excluded from it.

In addition to outpatient care in various medical institutions, the insurer sometimes offers the services of a personal doctor who advises the insured and coordinates his actions.

Underwater rocks

The disadvantage of the policy is that it may have many restrictions that the insured may not be aware of.

Everything else will have to be paid by yourself.

The insurance company only reimburses expenses prescribed by the doctor.

The insurance company only reimburses expenses prescribed by the doctor.

Self-treatment or the purchase of medicines will not be covered.

Another drawback is the list of clinics. In some policies, this list includes only public institutions and only one or two private medical centers.

It is not uncommon for a manager to send an insured employee to a cheaper or government-run clinic to reduce the insurer's costs.

Often, large insurance companies have their own network of medical centers and clinics. It is there that the insured persons will have to be served.

The employee can in no way influence the set of options in the insurance that the employer chooses. Unless he can pay extra money to expand coverage. Money for medical services the insurer will immediately send to the account of the clinic.Only in special cases is it possible to reimburse expenses in cash. The insurer has the full right not to pay for the part of the cost of treatment that exceeds the sum insured established by the contract.

Under corporate insurance, the insurer issues to the employer insurance policies for each insured employee. This is done within the first two weeks after payment. insurance contract. About, .

Subtleties

Insurance has its own quirks.

Insurance has its own quirks.

For instance, it may indicate a restriction on remote consultations of narrow specialists(if such a service is provided at all), a certain number of face-to-face consultations per year (for example, 1-2), and, of course, many exceptions to insured events.

If at an interview an employee is promised a VHI policy upon employment, then it is advisable to check in advance whether this item is spelled out in the employment agreement. Typically, the policy is given three to six months after hiring.

If it is assumed that the VHI will be signed after the probationary period, then this moment must also be agreed in advance and taken into account in the employment contract.

During the probationary period, insurance is almost never provided.

The consent of the employee must be expressed in writing. In this case, the policy often ceases to be valid immediately after the release order is issued, that is, even before the expiration of the working period (two weeks).

How to use?

On the website of large insurers, the insured will have access to " Personal Area”, which allows you to send a request for the provision of services, contact a doctor, receive oral and written online consultations, attach and store medical documents (test results, medical reports).

In addition to contacting through the websites of insurance companies, it is possible to contact them at a toll-free number and consult.

Why is it only available after a trial period?

If an employer has bought VHI for an employee, then this is an absolute plus.

If an employer has bought VHI for an employee, then this is an absolute plus.

Firstly, this is a great addition to the CHI.

The employee will have the opportunity to undergo a real high-quality examination and treatment in those clinics that he might not have been able to afford.

Secondly, it is a guarantee that round-the-clock service will be received − You can use the policy at any time of the day or night.

Service can also be anywhere, and not necessarily at the place of registration.

Of course, the provision of the policy VHI for employees should be taken as a bonus from the employer. For many, this speaks of the reliability of the company, and serves as an incentive for employment in this particular enterprise.Employers use the opportunity to make the vacancy more attractive, but only for employees who prove themselves.

Providing a policy after a year of work

Some companies are ready to provide a VHI policy to employees only after a year of work. This decision is most likely dictated by the need to save on additional costs.

But sometimes, large holdings provide programs not of the standard, but of the high price segment.

But sometimes, large holdings provide programs not of the standard, but of the high price segment.

So empowerment drive motivates employees to work longer and be more productive linger at the workplace.

Do they pay for sick leave?

The issuance of sheets of temporary disability (sick leave) and certificates for registering children in preschool and educational institutions is included in the VHI program.

For all consultations, analyses, studies and treatment during the term of the contract will pay Insurance Company.

But visiting doctors who are not related to the current disease is prohibited. Or you will have to prove the occurrence of two parallel insured events at the same time.This protects the insurance company from a situation where a client, being on sick leave with a sore throat, goes, for example, to a gynecologist "for prevention."

In any case, all visits for which you expect to receive payment or compensation from the insurance company must be agreed with the dispatcher. or may be read separately.

Ideally, if you receive written proof of payment, such as a letter of guarantee.

Useful video

Alfa Insurance prepared a presentation and shared its corporate experience VHI insurance. There is a lot of useful information for employers and employees:

Is the voluntary medical insurance policy valid after dismissal from work?

Upon dismissal, the policy is usually handed over.

Upon dismissal, the policy is usually handed over.

Moreover, many companies include a condition on the delivery of the policy in the bypass sheet and threaten not to pay the settlement if it is not fulfilled.

At the time of dismissal, the accounting department submits information on the completion of the service for this citizen, who is no longer an employee, under the corporate insurance program.

It is logical that after the dismissal, the VMI policy will cease to be valid in relation to the former employee.

Anything can happen, suppose the policy was left on hand or another malfunction occurred, and the former employee received medical care under the policy.

Will the employer be able to claim reimbursement of his expenses. May require.

But the case will likely never go to trial. Because it will be almost impossible to prove the composition of fraud.

What other things about corporate insurance would you like to know? Write in the comments and share your findings - under what policy what outlandish service did you manage to get!

In contact with

Voluntary health insurance is accompanied by the issuance of an appropriate policy, as well as mandatory. It is issued by citizens who wish to receive Additional services to provide qualified assistance, while avoiding queues and large expenses. VMI often acts as one of the elements of the corporate culture of an enterprise that forms policies for its employees. What the document includes, you will be able to figure out by examining the sample VHI policy for individuals.

What does it look like

There is no strict form for this form; each insurance company has the right to establish its own format. However, there is a list of information that must be contained in it. Lack of such data may invalidate the policy. Mandatory information included in the document includes:

- Period of validity of the insurance. Here, in addition to the day, month and year, it is mandatory to include the minutes and hours from which the insurance period begins and ends.

- The name of the insurance company.

- The name of the program installed under the specific policy.

- Full name of the insured person, indicating the date of his birth, passport details and address of residence.

- The amount of insurance premium paid by him.

- The amount for which the citizen is insured.

At the end of the form, the policyholder puts his signature and seal. The owner of the policy affixes the visa next to it. An addition to it is a receipt confirming the payment of the registration fee.