In How I Was Divorced

Maybe someone will come in handy - who has elderly parents or no more brains than me.

They call me from the Pension Fund - no, no, we are not from your social security, we are just checking them. You are such and such, were born then, retired from such and such - is that right? The head of the department of something there Anisimov Sergey Viktorovich is talking to you.

They ask for a long time whether I received any benefits, they are surprised that there was neither this, nor that, nor that, and they didn’t even congratulate an elderly person on the holiday - no, no, not a postcard. You should have been brought a box of chocolates. Have you monetized these benefits? Now let's see how much you have. The amount is not astronomical, of course, 11,135 rubles, but we will transfer it to you. Do not call your social security, we want to catch there who is unclean at hand - if there are any. No, everything is clean with you, no one signed for benefits for you. Only you will have to come to us and sign the documents, have such and such documents with you - let me make an appointment for you ...

And so on and so forth. He explains in detail and patiently how, where, when, he writes down already in a week - earlier it is impossible ...

Works brilliantly. And then he switches me "to the deputy chief accountant" - music plays, they do not immediately pick up the phone, but not for too long either. I tell a pretty female voice the number of the card to which I need to transfer - so far so good. Among other things, my aunt tells me to go to the nearest savings bank and arrange a service mobile bank to the number - she will dictate to me - so that they can control the transfer to the card ...

Dictated. Only you, he says, do it through an ATM, not in the window, but if they ask, tell them that you issue it to your number, otherwise they will force you to go to the window, and there such commissions will be removed from you. And don’t worry about the number, we will immediately give you this Beeline card or throw it away before your eyes ...

Anews has chosen some of the most common ways of "divorcing" older people and advises you to tell your older relatives about them.

The test results are ready, look for 100 thousand rubles

It is no secret that many pensioners regularly visit clinics and hospitals. And sometimes not because they get sick, but for preventive purposes. This is exactly what scammers fall for.

Their scheme is quite simple. The pensioner receives a call on his mobile or home phone, introduces himself as an employee of the polyclinic and is informed that the results of tests / examinations were allegedly received this morning.

Then the scammers act according to the circumstances. If a pensioner really recently took tests at a clinic, the alignment is ideal. A person is told that his life is in danger: if you do not start treatment today with drugs, which are very few in the city, there will be no chance of survival. The cost is declared. For example, 300 thousand rubles for a course of treatment, options are possible.

Further, scammers can clarify whether the pensioner holds cash and whether he has a bank account. If the money is at home, the criminals offer to send a courier with the “necessary medicines” and pay on the spot. At the same time, it is often specified with whom the “patient” lives. If with relatives, they may offer to meet on the street. If a old man agrees and lets fake doctors into the house, most often they sell him cheap vitamins or dietary supplements under the guise of medicine.

If the pensioner keeps the savings in the bank, the pensioner is offered to urgently go there, withdraw money, meet at the entrance with the “courier doctor” and transfer the necessary amount to him.

You never need to panic. No need to say how much is at home, and give your address. It is best to say that you do not intend to buy anything now, they say, decide on a purchase after consulting with your doctor and children. You can add that your son works in law enforcement.

If you nevertheless let slip about the savings, but have not yet met with scammers, you should immediately call your relatives and tell them about the situation that has arisen.

Imagine such an episode. The doorbell rings, there is a voice behind the door: “Social security for such and such a district, open it.” Hearing the name of a familiar organization, the pensioner opens the door, and then the performance begins.

Free legal advice:

A person who identified himself as a social worker reports that only today the Ministry of Health, together with the Department social protection(organization options are possible) holds a campaign for pensioners and offers to acquire an amazing device that cures almost all diseases. And all this, one might say, for some 20 thousand rubles. Moreover, the usual cost of the device, according to the pseudo-social worker, is 150 thousand.

Further, the intruder talks about the advantages of the device, listing all the diseases that, in principle, any elderly person can suffer from, and strongly recommends buying the device. Often scammers promise to return the money if the device is not to their liking for any reason.

Yielding to persuasion, the pensioner buys a device that turns out to be a useless trifle from a Chinese online store, the price of which is 300 rubles.

Remember that employees of state institutions are not involved in the sale of either medicines or medical devices. Do not be persuaded, stop the conversation as soon as it comes to money.

In no case do not tell where valuables are stored at home. If the guest nevertheless entered the apartment, do not take your eyes off him and try to send him out as soon as possible, saying that your relatives are about to come. Better yet, don't let strangers into the house at all.

Free legal advice:

You are entitled to a refund for purchased drugs

Another scam related to the health of the elderly. The pensioner is called allegedly from social security, the Central Bank or the prosecutor's office and informed that under the new law, all older people who have ever bought dietary supplements (and, as you know, very many bought them) are entitled to compensation from the state. The caller says this is because nutritional supplements have been found to be ineffective and retirees are the affected party. As a rule, the amount of compensation can vary from 200 thousand to a million rubles.

The happy pensioner literally melts from what he hears. And this is where the divorce begins. In order to receive money, an elderly person is asked to pay a state duty of approximately 10%. And they immediately provide clear instructions: go to an ATM or a bank branch and transfer money to such and such an account. After the transfer, the phones from which the scammers called, of course, stop answering.

Inform the caller that you decide all financial matters at the family council with the children and hang up. In no case do not transfer money and do not provide your phone number. bank card, and even more so the pin and cvc code.

There is a payment from the state for you, say the card number

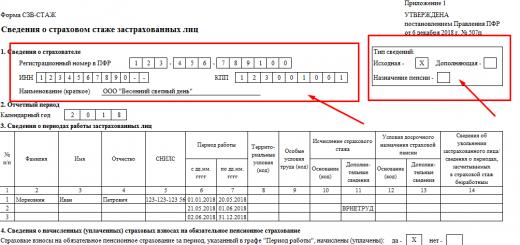

This fraudulent scheme is quite simple, it does not involve trips to the bank and transfers to someone's account. A person is simply called allegedly from the Pension Fund and told the good news that, they say, he is entitled to a one-time increase in pension payments from the state. And they add that you don’t need to go anywhere, just tell the card number, and the money will be transferred to you.

Free legal advice:

When an elderly person calls the card number, the caller begins to actively speak his teeth and, using complex terms, demands that he also be given passport data, a pension certificate number (for the sake of order - this is how it should be) and at the end - the cvc code of the card. And then he adds that now a code will come to the phone, which will also need to be reported in order to complete the transfer of compensation. As soon as a person fulfills all the instructions, a certain amount is debited from the card. Often - all available means.

The same as in the previous case.

You have been credited with an extra pension, you need to make a reconciliation

This case of fraud is reminiscent of shock therapy. They call the pensioner and tell him in a stern voice that last year his pension was mistakenly increased and extra money was added. The pensioner is nervous, asks how this could happen. He is no less strictly answered that now he urgently needs to check exactly how much extra money was transferred to him and demand to tell the card number. Any objections of a dumbfounded pensioner are suppressed something like this: if we do not conduct an audit, you will be fined.

If an elderly person reports the card number, followed by other data, the goal of the scammers, of course, is achieved: money is debited from the card, Anews notes.

Free legal advice:

Remember: neither the Pension Fund nor the social insurance, nor any other department is engaged in the calculation of compensation or recalculations "by phone" and does not call people to collect personal information.

Comments (3)

Maybe the state should try to somehow catch these scammers. and at the same time prevent leakage of personal data?

From our experience, into the treasury of popular anger:

Campaign for pensioners to replace interior doors, toilets, faucets, etc. If refused, let them sign a paper waiving the discount

Free legal advice:

You were recorded by a camera in a clinic, store, social security, savings bank. For this, you have been fined, let them fill out the protocol and check with the printout of the photo from the camera.

After a personal meeting with me, they called me with a threat to break the heads of the old people. A statement without evidence in the form of a recording of a conversation is not accepted.

You may be interested

Weather

Humanity will be washed away due to climate change

Society

200 parents rallied against the director of the Moscow school

Incidents

The driver of a passenger car stuffed with grenades escaped from the scene of an accident in Moscow

Science and technology

Determined when the Earth will become uninhabitable

Society

The results of the first stage of the volunteer competition "I want to do good" have been summed up

Incidents

Serbian party leader shot in Kosovo

map.ridus.ru: A special commission will deal with the erotic clip of the cadets

© 2011–2018 Reedus. Citizen Journalism Agency.

The use of Reedus materials is permitted only with the prior consent of the copyright holders. All rights to pictures and texts belong to their authors. The Site may contain material not intended for persons under the age of 21.

Free legal advice:

*The materials of the Reedus agency mention the following extremist and terrorist organizations banned in Russian Federation: "Right Sector", "Ukrainian Insurgent Army" (UPA), Islamic State (ISIS, ISIS), "Jabhat Fatah al-Sham" (former "Jabhat al-Nusra", "Jabhat al-Nusra"), National Bolshevik party (NBP), Al-Qaeda, UNA-UNSO, Taliban, Majlis of the Crimean Tatar people, Jehovah's Witnesses, Misanthropic Division, Korchinsky's Brotherhood, Slavic Union. Movement Against Illegal Immigration (DPNI), People's Will Army (AVN), International Association "Blood and Honor" ("Blood and Honor/Combat18", "B&H", "BandH"), Artpodgotovka.

Fraudsters calling home phones to pensioners

In general, yesterday at 10 p.m. (!) we heard a call to our home phone. I approach - a cute female voice asks Nikolai Nikolaevich.

So far, it is not surprising, clients sometimes call us on the city line, especially from other cities and foreigners.

NN picks up the phone, and from the conversation it turns out that they are calling from the pension fund (!) and find out that NN has received or not received it from pensions and other payments. He says that his wife is in charge of all the finances for his pension savings and hands over the phone to me.

Free legal advice:

I introduce myself by my last name. The girl says that she is Olga. OK then. He starts to wonder if we received a Moscow supplement to the pension from Sobyanin (!)

The first point to be wary of: as far as I know from my experience of communicating with officials, not a single organization ever calls any of the recipients, especially at odd hours. By the way, during the conversation, I gave the girl my mobile and asked to call back. So, the call came from a mobile Beeline number.

Government organizations never use mobile numbers to call customers.

Another reason to be wary: 1770 by 4 will not be 8500, but less. Plus, all Sobyanin's and other surcharges, for which a decision was made from above to "charge and issue", are sent without any intermediary calls along with the next pension, and such that "you were supposed to, but you did not receive" - does not happen. By the way, the girl Olga said that we called you, but we didn’t get through, and sent a notice, but you didn’t come!

Rave. In particular, we take out the mail regularly, we have a reliable box, and if the FIU sends notices, then only by registered letters against receipt.

Free legal advice:

Yeah, yeah, of course. The girl needs the pensioner to come to the ATM and put the card in there. Then there are her tasks.

Another point: with all due respect to the employees of the PFR and other funds, they never care so much that the recipient receives the funds due to him. Didn't get it - they will hang on the balance sheet for some time, and to hell with them.

And we went to the ATM, telling the girl Olga (she really called back) that yes, we are going, now we have gathered and run, sparkling with our heels, since it is so urgent.

The girl even told us which ATM near our house works around the clock! We didn't know, hehe.

We come to Sberbank, and the girl Olga calls again! Although the agreement was that we would call her directly from the ATM. No, apparently it didn't.

Free legal advice:

No, I say, giggling to myself, I didn't.

And deliberately aloud: - As it was on the card 80 rubles, and left.

Girl Olga continues:

Login to your personal account - mobile bank- and link our phone number to your card as a trusted one.

I even went to the ATM for this stage. And there it is written in large letters on a red background: do not perform this operation to unknown numbers at the request of persons unknown to you.

Free legal advice:

Uh-huh, - I think, - so you pierced.

I hand the phone to my husband.

Why is this needed? he asks. We already have mobile banking. What role will linking your phone to our card play in transferring the surcharge due to us?

Then log in to your Personal Account in deposit-card transfers ...

Free legal advice:

Did you enter the deposit-map? Olga asks. - Then dial the amount ... one ... zero ... and four more zeros ...

It's a hundred thousand, isn't it? I'm interested.

Ten rubles! - Olga answers with a blue eye. - And click "continue"!

Wow, they give. Dial with your hands and believe that it is ten rubles. And transfer this amount from the deposit to the card, and they will take it from the card somehow.

The ATM buzzed and issued a check: "Operation denied, error."

Free legal advice:

Which I broadcast to Olga on the phone with well-hidden gloating.

Yes? she was upset. - Well, let's then bind our phone as a trust, otherwise we will not be able to give you a surcharge ... again, you will receive notifications about all our promotions, medications, sales ...

Yes, the client was frustrated, and Olga got nervous and swam. In vain she said about medications: I still kept in my head that the employee of the Pension Fund of the Russian Federation, and not the social security, was calling us, and what does the medication have to do with it?

As soon as there was talk about "believe me", especially from alleged officials - drain the water, this is guaranteed to be a scam.

To which the husband said, "Okay, thank you," but the frustrated girl had already hung up.

Free legal advice:

In total, be careful, especially if there are pensioners in the family.

How older people are deceived - learning to recognize scammers

How old people are scammed

Everyone knows the saying: "Old, that small." And indeed it is. Elderly people, like children, are very trusting, sometimes even naive. This is used by scammers who, without a twinge of conscience, rob defenseless old people. Despite the abundance of information about cases of fraud, every year tens of thousands of elderly people become victims of swindlers, who voluntarily give all their savings to the scoundrels. In this article, we will talk about how the elderly are deceived, we will analyze the different types of fraud and how to protect against them.

How old people are scammed on the phone

In order to deceive the elderly, scammers have developed many methods. We will reveal just a few schemes according to which they operate.

An “employee” of the Pension Fund calls the home phone of an elderly person, addresses by name and patronymic and reports good news. Allegedly, he is entitled to a monthly increase in his pension. The PF will transfer it to the Sberbank card. Citizens are advised to urgently issue new map and indicate the mobile phone in the application (for the convenience of recalculation). The next day, the “happy” pensioner tells the scammers the number of the issued bank card.

Free legal advice:

Elderly people are also deceived like this: a person calls a pensioner and, introducing himself as a relative, says that he is in trouble, and tearfully asks him to help - send money by courier. After a while, a "messenger" arrives and takes the money. The amount of "help" was very different, some elderly people gave several hundred thousand rubles.

When asked why they did not recognize their own son (grandson, granddaughter, etc.) by the voice, all the injured elderly people answered: the connection was very poor (interference was deliberately created), and the strongest excitement from the news had an effect. Fraudsters without a twinge of conscience deceive the elderly, playing on their kindred feelings.

This is probably one of the oldest patterns. The police claim that now this is how deceiving older people is quite rare. Such telephone scammers have ceased to be trusted. But still, you should not lose vigilance. As they say, everything new is a well-forgotten old.

It is very common for older people to be scammed with "winnings" in the lottery. "Lucky" is informed that he won the car. For joy, he may not even realize that he has not bought any lottery tickets for a long time. He does not see clearly even after the "organizing committee of the lottery" offers him to pay tax on someone's personal account.

Free legal advice:

When older people who have already been deceived are deceived, this is the most inhuman kind of fraud. The victim of scammers is called by a “district police officer” and “warns” about the appearance of a criminal group that deceives the elderly. The victim reports that he has already fallen for their hook. Then the “district officer” asks to assist the investigation and help to catch the criminals “on live bait”. To do this, you need to give bait to swindlers - money (which, of course, will return to the owner) - and not tell anyone about this operation, so as not to frighten off the villains.

Then his "old acquaintances" scammers call the elderly man and again demand money. He gives them "bait". After this “operation”, the swindlers, along with the money and the “district policeman”, disappear without a trace.

How “medical workers” deceive the elderly

Often, scammers speculate on the desire of older people to receive medical treatment and improve their health. This is how “medical workers” deceive older people: a person calls, introduces himself as an employee of a polyclinic and reports that the results of tests have been received, which showed that the elderly person is seriously ill. A variety of diagnoses are called, many scammers “diagnose” even deadly diseases without remorse. The calling "doctor" offers the pensioner to undergo an examination and treatment or buy "miraculous" medicines (prices, of course, are fabulous).

Having agreed on a meeting, the "doctor" comes to an elderly person's home and conducts a "physical examination". Then he advertises a miracle cure "for all diseases" and persuades him to buy. At best, it will be just a dietary supplement, but it also happened that older people bought from such “doctors” drugs that were hazardous to health and should not be taken.

Prices for "miraculous" drugs depend on the "conscientiousness" of swindlers who deceive the elderly, often reaching several hundred thousand rubles. Old people, wanting to improve their failing health, give all their savings to the scoundrels.

"Health workers" can sell not only pills and potions, but also "miraculous" medical devices.

Free legal advice:

Some older people are sure that expensive treatment will restore lost health. But someone does not have money for expensive medicines and clinics, and someone simply cannot come to terms with the fact that the forces are leaving. And then a “savior angel” appears in the form of a pleasant-looking middle-aged woman and offers to buy a unique apparatus, developed using secret technologies at a former military factory, capable of curing all diseases and restoring youth.

She displays colorful brochures with pictures. The device blinks invitingly with multi-colored bulbs and makes soft sounds. Under this hum and wink, the uninvited guest announces that the company she represents, under a joint program with the government of the country specifically for pensioners in your area, is only now selling this miracle of medical equipment at low prices. Whereas its real value, for example, is over thirty thousand rubles.

The approval and support of the Government of the country for the ongoing action and its soon completion have a magical effect on the elderly. Almost 85% of pensioners agree to become owners of a “miracle device”. And, parting with the accumulated money, they become “happy” owners of a useless (at best) trinket made in China.

How “social workers” deceive older people

The following scheme, according to which the elderly are deceived, is very often used by scammers. Fraudsters pose as employees of the social security and report that the pensioner has been accrued an annual payment or compensation. But you can get it only after paying a certain fee. Having got the money, the scammers instantly disappear "in the fog."

Or they will find out from the pensioner the bank card number and access code in order to transfer the due subsidy to it. Naturally, after that, the money from the card "disappears" in an unknown direction.

Fraudsters often deceive older people in the following simple but reliable way. They come to their home, introduce themselves as employees of the social service and report that they have brought extraordinary financial assistance. But when paying "quite by accident" it turns out that only large bills remain. Pensioners gladly agree to exchange them. As a result, instead of real money, fakes are received.

Free legal advice:

Fraudsters often deceive older people, pretending to be social security workers, because this is an almost fail-safe way to get into a pensioner's apartment. And to distract and talk to the old people is generally a trifling matter for them. After the visits of such “social security workers”, the elderly discover the loss of money and valuables.

Posing as employees of social security, scammers take away passports from elderly people under the pretext of urgently replacing it with a new one. They collect huge loans in various banks in the name of the passport holder and draw up real estate transactions, as a result of which the old person may lose his home.

How old people are deceived by offering water filters

A scheme to deceive the elderly, very similar to that used by "health workers", was used by members of a criminal group that sold "miracle filters" to the elderly to purify water. Only they did not call pensioners on the phone, but came to their homes and played a real performance. With the help of simple technical and chemical methods, they showed the old people how the water flowing from the tap turns black. In this way they were convinced that it was dangerous to drink such water. Therefore, it is simply vital to purchase and install a water filter that costs only some 60 thousand rubles.

Elderly people gave money, and if there was not enough cash, they entered into loan agreements.

The police could not stop the activities of this criminal group for a long time, since their actions were assessed as “aggressive marketing”, and not as fraud. According to this scheme, scammers often deceive older people by selling other goods (medical devices, plastic windows, etc.).

Free legal advice:

How else to deceive gullible older people

There are several other types of scammers who, without a twinge of conscience, deceive the elderly.

These scammers deceive the elderly, pretending to be psychics, promising to get rid of diseases and improve fate. Now such "services" are often advertised on television. After watching such programs, pensioners themselves call the "healers". Often, scammers perform their magical rituals over the phone. The cost of one session can reach up to 50 thousand rubles. And you can deceive and rob naive old people for a very long time, if you convince them that a lot of time is needed to achieve a positive result.

This category of scammers acts arrogantly and unceremoniously. They enter the apartment, posing as social workers or sellers of various "wonderful" goods (filters, medicines, etc.). One of the swindlers "serves" and distracts an elderly person, the second searches the apartment. He takes all valuables and money, after which both leave. After such visits, pensioners do not immediately discover the loss.

These swindlers deceive their victims right on the street, in front of all honest people. They come up to an elderly person, pretend to be happy at the meeting and report with a happy smile on their faces that they are his second cousins. At the moment they need a small amount money, which the beloved uncle probably has. Then they express confidence that he will definitely help them in a kindred way. Having received the money, they hastily move away from the dumbfounded "relative".

How to protect older people from scammers

Now about the main thing. How to protect your own old people from scammers who deceive the elderly? Explain to them that it is not necessary to unconditionally trust a person, even if he appears to be an employee of reputable organizations (the prosecutor's office, clinics, ministries of health, etc.).

Representatives of government agencies never call to report any news (unless, of course, you yourself leave a request and your phone number for feedback).

If the caller calls you by name and patronymic and knows your address, marital status and other information, this does not mean at all that he is an official. Such data can be obtained in various ways.

If you believe the caller, then for insurance, ask his name, surname and position. Call the organization back and make sure that he is not deceiving you.

Never buy medicines and medical devices from people who introduce themselves medical workers, even if these products are equipped with instructions and quality certificates and are sold at a tempting discount. Remember that all these documents can be easily forged, and the price of such drugs in pharmacies is several times lower and discounts for pensioners are guaranteed there.

If you are told over the phone that you are ill and need to be hospitalized urgently, do not make any hasty decisions. Call people you trust completely and tell them about the phone call, ask for advice. It does not take a lot of time.

If a close person calls you on the phone (son, grandson, granddaughter, etc.), says that he is in trouble, and asks you to send money through a courier, do not rush to do this. Call the caller back, and if he does not pick up, dial other relatives.

Do not open the door to strangers and do not let them into the apartment. If, nevertheless, they opened, ask the person who came for his last name, first name, place of work and position held. Then call the organization he represents and inquire about him.

In order for a pensioner to receive social benefits, the PF will never require him to transfer money to any account. Don't forget about it.

Do not share your bank account details with anyone (for example, the access code to your credit card), even to employees sitting in a bank branch.

Tell all your elderly relatives about various ways fraud, about how the elderly are deceived. Convince the need to call you immediately in all suspicious cases. Be with them always in touch and provide them with help and support.

There are more and more schemes by which scammers deceive pensioners every day. One of them is a divorce for money using a phone call allegedly from the Pension Fund of Russia (PFR). Pseudo-employees use different tricks: extra payments not accrued on time, overpaid money, funded pension.

How pensioners are deceived by false employees of the pension fund

According to operational data, the number of phone calls from fraudsters posing as employees of the FIU has recently increased. The number usually belongs to a mobile operator or the call comes from another region. Fraudsters call pensioners on their home phones and address them by their first and middle names. This immediately disposes older people to the conversation.

It is important to understand that it is not difficult to get information about the owner of a landline and even a mobile phone now. The bases are publicly available on the Internet or they can be purchased on removable media.

Important: in exceptional cases, PFR employees call citizens and, as a rule, only to agree on the time of the visit. For communication, notifications sent by registered mail are used.

The main goal of deceiving pensioners by telephone scammers is to gain access to their personal account, persuade them to transfer money to another bank card or set the proposed mobile phone number as a trusted one, which will allow scammers to enter the pensioner's mobile bank.

Wrongly calculated payments

Divorce of pensioners by phone, allegedly from the Pension Fund, often concerns issues of calculating additional payments. The attackers call the pensioner and in a stern voice report that his pension was increased by mistake and an overpayment was formed. The dumbfounded old man begins to get nervous. When asked how this could happen, he gets one answer: the money must be returned, otherwise the citizen faces a fine for wasting budget money.

The elderly man, in a state of shock, agrees to return the overpaid funds. To do this, the attackers offer to name the details of the bank card where the pension is credited, ostensibly for verification.

After receiving the data, telephone scammers get full access to the pensioner's account.

Call of scammers about additional payments to pension

Telephone divorces for money may have another option - an elderly person is entitled to an increase. Scammers call and say that the citizen should receive a payment not accrued on time (for example, a new governor's allowance). The appeal is that notices were sent to the home address, but the recipient never showed up at the FIU.

Most of these calls occur at the end of the month.

The main argument when deceiving a pensioner: if they don’t have time to transfer money, an elderly person will never issue compensation.

PFR false employees offer a citizen to check the balance at an ATM for additional payments. A person sees that there was no cash receipts, then he is recommended:

- Link the proposed phone number to the card as a trusted one. This is how scammers get access to mobile banking and can manage the money of the deceived.

- Make a transfer from an account to a card. Please note that scammers do not name the amount, for example, "ten thousand". They work differently: enter the numbers "one, zero and three more zeros."

Divorce by phone for the money of the funded part of the pension

A new way to deceive pensioners over the phone is to transfer money to non-state pension funds (NPFs). An elderly person receives a call from a certain NPF. They address the pensioner by name and patronymic and report that they want to inform about the state of the personal account.

The deceived begins to say that he did not conclude anything, to which they answer in the receiver that this was done by his former employer. After they say that now they will call him back from another number and ask him to answer in the affirmative to three questions:

- Your name is …?

- Have you entered into an agreement with NPF “…”?

- Do you have a contract?

The essence of a telephone divorce is that the deceived pensioner gives his consent to transfer to another fund. For this, the agent who calls by phone receives a certain commission from the NPF (several thousand rubles - it all depends on the amount of the pensioner's savings). The old man himself has no benefit. And if the transition is made more than once every five years, all savings are lost - such is the legislation.

How to protect yourself from scammers for older people

According to statistics, scammers deceive pensioners more often than others, since older people are more gullible compared to other categories of the population. In order not to get into an unpleasant situation, you need to follow some rules. Remember:

- Representatives of the Pension Fund never call their clients from mobile phone numbers.

- PFR employees do not ask for card details.

- Additional payments to the pension are made either automatically or at the request of the pensioner. You can submit it only when visiting the branch, through your personal account or by sending it by mail.

- PFR employees do not call citizens to obtain personal information. They receive all information from documents provided by a citizen during a personal visit.

What confidential information should not be disclosed

When calling from an unknown phone number, always ask the person to give their last name, first name and patronymic, as well as the position and branch of the Pension Fund in which he works. In order to protect personal data from phone scammers, under no circumstances should you call:

- passport data;

- SNILS number;

- six-digit bank card number;

- pin;

- cvc-code - a three-digit number on the back of the card, which is used for online payments.

Video

On the territory of the Russian Federation, citizens are provided with a pension when they reach old age, or for other reasons.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

The required monthly payment is formed from insurance contributions that are made per citizen by the employer during official employment. At the end, a monthly pension is provided from the funded part of the funds.

But for Russians, there is an opportunity to make contributions not only to the state Pension Fund, but also to NPFs (non-state pension funds).

One of these institutions is NPF Soglasie, about whose activities there are a lot of negative reviews on the Internet (the pension fund Soglasie, they call and ask for personal data, or ask to confirm the fact of concluding an agreement with them) - thus, fraudsters act on behalf of the organization or having nothing to do with her.

Information about the company

The activity of any NPF in Russia is regulated by this legislation, namely federal law No. 75 dated 07.05.1998 (last edition) "On Non-State Pension Funds".

In the 1990s, the number of such institutions numbered about 300 organizations. Subsequently, there was a merger of small companies and now Russian market their number does not exceed 30.NPF "Consent" is one of the oldest institutions operating in the country since 1994.

At the moment, the company is one of the ten leaders of the Russian market of non-state pension funds in terms of the volume of savings funds of citizens

At the end of 2017, the amount of savings amounted to 74 billion rubles. The company actively supports all existing government programs, including is engaged in the provision of certificates "maternity capital".

In addition, it should be noted that the guarantee of pension payments is carried out at the expense of the Active Deposit Insurance Association.

How phone scammers operate

Many citizens of Russia have already faced dishonorable actions on behalf of NPF "Consent". But in some cases, calls come from scammers, and not from company employees.

In this case, the actions by phone are as follows:

- A call comes in from a local number.

- Next, the citizen clarifies information about the conclusion of the contract.

- References are made to the translation in non-state fund employer.

- Clarify all personal data of a citizen.

- After that, they ask you to wait for a call from another number and confirm the answers to the questions that the personal data is correct, the contract was concluded, and whether a copy of the agreement is on hand.

- Then another operator calls back and asks these three questions.

At the same time, citizens are assured that after that all Required documents to the address where he lives.

According to the management of the Soglasie company, their employees do not engage in such fraudulent activities.

Also from Consent, namely its leadership, an apology was received to all citizens of the Russian Federation who faced such calls.

What says NPF "Consent"

The fund itself denied such a statement. According to the management of the organization, their agents do not act like that. Further, apologies were made from JSC NPF "Consent".

Here is how Dmitry Nazarkin (head of the public relations department) commented on the situation:

I responsibly declare that such calls from employees of the NPF "Consent" cannot be received. The fund does not fraudulently attract citizens to transfer funded pensions to the company, and also does not impose services on Russians. The official website of the organization has all the contact information of the NPF, including phone numbers. At any time, a citizen has the right to call the institution and clarify information about whether he is a client of the company or not. It is also recommended to make relevant requests to the FIU regarding accruals, which can be done through the official website of the Pension Fund or the public services portal.

Through the website of the Pension Fund of the Russian Federation or the portal of public services for the population, each citizen can obtain information about the state of his savings account, as well as find out who has the funds at his disposal.

Where is my pension

Representatives of the FIU regularly warn Russian citizens about fraudulent activities. It is not recommended to put signatures in dubious documents, as well as provide information about where the place of residence is located.

In case of any illegal actions on the part of scammers, you should immediately contact the police.

It should be remembered that all actions of citizens in relation to their funded pension are exclusively voluntary.

You can request information by calling the PFR, where information will be provided on which state or commercial fund the citizen belongs to.

Also, when making a request to the NPF, you may encounter the fact that there are no savings in it, such situations can happen if the company has changed its name.

If necessary, a citizen can always return to the savings in the FIU, for this an application is written to the district branch of the state fund.

In the event that there are fears for savings that information for their transfer fell into the hands of malefactors, it is always possible to write a statement to the FIU or NPF that consent to the transfer was not given.

How to return it

To return the savings, as well as your personal data, you must contact Roskomnadzor.

This executive body is actively involved in such cases:

After the relevant proceedings are carried out, the citizen's personal data, as well as his funded part of the pension, will be withdrawn from the NPF and transferred back to the FIU.

How to terminate the contract

Termination of the contract with NPF "Consent" is possible in the event of certain cases, namely:

- after the death of the insured person – automatic termination;

- conclusion of a new agreement with the pension fund on OPS;

- return to the State Pension Fund of Russia;

- provided that the non-state foundation loses its license.

Upon revocation of the license, the concluded agreement is terminated automatically after three months.

After a citizen has chosen a new NPF, or decided to return to the Pension Fund and terminated the contract with the previous company, his funded part of the pension will be transferred to the appropriate account.

After the conclusion of a new contract, all information about it is entered in a single register.

Participation in ratings of expert agencies

As a rule, the conclusion of an agreement with an NPF in Russia occurs only after studying its ratings, as well as a long-term reflection of a citizen and making an appropriate decision.

Random or erroneous transitions from PFR to NPF are extremely rare. In this case, the organization "Consent" has the following ratings:

- the company is a full leader in terms of profitability (61.59%);

- NPF "Consent" is in the TOP-500 of the largest companies in the country;

- the fund is one of the five oldest non-state insurance institutions;

- is in the TOP-10 of the largest NPFs in Russia;

- the company is the leader in terms of payments of average monthly compulsory pension insurance.

In accordance with the reports of NPF "Consent" has been a leader in the Russian market for five years.

Russian agencies that publish information on ratings assigned the company an A+ category. The reliability of the organization is rated above average with a positive outlook.

What threatens the transition from the FIU to a non-state company

In the event that a citizen transfers his savings from a state fund to a commercial organization, there are some risks.

Let's consider in more detail what the transition threatens:

Based on this, we can conclude that, despite the high reliability rating, as well as profitability indicators, the transition from PFR to NPF is not always a reasonable step.

Non-state pension funds have been operating in the Russian market of insurance and providing the opportunity to accumulate pensions for a long time.

21.05.18 114 737 46

How I was secretly transferred to the left fund and what it cost me

At the end of 2017, I received a call from a non-state pension fund and was told that I was now their client.

Alexey Kashnikov

suffered from scammers in NPF

I didn’t conclude any contracts with anyone, and when I started to sort it out, it turned out that 80,000 R was actually stolen from me from my future pension.

At one time, I myself worked as an NPF agent, but even knowing all the tricks of insurers did not save me. In this article I will tell you how unscrupulous NPF agents can secretly deceive you.

This article is just the beginning of my fight against scammers. When there is some kind of continuation, I will supplement the article and report it on social networks - subscribe. But while I punish the scammers, a lot of time may pass, and you need to protect yourself from them now, so do not wait for my situation to be resolved - be prepared in advance.

What kind of NPF and what does old age have to do with it

Our future pension is divided into two parts: insurance and funded.

The insurance pension is money from people from the future. When you are old and someone else is young, the young will be thrown into your pension. How much you will receive in this part depends on many factors, from your experience to the scale of our country's imperial ambitions. We can significantly affect the size of the insurance pension, except perhaps by improving demographic situation in the country, so that during our old age in Russia there would be many able-bodied taxpayers.

A funded pension is your own money, which the state has allowed you to set aside in advance for old age. So you would give all your deductions to current pensioners, and now you can leave part of it on the account. You can do nothing with the funded pension - and then your insurer will be the Pension Fund of the Russian Federation, which by default will send savings to the management company VEB. People who choose this option are called "silent".

You can consciously choose the Pension Fund of the Russian Federation as your insurer by writing a statement about it. Then you will also remain in the FIU, but you will not be considered a “silent person”. You can also invest a funded pension through a non-state pension fund (NPF) and receive income with it. If the income is good and in the next 25 years no one decides to use it for the imperial ambitions of our country, then in old age you will have something to live on.

This is the same as if you are now investing part of your salary in stocks and bonds. You invest, investments bring income, and in old age you receive a pension from this money. Now imagine that it is not you personally who invests, but some management company that collects a lot of money from the population, invests this pile in financial instruments and makes a profit. This company is the NPF - a non-state pension fund.

Non-government pension funds earn from the profits they generate for their depositors, so they compete for clients. The more customers, the more money and the greater the potential profit. Sometimes, in pursuit of turnover, funds begin to play a dishonest game - and let's talk about that.

NPF agents

Non-state pension funds are financial companies, they deal with money: a million there, a million here, bought paper, sold paper, debit-credit. They do not always have a network of offices throughout Russia and their own sellers.

In order to attract money from the population, NPFs quite often turn to the services of agents. The agent sells the services of the NPF for a fee - it can be a person or a company. For example, an NPF can negotiate with a promoted bank so that it sells the services of this NPF to its customers. For each executed contract, the NPF pays a fee to the bank. Everyone is happy.

Agents can be banks, shops, website owners, your postman, your Apple dealer, your employer, and even all sorts of shady characters. By and large, the NPF does not matter through whom you executed the contract: the main thing is that you agree to transfer your money to this NPF. And the main thing for the agent is to draw up papers and get your fee. It doesn't matter to everyone, so it turns out ...

The fund works with agents directly or through brokers

Early transfer to another NPF

The state wants you to choose one pension fund and leave money there for a long time. Therefore, according to the law, you can move from one fund to another without financial losses once every five years. If you switch early, you will lose all investment income.

That is exactly what happened to me. In 2015, I signed an agreement with NPF "Doverie". At that time, there were 33,000 R in the savings account. For two years, my NPF invested money, and I received income. When I was fraudulently transferred to a new NPF, everything I earned burned down, and the original 33,000 R remained on the account.

But the losses didn't end there. The fact is that money from one NPF to another is not transferred clearly on January 1, but in the period from January 1 to April 1. That is, if during this period the funded pension has already left the old NPF, but has not yet entered the new one, then during this time you will not receive any income either. In fact, the money may freeze, they will be transferred to a new account later - in my NPF they told me that sometimes the deadline is delayed until September. With a yield of 10%, losses increase from 6930 to 8000 R.

I was quite satisfied with the yield of my old NPF - 10%. This is twice the rate of inflation. Now I am 35 years old, I have at least another 25 years before retirement. All this time, the lost money would continue to work. With a yield of 10%, 8,000 R by 2042 would turn into 80,000 R! I will miss this amount due to the fact that back in 2017 someone decided to transfer me to another NPF.

How scammers deceive in NPF

Some agents make a transfer from one NPF to another secretly from the client: the main thing is to get passport data and SNILS number from him. For each client brought, the agent receives from 500 to 5000 R, depending on the amount on the account of the future pensioner.

When I worked as an agent, our company used only legal ways to find clients. The most common are door-to-door visits and holding meetings of employees in large organizations. In addition, so-called cross-selling was widespread, when credit managers in banks or stores acted as agents. They suggested that clients conclude an agreement with NPFs when they received a loan or bought goods on credit. Before signing the contract, the client was always told what kind of fund we represent, what profitability it has, etc.

Width="1350" height="1424" class=" outline-bordered" style="max-width: 675.0px; height: auto" data-bordered="true"> In 2013 when I was working for a brokerage - agent, NPF paid from 1200 to 1500 R for each client

How they cheat when going around apartments

Sometimes agents cheat when going door-to-door, when you can talk to a person one-on-one, without witnesses. For example, agents pose as employees of a pension fund. From the point of view of the law, everything is clean here, because the NPF is also a pension fund, only a non-state one. A potential client, on the other hand, thinks that they came to him from the Pension Fund of the Russian Federation, and trusts the guest.

Offering a contract, agents can intimidate, saying that it is necessary to sign it, otherwise you can lose part of your future pension. This, by the way, is also half-truth: the agent can show the profitability of the fund - if it is higher than your current NPF, then part of the future pension is really lost.

Our competitors even opened a company with the name "Gosfond", issued certificates to agents with such an inscription - and sales soared. Conscientious NPFs never do this - we have the phrase "I'm from the pension fund" was banned.

One of my clients told how agents came to her house and said that our fund had closed and she had to urgently sign an agreement with a new NPF. In fact, our company simply merged with another NPF and changed its name. Competitors found out about this and began to scare customers.

Agents came to my house too. I let them in out of professional interest. They used this technique: they asked for SNILS “for verification”, they immediately called somewhere and told me that I was no longer in the customer database and that the contract urgently needed to be reissued. In fact, they checked SNILS with the combined database of several NPFs, but I was not there, because my fund simply did not submit data there.

How to cheat during a cross-sell

An employee of a bank, insurance company or microfinance organization can simultaneously work for an NPF. In this case, you may be given to sign the contract under the guise of other documents. For example, when you apply for a loan in a store and put signatures on a large number of papers. They may say that this is an insurance contract, it is free.

Many recruitment agencies work this way. The task is facilitated by the fact that for employment they need the same documents as for concluding an OPS agreement: a passport and SNILS. Applicants come to a recruitment agency and fill out a job search form. In fact, they are given to sign an application and a questionnaire for transfer to the NPF. Citizens after filling out the questionnaire are told that they will receive a call. They will have to confirm that they agree to the transition, and then they will be contacted for work. When the client confirms the transfer to the NPF, they may indeed be offered some vacancies, or they may even forget about it.

One client told me how an unfamiliar man came to their village and said that he was recruiting people for work. Under this pretext, he collected passport and SNILS data from those who wanted to find a job, then he gave them some papers to sign and left. No one got a job, but the next year everyone received a notice of transfer to the NPF.

- OPS agreement in triplicate. There will be 3 copies of the contract in total, each of which will be signed at least in two places.

- Applications for early transfer. Usually, just in case, clients are given two applications to sign at once: on the transfer from the PFR to the NPF and on the transfer from the NPF to the NPF.

- Consent to the processing of personal data.

Forgery of signatures

Forgery of signatures is already a crime. The fraudster receives a passport and SNILS, forges signatures, submits documents to the NPF - it seems like he himself sold services to a person. The client learns that he moved to a new NPF, only a few months later, having received a letter from the old one.

This is what happened in my case. As I later found out, an employee of the bank where I received the card transferred me to the new fund. She scanned my passport and SNILS, which was in the passport cover, quietly filled out the documents and reported to the fund: “Here, they say, they brought you a new client, give me money.”

It is difficult to avoid such a situation, because the cases when we are asked for copies of the passport and SNILS are not rare. At the same time, non-state pension funds themselves are trying to fight fraud. For example, they call and clarify whether the client really entered into an agreement - this is how they double-check the integrity of their agents.

Some NPFs require a photo of the client's passport from agents. True, scammers manage to bypass these barriers, buy databases of scanned documents, enter their own phone numbers into the contract in order to answer calls from NPFs on behalf of clients.

One of my colleagues from the NPF told me that scammers open entire factories for the production of false contracts: they hire special people who forge signatures, other employees answer the phones of the NPF, confirming the transition, and others hand over documents.

According to the law, forging signatures, providing copies of the passport and answering for the client by phone is still not enough to transfer the pension. After that, my identity and signatures are certified by one of three options: a personal visit to the FIU or the MFC, with the help of a notary public or an electronic signature. Who confirmed my identity, I don't know yet. My new NPF ignored this question, and now I am waiting for a response from the Pension Fund.

How to check if your money is safe

It will not work to find out if you were transferred ahead of schedule without your knowledge until the money leaves one NPF to another. In the old fund, they find out that the client has dropped out, already in fact - from the PFR. You will receive a letter stating that your money is in the new NPF, also only after the transfer.

Therefore, you need to regularly check if you have changed NPF. You can check it on the public services website by selecting personal account section "Notification of the status of the personal account in the Pension Fund of the Russian Federation":

Click "Get Service" and then "Get Full Details":

When the statement opens, you will see all the deductions of your employers and your insurer, as well as the date the contract with it comes into force:

The amount of the funded pension and profitability are not reflected in the statement, they can be found in the fund - on the website or by calling the hotline.

The agreement does not come into force immediately, but next year. If, while reading this article, you remembered that you recently signed something like that, you have a chance to return to the old NPF without financial losses. Find the new fund's hotline number on their website or in your copy of the contract and find out how to cancel the transfer.

What to do

If you find out that the funded part of the pension was transferred to a new NPF secretly from you, go to court with a request to declare the contract invalid. The money, together with the accumulated income, will be returned within 30 days - in such a situation, a special procedure for transferring the funded pension applies.

To do this, request by registered mail from your new fund an agreement and consent to the processing of personal data that you allegedly signed. They can be used as evidence in court. When I received my documents, I saw that the signatures for me were made by someone else's hand. Now I have filed a lawsuit.

You can go to court even if you signed the contract yourself, but you were not told about the loss of profitability. As practice shows, the courts also satisfy such claims.

Remember that the law is on your side. If you yourself did not sign the contract or you were misled, then you can prove everything in court.

Unfortunately, many people, when they find out about the transfer to a new NPF, simply wave their hands at it: they say, the money is small, why bother now, maybe the new fund will be better. There are three things to understand here:

- Now the money is small, but in 10-20 years they will run into significant interest.

- The choice of an insurer for compulsory pension insurance is your legal right. If you did not choose this NPF, there is no reason to stay in it.

- Most likely, you will only need to collect documents and appear at the court hearing. My lawyers say that they are not needed there and I can do everything myself.

Remember

- If you change NPF more than once every five years, you will lose investment income.

- It would seem that small lost amounts of investment income for retirement can turn into tens or even hundreds of thousands of rubles.

- Carefully read all the documents that you sign when obtaining a loan or employment (and in general always).

- Your passport and SNILS are enough for scammers to transfer you to a new NPF.

- If you have become a victim of unscrupulous agents, complain to your new NPF, the Pension Fund of the Russian Federation and the Central Bank.

- To return the funded part of the pension and income, apply to the court with a claim to recognize the OPS agreement as invalid.