Maternity capital funds, taking into account the numerous changes made to the program by the government and the State Duma as of 2017, can be used without waiting for the child to reach 3 years old in several ways.

- to pay the down payment on a mortgage (credit or loan);

- to pay part of the loan and interest for its use;

- for the repayment of mortgages by participantssavings and mortgage system of military personnel(NIS).

Currently, maternity capital can only be used forlump sum mortgage loan.

However, on June 3, 2017, the head of the Ministry of Construction of Russia, Mikhail Men, confirmed the information that now his department is developing a new law that will allowpay off monthly mortgage paymentsmother capital certificate. For the first time, this proposal was announced in January 2017 by Deputy Minister of Construction Nikita Stasishin, noting: “It seems to be a trifle, but on the other hand, while a person does not work, he does not have a headache, how to pay a loan every month.”

The opportunity offered by the Ministry of Construction in 2017 to pay off the mortgage monthly from the mother's capital will reduce the family's debt burden in a situation where one of the parents goes on parental leave and has no income to service the mortgage loan for 3 years.

Several important facts follow from this:

- Firstly, only working parents will be able to pay off the mortgage monthly from maternity capital (since parental leave for up to 3 years is provided for by the Labor Code).

- Secondly, it is not yet clear in respect of which child, in order of birth, such a right will be granted - in his last comments, the deputy head of the Ministry of Construction operates with the phrase “when the third child is born”, which seems unfair, since the familyreceives the right to maternity capital for the second child, with whom, until the age of 3, one of the parents is also on maternity leave.

What does it take to pay off a mortgage loan with maternity capital?

If approved by the bank, you are given a housing loan for the entire amount, while, as a rule, nothing is written in the loan agreement about mother capital. The procedure in this case is usually the following:

- You draw up for yourself the apartment or house you are purchasing or register an equity participation agreement (DDU) with Rosreestr.

- The bank transfers all the necessary credit funds to the account of the seller, with whom you now actually find yourself in the calculation and no longer interact.

- Until the moment you fully repay the debt and pay interest, the apartment will be pledged to the bank (mortgage ispledge of real estate ).

- At the bank, you take a certificate of the remaining debt on the loan and say that you will make early repayment of its part with the funds of the capital.

- Go to the branch of the Pension Fund (PFR) at the place of residence, hand over thereRequired documents along with a bank statement of debt.

- Within a month, the FIU reviews yourstatement of disposal and for another month he transfers money to the bank to pay off part of the mortgage, provided that it was a housing loan (that is, “for the purchase or construction of housing”).

After that, the bank will recalculate your new payment schedule, taking into account the early repaid part of the loan, while reducing the amount of the monthly payment or shortening the mortgage repayment period, that's all!

To pay off a mortgage with maternity capital, you must:

Suppose the purchased housing costs 2 million rubles. You have a certificate for maternity capital (MK) in your hands, which you want to send to pay off your mortgage.

The general procedure for this looks like this:

- You independently collect the down payment necessary for obtaining a loan (usually 20% of the total amount, i.e., in our example, 400 thousand rubles) and take the missing part (1.6 million rubles) from the bank to pay for a housing purchase transaction - purchase and sale of a finished apartment or house or shared construction in a new building.

- After the bank approves a loan for the missing amount of 1.6 million rubles, the following actions are taken:

- together with the seller, the necessary documents for housing are drawn up;

- a mortgage is registered and a certificate of ownership is issued in Rosreestr (cancelled, from 2017 - extracts from the USRN) or a registered equity agreement;

- the bank transfers the credit funds together with the down payment (in our example, for a total amount of 2 million rubles) to the seller.

- You, without waiting for the child to reach 3 years old, take a bank certificate of debt on a loan (1.6 million rubles), collect documents in the Pension Fund of the Russian Federation for the disposal of maternity capital, attaching a certificate from the bank.

- If the housing is not registered in shared ownership for all family members (including minor children), according to the law on mother capital, along with an application for disposal, it is necessary to submit a corresponding notarial obligation to the Pension Fund, in which the certificate holder undertakes to allocate shares to the children and the second spouse within 6 months after the full repayment of the debt and the removal by the bank of the encumbrance (mortgage) on the apartment.

- Within a month, employees of the Pension Fund consider your application, and then after another 10 working days the money is transferred to the bank to repay part of the loan (provided that the documents are in order and this is a housing loan).

Thus, within 1.5 months, until the employees of the Pension Fund transfer the maternity capital to the bank, you must pay the loan in full, i.e. for the entire debt taken in the amount of 1.6 million rubles. - After the MK funds are credited to the bank within 10 working days after the approval of the application in the Pension Fund, its employees will issue you a new payment schedule for the balance of the debt, and you continue to pay your loan to the end on your own, but at the same time by agreement with the bank or according to the terms of the agreement, the amount of the monthly payment can be reduced or the total maturity of the mortgage can be reduced.

- If the acquired housing at the time of obtaining a mortgage loan, for the full or partial repayment of which maternity capital funds were used, was not registered in the common shared ownership of spouses and children, then within 6 months after its full payment and removal of the mortgage by the bank through Rosreestr, it is necessary to fulfill the obligation on the allocation of shares by registering the common shared ownership of the apartment.

Lawyer. Legal consulting, experience in tax inspection. Date: June 2, 2017. Reading time 7 min.

To repay the loan with family capital, you need to collect a package of documents and apply to the Pension Fund. In most cases, a positive decision is made, but a refusal is also possible due to the non-compliance of the credit institution with the requirements of the law. If the Pension Fund allows the funds to be spent, the money is transferred to the bank account, which makes full or partial repayment of the debt. The right to own housing, paid for by maternity capital, is divided among all family members.

Maternity capital - funds allocated to the family at the birth of a second or adoption of a second or subsequent child. possible in different ways. One of the most common and popular is the repayment of a mortgage with maternity capital.

It has been established that the money received from the state can be used as a down payment when acquiring real estate on a mortgage, and can also be used to pay for housing loans, including the principal debt and interest for use. When the family took out a loan, it does not matter, since the law allows for the possibility of repaying the debt for obligations that arose before the birth of the child. Restrictions are established only in terms of repayment of certain debts arising from the loan: penalties, fines and other sanctions associated with non-fulfillment of obligations to make payments.

Repayment of a mortgage loan by maternity capital

It is allowed to use family capital after 3 years. To do this, you need to write an application to the branch of the Pension Fund.

Attention! You should contact the territorial office at the place of permanent residence. If the family lives at a different address, both spouses need to apply for temporary registration at the place of residence. Those living abroad apply directly to the Pension Fund of Russia.

Real estate can be purchased under a sale and purchase agreement when the house has already been built and put into operation, or it is a secondary market, or under an agreement on participation in shared construction. Also, maternity capital can be used to pay off debt on a loan taken to buy a home.

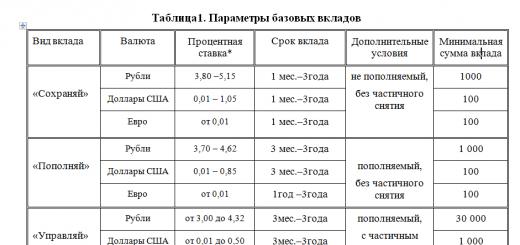

Table 1. List of documents required for submission to the Pension Fund (all documents are provided in copies, while the documents must be on hand).

| No. p / p | To pay the down payment on a loan | To pay the down payment on a loan for participation in shared construction | To pay off principal and interest on a loan | ||

| 1 | loan or loan agreement | ||||

| 2 | mortgage agreement (if any) | ||||

| 3 | obligation to register real estate in common ownership (original) | ||||

| 4 | contract of sale | contract for participation in shared construction | bank certificate on the balance of the principal debt and interest debt (original) | ||

| 5 | certificate of the amount paid and the remaining debt, as well as details for the transfer of maternity capital funds (original) | certificate of registration of ownership | |||

| 6 | agreement on participation in shared construction (if the apartment was purchased in this manner) | ||||

| 7 | permission to build a house (if the house is not put into operation) | ||||

| 8 | a document confirming the receipt of money under a loan agreement | ||||

| 9 | a document confirming membership in the cooperative (extract from the register of members, a copy of the application or decision on admission to the cooperative) | ||||

Important! The apartment must be owned by all family members. Shares are determined by agreement. If this was not done when acquiring real estate, then a notarized obligation is provided to the Pension Fund. The term is 6 months after the removal of the encumbrance.

In addition, you will need originals of other documents that will need to be provided to the PF or MFC employee:

- family certificate or its duplicate;

- passport;

- SNILS;

- if a representative is acting - his passport and power of attorney;

- a document confirming registration at the place of residence, if the documents are not submitted at the place of permanent residence;

- birth (adoption) certificate for all children;

- documents on the status of spouses (marriage certificate, spouse's passport, his certificate of registration at the place of residence);

- permission from the guardianship and guardianship authorities to spend funds if the guardian or foster parent applies;

- a document confirming the right of the child to use state support funds (marriage certificate, permission from the guardianship and guardianship authorities or a court decision declaring the minor fully capable).

Note! The term for consideration of documents is 30 days.

Based on the results of consideration of the application and the package of documents, the Pension Fund decides to refuse or satisfy the applicant's request. In case of a positive decision, the money is transferred immediately to the account of the organization that provided the loan. The term for transferring money is 10 days from the moment a positive decision is made.

After making a positive decision, you need to contact the bank and write an application for full or partial repayment of the debt at the expense of the funds allocated by the Pension Fund. If they fully repay the debt, then it is recommended to take a certificate of debt repayment, if partially - a new payment schedule.

Partial repayment of the mortgage by maternity capital

The money can be used to pay off all or part of the debt. The amount of maternity capital with which the family plans to repay the loan cannot exceed the amount of debt under the loan agreement. However, in practice, there are only a few such cases, in general, the amount of debt exceeds the amount of maternity capital.

When the bank receives funds from the Pension Fund, they are credited to the loan account and the bank recalculates the amount of the monthly payment. A loan taken on general terms will decrease by about 15%. If, under the terms of the agreement, a moratorium on early repayment of the loan is established, then the borrower will have to make a fixed contribution within the specified time. Only after the termination of the moratorium will it be possible to repay the loan ahead of schedule.

Example. A family of 4 took a loan for 10 years for 2 million rubles. The monthly fee was 23,094.11 rubles. The family used part of the maternity capital and sent 299,731.25 rubles to pay off the debt. After offsetting this amount, the amount of the monthly payment decreased to 21,615.22 rubles.

Attention! Each mortgage loan is different. The loan repayment procedure and subsequent relationships with the bank are based on the signed loan agreement.

Requirements for the organization that issued the loan

There are also requirements for the organization that issued the loan. It can be:

- licensed bank;

- another organization that issued a loan secured by real estate.

Important! In practice, families that took out loans from agricultural consumer cooperatives experienced problems due to the refusal of the Pension Fund to allocate maternity capital funds to repay such loans.

The refusals were due to a letter from the Deputy Chairman of the Board of the PF, which stated that the PF had no grounds to satisfy such applications. The list included not only agricultural cooperatives, but also microfinance organizations and consumer cooperatives that issued loans secured by mortgages.

In practice, a situation has arisen where families that have received loans from agricultural cooperatives are forced to go to court, but there is little positive judicial practice. To increase your chances of success, you need to check the following circumstances:

- the presence in the charter of the right to conduct activities, as well as the fact of assigning OKVED codes corresponding to this activity;

- availability of an approved provision on issuing loans for the purchase of residential real estate with mortgage security with the possibility of repayment at the expense of maternity capital;

- the transaction must be aimed at improving the living conditions of the family.

If you receive a refusal, you should appeal it in court and seek protection of your rights.

When the repayment of a mortgage loan by maternity capital may be refused

The Pension Fund may refuse to satisfy the application for various reasons:

- the right to state material support has been terminated;

- violation of the procedure for filing an application;

- the method of disposal of funds is not provided for by law;

- the amount indicated in the application exceeds the amount of maternity capital;

- restriction of parental rights;

- removal of a child;

- non-compliance of the organization that issued the loan with the requirements presented to it.

In addition, upon receipt of an application, the Pension Fund must check the following circumstances:

- deprivation of parental rights in relation to a child, with the birth of which the family has the right to state support;

- committing a crime against a child;

- cancellation of adoption.

In practice, there are cases when the PF fails for formal reasons. One of the cases that happened in practice was a refusal due to the submission of an application for the disposal of maternity capital funds along with an extract from the personal account on a deposit in the name of the spouse. The refusal was challenged in court. The court recognized the right of the family to use maternity capital, obliging the Pension Fund to transfer funds.

Watch the video for more information

Are you planning to pay off your mortgage with maternity capital? Then this article is for you! We will consider the procedure for repaying the main mortgage debt with a matkap, find out what documents to collect and where to submit them, in what terms the appeal will be considered, and what important nuances of the procedure will have to be faced with.

In order to improve the demographic situation in the country, the Government of the Russian Federation approves targeted social programs, including maternity capital. The funds provided by the program in the amount of 453,026 rubles can be used in several permitted areas, one of which is the repayment of a debt on a mortgage loan.

You can use the Family Mortgage Repayment Certificate in one of the following ways.

Capital as a down payment on a mortgage

In May 2015, a law was passed that allows the use of mother's capital to pay off a mortgage loan, without waiting for the child to turn three years old, as it was before. Families planning to improve their living conditions rushed to banks in order to use the funds from the certificate as a down payment on a home loan.

But not all banks agreed to such an operation. Under the conditions of most credit institutions, the initial payment was accepted exclusively in the form of free cash.

Similar principles are preserved in some financial companies to this day - due to the uncertainty of banks in the solvency of a client who resorts to the help of a parent certificate.

But the leading players in the credit market of the Russian Federation - Sberbank, VTB, Gazprombank - have now come to the conclusion that the amount of the first installment paid does not generally characterize the solvency of customers.

In order to use the state subsidy funds as an entry fee for a targeted loan, the matcap amount must cover from 10 to 20% (depending on the conditions of each bank) of the value of the purchased property. If the amount of the certificate is not enough, you will need to additionally deposit your own funds. Some banks, regardless of the size of the loan, require an additional payment in excess of the family certificate, to confirm the financial well-being of the borrower.

Partial loan payment

This option is the most reasonable.

In the case when the cost of housing is low, and the capital is used to fully repay the principal on the loan received, the family remains to pay the accrued interest. In this case, the mortgage is closed ahead of schedule, and the family quickly receives an apartment in its full ownership. But this ideal alignment is rarely realized in practice - the amount of maternity capital is often insufficient to fully repay the mortgage loan.

An important nuance - if you plan to partially pay off the loan, you should immediately notify the loan officer in charge of the transaction. If the bank agrees to close the majority of the principal loan with matcap, then the amount of accrued interest is subject to recalculation based on the remaining reduced amount of debt.

Paying off mortgage interest

The certificate can be used to pay off interest on a mortgage loan ahead of schedule. But…

First, you need to notify the bank about this and get approval for this operation.

Secondly, from a financial point of view, this is the most disadvantageous option for the family. In practice, it is used in hopeless situations when there is no other way to pay interest on a loan.

Regardless of the option chosen, the borrower needs to prepare the following list of documents.

Passport (original and several full copies of the document).

Certificate for maternity capital.

Bank mortgage loan agreement.

A certificate from the bank, which indicates the remaining amount of the loan and the general condition of the account.

Certificate of ownership of the property, taken on credit.

A completed form from the Pension Fund, with a statement from the borrower about the intention to use maternity capital to pay off a mortgage loan.

A notarized contract containing information on the need to register real estate in an equal family ownership, with equal shares for family members.

Banks are required by law to accept a family certificate as payment for a portion of a mortgage. Nevertheless, refusals are possible in practice - credit companies act selectively, making a decision in each specific case to grant a loan, or to refuse.

Conditions and procedure for repayment of a mortgage loan by mother capital

The procedure for repaying part of the loan with state subsidies is presented in steps in the table.

|

Deal stages |

Borrower's actions |

Notes |

|

Apply for a loan at the bank of your choice. 20% of the total value of the property must be own funds, to be paid as a down payment. For the remaining 80%, an application is submitted to the bank for a loan |

For all types of transactions: purchase and sale of an apartment, house or kindergarten |

|

|

Obtain credit institution approval |

||

|

Prepare, together with the seller, the necessary documents for an apartment or house |

||

|

The mortgage agreement must be registered with the territorial authority of Rosreestr and receive confirmation of ownership of the object Housing must be registered in shared ownership for all family members. |

Since 2017, “pink” certificates have been canceled, instead of them, extracts from the USRN are issued |

|

|

The bank transfers the full value of the property to the seller's account |

Down payment + loan amount |

|

|

Obtain a bank loan certificate |

Notify the bank of your intention to pay off part of the mortgage ahead of schedule |

|

|

Collect and submit to the Pension Fund a set of documents for the disposal of funds under the maternity certificate |

Without waiting for the child's age of three! |

|

|

Wait 30 days required by the PF to review the application |

||

|

After the application is approved by the Pension Fund, within 10 working days the amount under the certificate is transferred to the bank as repayment of the principal debt on the mortgage. |

Matcap can only be used to repay a home loan |

|

|

You should apply to the bank for a new payment schedule, taking into account the reduction of the principal loan debt, and continue to pay off the mortgage, but with a reduced monthly payment, or a reduced term for the full repayment of the loan. |

It is important to avoid delays and make mandatory loan payments strictly on schedule - otherwise the credit history will be spoiled. |

* List of documents for the purchase and sale of an apartment

- Passport of the owner of the property

- Documents confirming the basis for the emergence of ownership of housing.

- Certificate of ownership. Cadastral passport of the apartment.

- Technical passport and explication.

- A certificate from the tax service on the absence of tax debts.

- Certificates from housing and communal services and management companies about the absence of arrears in utility bills.

- Statement of the personal account of the apartment.

- Extract from the house book.

- Extract from USRR.

- The consent of the spouse (wife) to the transaction, certified by a notary.

- Consent of guardians and guardianship authorities to the transaction.

Requirements for the organization that issued the loan

Mortgages are a long-term business. Therefore, it is very important to choose the right banking institution for obtaining a loan. As a rule, borrowers make a decision in favor of a particular credit institution based on the interest rate and down payment. The lower these indicators, the more chances to attract borrowers.

There are many financial institutions ready to lend money secured by real estate ... But how not to make a mistake in choosing, and where to go for money?

It is better to contact large banks with many years of successful experience and an impeccable reputation. And although no credit company is immune from bankruptcy in the long term, but such an outcome is less real for a large, stable market participant. In addition to large banks, you can contact credit institutions that specialize specifically in mortgage programs. A positive feature for the bank is the variety of mortgage programs offered, the availability of its own housing base, partnerships with developers and real estate agencies.

So, an organization that has the right to issue loans can be:

Bank with a valid license;

Consumer Credit Cooperative;

Another organization that provides loans secured by real estate.

Consumer and agricultural cooperatives, as well as microfinance organizations, theoretically capable of issuing a loan, in practice often have a sad mortgage experience - the Pension Fund may refuse to transfer targeted funds to families who have received loans from such organizations.

To secure such a transaction, you should check the credit institution for compliance with the following points:

The charter of the organization should contain the right to conduct specialized activities, with the assignment of the relevant OKVED codes;

It is mandatory to have an approved regulation that allows the organization to issue mortgage loans for the purchase of housing, with subsequent partial repayment by means of a state subsidy;

The result of the transaction should be an improvement in the living conditions of the family that applied for a mortgage loan;

If, nevertheless, a refusal is received from the PF to repay part of the mortgage with a parent certificate, you can appeal this decision by going to court.

Military mortgage + maternity capital, can it be used together

Both the military mortgage and matkapital are special government programs to support Russian families. Servicemen, using the program of accumulative mortgage lending, can solve the housing problem and, before being transferred to the reserve, purchase housing as a property.

And if the family of a serviceman participating in the NIS has the right to receive another type of state support, maternity capital, can he combine the financial capabilities of the two programs?

The law does not prohibit such a combination of amounts. But families who decide to use both programs together face many difficulties in practice - they are presented in the table.

|

Military mortgage limit |

It will not be possible to increase the size of the maximum possible loan under the NIS with the parent certificate, the law establishes the maximum loan amount for military mortgage |

|

Difficulties with choosing a bank |

A credit institution must work simultaneously with two programs |

|

joint ownership |

Housing purchased as a result of combining the two programs must be registered as a common property, in equal shares for all family members |

|

Registered marriage |

To merge programs, the military member and the spouse who gave birth to the second child must be officially married |

|

Territorial issue |

Housing under two programs, can only be purchased in the territory of the Russian Federation |

But the main problem of combining the two instruments of financial public assistance is that these issues are dealt with by two different organizations. And this means that the family will have to simultaneously communicate with two different authorities and establish interaction between them.

In case of early dismissal of a serviceman, a member of the NIS, and his inability to independently pay the target loan and pay off obligations to Rosvoenipoteka, there is a risk of being left without housing - the property may be put up for public auction. If a combination of two programs was used, maternity capital will be lost!

Reasons for refusal to repay a mortgage loan by mother capital

What to do in cases when the branch of the Pension Fund refuses to accept an application with documents? The refusal must be reasoned, here are its main reasons:

An incomplete set of documents has been submitted, or the fact of their unreliability has been revealed;

The applicant is deprived of parental rights by a court order;

The amount on the application is more than the face value of the family certificate;

The method of spending targeted funds indicated in the application is not provided for by law;

Suspicion of obtaining a certificate illegally;

Acquired housing does not meet the requirements, the housing rights of children are violated;

The organization that issued the loan does not meet legal requirements.

The refusal can be challenged in court by issuing a statement of claim.

In addition to the above issues, upon receipt of the application, the employees of the Pension Fund must check whether the child's guardianship authorities have taken away the child from the parents, whether crimes against the child have been recorded, and the fact of the adoption is also checked.

The nuances of using maternity capital

The certificate does not expire, the holder can use it at any time.

When it comes to paying off a mortgage, it is important to be aware of the following nuances.

You can send funds to partially pay off the debt, and you can pay off the interest immediately after obtaining the right to maternity money, without waiting for the child to be three years old. The funds under the certificate will be credited against overdue debts, but various penalties, fines and penalties will not be paid with state support funds.

But the main problem is that the amount of mother's capital of 453,026 rubles is often not enough to buy your own home - you need to take a mortgage and pay it off with something. And you can get bank approval only if the family has a stable income.

In practice, it is not uncommon for spouses to file for divorce by the time the mortgage is fully paid. In this case, the allocation of a share will still be required, especially if the former spouses continued to pay the loan together. But you need to be prepared to resolve such issues in court.

Tip: after the full repayment of the mortgage loan, take a certificate from your bank branch confirming the fact of the complete closure of the debt. There are frequent cases when there is a "penny" outstanding debt, 100-200 rubles, on which serious penalties are wound up, increasing the balance of the debt to tens of thousands of rubles.

conclusions

So, one of the permitted and most popular ways to use maternity capital is to improve the living conditions of the family. Most often, state support funds are used to partially pay the principal debt on a mortgage; it is also allowed to use the amount as a down payment on a mortgage loan and to pay off interest on a mortgage.

Since a mortgage is a serious matter, with long-term prospects, it is important to soberly assess your financial capabilities and choose the right bank that works with the maternity capital program. It is better to opt for a large credit organization with many years of experience and an impeccable reputation.

Having collected a complete set of documents necessary for the transaction, you should contact the Pension Fund branch and submit an application. It happens that the Pension Fund refuses to set off maternity capital as payment for a target loan - the refusal must be lawful and reasoned, it can be appealed in court.

With the joint use of maternity capital and military mortgage programs, you can significantly reduce the burden of monthly loan payments, or shorten the loan period. But, in the event of early dismissal of a serviceman, you can lose both the acquired housing and family capital.

You can send matcap for partial payment and repayment of interest on the loan without waiting for the child to be three years old. But as a down payment, a family certificate is used only after the baby reaches the age of 3 years.

In the event of a divorce of the parents-co-borrowers, the mortgage will have to allocate a share to the former spouse, who continued to pay his part of the loan after the dissolution of the marriage.

Registration of a certificate for family capital after the birth of a second child provides an opportunity to direct the money allocated from the state budget for various needs. Moreover, the repayment of mortgages by maternity capital is becoming increasingly important, because in most cases citizens cannot afford to pay the entire amount of the cost of housing at a time. However, in order to use the funds, you will need to meet a number of conditions and, in general, have an idea of \u200b\u200bhow the certificate implementation procedure takes place.

Is it possible to use maternity capital to pay off a mortgage?

State support in the form of a certificate for a fixed payment is due to families after the birth of the second or each subsequent child. Moreover, this financing option is now considered the most popular, because most parents, in principle, will not interfere with financial assistance. Simply put, no one will refuse the opportunity to reduce the burden on the family budget.

The maternity capital project was launched back in 2007, and now the program has been extended until 2021. The amount due to applicants is 453 thousand rubles. Moreover, temporarily the value is not subject to indexation due to difficulties in replenishing the state budget.

The maternity capital project was launched back in 2007, and now the program has been extended until 2021. The amount due to applicants is 453 thousand rubles. Moreover, temporarily the value is not subject to indexation due to difficulties in replenishing the state budget.

However, despite the fact that the amount of family capital cannot be increased, the program has not lost its relevance at all. True, potential recipients of the certificate have many questions related to the options for spending money. Moreover, often citizens are interested in whether it is possible to spend funds to repay a mortgage loan.

And here it is worth turning to federal law No. 256-FZ. The legal act clearly indicates the areas in which it is allowed to spend family capital. One of them is the possibility of improving living conditions (paragraph 10).

It is allowed to spend funds on:

- buying a house or apartment;

- erection of a private building.

Since mortgages give people the chance to purchase square footage without a global hit on the budget, it is seen as one of the ways to improve existing living conditions. For example, buying an apartment is an order of magnitude larger than the previous one. Accordingly, it is quite possible to use maternity capital to pay off a housing loan. True, one way or another, it will be necessary to comply with certain conditions and meet the requirements of the bank and the FIU that provides funds under the certificate.

Mortgage loan payment methods

Clause 6 of paragraph 10 of Law No. 256-FZ explains exactly how it is allowed to spend family capital or part of it when it comes to repaying a mortgage loan. Funds can be implemented as follows:

- Spend on paying the first installment on a home loan.

- To pay off the principal amount of the debt. This method will reduce the body of the loan, and therefore reduce the amount of the mandatory payment or the repayment period of the mortgage itself.

- Pay interest on a loan. In fact, this procedure is rarely used. Usually, this method is chosen by persons planning to close the loan ahead of schedule in the future.

It is interesting that these possibilities can be grouped. In addition, now the possibility of repaying a mortgage with family capital has also appeared for those families that have issued a loan before the right to a certificate arises, in other words, before the birth of their second offspring.

When you can't use a certificate

It is important to understand that the direction of family capital to pay for a mortgage is possible only if we are talking about buying a home or building one from scratch. If, say, a family wants to take out a regular loan, for example, to purchase some kind of equipment, they will have to cover the debt on their own. Simply put, if the basis for issuing family capital is the need to pay for a standard consumer loan, no funds will be provided.

In addition, it will not be possible to spend capital for the following purposes:

- making monthly payments on a mortgage loan (this issue is being discussed and, probably, in the near future the direction will be open to certificate holders);

- repayment of fines and penalties for late obligatory contributions.

Do not forget that the state very vigilantly monitors the implementation of the norms of the law, preventing the waste of budget funds. Therefore, any attempts to use the certificate outside the scope of legalized capabilities are strictly suppressed and punished.

The main requirement for applicants for the implementation of a family certificate is the presence of a second child (native or adopted). If at his birth or upon the fact of his adoption into the family for education, the right to funding was not realized, it is allowed to use the funds at the birth of the third offspring, as well as each subsequent one. In other words, if there is only one child, the certificate will not be issued.

The main requirement for applicants for the implementation of a family certificate is the presence of a second child (native or adopted). If at his birth or upon the fact of his adoption into the family for education, the right to funding was not realized, it is allowed to use the funds at the birth of the third offspring, as well as each subsequent one. In other words, if there is only one child, the certificate will not be issued.

Other conditions include:

- real estate must be located within the Russian Federation;

- housing purchased or already purchased with credit funds must be jointly owned by all family members without exception (spouses and all children) six months after the loan is closed;

- funds are transferred to the bank account in a single payment, splitting the amount into several parts or issuing it in cash is not allowed.

And one more important nuance - to repay a mortgage loan, it is not necessary to wait for the child's third birthday. Funds can be used at any time. Although with respect to most of the areas in which the spending of mother capital is allowed, the rule is still valid.

In addition, in a separate order, it will be necessary to study banking programs for mortgage loans. It is important to find out in advance whether the chosen financial institution works with maternity capital and whether it allows repayment of the loan using its funds.

Interestingly, in most cases, banks do not refuse to pay interest or the loan body. But if we are talking about the down payment, problems can arise. This is due to the duration of the transfer of funds, because the mother capital is not issued in cash. Due to potential delays, some financial institutions are wary of customers wishing to use a certificate.

However, large and trusted banking organizations, most likely, will meet halfway in this matter. Especially if, according to other criteria, the client is ideal. But in any case, the use of mother capital is allowed only upon notification of the bank and obtaining the appropriate consent from it.

How to implement a certificate

The use of family capital funds is possible only with the approval of the Pension Fund. It is here that a request for the implementation of funds under the certificate is submitted.

The general algorithm of actions is as follows:

- preparation of documentation for the FIU (an important part of the documents is paperwork from the bank that provided the mortgage loan);

- a visit to the Pension Fund in order to apply for the use of a maternity certificate.

Further, the interested person is required to wait for a response from the FIU. The responsible commission is given 30 days for this. If the decision is positive within another 15-30 days, the funds will be transferred to the account of the financial institution.

In case of incomplete coverage of the amount of the mortgage loan, its owner will need to submit an application to the bank with a request to provide a new payment schedule. If the mortgage is repaid in full, it is worth requesting a certificate certifying the fact that there are no obligations to the credit institution.

What papers will need to be prepared

A request for the provision of mother capital funds for the repayment of a mortgage loan is submitted to the Pension Fund of the Russian Federation at the place of permanent registration of the certificate holder. The latter personally fills in the application form, which can be obtained on the day of the application.

Along with the completed request form, the submitter must provide the following documents:

- passport;

- certificate;

- an agreement on obtaining a mortgage loan, and the purpose of the issuance of funds must be indicated in the agreement - the purchase of housing, construction;

- a certificate from a financial institution indicating the balance of the debt and interest;

- real estate purchase agreement;

- documentation certifying the existence of ownership rights to an immovable object (extract from the USRN);

- birth certificates for each child;

- an obligation to transfer housing into common ownership, certified by a notary.

If the mortgage was issued to the spouse, his identity card will be required, as well as a certificate of fixation of the family union.

Certificate for maternity capital (in 2019 it is provided in the amount of 453026 rubles) can be used on the principal and interest on a targeted mortgage loan or a loan taken to purchase a home, but for this a series of . In order for the capital to pay a mortgage, the owner of the certificate must submit an application for disposal to the Pension Fund (PFR), attaching the relevant ones to it. It can be done before that how from the birth or adoption of a second or subsequent child will pass three years.

After the mortgage is paid in full and the encumbrance is removed from the dwelling, the owner of the dwelling owes his spouse (wife) and children, according to.

Photo pixabay.com

Is it possible to pay off a mortgage with maternity capital?

Maternity capital is allowed to be used for the payment, repayment of the principal debt and interest-bearing debt on a mortgage-secured housing loan or loan. According to part 6.1 of Art. 7 of Federal Law No. 256-FZ of December 29, 2006 on measures of state support for families with children, you can do it immediately after receiving a personal certificate, wait 3 years from the date of birth or adoption of a child, with the advent of which the right to mother capital arose, not necessary.

If housing was purchased with consumer credit funds, then the Pension Fund will not approve management of mother's capital. The owner of the certificate will have to prove in court that the loan was used to improve housing conditions.

A mortgage credit (loan), for the repayment of which family capital funds will be directed, can be issued before the second (subsequent) child was born or adopted.

To draw up a document to a notary must be provided:

- passport of the Russian Federation of the person giving the obligation (persons, if both spouses are indicated in it);

- birth certificates of all children;

- Marriage certificate;

- certificate for MSC;

- documents establishing the right to residential premises (purchase and sale agreement, equity participation, etc.);

- mortgage agreement;

- extract of ownership from the USRN;

- adoption certificate - if the children were adopted.

Depending on the situation, the list of documents may change, so it is necessary to consult in advance. with a notary.

The obligation may be given:

- certificate owner;

- his spouse (wife);

- by two parents (adoptive parents), if both of them are indicated as owners in the sales contract or loan agreement.

Every notary on one's own sets the price for this service. The maximum cost can be found on the websites of regional notary chambers.

If both parents are indicated in the obligation, then each of them must pay the fee.