Nikolaev I.A. - Financial director. - 2009. - No. 5.

Today, not a single company is insured against overdue and bad debts. Nevertheless, the risk of their occurrence can be significantly reduced if the dynamics of receivables is modeled in advance and credit limits allocated to counterparties are calculated on its basis.

What level of accounts receivable will be acceptable

Before negotiating with customers to reduce payment deferrals, credit limits, etc., the CFO will have to answer a key question: how much receivables can a company afford? An unsystematic approach to changing limits and terms for deliveries with deferred payment threatens to result in the loss of a significant share of customers or liquidity problems for the company. On the contrary, knowing the equilibrium level of receivables and the volume of sales planned for the corresponding period, it is possible to change the credit policy of the company reasonably.

To do this, you need to model the future structure of the assets and liabilities of the company's balance sheet. It would be incorrect to consider the amount of receivables that was formed at the end of last year as acceptable. For the vast majority of companies, sales volumes fell, and the share of loans and payables in the liabilities side of the balance sheet decreased. In such conditions, the amount of receivables simply cannot remain unchanged.

Therefore, the company's balance sheet is adjusted taking into account existing market trends and management's forecasts. In other words, it remains to be determined how the main balance sheet indicators will change in the near future (for example, at the end of the year) and, most importantly, the amount of receivables. Further measures to work with debtors - tightening the credit policy, reducing the share of sales on credit will be taken taking into account the figure received on the line "Accounts receivable".

Example

The consolidated balance sheet of the company is presented in Table. 1. With the development of the crisis, the situation in the company and in the market that the company is developing has changed dramatically. The leaders of the company came to the conclusion that the following changes are coming.

1. Due to the fall in demand, the turnover will decrease, which will lead to a decrease in the receipt of money from buyers. The balance of funds in the accounts will eventually be reduced by 35 percent.

2. A decrease in revenue will lead to a decrease in purchase volumes. In connection with the tightening of the credit policy of suppliers, the reduction in accounts payable will be even more drastic than the decline in sales, and will amount to 50 percent.

3. A decline in purchases will lead to a decrease in stocks of raw materials in the company's warehouses, and a reduction in production will lead to a decrease in stocks of finished products. The total amount of inventories, according to management's estimates, will be reduced by 30 percent.

4. Banks will freeze credit lines provided to the company, and previously taken loans will have to be repaid ahead of schedule. Under the most pessimistic scenario, the amount of debt on loans and borrowings will be reduced to zero.

By reflecting all these changes in the balance sheet, it is possible to simulate the financial position of the company at the time of the crisis (see the second part of Table 1) and the allowable amount of accounts receivable - it will be 235 million rubles - 41 percent less than before.

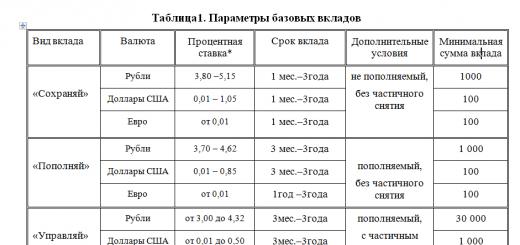

Table 1. Enlarged balance sheet, rub.

| Assets | Liabilities | |||

| Actual data for the previous year | Cash | 100 000 | Accounts payable | 600 000 |

| Accounts receivable | 400 000 | Credits and loans | 200 000 | |

| 1 000 000 | Equity | 1 000 000 | ||

| fixed assets | 300 000 | |||

| TOTAL | 1 800 000 | TOTAL | 1 800 000 |

| Assets | Liabilities | |||

| Modeled balance sheet structure | Cash | 65 000 | Accounts payable | 300 000 |

| Accounts receivable | 235 000 | Credits and loans | 0 | |

| Stocks of raw materials and finished products | 700 000 | Equity | 1 000 000 | |

| fixed assets | 300 000 | |||

| TOTAL | 1 300 000 | TOTAL | 1 300 000 |

Here it should be noted another important aspect of the company's activities, in which it is also necessary to maintain balance - the balance of cash flows. There have been many cases in recent economic practice when companies with positive net assets and good profitability went bankrupt and changed owners only because they could not pay their obligations on time due to lack of money. Therefore, in addition to balance sheet modeling, it is extremely important to pay attention to cash flow models.

How much to believe in debt

After the target level of the company's receivables is determined, as well as the requirements for the volume of receipts, it is necessary to distribute credit limits to customers. This problem can be solved using the indicator of receivables turnover.

The essence of the approach is to expertly assess how the turnover period for each client will change and, taking into account the planned sales volume for this counterparty, calculate the credit limits for buyers using the following formula:

Buyer Credit Limit = Planned Sales: Expected Turnover Period.

After the calculations of buyers' credit limits are performed in this way, the total amount of the average monthly receivables is compared with the target value of the receivables, which was obtained when building the balance sheet model. If it turns out that the amount of limits exceeds the allowable receivables, you will either have to proportionally reduce the calculated limits, or refuse to work with some counterparties.

Example

Data on planned sales volumes adjusted for the crisis and expected turnover rates by customers are presented in Table. 2. In the course of negotiations with representatives of Alpha LLC, it turned out that the counterparty was going to purchase products for 40 thousand rubles a month. At the same time, an agreement was reached with Alfa to defer payment for 34 days (turnover - 0.9 (30 days in a month: 34 days of payment deferral)). Accordingly, Alfa's credit limit amounted to RUB 44,440 (RUB 40,000: 0.9). The total amount of calculated credit limits is 281,993 rubles. Meanwhile, the target value of the maximum allowable level of accounts receivable was 231,000 rubles. Obviously, this is unacceptable and the company will have to adjust such generously allocated limits.

Table 2. Calculation of monthly credit limits by clients, rub.

| Client | Average monthly planned volume of sales to the client, thousand rubles. | Turnover of accounts receivable of the client, once a month | Accounts receivable limit for the year (planned revenue × turnover) |

| OOO "Alfa" | 40 000 | 0,9 | 44 444 |

| ZAO "Gamma" | 60 000 | 1,5 | 40 000 |

| Financial group "Beta" | 90 000 | 0,85 | 105 882 |

| JSC "Omega" | 70 000 | 1,0 | 70 000 |

| GC "Debt" | 26 000 | 1,2 | 21 667 |

| Total | 286 000 | 1,0 | 281 993 |

Revaluation of debtors

If the conditions for working with counterparties have changed (sales volumes, deferred payment terms, etc.), then you need to re-evaluate whether cooperation with them is beneficial for the company. And ideally, to conduct client scoring - to rank buyers according to the level of income that they bring to the company. Accordingly, those customers whose rate of return will be minimal will be deprived of the right to use deferred payment. The scoring is based on the following formula:

Client's profitability = Turnover × (1 - 1 / (1 + Percent markup) - Individual discount - (Receivables collection period: 30 days) × (Price of capital (cost of credit resources) / 12 months) - Share of variable costs in turnover) .

But in the current conditions, it is justified to make some amendments to this formula.

First, the turnover indicator is multiplied by a correction factor that characterizes the probability of non-repayment of funds by the buyer. Let us immediately make a reservation that it is impossible to determine the coefficient of non-return of funds otherwise than by the expert method. In practice, most often it is set as follows. For example, according to financial statements, the percentage of uncollectible receivables is 10 percent. It is from this value that they proceed, determining the coefficient of non-return of funds. For example, if the risk that the debtor will not repay its obligations is slightly higher than that of others, the average default risk ratio can be increased, for example, by 20 percent to 12 percent. Conversely, if it is a proven trusted client, the average risk ratio will be reduced by 50 or even 80 percent.

Secondly, the price of capital should be adjusted taking into account the current rates of attracting financial resources and the possibility of attracting them by the company in the current conditions.

Thirdly, the period of collection of receivables (receivables turnover in days) is taken not according to the actual data of previous periods, but taking into account a conservative expert assessment of this indicator.

Example

An example of calculating the profitability of clients, taking into account the risk of non-return of funds, is presented in Table. 3. Under the given conditions (discount, direct costs, turnover, individual discount, etc.), working with Omega OJSC, the profitability of which amounted to minus 1020 rubles per month, is unprofitable for the company. And if the company refuses the credit limit of JSC Omega, then it will meet the target value of receivables (235 thousand rubles), which was calculated when modeling the balance, and the receivable will be 211,993 rubles (281,993 rubles - 70,000 rubles .).

Table 3 Calculation of customer profitability

| № | Client | Direct costs, rub. | Markup percentage, % | Individual discount, % | Revenue, rub. | Margin, rub. | DZ collection period, rub. | Price of capital, % | Risk | Profitability of the client, rub. |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 1 | OOO "Alfa" | 33 333 | 30 | 10 | 40 000 | 6 667 | 34 | 30 | 0,12 | 733 |

| 2 | ZAO "Gamma" | 40 000 | 60 | 10 | 60 000 | 20 000 | 20 | 30 | 0,10 | 13 000 |

| 3 | Financial group "Beta" | 69 231 | 30 | 0 | 90 000 | 20 769 | 35 | 30 | 0,12 | 7 344 |

| 4 | JSC "Omega" | 60 870 | 30 | 15 | 70 000 | 9 130 | 30 | 30 | 0,12 | -1 020 |

| 5 | GC "Debt" | 19 259 | 40 | 5 | 26 000 | 6 741 | 25 | 30 | 0,08 | 4 199 |

| Total | 222 693 | 285 999 | 63 307 | 24 177 |

To make a decision, in addition to scoring, you can also use the compilation of a questionnaire for each client with data that allows you to assess the financial stability of debtors and understand how their activities were affected by the crisis. In such a questionnaire, simple questions are quite simple:

- how much the counterparty's turnover has changed (decreased);

- is it possible for the counterparty to receive credit from the bank;

- whether there were problems with payments of this company to other partners;

- whether the terms of payment of the counterparty under the contracts with the company have changed.

By collecting such information, you can understand which clients have become dangerous to give them a reprieve, and with whom you can work on the old terms. Of course, the important question is what sources to get the data from.

First, from the counterparty company itself. If she expects to continue cooperation and work with a delay, then she will be quite willing to share information. The reluctance to provide the requested information already indicates that the policy of working with this partner needs to be adjusted.

Secondly, do not neglect external sources of information - publicly available market information, specialized press, information from third parties. And, finally, the factual data on the payment discipline of the counterparty over the past 3-6 months will give a lot of food for thought.

In practice, for one counterparty company, all the necessary information can be obtained in 2-3 days.

Personal experience

Elena Tyabutova, financial director of OJSC Inmarko

First of all, we use information from the distributors themselves. Our regional managers work directly on the territory of distributors and in direct contact with them. We have previously received reports on their sales, on the condition of the equipment, but often the reports were not entirely correct. This year, we pay more attention to the quality of information about the state of affairs of our partners. Started a project to collect information on secondary sales.

In addition, we compare the performance of distributors and our direct sales affiliates (distributor analogue) in order to identify improvement areas both for our partners and for us. We also monitor information from the market - from partners, from banks, in the media.

Personal experience

Elena Ageeva, Financial Director of Golder Electronics

We monitor all information about our counterparties very, very carefully. Accounting alone is not enough for us. We try to obtain information from various sources. This includes the media (including the Internet), and direct communication with representatives of the counterparty. If this is a retail chain, then it is very useful to visit stores, see the availability of goods on the shelves, the number of customers, etc.

If the counterparty is located in the region, then we try to analyze the general situation in this region (especially if there are any city-forming enterprises and now they have financial problems). We also attend various events and conferences, especially those specialized in our industry. We need to understand what the real state of affairs in the partner's business is, whether he is facing a “technical” default on bonds or something worse in the near future. Any negative information is a signal to revise the terms of cooperation.

Pin on paper

It is clear that it is not enough just to define credit limits, it is necessary to ensure their implementation. Ideally, enter into the accounting system that the company uses, automatic blocking of shipments in excess of the limit.

But far from all companies have accounting systems that have such functionality, besides, today the financial director may simply not have enough time for this work. At a minimum, the calculated credit limits and the procedure for assessing the profitability of customers must be fixed in the credit policy, which should also contain data on the responsibilities of the departments involved in the management of receivables, the sequence of actions of personnel in case of delay in payment, the formats of documents used in the process of managing receivables.

Introduction

A new approach to the calculation of credit limits, proposed by OOO NVP INEK, and its implementation in a new module of the software package (PC AFSKKB), aroused increased interest among banking analysis specialists. One of the main advantages of this approach is that the calculation of lending limits is carried out simultaneously for the entire pool of borrowing banks, and the calculation process takes into account the dynamics of changes in the financial condition of borrowers in the past and possible relationships between them. At the same time, based on the results of practical use, the methodology INEK turned out to be significantly tougher than traditional methods of calculating credit limits. This is mainly due to the fact that modern methods of express analysis of the financial condition of borrowing banks do not directly assess the probability of loan default and are focused on using it in the traditional formula for calculating lending limits. In general, the traditional formula for calculating credit limits excludes the concept of credit risk as such. As a postulate, it is accepted that the limit calculated according to the traditional formula should in itself provide zero credit risk, i.e. the probability that the borrower will not repay such a loan decreases to zero. The INEC approach considers the value of the Synthetic coefficient not only as an assessment of the financial condition of the borrower, but also as an assessment of the probability of repayment of the loan received by him. Unlike the traditional formula for calculating limits, a decrease in the value of the Synthetic coefficient according to the INEC methodology corresponds to an increase in the probability of a borrower defaulting on a loan, which in turn causes a decrease in the lending limit. This reduction in the lending limit, which ensures equal risks for each borrower, occurs much faster than in the traditional limit calculation formula. A modification of the INEC methodology is described below, which combines the main provisions of the traditional lending limit calculation formula and the INEC methodology. The proposed modification of the INEC approach allows using the results of the analysis of the financial condition of borrowers in the same way as they were used in the traditional formula for calculating limits, while lending limits are calculated taking into account the dynamics of changes in the financial condition and possible relationships simultaneously for all borrowing banks. The traditional formula and methodology of INEC for calculating credit limits. Consider the traditional limit calculation formula:

L - calculated credit limit; BL - base limit; C - synthetic coefficient. Base limit - this is the maximum loan amount for a particular borrower for the period under consideration. Synthetic coefficient - reflects the assessment of the financial condition of the borrower, and takes values in the range from zero to one. One corresponds to a good assessment of the financial condition of the borrower, zero - unsatisfactory. It can be seen that the credit limit calculated according to formula (1) decreases relative to the base limit in direct proportion to the decrease in the Synthetic coefficient. with the following formula

L - lending limit; P - the degree of risk (probability of default) of the borrower; Pmin - the degree of risk of lending; Lmax - the maximum possible limit (limit on).

P - the degree of risk of the borrower;

C is the value of the synthetic coefficient.

For example, let the maximum value of the limit allocated for be set at 10 million rubles, and its risk level at the level of 0.01 (1%). If the risk level of a certain borrower is estimated at the level of 0.02 (2%), then its credit limit, in accordance with formula (2), will be 5 million rubles. Those. if the risk of non-return of the borrower doubles relative to the level of risk, its credit limit according to the INEC method will be halved relative to the maximum possible. when the value of the Synthetic coefficient decreases by half relative to unity, the value of the lending limit of such a borrower decreases tenfold already. For example, let the risk level be again set at 0.01 (1%). Reducing the Synthetic coefficient by half will lead to an increase in the borrower's risk, in accordance with formula (3), to a value equal to 0.5 (50%). In turn, such an increase in the degree of risk will cause, in accordance with formula (2), a decrease in the value of the lending limit for this borrower from 10 million rubles, the maximum possible for, to 200 thousand rubles, i.e. already 50 times. For comparison, the same decrease in the Synthetic coefficient in the case of using the traditional formula will, in accordance with formula (1), reduce the value of the lending limit of such a borrower relative to the Basic limit by only two times. Combination of approaches. Recall that according to the INEC methodology for calculating lending limits, the Synthetic coefficient is considered as the probability of repayment of the loan by the borrower. At the same time, the Synthetic Factor used in the traditional limit calculation formula is used as a reduction factor of the Basic Limit, and such a reduction in the limit is considered to reduce the risk of non-return to zero. The last statement raises certain doubts. Rather, it can be assumed that the risk of default in the traditional formula for calculating the limit is reduced to some acceptable value. If this statement is supplemented by the fact that such a risk of default should be the same for all borrowers, then it becomes possible to combine the traditional approach and the INEC methodology. Such a modified approach will make it possible to take into account the dynamics of changes in the financial condition of borrowers and their possible relationships in the traditional formula for calculating limits. If in the traditional formula we take the value of the maximum limit allocated as the Base Limit, then in accordance with formula (1), we can write the following

then in accordance with formula (2)

Consequently, the degree of risk of the borrower (probability of default), in contrast to formula (3), can now be calculated from the value of the synthetic coefficient as

Where P is the degree of risk (probability of non-return) of the borrower; Pmin is the degree of risk of bank lending; C is a synthetic coefficient. Suppose that reducing the limit according to the traditional formula really reduces the risk of non-return to some acceptable value, the same for any borrower. According to the INEC methodology, the risk of default is the same for each borrower and is equal to the following value

Then, in accordance with formulas (4) and (5), the credit limit can be found using the following formula

or otherwise

Thus, the value of the limit calculated according to the INEC method, in this case, exactly corresponds to the value of the limit calculated according to the traditional formula, provided that the limit allocated (Lmax) is taken as the Basic limit, and the borrower’s degree of risk (probability the value calculated according to formula (4). To take into account the dynamics of changes in the financial condition and possible relationships of borrowers, the risk degree (probability of default) of the borrower used to calculate the limits in the INEC methodology is taken using the values of the degree of risk (probability of default) of borrowers for the analyzed period, which can be calculated from the values of the Synthetic coefficient according to the formula (4). The calculation of limits according to the INEC methodology, taking into account the dynamics of changes in the financial condition and possible relationships between borrowers, is described in detail in. 6)). Consequently, the degree of risk of lending should be chosen by a bank analyst based on his subjective assessment of the quality of his financial analysis of borrowers. An example of practical application. For example, consider a pool of borrower banks, consisting of 4 banks of the same size. To assess their financial condition, we will use the express analysis of the system proposed by V. Ivanov. The approaches of the methodology are not considered in this article. Figure 1 shows the dynamics of changes in the Degree of confidence (the value of the Synthetic coefficient) for borrowers, calculated by the PC AFSBK based on express analysis. Accordingly, Figure 2 shows the dynamics of changes in the risk degree of borrowers calculated on the basis of formula (5), provided that the probability of default is set at 0.05 (5%). . Calculation parameters for the INEC methodology:

- The maximum possible loan is 100 million rubles;

- Probability of loan default - 0.05 (5%);

- Restrictions on the calculated limits - not set.

Figure 2 Degree of risk (probability of default) Table 1 shows the results of calculating credit limits for a pool of borrowers. It can be seen that the value of the limits calculated using the modified approach is significantly less than those calculated using the traditional formula. This is especially noticeable for borrowers whose assessment of the financial condition (the value of the Synthetic coefficient) has undergone significant changes over the analyzed period of time (Figure 1).

Table 1 Calculation of lending limits for a pool of borrowers

using modified INEC methodology

Name of the borrower | The current value of the Synthetic coefficient "CALYPSO" | The value of the calculated limit thousand rubles. |

|

(traditional formula) | |||

For comparison, Table 2 additionally shows the values of the Synthetic coefficient for each borrower, calculated according to the lending limits given in Table 1. It can be seen that the application of the generalized approach has led to a significant decrease in the values of the Synthetic coefficient (assessment of the financial condition) of borrowers included in the lending pool, due to taking into account the dynamics of changes in the financial condition of borrowers and their statistical relationships.

Name of the borrower | Synthetic coefficient "CALYPSO" |

Present value | Based on statistics and relationships |

Table 3 shows the estimated values of the current degree of confidence in borrowers and the degree of risk (probability of default) of loans obtained using the modified INEC methodology.

Name of the borrower | Degree of trust | Degree of risk (probability of non-return) |

|

Excluding statistics and relationships | Based on statistics and relationships |

||

Khitrov Pavel

Financial Director of LLC "Steel Industrial Company-M"

Due to the lack of systematic work with debtors, Steel Industrial Company-M faced an uncontrollable increase in accounts receivable and a decrease in liquidity.This problem was solved thanks to:

- creation of a procedure for assigning credit limits to buyers

- and systems of sales staff.

Prior to the introduction of the receivables management system at Steel Industrial Company-M LLC, information on customer debts could only be obtained from primary accounting documents (contracts, invoices). On the basis of this information, it was impossible to determine the amount and period of overdue receivables in the context of clients, which did not allow to control the conscientiousness of the fulfillment of obligations by individual clients.

The lack of a control system for accounts receivable also led to the fact that with an increase in planned sales volumes, sales managers increased accounts receivable by several times, giving products on credit. As a result, in January-February, when sales decreased due to the seasonal factor, the level of receivables exceeded the company's revenue.

Personal experience We had the same. The first inventory of receivables, carried out a year after the formation of our company, showed that it was impossible to understand what supplies were paid for and how much money could be received in the shortest possible time. At the same time, the amounts owed by both suppliers and buyers amounted to millions of rubles. |

Work on the implementation of the receivables management system was started in 2005. Four main areas of work on receivables management were identified:

- planning the amount of receivables for the company as a whole;

- management of buyers' credit limits;

- control of receivables;

- employee motivation.

Accounts receivable planning

When compiling the company's annual budget, the planned level of receivables is determined in several stages. The allowable amount of receivables should not exceed 50 million rubles. This limit was determined based on the accumulated statistics of the enterprise for previous years. It is believed that if the set sales plan is fulfilled, then if there are receivables not exceeding 50 million rubles, the company will not experience an acute shortage of funds.

Personal experience At the plants of our holding, the planned volume of receivables is limited to 10-15% of sales. In fact, taking into account the specifics of production for each contract, an individual schedule of mutual settlements with the counterparty is maintained. Contracts, as a rule, are long-term, according to them, shipment volumes, terms and amounts of payments are known. Therefore, when planning, actual contract schedules with buyers, as well as suppliers working on a prepaid basis, are taken into account. |

When forming the company's annual budget, the receivables limit can be revised, and, as a rule, in several stages.

The head of the commercial service, after analyzing the terms of the contracts concluded for the planned year, proposes to increase the volume of receivables in excess of a fixed amount. After that, for receivables in excess of the established limit, the cost of maintenance is determined - the company's expenses for servicing bank loans attracted to replenish working capital. When calculating the cost of maintenance, the highest interest rate of the entire loan portfolio of the company is applied. Then the additional sales volume for the current year is determined. It is assumed that these costs should be covered by profit from additional sales volume (in excess of the plan).

Example

Fixed level of receivables - 50 million rubles.

The planned sales volume is 1,500 million rubles. (50% growth is laid down).

The level of accounts receivable, at the suggestion of the head of the company's commercial service, should be increased by 50 million rubles. The cost of maintaining additional receivables is 6.5 million rubles. (50 million rubles x 13%, where 13% per annum is the cost of the company's credit resources).

The volume of sales required to cover the cost of maintaining additional receivables is 130 million rubles. (6.5 million rubles / 5%, where 5% is the average return on sales).

As a result, the requirements of the head of the commercial service can be satisfied, provided that the planned sales volume is 1,630 million rubles. (1500 million + 130 million).

The planned sales volume, determined taking into account the increased limit of receivables, is agreed with the head of commercial departments.

Buyer Credit Limit Management

In most cases, work with a new client begins on a prepaid basis. After the statistics of payments and deliveries for the counterparty has been accumulated, he can be granted a credit limit.

Distribution of credit limits

The credit limit (the maximum allowable amount of receivables) is set for each of the commercial departments of the company, allocated according to the industry principle, in proportion to the share of revenue for the previous period in the total sales of the company and is approved by the order of the General Director. According to the same scheme, the distribution of limits among managers working with buyers takes place. Each of the managers, in turn, must distribute the credit limit received by him among the clients. As a rule, for new customers who work with the company for no more than six months, the credit limit is set at an amount not exceeding the average monthly sales volume. For counterparties working with the company for more than six months, the credit limit is set by the manager and is mandatory approved by the credit committee. Such a limit is accepted or rejected based on the data of the report prepared by the financial controller. The report contains the following information on the client:

1. Name of the client.

2. Date of commencement of work with the company.

3. Department (manager working with the buyer).

4. Profitability of the client.

5. Reliability of the client.

6. Average delay for a client, days.

7. Reliability of business, points.

8. Marginal profit, thousand rubles.

9. Number of shipments.

10. Number of shipments that are overdue.

11. Credit limit (if set), thousand rubles

Most of these indicators are used by many companies when deciding on the size of the credit limit. Let us dwell in more detail on the indicators of profitability, reliability of the business and the client.

Profitability of the client. This indicator is determined by comparing the markup of a particular buyer with the weighted average markup for all customers. If the debtor's margin turns out to be higher, he is assigned the status "profitable", if lower - "unprofitable". The use of the markup value in determining the profitability of the buyer without taking into account the volume of sales is due to the fact that the company has limited storage space and all stocks are sold in a month. Taking into account that all products will be sold, it is more profitable to work with companies that have a higher margin.

Drawing. Buyer Strategies

Client reliability. Based on the payment statistics for each client, a weighted average late payment period is calculated, which is then compared with the allowable period (5 days). Clients with a delay of less than five days are assigned the status of "reliable". For example, a buyer for three deliveries has the following payment statistics:

- delivery "A" - the amount of 1000 thousand rubles, delay in payment of 5 days;

- delivery "B" - the amount of 100 thousand rubles, delay of 15 days;

- delivery "B" - the amount of 500 thousand rubles, timely payment.

The average delay in this case will be 4.06 days (1000 thousand rubles x 5 days + 100 thousand rubles x 15 days + 500 thousand rubles x 0) / (1000 thousand rubles + 100 thousand . rub + 500 thousand rubles), therefore, this client will be classified as "reliable".

The allowable late payment period is set to reduce the risk of bias in relation to a particular client. So, if the company's average delay in payments turns out to be quite long, for example, 20 days, then a client who has delayed payment for 19 days may fall into the category of reliable ones.

According to the author, it is acceptable to use the median method when determining the allowable delay period. For example, if the delay time for five customers is 1, 2, 4, 7, 10 days, respectively, then the average period will be 4 days.

Business reliability. This indicator characterizes the reliability of the business of the debtor company and is estimated in points. The main source of information in determining it is the buyer's financial statements, submitted upon request. First of all, the presence of the debtor's fixed assets is analyzed. Their absence may lead to a refusal to provide a credit limit, since in the event of a bankruptcy of a client, the company will not be able to compensate for losses at the expense of his property.

The second most important indicator is the dynamics of accounts payable. Its increase for half a year by two or three times indicates that the company may experience a solvency crisis, and the loan will not be provided.

In addition, the duration of the buyer's work in the market, the growth rate of revenue and profit, as well as additional information from the sales manager who traveled to the client's office or enterprise are taken into account. Based on the results of a comprehensive analysis, the credit committee issues a score from 1 (“Business is unreliable, the threat of bankruptcy”) to 5 (“Very reliable business”).

Category 1 customers do not receive products on a deferred payment basis. Clients of category 2 (“Business is unreliable”) are considered risky, but they can be set a credit limit that does not exceed the marginal profit of Steel Industrial Company-M for this counterparty over the past six months, provided that other indicators of work with this company meet the requirements .

As a result of a collective discussion at the credit committee, based on the indicators of profitability, reliability and the previous volume of purchases, a credit limit for the client is established. The credit committee also adopts a strategy for working with one or another counterparty, depending on its profitability and reliability. Steel Industrial Company-M has identified four types of strategies for working with customers (see figure).

Using the described work strategies, the company can increase the volume of income and liquidity of the business.

Review of credit limits

The credit limits that may be provided by commercial divisions to customers are reviewed quarterly or semi-annually, depending on the situation on the metals market.

To revise credit limits, the indicator “Receivables Management Efficiency Ratio” (K ef.upr.dz) is used, which is calculated as follows:

K ef.management = (Average markup for the company / Average markup for the department) x (Average delay for the company / Average delay for the department).

The credit limit can be increased to the subdivision that, based on the results of work for the quarter (half year), received the highest indicator K ef.upr.dz. The subdivision, for which this indicator has the lowest value, the credit limit is reduced by the same amount.

By analogy, the credit limits of buyers with whom a particular commercial unit works are revised, but when calculating the efficiency ratio of receivables management, the formula changes somewhat:

K eff.control.dz \u003d (Average margin for the department / Average margin for the client) x (Average delay for the department / Average delay for the client).

Accounts receivable control

The financial controller daily enters data on payment for previously made shipments into the company's information system, which generates reports on customer debt. Reports on the status of receivables are generated in the information section "department - manager - client - accounts". They include information on the amount and date of shipment, the number of days of grace granted, the date of payment according to the plan, the amount paid and the amount of debt, the amount of overdue payment and the number of days overdue. A consolidated report is generated for the company as a whole, in which clients are divided into groups depending on debt limits and the number of days overdue for each of the payments 1 .

All operations for the management and control of receivables are automated using the company's own software development. The automation information system allows you to control more than 200 debtors of the company every day, spending about 20 minutes a day on it. During the use of this system, the number of debtors has more than doubled, but manageability has not decreased.

Personal experience The control of the level of the credit limit of our company is carried out with the help of our own software development, created on the basis of "1C: Production Enterprise Management 7.7". If the payment deadline is missed, then shipments are suspended. The commercial department is given three days to solve the problem - the so-called "reaction time", then the client automatically enters the "stop list". For key clients, the response time is up to 10 days, but if the problem is not resolved within the allotted time, the client also falls into the “stop list”. Sometimes there are up to 100 companies in it. As the company's analysis showed, in most cases, the reason for late payments is not the difficult financial situation of the client, but the desire to use the seller's funds to finance their own activities. At the same time, company employees can refer to the inefficient work of the treasury, as well as to the forgetfulness and absence of key employees. In most cases, you can avoid such situations by sending a letter to customers notifying them of the need to pay off the debt. LLC "Steel Industrial Company-M" has developed standard forms of letters, the terms of sending and the content of which depend on the category of the client (new, reliable, VIP), as well as on the duration of the delay in payment. Letters are sent at the request of the financial director, but the opinion of the commercial director is taken into account. Letters can be sent to customers before the due date of payment (3 days in advance - reminder), after 3 and 5-10 days after the due date of payment (see figure). |

The motivation system for employees of commercial divisions

The motivation of employees of commercial divisions is based on the possibility of redistributing credit limits. A department that provides the company with a high level of margins with a minimum delay in payment gets the opportunity to increase sales. At the same time, the remuneration of managers is a fixed percentage of sales volume and accordingly increases with effective management of receivables.

At the same time, if the credit limit allocated to the department is exceeded, a fine is imposed on the head. The amount of the fine is determined as the product of the amount of exceeding the credit limit by the refinancing rate of the Central Bank of the Russian Federation and by 10%.

Expert opinion

Sergey Shebek

General Director of Pelikan Consulting Group CJSC (Moscow)

The receivables management system implemented in the company is highly commendable. The system covers three main areas in this area of financial management - planning and regulation of the amount of accounts receivable, control of its condition, work with unscrupulous debtors. We can recommend system developers to pay attention to two points.

First. It would be useful to classify the company's clients according to the business model they use. The trade and purchasing base, an industrial enterprise that purchases metal for the production of its main products, and a manufacturing company that buys rolled metal for its own consumption differ quite significantly. Such a classification would allow a better understanding of clients, the formation and use of differentiated methods for assessing their status and lending conditions.

Second. The authors of the system emphasize that the reasons for late payment of bills can be simple negligence, forgetfulness, poorly organized work of the treasury. In relation to this category of debtors, it is proposed to carry out methodological “sponsorship assistance”: to develop and transfer to clients drafts of internal regulations (memos) that determine the procedure for working with accounts payable, accepting and monitoring payment of invoices.

What makes a company provide commodity loans to its counterparty partners? Competition is forcing many companies to increasingly offer their customers sales with deferred payment. And if the purpose of deferred payment for the supplied goods, services is to increase sales volumes, then the reverse side of this "medal" is an increase in the volume of doubtful debts. Therefore, it is necessary to realistically assess all the advantages and losses, take into account the positions of competitors and develop the most flexible policy in this matter.

Methodology for analyzing the financial condition of a company

Very often, a company uses formal and informal methods to assess the financial condition of its counterparty.

Formal methods include:

obtaining the entire package of constituent documents;

obtaining current financial and economic reports on the company's activities;

verification of the powers of persons signing credit agreements, making this transaction;

analysis of the financial statements of the future credit partner (on the basis of these statements it is possible to calculate certain

coefficients: solvency, liquidity, turnover, etc.).

Also, together with a marketer and a specialist in the sales department, a financial specialist who assesses the state of the counterparty can take into account the general processes and trends observed precisely in the area where the company operates, for which the possibility of providing a commodity loan is being considered. If there is such an opportunity and a history of relationships with the company, it is necessary to analyze the existing experience of working with it (the dynamics of its development, the history of payments, sales, the absence of delinquency on previously granted commodity loans, etc.).

Based on all these data, an analytical report is prepared for the person making a decision on a commodity loan, characterizing the financial condition of a potential borrower. However, it is not worth placing so many hopes on the counterparty's current accounting data. Often they do not allow to properly assess the reliability of the company, and therefore it is possible to recommend the mandatory use of methods of informal assessment of the financial condition.

The informal methods are obtaining information about the counterparty from other sources (its suppliers, partners, buyers, etc.), it is necessary to evaluate assets (including those related not only to the counterparty itself, but also to persons affiliated with it), etc. Very often, such a function of "informal assessment of the counterparty" is assigned to the company's security service. And only after such a comprehensive and comprehensive analysis, it is possible to make a decision, according to the ABC analysis, to classify this client as a group of reliable, medium-reliable and unreliable counterparties. In order to make a subsequent decision on the advisability of its commodity lending.

The procedure for calculating the term and amount of commodity credit

What is the procedure for calculating the term and amount of commodity credit? The accuracy and correctness of the calculation of the term and amount of the maximum allowable receivables directly affect the economic security of the company, and these calculations must be approached with all seriousness and care.

To begin with, we calculate the optimal repayment period for receivables using a number of coefficients:

1) the actual term of turnover of receivables (turnover ratio):

Of \u003d V / DZ,

Where:

Of - the actual turnover of the company's accounts receivable;

B - gross revenue for a certain period (for example, a quarter), rubles;

DZ - the average amount of receivables for a certain period (quarter), rub.;

2) the period of repayment of receivables:

Pdz \u003d T / Of,

Where:

Pdz - period of repayment of receivables, days;

3) the turnover period required for the planned increase in revenue:

Op \u003d V / Pdz,

Where:

ABOUT n - turnover for the required increase, days;

4) the period of turnover necessary to achieve the required increase:

Cn \u003d T / Op,

Where:

Sp - the period of turnover of revenue growth, days;

T - duration of the analyzed period (quarter), days;

5) the optimal turnover period required to achieve the required increase in revenue:

Sdz \u003d Pdz - Sp.

You can also use a simpler formula for calculating the optimal term for granting a deferred payment: the average turnover of receivables (calculated according to the above formula) should not be higher than the average turnover of accounts payable, otherwise the company will face the problem of lack of working capital.

IN dz = O rk x K 1x (D To + D PC ),

Where:

Vdz - the maximum amount of receivables, rubles;

Ork - the planned volume of sales on credit, rubles;

K1 - coefficient of marginal income, times;

Dk - the average number of days of delay, days;

Dpk - the average number of days of delay, days

After all these parameters, which are optimal for the company as a whole, have been determined, it is already possible to calculate the amount and duration of credit resources in the context of each group of customers.

Accounts Receivable Service Costs

The financier must also remember that in the case when the company provides its customers with the opportunity to pay for the received goods, works and services in installments (commercial loans), it incurs some additional costs. These costs can be divided into three groups:

financing costs;

management costs;

expenses arising from late payment of accounts receivable

Financing costs arise because in the case of providing commercial loans to customers, the company finances these loans either at its own expense, which could be reinvested in goods or production, or at the expense of borrowed (borrowed) funds.

Management costs are made up of the costs of maintaining additional personnel who are engaged in maintaining client accounts, the need to purchase

additional office equipment, software, etc.

Expenses arising from late payment of invoices, also consist of overhead costs (registered letters to customers who are late in payment; telephone expenses, etc.), financial losses in the sale of receivables to a third party and costs directly related to a possible court case: payment for services

lawyers and lawyers, court fees.

Methodology for the analysis of receivables

In order to correctly assess all trends related to receivables, every financial manager must be able to analyze the scorecard associated with receivables. First of all, this is the value of the receivables turnover period (V / Dz). If this ratio has decreased compared to the previous period, it means that the company has reduced sales on credit. You should also carefully monitor the period of repayment of receivables. After all, the longer the period of repayment of receivables, the higher the risk of non-payment.

In addition to the above indicators, you should calculate:

7) the share of accounts receivable in the total volume of working capital according to the following formula:

UV \u003d (DZ / CO) x 100,

Where:

DZ - the average value of receivables for the period, rub.;

SO - the average value of working capital, rub.

The lower this indicator, the more mobile the structure of the company's property and the higher the financial stability;

8). the amount of doubtful receivables in the total volume of receivables:

SW.sdz \u003d (SZ / DZ) x 100,

where SZ is the average value of doubtful receivables, rub.

This indicator characterizes the "quality" of receivables, and its growth indicates a decrease in the company's liquidity, an increase in risks.

One of the components of the financial analysis of accounts receivable is the assessment of its real state. When making such an assessment, not only the amount

receivables, but also the date of its occurrence: current (non-overdue receivables), overdue (doubtful) and bad receivables are highlighted. Further, based on the analysis, a register of accounts receivable is compiled, in which all three groups of debtors are identified and any decisions are made for each

group: an active reminder to the debtor of the need for immediate payment, writing off a bad debt, etc.

The frequency of analytical reports of this kind depends on the duration of the cash flow cycle (average grace period). If all deferrals are provided for a sufficiently large number of days, for example 60 or more, then it is advisable to draw up this report no more than once a quarter. Although here

you need to remember that you can miss the time to make some operational decisions.

Studies conducted in many countries have revealed a very interesting trend: the longer the period during which the buyer undertakes to repay his debt, the greater the likelihood of bad debt. These probabilities, obtained for each enterprise by expert means, can be used in calculating the real

the value of receivables.

Number of impressions: 43978

29.04.2012

Key words: formula, calculation, trade credit, accounts receivable, accounts receivable, accounts receivable, credit, goods