A potential borrower who is looking for a banking institution to obtain a loan should be clearly aware of what goals he pursues when taking a mortgage program. Serious financial obligations are on the agenda, which are taken on for a long period of time, so you should soberly assess your capabilities. To get a mortgage on favorable terms, you need to compare rates and decide on other factors of the banking program.

What to look for when choosing a lender?

Today, Russia's leading banks offer their clients mortgage programs based on similar conditions. Pay attention to the following factors:

- The period calculated for loan repayments is from one year to 50 years;

- The minimum age of the borrower is 21;

- The maximum mortgage loan amount is up to 85% of the value of the purchased property;

- Down payment - from 10% to 50%;

- The interest rate is from 9.1%.

Each bank has the right to develop and present its own requirements for the size and type of collateral, the characteristics of the borrower (length of service, registration, marital status), etc.

We determine the best offer

When you make a choice in favor of a particular lender, remember that all of these factors can affect not only the final interest rate, but also whether you will be given a loan in principle.

To find the best mortgage offer, follows:

- Explore all mortgage programs from major banks in your area;

- If the interest rate seems extremely attractive due to the low cost, keep in mind that the bank officially marks the bottom bar. When applying, depending on your characteristics and a variety of aggregate conditions, the interest rate can increase significantly;

- You can make the final impression and make the right choice only during a personal appeal to the bank branch, after talking with a representative of the organization involved in mortgage loans.

Questions for a Mortgage Specialist

In consultation with a mortgage specialist, try to find out the following points:

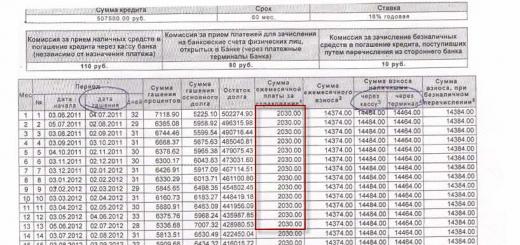

- Is there an option for early repayment of the loan? Is there a penalty for such an action, because some banks provide a fine of 3% of the remaining debt;

- Does a particular bank allow the issuance of a loan to the borrower if the share of the monthly payment is more than 40% of the total income of the borrower or the total income of his family;

- What actions will the bank take if the borrower has delayed the deduction of loan payments for one to several months, etc.

The practice of imposing penalties due to systematic violations of mortgage payments is present in most banks. When choosing a lender, you should find out what exactly threatens you for non-payment (intentional or involuntary).

Some banking organizations initiate trial. If the mortgaged apartment is foreclosed, its further sale may follow, and the proceeds are used to pay off the debt.

In this case, the affected borrower has at least one option: he will be offered rent housing in a specialized hotel-type facility or choose the option of settling in a housing reserve fund intended for mortgage clients who are insolvent.

Such conditions do not apply everywhere, so this is practically the first thing you should ask a potential lender.

Additional expenses

Banks try to make the presentation of mortgage programs as transparent as possible so that the borrower does not have any difficulties in choosing one or another lender.

However, in practice, when taking a mortgage, there are almost always additional expenses, which are due to the following factors:

- If an apartment is taken on a mortgage from the secondary real estate market, an appraisal expertise will be required. It is not free: the price for the procedure varies from three to twenty thousand rubles, depending on the qualifications of the appraiser, the requirements of the bank and the mortgage program itself;

- After determining the market value of the property, the bank calculates its collateral value. Payments on the resulting difference are borne by the borrower. On average, the difference will be about 15% - 20%. So, for example, if an apartment costs about 2 million, the bank will subtract about 15% of this amount (depreciation of housing, sales costs, etc.), providing the borrower with a loan for 1.6 million. It turns out that the additional payment to the owner will be about 380 thousand rubles . This amount is paid by the borrower;

- When taking out a mortgage loan, be prepared for additional costs for a mandatory insurance package. Some banks charge an interest rate for a customer's refusal to purchase life and health insurance;

- Registration of certificates, documents, payment of duties is also an inevitable cost item when taking a mortgage.

The most profitable mortgage programs for 2019

When choosing a lender bank, one cannot start only on whether the lowest mortgage interest rate is offered. The success of obtaining a loan is influenced by many conditions that are described in the programs of banks. At the moment, experts identify five favorites among borrowers.

Sberbank

The leading domestic lender has developed a unique program for borrowers, called "Acquisition of ready-made housing" . Briefly describe its essence in two points:

- Attractively low interest rate - from 10.5% (if the transaction is registered electronically);

- Opportunity to buy an apartment on the secondary market.

To become a member of the program, you must accept bank conditions. Their list includes:

- A loan to the borrower is issued in the amount of 300 thousand to 15 million rubles;

- The borrower can pay off the mortgage for 30 years;

- The initial payment will be one fifth of the cost of the residential property;

- The client must provide collateral.

On formation of an interest rate, according to the Sberbank program, the following factors influence:

- The amount of the first installment;

- Willingness of the borrower to purchase health and life insurance;

- If the applicant is a payroll client of the bank, lower rates apply to him;

- Loan terms;

- If the client provides documents confirming the source of income, this is counted positively for his credit reputation;

- Another factor that determines the size of the interest rate is the liquidity of property provided on security.

Additional advantages of the program include the absence of commission fees and penalties for early repayment. Also on the bank's website there is an online calculator that allows you to determine the approximate costs for the first time.

The name of this Russian bank, unlike its more famous competitors, is hardly heard by most citizens. Nevertheless, the new mortgage program he proposed called "New Building" is really an extremely interesting proposal. If we sum up all the factors, we can assume that this is practically the cheapest mortgage: as an advance, the borrower makes only 10% of the value of the property.

Others program conditions are:

- Client, this does not affect the formation of the interest rate;

- The interest rate does not change after registration of property rights;

- You can take a loan for the first installment from the partners of Promsvyazbank;

- You can use the maternity capital for the first installment.

When applying for a loan, the bank may request to provide two guarantors.

The bank has one of the most loyal programs for potential borrowers, called "Apartment on the secondary market".

IN conditions for issuing a loan includes:

- Lending for a period of one to 25 years;

- As a down payment, 15% of the value of the immovable object is paid;

- A loan can be issued for up to 26 million;

- The credit rate is 11.9%.

If the applicant does not agree to purchase personal insurance, the interest rate will increase by 0.5% - 3.2% (depending on the age of the borrower).

A Raiffeisenbank client has the right to choose:

- Method of loan repayment - depository or transfer to the seller's account;

- When he can receive the loan amount - after signing a mortgage agreement or completing the registration of property rights.

A specialized mortgage bank offers customers the following conditions:

- Rate of 10.75%;

- Advance payment - from 20%;

- The maximum loan amount is 10 million.

Requirements bank to borrowers and real estate:

- Russian citizenship;

- Accommodation in the region where there is a branch of the BZHF;

- The purchased apartment must be located in a building with a height of at least three floors.

pros jar:

- Percentage of approved mortgage applications – 82%;

- When applying for an Express+ mortgage, you can get approval within 24 hours;

- It is possible to take out a mortgage online and/or with two documents (passport and SNiLS).

Having calculated the possible costs and comparing them with the benefits of the BZHF program, we can assume that this is the most profitable mortgage offered (at least in terms of flexibility).

One of the most famous banks in Russia issues a mortgage on the basis of state support. To take a loan, you must have half the amount to buy real estate. The bank will lend the rest of the money at an interest rate of 10.8%. The loan is issued for a period of 12 months to 7 years.

Other requirements and conditions for borrowers:

- An increase in the interest rate by 0.5% with a decrease in the amount of the initial contribution and / or extension of the loan period;

- Loan repayment period - up to 30 years;

- Loan amounts from 3 to 8 million rubles for residents of the capital / St. Petersburg and regions, respectively.

One of the significant advantages of the program is that if the borrower refuses to insure life and health, the interest rate does not increase.

Conclusion

The choice of the most profitable mortgage depends not only on the reputation and conditions put forward by the lender. You also need to determine some points for yourself personally, namely:

- Availability of the amount for the down payment;

- Desired loan amount;

- Mortgage payment period;

- Loan repayment method.

Remember that you cannot act when choosing a mortgage, as when applying for a simple loan. That is, you cannot contact several banks at once, hoping to get approval in some way, and then decide as events unfold.

You may get pre-approved, but the further processing steps are expensive and time-consuming, so you need to choose your lender carefully and without a back-up plan.

Mortgage rates vary from bank to bank. Its value depends on the period for which you take a loan, on the availability of collateral, insurance, commission payments.

Many banks hold temporary promotions, reducing the cost of a loan to purchase a home.

Pledges and sureties

When deciding whether to take out a mortgage, please note that in conditions of market instability, credit organizations set strict requirements for collateral.

Until the moment of registration in the register of ownership of the acquired property, most likely, it will be necessary to issue not only a guarantee from solvent persons, but also an additional liquid pledge - an already existing car or apartment.

"Anti-crisis" mortgage products

Credit institutions are interested in attracting wealthy clients. Mortgage banks are actively offering new products for individuals that are in demand during the crisis, but are quite expensive.

For example, FC Otkritie offers a service for previously issued in other commercial banks. Obligations received in foreign currency are converted, at the request of clients, into rubles. The minimum interest rate on "on-lending" is 13% per annum. It grows if certain conditions for comprehensive services in the bank are not met by the following values:

- +0.25% - for borrowers who are not payroll clients of the bank;

- +1% - for business owners;

- +0.5% - in case of refusal to pay a one-time fee for "reducing" the rate;

- +4% - if life insurance and employment contracts are not concluded.

Also, FC Otkritie offers a loan product called Ipoteka Plus: money is issued against the security of existing real estate for the purpose of its overhaul. Provision of documents confirming the intended use is not required. Interest rate - 16.25% per annum. The maximum term of financing is 30 years.

Loans for the purchase of housing with state support

The most significant parameter when a mortgage is issued is the rate. There is a calculator for calculating the amount of overpayments on the official website of each bank.

The cost of servicing a mortgage is reduced when obtaining a loan under the program of state subsidies for loans for the purchase of unfinished apartments in the primary housing market.

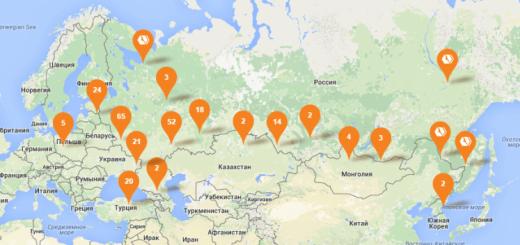

The participating banks are allocated funds from the Pension Fund, due to which they get the opportunity to reduce rates on mortgage loans for the purpose of purchasing apartments in new buildings. Currently, PJSC Sberbank of Russia, Gazprombank, VTB 24, Uralsib, Rosselkhozbank, Promsvyazbank and many other lending organizations have joined the program.

Mortgages with state support can be obtained in the amount of up to 8 million rubles. in the Moscow and St. Petersburg regions, in other regions - no more than 3 million rubles. The longest loan term under the Novostroyka program, according to the rules, is 30 years. Your contribution must be at least 20% of the price of the property that is being purchased.

You can buy square meters with loans received under the subsidy program only from developers approved by banks.

When applying for a loan with state support, an appropriate calculation of the mortgage is carried out. Sberbank sets a fixed interest rate, 12% per annum, before and after registering the ownership of the acquired property in the Rosreestre. In this case, it is mandatory to conclude a life insurance contract for the borrower. For violation of the condition on the annual renewal of the policy, the rate rises to 13% per annum.

In PJSC "VTB 24" you can also get a loan with state support at 12% per annum, with the obligatory execution of a comprehensive insurance contract.

In Gazprombank, the mortgage interest rate is from 11.25% per annum.

In PJSC Bank VTB, a loan "Novostroyka" is issued with an initial payment of 15% of the amount at 11.75% per annum. The decision to grant a loan is made within 24 hours.

In FC Otkritie, the rate on mortgages with state support is from 11.45% per annum, mandatory payments (surcharges) in total do not exceed 2.5% per annum. A large number of construction companies are accredited by the bank.

Loans under the Young Family Program

Another way to get the mortgage rate lower is to apply for a loan under the Young Family subsidy program.

If the age of both husband and wife does not exceed 35 years, and the couple, according to the law, needs better living conditions, it is advisable to contact the district administration. When buying an economy-class house or apartment, the state will pay up to 30% of the price of housing.

In for a young family is usually cheaper. There are fewer incremental factors applied to it.

In the mortgage "Young Family" varies depending on the term of the loan and the size of the down payment.

Interest rates on the mortgage "Young Family" in PJSC "Sberbank of Russia" are presented in the table.

Many commercial banks also have the right to accept housing certificate funds as repayment on a loan, but do not provide interest rate benefits.

However, a mortgage for a young family is now also a means of acquiring a house or apartment at a much lower cost.

How to determine future mortgage costs

When comparing lending conditions in different banks, be sure to ask the manager to prepare a preliminary calculation of the mortgage. Sberbank, VTB-24, FC Otkritie and other banks on their official websites show only an approximate amount of future loan servicing costs.

Check with the responsible person who advises you:

1. Is an appraisal of the acquired property required? If so, at whose expense is it carried out?

2. How much will be the cost of notarization of the transaction?

3. Which of the parties to the transaction pays the state fee at the registration chamber?

4. Will the mortgage rate be higher before the registration of the encumbrance of the pledge in favor of the bank?

5. What will be the additional payments under the loan agreement, in addition to the interest rate?

6. Is it necessary to insure the collateral, as well as the life and health of the borrower? How much will the policy cost?

7. What will be the repayment schedule for the loan?

8. Are there any restrictions on early repayment of a loan?

9. What fines and penalties are provided for by the loan agreement?

Only with complete information, you can decide whether to buy a home right now.

Mortgage from Sberbank for future owners of apartments and houses in the secondary market

Loans to individuals in the country's largest bank remain profitable and inexpensive. Financing for the purchase of a finished house or apartment can be obtained in the amount of 300,000 rubles. for up to 30 years at an interest rate of 12.5% to 16.5% per annum. Your down payment is 20% or more of the price of future housing.

When determining the loan term, your actual age will be taken into account. According to the rules of lending, at the time of the final repayment of the loan, the borrower must be no more than 75 years old.

The loan amount you will be given will be the smaller of:

80% of the purchase price of a house or apartment,

80% of the appraised value of the property.

The acquired real estate is issued as a pledge and is insured against the risks of loss, death, damage without fail.

Upon receipt of a housing loan in the amount of up to 15 million rubles. in Sberbank, it is possible not to confirm the fact of having a permanent place of work and not to provide income statements.

You will not need to pay a commission for issuing a loan.

Until the right of ownership of the acquired property arises, other forms of security must be provided as security for the loan: a pledge of property or a guarantee of solvent persons.

An important advantage of obtaining a mortgage at Sberbank is the possibility of early repayment without additional fees or commissions. However, it will be necessary to notify the lending office in advance about partial or full repayment of the loan.

Calculation of the cost of housing loans in Sberbank

The mortgage rate is lower in the following cases:

- Loan term within 10 years.

- You receive a salary to an account opened with Sberbank

- Initial payment - from 50% and above.

- You have submitted income statements to the bank. Experience at the most recent place of work is at least 6 months. The total period of employment for the last 6 years exceeds 1 year. This requirement does not apply to payroll customers of the bank.

- Life and health are insured in one of the accredited companies.

Approximate mortgage interest rates are shown in the table below.

Added to these rates:

- +0.5% - if you do not receive income to the bank's salary accounts.

- +1% - for the period until the registration of ownership of the acquired property.

- +1% - if the borrower's life is not insured.

Loan products for the purchase of finished housing

Competitive mortgage lending programs in the secondary market are offered by PJSC VTB24. Its main advantage is that the down payment can be from 15% of the cost of a house or apartment.

Loans are provided for up to 30 years at 13.5% per annum upon conclusion of a comprehensive insurance contract. In the absence of an insurance policy, the interest rate is 14.5%.

A 0.5% discount is provided to customers who receive salaries on accounts with PJSC VTB 24.

PJSC VTB Bank previously worked exclusively with representatives of large and medium-sized businesses. However, after the takeover, he began to develop the retail direction.

Since May 2016, VTB has also been offering mortgage products to individuals. Since the retail direction of lending in the bank is only open, the mortgage rate is extremely low, ranging from 11% per annum.

Favorable financing conditions are offered by Promsvyazbank PJSC. The initial payment for individual programs is from 10%. The interest rate on mortgages in the secondary housing market is from 13.35% per annum.

Inexpensive loans are issued to clients by AO Raiffeisenbank. Interest rates for the purchase of finished housing and apartments in new buildings for payroll clients range from 11% per annum, for persons who receive a salary from non-Raiffeisenbank JSC - 12.25-12.5% per annum. Down payment - from 15% of the cost of housing. However, the maximum possible loan term is quite short, only 25 years, which affects the amount of monthly payments.

Conclusion

In the context of the financial crisis, banks are still interested in active cooperation with solvent customers. If you have a sufficiently high income, which is officially confirmed, do not rush to accept an offer from the first mortgage center that agreed to lend to you. Look for optimal conditions.

In conclusion, I would like to give advice, borrowed from Bodo Schaefer's book "A Dog Called Mani": try to deal only with those bank managers that you like. In this case, every transaction will be successful.

Many people, not having enough money to buy an apartment or a private house for cash, turn to banking institutions to get a loan to buy real estate.

The most profitable mortgage in Moscow banks

Consider the popular offers of Moscow banks for the mortgage of the current year.

- Leading Russian bank Sberbank offers low mortgage rates. Ready-made housing in this credit institution will be offered to you at a rate of 10.75% per annum. The bank offers such a low percentage on the condition that you are a young family and you have three or more minor children as dependents. In this case, the loan is given for a period of 10 years, and the down payment will be more than 50%. If you have less than three children to raise, the rate will start at 11.5% per year.

- Rosselkhozbank has the lowest mortgage rate in Moscow under the Mortgage with State Support program. This is 10.9% per annum for Russian citizens from 21 to 64 years old who have documented their income. If the borrower refuses insurance, the bank will increase the rate by 7%. Loan term - up to 30 years, advance amount - 20% of the loan value. These loans are for pre-owned housing or housing in buildings under construction.

- Promsvyazbank makes an offer with the lowest mortgage interest in Moscow, which will be 12%. The person must be 21 years of age at the time of taking out the loan. The loan is granted for at least 3 years.

- Profitable mortgage 2020 in the city of Moscow is offered by Svyaz-Bank with a rate of 12.25%. In this case, the advance payment should be equal to 50-90% of the price of the apartment, the term of the loan is 3-10 years. The borrower must have a salary card of this bank.

- MTS Bank gives loans in Moscow for housing on the secondary market to applicants who are somehow related to this financial institution (have cards for payments or are employees of AFK Sistema). Advance payment - 50-85%, 3-10 years of loan provision. Payments are calculated in equal monthly installments.

- Gazprombank sets the percentage of the annual rate, according to the amount of the first payment. 11.5% - in the event that there is a salary card of the specified bank, the first installment is more than 50%. Resale real estate is taken on credit from state-owned Moscow enterprises.

Which bank is better to take a mortgage in 2018? The choice of a mortgage bank should be made based on the analysis of many factors. Which ones? Here are our recommendations.

Which bank is better to take a mortgage in 2018:

Today we'll talk about Which bank is better to get a mortgage . Today you will receive: list banks giving mortgage , information on what to look for when choosing a bank, in which banks give mortgages for special programs how to choose a mortgage bank step by step, as well as the main trends in the mortgage market in 2018.

Features and development trends in the market

mortgage loans in 2018

In the conditions of a protracted economic crisis, no one can guarantee that the work of the enterprise will remain as easy and stable, or that wages will remain at the current level. As in 2016, there are potential risks associated with an increase in inflation, which means a decrease in purchasing power, when, with the same amount of income, a person will buy much less than now.

Experts do not see a decrease in the manifestations of the negative consequences of the economic crisis in the next decade. There are several points that will affect the state of the mortgage lending market:

- stagnation of the construction industry and "freezing" of unfinished projects;

- state support, artificial containment of the increase in mortgage lending rates - under the influence of a number of economic factors;

- social projects may be reduced due to insufficient funding.

The following development of the situation regarding the offer of banks is possible:

- lower interest on mortgage loans;

- increasing requirements for applicants, especially for financial solvency.

When resolving the issue, Where is the best place to get a mortgage? , the credit rate is not the main thing. Trading conditions in 2016 led developers to add additional costs for materials and components to the cost of square meters. Will it be profitable take a mortgage in an unstable economic situation?

Do not rely too much on reviews and pay attention to ratings, looking for where better take out a mortgage And what is the best mortgage bank . When making a decision, be guided not only by what I take borrowed funds for. To avoid an unpleasant incident, consider the situation in the future.

The beginning of the year was marked by an important event - the abolition of the state mortgage. This indicates that the government is looking positively into the future. The market has digested this change of situation. At first, banks returned rates to a fairly high level, but after up to 10.9%, all other market participants rapidly began to improve their offers.

At the moment, the supply market for standard customers has stopped at 10%. But this is not the limit.

Mortgage 6 percent in 2018 becomes a reality. On November 25, 2017, Vladimir Vladimirovich Putin, at a meeting of the coordinating council for the development of a national strategy for the state's actions in the interests of children, said that from 2018, in addition to other options for helping families with children, a special mortgage program "Mortgage 6%" will be developed.

And so: the leading banks of Russia recently announced the start of issuing preferential mortgage loans for families with children at a rate of 6% per annum.

You can learn the most at the moment from another article.

How to choose

Choosing a Mortgage Bank should be done based on the analysis of several factors:

- bank stability. Look at the Central Bank website to see if the bank has a license, what place it occupies in terms of capital.

- Favorable mortgage program. Conduct a preliminary comparative analysis of several offers from different banks. Pay attention to additional commissions, fees, insurance, etc.

- Serviceability. Look, first of all, at the offers of your payroll bank. It’s not so interesting to go to the office every time, but here all the write-offs will occur from the card. Find out how many branches the bank has and if there is a bank branch near you. Pay attention to the possibility of online service. Is it possible to make early repayment online without going to the bank.

- Which bank has the most loyal policy? Look at the list of banking institutions that give mortgages and read reviews about banks. Find out if you qualify for this bank.

You can find a list mortgage banks , but the rating of banks does not always reflect the real state of affairs. The low rates offered may be advertising hiding other payments.

Let's take the TOP-30 mortgage banks in the country

This table shows offers in the secondary market:

| Bank | Bid, % | PV, % | Experience, months | Age, years | Note |

| Sberbank | 10 | 15 | 6 | 21-75 | 9.5% young family, salary discounts 0.5% and 0.1% if electronic registration |

| VTB 24 and Bank of Moscow | 9,5 | 15 | 3 | 21-65 | 9.25% if the apartment is more than 65 sq.m., wage earners PV 10%, |

| Raiffeisenbank | 10,99 | 15 | 3 | 21-65 | |

| Gazprombank | 10 | 20 | 6 | 21-60 | |

| Deltacredit | 12 | 15 | 2 | 20-65 | FB 20% PV, 1.5% discount if 4% commission |

| Rosselkhozbank | 10,25 | 15 | 6 | 21-65 | 10% PV for finished for a young family, 0.25 discount if over 3 million, another 0.25 discount if through partners |

| Absalut bank | 11 | 15 | 3 | 21-65 | FB +0.5% |

| Bank "Revival | 11,75 | 15 | 6 | 18-65 | |

| Bank "Saint-Petersburg | 12,25 | 15 | 4 | 18-70 | |

| Promsvyazbank | 11,75 | 20 | 4 | 21-65 | |

| Russian capital | 11,75 | 15 | 3 | 21-65 | |

| Uralsib | 11 | 10 | 3 | 18-65 | 0.5% higher if bank form and will be 20% PV |

| AK Bars | 12,3 | 10 | 3 | 18-70 | 0.5% discount from partners |

| Transcapitalbank | 12,25 | 20 | 3 | 21-75 | you can reduce the rate by 1.5% for 4.5% commission |

| Bank Center-Invest | 10 | 10 | 6 | 18-65 | |

| FC Otkritie | 10 | 15 | 3 | 18-65 | 0.25 plus if FB, 0.25% discount for corporate clients, reduction by 0.3% if you pay a commission of 2.5%, for payroll employees the first installment is 10% for FB 20% |

| Sviaz-bank | 11,5 | 15 | 4 | 21-65 | |

| Zapsibkombank | 11,75 | 10 | 6 | 21-65 | 0.5% discount for salary employees |

| housing finance | 11 | 20 | 6 | 21-65 | |

| Credit Bank of Moscow | 13,4 | 15 | 6 | 18-65 | |

| Globex bank | 12 | 20 | 4 | 18-65 | 0.3% discount for salary employees |

| Metallinvestbank | 12,75 | 10 | 4 | 18-65 | |

| Bank Zenith | 13,75 | 15 | 4 | 21-65 | |

| Rosevrobank | 11,25 | 15 | 4 | 23-65 | |

| Binbank | 10,75 | 20 | 6 | 21-65 | |

| SMP bank | 11,9 | 15 | 6 | 21-65 | 0.2% discount if the PV is 40% or more, 0.5% discount if the client belongs to the preferential category, discount for a quick exit to the transaction rate 10.9 - 11.4% |

| AHML | 11 | 20 | 6 | 21-65 | |

| Eurasian Bank | 11,75 | 15 | 1 | 21-65 | |

| UniCredit Bank | 12,15 | 20 | 6 | 21-65 | |

| Alfa Bank | 11,75 | 15 | 6 | 20-64 | 4% commission - 1.5% discount works on delta |

primary housing

| Bank | Bid, % | PV, % | Experience, years | Age, years | Note |

| Sberbank | 10 | 15 | 6 | 21-75 | 9.9 upon electronic registration of the transaction; -0.5% if the employee is Sberbank; 7.4% -8% if subsidized by the developer |

| VTB 24 and Bank of Moscow | 9,45 | 15 | 3 | 21-65 | 9.2% if the apartment is more than 65 sq.m., wage earners PV 10%, |

| Raiffeisenbank | 9,99 | 15 | 3 | 21-65 | 10% PV for salary employees, 0.59-0.49 discount for certain developers |

| Gazprombank | 9,5 | 20 | 6 | 21-65 | 10% ROI for gas companies, 15% ROI for large partners |

| Deltacredit | 12 | 15 | 2 | 20-65 | FB 20% PV, 1.5% discount if 4% commission, |

| Rosselkhozbank | 9,45 | 20 | 6 | 21-65 | maternity capital without PV the rate does not change, 0.25 discount if over 3 million, another 0.25 discount if through partners |

| Absalut bank | 10,9 | 15 | 3 | 21-65 | FB +0.5% |

| Bank "Revival | 10,9 | 15 | 6 | 18-65 | |

| Bank "Saint-Petersburg | 12 | 15 | 4 | 18-70 | 0.5% discount for salary employees and with a closed mortgage in a bank, -1% after entering a house |

| Promsvyazbank | 10,9 | 15 | 4 | 21-65 | 10% PV for key partners |

| Russian capital | 11,75 | 15 | 3 | 21-65 | 0.5% discount for clients through bank partners, 0.5% discount for PV from 50% |

| Uralsib | 10,4 | 10 | 3 | 18-65 | 0.5% higher if the form of the bank and will be 20% RO, 0.41% discount for RO 30% and above |

| AK Bars | 11 | 10 | 3 | 18-70 | discount 0.3% if PV 20-30%, over 30% discount 0.6% |

| Transcapitalbank | 13,25 | 20 | 3 | 21-75 | you can reduce the rate by 1.5% for a 4.5% commission, after entering the house, the rate is reduced by 1% |

| Bank Center-Invest | 10 | 10 | 6 | 18-65 | from 5-10 years the rate is 12% further the Mosprime rate index (6M) as of October 1 of the previous year +3.75% per annum |

| FC Otkritie | 10 | 15 | 3 | 18-65 | 0.25 plus if FB, 0.25% discount for corporate clients, decrease by 0.3% if you pay a commission of 2.5%, 10% PV if a salary employee, 20% PV on FB |

| Sviaz-bank | 10,9 | 15 | 4 | 21-65 | |

| Zapsibkombank | 10,99 | 15 | 6 | 21-65 | 0.5% discount for salary employees |

| housing finance | 11 | 20 | 6 | 21-65 | |

| Credit Bank of Moscow | 12 | 10 | 6 | 18-65 | |

| Globex bank | 11,8 | 20 | 4 | 18-65 | 0.3% discount for salary employees |

| Metallinvestbank | 12,75 | 10 | 4 | 18-65 | |

| Bank Zenith | 14,25 | 20 | 4 | 21-65 | |

| Rosevrobank | 11,25 | 20 | 4 | 23-65 | |

| Binbank | 10,75 | 20 | 6 | 21-65 | |

| SMP bank | 11,9 | 15 | 6 | 21-65 | 0.2% discount with a PV of 40% or more, 0.5% discount for preferential customers, rate 10.9 - 11.4% for a quick exit to a deal |

| AHML | 10,75 | 20 | 6 | 21-65 | |

| Eurasian Bank | 11,75 | 15 | 1 | 21-65 | 4% commission - 1.5% discount works on delta |

| Yugra | 11,5 | 20 | 6 | 21-65 | |

| Alfa Bank | 11,75 | 15 | 6 | 20-64 | 4% commission - 1.5% discount works on delta |

At what points in cooperation with banks

special attention must be paid to:

- Let's take the bet calculation method. It can be fixed or floating. In government programs, it promises to be constant throughout the entire period of debt payment. The floating rate depends on the state of the money market. The fixed rate has its drawbacks. Banks often apply an individual approach to each applicant. The final rate for a particular person may differ significantly from the one declared at first.

- Initial deposit. The smaller it is, the higher the rate.

- Borrower requirements. Interested in choosing a bank for a mortgage on two documents without proof of income? Get ready for high interest rates.

- Banking commission. Often, taking a loan at a low interest rate, you have to pay a one-time additional fee for transaction support. Sometimes this is useful.

- Insurance services. The borrower's life and disability are voluntarily insured. If you refuse voluntary insurance, the rate will increase by 1-1.5 points.

- Loan maturity. Where is the best place to take it? An ideal mortgage, according to experts, is optimal for a 20-year period. With a shorter term, the regular payment is higher, with a longer term, there will be a tangible overpayment of interest.

Choosing a bank and the most profitable

loan product

- Before revising the data, V which bank will be profitable to take a mortgage , choose a property. You can buy apartments in new buildings and on the secondary market, private houses, it can be a room, a share in an apartment, an apartment, a cottage, a land plot, a summer house, a townhouse.

- Pay attention to the conditions of special programs and state support programs. What is the benefit of participating in them? Military mortgage - the possibility of obtaining housing for military personnel, monthly fees and advance payments are paid by the state. Mortgage "Young Family" - an opportunity to obtain preferential loans with low interest and a down payment to persons under 35 years old. The option of purchasing housing with maternity capital is the most profitable mortgage for families with two or more children. Social mortgage - a loyal interest rate policy and advance support for socially significant professions.

- Assess your own financial situation. You can take out a mortgage without making an advance, with an advance of 5-10%, 15-20% or 30-50%.

- Find out what the quality of your credit history is. It is advisable to check the borrower's dossier before applying. They don't give mortgages to people with bad credit.

- Decide on a package of documents. Banks may vary. In some institutions, it is possible to execute a transaction on the basis of a certificate in the form of a bank, while in others it is not.

- Identify the presence / absence of additional commissions and contributions. Sometimes the cost of insurance, the issuance of a loan are large, the result is a very expensive loan. A more profitable option may be a program with a rather large rate, but with lower costs related to servicing the loan.

- Calculate the required amount. The approximate value of the property must be compared with the money available. The difference is the borrowed amount.

- Check yourself for compliance with the minimum requirements of the selected lender to the borrower.

- Analyze mortgage offers. Find several options where they offer to take with a small rate. First of all, you should contact the bank where the salary is issued. Here they will offer a loyal rate and a discount on the initial payment.

- Calculate the payment and the required income. Annuity allows you to deposit equal amounts every month and increases the likelihood of a positive decision on the application to the applicant, even with a small income. Differentiated mortgage payments provide an opportunity to save money, but the first payments will be large. A mortgage calculator will help you choose the option.

- Decide on a deadline. A long term allows you to reduce the amount of the monthly payment, which directly affects the approval of the application. When available funds appear, repay loans in large amounts. The bank will recalculate the interest.

- Don't overestimate your strength over monthly costs. Important events for the personal budget can significantly affect the financial situation, so you will have to urgently look for where to get money for the next payment.

- Choose the best way to apply for a loan. You can apply for a mortgage at a bank office. A remote application posted on the website of a credit institution gives a discount on the rate.

- If you don’t want to figure out on your own which bank has the lowest mortgage percentage, then it’s easier to entrust the task to a mortgage broker.

Nuances of choice

- When choosing a mortgage, it is better to pay attention to ready-made housing or housing that is nearing the end of construction.

- Pay attention to the liquidity of the future acquisition. If necessary, it can be sold in order to pay off debt obligations with the money received.

- If borrowed in the currency of the main part of the income, then it is predicted to remain the same currency for a long time.

- Loan payments must not exceed 30% of gross income. When planning a mortgage loan, one should assume different developments and agree on possible consequences with co-borrowers and "soulmates" before signing a loan agreement.

- It is best to get a long-term mortgage so that the monthly payments are affordable for your own budget.

- Draw up an agreement with the possibility of early repayment without penalties, so that when income increases, you can pay off your debt obligations faster, and loans will be cheaper.

- Borrowers who make a good advance payment (30-50%) can count on loans that are more democratic in terms of conditions.

- Not only comparison of conditions is obligatory. Reading a mortgage agreement requires special attention.

- Experts recommend not to take the bet as the basis of choice. It may just be a gimmick to expand your customer base. On average, 10-13 per annum is offered, if you promise a lower percentage, study other conditions in the rating of banks more carefully.

- Some clients who receive financial assistance forget about the availability of insurance when choosing a mortgage. Mandatory real estate insurance is legally established, the borrower may refuse all other types of insurance programs. But often it is the consent to voluntary insurance that affects the rate.

- Often, a fee is charged for processing and issuing a loan (from 1 to 4% of the amount). The higher the commission, the lower the interest. To understand where it is more profitable to take a mortgage, the size of the commission is compared with the full overpayment. Account maintenance fee is charged every month. In this case, the benefit from a rate cut is often small or non-existent.

- The cheapest mortgage in some regions is obtained through regional loan products.

The best banks with options for special programs

- Which bank is better to take a military mortgage? Gazprombank - 9.5% per annum, 2,250,000 rubles, initial payment - 20%.

- Which banks give customers mortgages with mother capital? Sberbank - from 300,000 rubles, from 7.4% per annum, insurance - 1% of the amount (in case of refusal of the service, 1% is added to the rate).

- In which bank will it be better to take a mortgage for young people? Favorable conditions for a young family from the Russian Agricultural Bank: from 1 to 20 million rubles, from 9.1% per annum, advance payment - from 10% for secondary housing, 10% more - for primary housing Sberbank has a similar program from 10.25%, but only for ready-made housing and for salary workers when registering a transaction electronically. For other people, the base rate is 11.25.

- In which bank can I get a mortgage for refinancing? Mortgage refinancing at Sberbank is one of the most profitable. Ready to issue from 500,000 rubles at 10.9% per annum, proof of income is required.

- In which bank would it be better to take a mortgage on two documents? VTB 24 - 10.4% per annum, up to 500,000 rubles.

- In which bank will it be profitable to take a mortgage on a house and land? Rosselkhoz Bank - 100,000-20,000,000 rubles, advance payment - from 15% (maternity capital can be used), from 9.75% per annum.

- Which bank lends to foreigners? VTB24 - from 600,000 rubles, 9.4-10.4% per annum, minimum advance payment - from 15%.

- Without an initial fee lends Metallinvestbank. It is proposed to take a mortgage on an apartment in an apartment building in the primary and secondary markets at 12% per annum.

Sberbank in 2020 offers a whole range of mortgage loans. The main ones are:

2. Purchase finished housing;

3. Construction of a residential building;

In addition, there is a special promotion that provides benefits for young families.

In this review, correspondents of the Business Information Agency website will analyze the features of Sberbank mortgage loans for the purchase of finished housing.

You will find out the current conditions, interest rates and the size of the initial payment.

We will tell you who can take a secondary mortgage at Sberbank, how it is easier to do this, and what documents you need to collect for this.

Mortgage in Sberbank for secondary housing in 2020

This mortgage program is intended for the purchase of an apartment, residential building or other residential premises in the secondary real estate market.

Sberbank mortgage conditions for secondary housing in 2020

Funds are available under the following conditions:

✓ Min. amount: from 300,000 rubles;

✓ Max. amount (no more):

85% of the contractual value of the loaned residential premises;

- 85% of the appraised value of another property that is pledged.

✓ Term: up to 30 years.

✓ An initial fee:

From 10% - for payroll clients;

- from 15% - for ordinary individuals;

- from 50% for clients who did not provide proof of income and employment.

Sberbank mortgage interest rates for secondary housing

Valid for clients receiving a salary to a card/deposit account with Sberbank, subject to the life and health insurance of the borrower:

Allowances:

0.3% - when buying an apartment not chosen on Domclick.ru, or an apartment not participating in the promotion "0.3% Discount on Domclick.ru";

+ 0.4% - with an initial payment of up to 20% (not including the upper limit);

+ 0.5% - if you do not receive a salary on a Sberbank card;

+ 0.8% - if you did not provide proof of income and employment;

+ 1.0% - in case of refusal of life and health insurance of the borrower.

See also:

How to apply for a Sberbank mortgage on ready-made housing

Now that we have found out the basic conditions and interest rates of a Sberbank mortgage loan for finished real estate, we can understand the intricacies of the loan process itself.

1 In order not to make unnecessary movements, find out in advance whether you meet the requirements that Sberbank imposes on borrowers.

Requirements for borrowers

Age. Citizens of the Russian Federation aged at least 21 years old can apply for a secondary mortgage at Sberbank today. It is also important that at the time of repayment of the loan you are no more than 75 years old.

Experience. It also requires at least 6 months of experience at the current place of work and at least 1 year of total experience over the past 5 years (does not apply to payroll clients of Sberbank).

Co-borrowers under the loan can be no more than 3 individuals, whose income is taken into account when calculating the maximum loan amount.

2 If you are planning to buy an apartment using borrowed funds from Sberbank, to begin with, soberly calculate your financial capabilities. Remember that the loan is taken not for one year, but for a long period. During this time, your income may change both up and down. Therefore, calculate the loan on the mortgage calculator. For a detailed calculation, it is better to use the calculator on the official website of Sberbank. But preliminary calculations can be done on our online mortgage calculator.

Mortgage Calculator

3 Submit an application for a mortgage loan via the Internet. You can do this on the DomClick website from Sberbank. There you can register in your personal account and consult with a specialist in a chat or by phone.

4 Prepare the necessary documents and send their copies to Sberbank to your mortgage manager. They can be downloaded through the DomClick website.

Documents for obtaining a mortgage

To consider an application for a mortgage loan for finished housing, you must submit the following package of documents to the bank:

- application-questionnaire of the borrower/co-borrower;

- passport of the borrower/co-borrower with a registration mark;

- a document confirming registration at the place of stay (if there is a temporary registration);

- documents confirming the financial condition and employment of the borrower/co-borrower (See the full list in pdf format).

Documents that can be provided after the approval of the loan application:

- documents on the residential premises to be credited (may be provided within 90 calendar days from the date of the Bank's decision to issue a loan);

- documents confirming the availability of the down payment.

5 Sberbank promises to consider a loan application within 2 working days from the date of submission of a complete package of documents. And after the mortgage is approved for you, it's time to choose an apartment. You can also do this on the DomClick website, where a wide range of ready-made apartments is presented. But you can search for housing on your own on ad sites or with the help of realtors.

6 After you have chosen an apartment, send its details for approval to your mortgage manager. If the bank is ready to accept it as collateral, then you can make a deal.

7 Sign the required documentation at the bank office. You can send documents for registration without visiting Rosreestr or the MFC, but using the "Electronic Registration Service" from Sberbank.

? Question answer

Is it possible to use maternity capital for a down payment?

When purchasing ready-made housing on credit with the help of Sberbank, you can use maternity capital funds for the down payment (or part of it). The basic conditions and rates of mortgage programs do not change. The main thing is to agree with the seller on the procedure and deadline for receiving maternity capital funds, since this amount is not transferred from the Pension Fund immediately.

How to repay a loan?

The money is returned to the bank in monthly annuity (equal) payments.

Partial or full early repayment of the loan is allowed. The minimum amount of early repayment is not limited. There is no charge for this.