A housing loan has become one of the ways to solve the housing problem. Lately, I've been thinking that a mortgage is the only possible home loan option. I own a mortgage and pay regular annuity payments. However, recently I met a person who did not take out a mortgage when buying a home, but took out a consumer loan for the maximum amount from Raffeisenbank. My employer has a salary project in this bank, and the loan was obtained at a reduced rate of 15 percent. In principle, this is not a big rate, given that I have a rate of 12.75 now (was 14.75 before obtaining ownership.

However, the question is different - which is more profitable and easier? Take out a mortgage or arrange and get a cash loan that you can spend on buying a home.

There are both settlement points - it is necessary to calculate the overpayment on the loan, as well as additional costs when buying a home, which do not depend on whether you take a mortgage or a cash loan.

The main additional costs when buying a home

Such costs include the costs of a realtor, registration of documents in the registration chamber - payment of state duty. These costs will be in any case. The price in different regions will be different, if another person does it for you - these are additional costs. You will also need to certify the contract of sale, it is possible to draw it up - the costs of a notary and a lawyer. Checking the legal purity of the object of purchase also leads to additional costs.

Preparation for the transaction may take additional time due to the fault of the seller - it may be necessary to pay utility bills. When buying an apartment, you always need a down payment. For a mortgage, it is important - very often the interest rate depends on it. Now the minimum contribution is 10 percent or more.

The main differences between a mortgage and a consumer loan.

The main difference between a mortgage is the rate. It is less for a mortgage than for a consumer loan. But with a mortgage, there are a number of additional costs that can make getting a cash loan more financially beneficial.

The first is mortgage insurance. You must insure the purchased property against loss as a result of an accident (gas explosion, flood). Moreover, insurance is done in favor of the bank - in the event of an accident, the bank receives the money. You also insure your life and health in case you are unable to pay your mortgage due to illness. In addition, the loss of property rights is insured. Without insurance, you may not be given a mortgage at all, or they may be given at a rate higher by 2-5 percent, which is very unprofitable for you. The second important point is the obligation to mortgage the apartment to the bank.

The bank requires a mortgage on an apartment - this is a prerequisite for a housing loan. When registering your ownership right, you will be given a certificate with an encumbrance. The apartment is actually owned by the bank until the full payment of the mortgage. In case of non-payment, the Bank will take the apartment, sell it and pay your debt from the proceeds. The rest will be returned to you. With an annuity interest scheme, you pay high interest initially, resulting in a very small balance.

With a cash loan, insurance is an optional condition. But it is very difficult to get such a loan for a large amount. But the advantage of such a loan is the lack of collateral. The apartment immediately belongs to you. The only risk - the risk of non-payment - in the event of this case will lead, in the worst case, to communication with collectors. But the bank will not be able to take the apartment. However, the risk of losing the title due to black realtors and sellers. To do this, you need to carefully approach the choice of purchase. The advantages of a mortgage are that the bank checks the cleanliness of the apartment. In the case of a new building, this issue can be removed.

In addition, an apartment under a mortgage is more difficult to sell.

Mortgage buns.

Mortgages have some additional benefits.

The first is a rather long time. You can borrow money for 5-30 years by choosing an annuity payment that is convenient for you. In addition, a differentiated loan repayment scheme is possible, which is generally more profitable than an annuity.

Read also:

In the case of a cash loan, the term is up to 5 years, which makes the monthly payment higher and unbearable for many.

However, here the question of early repayment arises - it will be more profitable with a short loan term.

The second important benefit of a mortgage is the possibility of obtaining a tax deduction. It can be obtained once in a lifetime and only in the amount of 13 percent of the loan amount.

Maximum 13% of 3 million or 390 thousand Plus 13 percent of the amount of interest paid. Plus 13 percent of the cost of finishing materials in case of buying an apartment in a new building

This is a pretty strong argument. But it is necessary to collect the necessary set of documents to receive a deduction from the tax. The deduction can be obtained directly from the tax office and from your employer if you have a white salary.

What to choose?

As you can see, each option for obtaining money for housing has a lot of its advantages and disadvantages.

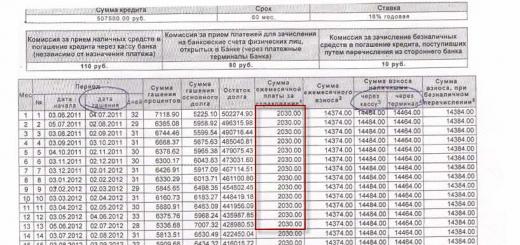

For example, we want to take a loan for 507,500 rubles. for a period of 5 years.

Here is an example of a real loan from Orient Express Bank

As can be seen from the graph, every month the user, in addition to the next payment, pays insurance - 2030 rubles

Let's calculate how many insurance payments came out

2030 * 60 = 121800

We will take the final overpayment from the bank schedule - 233316.66

A mortgage loan can be taken at a rate of not 18 percent, but 13%. (For example, in Deltacredit)

Let's make a table to compare the two loans. We will not take into account possible commissions in the plate, we only take into account what we pay to the bank and insurance.

If you look, you can see the following diagram

Mortgage or consumer credit?

What is the concept of a mortgage and how to get it? All the pros and cons? Interest rate terms? What are the main advantages in concluding a contract of employment? What additional costs may affect the customer? All the pros and cons of a mortgage?

All consumer rights are very seriously protected. All possible options and cases are considered when paying the amount received, as well as the possibilities of the recipient with a possible loss of ability to pay. What should you pay attention to.

Key points for getting a loan

- It is necessary to decide on the desired amount and the possibility of monthly payments. When determining the monthly payment, it is necessary to calculate so that the maximum amount is about 30% of the monthly income received.

- Compare in advance the possibilities of payments, prices on the market and those offered by banks. Very often, prices are cosmically inflated, in this case, you need to choose another source.

- Valuation of the property to be left as collateral. After all, the amount received is completely determined by the pledge, which is why it is very important to collect exactly the amount that is needed.

- When choosing a location for real estate, it is worth remembering that location can also significantly change the price. As a rule, the farther the area is from the center and important places, the cheaper it is per square meter.

- It is best to apply in several banks. And if approved by one of them, call and refuse the second. There should always be a fallback to solve a problem.

What documents do you need to collect to get a mortgage loan?

- To write an application.

- Fill out the form provided by the selected bank.

- Copies of passport, certificate of registration, payment of monthly taxes and certificate - income.

- All income for the month must be supported by the availability of relevant documents, documents for the presence and possession of expensive property, documents confirming the death of relatives, all bank accounts, documents on all credit histories for the entire period of life, statements with timely payments of housing and communal services.

So what constitutes a loan taken to buy an apartment

A loan for the purchase of property is classified as a non-targeted loan necessary to meet personal needs. A consumer loan is very close to a mortgage, however, it has its own differences. This type of lending is free in nature and in no way can control the actual expenditure of the funds received. The collateral is not a possible apartment, but one that is already really available.

The maximum possible amount to receive can be 85% of the value of the property, which is given by the borrower as collateral. There are banks that are characterized by limits on monthly payments.

How to get a consumer loan

- All required documents must be submitted to the bank.

- Wait for committee approval.

- Draw up a pledge agreement.

- Pay cash.

As an example, consider the requirements for obtaining a consumer loan by one of the leading banks in the country - Sberbank of Russia.

- Submit documents to the bank that will confirm the monthly income of both the guarantor and the future recipient of the loan.

- Application form completed and signed by both parties.

When applying to other banks, be prepared to submit a number of other documents. Among the required documents, one can find on timely payment of housing and communal services, profit not only official, but also unofficial, monthly income of all family members, certificates that will confirm the absence of mental illness, documents confirming the presence of real estate and property, such as on the part of the recipient, and on the part of the guarantor, copies of identity documents, military ID, original or copy of the work book.

When is the best time to apply for a mortgage rather than a personal loan?

It is best to use a mortgage at a time when there is no way to pay big money in a short time. A mortgage will help save an impressive amount of money, since there is a very small percentage, the main thing is to choose the necessary property or real estate for a certain amount. A very good way to get an apartment for all those who really want it and need it, but at the same time are not ready to immediately pay big money.

What are the main pros and cons of using a consumer contract

- It is not necessary to have any property or valuable thing.

- You can use the funds at your discretion.

- Getting a loan takes place in a very short time, while there is no red tape and collecting a lot of papers and documents.

- Bank approval required.

Flaws:

- A very high percentage. The final amount is significantly different from the received.

- Short term for repayment of loans. Forces each month to pay a very large amount or even become unaffordable to others, depending on the monthly income.

- The interest rate sometimes reaches 19%.

- When obtaining a loan of up to 750,000 Russian rubles, it is not necessary to pledge some property, more than the above amount - a pledge is a prerequisite for resolving the issue in a positive way for the client.

With a mortgage, the interest is about 16%, and the repayment term of the loan received can reach up to 50 years. Most often, a mortgage loan is issued to people until they become pensioners. There are even programs that can issue a loan for 75 years. The maturity of the income loan is up to 5 years.

Pledge of an apartment, car or other valuable property is a good help for obtaining bank approval for a loan. Documents for housing are given to recipients only upon completion of the transaction, so, until that moment they are with the creditor. The lender most often makes a deal with someone who has a very good regular monthly income. Also, an important factor for approval is an even credit history, delays, existing loans that have not been paid on time will not allow you to issue a loan. Sometimes it is not enough for a bank to use only one person as a guarantor, it is for this that sometimes there are several.

The borrower can always leave valuable property as collateral to increase the chances of approval. When leaving property for the required amount, a positive response is almost always obtained. This is a pledge for the lender that in case of non-payment in the future, he can take this property for himself and appropriate it for his needs.

Additional costs when applying for a loan

An income loan implies an additional monthly payment of two percent for maintenance. The insurance policy immediately takes up to 10 percent of the amount received, with a pledge of an apartment - once a year. When pledging real estate, the future recipient of the loan will also have to fork out a little, so the appraisal of the apartment is usually about 5 thousand Russian rubles, in order to check the object you need to pay almost 15 thousand rubles. Preparation of all necessary documents, their correct filling and further registration is 30,000 rubles. When contacting the help of a realtor, be prepared to pay up to 8 percent of the amount received, in case of a positive outcome, the broker, in turn, will take about 3 percent. When applying for help to a notary, you need to prepare five thousand rubles in advance, that's how much he takes just for considering an application, regardless of the future result. The main differences between a mortgage and a consumer loan are that a mortgage is used for a specific purpose, while a consumer loan is free and the money received can then be spent by the recipient on other needs. Mortgages are given up to 50 years, and there are cases when up to 75, which is accompanied by small monthly payments, and a consumer loan is accompanied by the issuance of money for up to several years - this forces the borrower to make large payments every month. A mortgage forces you to leave expensive property on credit, but there is no ordinary loan, and besides, the interest on a mortgage is slightly less than on a regular one. As a result, it will help to save a very decent part of the money.

How best to get housing is a question that everyone who wants to personally decide on, since it is he who will be the one to deal with his problems in the future. Be careful and read the deal very carefully before entering into it.

Mortgage as a type of loan

Many do not know that there were times when an apartment was received free of charge, now it is almost impossible for a civilian who has nothing to do with law enforcement and some budget organizations.

Therefore, citizens face the issue of improving living conditions for themselves, their children or grandchildren. Far from everyone can afford to buy an apartment without resorting to, then reflections begin on how best to resolve the issue at the lowest cost, which is more profitable to take.

Mortgage is a type of loan, the bank allocates funds for some time for the purchase of real estate with a restriction on the disposal of this property by the owner, it is issued without collateral. Banks try to ensure the return of borrowed money with interest, real estate pledge is the best guarantee, therefore, the interest on a mortgage loan is lower than on other loans.

Mortgage features

The positive aspects of obtaining a mortgage are as follows:

- The loan rate is lower than other types of borrowing.

- The duration of the contract reduces the amount of the monthly payment.

- Compulsory insurance of the borrower and real estate will allow, in case of unforeseen circumstances, to repay the loan at the expense of insurance.

- The debtor gets the opportunity to reduce the tax base by the amount of payments.

- You can use maternity capital to make a down payment or reduce the principal debt.

- When applying for a mortgage, the insurance company and the bank will confirm the legal purity of the apartment, the inability to challenge the purchase by third parties.

- The ability to act as co-borrowers to family members, which allows you to increase the loan amount.

- Possibility of getting into the program with preferential conditions.

In addition to the advantages of signing a contract, there are also disadvantages:

- The conclusion of a mortgage agreement will require a lot of time for the bank to collect and verify a package of documents.

- It will require expenses for insurance of the client and the acquired property, for real estate valuation.

- If the client needs a small amount, the bank may not be interested in issuing a loan.

- You can dispose of the purchased apartment, donate, sell, exchange at the end of the contract.

- Not every apartment is suitable for a bank as a security for a loan; real estate from accredited developers is required.

- A down payment is required, from 10 percent of the loan.

- If an aged person wants to take out a loan or elderly people are co-borrowers, this can lead to a reduction in the terms of the agreement and, accordingly, an increase in monthly payments.

- After fulfilling the terms of the contract, the borrower will need to remove restrictions on the disposal of the apartment, this will take some time.

What is a consumer loan

A consumer loan is provided by a bank to a borrower for money for a certain period, usually it is short-term, it can be used for any purpose, depending on the amount, it does not require property as collateral.

A consumer loan is provided by a bank to a borrower for money for a certain period, usually it is short-term, it can be used for any purpose, depending on the amount, it does not require property as collateral.

Benefits of obtaining a consumer loan:

The application is considered quickly, a small package of documents.

- Compulsory insurance is not required.

- Collateral is required for a large loan amount.

- The type of housing to be purchased does not need to be agreed with the bank.

Even with a good income, if there are children, a mortgage looks preferable if circumstances change. Reducing the interest rate, the possibility of drawing up a contract for up to 30 years, make it possible to pay for the purchase of an apartment without much damage to the budget.

Making a decision about choosing a type of loan should be after serious consideration of all the possibilities and consequences of this step. What is better, a mortgage or a loan, in each specific circumstance, the choice may be different, depending on the purpose for which an apartment is being bought. If you have savings and need a small amount and quick clearance, the ability to dispose of the apartment immediately after purchase, then it is better to consider obtaining a non-purpose loan.

If there is no savings, rent is comparable to loan payments, then you should look at the possibility of obtaining a mortgage, it is better to constantly pay for your property than pay the owner of someone else's home.

The profitability of a particular type of lending depends on the specific circumstances and capabilities of the individual.

How to choose a mortgage, or a consumer loan when buying a home, see the following video:

Jul 18, 2018 Benefit Help

You can ask any question below

Over the past six months, the popularity of loans for the purchase of real estate has increased dramatically. In 2020, the apartments themselves have become cheaper, and the interest rates of banks are lower. In this regard, many potential clients of financial and credit institutions have a question about what is better: a mortgage or a loan. First of all, it should be noted that a mortgage is nothing more than a kind of loan. And in most cases, it is compared with another type of loan - consumer non-targeted credit.

A mortgage is a type of loan in which the acquired property (real estate) becomes a pledge and guarantees the fulfillment of the obligations of the debtor. This approach reduces the risks of the bank and makes it possible to reduce the cost of the loan.

Banks always compensate for the uncertainty in the future by the price of their own services. In fact, conscientious clients pay for those borrowers who will not repay the loan and will avoid paying penalties in every possible way (usually these make up 1-2% of the bank's clients).

Real estate is a very reliable collateral. An apartment is not a car, it cannot be stolen or get into an accident, it cannot be moved in space and hidden from collectors. And compared to a general purpose loan, a mortgage loan looks all the more reliable. The number of outstanding debtors in this case is much less, and mortgage interest rates are much lower. Although the cost of the loan is far from the only difference between a mortgage and a general purpose loan.

Pros and cons of mortgages

Negative side

Thinking about what is more expedient - a mortgage or a loan to buy an apartment - you need to consider the following features of a mortgage.

Thinking about what is more expedient - a mortgage or a loan to buy an apartment - you need to consider the following features of a mortgage.

- Making a mortgage loan procedure is long. The bank will require a large package of documents, will carefully check everything and, as a result, may refuse to provide money.

- The client will need to buy insurance for the purchased property, as well as insure their own life and health.

- Have a mortgage there is a minimum size. Many banks are reluctant to provide amounts less than 500 thousand rubles.

- Purchased apartment becomes a pledged property. Until the loan is repaid, it cannot be sold or used as collateral for another loan.

- When making a transaction, the client will need to pay for the real estate appraisal procedure.

- The bank will issue a loan for the purchase of not every property. The borrower is limited in the choice of future housing.

- Banks have a negative attitude to the fact that minor children or disabled people will be registered in a loan apartment. This makes it difficult to implement the encumbrance.

What's Good About a Mortgage

Comparing the options for acquiring real estate and choosing a mortgage or a loan to buy an apartment, you need to take into account the positive aspects of the mortgage. There are many of them:

Comparing the options for acquiring real estate and choosing a mortgage or a loan to buy an apartment, you need to take into account the positive aspects of the mortgage. There are many of them:

- The interest rate on this loan is relatively low.

- loan repayment period is long which lowers your monthly payment. and makes credit relatively easy,

- purchased insurance can really be useful,

- using the mortgage scheme, the borrower receives the right to a tax deduction (reduction of income tax on the amount of payments to the bank),

- the corresponding category of borrowers can use such a financial instrument as maternity capital and significantly reduce the body of the loan or the down payment.

An important advantage of a mortgage is that the legal "purity" of the apartment that is planned to be bought will be analyzed not only by the buyer, but also by the bank's specialists, as well as by the security service of the insurance company. This reduces the chance that the real estate acquisition deal will be challenged in the future.

In addition, evaluating what is more profitable - a mortgage or a loan for an apartment - it is worth taking a closer look at special government programs to support mortgage lending. They significantly limit the borrower in choosing an apartment (apply only to housing from accredited developers), but greatly reduce the cost of a loan. At the moment, it is realistic to get a loan for 30 years at a rate of less than 12% per annum. As a result, the monthly payment will be 3-4 times lower than with a short-term non-purpose consumer loan.

When does it make sense to take out a consumer loan for housing?

It makes sense to use a non-targeted loan to buy a home only in one case - if you need a relatively small amount for a short period. Suppose that the borrower can pay from his own funds 85-90% of the cost of the apartment or expects to receive a large inheritance as soon as possible, at the expense of which he intends to cover the debt. Under such circumstances, the short term for the execution of a loan agreement and significant savings on “accompanying” payments are important, and the overpayment due to the high rate will be small.

It makes sense to use a non-targeted loan to buy a home only in one case - if you need a relatively small amount for a short period. Suppose that the borrower can pay from his own funds 85-90% of the cost of the apartment or expects to receive a large inheritance as soon as possible, at the expense of which he intends to cover the debt. Under such circumstances, the short term for the execution of a loan agreement and significant savings on “accompanying” payments are important, and the overpayment due to the high rate will be small.

If it is possible to pay 60-70% of the cost of housing, and the loan is planned to be repaid in 3-4 years, then a mortgage “according to two documents” may be appropriate. Such a loan does not create problems when applying for a loan, does not greatly restrict the client in choosing an apartment and does not greatly increase the interest rate.

When evaluating the presented loan products, one must also take into account the fact that with a mortgage, spouses automatically acquire rights to real estate, even if only one person acted as a borrower. In the case of a non-purpose loan, it is possible to use the funds that were in the account before marriage to pay off the debt. This will make only one of the spouses the owner of the apartment.

Video: Mortgage or loan - pitfalls

Many people who decide to buy a home with a bank loan do not know what is best, mortgage or personal loan. Both of these methods have their own characteristics and nuances. For example, a mortgage is characterized by larger amounts and a longer repayment period, which is very convenient. However, not all customers can get it. In this article, we will analyze what is better to issue, mortgage or loan, and what are the conditions for these products.

So you've decided to buy apartment or a private house, but for this you do not have enough funds. You go to Sberbank and want to take credit. It should be noted right away that there are no special loans for the purchase of housing (except for a mortgage), so you will have to apply for a loan for any needs. Under this program, the cash limit is much more modest than for a mortgage. If you need just a small part of the funds for housing, then this option will suit you. Getting it is much easier and faster than a home loan, and you will also need fewer documents.

Conditions

IN consumer credit From Sberbank, the following conditions apply today:

limit - from 30 thousand to 5 million rubles;

interest rates– from 11.9% per annum;

crediting period - 3 months. - 5 years;

currency - Russian rubles;

no issuance fee;

no deposit required.

Advantages

What to choose - mortgage or home loan? Now we will give you an example of what advantages consumer lending has:

simplified registration procedure;

1-2 documents are required;

housing will not be pledged, but will be fully owned by the buyer (he will be able to sell, rent, donate);

you can not take out life insurance (this is optional);

no need to pay for the services of an appraisal company;

there are no other expenses that are in the mortgage.

Flaws

However, the consumer loan V Sberbank and its shortcomings:

high interest rate;

short loan term;

limited funds limits.

If the lender indicated in the conditions that he was ready to lend to customers in the amount of up to 5 million rubles as part of a consumer loan, then in practice this does not mean that it will be so. It's just a marketing ploy. The interest rate and the maximum loan amount are calculated for each client individually, based on his income. It may happen that a person is approved for a small amount of money at a higher percentage.

So what to choose - mortgage or personal loan? A lot of people believe that when buying a home though more profitable mortgage. With this type of lending, the acquired property remains pledged to the bank until the borrower fully repays the debt. Thanks to collateral, lenders reduce interest on this type of lending, as they have less risk. Pay attention to the state-supported mortgage provided by Sberbank. It is issued to certain categories of citizens and allows you to save a lot of money. If the client has maternity capital, then they can pay off part of the mortgage loan.

Conditions

Sberbank issues mortgage loans in 2019 on the following terms:

Advantages

So anyway, mortgage or loan? It is impossible to understand until you know about all the advantages and disadvantages of mortgage lending. Then you can compare the information received and draw a conclusion. The benefits of a mortgage include:

low interest rate;

long period of return of funds;

life insurance can be a useful service;

you can take advantage of the tax deduction and return 13% of the cost of housing back;

you can pay part of the mortgage with maternity capital.

Flaws

Mortgage It also has its drawbacks, which should be mentioned:

longer procedure of registration;

compulsory expensive insurance real estate;

there is a minimum cash limit, it will not work to borrow a smaller amount;

the acquired property will be pledged to jar the entire period of the refund (it cannot be sold, rescheduled, donated);

payment for the services of an appraisal company;

Sberbank does not lend to all housing, but only to those that meet its requirements.

What to choose

What to choose - mortgage or consumer loan? To this question, each borrower must answer himself. Each method has its own advantages and disadvantages. Just decide what you need - a large amount of cash or a quick and easy registration. Are you willing to pay the multiple costs associated with mortgage or you don't profitable. How many people, so many opinions, so it is impossible to unambiguously answer this question.