Today I will tell you about what is a futures or futures contract. I think that all of you constantly hear or read in the news: “oil futures have fallen in price…”, “gold futures have updated a minimum…”, etc. So, after reading this article, you will be able to form a clear idea of what a futures is in order to correctly interpret such statements and understand what exactly they mean.

What is a futures?

The term "futures" is borrowed from the English language (futures) and comes from the word future (future).

Futures (or futures contract) is one of the so-called. derivative financial instruments or financial derivatives used in trading on exchanges and non-exchange markets, the meaning of which is to pre-fix the price of a transaction (purchase or sale of an asset) for a specific period or a specific date in the future.

Previously, futures were a security, now they can be issued in the form of a paper contract with signatures and seals of the parties, but much more often futures are used electronically and are concluded by simply pressing the button of the trading terminal, like buying / selling any exchange assets.

A futures differs from another similar derivative instrument - an option in that it only implies the right to make a deal at a given price, and a futures contract imposes an obligation to make a deal. However, there is an option to abandon the futures, which I will mention later.

You already have the first idea of what a futures is, now we will consider this issue in more detail.

Futures types.

There are various classifications of futures contracts, but we will be interested in the main 2 types of futures:

1. Deliverable futures- a futures contract that involves the actual delivery of goods on a specified date at a pre-fixed price. At the same time, if the delivery is not carried out for any reason, the exchange imposes a special penalty on the supplier in favor of the buyer.

2. Non-deliverable or settled futures- a futures contract that does not involve the actual delivery of goods, but only involves cash settlements between the seller and the buyer at a pre-fixed price of the goods on a specified date.

Recently, settled futures have become the most widespread - they have become a popular exchange-traded asset that is bought and sold both for the purpose of hedging risks and for speculative purposes.

I think it is no secret to anyone that when traders buy, for example, oil, they do not store it in barrels at home, it is only displayed on their trading accounts. The same thing happens with settlement futures for oil, other commodities, securities, currencies and other assets. That is, it is quite normal world practice.

Futures specification.

All parameters of a futures transaction are specified in the specification of the futures (in exchange trading, all this happens electronically). A futures specification must include the following parameters:

– Type of futures (settlement or delivery);

– Subject of the contract (instrument) – the name of the asset on which the futures contract is concluded;

– The volume (quantity) of the asset to conclude a transaction;

– The term of the futures contract;

– Delivery date (or settlement date);

– The name of the exchange through which the futures are concluded;

– The amount of the deposit margin – a contract execution guarantee deposited at the time of its conclusion and kept on the exchange until the futures are executed or not executed. Deposit margin is charged on both sides of the contract, its size is usually from 2 to 10% of the transaction amount.

During the validity period of the futures, the so-called. variation margin- the difference between the contract price and the real market price of the asset. In fact, the variation margin shows the value of the profit or loss from the conclusion of the contract for the supplier and the buyer for each specific day as a cumulative total.

Using futures.

The use of futures contracts has two main purposes:

1. Risk hedging– insurance protection against possible further changes in the price of an asset in an undesirable direction.

2. Speculative earnings- futures are exchange-traded assets, and therefore they can be resold many times during their validity period, the price for them can rise or fall, and traders earn on this.

Futures can be called highly liquid exchange instruments, however, at the same time, their price is very unstable: they can add or lose their value very significantly in short periods of time. Futures prices fluctuate significantly more than the prices of those assets that are sold on them - this is very important to know! Therefore, the use of futures for speculative purposes is more suitable for professional traders, and for beginners, I would not advise at all to consider this tool as an asset for making money.

How is a futures contract executed? Examples.

Let's consider how the settlement futures works on a specific example. Let's say the current oil price is $50 per barrel. An upward trend is predicted. The buyer enters into a futures contract with the seller for a period of 3 months to buy 1 barrel of oil for $55. Next, we will consider different possible situations for the execution of a futures contract.

Situation 1. After 3 months, the price of oil becomes $55. There are no transactions on the trading accounts of the buyer and the seller. In this situation, none of the parties to the transaction lost anything, but did not earn anything either.

Situation 2. After 3 months, the price of oil becomes $60. $5 (the difference between the actual price and the contract price) is deducted from the seller's account and credited to the buyer's account. The buyer in this situation earned 5 dollars, and the seller lost them.

Situation 3. After 3 months, the price of oil becomes $40. $15 (the difference between the actual price and the contract price) is deducted from the buyer's account and credited to the seller's account. The buyer in this situation made a mistake and lost $15, while the seller earned.

Situation 4. A month later, the price of oil becomes $60. The buyer sells his futures to another buyer at $65. $10 is deducted from the account of another customer and credited to the account of the first customer. The first buyer earned $10, and the profit or loss of the second will depend on how the price changes further. Now the obligation to fulfill the purchase from the seller of 1 barrel of oil for $65 has passed to the second buyer.

These are all, of course, simplified examples of the use of futures in exchange trading, however, they give an idea of how everything happens. In fact, all these processes are automated, hundreds of thousands, millions of futures contracts are concluded and executed automatically every day.

In fact, we can say that the profit or loss from the use of the futures is equivalent to the profit and loss from a transaction in which the buyer would buy an asset from the seller at the market price on the day the futures were concluded, and then sell it back to him on the day the futures contract ended at the market price for This moment.

There is only a small caveat: the buyer and the seller pay a small commission to the exchange for supporting the transaction, and are also required to allocate additional amounts for the deposit margin (transaction security), which are returned to trading accounts after the execution of the futures.

If the seller or the buyer refuses the futures during its validity period, then mutual settlements between the parties take place according to the principle described above (the difference between the futures price and the current market price is listed), but in addition, the refusing party pays the other party a penalty for refusing the transaction. All this happens automatically, penalties are written off by the exchange at the expense of the deposit margin pledged for the transaction.

Now you know what a futures is, what types of futures are used in practice, what is included in the specification of a futures, how a futures contract works, what interest it is in terms of risk hedging and speculative earnings. I hope that everything is clear to you, and if not, you can always ask questions in the comments.

Don't forget to take the time to improve your financial literacy on the site. This is very important for life in modern conditions. See you soon!

5 (99.93%) 1183 vote[s]

Surely you have already noticed on various financial sites, where there are currency quotes and economic news, a special section "Futures". However, there are many varieties of them. In this article, we will talk about what Futures are, why they are needed and what they are.

1. What is Futures

Futures(from the English "futures" - the future) is one of the liquid financial instruments that allows you to buy / sell goods in the future at a pre-negotiated price today

For example, buying December futures in the summer, you will be delivered this commodity in December at the price you paid in the summer. For example, it can be stocks, currency, goods. The end of the contract is called expiration.

They have been widely used since the 1980s. Futures are just one of the speculations for many traders these days.

What are the goals of the futuresThe main purpose of futures is to hedge risks

For example, you own a large block of shares in a company. The stock market is going down and you want to get rid of them. But selling such a large volume in a short period of time is problematic, as this can cause a collapse. Therefore, you can go to the futures market and open a position for a fall.

Also, a similar scheme is used in periods of uncertainty. For example, there are some financial risks. They may be connected with the elections in the country, with some uncertainties. Instead of selling all your assets, you can open opposite positions in the futures market. Thus, protecting your investment portfolio from losses. If the futures will fall, then you will earn on it, but lose on shares. Similarly, if stocks rise, you will earn on this, but lose on futures. You kind of support the "status quo".

Note 1

In textbooks, you can see another name - "future contract". In fact, this is the same thing, so you can say whichever is more convenient for you.

Note 2

A forward is very similar in definition to a futures contract, but is a one-time transaction between a seller and a buyer (private arrangement). Such a transaction is carried out off the exchange.

Any futures must specify the expiration date, its volume (contract size) and the following parameters:

- name of the contract

- code name (abbreviation)

- contract type (settlement/delivery)

- contract size - the amount of the underlying asset per one contract

- terms of the contract

- minimum price change

- minimum step cost

Nobody issues futures like stocks or bonds. They are an obligation between the buyer and the seller (i.e., in fact, traders on the exchange create them themselves).

2. Types of futures

Futures are divided into two types

- Estimated

- Deliverable

With the first, everything is simpler, that nothing will be delivered. If they are not sold before the execution, the transaction will be closed at the market price on the last day of trading. The difference between the opening and closing prices will be either profit or loss. Most Futures are settled.

The second type of futures is deliverable. Even by the name it is clear that at the end of time they will be delivered in the form of a real purchase. For example, it could be stocks or currencies.

In fact, Futures is an ordinary exchange instrument that can be sold at any time. You don't have to wait until the due date. Most traders strive to simply earn money, and not to buy something in reality with delivery.

For a trader, futures for indices and stocks are of the greatest interest. Large companies are interested in reducing their risks (hedging), especially in the supply of goods, so they are one of the main players in this market.

3. Why Futures are needed

You may have a logical question, why do we need Futures when there are base prices. The history of the issue of their appearance goes back to the distant 1900s, when grain was sold.

In order to insure against strong fluctuations in the cost of goods, the price of future products was laid in the winter. As a result, regardless of the yield, it was possible for the seller to buy at an average price, and for the buyer to sell. This is a kind of guarantee that one will have something to eat, the other will have money.

Also, a futures contract is needed to predict the future price, more precisely, what the bidders expect it to be. There are the following definitions:

- Contango - an asset is trading at a lower price than the futures price

- Backwardation - an asset is trading at a higher price than the futures price

- Basis is the difference between the value of an asset and a futures contract

4. Trading Futures - how and where to buy

When buying a futures on the Moscow Exchange, you need to deposit your own funds for approximately 1/7 of the purchase price. This part is called "warranty provision". Abroad, this part is called margin (in English "margin" - leverage) and can be much smaller (on average 1/100 - 1/500).

The conclusion of a supply contract is called "hedging".

In Russia, the most popular futures is the RTS index.

You can buy futures from any Forex broker or on the currency section of the MICEX. At the same time, free "leverage" is given, which allows you to play for decent money, even with a small capital. But it is worth remembering about the risks of using leverage.

Best Forex Brokers:

Best brokers for MICEX (FORTS section):

5. Futures or Stocks - what to trade on

What to choose for trading: futures or stocks? Each of them has its own characteristics.

For example, by purchasing a share on it, you can receive annual dividends (as a rule, these are small amounts, but nevertheless, there is no extra money). Plus, you can hold shares for as long as you like and act as a long-term investor and still receive at least a small, but percentage of profit every year.

Futures is a more speculative market and it hardly makes sense to hold them here for more than a few months. But they discipline the trader more, because here you have to think about a shorter period of the game.

Commissions for operations on futures are about 30 times lower than on stocks, and plus, leverage is issued free of charge, unlike the stock market (here the loan will cost 14-22% per annum). So for fans of scalping and intraday trading, they are the best fit.

In the stock market, you cannot short (be short) some stocks. Futures don't have this problem. You can buy both long and short all assets.

6. Futures on the Russian market

There are three main sections on the MICEX exchange where there are futures

- stock

- Shares (only the most liquid)

- Indices (RTS, MICEX, BRICS countries)

- Volatility of the MICEX stock market

- Monetary

- Currency pairs (ruble, dollar, euro, pound sterling, Japanese yen, etc.)

- Interest rates

- OFZ basket

- Eurobond basket RF-30

- Commodity

- raw sugar

- Precious metals (gold, silver, platinum, palladium)

- Oil

- The average price of electricity

The name of the futures contract has the format TICK-MM-YY , where

- TICK - ticker of the underlying asset

- MM - futures execution month

- YY - futures settlement year

For example, SBER-11.18 is a futures contract for Sberbank shares with settlement in November 2018.

There is also an abbreviated name of the future, which has the format CC M Y, where

- CC - two-character short code of the underlying asset

- M - letter designation of the month of execution

- Y - the last digit of the year of execution

For example, SBER-11.18 - a futures contract for Sberbank shares in the abbreviated name looks like this - SBX5.

The MICEX adopted the following letter designations for months:

- F - January

- G - February

- H - March

- J - April

- K - May

- M - June

- N - July

- Q - August

- U - September

- V - October

- X - November

- Z - December

Related posts:

The language of stock traders to an unprepared person seems like complete gibberish: forward, futures, hedging, options. Although, under these words quite understandable actions are hidden. This is not an attempt to hide from the uninitiated, it's just more convenient.

What is a futures contract

The meaning of the term "future" can be understood based on the translation from English of the word future - future.

Futures (futures contract): a transaction, the price and quantity of goods for which are fixed at the time of signing the contract, and obligations (the need to pay for the transaction) will arise through futures-determined time.

The “Defined Time” must be at least more than two business days. Otherwise, this transaction is called differently.

Simply put, futures is risk trading. At the same time, the counterparty, who does not want to take risks, offers his future product at a bargain price. For this he receives a secured sale. The buyer, at his own risk, may receive the goods at a lower price in the future.

The difference between a futures contract and a forward contract is that forward- This is a one-time, non-standardized, over-the-counter transaction. Futures are traded on the stock exchange, and constantly.

Often at the expiration date, the real deal doesn't happen, it's done payment of the difference between the contract price and the actual market price on the day specified in the contract.

Suppose a farmer lists a futures contract for the sale of wheat at $100 per barrel in the spring. In autumn, the price of wheat at the time of the purchase of the goods is $110 per barrel. Here is 10% net profit. And perhaps in a month it will be $130 per barrel.

In this case, the farmer is the hedger (), and his buyer is the speculator. This word still has a negative connotation, although a stock speculator is a player who makes money on risky operations. The price could fall to $90, then the speculator would be in the red.

Read more about the difference between futures and options. Although these concepts are very similar, there are differences.

Index futures

Often in the economic section of the news there are words: Dow Jones (Dow-Jones), Nasdaq (Nasdaq), RTS (Russian stock index). The value of these indices is calculated from a set of indicators of the economy to which the index belongs.

The first of these are American. Dow Jones is an industrial index that characterizes the market position of the 30 largest US companies. Nasdaq operates shares of high-tech corporations.

Futures contracts can be concluded not only for the supply of goods, but also for changes in indices. Such futures are called index futures. Here, the profit (or loss) is the change in the value of the index on which the deal was made. The contract stipulates the price of one point, at the end of the futures settlements are made.

The purpose of concluding a contract may be speculation on changes in the index or hedging of securities included in the calculation of this indicator.

On Russian exchanges, the most popular remains futures on the RTS index which is characterized by:

On Russian exchanges, the most popular remains futures on the RTS index which is characterized by:

- high liquidity;

- minimum costs;

- maximum leverage.

When concluding a futures contract on indices, all relations between the buyer and the seller going through the stock market, without the need for direct contact. Both the accrual of profits and the write-off of losses.

Upon the expiration of the contract, each participant in the transaction, based on the results of the auction, will be credited (or deducted) the amount of the difference between the futures and the real, the exchange receives its percentage for mediation.

Gold futures

Just like conventional futures, a gold trade has the same principles, only the underlying asset is gold. Futures can be (similar to other types of contracts):

The benefit of gold futures is that the exchange provides a leverage of 1:20. That is, for transactions, a collateral of 5% of the transaction amount is sufficient. But the risk increases proportionally.

Actions that make it possible to make a profit or reduce risks:

- purchase in anticipation of an increase in the price of metal;

- purchase in anticipation of a decrease in the price of metal;

- trading using the exchange "shoulder";

- hedging losses from rising gold prices;

- hedging losses from a decrease in the value of gold.

Oil futures

Oil futures are traded on the following exchanges:

Now only 2% of futures transactions are made by real oil suppliers and consumers who hedge their risks. The remaining 98% of transactions are made by speculators.

Trading on stock exchanges electronic, there is no physical delivery of oil. At the end of trading, settlements between the parties to the futures are made.

The benefit of working in this market is to provide a credit "shoulder" (1:6), the minimum lot is 10 barrels. Therefore, you can start earning by investing a symbolic amount - a little more than 7,000 rubles.

Just as in the case of gold, having leverage represents both a large gain and a loss in the same proportion.

Experts believe futures transactions are the most risky. The probability of success here is equal to the probability of loss - 50/50. Therefore, it is not recommended to invest more than 20% of capital in this sector.

Ilya Efimchuk, Nikita Varenov 28.04.2009 10:00

122264

Widerulerapplying toFORTSfuturesAndoptionsattractsattentionTothismarketmanynewpotentialparticipants. After all, it is hereatthemThere isopportunitytradeinaccessibleon other exchangesassets: indexRTS, gold, oil, interestrates. However, these instruments are somewhat more complicated than stocks and bonds, but also potentially more profitable.Let's start with a simpler one - futures.

For most people, even those who have been working in the financial market for a long time, the words futures, options, derivatives are associated with something extremely distant, incomprehensible and little connected with their daily activities. Meanwhile, almost everyone, one way or another, came across derivative instruments. The simplest example: many of us are accustomed to following the dynamics of the world oil market at the prices of reference grades - Brent or WTI (Light Crude). But not everyone knows that when they talk about the growth / fall of quotations for raw materials in London or New York, then we are talking about the prices of oil futures.

Forwhatneededfutures

The meaning of the futures is extremely simple - two parties enter into a deal (contract) on the stock exchange, agreeing on the purchase and sale of a certain product after a certain period of time at an agreed fixed price. Such a commodity is called the underlying asset. At the same time, the main parameter of the futures contract, which the parties agree on, is precisely the price of its execution. When entering into a transaction, market participants can pursue one of two goals.

For some, the goal is to determine a mutually acceptable price at which the actual delivery of the underlying asset will be carried out on the date of the contract. By agreeing on a price in advance, the parties insure themselves against a possible adverse change in the market price by the specified date. In this case, none of the participants seeks to profit from the futures transaction itself, but is interested in its execution in such a way that pre-planned indicators are observed. Obviously, when concluding futures contracts, such logic is followed, for example, by manufacturing enterprises that buy or sell commodities and energy resources.

For another type of derivatives market participants, the goal is to earn on the movement of the price of the underlying asset over the period from the moment a transaction is concluded to its closing. The player who managed to predict the price correctly, on the day of the execution of the futures contract, gets the opportunity to buy or sell the underlying asset at a better price, which means making a speculative profit. It is obvious that the other side of the transaction will be forced to make it at a price that is unfavorable for itself and, accordingly, will incur losses.

<Реклама>. The classic book by the legendary trader Larry Williams "Futures Trading Secrets: Go with the Insiders" is on sale on the LitRes website. You can buy it from this link.

It is clear that in the event of an unfavorable development of events for one of the participants, he may be tempted to evade the fulfillment of obligations. This is unacceptable for a more successful player, since his profit is formed precisely from the funds paid to the losers. Since at the time of the conclusion of the futures contract, both participants expect to win, they are simultaneously interested in insuring the transaction against the dishonest behavior of the losing party.

The issue of counterparty risks is directly faced not only by speculators, but also by companies that insure (hedge) against unfavorable price changes. In principle, it would be enough for representatives of real business to seal the contract with a firm handshake and the seal of the company. Such a bilateral OTC transaction is called a forward contract. However, the greed of one of the parties may turn out to be irresistible: why suffer a loss under the contract if your forecast was not justified and, for example, you could sell the goods at a higher price than stipulated in the forward. In this case, the second party to the transaction will have to initiate lengthy litigation.

Clearingcenter

The best solution to the problem of guarantees is to involve an independent arbitrator, whose main role is to ensure that the parties fulfill their obligations, no matter how great the losses of one of the participants will be. It is this function that the exchange clearing center (CC) performs in the futures market. A futures contract is concluded in the exchange system, and the clearing center ensures that on the settlement day each of the trading participants fulfills its obligations. Acting as a guarantor of the execution of contracts, the clearing center ensures that a successful speculator or hedger (insurant) receives the money earned, regardless of the behavior of the other participant in the transaction.

From a legal point of view, when making a deal on the exchange, traders do not enter into a contract with each other - for each of them, the other party to the transaction is the clearing center: for the buyer, the seller and, conversely, for the seller, the buyer (see Fig. 1). In the event of claims in connection with the non-execution of the futures contract by the opposite party, the exchange player will demand compensation for lost profits from the clearing center as from the central party for transactions for all market participants (there are special funds in the CC for this). Clearing house arbitrage also protects trading participants from a theoretical stalemate in which both parties fail to meet their contractual obligations. De jure and de facto, when concluding a futures deal on the stock exchange, a trader is not associated with a specific counterparty. The clearing center acts as the main connecting element in the market, where an equal volume of long and short positions makes it possible to depersonalize the market for each of the participants and guarantee the fulfillment of obligations by both parties.

In addition, it is the lack of binding to a specific counterparty that allows a market participant to exit a position by entering into an offset deal with any player (and not just with the one against which the position was opened). For example, you have a buy futures open. To close a long position, you need to sell a futures contract. If you sell it to a new participant: your obligations are canceled and the clearing house remains short against the long position of the new participant. At the same time, there are no changes on the account of the participant who sold the contract at the time when you just opened the position - he has a short futures against the long position of the clearing center.

Warrantysecurity

Such a system of guarantees, of course, is beneficial to market participants, but is associated with great risks for the clearing house. After all, if the losing party refuses to pay the debt, the CC has no other way but to pay the profit to the winning trader from its own funds and start legal prosecution of the debt bidder. Such a development of events, of course, is not desirable, so the clearing house is forced to insure the corresponding risk at the time of the conclusion of the futures contract. For this purpose, the so-called collateral (GA) is charged from each of the bidders at the time of buying and selling a futures contract. In fact, it represents a security deposit that will be lost by a participant who refuses to pay the debt. For this reason, margin is also often referred to as deposit margin (the third term is initial margin, as it is charged when a position is opened).

In the event of a default by the losing party, it is at the expense of the deposit margin that the profit will be paid to the other participant in the transaction.

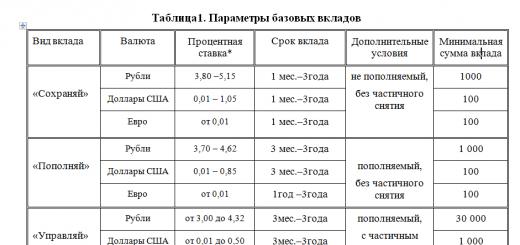

Margin performs another important function - determining the allowable volume of the transaction. Obviously, when concluding an agreement on the sale and purchase of the underlying asset in the future, no transfer of funds between counterparties occurs until the moment the contract is executed. However, there is a need to “control” the volume of transactions so that no unsecured obligations arise on the market. The insurance that the participants who have concluded futures contracts intend to execute them, and that they have the necessary funds and assets for this, is a guarantee, which, depending on the instrument, ranges from 2 to 30% of the contract value. Thus, having 10 thousand rubles on the account, the trading participant will not be able to speculate in futures for shares worth, for example, 1 million rubles, but will actually be able to make margin transactions with a leverage of up to 1 to 6.7 (see Table 1), which significantly exceeds its investment opportunities in the stock market. However, an increase in financial leverage naturally entails a proportional increase in risks, which must be clearly understood. It should also be noted that the minimum base rate of GO can be increased by the decision of the exchange, for example, with an increase in the volatility of the futures.

Table.1 Warranty in FORTS

|

(minimum basic size of GO as a percentage of the value of the futures contract and the corresponding leverage) |

||||

|

underlying asset |

Pre-crisis parameters* |

Current parameters in a crisis |

||

|

Stock market section |

||||

|

RTS index | ||||

|

Industry index for oil and gas | ||||

|

Industry indices for telecommunications and trade and consumer goods | ||||

|

Ordinary shares of OAO Gazprom, NK Lukoil, OAO Sebrbank of Russia | ||||

|

OAO OGK-3, OAO OGK-4, OAO OGK-5 | ||||

|

Ordinary shares of MMC Norilsk Nickel, OAO NK Rosneft, OAO Surgutneftegaz, OAO Bank VTB | ||||

|

Preferred shares of OAO Transneft, OAO Sberbank of Russia | ||||

|

Ordinary shares of OJSC MTS, OJSC NOVATEK, OJSC Polyus Gold, OJSC Uralsvyazinform, OJSC RusHydro, OJSC Tatneft, OJSC Severstal, OJSC Rostelecom | ||||

|

Shares of companies in the electric power industry | ||||

|

Federal loan bonds OFZ-PD issue No. 25061 | ||||

|

Federal loan bonds OFZ-PD issue No. 26199 | ||||

|

Federal loan bonds of issue OFZ-AD No. 46018 | ||||

|

Federal loan bonds OFZ-AD issue No. 46020 | ||||

|

Federal loan bonds OFZ-AD issue No. 46021 | ||||

|

Bonds of OAO Gazprom, OAO FGC UES, OAO Russian Railways, as well as bonds of the City bonded (internal) loan of Moscow and Moscow regional internal bonded loans | ||||

|

Commodity Market Section |

||||

|

Gold (refined bullion), sugar | ||||

|

Silver (refined bullion), diesel fuel, platinum (refined bullion), palladium (refined bullion) | ||||

|

URALS oil, BRENT oil | ||||

|

Money Market Section |

||||

|

US dollar to ruble exchange rate, euro to ruble exchange rate, euro to US dollar exchange rate | ||||

|

Average rate of interbank overnight loan MosIBOR*, | ||||

|

MosPrime 3-month loan rate* | ||||

* For futures on interest rates, other methods of determining the size of leverage are used (a separate article will be devoted to these instruments in the future).

variationalmargin, orHowformedprofit

Own risk management is the prerogative of the bidder. However, the risks associated with the fulfillment of its obligations to other traders, as mentioned above, are monitored by the clearing center. It is obvious that the size of the guarantee deposited by the player when concluding a futures contract is directly related to the volatility of the underlying instrument. So, when trading stock futures, you will have to make a security deposit of 15-20% of the contract value. When entering into futures linked to significantly less volatile assets (for example, government bonds, the US dollar or short-term interest rates), the required amount of collateral may be 2-4% of the contract value. However, the problem is that the price of each futures contract is constantly changing, just like any other exchange instrument. As a result, the clearing center of the exchange faces the task of maintaining the collateral deposited by the participants in the transaction in an amount corresponding to the risk of open positions. This correspondence is achieved by the clearing house by daily calculation of the so-called variation margin.

The variation margin is defined as the difference between the settlement price of a futures contract in the current trading session and its settlement price the previous day. It is accrued to those whose position turned out to be profitable today, and debited from the accounts of those whose forecast did not come true. With the help of this margin fund, one of the participants in the transaction extracts speculative profit even before the contract expires (and, by the way, has the right to use it at its discretion at this time, for example, to open new positions). The other participant bears financial losses. And if it turns out that there are not enough free funds on his account to cover the loss (the participant guaranteed the futures contract in the amount of his entire account), the variation margin is deducted from the guarantee margin. In this case, the exchange clearing center, in order to restore the required amount of the security deposit, will require additional money (make a margin call).

In the above example (see How the variation margin flows ..) with futures for the shares of MMC Norilsk Nickel, both participants entered into a deal, blocking 100% of cash in the GO for these purposes. This is a simplified and uncomfortable situation for both parties, since the transfer of the variation margin will oblige one of them to urgently replenish the account the very next day. For this reason, most players manage their portfolios in such a way that they have enough free cash to at least compensate for random fluctuations in the variation margin.

Execution (supply) Andearlyexitfrompositions

According to the method of execution, futures are divided into two types - delivery and settlement. When executing supply contracts, each of the participants must have the appropriate resources. The clearing center determines pairs of buyers and sellers who must conduct transactions with the underlying asset between themselves. If the buyer does not have all the required amount of funds or the seller does not have a sufficient amount of the underlying asset, the clearing center has the right to fine the participant who refused to execute the futures for the amount of the collateral. This penalty passes to the opposite party as compensation for the fact that the contract is not performed. For deliverable futures in FORTS five days prior to their execution, the GI increases by 1.5 times to make the alternative of not entering the delivery completely unprofitable compared to possible losses from the price movement in an unfavorable direction. For example, for stock futures, margin increases from 15% to 22.5%. These contracts are unlikely to accumulate such a huge loss in one trading day.

Therefore, players who are not interested in real delivery often prefer to get rid of obligations under the contract before the deadline for its execution. To do this, it is enough to make a so-called offset deal, within the framework of which a contract is concluded, equal in volume to the one concluded earlier, but opposite to it in the direction of the position. In this way, most participants in the futures market close positions. For example, on the New York Mercantile Exchange (NYMEX), no more than 1% of the average volume of open positions on futures for WTI oil (Light Crude) reaches delivery.

With settled futures, for which there is no delivery of the underlying asset, everything is much simpler. They are executed through financial settlements - as well as during the life of the contract, bidders are charged a variation margin. Therefore, under such contracts, the collateral is not increased on the eve of execution. The only difference from the usual procedure for calculating the variation margin is that the final settlement price is determined based not on the current value of the futures, but on the price of the cash (spot) market. For example, for futures on the RTS index, this is the average value of the index for the last hour of trading on the last trading day for a specific futures, for futures on gold and silver, the value of the London Fixing (London Fixing is one of the main benchmarks for the entire world market of precious metals).

All futures for shares and bonds circulating in FORTS are deliverable. Contracts for stock indexes and interest rates, which by their nature cannot be executed by delivery, of course, are settlement contracts. Commodity asset futures are both settled (for gold, silver, Urals and Brent oil) and deliverable - a futures for diesel fuel with delivery in Moscow, for sugar.

Pricingfutures

Futures prices follow the price of the underlying asset on the spot market. Let's consider this issue using the example of contracts for Gazprom shares (the volume of one futures contract is 100 shares). As can be seen in Figure 2, the futures price almost always exceeds the spot price by a certain amount, which is usually called the basis. This is due to the fact that the risk-free interest rate plays an important role in the formula for calculating the fair futures price per share:

F=N*S*(1+r1) - N*div*(1+r2),

where N is the volume of the futures contract (number of shares), F is the price of the futures; S is the spot price of the share; r1 – interest rate for the period from the date of conclusion of a transaction under a futures contract until its execution; div is the amount of dividends on the underlying share; r2 – interest rate for the period from the date of closing the register of shareholders (“cut-off”) until the execution of the futures contract.

The formula is given taking into account the impact of dividend payments. However, if dividends are not paid during the circulation period of the futures, then they do not need to be taken into account when determining the price. Usually, dividends are taken into account only for June contracts, but recently, due to the low dividend yield of shares of Russian issuers, the impact of these payments on the value of futures is extremely low. And the role of the risk-free interest rate, on the contrary, remains very large. As you can see on the chart, the size of the basis gradually decreases as the date of the futures expiration approaches. This is explained by the fact that the basis depends on the interest rate and the period until the end of the contract circulation - every day the value of the interest rate decreases. And by the day of execution, the prices of the futures and the underlying asset, as a rule, converge.

"Fair" prices in the futures market are set under the action of participants conducting arbitrage operations (usually large banks and investment companies act in their role). For example, if the price of a futures differs from the price of a stock by more than the risk-free rate, arbitrageurs will sell futures contracts and buy shares in the spot market. To quickly carry out the operation, the bank will need a loan to purchase securities (it will be paid at the expense of income from arbitrage transactions - that is why the interest rate is included in the futures price formula). The position of the arbitrageur is neutral with respect to the direction of the market movement, since it does not depend on the exchange rate fluctuations of either the stock or the futures. On the day the contract is executed, the bank will simply deliver the purchased shares on the futures, after which it will pay off the loan. The final profit of the arbitrageur will be equal to the difference between the prices of buying shares and selling futures minus interest on the loan.

If the futures are too cheap, then a bank that has an underlying asset in its portfolio has a chance to earn a risk-free profit. He just needs to sell shares and buy futures instead. The arbitrageur will place the freed funds (price of sold shares minus collateral) on the interbank lending market at a risk-free interest rate and thereby make a profit.

However, in some situations, the basis can "get rid" of the interest rate and become either too large (contango), or vice versa go into the negative area (backwardation - if the futures price is lower than the value of the underlying asset). These imbalances occur when the market expects a strong move up or down. In such situations, the futures may outpace the underlying asset in terms of growth / fall, since the costs of operations in the derivatives market are lower than in the spot market. With a massive onslaught from only one side (either buyers or sellers), even the actions of arbitrageurs will not be enough to bring the futures price to a “fair” one.

Conclusion

Five years ago, the instrumentation of the futures and options market in Russia was limited, in fact, only to contracts for shares, so the derivatives market was forced to compete for clientele with the stock market. There were two main arguments for choosing futures: an increase in financial leverage (leverage) and a reduction in associated costs. Options have a lot more competitive advantages: the ability to profit from a sideways trend, volatility trading, maximum leverage and much more, but options also require a lot more preparation. The situation with futures changed dramatically when there were contracts for stock indices, commodities, currencies and interest rates. They have no analogues in other segments of the financial market, while trading in such instruments is of interest to a wide range of participants.

Derivatives market - a segment of the financial market where futures contracts (derivatives) are concluded

Derivative instrument (derivative, from English derivative) is a financial instrument, the price of which depends on a certain underlying asset (underlying asset). The most famous are futures and options - futures contracts (contracts), which define the conditions for concluding a transaction with the underlying asset at a certain point in time in the future, such as price, volume, term and procedure for mutual settlements. Until the expiration date (circulation), futures and options themselves act as financial instruments that have their own price - they can be resold (assigned) to other market participants. The main exchange platform for derivatives in Russia is the Futures and Options market on the RTS (FORTS).

A futures contract (from the English future - future) is a standard exchange contract, according to which the parties to the transaction undertake to buy or sell the underlying asset on a certain (set by the exchange) date in the future at a price agreed upon at the time of conclusion of the contract. Usually, futures with several expiration dates are in circulation on the exchange, mainly tied to the middle of the last month of the quarter: September, December, March and June. However, liquidity and the main turnover, as a rule, are concentrated in contracts with the nearest settlement date (the settlement month is indicated in the futures code).

Open position (Open Interest)

When buying or selling a futures, traders have an obligation to buy or sell an underlying asset (such as a stock) at a specified price or, as the trades say, “buy or sell positions are opened.” The position remains open until the contract is executed or until the trader enters into a deal opposite to this position (Offset Deal).

Long position (Long)

A trader entering into a futures contract to buy the underlying asset (buying a futures) opens a long position. This position obliges the owner of the contract to buy an asset at a specified price at a certain point in time (on the day the futures are settled).

Short position (Short)

Occurs when concluding a futures contract for the sale of the underlying asset (when selling contracts), if no buy positions (long positions) were previously opened. With the help of futures, you can open a short position without having the underlying asset available. A trader can: a) acquire the underlying asset shortly before the execution of the futures; b) early close a short futures position with an offset transaction, fixing its financial result.

The essence of the futures on the example of gold

The jeweler will need 100 troy ounces of gold in three to four months to make jewelry (1 ounce = 31.10348 grams). Let's say it's August and one ounce is worth $650, and the jeweler is afraid of rising to $700. He has no free $65,000 to buy the precious metal in reserve. The way out is to conclude on the exchange 100 futures contracts for the purchase of gold with execution in mid-December (the volume of one contract is equal to one ounce). Those. the jeweler will need all the necessary funds only by the end of the year. Until that time, he will only need to keep on the exchange a guarantee (collateral), the amount of which will be $6,500 - 10% of the cost of 100 futures (for more details on the guarantee, see Table 1). Who will sell futures to the jeweler? This may be a stock speculator or a gold mining company that plans to sell a batch of precious metal in December, but fears a fall in prices. For her, this is a great opportunity to pre-fix the level of income from the sale of goods not yet produced.

Fromstories

The principles of organizing futures trading that are used today on exchanges appeared in the USA in the 19th century. The Chicago Board of Trade (CBOT) was founded in 1848. At first, only real goods were traded on it, and in 1851 the first fixed-term contracts appeared. At the first stage, they were concluded according to individual conditions and were not unified. In 1865, standardized contracts were introduced on the CBOT, which became known as futures contracts. The specification of the futures specified the quantity, quality, time and place of delivery of the goods.

Initially, contracts for agricultural products were traded on the futures market - it was precisely because of the seasonality of this sector of the economy that the need arose for contracts for future deliveries. Then the principle of organizing futures trading was used for other underlying assets: metals, energy resources, currencies, securities, stock indices and interest rates.

It is worth noting that agreements on future prices for goods appeared long before modern futures: they were concluded at medieval fairs in Flanders and Champagne in the 12th century. A kind of futures existed at the beginning of the 17th century in Holland during the “tulip mania”, when entire segments of the population were obsessed with the fashion for tulips, and these flowers themselves cost a lot of money. At that time, not only tulips were traded on the exchanges, but also contracts for future harvests. At the peak of this recession-ending mania, more tulips were being sold in the form of fixed-term contracts than could grow on all of Holland's arable land.

At the beginning of the 18th century in Japan, rice coupons (cards) began to be issued and circulated on the stock exchange in Osaka - in fact, these were the first futures contracts in history. The coupons represented buyers' rights to the still-growing rice crop. The exchange had rules that determined the delivery time, variety and quantity of rice for each contract. It was rice futures, which were the subject of active speculation, that led to the emergence of the famous Japanese candlesticks and technical analysis.

Market adjustment. Market revaluation system (Mark-to-Market)

A system used on futures exchanges that aims to avoid large losses on open futures or options positions. Every day during the clearing session, the Clearing Center fixes the settlement price of futures contracts and compares it with the position opening price by the trading participant (if the position was opened during this trading session) or with the settlement price of the previous trading session. The difference between these prices (variation margin) is deducted from the account of the participant who has a losing position and credited to the account of the participant who has a profitable position. During the clearing session, simultaneously with the transfer of the variation margin, the size of the collateral in monetary terms is also reviewed (by multiplying the settlement price by the GO rate in percent).

The market revaluation system also makes it possible to significantly simplify the procedure for calculating profit-loss on offset trades - the clearing center does not need to store information about who, when and against whom opened this or that position. It is enough to know what positions the participants had before the start of the current trading session (under a futures contract for one underlying asset with a specific settlement date, the positions of all players are taken into account at the same price - at the settlement price of the previous trading session). And for further calculations, the exchange and CC need prices and volumes of transactions of only one current trading day.

Leverage or Leverage

Shows how many times the client's own funds are less than the value of the underlying asset being bought or sold. For futures contracts, the leverage is calculated as the ratio of the size of the margin (initial margin) to the value of the contract.

In the case of futures, leverage does not arise due to the fact that the client takes a loan from a brokerage company or a bank, but due to the fact that opening a position on the exchange does not require paying 100% of the value of the underlying asset - you need to deposit a guarantee.

Margin Call or Margin Call

The requirement of the brokerage company to the client or the clearing center to the clearing member to add funds to the minimum balance to maintain an open position.

Rollover (Roll-over)

Transferring an open position to a contract with the next execution month. Allows you to use futures as a tool for holding long-term positions - both long and short. With the help of rollover, you can invest for the long term in underlying assets that are difficult to access on the cash market or are associated with higher costs (for example, gold, silver, oil).

How the variation margin flows and the margin is re-established (on the example of a futures on shares of MMC Norilsk Nickel)

Suppose two bidders entered into a futures contract for the supply of 10 shares of MMC Norilsk Nickel at a fixed price with expiration in September 2007. At the time of the agreement, the futures price was 35,000 rubles. Since the margin for this instrument is set at 20% of its value, each trader needs to have 7,000 rubles on their account to participate in the transaction (see Table 1). The Clearing Center reserves (blocks) these funds in order to guarantee the fulfillment of the obligations of the parties.

The next day, trading closed at 34,800 rubles. Thus, the price of the futures decreased, and the situation developed in a favorable way for the participant who opened a short position. The variation margin in the amount of 200 rubles, which is the difference between the settlement prices of the first and second days, is transferred to the seller, and his deposit increases to 7200 rubles. Since the funds are debited from the futures buyer's account, his deposit is reduced to 6800 rubles. From the point of view of the clearing center, this situation is unacceptable, since the collateral for each of the participants must be maintained in the amount of at least 20% of the current value of the contract, which is 6,960 rubles at a futures price of 34,800 rubles. Therefore, the clearing center will require the buyer of the futures to replenish the account in the amount of at least 160 rubles. Otherwise, his position will be forcibly closed by the broker.

On the third day, prices rise and the contract for the supply of 10 shares of MMC Norilsk Nickel costs 35,300 rubles at the end of trading. This means that the situation has changed in favor of the buyer of the futures, and he will be credited with a variation margin in the amount of 500 rubles or the difference between 35,300 and 34,800 rubles. Thus, the buyer's account will be 7300 rubles. The seller, on the contrary, will reduce his funds to 6,700 rubles, which is significantly less than the required deposit margin, which now stands at 7,060 rubles (20% of the contract price of 35,300 rubles). The clearing center will require the seller to top up the collateral in the amount of at least 360 rubles, and the buyer, in turn, can dispose of free funds in the amount of 240 rubles (funds on the account - 7300 minus GO - 7060 rubles).

Suppose that on the fourth day both participants decide to close their positions. The transaction price was 35,200 rubles. When it is made, the variation margin is transferred for the last time: 100 rubles are debited from the buyer's account and go to the seller. At the same time, the collateral of both participants is released, and the entire amount of the remaining funds becomes free for use: they can be withdrawn from the exchange or new positions can be opened for them. The financial result of operations for the buyer was expressed in 200 rubles of profit received in the form of a variation margin (-200 + 500-100 or 35,200-35,000 rubles), and the seller suffered a loss in the same amount.

Tab. 2 Movement of funds on long and short positions in a futures contract for 1,000 shares of MMC Norilsk Nickel

|

Price |

Warranty (20%) |

Buyer |

Salesman |

|||||||

|

Account funds |

Variation margin |

Available funds |

Account funds |

Variation margin |

Available funds |

|||||

|

before |

after |

before |

after |

|||||||

|

|

| |||||||||

Delivery contract execution price

At the very beginning of the article, we stipulated that when concluding a futures contract, the parties agree in advance on the delivery price. From an economic point of view, this is how it turns out, but from the point of view of the movement of money in the accounts of market participants, the situation looks a little different. Let's consider the situation on the example of the same September futures for the shares of MMC Norilsk Nickel. Suppose after two traders entered into a contract at the end of July at a price of 35,000 rubles, by mid-September the futures price rose to 40,000 rubles and at the close of the session on the last day of trading (September 14) stopped at this level. It is at this price that the delivery will be made - the buyer will pay the seller 40,000 rubles for 10 shares of MMC Norilsk Nickel. But during the time of holding a long position, the buyer will receive a positive variation margin in the amount of 5,000 rubles (40,000-35,000) - the clearing center will write it off from the seller's account. Therefore, the buyer will have an increase on the deposit in order to compensate for the increase in the cost of delivery compared to the price of the original transaction.

Trading toolsGood afternoon trading blog readers. The word futures is an agreement or contract between a buyer and a seller that obliges both to buy or sell some asset at a specific time in the future at the current price.

These contracts are freely circulating on exchanges, traded with a fairly large leverage(10:1 or 20:1), which is very popular among experienced speculators. After reading this page to the end, you will understand the main idea that I want to convey to you: futures is a fairly powerful and profitable financial instrument for trading, but it carries great risks for a novice trader due to its trading features.

Imagine a baker who makes beautiful and tasty products from wheat flour. His business is stable, orders are placed months in advance. He buys wheat from the nearest farmer at an adequate price. What will happen to the pre-order baker's business if next year's harvest is poor and the price of wheat rises? In simple words, he will suffer losses.

With these considerations, the baker comes to the farmer and offers to conclude an agreement for the purchase of 10 tons of wheat. at the current price next year for a small prepayment (warranty support) 5-10% of the total transaction value. The first undertakes to buy, and the second to sell. The farmer agrees, since another farm has opened nearby, which is a considerable competitor to him. Who knows if he can sell grain next year?

This contract is a futures contract. Whatever happens next year, the deal must be done. Both parties are on an equal footing. If the wheat harvest is poor, the price of wheat will rise. The baker will be pleased because he buys at the old price, and the farmer, although he will not be offended, will be disappointed.

If the wheat harvest is excellent, then its price will fall. The farmer is happy that he can sell his product at a higher cost, and the baker is upset, although his business continues to operate steadily.

Let's summarize briefly. Futures is:

- A tool that puts the buyer and seller in equal conditions;

- Commitment buy Sell underlying asset, which in our example is wheat. The underlying assets can be stock indices, goods and raw materials, currency, precious metals and other assets;

- Treaty or just a piece of paper that stands 5-10% from the entire value of the transaction. The transaction itself is completed 100% only in the future after the expiration of the contract.

What is a futures for?

First, to limit risks. In the example above, both the farmer and the baker simply wanted to insure their businesses against unexpected price changes. That is, futures is one of the hedging methods. You buy it to hedge against an increase in the value of the underlying asset and sell it if you need to limit losses when the price of the underlying asset falls.

Secondly, futures is an ideal tool for speculation. On a futures exchange, a trader does not wait for the contract to expire in order to receive the underlying asset. He actively buys and sells futures for only 5-10% of the value of the entire transaction. This is a prime example margin trading when you get leveraged from 10 to 1 to 20 to 1.

What are the risks of futures trading?

Futures is a purely speculative instrument. It's just that no one can predict what the price of the underlying asset will be in a year or a few months. For example, the amount of wheat on the shelves of the markets depends on natural conditions that affect the harvest, storage conditions and delivery options (transport, roads). Can you predict all this and make your bet? Of course not.

To help you understand this, compare futures with share? If a business shows an increase in profit from year to year, then the price of its shares will increase in the future. Investors like Buffett know this well and make money this way.

Another feature of futures is margin trading. You are getting leverage, which makes it possible to open positions exceeding 10 or even 20 times your trading account. Thus, if, for example, a $1 fluctuation in the stock price corresponds to a profit or loss of $1 (per 1 lot), then a $1 change in the futures price corresponds to a profit or loss of $10 or $20 (per contract).