The management company Raiffeisen Capital was established by the financial corporation ZAO Raiffeisenbank. The company is an advanced player in financial market, is a member of the Association for the Protection of Investor Rights and the National League of Managers NP.

Investing with funds

The main activity of the management company is the coordination of capital investments of individuals and legal entities through mutual funds and trust management. The structure of Raiffeisen Capital Management Company includes:

- "Raiffeisen - Shares" is an investment fund designed for capitalists who consider long-term investments in Russian companies as one of their priorities. The main tools for making a profit are shares of stable companies.

- "Raiffeisen - Bonds" is an open-ended fund whose main clients are conservative investors aimed at investing in bonds and other debentures, backed by state monetary reserves.

- "Raiffeisen - Balanced" is a fund that attracts the attention of capitalists seeking to achieve a balance of high-risk and reliable instruments in one portfolio. The company's dominant asset is shares, losses on which are offset by the presence of bonds with guaranteed coupon income.

- "Raiffeisen - USA" is a fund of the management company "Raiffeisen Capital", created to carry out profitable transactions on stock market USA

- "Raiffeisen - Consumer Sector" is a fund that satisfies the interests of capitalists who highly value the possibilities for developing the consumer sector of the economy. The core of the fund is securities large retailers, as well as companies closely related to the production of consumer goods.

- "Raiffeisen - Raw Materials Sector" is a fund that fulfills the financial needs of capitalists who are ready to invest monetary resources in the raw materials sector.

- "Raiffeisen - Information Technology» an open-ended fund that invests financially in the information business. The fund makes daily transactions involving shares of information, telecommunications and other similar companies.

- "Raiffeisen - Electric Power" is a fund intended for capitalists who expect to make a profit through financial investments in shares of companies operating in the electric power industry.

- "Raiffeisen - MICEX Index" is a fund that uses the main trends of the stock exchange as a guide. Priority is given to transactions with shares of companies forming the blue chip segment, as well as corporations in the field of trade and communications.

- "Raiffeisen - Industrial" - the company invests monetary assets for the implementation of infrastructure projects.

- "Raiffeisen - Asia" is a fund of the management company "Raiffeisen Capital" created to carry out profitable transactions on the stock market of the Asian region.

- "Raiffeisen - BRIC" is a fund created to carry out profitable transactions on the stock market of countries included in the BRIC structure.

- "Raiffeisen - Gold". The fund's financial injections are aimed at completing transactions for the acquisition of precious metals. The fund is an attractive object for investors who adhere to classical thinking and seek to place financial resources for the long term.

- "Raiffeisen - Treasury" is a fund that attracts the attention of investors who have faith in receiving coupon income on bonds;

- "Raiffeisen - Active Management Fund" is a fund created to carry out profitable transactions on the stock markets of the USA, Europe and Asia. Aimed at capitalists who are ready to place financial resources for a period of 2 years or more.

- "Raiffeisen - Eurobonds", the Raiffeisen Capital fund of the management company, which is based on the principle of investing in dollar assets, which during the period of ruble stagnation are an effective means of generating profit.

- "Raiffeisen - Second Tier Equity Fund" - the company is focused on acquiring shares of little-known corporations that are at the stage of intensive development.

Personal investment tactics

Conditions of increased market volatility often dictate to investors the choice of a personal management strategy financial means. Ex. the company is ready to provide a manager to develop unique investment tactics for both ordinary and corporate investors.

Limited Liability Company Management Company "Raiffeisen Capital" actively cooperates with institutional investors, such as non-state pension funds And Insurance companies. The main activity is the investment of investors' own and attracted financial resources into the most profitable instruments.

Good day, Dear readers and subscribers of the investment blog!

Back in the middle of summer, after I began to show results in , I promised to tell you about this type of investment, and specifically about an instrument from my portfolio - open Mutual fund Raiffeisen bonds which is under control Management Company "Raiffeisen Capital".

In one of the reports, I was asked a question about how I calculate the yield on bonds, because if you invest directly in bonds, it is not very simple, you need to deal with coupons, redemptions, etc. Everything depends on the fact that they exist and the profitability on them is calculated differently.

So, in order not to burden myself with all these subtleties and additional monitoring, I, as a preferential, selected the Raiffeisen Capital Mutual Fund for myself, especially since bonds must be in the portfolio on a par with shares, both as an independent investment instrument and to reduce risks when investing in securities.

If we talk about direct investment in bonds, then we cannot fail to note the fact that bonds are less risky (and, accordingly, less liquid) compared to.

Let's return to the discussion of the product of the management company Raiffeisen Capital - Mutual Fund Raiffeisen Bonds:

- Basic information about the fund:

- In this open mutual fund, the main investments and distributions are made up of shares of debt obligations (bonds) of the Government of the Russian Federation, constituent entities of the Russian Federation and major Russian companies, the so-called blue chips and a small share of shares of foreign companies. The main strategy for managing a bond fund is aimed at preserving capital in the face of official inflation.

The fund is managed by investing in debt instruments with moderate returns that exceed average rates on bank deposits and at the same time have a high level of reliability.

- Portfolio structure:

- Investment is carried out in accordance with tariff plan:

— the acquisition of a share can occur at any time, while the value of the share is determined daily;

— the minimum investment level is 15 thousand rubles for the first purchase, and then the level is reduced to 3 thousand rubles, i.e. subsequent purchases can be made from 3 thousand rubles.

— if you study the investment conditions on the Raiffeisen Capital website, then for the purchase of bond units an investment period of more than 1 year is recommended and here’s why:

There is a commission when redeeming shares and the longer the investment period, the more profitable the redemption:

1) when repaying before 182 days, a commission of 2% is charged

2) from 182 days to 365 days inclusive - 1%

3) after 365 days there is no charge.

At the time of preparation of the material, the yield of the Raiffeisen bond fund is as follows:

On the chart, which can be viewed at different time periods, by setting the desired one either at the bottom of the calendar, or by moving the lever to the right or left (everything is marked and shown with arrows), you can clearly see how the fund’s profitability and the volume of invested funds have changed.

The growth schedule is not ideal and this is quite typical for investments without a fixed profitability. Despite the drawdowns, the general trend remains positive, although a decline always confuses some investors and it is clear how much the fund’s capital has decreased after an unstable situation.

Many people psychologically cannot bear the disadvantages, but, often, this allows them to make big profits precisely at such moments when replenishing funds at a drawdown.

Of course, it is not a fact that as soon as you add funds, growth will immediately begin, the decline may continue, but sooner or later a rebound will occur and it will be possible to record additional profit from investing in the instrument. Just such a clear example (and it is almost ideal) can be seen on the graph of the growth of a bond mutual fund.

- In the information sections you can study:

— reporting, where reports on the fund for different periods, certificates of the value of the fund’s assets, balance sheets and explanatory notes to these documents are provided in PDF format;

— documentation on the fund: tariffs, rules of trust management, track possible changes in the documentation;

— and also use an investment calculator that will help you navigate the returns of past periods:

First, you need to select the type of mutual fund, set the dates and click calculate or view the dynamics on the chart.

- Also, in the line of mutual funds of Raiffeisen Capital, there are various open-end funds and, in the future, the investor has the right to exchange one share for another (except for the Raiffeisen - Precious Metals commodity market mutual fund) or invest in different ones after first studying their history:

- You can purchase shares of Raiffeisen Capital Management Company through the nearest branches of Raiffeisen Bank. To do this, you just need to come with a passport and money, and then go through all the formalities (fill out application forms, questionnaires), and after all, you will only have to regularly monitor the selected investment instrument and review it every week. results via the Internet personal account and fix it.

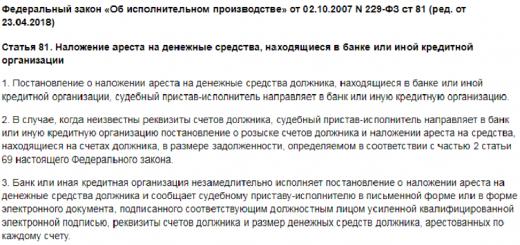

- As for paying income taxes, here is the same as when investing in shares through a broker:

When making profit from investing in shares, income must be subject to personal income tax in accordance with the Tax Code of the Russian Federation. At the same time, Raiffeisen Capital Management Company has the status of a tax agent for individuals investing in shares and, in accordance with Articles of the Tax Code of the Russian Federation 214.1 and 226, Chapter 26, after the redemption of shares, it is obliged to calculate, withhold and pay tax (personal income tax) to the budget.

Tax rates currently are:

1) 13% for tax residents RF;

2) 30% for tax non-residents of the Russian Federation.

Finishing tax period Raiffeisen Capital Management Company is obliged to provide the investor with a certificate of income if he needs one and he issues a written request.

If the shareholder is not individual, and the enterprise, i.e. If you are a legal entity, then all operations related to the calculation and payment of taxes are carried out independently. Tax rate in this case it will be 20%, which corresponds to the Tax Code of the Russian Federation, art. 284 clause 1 and it will be the same both for enterprises resident in the Russian Federation and for those who do not have a representative office in Russia (Articles 284, 306-311 Tax Code RF).

When exchanging units, transactions are not subject to taxes.

- Despite small risks when investing in bond funds, they are nevertheless preserved, and at this point I would like to remind you and provide a link to an article on the blog, which I regularly recommend reading, and also took a screenshot from the website of Raiffeisen Capital Management Company, where possible risks are described in detail:

This concludes today’s review and I would like to wish that all instruments in your portfolio remain in a positive trend and risks are minimal.

Good luck and profit to everyone!

******************************************************************************************************************

Mutual investment funds are a fairly popular investment instrument today, which is actively offered by banks at any opportunity, and RaiffeisenBank is no exception.

For those who do not know what this “beast” is, we have prepared a small educational program.

A mutual investment fund is a kind of “financial structure” that has nothing in common with “pyramids” and other inventions of the era of the “wild 90s”. In essence, this is a service company that, like a bank, is a professional investor. Anyone can contribute to a mutual fund with minimal effort. cash. In return, he receives a “security” or share confirming the amount of the deposit. The fund, in turn, depending on its specialization, invests the funds received in the real sector of the economy, precious metals, other securities, etc. The specialization of the fund, as a rule, is directly indicated in its name.

The mutual fund is “managed” by a management company (“general director”), whose goal is to increase the fund’s property and, consequently, enrich its investors. Depending on the performance of the “CEO,” the investor may receive either income or loss.

Of course, no one distributes any dividends at the end of the year. The shareholder receives actual income if he sells his share at a price higher than the purchase price of this share, as well as the management company’s commission (if any). We strongly recommend that you find out about the size of such commissions in advance.

Compared to bank deposit, then, of course, mutual funds are a riskier investment instrument. However, as in any financial affairs, “risk costs money,” therefore, as a rule, the profitability of a mutual fund can be significantly higher than the contribution under a successful combination of circumstances.

At the same time, the mutual fund is much more flexible: the shareholder can at any time increase or decrease his share by buying/selling at the current market value of the share.

However, remember that when communicating with a mutual fund consultant, it is very important to understand all the details of the fund’s activities (specifics, strategy, portfolio, terms of the agreement with the management company, etc.). Remember, there are no stupid questions! But stupid mistakes due to ignorance and the real loss of your own money are a very specific threat in this case.

“What, where, when” – overview and dynamics

Let's see how things were going for mutual funds managed by Raiffeisen Capital in 2015, which was so difficult and eventful. We will compile the success rating of mutual funds based on the level of profitability growth compared to 2014. This is how the places were distributed:

- Raiffeisen - Shares . The fund's specialization is shares of leading Russian companies that shape the long-term development of the national economy (these are not only companies in the mining sector, but also in the financial and consumer sectors). A fairly diversified option in terms of risks. Despite the difficult political and economic relations in the world, mutual funds in this area showed the highest growth - 36.8%.

- Raiffeisen - Raw materials sector. This package consists of leading companies extracting and processing oil and gas, as well as those involved in metallurgy and mineral fertilizers. This may be why the increase in profitability is slightly lower - 36.3% (the portfolio is more highly specialized).

- Raiffeisen – Information technologies. In the era of the development of cyberspace and communications, this investment option can be considered a win-win, since it assumes the most favorable risk/return ratio even in an ambiguous economic situation. This turned out to be true in 2015 – 33.48% growth.

- Raiffeisen - Bonds. It is considered the most conservative mutual fund, since it is based on debt securities of companies with a high share of state participation. Most likely, thanks to the strategy “you drive slower, you will continue to move”, in terms of profitability, such a mutual fund is always among the leaders - 29.04% growth.

- Raiffeisen – Active Management Fund. The portfolio includes shares of the largest Russian and foreign companies, as well as assets of promising foreign “second-tier” companies. Also a win-win option with proper diversification of investments - 27.35%.

- Raiffeisen - USA. The fund for investors who have no doubts about the success and steadfastness of the world's largest economy has shown quite good results. The case when “the record book works for the student” – 27.34% increase.

- Raiffeisen - Industrial. The basis of the portfolio consists of companies in the metallurgical sector, as well as companies in related industries: construction, mechanical engineering and chemical industry. An unexpectedly good result in the conditions of the “crisis” – 24.41%.

- Raiffeisen - Consumer sector. Even despite the crisis, which primarily affects companies in the consumer sector due to the decrease in the purchasing power of the population, the mutual fund showed an increase of 23.08%.

- Raiffeisen – MICEX blue chip index. The fund is in the “passive management” category, as it follows the dynamics of the MICEX index. Growth – 23.07%.

- Raiffeisen – Debt markets developed countries. The portfolio consists of corporate debt assets of the largest American and European companies with high credit quality - 19.99%.

- Raiffeisen - Europe. The mutual fund also belongs to the “passive” category, as it follows the dynamics of the MSCI EMU index (formed from shares of the largest European companies that are members of the Economic and Monetary Union) – 18.35%.

- Raiffeisen - Balanced. As the name suggests, the mutual fund's strategy is a combination of debt and property securities of the largest international companies - 14.17%.

- Raiffeisen - Gold. Historically, it is considered the most stable investment, especially during the period of depreciation of the ruble - 12.86%.

- Raiffeisen - Treasury. The lion's share is made up of government securities of the Russian Federation. Like gold, this is also an investment with the lowest degree of risk, and therefore one should not expect a high level of return - 11.42%.

- Raiffeisen - Electric Power Industry. The bet on companies in the electricity sector in 2015 can be considered not very successful - only 10.28% growth.

Raiffeisen - Emerging Markets. Investments in developing economies this year have not met expectations - only 7.23% annual growth. - Raiffeisen - Precious metals. A clear outsider, since he was the only one who “reached the finish line” with a negative result: – 6.04%.

In general, 2015 can be called quite successful: more than half of Raiffeisen Capital mutual funds showed annual growth of more than 20%, that is, inflation risks were leveled. However, as in the case of weather forecasting, any forecast of the financial success of a particular mutual fund for 2016 is doomed to failure in advance. Optimists, as always, will believe in a bright future, and pessimists will try to get rid of mutual funds as quickly as possible in order to fix the existing profitability. Decide for yourself who to classify yourself as.

Sofia began working at Raiffeisen Capital Management Company in 2012 as a specialist in the Mutual Investment Funds Department of the Sales and Marketing Department. Since 2014, she worked as an analyst, and since January 2019, as a senior analyst, covering all major sectors of the Russian stock market: oil and gas, metallurgy, retail, telecoms, finance, electric power. Previously she worked at JSC Raiffeisenbank. Sofia graduated from the Far Eastern Federal University with a degree in Finance in 2008.

Participates in the CFA program (level 3 candidate), has qualification certificates 1.0 and 5.0.

Show all Hide

Has 12 years of experience in the field of asset management. He joined the Raiffeisen Capital management team in April 2008 and manages sector investment funds. Before joining Raiffeisen Capital, he worked at MDM Management Company, where he was responsible for the formation of share portfolios. At the end of 2010 and 2011, he was included in the top ten best portfolio managers according to RBC.Rating. He received a bachelor's degree in finance from the University of Alaska, as well as a master's degree in economics from the Financial Academy under the Government of the Russian Federation.

Has FFMS qualification certificates series 1.0 and 5.0.

Show all Hide

He joined the Raiffeisen Capital management team in 2011 as an analyst for the electric power sector, since 2013 he has held the position of portfolio manager, and in January 2019 he was appointed head of the investment department. Graduated from the Moscow Institute of Physics and Technology in 2008, in 2010 he graduated from the Russian Economic School. Participates in the CFA program (level 3 candidate), has an FSFM series 1 certificate.

Stanislav joined Raiffeisen Capital Management Company in December 2018 as a risk manager, and in July 2019 he was appointed manager of the company's bond portfolios. Previously, he worked as a specialist in the credit analytical department of Raiffeisenbank, and from 2013 to 2018. – risk manager at NPF Transneft. He graduated from the Russian State University of Oil and Gas in 2008, and in 2011 from the Financial University under the Government of the Russian Federation with a degree in Financial Markets.

Sofia began working at Raiffeisen Capital Management Company in 2012 as a specialist in the Mutual Investment Funds Department of the Sales and Marketing Department. Since 2014, she worked as an analyst, and since January 2019, as a senior analyst, covering all major sectors of the Russian stock market: oil and gas, metallurgy, retail, telecoms, finance, electric power. Previously she worked at JSC Raiffeisenbank. Sofia graduated from the Far Eastern Federal University with a degree in Finance in 2008.

Participates in the CFA program (level 3 candidate), has qualification certificates 1.0 and 5.0.

Show all Hide

Has 12 years of experience in the field of asset management. He joined the Raiffeisen Capital management team in April 2008 and manages sector investment funds. Before joining Raiffeisen Capital, he worked at MDM Management Company, where he was responsible for the formation of share portfolios. At the end of 2010 and 2011, he was included in the top ten best portfolio managers according to RBC.Rating. He received a bachelor's degree in finance from the University of Alaska, as well as a master's degree in economics from the Financial Academy under the Government of the Russian Federation.

Has FFMS qualification certificates series 1.0 and 5.0.

Show all Hide

He joined the Raiffeisen Capital management team in 2011 as an analyst for the electric power sector, since 2013 he has held the position of portfolio manager, and in January 2019 he was appointed head of the investment department. He graduated from the Moscow Institute of Physics and Technology in 2008, and in 2010 he graduated from the Russian School of Economics. Participates in the CFA program (level 3 candidate), has an FSFM series 1 certificate.

Stanislav joined Raiffeisen Capital Management Company in December 2018 as a risk manager, and in July 2019 he was appointed manager of the company's bond portfolios. Previously, he worked as a specialist in the credit analytical department of Raiffeisenbank, and from 2013 to 2018. – risk manager at NPF Transneft. He graduated from the Russian State University of Oil and Gas in 2008, and in 2011 from the Financial University under the Government of the Russian Federation with a degree in Financial Markets.