The mineral extraction tax (MET) is a federal tax and is the main one in the system of mandatory payments for the use of natural resources. The tax was established in the Russian tax system in 2002 and replaced the payment for the use of subsoil in the extraction of minerals, deductions for the reproduction of the mineral resource base.

The procedure for taxation of mining operations is determined by Ch. 26 Tax Code Russian Federation(NK RF).

Reference. According to Rosstat, the share of MET in the amount of taxes, fees and other payments received by the consolidated budget of the Russian Federation in January-October 2011 amounted to 21.6%. Thus, the tax ranks second after corporate income tax in tax revenue consolidated budget of the Russian Federation.

Payers, objects of taxation

MET payers are organizations and individual entrepreneurs who are subsoil users in accordance with the legislation of the Russian Federation (Article 334 of the Tax Code of the Russian Federation). The user of a subsoil plot is obliged to register with the tax authority as an MET payer at the location of this site within 30 calendar days from the date of state registration of a license (permit) to use the site (clause 1, article 335 of the Tax Code of the Russian Federation). If the development of minerals is carried out on the continental shelf of the Russian Federation, in the exclusive economic zone and in other territories provided for in paragraph 2 of Art. 335 of the Tax Code of the Russian Federation, the taxpayer is subject to registration at the location of the organization or at the place of residence individual.

In paragraph 1 of Art. 336 of the Tax Code of the Russian Federation, a set of minerals recognized as an object of taxation is given:

- 1) minerals extracted from the subsoil on the territory of the Russian Federation on a subsoil plot provided to the taxpayer for use in accordance with the legislation of the Russian Federation;

- 2) minerals extracted from wastes (losses) of extractive industries, if such extraction is subject to separate licensing in accordance with the legislation of the Russian Federation on subsoil;

- 3) minerals extracted from the subsoil outside the territory of the Russian Federation, if this extraction is carried out in territories under the jurisdiction of the Russian Federation (as well as leased from foreign states or used on the basis of an international treaty) on a subsoil plot provided to the taxpayer for use.

In paragraph 2 of Art. 336 of the Tax Code of the Russian Federation specifies the objects of nature management that are not objects of taxation of the MET.

Example. JSC "Krater" carries out activities for the extraction of various minerals on the basis of the relevant licenses for the use of subsoil. natural resource tax fossil

In September, the organization mined 20 tons of brown and 10 tons of hard coal, 15 tons of natural graphite. A new commercial ore deposit has been explored. The estimated volume of mineral reserves is 10,000 tons. The business entity plans to obtain a license for the development of this subsoil area and start work in the first quarter of next year. In the course of the work, 5 tons of mining non-metallic raw materials were extracted from mining waste. A special license has been obtained for extraction in accordance with the legislation of the Russian Federation. Mining was also carried out outside the Russian Federation in the territories under its jurisdiction (28 tons of ferrous and non-ferrous metal ore). Additionally, 3 tons of ferrous metal ore were obtained from our own dump. The organization managed to extract 15 tons of geological collection materials, 8 tons of minerals from geological objects of cultural significance. Which of the minerals are objects of taxation of the MET?

Brown and hard coal, natural graphite, as well as mining non-metallic raw materials obtained from mining waste are types of extracted minerals recognized as objects of taxation (clause 2 of article 337, clause 2 of clause 1 of article 336 of the Tax Code of the Russian Federation). Since organizations that are users of subsoil in accordance with the legislation of the Russian Federation (Article 334 of the Tax Code of the Russian Federation) are recognized as MET payers, there are no grounds for paying this tax in relation to a new commercial ore deposit. Mined ores of ferrous and non-ferrous metals are types of minerals recognized as the object of taxation of the MET in accordance with paragraphs. 4 p. 2 art. 337 of the Tax Code of the Russian Federation. The conditions for the extraction of these resources comply with the conditions established by paragraphs. 3 p. 1 art. 336 of the Tax Code of the Russian Federation, which also defines them as objects of nature management subject to taxation. Therefore, in this case, the MET is paid.

Minerals extracted from own dumps or wastes (losses) of mining and related processing industries, if they were subject to taxation in the generally established manner during their extraction from the subsoil, are not included in taxable on the basis of paragraphs. 4 p. 2 art. 336 of the Tax Code of the Russian Federation. Extracted geological collection materials, minerals from geological objects of cultural significance should be excluded from being subject to taxation in accordance with paragraphs. 2 and 3 paragraph 2 of Art. 336 of the Tax Code of the Russian Federation.

Thus, for the purpose of taxing the MET, the following minerals should be taken into account:

- - brown (20 tons) and hard (10 tons) coal;

- - natural graphite (15 tons);

- - mining non-metallic raw materials (5 tons);

- - ores of ferrous and non-ferrous metals (28 tons).

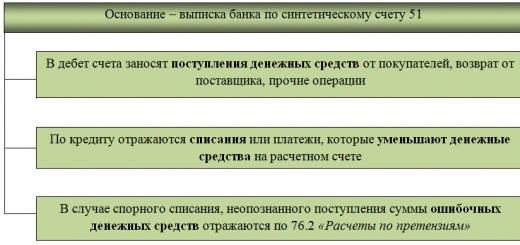

Tax base, procedure for determining the amount of extracted minerals. The procedure for assessing the value of extracted minerals when determining tax base

The tax base for MET is determined in accordance with paragraph 2 of Art. 338 of the Tax Code of the Russian Federation in two ways:

- 1) as the cost of extracted minerals, with the exception of dehydrated, desalted and stabilized oil, associated gas and combustible natural gas from all types of hydrocarbon deposits;

- 2) as the number of extracted minerals in physical terms during the extraction of dehydrated, desalted and stabilized oil, associated gas and combustible natural gas from all types of hydrocarbon deposits.

The procedure for determining the amount of minerals for tax purposes is enshrined in Art. 339 of the Tax Code of the Russian Federation and provides for the following methods for its assessment:

- - direct method - through the use of measuring instruments and devices;

- - indirect method - calculation, according to the content of the extracted mineral in the mineral raw materials extracted from the bowels (waste, losses).

In this case, if the use of the direct method is not possible, the indirect method is used. The direct method involves taking into account the actual losses of minerals related to the tax period in which they were assessed. The chosen method must be approved by accounting policy organization and can be changed only if changes are made to the technical project for the development of a mineral deposit in connection with a change in the applied mining technology (paragraph 2, clause 2, article 339 of the Tax Code of the Russian Federation).

Paragraph 1 of Art. 340 of the Tax Code of the Russian Federation provides for the following methods for assessing the value of a extracted mineral when determining the tax base for the MET:

- 1) based on the existing taxpayer for the relevant taxable period selling prices excluding subsidies;

- 2) proceeding from the realized prices of the extracted mineral for the taxpayer for the corresponding tax period;

- 3) based on the estimated value of the extracted minerals.

The proceeds from the sale of the extracted mineral is reduced by the amount of the taxpayer's expenses for the delivery of the mineral. Such expenses may include expenses for the payment of customs duties and fees in foreign trade transactions, for the delivery of minerals from the finished product warehouse to the recipient, for cargo insurance (paragraph 4, clause 2, article 340 of the Tax Code of the Russian Federation).

We emphasize that the cost of a unit of extracted mineral should be defined as the ratio of proceeds from the sale of these resources to the amount of sold extracted mineral. According to paragraph 4 of Art. 340 of the Tax Code of the Russian Federation in the absence of the sale of minerals, the cost of the extracted resources is determined based on the estimated cost of minerals. In order to form the estimated cost, it is necessary to take into account a number of expenses that the taxpayer had in the tax period (material expenses, labor costs, the amount of accrued depreciation, expenses for the development of natural resources, etc.). This is enshrined in the provisions of paragraph 4 of Art. 340 of the Tax Code of the Russian Federation.

Example. OJSC "Start" mines potash salt in accordance with the license valid until January 1, 2010. In January of this year, the organization produced 360 tons of salt. In the domestic market, 300 tons were sold in the amount of 2,400,000 rubles. in view of VAT. Production and distribution costs natural resource amounted to 2,000,000 rubles. in view of VAT. What are the amounts of mineral extraction tax and corporate income tax payable to the budget?

Since the organization has sold products, the cost of a unit of extracted mineral is determined as the ratio of proceeds from the sale of the extracted mineral to the amount of the sold extracted mineral (paragraph 8, clause 2, article 340 of the Tax Code of the Russian Federation). Sales proceeds without VAT will amount to 2,033,898 rubles. (2,400,000 rubles - 2,400,000 rubles x 18/118). The cost of 1 ton of extracted salt for tax purposes is 6779.7 rubles. (2,033,898 rubles: 300 tons). The cost of the entire volume of salt produced is calculated as follows: 6779.7 rubles. x 360 t = 2,440,692 rubles. The MET rate for potash salt is set at 3.8% (paragraph 1, clause 2, article 342 of the Russian Tax Code). The amount of mineral extraction tax for the extraction of potash salt will amount to 92,746.3 rubles. (0.038 x 2,440,692 rubles).

Organization expenses (without VAT) - 1,694,915 rubles. (2,000,000 rubles - 2,000,000 rubles x 18/118). Profit received from the sale of potash salt as a tax base is determined in accordance with Art. Art. 247 and 274 of the Tax Code of the Russian Federation:

RUB 2,033,898 - 1,694,915 rubles. = 338,983 rubles.

The corporate income tax rate is determined by paragraph 1 of Art. 284 of the Tax Code of the Russian Federation and is 20%. The amount of corporate income tax is calculated as 0.2 x 338,983 rubles. = 67,796.6 rubles.

The tax period for the MET is a calendar month (Article 341 of the Tax Code of the Russian Federation). MET tax rates are differentiated depending on the type of mineral; There is also a 0% rate. According to paragraph 1 of Art. 342 of the Tax Code of the Russian Federation, the 0% rate is applied in the production of associated gas, groundwater containing minerals, the extraction of which is associated with the development of other types of minerals, etc. Federal Law No. 158-FZ of 22.07.2008 amended the wording of paragraphs. 8, paragraphs are introduced. 10, 11, 12 p. 1 art. 342 of the Tax Code of the Russian Federation. According to the amendments, taxation at a rate of 0% is carried out when oil is extracted from subsoil plots located wholly or partially within the borders of the Republic of Sakha, the Irkutsk Region, the Krasnodar Territory, located north of the Arctic Circle wholly or partially within the boundaries of internal sea waters and the territorial sea, on the continental shelf of the Russian Federation, as well as in the Azov and Caspian Seas, the Nenets, Yamalo-Nenets Autonomous Okrugs, the Yamal Peninsula. At the same time, the Tax Code of the Russian Federation establishes limit indicators for the accumulated volume of oil produced and the period for developing reserves of a subsoil plot for all of the above cases in order to apply the 0% rate for calculating the MET.

In addition to the severance tax rates Art. 342 of the Tax Code of the Russian Federation establishes coefficients that characterize the dynamics of world oil prices, the degree of depletion of the reserves of a subsoil plot and are used to calculate the MET for oil production.

Example. OJSC Skala has a license for oil production and operates on the subsoil area of the Oktyabrskoye field, as well as on the site located in the Nenets Autonomous Okrug. The accumulated volume of oil produced at the last of these sites is within 5 million tons, the reserve development period is three years. In January 2009, 500 tons of oil were produced from the bowels of the first block. The actual losses amounted to 1.2 tons. They correspond to the standard losses. Separated associated petroleum gas and impurities were obtained in the amount of 0.5 tons. Kv - the coefficient reflecting the degree of depletion of reserves, is taken equal to 0.3. 30 tons of oil were produced from the bowels of the second field. The average level of prices for Urals oil in the period under review was in the range of 46.94 US dollars per barrel, the average value of the US dollar against the ruble was 32.89 rubles. for US dollars. What amount of MET must be transferred by the taxpayer to the budget?

Oil production at the site located in the Nenets Autonomous Okrug, from January 1, 2009, is subject to MET at a rate of 0% (clause 12 clause 1 article 342 of the Tax Code of the Russian Federation). When taxing oil production from the Oktyabrskoye field, it should be taken into account that the volume of extracted minerals within the limits of standard losses is also taxed at a preferential rate of 0% (clause 1 clause 1 article 342 of the Tax Code of the Russian Federation). In addition, according to the new wording of paragraph 1 of Art. 339 of the Tax Code of the Russian Federation, the amount of dehydrated, desalted and stabilized oil produced is determined in units of net mass, which is understood as the amount of oil minus separated water, associated petroleum gas and impurities, as well as minus the water contained in oil in a suspended state, chloride salts and mechanical impurities determined by laboratory analyses. Thus, the volume of oil produced, taken into account for tax purposes, is 498.3 tons (500 tons - 1.2 tons - 0.5 tons). According to paragraph 3 of Art. 342 of the Tax Code of the Russian Federation, the coefficient characterizing the dynamics of world oil prices (Kts) is determined by the formula:

Kts \u003d (C - 15) * P / 261 \u003d (46.94 - 15) * 32.89 / 261 \u003d 4.0249,

where C is the average price level for Urals oil for the past tax period;

P - the average value for the tax period of the US dollar against the Russian ruble.

According to paragraph 3 of Art. 342 of the Tax Code of the Russian Federation, the Kc coefficient is rounded to the 4th decimal place. Kv according to the conditions of the example is 0.3. In accordance with par. 2 p. 2 art. 338 of the Tax Code of the Russian Federation, the tax base for dehydrated, desalted and stabilized oil is determined as the amount of minerals extracted in physical terms. In paragraph 2 of Art. 342 of the Tax Code of the Russian Federation provides for the severance tax rate in the amount of 419 rubles. per 1 ton of oil produced, which should be multiplied by the coefficients Kc and Kv. With this in mind, the severance tax is 252,105 rubles. (419 rubles x 498.3 tons x 4.0249 x 0.3).

Example. Alfa OJSC was registered with the tax authority as a MET payer as an organization engaged in gold mining. In February of this year, the organization produced 200 kg of concentrate containing gold. After processing at the refinery, 170 kg of pure gold was obtained. The entire amount of the precious metal received was sold on the domestic market in the amount of 119,000,000 rubles. (VAT included). What is the amount of VAT payable to the budget by the taxpayer?

In accordance with the clarification of the Ministry of Finance of Russia (Letter dated October 30, 2008 N 03-06-06-01 / 24), concentrates and other semi-products containing gold are recognized as a type of extracted mineral (paragraph 18, clause 2, article 342 of the Tax Code of the Russian Federation). In this regard, the volume of the extracted concentrate before its processing, that is, the extracted mineral in the amount of 200 kg, is subject to taxation.

Proceeds from the sale of precious metal without VAT - 100,847,000 rubles. (119,000,000 rubles - 119,000,000 rubles x 18/118).

The cost of 1 kg of the extracted mineral is assumed to be 593,218 rubles. (100,847,000 rubles: 170 kg).

The total cost of the extracted mineral is 118,644,000 rubles. (200 kg x 593,218 rubles).

The MET rate for the extraction of concentrates and other semi-products containing gold is set at 6% (clause 2, article 342 of the Tax Code of the Russian Federation).

The amount of MET will be 7,119,000 rubles. (0.06 x 118,644,000 rubles).

Important aspects in the taxation of natural resources are the procedure and terms for paying the mineral extraction tax and submitting a tax return. The MET is paid according to the results of the tax period no later than the 25th day of the month following the expired tax period (Article 344 of the Tax Code of the Russian Federation). We emphasize that the tax is paid at the location of each subsoil plot that is in the use of the taxpayer. If minerals are mined outside the territory of the Russian Federation, the tax is paid at the location of the organization or the place of residence of the individual entrepreneur. According to par. 2 p. 1 art. 345 of the Tax Code of the Russian Federation, a tax return is submitted by the taxpayer at his location (place of residence).

The extraction of minerals on the continental shelf, the territory of the Russian Federation, as well as on contractual terms outside it, requires mandatory registration with the tax authorities at the place of registration of the entrepreneur, organization, individual. Contacting tax authority must take place no later than 30 days from the date of registration of the type of activity.

MET objects

The objects of taxation are all minerals extracted from the bowels of the earth in the territory of the Russian Federation, in the area established by law. Production waste used for further processing and subject to licensing. Minerals mined outside of Russia, but in the territory under its jurisdiction.

These objects include:

Coal, slates, peat, anthracites;

Oil, gas and other hydrocarbons;

Useful ore components, as well as components of ferrous, non-ferrous and radioactive metals. Raw materials of rare metals;

Non-metallic components (gypsum, gravel, pebbles, sand, etc.), as well as mining and chemical components (phosphorite ores, salts, sulfur, etc.);

A product used in the radio-electronic and optical industries (Piezo-optical quartz, Icelandic spar, optical fluorite).

Gems;

Salt natural;

Underground mineral waters.

The tax base is calculated depending on the type of fossil, each of which has its own rates. The reporting period is a calendar month.

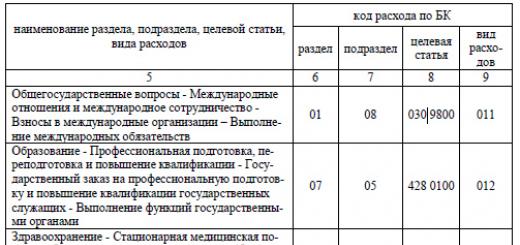

MET rates in 2020 (table)

| Bid, % | Fossil types |

|---|---|

| 3,8 | Potassium salts |

| 4,0 | Apatite-nepheline, apatite and phosphorite ores; Hard coal, brown coal, anthracite and oil shale |

| 4,8 | Standard ores of ferrous metals |

| 5,5 | Mining and chemical non-metallic raw materials (except for potash salts), apatite - (with the exception of nepheline and phosphorite ores); Salts of natural and pure sodium chloride; Raw materials of radioactive metals; Underground industrial and thermal waters; Non-metallic raw materials used mainly in the construction industry; Nephelines, bauxites |

| 6,0 | Mining non-metallic raw materials; Bituminous rocks; Concentrates and other semi-finished products containing; Other minerals not included in other groups |

| 6,5 | Conditional product of piezo-optical raw materials, high-purity quartz raw materials and semi-precious raw materials; Concentrates and other semi-finished products containing precious metals (excluding gold) |

| 7,5 | Mineral water |

| 8,0 | Natural diamonds, other precious and semi-precious stones; Standard ores of non-ferrous metals (with the exception of nephelines and bauxites); Multi-component complex ores, as well as useful components of complex ore, with the exception of precious metals. |

| 16,5 | Hydrocarbon raw materials |

| 17,5 | Gas condensate from all types of hydrocarbon deposits |

| 135 rubles per 1000 cubic meters. | Combustible natural gas from all types of hydrocarbon deposits |

| 419 rubles per ton, taking into account the coefficients Kc and Kv | Oil dehydrated, desalinated and stabilized |

The following exemptions apply to the main tax rates in 2020:

The tax on extracted minerals with the application of a coefficient of 0.7 to the main rate is paid by those organizations that independently develop and search for deposits. Or on 07/01/2001 they were fully reimbursed to the state and exempted from the “replenishment tax”.

An 80% tax relief can be granted for worked-out areas, subject to the provision of data on the accounting of produced oil;

The zero rate is applicable for oil production up to 25,000,000 tons in the Republic of Sakha, Irkutsk Krasnoyarsk Territory.

MET 0% is applied to newly developed fields in terms of: regulatory waste, associated gas, predicted losses. As well as mining in waste raw materials, dumps and waste;

Groundwater is not taxed: outside the state balance, used for agricultural needs, extracted during control and revision work, used for medicinal purposes.

The procedure for paying taxes in 2020

Based on the declaration approved by the Order of the Ministry of Taxation of the Russian Federation of December 29, 2003 N BG-3-21/727, the amount payable is calculated. The calculation is made for each fossil and for each extraction method separately. Payment is made no later than the 25th day of the month following the reporting month.

The Production Sharing Agreement provides for the following features:

1. Payment of taxes is the responsibility of the investor or operator;

2. The tax base takes into account not only certain types of minerals and extraction sites, but also types of agreements;

3. For all extracted resources, with the exception of oil and gas condensate, a coefficient of 0.5 is applied;

4. By decision of the subject of the federation, the investor may be exempted from paying local taxes and fees;

5. Part of the taxes can be paid in kind during the division of production;

6. The issuance of licenses, participation in competitions, geological research and other information about minerals are paid for by means of one-time and regular payments.

Calculation of MET in 2020

The calculation of the mineral extraction tax is carried out according to the rules regulated by Article 340 of the Tax Code of the Russian Federation:

- The calculation must be made for each deposit and all types of minerals separately.

- The calculation method used must be fixed in the payer's accounting policy for a year. The possibility of changing the method is provided only at the end of the calendar year.

- When determining the amount of MET to tax accounting raw materials that have passed the full technological cycle are accepted. The volume of raw materials sold or used for the needs of the payer before the end of the technological cycle is included in the calculation of the MET (clause 8, article 339 of the Tax Code of the Russian Federation).

- When calculating the MET for certain types of minerals, the use of increasing and decreasing coefficients was established.

Below are the formulas used to calculate the MET:

MET = Tax base × Tax rate.

How mining taxes are distributed

Payments for the extraction of hydrocarbons, as well as the use of subsoil, are made in the ratio of 40:60 to the Federal and local budgets, respectively. The extraction of common minerals is fully paid for in the constituent entity of the Russian Federation. Production on the shelf and other zone, which is in the legal possession of the Russian Federation, is paid exclusively to the Federal budget. When signing a production sharing agreement, the date of the document is taken into account, since the rules apply at the time of its signing.

Foundation and legal basis

Mineral extraction tax (MET) is federal tax, regulated by chapter 26 of the Tax Code of the Russian Federation. Since it is paid by subsoil users, one of the most important documents for understanding and applying the MET is also the Law of the Russian Federation of February 21, 1992 N 2395-1 "On Subsoil".

Taxpayers

- Organizations and individual entrepreneurs registered and recognized as subsoil users.

- Organizations, information about which is included in the Unified State Register of Legal Entities on the basis of Article 19 federal law dated November 30, 1994 N 52-FZ, recognized by subsoil users in accordance with the legislation of the Russian Federation, as well as on the basis of licenses and other permits acting in accordance with the procedure established by Article 12 of the Federal Constitutional Law dated March 21, 2014 N 6-FZ " On the admission of the Republic of Crimea to the Russian Federation and the formation of new subjects within the Russian Federation - the Republic of Crimea and the federal city of Sevastopol.

By general rule taxpayers must register as an MET taxpayer at the location of the subsoil plot they use within 30 calendar days from the date of state registration of the license to use the subsoil plot.

A special registration procedure has been established for subsoil users in the Crimea and Sevastopol.

Registration is carried out at the location of the organization or at the place of residence of an individual (if the taxpayer is an individual entrepreneur).

The Ministry of Finance of the Russian Federation also additionally determines the features of registration as taxpayers of the MET - see Order Order of the Ministry of Taxes of the Russian Federation dated December 31, 2003 N BG-3-09 / 731.

Object of MET taxation

Minerals are recognized as the object of taxation:

- extracted from the subsoil on the territory of the Russian Federation on a subsoil plot provided by law (including from a hydrocarbon deposit);

- extracted from waste (losses) of extractive industries, subject to separate licensing;

- mined from the subsoil outside the Russian Federation in territories leased or used under international agreements, as well as under the jurisdiction of the Russian Federation.

Not subject to taxation:

- common minerals, incl. groundwater extracted by an individual entrepreneur and used by him directly for personal consumption;

- mined (collected) mineralogical, paleontological and other geological collection materials;

- extracted from the subsoil during the formation, use, reconstruction and repair of specially protected geological objects of scientific, cultural, aesthetic, health-improving or other social significance;

- minerals extracted from own dumps or waste (losses) of mining and related processing industries;

- drainage groundwater;

- coal bed methane.

Types of minerals

- Coal and oil shale

- Hydrocarbon raw materials (oil, gas condensate, combustible natural gas, coal bed methane)

- Commercial ores of ferrous and non-ferrous metals, rare metals forming their own deposits

- Useful components of complex ore

- Mining and chemical non-metallic raw materials (apatite, phosphorite ores, salts, sulfur, spar, earth paints, etc.)

- Mining non-metallic raw materials

- Bituminous rocks

- Raw materials of rare metals (indium, cadmium, tellurium, thallium, gallium, etc.)

- Non-metallic raw materials used mainly in the construction industry (gypsum, anhydride, chalk, limestone, pebbles, gravel, sand, clay, facing stones)

- Conditional product of piezo-optical raw materials (topaz, jade, jadeite, rhodonite, lapis lazuli, amethyst, turquoise, agate, jasper, etc.)

- Natural diamonds, other precious stones (diamonds, emerald, ruby, sapphire, alexandrite, amber)

- Concentrates and other semi-products containing precious metals (gold, silver, platinum, palladium, iridium, rhodium, ruthenium, osmium) as well as ligature gold that meets the national standard ( specifications) and (or) the standard (technical specifications) of the taxpaying organization

- Natural salt and pure sodium chloride

- Underground waters containing minerals and healing resources, as well as thermal waters

- Raw materials of radioactive metals (in particular, uranium and thorium).

The tax base

The tax base for mineral extraction tax is defined as the cost of extracted minerals for each type, taking into account the established various rates. It is determined separately for each mined mineral.

The cost of hydrocarbon raw materials produced at a new offshore hydrocarbon field is determined in a special way. How to determine the tax base on it is stated in article 340.1 of the Tax Code of the Russian Federation. The tax authorities are informed about such deposits by the federal executive body responsible for maintaining the state balance sheet of mineral reserves.

With regard to other types of extracted hydrocarbon raw materials, as well as coal, the tax base is determined as the amount of extracted minerals in physical terms.

The general procedure for assessing the value of extracted minerals when determining the tax base is specified in Article 340 Tax Code RF.

Taxable period

calendar month.tax rates

The rates are set for each type of minerals by Article 342 of the Tax Code of the Russian Federation.

Rates in 2017

- 0% or 0 rubles, if in relation to the mined mineral the tax base is determined as the amount of mined minerals in physical terms (when mining, for example, minerals in terms of standard losses of minerals, etc.);

- from 3.8% to 8% for various minerals, the tax base for which is determined based on their value;

- 919 rubles for the period from January 1, 2017 for 1 ton of desalted, dehydrated and stabilized oil produced. At the same time, the specified tax rate is multiplied by a coefficient that characterizes the dynamics of world oil prices (Cp). The resulting product is reduced by the value of the index Dm, which characterizes the features of oil production. The value of the indicator Dm is determined in the manner prescribed by Art. 342.5 of the Tax Code of the Russian Federation. The formula for determining the Dm coefficient was amended by the new edition of the Tax Code N 204 dated December 28, 2016: the Kk value was added, which reduces the indicator. Kk for the period from January 1 to December 31, 2017 inclusive is 306, 357 - for the period from January 1 to December 31, 2018 inclusive, 428 - for the period from January 1 to December 31, 2019 inclusive, 0 - from January 1, 2020 . In 2016, the oil rate was RUB 857;

- 42 rubles per 1 ton of gas condensate produced from all types of hydrocarbon deposits. At the same time, the specified tax rate is multiplied by the base value of a unit of standard fuel, by a coefficient characterizing the degree of difficulty in extracting combustible natural gas and (or) gas condensate from a hydrocarbon deposit, and by a correction factor;

- 35 rubles per 1,000 cubic meters of gas in the production of combustible natural gas from all types of hydrocarbon deposits. At the same time, the specified tax rate is multiplied by the base value of a unit of reference fuel and by a coefficient characterizing the degree of difficulty in extracting combustible natural gas and (or) gas condensate from a hydrocarbon deposit. The resulting product is summed up with the value of the indicator characterizing the cost of transporting combustible natural gas. If the amount received is less than 0, the tax rate value is assumed to be 0.

- 47 rubles per 1 ton of anthracite mined.

- 57 rubles per 1 ton of coking coal mined;

- 11 rubles per 1 ton of brown coal mined;

- 24 rubles per 1 ton of mined coal, except for anthracite, coking coal and brown coal;

- 730 rubles per 1 ton of multicomponent complex ore mined in subsoil plots located wholly or partially in the territory of the Krasnoyarsk Territory containing copper and (or) nickel and (or) platinum group metals;

- 270 rubles per 1 ton of multicomponent complex ore that does not contain copper and (or) nickel and (or) platinum group metals mined in subsoil plots located wholly or partially in the territory of the Krasnoyarsk Territory.

- for anthracite - 1.102;

- for coking coal - 1.668;

- for brown coal - 0.996;

Last year, the conditions under which the Kkan coefficient is equal to zero in relation to subsoil plots located wholly or partially in the Caspian Sea improved. These conditions are placed in a separate subparagraph 9 of paragraph 4 of Article 342.5 of the Tax Code of the Russian Federation.

With regard to oil produced in these subsoil areas, the Kkan coefficient remains zero until the 1st day of the month following the one in which one of the circumstances listed in the Tax Code of the Russian Federation occurred. Such a circumstance is, for example, the achievement of a certain level of cumulative oil production (with the exception of the cumulative volume at new offshore fields in a given subsoil area). Since 2016, this limit is 15 million tons instead of 10 million tons, as previously established.

When calculating the MET for gas, the Kgp coefficient is used, which characterizes the export profitability. Recall that the base value of the MET rate for gas condensate from all types of hydrocarbon deposits is multiplied by the Kkm coefficient, as well as by the base value of a unit of standard fuel Eut and the coefficient Kc, which characterizes the degree of complexity of extracting combustible natural gas and (or) gas condensate from a hydrocarbon deposit. raw materials.

The value of the correction factor has changed in the version of the Federal Law of November 30, 2016 N 401-FZ.

MET tax deduction

Article 343.1 of the Tax Code of the Russian Federation regulates the right of a taxpayer to receive a tax deduction - you can, at your choice, reduce the amount of tax calculated for the tax period when mining coal at a subsoil plot by the amount of economically justified and documented expenses of the taxpayer in the tax period and related to ensuring safe conditions and labor protection during coal mining in this subsoil area.

IN tax deduction the following costs are included:

- material expenses of the taxpayer, determined in the manner prescribed by Chapter 25 "Income Tax" of the Tax Code of the Russian Federation;

- the taxpayer's expenses for the acquisition and (creation) of depreciable property;

- expenses for completion, additional equipment, reconstruction, modernization, technical re-equipment of fixed assets.

The right to apply this tax deduction is directly related to the obligation of the MET taxpayer - the employer to ensure safe working conditions and their protection.

The procedure for recognizing expenses in order to apply this deduction should be reflected in the accounting policy for tax purposes.

Procedure and terms of tax payment, reporting

At the end of the month, the amount of tax is calculated separately for each type of extracted minerals. The tax is payable to the budget at the location of each subsoil plot provided to the taxpayer for use.

The tax is paid no later than the 25th day of the month following the expired tax period.

Subsoil users pay regular payments quarterly no later than the last day of the month following the expired quarter, in equal installments in the amount of one fourth of the payment amount calculated for the year (Law of the Russian Federation of February 21, 1992 N 2395-1).

The procedure and conditions for collecting regular payments for the use of subsoil from subsoil users are established by the Government of the Russian Federation, and the amounts of these payments are sent to the federal budget.

The MET declaration is submitted to the tax authority at the location Russian organization, place of residence of an individual entrepreneur, place of business foreign organization through branches and representative offices established on the territory of the Russian Federation.

The obligation to submit a tax return arises from the tax period in which the actual extraction of minerals began. It is submitted no later than the last day of the month following the expired tax period. The MET tax return can be submitted both in paper and electronic form.

Pay attention!

Taxpayers whose average number of employees for the previous calendar year exceeds 100 people, as well as newly created organizations whose number of employees exceeds the specified limit, submit tax returns and calculations only in electronic form. The same rule applies to the largest taxpayers.

A complete list of federal electronic document management operators operating in a particular region can be found on the official website of the Office of the Federal Tax Service of Russia for the constituent entity of the Russian Federation.

NDPI: what's new in 2017?

Some changes in 2017 tax rates and the values needed to calculate the coefficients.

When paying tax on oil production, the rate will be 919 rubles for the period from January 1, 2017 per 1 ton of desalted, dehydrated and stabilized oil produced. At the same time, the specified tax rate is multiplied by a coefficient that characterizes the dynamics of world oil prices (Cp). The resulting product is reduced by the value of the index Dm, which characterizes the features of oil production.

The value of the indicator Dm is determined in the manner prescribed by Art. 342.5 of the Tax Code of the Russian Federation. The formula for determining the Dm coefficient was amended by the new edition of the Tax Code N 204 dated December 28, 2016: the Kk value was added, which reduces the indicator.

Kk for the period from January 1 to December 31, 2017 inclusive is 306, 357 - for the period from January 1 to December 31, 2018 inclusive, 428 - for the period from January 1 to December 31, 2019 inclusive, 0 - from January 1, 2020 . In 2016, the oil rate was RUB 857;

Tax rates for coal are multiplied by deflator coefficients, which are determined and subject to official publication in the manner established by the Government of the Russian Federation (Decree of the Government of the Russian Federation of November 3, 2011 N 902 "On the procedure for determining and official publication of deflator coefficients to the extraction tax rate minerals in coal mining).

The deflator coefficients for the 1st quarter of 2017 will be:

- for anthracite - 1.102;

- for coking coal - 1.668;

- for brown coal - 0.996;

- for coal, except for anthracite, coking coal and brown coal - 1.132.

This was established by Order of the Ministry of Economic Development of Russia dated January 18, 2017 N 8 "On the deflator coefficients to the tax rate for the extraction of minerals in coal mining."

When calculating the MET for gas, the value of the correction factor was changed in the version of Federal Law No. 401-FZ of November 30, 2016.

From January 1, 2017, paragraph 15 of Article 342.4 states that the Kkm coefficient is equal to the result of dividing the number 6.5 by the value of the Kgp coefficient. The new norm established the krp as follows: 1.7969 - for the period from January 1 to December 31, 2017 inclusive, 1.4022 - for the period from January 1 to December 31, 2018 inclusive, 1.4441 - for the period from January 1 to December 31 2019 inclusive - for taxpayers - owners of objects unified system gas supply, or participants with a share of ownership;

For other taxpayers, Kgp is equal to 1.

Pay attention!

When paying arrears for all taxes, from October 1, 2017, the rules for calculating penalties will change. In case of a long delay, large amounts of penalties will have to be paid - this applies to arrears that arose after October 1, 2017. Changes have been made to the rules for calculating penalties, which are established for organizations in paragraph 4 of Art. 75 of the Tax Code of the Russian Federation.

If, starting from the specified date, the payment is overdue by more than 30 days, the interest will be calculated as follows:

- based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation, effective from the 1st to the 30th calendar days (inclusive) of such a delay;

- based on 1/150 of the refinancing rate of the Central Bank of the Russian Federation, relevant for the period starting from the 31st calendar day of delay.

In case of delay of 30 calendar days or less, the legal entity will pay penalties based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation.

If arrears are paid before October 1, 2017, the number of days of delay does not matter, the rate in any case will be 1/300 of the Central Bank refinancing rate. Recall that since 2016 the refinancing rate is equal to the key rate.

Mineral extraction tax: 8 categories of raw materials that are most often mined + 2 methods for calculating the amount of extracted and 3 ways to evaluate it + 19 tax rates on different types mineral.

It is believed that gas, coal, oil and so on are wealth that belongs to all the people of Russia. But not everyone has the right to earn money on them.

In order to balance this situation and get new sources to fill the budget, a mineral extraction tax was introduced, which must be paid by those involved in this very extraction.

As with every tax law, this one has its own nuances. You need to know and remember about them so as not to lose money and not work to the detriment of your interests.

What is a mineral extraction tax?

The tax in question is relatively new.

The extraction of coal, precious stones, peat and other things existed a long time ago. In some historical periods, they did not pay for it at all.

In Soviet times, all natural resources were managed exclusively by the state.

With the collapse of the Soviet Union in the 1990s, lawlessness reigned, when what succumbed to theft was stolen at a terrible pace.

Attempts to restore order led to the emergence of excises on oil, as well as deductions to the state budget for the processing of the material and raw material base.

And only in 2002 all this was replaced.

In the Tax Code of the Russian Federation, Chapter 26 is assigned to materials extracted from underground, which is worth 13 Articles.

What types of minerals are there and which of them are taxed?

Article 337 of Chapter 26 of the Tax Code of the Russian Federation indicates what exactly should be considered the object of taxation:

From the same section we learn what cannot be called minerals, and, accordingly, taxed.

The following types of minerals are most often taxed:

1. | oil shale, e.g. coal |

2. | peat |

3. | hydrocarbon raw materials (gas, oil) |

4. | ferrous and non-ferrous metals |

5. | natural diamonds |

6. | mining and chemical non-metallic raw materials (sulfur, iodine, bromine) |

7. | mining non-metallic raw materials (quartz, graphite, talc) |

8. | semi-products containing one or more precious metals and other |

If you are engaged in mining, you should know what exactly is the object of taxation and what is not.

The objects of taxation are | Not recognized as objects of taxation |

|---|---|

minerals extracted from the subsoil on the territory of the Russian Federation on the subsoil plot provided to the taxpayer for use in accordance with the legislation of the Russian Federation | common minerals and groundwater, not listed on the state balance of mineral reserves, extracted by an individual entrepreneur and used by him directly for personal consumption |

minerals extracted from waste (losses) of mining production, if such extraction is subject to separate licensing in accordance with the legislation of the Russian Federation on subsoil | mined (collected) mineralogical, paleontological and other geological collection materials |

minerals extracted from the subsoil outside the territory of the Russian Federation, if this extraction is carried out in territories under the jurisdiction of the Russian Federation (as well as leased from foreign states or used on the basis of an international treaty) on a subsoil plot provided to the taxpayer for use | minerals extracted from the subsoil during the formation, use, reconstruction and repair of specially protected geological objects of scientific, cultural, aesthetic, health-improving or other social significance. The procedure for recognizing geological objects as specially protected geological objects that have scientific, cultural, aesthetic, sanitary, health-improving or other social significance is established by the Government of the Russian Federation |

minerals extracted from own dumps or waste (losses) of mining and related processing industries, if during their extraction from the subsoil they were subject to taxation in accordance with the generally established procedure |

|

drainage underground waters not taken into account in the state balance sheet of mineral reserves extracted during the development of mineral deposits or during the construction and operation of underground structures |

More detailed information about objects / non-objects of taxation can be found in Art. 336 Ch. 26 of the Tax Code of the Russian Federation.

Who can become a tax payer for extracted valuable minerals?

There is a separate Law No. 2395-1 “On Subsoil” in the Russian Federation, which was adopted back in 1992. So, according to this law, fossils are provided for:

- commercial mining;

- geophysical testing;

- geological research;

- engineering works;

- search for the richest deposits;

- collection of samples for scientific studies;

- construction of facilities not related to mining, etc.

Opens Chapter 26 of the Tax Code (TC) of the Russian Federation Article 334, which indicates who, who will pay money to the budget of the state.

But you do not have to be a registered private entrepreneur in order to get the right to extract minerals, since the state can make you happy with such a right:

- foreign citizens;

- simple communities;

- legal entities etc.

But, of course, unless you are a researcher who needs to get a few samples for his scientific work, and a businessman who has put the extraction of natural resources that are stored underground on the stream and earns money on it, then he will have to pay taxes.

Mineral extraction tax: taxation conditions

The taxation of the extraction of oil, gas, coal and other minerals has its own characteristics, which are described in detail in Articles 342 - 344 of Chapter 26 of the Tax Code of the Russian Federation.1) How to calculate and how to evaluate the extracted valuable minerals in order to pay tax on them?

The amount you need to pay depends largely on how much material you extract.

You will have to determine the amount of mined on your own, using one of two methods:

In fact, measurements are made for you by measuring devices, for example, weights.

Be sure to take actual losses into account when measuring.

Indirect.

You make calculations based on the amount of raw materials that you managed to extract, in relation to the mineral material.

It is also important to evaluate the value of the volume you have extracted so that you are not suspected of tax fraud, using one of 3 methods:

- The sale price of raw materials minus the amount of the state subsidy (relevant for those who managed to get help from the state).

- Net realizable value if no cash benefits from state budget You do not have.

- Estimated value of minerals (used by those who do not sell mined raw materials).

Learn more about Mineral Extraction Tax

the next video will tell.

What is MET and who is subject to taxation?

2) Tax on the extraction of the most common minerals.

The Tax Code of the Russian Federation states that:

It is necessary to pay the tax, as well as to submit a declaration, which would indicate the volumes of production and sale of raw materials, before the 25th day of the current month.

It is best not to be late with your tax return, as you will have to shell out a lot more money through penalties.

Now the fine is calculated according to the new rules (Article 75, paragraph 4):

If tax payments are delayed by 30 days, then the penalty for the violator will be calculated according to one of two formulas:

Article 343 of the Tax Code of the Russian Federation is devoted to tax rates for the extraction of various minerals.

We see that in 2017-2018 the following rates are determined:

№ | tax rate | Explanation |

|---|---|---|

1. | 0% or 0 rub. | It is valid when, in relation to the extracted mineral, the tax base is determined as the amount of extracted minerals in physical terms (during the extraction, for example, of minerals in terms of standard losses of minerals, etc.). |

2. | 3,8 – 8% | It is used when it is possible to establish the cost of minerals of different types. |

3. | 919 rubles | For 1 ton of oil. The amount is multiplied by Kc (coefficient of change in world oil prices). The resulting product is reduced by the value of the index Dm, which characterizes the features of oil production. In 2017, Dm is set at 306. |

4. | 42 rubles | For 1 ton of gas concentrate from hydrocarbon deposits. This rate should be multiplied by the base value of an equivalent fuel unit, by a coefficient characterizing the degree of difficulty in extracting combustible natural gas and (or) gas condensate from a hydrocarbon deposit, and by a correction factor. |

5. | 35 rubles | For 1,000 cubic meters in the production of combustible natural gas. The amount of combustible natural gas pumped into the reservoir to maintain reservoir pressure, subject to taxation at a tax rate of 0 rubles, is determined by the taxpayer independently on the basis of data reflected in duly approved forms of federal state statistical observation. |

6. | 47 rubles | For 1 ton of anthracite |

7. | 57 rubles | For 1 ton of coking coal |

8. | 11 rubles | For 1 ton of brown coal |

9. | 24 rubles | For 1 ton of other type of coal, except for brown and coking |

10. | 730 | |

11. | 270 rubles | Per 1 ton of multi-complex ore containing copper, nickel and platinum metals |

12. | 3,8% | When mining potassium salt |

13. | 4% | When mining peat, oil shale, apatite-nepheline, apatite and phosphorite ores |

14. | 4,8% | When mining ores of ferrous metals |

15. | 5,5% | When extracting raw materials of radioactive metals, mining and chemical non-metallic raw materials (with the exception of potash salts, apatite-nepheline, apatite and phosphorite ores), non-metallic raw materials used mainly in the construction industry, natural salt and pure sodium chloride, underground industrial and thermal waters, nephelines, bauxites. |

16. | 6% | When mining non-metallic raw materials, bituminous rocks, concentrates and other semi-products containing gold, other minerals not included in other groups. |

17. | 6,5 % | When extracting concentrates and other semi-products containing precious metals (except for gold), precious metals that are useful components of a multicomponent complex ore (with the exception of gold), a standard product of piezo-optical raw materials, highly pure quartz raw materials and gemstone raw materials. |

18. | 7,5 % | When extracting mineral waters and therapeutic mud |

| 19. | 8 % | When mining conditioned non-ferrous metal ores (with the exception of nephelines and bauxites), rare metals, both forming their own deposits and being associated components in the ores of other minerals |

This amount can be reduced by reducing the rate of 0.7. However, not all entrepreneurs can take advantage of such benefits.

Or legal entities that are engaged in subsoil extraction in accordance with the definition of legislation.

Payments are made in accordance with Chapter 26 of the Tax Code of the Russian Federation. Elements of taxation include the order of payment, payers, tax base, interest rate.

What is the tax period for MET

The subsoil is provided for use when the entrepreneur has received a license for development.

It includes the main document on the official letterhead with the coat of arms of the Russian Federation and applications that regulate the conditions of production. The latter may be in graphic or text form.

How payouts are calculated

The tax rate for mining is determined by Article 342 of the Russian Tax Code. It varies from 0 to 16.5 percent. The determining factors can be:

- type of minerals;

- individual derived fossils;

- characteristics of the extracted minerals.

The established tax rates can be divided into two types. Ad valorem is measured as a percentage, here the tax base is the value of the obtained minerals.

This type of bet is used for most types. Specific rates are calculated in cost per ton.

In this case, the tax base is the amount of minerals received. Specific rates apply for some types, such as oil and gas.

The 0% preferential rate is intended for mining the following types mineral:

- mineral waters obtained for medicinal purposes;

- groundwater used for agricultural purposes or obtained from new subsoil plots;

- extra-viscous oil;

- associated gas;

- minerals obtained as a result of the development of decommissioned or low-quality reserves;

- losses during development, which are within the framework of the regulations determined by Decree of the Government of the Russian Federation No. 921 of December 29, 2001.

When calculating tax payments for gas, a number of corrective values are also provided. They show the unit of fuel (Eut), the complexity of the work to extract the resource (Ks). Additionally, a correction number, denoted by Kkm, is applied.

What else affects the tax rate

The rate of tax on the extraction of minerals depends not only on the type, but also on the region where the development is carried out.

The preferential rate is available for a number of regions: Irkutsk Region, Krasnodar Territory, Nenets District, the Republic of Yakutia, as well as areas located beyond the Arctic Circle. This list includes the seas: Azov, Caspian, Okhotsk, Black.

Important: the preferential rate applies to production carried out within the limits of certainarticle 342 of the Tax Code of the Russian Federation .

In 2016, some adjustments were made to the calculation of contributions for oil produced in the Caspian Sea. As a result, the preferential rate stays in effect longer.

Under the previous conditions, when the accumulated volume of oil production reached 10 million tons, from the first day of the next month it was impossible to apply the zero value of the coefficient. Now this volume is 15 million tons.

Compared to the previous year, the base value increased in 2016. If earlier it was 766 rubles per ton, now it is 857 rubles. This difference is indicated in 9 p. 2 art. 342 of the Tax Code of the Russian Federation.

How is the tax deduction for coal mining

How the tax base for MET is determined

The tax base for payers engaged in mining and other types of extraction is the value of minerals obtained during a calendar month.

It is this period, according to the procedure for paying the MET, that is defined as reporting period. Operations related to reporting and direct payment are regulated under articles c to the Tax Code of the Russian Federation.

If an enterprise extracts hydrocarbon raw materials or coal, the amount of obtained minerals is considered as a tax base.

If development has just begun at an offshore field, the cost of the raw materials received is calculated in a different order, in accordance with article 340.1 of the Tax Code of the Russian Federation.

About new subsoil plots employees tax service report to the authorities authorized to monitor the indicators of mineral reserves.

- Direct. Here, standard equipment, for example, scales, is used to carry out measurements.

- Indirect. This method is used when it is not possible to take measurements first. In this case, the amount of product is calculated using formulas.

How to Calculate the Cost of Mined Minerals

There are three ways to calculate the value of extracted products.

- Calculation based on the price at which minerals are sold.

- The second method is used in cases where the state does not provide subsidies to compensate for the difference between the wholesale cost and the selling price. Here the calculation is made without taking into account.

- If the goods were not sold during the tax period, the price for the received minerals is determined on the basis of calculations. In the absence of sales, call real price difficult. In order for the resulting figure to be as close as possible to the actual one, the costs of extracting resources should be taken into account. Among other costs, this includes wages and further research, maintenance of work equipment.

If the delivery of materials is carried out by the supplier, the profit from the sale is reduced. You will need to take into account such costs as payment for fuel, customs duties, insurance transfers.

The procedure for calculating the MET in 2016

The amount for the payment of the MET is calculated as a percentage of the value of the received minerals. These percentages are equal to the tax rate.

When taxing the extraction of gas condensate and oil, for calculations it will be necessary to multiply two values:

- the amount of the tax base, expressed in the amount of the substance received;

- tax rate, which is adjusted with a coefficient that reflects the dynamics of oil prices in the world.

Mineral extraction tax is charged for the tax period for each type of substances separately.

Payments are made for obtaining materials from the bowels, as well as losses or waste from mining or other production.

In total, the tax payment is formed from the amount of accruals for the production of each separate species mineral.

In some cases, the tax is calculated for each development site. This amount can also be calculated from the total payment. To do this, you need to know the share of extracted minerals in a particular area of the total production.

What other subsoil use is provided for by law

According to the legislation of the Russian Federation, subsoil can be used for a number of purposes.

- Geological research. Conducted both locally and on a large scale. During such studies, the presence of minerals and other procedures are assessed. Mineral resources are not mined.

- Collection of collectibles. This includes valuable paleontological and other finds.

- Construction of non-subsoil development facilities and their subsequent commissioning.

- Update of important geopolitical objects.

- Search and extraction of minerals.

Tax payers are individuals and legal entities engaged in this type of activity. All other activities are not subject to taxation.

Payers are not always able to immediately attribute the extracted product to one of the types of minerals. When determining a specific group, international, national and regional standards must be taken into account.

The requirements set by the entrepreneur himself also play a certain role. However, in practice, always guided by the highest standards.

The criteria set by the entrepreneur are relevant only in the absence of regional ones. Similarly, between regional and state standards, the priority is the latter.

How are tax payments distributed?

When the payer pays the amount of MET, 40% of the funds go to the federal budget. Most of it - 60% - goes to the budget of the constituent entity of the Russian Federation. It should be noted that this does not apply to the extraction of hydrocarbon raw materials, as well as common minerals such as clay or sand.

If mining is carried out on the territory of an autonomous okrug, which is considered part of the region, the funds are distributed on the basis of an agreement concluded between the oblast and the autonomous zone.

When extracting hydrocarbon raw materials, the entire amount of the tax is transferred to the federal budget. If the payment is made for the extraction of common minerals, all money is transferred to the income of the subject.

When developing outside the territory of the Russian Federation, as well as the continental shelf and the exclusive economic zone, the funds go to the federal budget.

Mineral extraction tax is a mandatory payment.

The tax base, depending on the type of resources, is the cost or quantity of the products received. The tax is charged for each type of minerals separately.

MET payers are individual entrepreneurs and organizations involved in the development of subsoil and the extraction of certain resources.

43 Mineral extraction tax