In our life there are various situations, including when buying various goods. Sometimes it becomes necessary to return the goods to the seller, and it does not matter for what reason. In principle, there is nothing complicated about this, and many of us have encountered similar situations. But what to do if the goods were not purchased for cash, but issued on credit, is it possible to return the goods purchased on credit and how to do it correctly? Let's take a closer look at this.

Today's lending market offers us a large number of projects related to consumer loans. With the advent of these services, most Russians no longer need to save money and limit themselves in buying the necessary things. If suddenly the computer breaks down and refuses to work, few will succumb to panic. A person will simply get ready, take a passport and go to the nearest electronics store. There he will turn to a loan officer and within half an hour he will issue a loan for the purchase of a new computer.

But what if the purchased item does not meet your requirements and needs to be returned? Will it be accepted in the store? The consumer protection law clearly states that any product can be returned to the seller at the request of the client. This rule is no exception for goods purchased on credit. If you paid for the goods with a credit card, there will be no difficulties with the return of the goods. All that is required of you is a visit with the goods in your hands to the store where it was purchased and a written application for a return. After consideration of the application, the money spent will be quickly returned to the credit card.

The procedure for returning goods purchased on credit

But in order to return goods to the store for the purchase of which a consumer loan was issued, it is necessary to adhere to a certain algorithm of actions. Only strict observance of all the rules will help you avoid financial problems and conflict situations with the bank.

1. A matter of first necessity will be a trip to the organization that sold you the goods. In the store, you must submit an application addressed to the general manager of the store. To confirm the fact of purchase, a receipt is attached to the application, indicating the purchase of a particular product in this particular store. The application is written in free form, in which you must briefly state the essence of the problem and ask for a full refund of the amount of money spent.

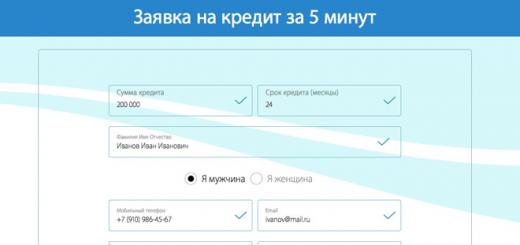

EXAMPLE SAMPLE:

In the event that you are returning an item due to a defect, you must indicate this fact in the application. Most likely, the organization will appoint an examination, as a result of which you will be returned the money for the damaged goods.

If, when applying for a loan for the purchase of goods, you made an initial payment to the cashier of the store, the store management will pay you only this amount. The store has nothing to do with everything else. Most likely, the bank has already deposited the balance of the value of the purchased item and the item to the account of the trade organization and is quietly waiting for you to start making monthly payments on the loan. The store, within 10 days after the return of the goods, is obliged to transfer the full cost of the goods minus the initial payment to your bank credit account. Therefore, further proceedings will take place with the bank that issued you the loan.

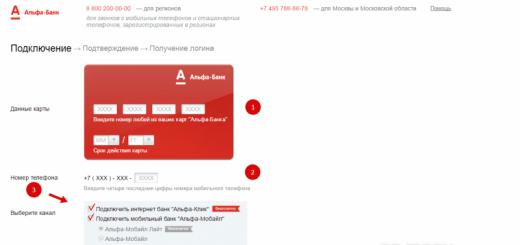

2. Next, you need to contact the bank. In a credit institution, you need to write an application with a request to terminate the contract for the sale of goods, for the purchase of which the borrowed funds went. Be sure to indicate in the application that the goods have already been returned to the store, and the management of the organization has returned the amount of the down payment to you.

After all the necessary nuances are taken into account and documented and the loan agreement between the bank and the borrower is terminated, do not forget to take care of the bank closing your credit account. You must have confirmation that your credit relationship with the bank is completely canceled. Often, interest and commission fees occur on an open credit account, which the bank will remind you of when you have already forgotten about returning the goods purchased on credit. Whatever arguments you give, you still have to pay the bill. Therefore, in order to avoid such problems, make sure that the bank closes your credit account. To confirm this fact, ask the bank for a special certificate.

The Law of the Russian Federation “On Protection of Consumer Rights” states: “In the event of the return of goods of inadequate quality purchased by the consumer at the expense (loan), the seller is obliged to return to the consumer the amount of money paid for the goods, as well as to reimburse the interest paid by the consumer and other payments under the consumer loan agreement ( loan)."

Article 24.6. (The paragraph was additionally included from July 1, 2014 by the Federal Law of December 21, 2013 N 363-FZ)

It would seem that there is nothing wrong with returning goods purchased on credit. But sometimes there are times when the trade organization refuses to accept the returned goods and return the money. If reclaiming your own money seems impossible to you, feel free to contact a lawyer and file a lawsuit in court. If the value of the goods is very high, you should immediately apply to the world court. In the case of a small amount of money, the district authority will also help. At the same time, the organization that refused to return the goods to you, if you win, is obliged to compensate all legal costs.

Sometimes situations arise when the buyer notices that the purchased product does not meet his requirements, but he has already paid money for it. In the case when the purchase was made for cash, people, as a rule, do not get lost and, taking a check for the purchase, go to the store to change the purchase or receive the amount paid back. And how does everything happen in the case of a loan (for example, is it possible to return the phone to the store if it was taken on credit: you can learn more about the same issue)?

Return of goods on credit - how does it work?

You should focus on which goods can be returned under the law and which cannot (this is the same with different types of insurance, although, for example, it is mandatory). According to regulatory requirements, any product (not included in the list of goods not subject to exchange and return by the Decree of the Government of the Russian Federation) that did not suit the buyer in the following parameters is subject to return or exchange:

- Appearance;

- The size;

- Model;

- Color spectrum;

- Equipment.

In addition, the obligatory conditions are that the trade dress of the purchase, consumer properties, factory labels and manufacturer's seals are preserved.

That is, regardless of whether the payment was in cash or the purchase was made on credit, the conditions for exchange and return are no different, with the only difference being that in the first case the store returns the money to the buyer, in the second case - to the bank.

The whole procedure is as follows:

- The buyer comes to the store and announces his intention to receive a refund for the purchase.

- Store employees determine whether the purchase meets the eligibility criteria for a return.

- A special documentary form is filled out.

- After that, the store returns the money to the bank and closes the loan agreement ahead of schedule.

The only point - in the event that an initial payment was made, then the store returns this amount directly to its client. Nothing more is required from the buyer.

How to return goods purchased on credit according to the law?

As already mentioned above, the requirement to return goods that meet the listed parameters is completely legal - this issue is regulated by Article 25 of the Federal Law "On Protection of Consumer Rights". In addition, the transactions in question are possible only if no more than 14 calendar days have passed since the transaction was completed.

Regarding the need for a check to carry out the transaction in question, the consumer protection law states that this document can be replaced by the testimony of witnesses who will confirm the fact of the purchase.

In theory, everything is true, but in practice it will be extremely difficult - the testimony of witnesses will be taken into account only in court. And even then, it is very difficult to find people who will confirm such things.

Return of goods purchased on credit within 14 days

As mentioned above, these procedures are possible only if no more than 14 days have passed since the conclusion of the transaction. Regardless of any other conditions. In the event that the non-compliance of the purchase with the requirements of the client was discovered later, then the exchange and return are not possible.

Can I return goods purchased on credit the next day?

You can return or exchange the purchase on any day, within fourteen days from the date of the transaction (the date will be indicated on the cash receipt). So even the next day, even the last, even after ten minutes - the procedure will not have any differences.

Exchange of goods purchased on credit

Regarding whether it is possible to exchange goods purchased on credit for another, this operation is quite possible. If an exchange for an equivalent product is made, then you don’t even have to re-register the loan agreement - you just fill out an exchange form in the store, and that’s it.

But if an exchange is made for a cheaper or more expensive product, then you will first need to complete the return procedure, and then only make a re-purchase.

Return of goods purchased with a bank card

The service "goods on credit" in our time is very popular among the population. When a person does not have enough money to purchase the necessary goods, he solves his problems with the help of such a service. Credits for goods are not provided by the trading enterprises themselves, this function is performed by the banks with which the contract is concluded. As a result, the store sells its goods, and the buyer receives the coveted purchase by concluding a loan agreement with the bank.

Before signing an agreement for a consumer loan in a trading company, carefully read the terms of the document. It, as a rule, sets out in detail the procedure for settlements between the bank, the borrower and the store when returning the goods. Be extremely careful when signing a loan agreement in a store, as each bank offer has its own characteristics.

An item purchased on credit is not the property of the borrower until the loan is fully repaid. Credit documents, along with the conditions for granting a loan, contain a pledge agreement, which is acquired at the expense of the loan funds of the goods. This means that the borrower does not have the right to sell the thing, return it to the store, pledge it without coordinating his actions with the bank.

Reasons for the return (exchange) of goods purchased on credit

If the goods purchased on credit turned out to be faulty, first of all, you should think about warranty repairs. Returning or exchanging goods will be somewhat more difficult. In the case of a technically complex product, the buyer, having discovered defects in it, has the right to refuse to fulfill the terms of the sales contract and submit a claim for a refund of the amount paid for such a product, or for its replacement with the same or another product with a corresponding recalculation of the price. But these actions are possible only within 15 days from the date of receipt by the consumer of such goods.

If the 15 day period has expired, then these requirements can be satisfied in one of the following cases:

- upon detection of a significant defect in the product;

- in case of violation by the trade enterprise of the deadlines established by law for the elimination of defects in the goods;

- if it is impossible to use the goods for their intended purpose in the aggregate for more than 30 days during each of the years of the warranty period due to the repeated elimination of its various shortcomings.

In accordance with Art. 24 of the Law of the Russian Federation "On Protection of Consumer Rights", when returning a low-quality product sold on credit, the buyer is returned the amount of money that he paid for the product by the day the credit product was returned, as well as the fee for providing the loan (if such was provided for by the terms of the contract).

The procedure for returning goods taken on credit

Here, first of all, it is necessary to understand that return of goods to the merchant and termination of the loan agreement - two different operations with different organizations. This means that when returning the goods, special attention should be paid to drawing up a return certificate (a copy of this document must be on hand) and pay attention to the date the cash was returned to the buyer (if they paid some percentage of the amount to the cashier of the store). The buyer must contact the bank on the same day when the act appears in his hands. Otherwise, the growth of the percentage for the use of the goods will not stop, regardless of whether he handed over the goods to the store or not. That is, only the date when the client applied to him with an application to terminate the loan agreement matters for the bank, and not the date when he handed over the goods to the store. Also, during the execution of documents at the bank on the termination of the loan agreement and the return of some amount, it is necessary to clarify the amount of your debt as of the current date, since, most likely, some minimum interest has already been accumulated. If a defective product is found, you can simply return it to the store (this is possible only during the warranty period), but the credit for returning the product is not canceled.

Be sure to keep paying off the loan!

Until the end of the contract, you should not stop or reduce loan payments. Even if the product has been in warranty repair for several months, the customer must fulfill the terms of the loan in the prescribed amount. If you are due to ignorance or due to lack of funds, then you will be charged interest for the delay, because of which your product, which turned out to be of poor quality, will also be very expensive for you.

Much easier for those who the credit agreement at the time of the return of the goods has already been completed. The borrower must obtain from the bank a document confirming the completion of the loan agreement and the absence of debt on it. By contacting the store with this paper and writing an application for termination of the sale and purchase agreement, the buyer will either receive the funds in cash, or they will be transferred to his bank account.

How to return interest on a loan?

To compensate for material damage associated with the payment of interest on the loan, the buyer will need to go to court. But here it must be borne in mind that the court will pay attention only to the period during which the client paid the court, but he did not use the goods due to their breakdown.

If it was not possible to agree with the bank or the store ...

If the employees of the bank and the store did not meet you halfway and are not going to return the money for the goods purchased on credit, then you have no choice but to try to do it in court. In this case, you must adhere to the rules for filing a claim for the return of goods. Depending on the value of the goods and the price of the claim, the claim is submitted to the district or world court. The Law on the Protection of Consumer Rights (Article 17) provides for alternative jurisdiction: claims can be sent to the court that the consumer chooses - at the location of the defendant and the address of the conclusion of the contract for the sale of goods on credit or at the place of residence of the plaintiff.

If, as a result of the consideration of the case, a decision was made with which you do not agree, then you have the right to appeal against it within 10 days from the date of the court decision. If the decision is reversed, the case will be returned to the court for retrial by a new panel of judges. In a new consideration of the case, the court will have to take into account the above, check the arguments and objections of the parties that deserve attention, evaluate them and, on the basis of the established, make a decision in accordance with the substantive and procedural law. The borrower, in the absence of experience in litigation, should use the services of a professional consumer protection lawyer.

Many consumers prefer not to save up finances for some time in order to purchase the thing they are interested in, the right thing, but simply apply to the bank for a loan or purchase what they have planned from implementers who practice selling on credit in installments.

Most often, such purchases are called the most emotional and even thoughtless, since many are carried out at low prices, while not taking into account the quality of products.

If there are some inconsistencies, such as a malfunction of the product or the owner simply stopped liking it, the question arises of returning the product purchased on credit?

The rights of consumers, as well as the features of the return procedure, will be discussed later in the article.

Can I return an item purchased on credit?

Russian law states that the specified clauses in the document on consumer rights fully apply to goods purchased on credit.

And this means that a dissatisfied user has the right to contact the competent authorities in order to return non-conforming products. Having discovered shortcomings, a technique or thing can not only be sent to the implementer, but also, if desired, exchanged for another.

But what is important in this procedure is that not all commodity units are subject to exchange.

All the nuances of reversing registration depend on the terms of the loan agreement, which everyone should familiarize themselves with at the initial stage of the transaction, without fail clarifying questions about the possibility of refusing products of inadequate quality.

In addition, the solution to such problems is also connected with the method of carrying out borrowed shopping, since one group of citizens prefers post-lending, that is, they are served directly at the store department by contacting a credit manager, the other goes directly to the bank and draws up consumer loans there.

It is important to clearly understand that the return of goods purchased on credit must be due to real claims and is available in such situations:

- malfunction, the product did not like it, the size of the clothes did not fit - within two weeks;

- if a marriage is found - a warranty period.

In any case, in order to achieve a result, the buyer must follow the correct algorithm of actions. More on this below.

Features of the return of goods!

You can return a product purchased on credit, which was issued in a banking structure, based on article 24 of the law on consumer rights, where paragraph 6 says that the buyer has the right to demand from the store, in case of reversal, the amount of the full purchase price plus the interest already paid and commission fees.

In order to correctly realize the intended goals, it is first necessary to correctly draw up a written claim.

For this type of application, the amount of the amount to be reimbursed must be indicated, taking into account commissions for services. The next step in the case should be the transfer of paper to the store, while the buyer must receive a mark, a signature, which would indicate the consumer's appeal.

The seller, in turn, undertakes to accept the goods for diagnostics and evaluation, which will take about 10 days. Official confirmation at this stage is the drawing up of an act of sale, receipts or receipts.

If the outcome was achieved peacefully, then the consumer should as soon as possible return the finances in the required amount or the amount that was established by mutual desire of the two parties.

After that, you need to contact the lender's branch and close the current loan, if necessary, pay the missing amount, which increased during the accumulation of interest, receive a certificate indicating the full repayment of the debt.

In case of refusal of the seller, the buyer has every right to go to court, in addition, in addition to demand compensation for moral damage.

The nuances of the return of products purchased in installments!

Can I return an item purchased on credit? As it turned out from the above information, this is a very real process, which also applies to products purchased in installments.

So, based on the same law “On Consumer Rights”, in paragraph 5 it is noted that the return of an inappropriate commodity unit requires the store to reimburse the buyer’s already paid amounts.

That is, the cost of production is not returned in full, but at the same time, the borrower has the right to demand finances spent on a commission for services, as well as the payment of interest.

An appeal to a trade structure, as in the case of consumer lending, is carried out in writing, where the consumer himself must competently file a complaint and describe what exactly it manifests itself in. The copy of the applicant is confirmed by the seal of receipt. Further, the buyer transfers the item to the salon diagnosticians and waits for 10 days.

If the store tries to exonerate itself of all charges and refuses to pay damages, the case may be sent to court hearings.

However, consumers should understand that the seller is wrong only in cases where the case has not lost its expiration date, the claims are justified, and the return or exchange is clearly stated in the loan agreement.

How to terminate the contract with the bank and the seller?

A poor-quality purchase, and even made on a loan, is always emotionally unpleasant and requires a lot of time for proceedings, which often end even in court, and as you know, this is a very lengthy process.

However, the consumer needs to be aware that in the case of paying for a commodity unit with money borrowed from a bank, he needs to notify the bank of claims against the store, and then provide an official act of sale with the aim of.

If the distributor canceled this agreement, the creditor returns to the client the entire amount deposited on the account of the institution. After making all payments, the bank closes the current loan.

But it is worth noting that, ideally, events develop only in those cases in which consumers paid due attention to the points on the conditions for making a purchase and situations with returns and exchanges, but practice shows that there are very few such most reasonable borrowers.

Termination of the transaction with the seller begins after the reasons for the refusal to purchase are indicated, after consideration of the case, it passes to the competent experts of the distributor.

As a rule, salons try to accept inexpensive purchases immediately after treatment and pay compensation to customers without any problems in order to maintain their reputation.

As for expensive purchases, official red tape most often occurs with them, after a trial in which the user can receive a settlement at the checkout, that is, the store returns the amount paid in full. Termination of the contract begins after the user has satisfied his claims.

Is the buyer entitled to monetary compensation in case of return of goods purchased on credit?

According to the law “On Consumer Lending”, the seller undertakes to pay the client who applied with a return item the entire amount spent at the time the application was made with claims.

The amount of payments does not include insurance services and commission for banking services. If we are talking about a consumer loan provided for the purpose of making a purchase in a store, then the contract for such a transaction can only be terminated upon the provision of a package of documents from the seller, on resolving the situation and canceling the act of sale.

As a conclusion, we can say that buyers who make purchases on credit fully receive the support of the law, as soon as it enters into force and whether it will have its power, it will depend on the attentiveness, prudence and education of borrowers.

Since, before concluding a deal to purchase products on credit, customers should study in detail all the clauses of the contract, discuss them with the assignor, and, if necessary, make regulatory changes so that in situations with non-compliance of the goods they do not have to go directly to the court.

It is also worth noting that buyers, before claiming a return, must independently evaluate the progress of further proceedings, since after two weeks and the warranty period, it is inappropriate and ineffective to make claims. Overdue charges are not taken into account, and sellers have every right to do so.

Return or exchange of goods on credit is possible, but for this you need to correctly carry out this procedure. Purchasing goods with credit funds is a popular way to make purchases in the modern world. Often there are situations when you don’t have the right amount of money for the product you like, but you don’t want to postpone the purchase. Then the ideal option is to pay at the expense of credit funds provided by the bank. However, what if the product turned out to be of poor quality or did not fit for some reason?

The return process is quite complicated and painstaking, therefore, if the reason for this decision is only a product malfunction, then you should first contact the Service Center and use the warranty repair.

If the purchased product is among the technically complex products, then in the event of a breakdown, it is better to demand a replacement, or return the purchase, refusing to fulfill the signed contract, since the product provided does not comply with the standards established by law.

This operation is possible only within 15 days from the date of purchase. There are a number of circumstances under which it is possible to return a credit product even after the expiration of the specified period.

Such reasons may be:

- serious deficiencies discovered during use;

- severe delay by the enterprise of the product and violation of the deadline specified in the agreement for the elimination of the problem;

- the inability to use the purchased product for thirty days (per year) due to its being in the manufacturer's or store's repair shop;

- constant breakdowns over a long period.

According to the norms specified in Article 24 of the Law “On Protection of Consumer Rights”, after the return of a low-quality product to the selling company, the creditor is obliged to return all the funds that were paid for this product, including money for credit services.

The procedure for returning goods taken on credit

First of all, it is worth distinguishing and understanding that when making a purchase at the expense of credit funds, there is cooperation with two offices at once - a bank that provides a loan and a store that offers goods. The consumer can make a return by providing the product to the store where it was purchased.

Important! The main condition for the return of any product is the preservation of the integrity of the packaging, external and internal elements, receipts and documents for the products.

There are certain return conditions established by law. They will help not only to return the purchased product, but also to avoid possible misunderstandings with the bank that provided its services.

Treaty

This document contains all the terms and conditions of the acquisition and its return. As a rule, the contract contains a detailed description of the procedure with all the nuances and can be used as instructions for planning your further actions.

Drawing up a claim

After a detailed acquaintance with the signed agreement, it is necessary to draw up a claim to the selling party, which will indicate the reason for such a decision and the requirement to eliminate it (replacement with a similar or different product, return).

After a detailed acquaintance with the signed agreement, it is necessary to draw up a claim to the selling party, which will indicate the reason for such a decision and the requirement to eliminate it (replacement with a similar or different product, return).

If the returned goods were defective, then in addition to personal funds, the buyer has the right to demand compensation for the already paid credit interest and other payments prescribed in the terms of the contract.

READ ALSO:

How to write an application for the return of goods

In order for the expressed wishes to have weighty evidence, copies of the loan agreement and checks of paid receipts must be attached to the main application.

In order for the bank to fulfill your request and return the funds for the purchased goods, you must indicate your bank details (card number, account number, etc.) in the application. After receiving the claim, bank representatives are required to give their answer and transfer funds within 10 days.

Attention! If after the expiration of the specified period the money has not been credited to the account, then the plaintiff has the right to demand payment of damages for the delay, which is 3% of the total amount. An exception may be cases in which the contract specifies other terms for the return of money.

It is necessary to draw up a claim in two copies, one must be transferred to the selling company, the second must be kept, while asking to make a mark on the acceptance of this document indicating the date of application.

If the store representative refuses to accept the application, then it is necessary to send a claim in writing with a detailed description of the attachment and the service of notification of delivery of the letter.

Certificate of return of goods

Having reached this stage, you should be very careful, because it is this document that is the main evidence in further proceedings through a peace agreement with the bank or a lawsuit.

In addition to the fact of a return or exchange, the document must contain a detailed description of the reason for the return (external defects, malfunction of the product, its complete breakdown). Also, the party that sold the goods must indicate the amount of funds that were returned after the execution of the act.

Application for termination of the agreement on the use of credit funds

A bank and a store can conclude an agreement on cooperation and joint provision of services to a certain circle of consumers, however, they are different offices and resolving issues with them requires separate procedures.

Even if the wrong product was returned, this does not release the consumer from his credit obligations, therefore, it is not worth stopping paying monthly installments. First you need to draw up a special application for the termination of a loan agreement or a pledge agreement and submit it to the bank.

The process of terminating a loan agreement

There are two ways to carry out this procedure:

There are two ways to carry out this procedure:

- Easier process. This option is possible only if no more than 30 calendar days have passed since the signing of the contract. In this case, you just need to return the loan amount to the bank ahead of schedule and close the contract.

- Standard procedure. This method is relevant for those whose credit obligations last for more than 30 days. In this case, you need to file an application for termination of the contract, with the specified legal basis for this. The basic law that can be used is paragraph 1 of article 451 of the Civil Code of the Russian Federation. He says that the termination of the agreement is possible if a significant change in circumstances occurs, this number includes the termination of the contract with the store where the purchase was made. You can also indicate the reason for this action: improper product condition, the presence of internal or external defects, non-compliance with specifications, etc.

In addition to the main application, it is also necessary to collect a package of documents confirming the facts indicated in the application. The documents include: a claim, an act on the return of goods, an examination certificate (if it was necessary for confirmation), checks and receipts.

Important! Until the official termination of the contract with the bank, you must continue to make payments indicated in the document. Otherwise, the bank may charge additional penalties for violation of the terms of the agreement.

Exactly the same procedure applies to receiving funds debited from a credit card. After returning the goods, you need to submit an application and after considering it, the credit must be canceled, and the share already paid will be credited to the card.