Modern banks allow you to store money not only in national, but also in foreign currency. This is convenient for those who constantly cooperate with foreigners, or prefer to keep their savings in dollars and euros. But not everyone knows how to take advantage of this opportunity. In this article, you will learn how a current currency account differs from a transit or special one. In addition, you will understand that it is necessary to open a foreign exchange transit account for legal entities in our country, and you will be able to use the information received in practice.

Currency account: what is it and why is it needed?

A currency account differs from a regular account only in that it holds foreign currency funds. If you receive money from foreign partners, then it makes sense to open just such an account so as not to lose interest when exchanging currency. Fluctuations in the exchange rate will become less relevant for you, and their sum difference will be reflected only in accounting.

By law, a currency current account can be opened:

- Individual;

- Organization;

- Entity.

To do this, you need to collect all the necessary documents and meet with a bank representative to conclude an agreement. It is worth asking for a list of necessary documentation in advance and specifically at the bank whose services you plan to use. There you will be explained in detail how to open a foreign currency account for a legal entity or individual.

If you do not want to keep all your savings in one place, then no one forbids you to open a foreign currency transit account in a bank with which you have not previously been connected in any way.

But using the services of an institution in which you already have investments is still much more profitable - this will save you time, and the list of necessary documents will be smaller.

When opening, keep in mind that only one type of currency can be stored on it. That is, you cannot transfer dollars, sterling, and euros there at the same time. To do this, you will need three different locations. In most banks, opening and using a foreign currency account is free of charge, as well as accounting for funds in a foreign currency account. If a separate fee is charged for this, bank employees will warn you about this.

What is the difference between current and transit accounts?

Money in a foreign currency account can not only be accumulated, but also actively used. By concluding a contract with a bank, you get the opportunity to use two accounts at once:

- transit;

- current.

Both are essential to running a business. A transit currency account is used to receive funds. It is to him that your employers or partners can transfer money.

In fact, this is the internal storage of the bank itself, which you cannot use. It is necessary in order to keep records of operations on foreign currency accounts, as well as accounting for funds in foreign currency, which are stored in one place. Therefore, all funds received must be transferred. Only after that you will be able to carry out all the currency transactions you need:

- pay off loans;

- withdraw cash;

- Transfer the required amounts.

The process of transferring money from a transit account to a current account may seem complicated and full of unnecessary steps at first. After the sender transfers the required amount, you cannot immediately use your funds. You will need to wait for the transfer notification from the bank itself and provide documentation for this transaction. Information about the receipt of funds, as a rule, comes within fifteen business days. As for the documentation, it can be contracts, reports or any other evidence that the transaction was carried out legally and in accordance with all the rules. This is necessary for accounting for foreign exchange transactions.

After everything is checked by bank employees, the funds will be transferred from the transit account to the current one.

Additional bonuses

In addition to the options that have already been discussed earlier, there is also a special transit account. You already know what a transit account is, but this subtype of it has its own characteristics. It is worth talking about it separately, since its opening takes place without your active participation. It is also used for the most part by the bank to account for transactions in foreign currency.

This is a kind of way to control the resident. The Bank has the full right to keep records of operations on the foreign currency account and uses this for its own security. It is used if the resident is regularly engaged in the sale and purchase of currency. In this case, you need to account for foreign exchange funds and operations on a foreign currency account so that everything can be checked at any time.

Most often, it is opened not for an individual, but for an organization. Its leaders in this case, too, can take advantage of the new account. If the company has the necessary documents, then it can be used for various transactions related to the purchase or sale of foreign funds.

True, not everything is allowed here. So, for example, you can't:

- Buy another currency with this money;

- Acquire securities.

However, the funds available there can be used to cover travel expenses. But its main purpose, as already mentioned, is to keep records of operations on foreign currency accounts.

As you can see, opening and using a foreign currency account in our country is not such a complicated process as it seems at first glance. Use the information received and keep the money correctly.

Opening a transit bank account is required in cases where an individual or legal entity is engaged in foreign economic activity and accepts payments for its goods and services in foreign currency. At the same time, the legal form of the business does not matter. What a transit account is, what steps you need to go through when opening it, and what nuances of its use exist, readers will learn from this material. Actually, nothing complicated.

Transit account in a financial institution. What it is?

The transit account of the company serves to transfer funds in foreign currency for the goods sold by the business entity. or services provided. For a transit account, its inextricable connection with a currency account is characteristic. Mandatory. In other words, a transit account cannot exist without a currency one. And vice versa. It should also be emphasized that funds in foreign currency can be kept in a transit account for a period not exceeding 15 days. During this time, they are subject to transfer - to the main, currency. Or must be converted into national currency. And transferred from the transit account to the current one. Everything is extremely simple.

Instructions for opening a transit account

So, in more detail. As noted above, a transit account is tied to a currency account and cannot function without the latter. What are the main steps to go through when opening it? First of all, a business entity must provide a financial institution with a copy of the charter of its organization and accompany it with an application on the appropriate form with a request to open a currency and transit account. At the same time, it is necessary that the document spells out the possibility of working with the currency of other states.

After that, bank employees issue a bank card. This process is accompanied by the provision of a list of authorized persons of the company who are entitled to access the transit account. In addition, sample signatures of these employees must be provided.

At the same time, the business entity or its representative is obliged to provide the bank with documents confirming the legality of the opening and operation of the enterprise. It should be noted that if the company has undergone reorganization, you will also need to provide relevant certificates. At the final stage, the organization submits to the financial institution documents indicating the legality of the origin of the credited foreign exchange earnings.

Conclusion of an agreement

Upon completion of all the stages listed above, the financial institution and the business entity conclude a separate agreement on opening transit and foreign currency accounts. When working related to the sale of goods and services for foreign currency, company representatives indicate a number for payment to their counterparties.

It should be noted that there are certain rules not only for opening a transit account, but also for subsequent work with it. So, within 7 days after its appearance, a business entity must notify the tax authorities at the place of registration of its company. In addition, the relevant pension fund administration should also be notified. Otherwise, penalties will follow.

It is also required to notify the social insurance fund about the opening. Here it must be emphasized that state bodies are not entitled to make claims about the lack of notification of the opening of a transit account. It is very important.

The transit account has characteristics that significantly distinguish it, which must be reported to the Federal Tax Service Inspectorate. In addition, the need for an organization does not depend on the desire of an individual or legal entity. Its opening is mandatory and carried out in the prescribed manner as an addition to the foreign currency account, which should be reported to the state authorities. Everything is very serious.

Finally, it is worth mentioning the requirements for documents confirming the legitimacy of posting foreign currency to a transit account. This may be: an act of work performed, a contract for the supply of goods or the provision of services, and other evidence. In this case, the documents must be provided in Russian, and the translation from a foreign language must be certified by a notary.

If a resident organization (resident individual entrepreneur) plans to conduct foreign economic activity, then it must conduct settlements when carrying out foreign exchange transactions through bank accounts (parts 2.3 of article 14 of the Law of December 10, 2003 N 173-FZ, hereinafter - Law N 173 -FZ). When opening a current currency account, the bank simultaneously opens a transit currency account for a resident (clause 2.1 of Instructions of the Bank of Russia dated 30.03.2004 N 111-I, hereinafter - Instructions N 111-I). That is, the opening of such an account occurs automatically and regardless of the will of the company (IE).

Initially, the currency transferred to the resident, both by bank transfer and in cash (Letter of the Bank of Russia dated October 27, 2004 N 09-15-2-10 / 83630), is credited specifically to the transit account. Then, on the basis of an order to debit the credited currency from it, the money is transferred to the resident's current currency account (clauses 2.2, 2.3.3 of Instruction No. 111-I).

A transit account is a special purpose account that does not require the conclusion of a separate bank account agreement. Accordingly, it is not a bank account in the sense that the Civil Code of the Russian Federation implies (Article 845 of the Civil Code of the Russian Federation).

Recall that once all residents had to sell part of the received foreign exchange earnings on the domestic foreign exchange market of the Russian Federation. There was a time when 30% of the proceeds went to the mandatory sale (part 1 of article 21 of Law N 173-FZ as amended, valid until 06/30/2004). Then the share was reduced to 25%, then to 10%, and today it is 0% (clause 1.2 of Instruction N 111-I). That is, now the received currency can be kept on the currency account for as long as you like.

What amounts are not credited to the transit account

Certain funds, bypassing the transit account, are credited immediately to the resident's current currency account (clause 2.2 of Instruction No. 111-I). So, if a resident has several current currency accounts opened in a bank, then when transferring money from one of them to another, the amount will not go to the transit account, but will immediately be credited to the desired current currency account.

Also, the money will immediately go to the current currency account of the resident in the bank if he transfers the currency from his own current currency account opened in another bank.

Actions of a resident if money was received to the transit account from a non-resident

Since banks are agents of currency control, they have the right to request from residents documents related to the conduct of foreign exchange transactions (clause 9, part 4, article 23 of Law N 173-FZ). And in accordance with the Instruction of the Central Bank, a resident, when crediting money to his transit currency account within 15 working days, together with an order to write off foreign currency from a transit currency account or without it, must submit to the bank (clause 2.1 of the Instruction of the Bank of Russia dated 16.08.2017 N 181-I, hereinafter - Instructions N 181-I).

an account of a legal or natural person opened to a client by a bank or other credit institution, on which foreign currency is located and associated with a variety of foreign economic transactions carried out in accordance with the norms of the legislation of the state

Information about foreign currency accounts of legal entities and individuals, what is a foreign currency account and the procedure for opening and maintaining it, current and transit foreign currency accounts, a foreign currency account with a bank or other credit institution and settlement operations performed by the owner of a foreign currency account

Expand content

Collapse content

Currency account is, the definition

Currency account is a foreign currency account opened by a legal or natural person with a bank or other credit institution. The procedure for opening and maintaining a foreign currency account is regulated by the relevant laws of the state and orders of the Central Bank. A foreign currency account is opened for conducting settlements in foreign economic activity, including for receiving payment in accordance with contracts and paying penalties and fines to foreign partners.

Currency account is a bank account in which the foreign currency of individuals and legal entities, state institutions is located. Banks accrue interest on foreign currency accounts in the currencies in which they receive income from the placement of funds on the international foreign exchange market.

Currency account is account in a foreign bank in the currency of the country where the bank is located.

Currency account is a bank account in foreign currency, opened in accordance with the norms of the law for legal entities for settlements related to certain foreign economic transactions.

Currency account is the account of enterprises and associations in foreign currency, which receives payments from foreign counterparties, foreign currency funds received on credit.

Currency account is an account in foreign currency and transferable rubles opened for a client by a credit institution. The currency account is formed at the expense of payments received from foreign trade operations, and at the expense of foreign exchange funds received on credit; is intended to pay for goods and services received by import, as well as to pay fines and penalties to foreign counterparties in case of violation of conditions and agreements.

Currency account is in accounting, an account for posting business transactions and transactions denominated in foreign currency.

Currency account is bank account of the firm, enterprise in foreign currency; is formed by deductions from foreign economic activity and foreign currency loans. The foreign currency account is designed to pay for both goods and services for imports, as well as fines and penalties to foreign counterparties in case of violation of the terms of contracts and agreements.

Currency account is account in foreign currency and transferable rubles. The currency account is formed at the expense of payments received from foreign trade operations and at the expense of foreign exchange funds received on credit, is intended to pay for goods and services received by import; to pay fines and penalties to foreign counterparties in case of violation of terms and conditions and agreements.

Currency account is a bank account designed to record transactions with currency received in the domestic foreign exchange market.

Currency account is an account in a banking institution owned by a legal or natural person, on which their funds are accumulated and spent in foreign (convertible) currency. Banks accrue interest on funds in foreign currency accounts in the currencies in which they receive income from the placement of funds on the international foreign exchange market.

Currency account is a bank account in foreign currency, opened in accordance with the norms of national legislation for legal entities and individuals for settlements related to foreign economic transactions.

Currency account is an account where funds in foreign currency are placed for their subsequent management.

Purpose of a currency account

For the successful conduct of foreign economic activity, both a legal entity and an individual who is engaged in entrepreneurship must have a foreign currency bank account.

Such an account is opened for a client in financial institutions and with its help operations are carried out on spending, accruing or accumulating currency. On funds held in foreign currency accounts, the bank accrues interest, since it has a profit from the cash reserves of the client who placed the currency in it.

Only those commercial banks that have a license from the Central Bank for such activities are entitled to open foreign currency accounts.

Opening a currency account

If an organization already has an open current account in rubles in a bank, then in order to open a foreign currency account, it will need to provide only two documents to a credit institution (since the rest have already been provided):

Application for opening a foreign currency account;

Agreement for its management.

If a foreign currency account is opened in another bank, that is, in one where there is no open ruble account, then in addition to these documents, the entire package of mandatory documents is required to conclude an agreement with the bank:

Notarized copies of constituent documents (charter, memorandum of association, decision, etc.);

Notarized copy of the state registration certificate;

A copy of the certificate of registration with the tax authority;

Card with samples of signatures of persons entitled to dispose of the account, and a sample of the seal;

A copy of the information letter on registration with the statistical authorities.

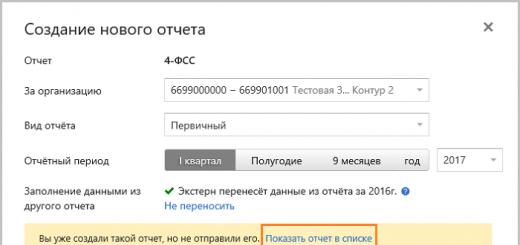

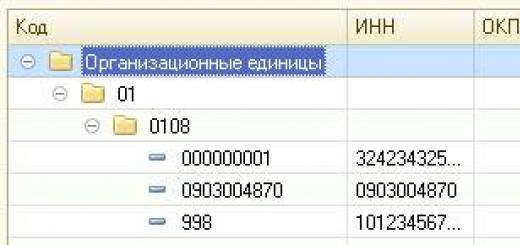

When an organization enters into an agreement to open a foreign currency account with a bank, in fact, not one, but three accounts are actually created:

Current currency account - to account for the currency at the disposal of the organization;

Transit currency account - to account for incoming currency earnings;

Special transit currency account - to account for the currency purchased on the domestic foreign exchange market.

As with opening a regular current account, when opening a foreign currency account, it is necessary to notify the tax office within seven days in accordance with Article 23, Part 2 of the Tax Code of the Russian Federation. The fine for failure to comply with this requirement is 5 thousand rubles (Article 118 of the Tax Code of the Russian Federation, part 1 (2)).

Individuals also have the right to open foreign currency accounts in banks and carry out operations on them. To do this, it is enough for a citizen to present a passport and write an application for opening an account in foreign currency. A service agreement is concluded between the bank and the client.

Types of currency accounts

The types of foreign currency accounts of clients are provided for by the instruction of the Central Bank, depending on the mode of their functioning.

Currency accounts of legal entities

To carry out foreign economic settlements, foreign currency accounts are opened for residents in an authorized bank.

In connection with the mandatory sale of a part of the currency by Russian legal entities and individuals to the currency reserve of the Bank of Russia and directly on the domestic foreign exchange market, two parallel accounts are opened for resident legal entities:

Transit currency account;

Current currency account.

Also, a special transit account can be opened for resident legal entities, which is opened for the purpose of accounting for transactions made by a resident for the purchase of foreign currency in the domestic foreign exchange market and its resale.

Transit currency account

A transit currency account is a special bank account opened for crediting the organization's foreign exchange earnings. It takes into account the receipt of funds under the export contract in full. The balance of funds can be sold for rubles on a written order of the organization - an application for currency conversion.

The transit currency account is intended for crediting in full all foreign currency receipts in favor of the organization, with the exception of the following funds credited to the current currency account:

Funds received from one current currency account of an organization opened with an authorized bank to another current currency account of this organization opened with this organization in an authorized bank;

Funds received from the authorized bank, in which the current currency account of the organization is opened, under agreements concluded between them;

Funds received from the current currency account of one Russian organization to the current currency account of another Russian organization, opened in one authorized bank.

For a number of purposes, funds can be spent directly from the transit account. So, it can be used to pay residents and non-residents for the delivery of goods, their insurance, freight forwarding in foreign territory, as well as pay customs fees and bank commissions.

Until January 1, 2007, there was a norm according to which the organization was obliged to sell a certain part of foreign exchange earnings in accordance with the Instruction of the Central Bank of March 30, 2004 No. 111-I “On the mandatory sale of a part of foreign exchange earnings in the domestic foreign exchange market of the Russian Federation” (as amended) . At different times, depending on the situation in the foreign exchange market, the Bank of Russia set a standard of 10%, and even 50%. Now this rate is zero. Thus, transit settlement accounts are used exclusively for the purposes of currency control.

Current currency account of a legal entity

Current currency account - a bank account designed to record transactions with currency received in the domestic foreign exchange market.

Currency earnings on the current currency account at the order of the account holder can be:

Listed abroad for import operations;

Transferred to foreign trade organizations to pay for imported goods;

Sold at the currency exchange, auction;

Transferred to pay the debt for a loan in foreign currency;

Used to pay for travel expenses, postal and telegraph services;

Used for other purposes with the permission of the Ministry of Finance of the Russian Federation, the Central Bank of Russia or an authorized bank.

Special transit currency account

A special transit currency account is opened by an organization if it purchases foreign currency. The purchased currency is credited to this account and must be used by the organization for the purposes for which it was purchased within seven calendar days. If during this period the currency has not been used, it is subject to resale.

Currency accounts of individuals

The following types of currency accounts can be opened for resident individuals:

Current currency account;

Term deposit;

Currency account type A;

Current account type B.

Current currency account of an individual

The resident's funds are on the current currency account, he can dispose of them at his own discretion, if this does not contradict the law.

Term currency deposit

Term deposit - foreign exchange account. These are funds on deposit accounts, certificates of deposit, interbank deposits, savings deposits in foreign currency, bills of exchange.

Currency account type A

Currency account type A - free export and transfer of currency abroad is allowed from it.

Currency account type B

Current currency account type B - this is an account with partial restrictions on the export and transfer of currency abroad.

Servicing a currency account by a bank

The Bank shall open only one foreign currency account in freely convertible currency for the owner of foreign exchange funds. Conversion of one currency into another is carried out at the current rate of the international currency market on the day of the operation and without limitation. Exchange rate differences in the currency account are revealed on the first day of each month (or at the discretion of the enterprise during the month) and are attributed, depending on the accounting policy of the enterprise, either to the profit and loss account, or preliminary to future income with the final entries written off at the end of the year to the profit account and losses.

The currency of the account is determined at the choice of the client, but taking into account the fact that authorized banks have the right to open accounts in the following foreign currencies: Australian dollars, Austrian shillings, British pounds sterling, Belgian francs, German marks, Dutch guilders, Danish krones, Italian lira, Canadian dollars, Norwegian krone, US dollars, Finnish marks, French francs, Swedish krona, Swiss francs, Japanese yens, ECU, Spanish pesetas, Greek drachmas, Irish pounds, Icelandic krones, Kuwaiti dinars, Lebanese pounds, Portuguese escudos, Singapore dollars, Turkish lira. In order to establish the customs value of exported and imported goods, the exchange rates of these currencies against the ruble are used. Rates are set by the Central Bank of the Russian Federation and published in Rossiyskaya Gazeta and Izvestia.

On behalf of citizens, banks open current accounts and deposits in foreign currency and carry out operations on them. Commercial authorized banks, upon receipt of a citizen's application and presentation of an identity card, open a personal currency account. Then the current account agreement is signed. By order of the owner, the funds can be paid in cash, while at the request of the client, a permit is issued for the export of currency in the presence of a foreign passport with a visa. By order of the owner, funds from the current account can be transferred to his name abroad, to the accounts of stores that trade in foreign currency in the country. By order of the account holder, funds can be placed on a term deposit or deposit. Banks accrue interest on current accounts and deposits in accordance with agreements.

The Bank accrues and pays interest on foreign currency accounts in those currencies for which it receives income from their placement on the international currency market. Interest is calculated once a quarter.

For current foreign currency accounts, the interest rate is determined on the basis of rates on short-term deposits in the international foreign exchange market. Then the average rate for individual currencies is calculated based on data published by Reuters. In this case, the rate is reduced by 1.5%. According to international practice, interest payments are either not made at all, or are made at rates significantly lower than the international market rates, i.e. if the interest rate for currencies on the international market is less than or equal to 1.5%, then no interest is accrued on them.

On behalf of the client, the bank can accept funds from a foreign currency account into deposits for various periods. These funds are kept in deposit accounts, ie. an account that reflects the movement of deposits. On deposits in deposit accounts, the bank can also charge income in the form of interest.

In modern banking practice, two options for calculating interest are used:

On a contractual basis between the depositor and the bank, i.e. the depositor submits an application with a request to accept foreign currency for storage for a period;

The same as for current accounts, i.e. the rate is calculated based on the rates established in the relevant period on the international currency market.

All payments from current foreign currency accounts are made by the bank within the balance of funds on the account. By decision of the Board of the Bank, its most reliable clients are granted the right to make payments on an overdraft - this is the amount within which the bank credits the owner of a current foreign currency account. The amount of such a loan, the form of its security, repayment periods, etc. are established by agreement between the bank and such holders of current foreign currency accounts.

As transactions are made, the bank informs the client by providing an extract from a foreign currency account.

Transfers to and from the country of foreign currency for settlements without deferred payment for the export and import of goods, works and services, as well as for settlements related to crediting export-import operations for a period of not more than 180 days;

Receipt and provision of financial loans for a period not exceeding 180 days;

Transfers to and from the country of interest, dividends and other income on deposits, investments, loans and other transactions related to the movement of capital;

Non-commercial transfers, including transfers of wages, pensions, alimony, and other similar transactions.

Operations related to the movement of capital

Currency transactions related to the movement of capital:

Direct investment, i.e. investments in the authorized capital of the organization in order to generate income and obtain rights to participate in the management of the organization;

Portfolio investment, i.e. purchase of securities;

Transfers in payment for the ownership of buildings, structures and other property (including land and its subsoil), attributable to real estate under the laws of the country;

Granting and receiving a deferred payment for a period of more than 180 days for the export and import of goods, works and services;

Providing and receiving financial loans for a period of more than 180 days;

All other currency transactions that are not current.

The rights of banks to work with foreign currency

It should be noted that such an area of banking activity as opening foreign currency accounts is determined by the level of license that the bank receives. There are general, extended and one-time licenses. A bank that has a general license can conduct foreign exchange transactions both in Russia and in the countries of the world.

An extended license holder is only allowed to cooperate with six foreign financial institutions. Obtaining a one-time license entitles you to only one specific currency operation.

A legal or natural person can open a foreign currency account with a bank only in the foreign currency with which this bank is allowed to work. When issuing a license to work with accounts in foreign currency, the Central Bank focuses on the capabilities of a commercial bank - the level of technical equipment and qualifications of bank employees, as well as on strict compliance with established requirements by this bank.

System of currency regulation and control

Most of the foreign exchange transactions of residents with non-residents are carried out through bank accounts. Therefore, the conditional "currency control barrier" between the ruble payment system and the external financial world is designed primarily with the use of such accounts. Namely, the operations of residents on foreign currency accounts and the operations of non-residents on ruble accounts are strictly regulated. According to the Law “On Currency Regulation...”, the procedure for opening and operation of such accounts in authorized banks is established by the CBR. At the same time, foreign currency accounts of non-residents, as well as ruble accounts of residents, are essentially outside the sphere of interests of the currency control authorities.

Currency accounts of residents in Russia

According to the Law “On Currency Regulation and Currency Control”, residents may have foreign currency accounts with authorized banks.

About the currency control of the Russian Federation

Currency accounts of residents - legal entities in Russia

The main features of the system are as follows:

Foreign exchange earnings from non-residents go to the transit account;

Foreign exchange earnings are subject to a partial mandatory sale (currently 25%), after which the balance can be credited to the current account. (But some types of income, including loans received, are not subject to mandatory sale.);

The currency purchased by a resident for rubles is credited to a special transit account, after which it is either transferred to the purposes declared during its purchase, or is subject to resale. It cannot be credited to the current account;

Funds on the current account are at the full disposal of the enterprise and can be used for any legal purposes, including for paying for goods and services received from a non-resident, as well as for selling for rubles;

The purchase of one foreign currency for another is allowed without restrictions.

As you can see, the system is designed in such a way as to prevent the free transfer of the enterprise's ruble funds into foreign currency and its uncontrolled sending abroad.

Ruble settlements with non-residents are carried out without any restrictions or permissions, but in accordance with the regime of ruble accounts of non-residents, which are discussed below.

Currency accounts of residents - individuals in Russia

The whole described structure with transit accounts does not apply to residents - individuals who open only a regular current currency account. However, this in no way exempts individual entrepreneurs from currency control, including on export and import transactions in accordance with CBR instructions 86-I and 91-I, as well as from the mandatory sale of export foreign exchange earnings.

Currency accounts of residents abroad

As sad as it sounds, the activities of foreign banks are not controlled by the Central Bank in any way, and, accordingly, they cannot be agents of Russian currency control. Therefore, the opening of resident accounts abroad (according to the Law, it is regulated by the CBR), in general, is not welcome: as a rule, this requires special permission from the CBR. However, there are currently important exceptions to this rule, including for personal accounts.

Currency accounts of residents-legal entities abroad

Legal entities also received some concessions. First, without the permission of the Central Bank, foreign accounts in non-convertible currency are opened to service international construction contracts. Secondly, without permission, accounts are opened for servicing foreign representative offices of Russian organizations.

Why are these types of accounts allowed? Obviously, the logic here is this. As a general rule, all commercial transactions, including foreign ones, are conducted by a Russian company through accounts in Russian banks. A foreign representative office is an example of when such a procedure (payment of expenses from Russia) would create enormous inconvenience, which was the reason for the introduction of concessions. The most important case when an organization conducts meaningful activities abroad, without necessarily creating its own representative office there, is construction. If the payment for the work contract is in a convertible currency (dollars, etc.), then you can get by with Russian accounts. However, opening an account in the Russian Federation in some exotic currency may be difficult or impossible, which is why the builders were allowed to open them right on the spot.

Currency accounts for builders abroad

Permission to open accounts in non-convertible currency for servicing construction contracts was given by amendments directly to the Law (in 2001). Subsequently, the CBR issued a special Regulation 200-P regulating the procedure for opening and maintaining such accounts (Regulation of the Central Bank of October 16, 2002 N 200-P "On the procedure for opening and maintaining legal entities - residents of accounts in foreign currency outside the Russian Federation for settlements on international construction contracts).

The regulation provides a closed list of grounds for crediting and debiting money to such accounts. (If the transaction is not included in the list, CBR permission is required for its implementation.) Accounts can be used for settlements both under the contract itself and for servicing other transactions related to the contract. This includes: crediting and debiting funds related to payment for goods, works and services under the contract, maintenance of representative offices opened in connection with the execution of the contract, payment of wages and travel expenses, payment of bank commissions, taxes, duties, etc. Of course, you can transfer money to this account from the Russian accounts of the construction organization and vice versa.

According to the regulation, the circle of countries where such accounts can be opened is determined by the Central Bank, as well as the list of non-convertible currencies. The list of such countries and currencies (in the amount of 51) is determined by the Instruction of the Central Bank of August 3, 2001 N 1010-U. To service one contract, you can open only one such account, and it is in the country where the construction work is carried out (which is logical).

In addition to an account in a non-convertible currency, one more account can be opened for servicing this work contract - in a convertible currency (that is, not included in the mentioned list of the CBR), but with special permission from the CBR. This account is used to transfer money from non-convertible currency to convertible and vice versa.

It should not be thought that the ability to open an account without special permission means that it can then be disposed of uncontrollably. The Russian organization within 10 days notifies its tax authority of the opening of a foreign account and then monthly submits to it a report on the movement of funds on the account (with extracts attached). A copy of the report - already without extracts, but with a mark from the tax authority - is sent to the CBR.

The account can operate for 5 years after the conclusion of the contract, since this is the period provided for the return of foreign exchange earnings from construction work. After the account is closed, the tax authority is notified about this - also within 10 days.

The main features of this order are as follows:

The account is opened only in non-convertible currency (the list of countries and currencies is established by the Central Bank);

Settlements are allowed only under this contract (meaning both income and construction costs);

Account replenishment from Russia is allowed;

The account is closed no later than five years after the conclusion of the work contract (the maximum permitted period for receiving foreign exchange earnings).

Currency accounts for representative offices abroad

The second case, when permission from the CBR is not required to open an account abroad, is the account of a foreign representative office of a Russian company. Strictly speaking, a representative office is not a separate legal entity, so the expression "account of representative office" is not entirely correct. More correctly - "an organization's account intended for servicing the activities of its representative office", but it turns out to be too long, so a shorter expression is usually used.

On October 16, 2002, the CBR adopted Regulation No. 201-P "On the procedure for opening and maintaining foreign currency accounts by resident legal entities outside the Russian Federation to service the activities of their representative offices."

According to the Regulations, an account for a foreign representative office is opened without special permission, but, as in the previous case, the tax authority is notified about this within 10 days.

For a representative office, you can open two accounts - one in the currency of the country where it is located, and the second - in any other currency. This Regulation also provides for a closed list of permitted transactions on the account (if the transaction is not on the list, a separate permission from the CBR is required). Needless to say, this list is very limited. It is allowed to carry out only those operations that are directly related to the maintenance of the existence of the representative office itself. The account is credited mainly with money transferred from Russian accounts of the same organization or converted from another account of the same representative office (plus, possibly, bank interest, as well as refunds, etc.). You can use the money on the account to transfer funds to Russian accounts of the same organization, to buy foreign currency, to pay taxes and duties, court costs, bank commissions, as well as to pay salaries, travel expenses and other expenses of the representative office.

However, the representative office's accounts may not be used for business or investment activities. Operations related to the acquisition of rights to real estate (except for payments for the lease of premises) are also prohibited. Such operations can only be carried out from the Russian accounts of the organization in the usual (established by law and CBR documents) procedure: transaction passport, if necessary, permission from the CBR, etc.

Among other things, there are restrictions on the amounts that can be kept on the accounts of the representative office. First, the accounts of all foreign representative offices of a Russian organization should not contain more than 15% of the sum of all its assets. In addition, at the end of the quarter, the account should not have too much free money: a maximum of twice as much as was spent from this account during the same period. The "surplus" should be repatriated to Russia.

The report on the movement of funds on the account of the representative office is submitted quarterly to the tax authorities and the CBR. When the representative office is closed, its accounts are also closed, and the money is transferred back to Russia to the organization's accounts.

The main features of this order are as follows.

It is allowed to open two accounts: in the currency of the country where the representative office is located, and in any other (for example, in dollars);

Only operations related to the maintenance of the mission itself are allowed; commercial and investment operations on the accounts of the representative office are prohibited;

Replenishment of the account from Russia is provided;

The amount of funds in the account should not exceed 15% of all assets of the organization;

The amount of funds on the account must not exceed a certain standard (at the end of the quarter - no more than twice the quarterly expenses of the representative office), the "surplus" is repatriated to Russia;

The Russian tax authority is informed about the opening of the account;

A report on the movement of funds on the account is submitted to the tax authority and the CBR;

When a representative office is closed, its accounts are also closed.

Currency accounts of residents-individuals abroad

After the sad events of 1998, which left the Russian banking system in ruins, it is unlikely that anyone will be surprised by the fact that a Russian bank is not the most reliable place to store their savings. Yes, right now there seems to be no direct reason for concern. But even before that crisis, the prospects looked quite rosy.

Due to these simple considerations, those Russians whose savings do not match the size of their mattress or a jar buried in the garden inevitably turn their eyes abroad. As a matter of fact, many of them applied there even before the crisis, and for the same reasons - and, apparently, they turned out to be right. Despite all the current vicissitudes with the dollar and the Western economy as a whole, which our fellow citizens are following with bated breath, there can hardly be any doubt that a completely average Western bank is much more reliable than even the best of domestic banks, with all due respect to the latter.

In addition, if the savings are really serious, it requires investment - usually in securities. The Russian stock market, despite its potential profitability, inspires even more fear than the banking system. And this is another argument in favor of an account in a Western bank: it is natural to invest in American, say, shares from an American account.

Previously, Russian citizens (more precisely, residents - individuals, which is not quite the same thing) were allowed to open an account abroad only in case of temporary stay in the respective country (however, this is still allowed). When a resident returns home, such an account is closed without fail, and the funds are transferred to Russia (Letter of the State Bank of the USSR dated May 24, 1991 N 352 "Basic provisions on the regulation of foreign exchange transactions in the territory of the USSR", section VIII, clause 11).

The long-awaited permission for the free opening of accounts by Russians abroad was given by the CBR in 2001 (Instruction of the Central Bank of August 29, 2001 N 100-I "On accounts of resident individuals in banks outside the Russian Federation"). However, the permit comes with a number of significant limitations.

The main features of the new order are as follows:

Accounts are opened only in countries on a certain "white list" (member countries of the OECD or FATF);

Only non-commercial operations on the account (not related to entrepreneurial activity) are allowed;

Funds from Russia are transferred to the account without limiting the amount;

However, no more than $75,000 per year can be transferred to purchase securities;

When transferring cash from Russia, a document on their origin is submitted (for example, a certificate of purchase of currency);

Capital transactions on the account are carried out in accordance with Russian legislation (as a general rule, permission from the CBR is required);

The Russian tax authority is informed about the opening (and closing) of the account (and in order to transfer money from the Russian Federation, it is necessary to present a notification with a note from the tax authority);

At the request of the tax authority, he is provided with account statements.

Thus, to purchase from such an account, for example, real estate (capital transaction), permission from the CBR is still required. However, it is essential that in this case the resident makes sure that his actions do not violate the currency legislation. This is, in a sense, a new situation, since when transactions are made through accounts in Russian banks, they are supervised by authorized banks as currency control agents. A foreign bank, of course, will not require permission from the Central Bank to carry out a capital operation. However, for such actions, the resident can then be held liable in the Russian Federation in court.

Types of currency accounts abroad

As in Russia, there are various types of foreign bank accounts. Let's consider the main ones.

Accounts in foreign banks

Current account abroad

The account can be current (current account), that is, intended for servicing personal expenses and income or commercial activities of its owner. On the balance of such an account, interest is either not accrued at all, or symbolic interest is accrued. A checkbook or debit card can be linked to a current account.

Card account abroad

A card account is opened when a customer receives a credit card. It serves to record transactions on this card and the subsequent repayment of debt by the client, usually from a current account. However, as already mentioned, a card (if it is a debit card, not a credit card) can also be linked directly to a current account, without opening a separate card account.

Deposit account abroad

On a fixed deposit account, money must be kept continuously for a certain minimum period and bring more tangible income. However, one should not expect the impossible: at present, interest on the dollar is only about 3% per year (in better times, you could get 5% or even more). The minimum deposit is usually ten thousand dollars.

Private investment account abroad

Money in a private banking account is intended for long-term investments in securities. Typically, such an account is opened in a specialized branch of a bank or even in a specialized bank that deals specifically with attracting and placing private investments. Large banks (such as the Swiss UBS) are interested in clients who intend to invest at least several hundred thousand dollars. The account manager will help the investor choose among the investment instruments offered by the bank - usually the lion's share of them are investment funds affiliated with the bank itself.

If we are talking about millions of dollars, the client can safely count on a special attitude: the manager will create an individual portfolio for him, based on the client's requirements for reliability and profitability. Income (or losses) from investments made is a value not determined in advance. It, among other things, radically depends on the general state of the world economy - in any case, on the economy of the country where investments are made. If everything goes well, you can get ten percent per annum. However, you can lose just as much.

Operational investment account abroad

An operational investment account (brokerage account, investment account) is opened with a brokerage company or a bank that provides brokerage services in the securities market. The purpose of the account is to serve the current operations for the purchase and sale of securities through this broker. As a rule, in this case we are not talking about long-term investments, but about conducting operations of a speculative nature. Accordingly, the client usually independently decides what to buy and what to sell, and the business of the bank (broker) is to promptly follow his instructions.

To open such an account, quite a modest amount (ten thousand) is enough. As for profitability, then, of course, it is even less certain than in the previous case, and depends not only on the state of the markets, but, above all, on the individual abilities and inclinations of the player (account holder). Income, as well as losses, can amount to tens of percent - and not only per year, but also per month. Approximately the same can be said about specialized accounts for operations in the foreign exchange markets (FOREX account).

State on foreign accounts of citizens

Until recently, our state was extremely wary of foreign accounts of its citizens, considering them as a tool, or at least a symptom, of capital flight from Russia. Back in 1991, in a presidential decree under the optimistic title "On the Liberalization of Foreign Economic Activity" (which has now ceased to be valid), it was determined that Russian citizens' investments abroad are carried out only under special licenses. Investment primarily meant the acquisition of securities, but also simply a deposit in a foreign bank.

Only Russians temporarily residing abroad were allowed to open an account without a license, and they were required to close it when they left for their homeland. The Central Bank was in charge of issuing licenses. According to informed sources, all Russian citizens who managed to complete the procedure for such licensing could be counted on the fingers. This does not mean that there was no investment, just that the majority preferred not to suffer with obtaining a license, but simply open accounts for their offshore companies. True, the acquisition of shares in these companies was also formally subject to licensing, but the shares were also rarely issued in their own name, but usually in the name of so-called nominal shareholders. However, especially cynical entrepreneurs also opened personal, mostly savings, accounts in foreign banks without any licenses, not unreasonably counting on the fact that the Central Bank had a short hand to get to them.

Serious shifts towards liberalization took place only in 2001. According to the amendments to the Law "On Currency Regulation and Currency Control" adopted in May, residents of the Russian Federation can now transfer abroad up to 75 thousand dollars a year without licenses and restrictions to purchase foreign securities. papers. Of course, when selling these securities, it is allowed to transfer the proceeds received back to Russia.

In August, with the adoption of Central Bank Instruction No. 100-I, an equally pleasant event occurred: Russians were finally allowed to open accounts abroad without licenses, albeit with a number of reservations. Firstly, an account can not be opened in any country, but only in one that is particularly trustworthy, according to a special "white list". Secondly, an account can only be opened for non-business purposes. Thirdly, there are some restrictions on crediting money to the account. But on the other hand, the money in the account is allowed to be used for investments in foreign securities and for other foreign exchange transactions related to the movement of capital (within the framework, however, of Russian legislation). And of course, Russians are allowed to freely transfer funds from foreign accounts back to their accounts in Russia. The owner must report the opening and closing of accounts abroad to his tax office.

Note that for Russian legal entities, everything remains the same, that is, opening foreign accounts and investing abroad require, generally speaking, licenses from the Central Bank.

Legal nuances of foreign accounts of citizens

Accounts of Russian residents abroad are subject to consideration by Russian legislation on currency control. The main one in this legislative block is the "framework" Law "On currency regulation and currency control" of October 9, 1992, with subsequent amendments. On its basis, by-laws are issued, primarily instructions of the Central Bank, which, according to the Law, is the main body of currency control.

In accordance with the Law, a resident is an individual who has a permanent place of residence in the Russian Federation, even if he is temporarily abroad. Note that the concept of a resident (individual) for the purposes of currency control is not equivalent to either the concept of a citizen of the Russian Federation or the concept of a tax resident of the Russian Federation.

According to the Law, transactions with foreign currency and securities in foreign currency are divided into current currency transactions and currency transactions related to the movement of capital. Current transactions include trading operations not related to long-term lending, transfer of dividends and interest, transfers of a non-trading nature. Foreign exchange transactions associated with the movement of capital include investments (both in securities and real estate), long-term lending.

According to the Law, current currency transactions are carried out by residents without restrictions, and "capital" transactions are carried out in the manner established by the Central Bank (by default - by its special permission), with the exception of those that are directly permitted in the Law itself.

Permission for individuals to invest abroad in securities up to 75 thousand dollars a year was spelled out directly in the Law by amendments dated May 31, 2001 (this is a "capital" foreign exchange transaction). With regard to accounts abroad, the Law establishes that the procedure for opening them is determined by the Central Bank.

For individuals, this procedure is determined by the Instruction of the Central Bank of August 29, 2001 No. 100-I "On accounts of resident individuals in banks outside the Russian Federation." The instruction permits individuals-residents of the Russian Federation to open accounts only in OECD and FATF member countries and for purposes not related to entrepreneurial activity.

According to the Civil Code of the Russian Federation, entrepreneurial activity is an independent activity carried out at one's own risk, aimed at systematically making a profit from the use of property, the sale of goods, the performance of work or the provision of services. When carrying out entrepreneurial activities, state registration is required.

On September 17, 2001, CBR Regulation No. 39 "On the procedure for conducting certain types of foreign exchange transactions in the Russian Federation ..." was amended. The list of currency transactions related to the movement of capital, which are carried out without special permission, has been expanded. In particular, the mentioned changes in the Law are reflected (75 thousand per year abroad for securities). In addition, it is now possible to transfer money to your account abroad for other purposes (except for the purchase of securities). And one more change that is important for individuals: in general, in order to make even a permitted foreign exchange transaction, documents confirming its nature must be submitted to the bank, however, for (permitted) transactions up to $ 2,000, they were allowed to be carried out without supporting documents.

Where is it allowed to open currency accounts

So, according to Instruction No. 100-I, Russians are allowed to open accounts not anywhere, but only in "trustworthy" countries. Members of the Organization for Economic Cooperation and Development (OECD) and/or the Financial Action Task Force on Money Laundering (FATF) are considered to be such. The list includes 34 countries, including all the most developed ones (USA, Japan, Great Britain, Germany, etc.). Of the Eastern European countries, Poland, Slovakia, and the Czech Republic are represented. There are even offshore financial centers: Luxembourg, Singapore, Hong Kong, Switzerland. Alas, Cyprus, so beloved by Russian businessmen, is not on the list; Latvia is not there either.

Why did the Central Bank only include members of these venerable international organizations on its list? After all, Russia is not a party to any of them! The point here is this. The OECD is known, among other things, as a fighter against offshore zones. It maintains its "black list" of "wrong" offshore zones, that is, those who do not want to exchange tax information with OECD countries. The list currently includes seven jurisdictions. FATF is an outpost of the international fight against money laundering and terrorist financing. Its "black list" of countries that are not actively fighting money laundering includes 15 jurisdictions. In principle, from the point of view of the Russian Central Bank, it would seem logical to use these "black lists" in order to prohibit the opening of accounts in these countries, and allow them in all others. However, the Central Bank acted differently, having compiled a "white list" of the participants in these organizations themselves.

Such a desire to be "holier than the pope" (in this case, the FATF) in the fight against money laundering looks somewhat comical in light of the fact that Russia itself is on the "black list" of the FATF. Perhaps it was precisely this circumstance that was the reason that they decided to refuse to mention this list in the Instruction.

Purposes of opening a foreign currency account abroad

According to Instruction 100-I, the opening of foreign accounts is allowed only for purposes not related to entrepreneurial activities. Thus, the accounts are mainly for personal expenses, but also for savings and investments. A resident entrepreneur can open an account to service his activities only in a Russian bank.

According to the Instruction, a resident can use the funds on the account to carry out foreign exchange transactions related to the movement of capital (ie, primarily investments) - in accordance with the requirements of the Russian currency legislation. That is, in the general case, under the license of the Central Bank, but with exceptions.

As far as investments are concerned, they are not considered entrepreneurship in and of themselves. According to the Civil Code, entrepreneurial activity is considered to be "activity for the systematic receipt of profit", and investment is rather a one-time act. Thus, opening private investment accounts and acquiring securities through them is quite acceptable. As mentioned, during the year you can transfer up to 75 thousand dollars to your account without a license for such investments.

However, if we are talking about an operational investment account through which transactions for the purchase and sale of securities are carried out by a resident on a permanent basis, then such activity is already clearly entrepreneurial, which is unacceptable. And what if the operations take place once a month? Semiannually? How to draw a precise line between the two types of investment accounts and how the state can control the observance of this line is, in general, an open question.

We also note that without a license from the Central Bank, investments are only allowed in securities. Therefore, to acquire, say, real estate, permission is still required. However, the following solution to the problem immediately suggests itself: real estate is registered in the name of a company (offshore or non-offshore), and investments are made in the shares of this company - and this does not require a license.

Control over currency accounts abroad

The procedure and the very possibility of opening accounts for Russians abroad are determined by the Central Bank of the Russian Federation. However, control over operations on a foreign account lies outside its competence (according to the Law "On Currency Regulation ...", the Central Bank controls only the foreign exchange transactions of residents carried out in Russia), and, perhaps, its physical capabilities. Therefore, in its Instruction No. 100-I, the Central Bank instructs residents to report the opening of foreign accounts to their tax authority, thereby gracefully transferring the burden of responsibility to the territory of a neighboring department. The notification form prescribed by the Instruction contains the obligation of the resident to provide account statements "upon request" of the tax authority. Naturally, any income received through a foreign account is subject to taxation in Russia - along with any other income of the taxpayer.

When working with an account, one should not forget that in addition to Russian currency and tax control, there is foreign control.

Firstly, now in almost all countries of the world, under pressure from the world community (represented by the same FATF), rather strict laws against the laundering of illegal capital have been introduced. This applies even more so to the FATF member countries themselves. At the slightest suspicion of laundering, the bank is obliged to report them to the competent authorities, and the transaction itself may be suspended until the circumstances are clarified. Thus, care should be taken to ensure that the nature of account transactions is understandable to the bank, that is, each payment must contain clear information about its purpose and recipient (payer). It is also desirable not to conduct transactions with residents of jurisdictions from the "black list" of the FATF, which in itself is already a reason for suspicion. And, of course, depositing large amounts of cash into the account is considered extremely suspicious.

Secondly, the account holder may incur tax liabilities abroad in connection with account transactions. An example is a withholding tax on interest income. The withholding tax is paid by the person who pays the income (in the case of interest, the bank), but other taxes may arise, so this issue requires separate consideration. It is highly advisable to consult with a tax specialist in that country. When paying taxes in Russia, taxes legally paid abroad are credited to the taxpayer, but only if there is an agreement with this country on the exclusion of double taxation.

Thirdly, there may be currency control in the country where the bank is located. In general, currency regulation is primarily a system for protecting a weak national currency from an aggressive external financial environment. Therefore, for such strong, freely convertible currencies as the dollar and the euro, there is no currency control in the usual sense. However, if an account is opened, for example, in the Czech Republic and in Czech crowns, you should at least familiarize yourself with the Czech currency regulation rules.

Violation of instructions on opening an account abroad

What happens if a Russian resident opens an account abroad, bypassing the provisions of Instruction No. 100-I, that is, in the "wrong" country or without notifying the tax authority, and if the competent authorities become aware of this? We hasten to reassure - in general, nothing particularly terrible. Such an offense is only an administrative offense and there are no serious sanctions for it.

Actually, nothing at all is provided for the opening itself, but for the implementation of foreign exchange transactions through such an illegally opened foreign account, an administrative fine is imposed - from one tenth to one size of the transaction amount (Article 15.25 of the Code of Administrative Offenses). That is, they can be fined for the entire amount transferred to the account. A fine of the same size is provided for the commission without a license of those foreign exchange transactions (for example, the purchase of real estate) for which such a license is required, even if the transactions were carried out through a "legitimate" account.

However, we emphasize that we are talking about punishment for the operations themselves on the account. If, in addition, it turns out that these transactions are associated with tax violations or, God forbid, fall under the article on laundering, the sanctions will not seem small.

Transferring money to a foreign currency account abroad

According to Instruction No. 100-I, a resident has the right to credit to his foreign account the currency legally exported from Russia in the form of cash, transferred from Russia by bank transfer, or received directly abroad (but not from entrepreneurial activity!).

As for the transfer from Russia to your own account, the procedure for its implementation is described in detail in the Instruction itself. No special formalities are required - it is enough for a resident to submit to a Russian bank where he has a foreign currency account, a transfer application (the form is being developed by the bank), an identity document (passport), well, and a copy of the notification to the tax office about opening a foreign account - with a mark on receipt (so as not to forget to register). If a resident transfers money without opening a foreign currency account in a Russian bank (that is, brings it to a Russian bank in cash), you must additionally provide a document confirming their origin (for example, a purchase certificate).

How to open a foreign currency account

As for the procedure for opening an account, everything is, in principle, simple. The client submits his documents to the bank (passport, references, etc.), fills in bank forms. The bank checks the documents - and the client itself through its own channels - and opens an account. Done, you can deposit money. However, there are nuances.

First, you first need to decide which bank you want to open an account with. This is not so simple and depends not only on the reputation of the bank, but also on the nature of the account: savings, investment, etc. Different banks offer different types of accounts, different services and different interest rates.

Currency account abroad

Secondly, you need to find a bank that will agree to open an account for you. As already mentioned, not all banks are willing to work with Russians.

Thirdly, it is necessary to prepare documents in accordance with the requirements of the bank. Get yourself banking and professional advice. Make sure that their text meets the wishes of the bank. Translate and certify the translation, if required. And what will you do if the bank asks you to put an apostille on your electricity bill provided as proof of address?

Last but not least, you need to speak the same language as bank employees (for banks that work with international clients, English is usually sufficient). And some of our compatriots have problems with foreign languages.

Due to all these technical difficulties, it is often reasonable to entrust the opening of an account in a foreign bank to specialists. Many Russian law and registration firms provide services for opening accounts in foreign banks. Specialists will advise you on choosing a bank, help you prepare the necessary set of documents, negotiate with the bank, give you bank forms to fill out, and then send all the documents to the bank. In many cases, you will not even need to travel abroad (although some banks still insist on a personal visit of the account holder).

Note that large amounts should not be deposited to the bank through an intermediary opening an account. It is better to make a transfer directly to the bank after the account is opened. In general, all further work with the account in the future is carried out directly - no intermediaries are inappropriate here.

And one more note. On the Internet, you can often come across offers to open a bank account directly online. Be careful: THESE ARE CROOKS. As follows from the above, not a single normal bank in any normal country in the world will open an account without examining the client's documents and without bank cards with his own signature. In the best case, an offshore bank with a capital of ten thousand dollars can stand behind such an offer, the reliability of which is better not to talk about. In the worst case scenario, there is not even such a bank, and the criminals collect fees from the gullible inhabitants of cyberspace without any banking license.

Perhaps it is true that such an offer is just a publicity stunt for a real bank. In this case, you do not actually open an account online, but only apply for its opening, and in order to complete the procedure, you need to send all the necessary documents to the bank. Do not flatter yourself: most likely, accounts are opened only for residents of the country where the bank is located (and this is probably the United States). And, in any case, before responding to an offer, it is necessary to figure out what kind of bank makes it, where this bank is located and has a license, what is its capital, who is the main shareholder, etc. If this information is not available on the bank's website, see the previous paragraph.

Foreign currency account management

After the account is finally opened and money has been deposited into it, it needs to be managed somehow, that is, to make payments. As everyone knows, in order to make a payment from an account in a Russian bank, you need to fill out a payment order, painfully checking the numbers in the infinitely long numbers of accounts, correspondent accounts, BIC and TIN. Happy Americans do not know what a paycheck is: most corporate payments are made using checks (only the name of the recipient is indicated from the details of the recipient), and most personal expenses are paid by cards. In Europe, direct bank transfers are more common, but fortunately account numbers are shorter than ours.

Your newly opened account may also have a checkbook or card linked to it. If the account is for small personal expenses, this may be sufficient. However, there are several "buts". Not all banks issue checkbooks. Not all banks issue cards. Not all firms accept checks, especially those drawn on a bank in another country. Not all companies accept card payments. Not all payments can be made by card (there are restrictions on the amount of transactions). Therefore, the most universal means of managing an account, available by default, is still a payment order.

A payment order is an instruction from a client to a bank, which indicates what exactly the client wants to do with his money (transfer so much from such and such an account to such and such details). It can be drawn up in free form (in a language understandable to the bank), or the bank can offer the client a ready-made form to fill out. The order is dated and signed by the client, after which it is delivered to the bank.

By default, the bank accepts payments in the original. If the client is located in Russia, he will have to send them abroad by regular mail (unreliable) or courier mail (expensive). Therefore, under a separate agreement with the client, the bank may agree to accept instructions sent by fax. It is clear that in this case it costs nothing for an attacker to forge the client's signature on the payment order. Therefore, when managing an account by fax, the bank and the client usually agree on a password or even on a whole system of codes that change depending on the payment amount, date, etc. This system is determined by a code table or a special calculating device for calculating codes, which the bank provides to the client. The code (password) calculated in this way is indicated on the payment order to confirm its authenticity.

In our age of informatization, more and more banks are switching to remote account management. Such control is carried out using the client's computer through a direct modem connection to the banking server via a telephone line or via the Internet. The first option is more expensive (international phone calls) and less reliable due to the quality of Russian telephone lines. Not all experts regard the second option as safe from the point of view of protection against cybercriminals, but in principle, modern encryption technologies provide a fairly high level of reliability. Plus, a device similar to the one already described can be used to calculate the code. Account management is carried out using a specialized program provided by the bank, or even simply from a browser window (when connected via the Internet). Some banks use a compromise approach: you can check the account balance online, but you need a written instruction to make a payment.

Remote account management is not very relevant for savings and long-term investment accounts. For commercial (primarily corporate) accounts, it is highly desirable. But for operational investment accounts, transactions on which must be made in real time, it is simply a vital necessity. Therefore, banks that open such accounts usually provide this service by default.

Accounts of non-residents in Russia

Currency accounts of non-residents in Russia are not subject to currency control. Once the money is in such an account, it can be freely transferred abroad. From the point of view of a resident, a foreign currency account of a non-resident in a Russian bank for the purposes of currency control is no different from his own account in a foreign bank.

Non-residents' transactions are regulated primarily at the level of their ruble accounts. The main ideas embodied in the relevant regulations are as follows:

Non-residents freely acquire rubles for foreign currency to carry out both current and investment operations;

Non-residents freely acquire currency for rubles to repatriate income from such operations;

It creates obstacles for non-residents to withdraw funds from the country that are not related to income from these operations (in particular, converting and sending ruble loans abroad).

The corresponding procedure is established by Instruction 93-I of the CBR (Instruction of the Central Bank of October 12, 2000 N 93-I “On the Procedure for Opening Bank Accounts of Non-Residents in the Currency of the Russian Federation by Authorized Banks and Conducting Operations on These Accounts”).

In accordance with Instruction 93-I, ruble settlements between residents and non-residents are carried out without restrictions through ruble accounts of non-residents. This means that a resident (as well as a non-resident) does not need any permission from the CBR to conduct them. However, transactions must be carried out in accordance with the mode of accounts of a non-resident: part of the transactions occurs through one type of account, the other part - through another type of account.

To transfer rubles to the correct account of a non-resident, a resident must indicate the operation code (according to the CBR classifier) during the transfer, as well as document the nature of the operation (a copy of the contract is sufficient). If the amount of payment to a non-resident does not exceed 500 minimum wages (minimum wages), then supporting documents are not required, but the code must still be indicated.

If a non-resident transfers rubles, he also indicates the transaction code, but does not have to submit any supporting documents.

If the payment suddenly arrived without a code, the recipient's bank credits the funds, but sends information about the violation to the CBR territorial office (in this case, not the sender of funds, but his bank will be punished).