One of the goals of modern banks is the constant development and improvement of services that allow customers to independently maintain their accounts and cards at the right time, without leaving home. Such proposals include Personal Area mobile bank Russian Standard, providing access to numerous options.

Mobile banking features

Mobile bank RSB (RSB Mobile) is an application for smartphones (tablets), an analogue of Internet banking. It is available wherever there is a cellular coverage area, works around the clock 365 days a year.

Russian Standard has developed a convenient mobile bank

With this program, the client will be able to:

- control your accounts;

- receive useful information;

- make a request to activate services, open cards, deposits;

- make payments and transfers;

- issue and repay loans, increase their limit;

- set up auto payment for a cell phone;

- track the accrual of bonuses and cashbacks;

- block the card.

Most purchases in supermarkets are paid for with plastic cards. Their owners want to quickly track the balance of the account, study statements of expenditure or income transactions. They can request this data directly in the store through the smartphone application.

When shopping online, online payments are indispensable. With a mobile bank, making them will become even faster and easier, especially if you issue a virtual card. It is also easy to pay for utilities, television, cellular communications, Internet access by creating templates for regular payments.

At any time, the RSB Mobile application will provide information about the addresses and working hours of ATMs, terminals, bank offices, tell you about the company's news, the current exchange rate.

To open a deposit or get a loan, now you do not need to contact the office. These procedures will be carried out by the Mobile Bank of Russian Standard Bank. And if the client has a positive reputation, then he has the right to request an increase in the credit limit.

The most common transactions that people make through banking services are transfers between their own accounts or other customers. RSB Mobile allows transfers by account, card or phone number (if the recipient is also a mobile bank user).

Internet banking login

Where to download the program

The RSB mobile product was first released on April 26, 2012. The bank itself is its developer, and no subscription fee is charged for downloading and using it. As of May 2018, versions 3.22.10.690 for Android, 5.8.2 for iPhone, 1.0.10.64 for tablets are available. Updates for the program appear regularly.

According to the results of a sociological study of banking applications mobile banking rank in 2017, RSB Mobile entered the TOP 3 as the most effective mobile bank for tablets.

Russian standard mobile bank, which can be accessed only through gadgets, can be downloaded in several ways:

- directly at http://mob.rsb.ru by selecting the operating Android system, iPhone or Windows Phone;

- in Google Play services, Microsoft Store, AppStore, Samsung Apps;

- on the website https://www.rsb.ru/ under the link "remote services".

The installation will take a few minutes, after which the program will start running.

Mobile Bank updates appear regularly, which can also be downloaded for free. Software developers promptly fix errors found in the application, and also offer customers new features. Since 2017, the PFM Light option has been launched. With its help, the user can track the categories of their main expenses and manage personal finances more efficiently.

How to enter mobile banking

To log in to the Russian Standard mobile bank, you need to enter into bank branch remote service agreement, get a login, password, individual code for multiple use.

Attention: the login data for RSB Mobile is different from similar codes for Internet banking.

Clients who issue a multifunctional card "Bank in your pocket" additionally receive registration in the Mobile Bank and can use it immediately after downloading.

Registration in mobile banking

After entering the password in the application, the main menu opens with the following items:

- all accounts;

- cards;

- deposits;

- payment for services;

- transfer between accounts;

- transfer by phone number;

- transfer by card number;

- template payment;

- issuance of a virtual card;

- terminals, ATMs, offices;

- discounts;

- exchange rates;

- news;

- contacts.

Navigation through the sections is clear and usually does not cause difficulties. In addition to the above functions, you can order sending receipts by e-mail, get acquainted with the bank's tariff plans, ask chat consultants a question, issue a card with an exclusive pattern.

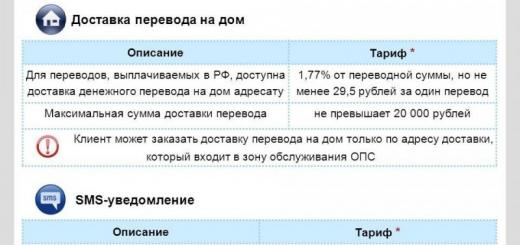

Through the mobile bank, the client can manage the connection and disconnection additional services. For example, activate the SMS service (notification of completed transactions, balance changes, repayment of loans using messages). This option is paid.

Restoring access to your personal account

Russian Standard mobile bank personal account is protected from unauthorized access by a password. If suddenly the user lost or forgot his credentials, he can restore them by calling 8-800-200-3203 (toll-free). The operator will ask you to provide passport data, card number or service agreement.

If you have access to Internet banking, you can change your RSB Mobile login via your computer in the Settings → Personal Information section. Changing the password is available in the personal account of the Mobile Bank or by calling the support service number.

Service functions

Security

Many users are interested not only in the question “how to connect the Russian Standard mobile bank”, but also how safe it is to use this application. But don't worry: RSB Mobile has a reliable security system.

First of all, the entrance to the program is made using the login. Each user transaction is carried out only after entering a four-digit personal code. It is possible to connect client identification by graphic cipher or fingerprint (if the device supports this function). If there is no activity, the application closes after a few minutes.

- install an anti-virus program on your phone or tablet;

- do not leave the device unattended, do not disclose the password to unauthorized persons, do not save credentials when entering.

Money transfers to pay for the services of third-party companies are made through the licensed payment systems Rapida and Cyberplat.

For online shopping on the Internet, it is better to issue a virtual card, to which you can transfer part of the funds from your any account. It will have other details (number, account), so even if this data is leaked, the main card will remain safe.

You can refuse to use the Russian Standard Mobile Bank at the company's office by terminating the service agreement. After that, access to the application will automatically close.

06 Aug

IN modern world we can’t tear ourselves away from our smartphone even for a minute and always carry it with us. After all, now the phone is needed not only for calls, but also for communication, games and work. Russian Standard Bank keeps up with the technologies of the current century and is pleased to present its customers with a mobile version of its Internet banking. Via mobile bank Russian Standard you can carry out all the same operations, but at any time and place convenient for you. The only thing you need for this is the presence of an Internet connection using 3G or Wi-Fi.

Features of the mobile application of the bank Russian Standard

The capabilities of the mobile version of the bank are not very different from the basic version. Let's look at all the available features of the application at the moment.

- Connection and disconnection of services;

- Transfers by phone number;

- Transfers from card to card;

- Opening deposits and accounts;

- Payment for services through previously created templates;

- Opening a virtual card;

- Possibility to subscribe to notifications about debts for housing and communal services;

- Creation of auto payments for mobile communications;

- Possibility to send an application for a loan;

- Communication with bank employees in an online chat;

- Possibility to send receipts to e-mail or social networks;

- View tariff plans of your bank cards;

- Possibility to order a bank card with an individual design;

- Connecting to the RS Cashback program and viewing accumulated bonuses;

- View card information.

We have listed the most basic and interesting features available in mobile application jar. We invite you to install the application yourself and visually evaluate the possibilities, convenience and functionality of the application.

Latest versions of the mobile application

Russian Standard regularly updates its applications, adding new features and functional solutions to them. Over the past July, the bank has updated its applications three times. As of August 1, 2017, the latest versions of the applications are as follows:

- For Android, the latest version of the application 3.6.4

- For iOS, the latest version of the application 5.4.2

- For Windows Phone the latest version of the application 3.0.0

In the latest updates, applications have been added such features as sending an application for a loan, the ability to communicate with bank employees in a chat, as well as creating auto payments for mobile communications.

The cost of using the application

Mobile banking Russian Standard is free for both download and operation. You do not need to connect and pay for any additional service packages. You just need to download the app from one of the official app store and run it. After all, when you connect to the Russian Standard Internet Bank, you automatically get access to the mobile bank.

The only thing you should take care of is the availability of Internet traffic. We recommend downloading applications via free Wi-Fi networks.

Where and how to download Russian Standard Mobile Bank?

You can download the mobile application to your smartphone from the official online store. At the moment this is AppStore, Google Play And Windows Phone Store. The applications of these stores are probably already installed on your phone.

To download the application, you need to open the AppStore, Google Play and Windows Phone Store programs (depending on your operating system) and enter the phrase: . In the search results provided, select the official app, usually the first one. Also, before downloading, read the description of the application in detail and make sure that the developer specified exactly Russian Standard Bank.

Login to the mobile application of Russian Standard Bank

So, to get started with the application, you need to go into it. To do this, you will need a username, password and private idintifier. You should have received all these data by SMS when signing the banking service agreement.

If you have forgotten your username and password, you can recover them. There are two ways to recover data:

- Call to Call Center bank toll-free number 8 800 200-3-203 and ask bank employees to recover lost data;

- Re-register or restore access through the mobile application. To do this, when entering the application, click on the link " Get or restore access”, and then enter the data in all required fields.

I think that the second method will be most convenient for you, because you can access the mobile application at any time of the day without queues and expectations.

Also, do not lose and forget your " Private idintifier”, which you will need to confirm the transactions made in the mobile bank. This code, as well as your login and password, will be sent to you by SMS when signing a banking service agreement.

Restrictions and limits of operations in the mobile application

At the moment, we do not know information about restrictions and limits. Therefore, we advise you to personally contact the bank employees and clarify all the limits that are available in the mobile version of Russian Standard Bank.

We have introduced you to the main features and functions of the Russian Standard Mobile Bank. You can ask all questions and suggestions about the application in the following way:

- Call to Call Center bank toll-free number 8 800 200-3-203 ;

Commercial banks offer their customers the most comfortable service conditions. Indeed, today, in order to make various financial transactions, you do not need to spend time going to a bank branch, all this and much more can be done using remote banking services. Russian Standard Bank is no exception, it not only offers Internet banking available to users from a computer or laptop, but also its mobile version. It is the Russian Standard mobile bank that we will consider in more detail.

About the application

So, Russian Standard mobile bank is not an SMS-informing service, but application for mobile devices on iOS, Android, Windows Phone. Accordingly, owners of smartphones, iPhones, and Windows Phones can access it. if we talk about the advantages of a remote service, then there are a lot of them, and if we talk about its capabilities, then with the help of a mobile bank you can:

- control your accounts and credit obligations;

- check reports on completed transactions;

- pay for goods and services;

- transfer funds to customers of Russian Standard Bank and other financial institutions;

- pay for housing and communal services, taxes, fines and state duties, mobile communication services;

- receive news from Russian Standard Bank.

Thus, in terms of its functionality, mobile banking is in no way inferior to Internet banking. To access your account, the user will only need a mobile device and access to the Internet.

How to download the application

You can download the Russian Standard Bank application in several ways, consider all of them. If you are the owner of iPhone or iPad, Android or Windows Phone mobile devices, that you can easily download any mobile applications through the AppStore, Google Play or Microsoft Store, for sure, these sites are known to all gadget users.

Please note that there is no charge for downloading applications, the official developer is Russian Standard Bank.

Another way is through the official website of the bank. To get started, open the main page of the official resource, find the "Remote Services" section in the menu and follow the mobile bank link. Then you will find the "App Store" button, click on it. The system will take you to a page where you need to select the platform of your mobile device, click on it. You will then see a button to download the app from the app store for the respective device, for example, for android you will find a download button on google play click on it.

After carrying out all the above manipulations, the system will direct you to the page of the online application store. If the account is registered in the browser version of Google, then your registered devices will automatically be displayed in the download form, and you can click the "Install" button without any problems. Otherwise, you can also click the "Install" button or a form from Google will appear in front of you where you need to enter the password for your account.

Please note that the application is available for download on Android version 4.1 and later.

Account registration

The second important question for users is how to connect the Russian Standard mobile bank. That is, after downloading, you need to register a personal account, through which in the future you will get access to your card accounts. In fact, everything is simple and accessible here, you must contact the bank and sign a comprehensive service agreement, unless, of course, I signed it when I issued a service package or a bank card.

If you do not remember your login and password and it is not specified in the service agreement or it was sent in an SMS message, but you did not save it, then you need to get new data. You can do this by calling the contact center at 8 800 200 3203. Prepare binding document, proof of identity bank card and your contract. After dialing the number, wait for the operator's response and inform him of your intention to receive a login password and a personal code for a mobile bank. By the way, the data for accessing the Mobile Bank Internet banking is different.

Please note that along with the login and password, users will receive a personal code necessary to confirm any operations in the mobile application, it is reusable, that is, it must be entered every time the system requires it.

To summarize, the personal account in the Mobile version of Russian Standard Internet banking allows you to remotely use all the services of financial institutions. And the main advantage is that the client is not tied to the computer, its location and time of day. The service is available around the clock anywhere in the world.

Commercial banks offer their customers the most comfortable service conditions. Indeed, today, in order to make various financial transactions, you do not need to spend time going to a bank branch, all this and much more can be done using remote banking services. Russian Standard Bank is no exception, it not only offers Internet banking available to users from a computer or laptop, but also its mobile version. It is the Russian Standard mobile bank that we will consider in more detail.

About the application

So, Russian Standard mobile bank is not an SMS-informing service, but application for mobile devices on iOS, Android, Windows Phone. Accordingly, owners of smartphones, iPhones, and Windows Phones can access it. if we talk about the advantages of a remote service, then there are a lot of them, and if we talk about its capabilities, then with the help of a mobile bank you can:

- control your accounts and credit obligations;

- check reports on completed transactions;

- pay for goods and services;

- transfer funds to customers of Russian Standard Bank and other financial institutions;

- pay for housing and communal services, taxes, fines and state duties, mobile communication services;

- receive news from Russian Standard Bank.

Thus, in terms of its functionality, mobile banking is in no way inferior to Internet banking. To access your account, the user will only need a mobile device and access to the Internet.

How to download the application

You can download the Russian Standard Bank application in several ways, consider all of them. If you are the owner of iPhone or iPad, Android or Windows Phone mobile devices, that you can easily download any mobile applications through the AppStore, Google Play or Microsoft Store, for sure, these sites are known to all gadget users.

Please note that there is no charge for downloading applications, the official developer is Russian Standard Bank.

Another way is through the official website of the bank. To get started, open the main page of the official resource, find the "Remote Services" section in the menu and follow the mobile bank link. Then you will find the "App Store" button, click on it. The system will take you to a page where you need to select the platform of your mobile device, click on it. You will then see a button to download the app from the app store for the respective device, for example, for android you will find a download button on google play click on it.

After carrying out all the above manipulations, the system will direct you to the page of the online application store. If the account is registered in the browser version of Google, then your registered devices will automatically be displayed in the download form, and you can click the "Install" button without any problems. Otherwise, you can also click the "Install" button or a form from Google will appear in front of you where you need to enter the password for your account.

Please note that the application is available for download on Android version 4.1 and later.

Account registration

The second important question for users is how to connect the Russian Standard mobile bank. That is, after downloading, you need to register a personal account, through which in the future you will get access to your card accounts. In fact, everything is simple and accessible here, you must contact the bank and sign a comprehensive service agreement, unless, of course, I signed it when I issued a service package or a bank card.

If you do not remember your login and password and it is not specified in the service agreement or it was sent in an SMS message, but you did not save it, then you need to get new data. You can do this by calling the contact center at 8 800 200 3203. Prepare a mandatory document proving the identity of the bank card and your contract. After dialing the number, wait for the operator's response and inform him of your intention to receive a login password and a personal code for a mobile bank. By the way, the data for accessing the Mobile Bank Internet banking is different.

Please note that along with the login and password, users will receive a personal code necessary to confirm any operations in the mobile application, it is reusable, that is, it must be entered every time the system requires it.

To summarize, the personal account in the Mobile version of Russian Standard Internet banking allows you to remotely use all the services of financial institutions. And the main advantage is that the client is not tied to the computer, its location and time of day. The service is available around the clock anywhere in the world.

Russian Standard is an application for clients of the bank of the same name who use portable devices based on the Android operating system.

Opportunities

In addition to basic operations, the Russian Standard application will be able to help pay for popular services - cellular communications, the Internet, utilities, and more. As for transfers from card to card, they are implemented quite conveniently here. You do not have to remember the recipient's card or account number - the transfer can be sent by specifying the mobile number. Such a system operates not only for transfers to Russian banks but also for foreign ones. Also, using the application, you can apply for a loan and apply for opening a deposit.

Communication with technical support is allowed only in the form of a chat. Conveniently, when talking with a bank employee, you can attach a screenshot. This often helps resolve the issue faster.

Usage

Russian Standard differs from similar applications in that it allows you to link cards from other banks to your account. Such functionality, as far as we know, is not implemented in any other mobile banking.

Key features

- performs the usual financial transactions: transfers, payment for services, and so on;

- allows you to control your finances, as well as track spending statistics;

- allows linking cards of third-party banks to a user account;

- supports sending payments without specifying an account or card number - by mobile number;

- allows you to log in using your login, password or pattern;

- has a nice modern interface;

- only works with new versions of android.