Account 58 "Financial investments" is intended for detailed accounting of the enterprise's investments. What is financial investment? What is the procedure for accounting 58? Let's look at typical examples and wiring.

Account 58 is...

Regulatory requirements for the formation of data on financial investments in accounting are regulated by PBU 19/02. In accordance with paragraph 3 of this document, the following are recognized as investments of a legal entity:

- Securities (CB) of state and municipal structures.

- Other securities, including overdue ones (debt bonds, promissory notes).

- Provided loans.

- Contributions to the authorized capital of enterprises, incl. subsidiaries or dependent companies, under simple partnership agreements.

- Accounts receivable transferred by assignment.

- Deposit deposits.

- Other types.

Note! Investments in own securities are not considered financial investments; bills of exchange for settlements for goods sold; precious metals, art objects, jewelry valuables; others

Thus, accounting account 58 is a summary of information on the movement of short-term (for a period of less than 1 year) and long-term (more than 1 year) investments of an enterprise on sub-accounts opened, depending on the need.

According to Order No. 94n dated October 31, 00, account 58 “Financial investments” may have the following sub-accounts:

- Account 58. 1 - to reflect information on shares and shares.

- Account 58. 2 - to reflect information about debt securities.

- Account 58. 3 - to reflect information on loans granted to other companies.

- Account 58. 4 - to reflect information about contributions under simple partnership agreements.

Count 58 - active or passive?

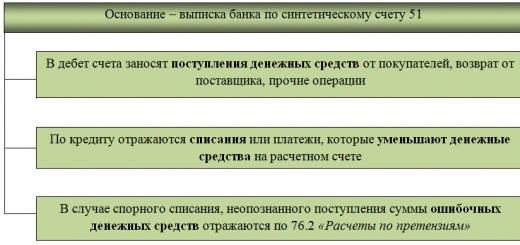

The organization's investments are placed on the debit of account 58 in correspondence with cash or other accounts - 50, , 51, , 76, 75, 98, . The credit of account 58 reflects the repayment of loans, the excess of the purchase price of the securities over the nominal value, the redemption and sale of the securities, the return of assets on deposits of a simple partnership and other operations. Correspondence is carried out with accounts - 52, 51, 76, 90, 80, 91, 99. The balance of the active account 58 shows the balance of the value of financial investments as of a given date.

Important! 58 account in the balance sheet is displayed together with account. 73 and 55 (in terms of loans to staff and deposits) under lines 1170, 1240, depending on the validity period, minus the balance on the account. 59, where reserves for depreciation of investments are formed.

sch. 58 "Financial investments" - examples of postings

To make the correspondence of account 58 more understandable, let's look at practical examples:

Example 1

"On the transfer of fixed assets / funds as a contribution to the charter under a simple partnership agreement." Let's say the company paid its share of the equipment. The market value is estimated at 400,000 rubles, posting - D 58.4 K 76 for 400,000 rubles. under contract.

Accordingly, the object is written off from the balance sheet. When paying a deposit in money, the posting is D 58.4 K 50, 51, 52.

Example 2

“On investments in debt securities”. Suppose an organization purchased shares for 100,000 rubles. The accountant will do the following:

D 58.1 K 51 per 100,000 rubles. - reflects the purchase of shares.

D 58.1 K 91.1 for 700 rubles. - an increase in the share price. When decreasing, reverse posting D 91.2 K 58.1 is performed.

D 76 (62) K 91.1 for 120,000 rubles. - reflects the sale of shares to a legal entity.

D 91.2 K 58.1 for 100,700 rubles. – reflected the write-off of the current book value of the sold shares.

Example 3

"By granting a loan to a legal entity or employee."

The organization issued a loan to another enterprise for 500,000 rubles, posting - D account 58.03 K 51. At the same time, interest is calculated monthly according to D 76 K 91.1,

and the repayment of the principal debt and interest obligations is carried out by transferring funds to the borrower's account D 51 K 58.03. If a loan is issued to an employee of an organization, it is more expedient to fix all calculations through an account. 73.

Conclusion - we figured out how account 58 is reflected in the balance sheet; found out what typical postings make out the movement of various financial investments of the enterprise and what legislative documents regulate the accounting of investments.

Financial investments"

58.1 - "Shares and shares";

58.2 - "Debt securities";

58.3 - "Granted loans";

58.4 - "Contributions under a simple partnership agreement", etc.

SHARE - a share of the company's capital, which gives the right to participate in general meetings of shareholders, to receive a dividend and part of the company's property in the event of its liquidation. P. is expressed in a certain document - a certificate, to which coupons for receiving dividends are attached.

SHARES - securities issued by a joint-stock company, the owners of which are granted all property and personal rights associated with the possession of a share: a) the right to receive dividends, depending on the size of the corporation's profit; b) the right to participate in the management of the corporation by voting at meetings; c) the right to receive part of the property after the liquidation of the corporation. The rights are exercised in the amount proportional to the size of the shares.

D 58 K 51 - the occurrence of an object of financial investments is reflected (when transferring or paying for this object from a current account);

D 58 K 76 - the occurrence of debts to counterparties is reflected (if payment for financial investment objects is made later than obtaining ownership rights to them, for example, in the case of securities).

D 91 K 58– reflected the negative difference between the purchase and par value (or between the par and purchase value) of purchased debt securities.

On account 58, investments are accounted for at their actual cost (in the amount of expenses incurred for their acquisition).

Financial investments are the second in terms of liquidity after cash on hand and on current accounts.

Account 59 "Reserves for the depreciation of financial investments" is intended to summarize information on the availability and movement of reserves for the depreciation of financial investments of the organization.

The reserve is formed at the expense of financial results (as part of operating expenses), which is reflected in the accounting entry on the debit of account 91 “Other income and expenses” and the credit of account 59 “Provisions for depreciation of financial investments”. A similar entry is made with an increase in reserves in the event of a further decrease in the estimated value of financial investments.

The reserve is reduced (used) in the following cases: if the estimated value of the relevant assets increased in the reporting period, if their value is no longer subject to a steady significant decrease, and also when these assets are disposed of. At the same time, an entry is made in the debit of account 59 “Provisions for depreciation of financial investments” in correspondence with the credit of account 91 “Other income and expenses”.

In the financial statements, financial investments for which an allowance for impairment has been created are reflected at book value minus the amount of the reserve. In the balance sheet-net, when reflected in the asset, the difference between 58 and 59 accounts is reflected. Those. there is no account in the liabilities side of the balance sheet 59!

Reserve for depreciation of financial investments” (passive, contractive to account 58).

If we have a large number of shares of one company, and its shares have fallen sharply in price, we cannot reflect these changes in account 58, because. this will lead to misrepresentation of the financial statements.

The allowance for depreciation of financial investments is created by the following entry:

D 91.2 K 59

D 59 K 91.2 - reserve amount restored

As soon as the financial investments are retired, the corresponding amounts of the reserve are written off to the other income of the enterprise (91.1).

Normative regulation of accounting for bills of exchange is carried out by the "Regulations on promissory and transfer bills" of August 7, 1937.

When bills are purchased, they are accounted for at actual cost on account 58, and disposal is reflected through account 91.

D 60 K 91- We pay by promissory note with the supplier.

If we purchased a bill of exchange with a face value of 1000 rubles, and with a discount it actually passed to us for 900 rubles, then we will reflect the purchase price in accounting - 900 rubles.

When this bill is retired, we will make the following postings:

D 60, 76 K 91.1 1000

D91.2 K 58 900

A credit balance of 100 rubles is formed, income tax is paid from them.

If we provide a loan, then we make the posting:

D 58 K 51

If our main activity is the purchase and sale of financial investments, then income and expenses are charged to account 90, otherwise - to account 91.

When transferring shares, bills, i.e. when they are disposed of and sold, the posting is made:

D 90.1, 91.2 K 58

Wiring is not allowed: D 60 K 58

D 76 K 91.1- reflects the interest accrued on loans;

If a loan is granted to an employee, then interest will be accrued to account 73.

D 73 K 91.1

If we have accrued dividends on the objects of any financial investments, then we will reflect their receipt by posting:

D 51 K 91.1

58.4 - "Contributions under a simple partnership agreement"(joint activity of enterprises, which is conducted on the accounting records of one of the enterprises);

When depositing assets, account 58 is used.

Under a simple partnership agreement, funds were deposited from the current account:

D 58 K 51

The following materials have been introduced under the simple partnership agreement:

D 58 K 10

And if we bring them at a higher price, then the transfer of materials will have to be reflected in this way.

This material, which continues the series of publications on the new chart of accounts, analyzes account 58 "Financial investments" of the new chart of accounts. This comment was prepared by Ya.V. Sokolov, Doctor of Economics, Deputy Chairman of the Interdepartmental Commission for the Reform of Accounting and Reporting, Member of the Methodological Council for Accounting under the Ministry of Finance of Russia, First President of the Institute of Professional Accountants of Russia, V.V. Patrov, professor of St. Petersburg State University and N.N. Karzaeva, PhD in Economics, Deputy director of the audit service of Balt-Audit-Expert LLC.

|

* Note: Unfortunately, here (in the explanations to account 58 "Financial investments") a mistake was made: this account, when additionally accruing the amount of excess of the nominal value of purchased securities over their purchase value, should not be credited, but debited.

|

In general, it can be said that account 58 "Financial investments" reflects various types of participation of one company in the affairs of another, while emphasizing that this account takes into account values that are not only transferred on account of these investments, but also to be transferred (meaning securities, the ownership of which has already passed to the buyer).

Most often, this participation is expressed in the acquisition of securities. However, their market price fluctuates all the time, and the problems of valuation become decisive in this area of accounting. The old instruction noted that securities (shares, bonds, etc.) are accounted for in financial investment accounts at their purchase price. The new instruction does not say anything about this, since the procedure for assessing assets is determined by other regulatory documents, in particular, the Regulation on Accounting and Accounting, in paragraph 44 of which it says: "Financial investments are accepted for accounting in the amount of actual costs for the investor" , and these costs in some cases are more than the purchase price by the amount of certain expenses (fees for information and consulting services related to the acquisition of securities; remuneration to an intermediary with the participation of which securities were purchased, etc.).

According to classical terminology, the excess of the market price over the face value is called agio, and lowering the disaggio. There has been much debate in the literature about whether these processes change the value of the firm's capital.

The answer "yes" is realistic, since in this case the value of both securities, and, more importantly, the total value of assets, is more correctly shown.

The answer "no" is no less realistic, since in this case the amounts that were actually invested in these securities and, accordingly, in the assets of the company, remain in the account.

Practice, based on the requirement of prudence, has developed a compromise solution: the agio is not reflected in the accounting, and the dizagio is reflected using account 59 "Provisions for the depreciation of investments in securities."

In general, account 58 "Financial investments" includes, in essence, a set of independent accounts, which are called sub-accounts.

Let's consider each of them.

58.1 Units and Shares

The administration of the enterprise can make contributions to the authorized capital of commercial organizations, buy their shares, i.e. invest in other organizations.

A share is an issuance security that secures the rights of its owner (shareholder) to receive a part of the profit of a joint-stock company in the form of dividends, to participate in the management of a joint-stock company and to a part of the property remaining after its liquidation.

Investments in emissive securities may be carried out:

- in the form of cash deposits through the purchase of shares;

- in the form of direct investments in the authorized capital of funds;

- by transferring various tangible and intangible assets.

All of the above greatly complicates the characterization of sub-account 58.1 "Shares and Shares". It can be called:

- a material account, if we take into account the material values contributed to the authorized capital of a third-party enterprise;

- an account for accounting for funds, based on the place where it was placed by the compilers of the chart of accounts, and from the possibility of relatively quick liquidity of securities;

- settlement account, because in all cases we are talking about the relationship between the persons who gave the capital and the persons who received it.

The above interpretations of sub-account 58.1 "Shares and shares" lead to three versions of securities accounting:

1. They can be fixed at face value.

Advantages. Simplicity of accounting and inventory of securities. The subaccount balance is equal to the sum of nominal values. The amount of financial investments taken into account turns out to be equal to the share that corresponds to the value of the authorized capital of the enterprise to which these shares belong.

Flaws. The real value of shares almost never corresponds to their face value and, therefore, the balance of sub-account 58.1 "Shares and shares" will not be real.

2. They can be fixed at the actual purchase price.

Advantages. The balance of account 58.1 "Shares and shares" reflects the funds actually invested in them.

Flaws. The balance of account 58.1 "Shares and shares" rarely corresponds to the amount of capital owned by the buyer in the company that issued the shares. This circumstance, in particular, somewhat complicates their inventory.

3. They can be fixed at the current rate.

Advantages. The balance of account 58.1 "Shares and shares" shows the liquidation value of the shares, i.e. the price at which these shares can be sold at a given moment.

Flaws. The stock price changes all the time, which forces the accountant to constantly resort to their revaluation. Their inventory is sharply complicated. The value of actually invested capital, in essence, disappears, and it is quite difficult to calculate the amount of nominal capital.

From the point of view of the prudence principle, the second and third concepts should be adopted. Shares should be accounted for at the actual purchase price (second option), but if their current price falls below the purchase price, then the difference should be written off as a loss.

All investments are shown in the debit of account 58 "Financial investments" subaccount "Shares and shares" in full (at actual cost). In this case, the nominal value of the security is not important. It is charged at actual cost. In the same way, the size of the purchased share in the authorized capital of the enterprise is not important. It must be credited by the buyer for the amount actually received.

For example, if the par value of a share is 50,000 rubles, and 200,000 rubles were paid for it, then the buyer debits account 58 "Financial investments" subaccount "Shares and shares" for 200,000 rubles.

In this case, the amount of the authorized capital will not coincide with the amount of deposits held by the owners on account 58 "Financial investments", but the share in the capital remains unchanged. Unless otherwise provided in the agreement approved by all founders. Those. in our case, the actual contribution will be four times higher than the share to which the rights of our investor will apply.

Shares, like all property and property rights, are reflected in the balance sheet of the enterprise, subject to the availability of ownership rights to these objects.

According to Art. 145 of the Civil Code of the Russian Federation, securities, according to the ownership of the rights certified by the security, are divided into:

- bearer securities (the rights belong to the bearer of the security);

- registered securities (the rights belong to the person named in the security);

- order securities (the rights belong to the person named in the security who can exercise these rights himself or appoint another authorized person by his order (order).

Depending on the designation of the owner, shares are registered, the owners of which are registered in the register, and bearer shares, the owners of which are not registered in the register.

Registered shares - shares, information about the owners of which must be available to the issuer in the form of a register of owners of securities, the transfer of rights to which and the exercise of the rights assigned to them require mandatory identification of the owner.

The requirements for the content of the register of shareholders are the basis for the organization of operational accounting of the movement of shares. Mandatory requisites of the register are the following data:

- about the joint-stock company;

- on the size of the authorized capital;

- on the number of shares announced for issue;

- on the nominal value of the shares announced for issue;

- on categories (types) of shares announced for issue;

- on the number of outstanding shares;

- on the nominal value of shares issued into circulation;

- on categories (types) of shares issued in circulation;

- about the split of shares;

- on the consolidation of shares;

- on shares of the company redeemed by the enterprise at its own expense (number, nominal value, categories (types));

- about each shareholder;

- on the payment of dividends.

The register of shareholders is maintained either directly by the joint-stock company or, on its behalf, by a bank, an investment institution (except for an investment consultant), a depository, a specialized registrar.

Joint-stock companies with more than 1,000 shareholders are required to entrust the maintenance of the register of shareholders to any of the above organizations.

The moment of transfer of rights to the securities themselves and the rights attached to them depends on the method of storage and accounting of securities: in a depository or a special system for maintaining the register of shareholders. The moment of transfer of rights to securities from the issuer or buyer to the acquirer is presented in the table.

Table 1

Transfer of rights to securities

and exercise of rights secured by securities

On the sub-account "Shares and shares" of account 58 "Financial investments", investment objects are reflected in accordance with paragraph 44 of the Regulation on accounting and financial reporting in the Russian Federation in the event that the ownership of the securities belongs to the enterprise. If the ownership of the securities has not yet been transferred to the enterprise, then the amounts paid on account of the objects of financial investments to be acquired are shown in the assets of the balance sheet as debtors.

However, under the item of accounts receivable, until the moment of recognition of the rights to the security, the expenses for the acquisition of shares can be reflected only under one item - the amounts paid in accordance with the agreement to the seller. Other items of expenditure, in particular:

- amounts paid to specialized organizations and other persons for information and consulting services related to the acquisition of securities;

- remuneration paid to intermediary organizations with the participation of which securities were purchased;

- interest expenses on borrowed funds used to purchase securities prior to their acceptance for accounting

cannot be reflected under accounts receivable due to the fact that services have already been rendered and accepted. These costs must be recorded either as an asset, or as a deferred expense, or as a loss. It seems appropriate to record these costs on account 58 "Financial investments" to open a special sub-account "Expenses for the acquisition of securities".

Depending on how the shares were received, accounting is carried out according to different schemes.

In the event that an enterprise is the founder of another enterprise, then financial investments in shares are accepted for accounting in the assessment, in accordance with the constituent documents. And the difference between the balance valuation of the property transferred as a contribution to the authorized capital and the valuation of shares agreed by the founders is reflected in account 91 "Other income and expenses".

Example

The initial cost of the fixed asset, which is made as a contribution to the authorized capital, is 100,000 rubles. The amount of accrued depreciation for this object is 40,000 rubles. The founders established that the contribution of the participant who made this fixed asset as a contribution to the authorized capital is 80,000 rubles.

The accounting scheme for operations on making deposits in a newly created enterprise will look like this:

Debit 02 Credit 01 - 40,000 rubles. - accrued depreciation written off; Debit 58.1 Credit 01 - 60,000 rubles. (100,000 - 40,000) - a fixed asset item made as a contribution to the authorized capital was written off; Debit 58.1 Credit 91.1 - 20,000 rubles. (80,000 - 60,000) - reflects the difference between the balance valuation of the fixed asset and the valuation of the contribution to the authorized capital.

If an enterprise acquires shares of a company after its creation, then in this case the shares will be accounted for on account 58 "Financial investments" at the actual cost of their acquisition, regardless of the nominal valuation of the shares, as noted above.

Example

The company purchased 100 shares with a nominal value of 100 rubles. for 1 share at a price of 110 rubles. for 1 share. The shares were paid before the entry in the register of shareholders. At the same time, the company paid the intermediary organization a commission in the amount of 0.5% of the transaction - 55 rubles. and VAT 20% - 11 rubles.

The accounting scheme for transactions on the acquisition of shares will be as follows:

Debit 60 Credit 51 - 11,000 rubles. - 100 shares paid; Debit 60 Credit 51 - 66 rubles. - the commission of the intermediary organization is paid; Debit 58.5 Credit 60 - 66 rubles. - costs incurred for the acquisition of shares (commission fee); Debit 58.1 Credit 60 - 11,000 rubles. - shares are accepted for balance at the seller's price; Debit 58.1 Credit 58.1 - 66 rubles. - written off the cost of acquiring shares on the increase in the value of shares.

There may be cases when shares are acquired on the basis of an exchange agreement.

Example

Shares worth 80,000 rubles. are acquired in exchange for fixed assets with an initial cost of 100,000 rubles. with the amount of accrued depreciation in the amount of 40,000 rubles, then the entries in the accounting accounts will be made as follows:

Debit 02 Credit 01 - 40,000 rubles. - written off accrued depreciation in the amount; Debit 58.1 Credit 01 - 60,000 rubles. - written off the object of fixed assets, made as a contribution to the authorized capital.

When due income or dividends are declared on shares and shares, the income of their recipients arises (recognises) precisely after the announcement, and not at all when the money arrives. Therefore, upon receipt of a notice of the amount of income due, a posting is made:

Debit 76.3 "Calculations on due dividends and other income"

Loan 91.1 "Other income"

It is curious that the money may never arrive, but the income is already considered received.

Problems related to the accounting of financial investments often do not have an unambiguous solution, and we will consider several practical examples.

Example

Firm A contributed to the authorized capital of firm B the right to use some areas of its building, estimating this right at 10 million rubles, the term of use is 10 years.

Practice has developed several solutions.

Option 1

Debit 58.1 "Shares and shares" Credit 83 "Additional capital"

Advantages. The loan correctly shows the resulting capital gain as a result of the transaction. True, this increase occurs only for ten years, and each year this increase will decrease, since during each year the accountant must make a posting:

Debit 83 "Additional capital" Credit 91.1 "Other income"

Flaws. In this case, the real loss of opportunities associated with the use of fixed assets is not reflected, since the structure of the assets of the balance sheet of firm A actually changed: there were fixed assets, and financial investments appeared instead of them.

Option 2

Debit 58.1 "Shares and shares"

Credit 01 sub-account "Fixed assets contributed to the capital of a third-party organization".

Advantages. A special contractive sub-account is introduced, which, in accordance with the requirement of the priority of content over form, correctly reflects the actual cost of fixed assets at the disposal of firm A.

Flaws. An artificial sub-account is created, additional entries appear, the value of fixed assets owned by firm A is distorted, and the benefits received by it from the financial investments made remain unclear.

Option 3

Debit 58.1 "Shares and shares" Credit 98 "Deferred income" Debit 98 "Deferred income" Credit 91.1 "Other income"

According to clause 47 of the methodological recommendations on the procedure for the formation of financial statements of an organization in the event that an organization receives securities (shares) free of charge, including under a donation agreement, "these assets are reflected in the balance sheet in the same way as the procedure for reflecting funds for targeted financing." The procedure for reflecting the funds of targeted financing by commercial enterprises provides for the balances of the amounts of funds received from targeted financing (from the budget, from other organizations and citizens) to be reflected in the group of articles "Deferred income". The reduction of these balances is carried out as non-operating income is recognized in the reporting period:

- when leaving for the purposes of the organization's activities, the MPZ acquired at the expense of targeted funds;

- when accruing depreciation on property acquired at the expense of these funds;

- at the completion and delivery of scientific research work, etc.

Therefore, only when the use of assets received free of charge is recognized, deferred income should be included in the income of the reporting period. Obviously, the use (or profit) of securities can be confirmed only at the time of accrual of income (dividends) on these securities. However, the very fact that an enterprise has shares indicates that it has the right to receive income and take part in the management of an enterprise that issued securities.

According to paragraph 11 of the accounting regulation "Expenses of the organization" (PBU 10/99), the expenses associated with the write-off of other assets, including securities, are operating expenses and are reflected in account 91 "Other income and expenses".

Income from the sale of securities is accounted for on the credit of sub-account 1 "Other income" of account 91 "Other income and expenses" in correspondence with account 62 "Settlements with buyers and customers".

Correspondence of accounts for accounting for the sale of equity securities:

Debit 91.2 Credit 58.1 - book value of an equity security written off; Debit 62 Credit 91.1 - reflected income from the sale of securities; Debit 91.2 Credit 60 - a commission was charged to intermediary enterprises for the sale of securities;

The financial result from the sale of securities was revealed:

Debit 91.9 Credit 99 - profit; Debit 99 Credit 91.9 - loss.

In the event of bankruptcy of an enterprise - the issuer of securities, when it becomes impossible to receive income from them, such securities must be written off, and the resulting losses are subject to reflection as non-operating expenses on sub-account 2 "Other expenses" of account 91 "Other income and expenses".

According to paragraph 3.5. the procedure for recording operations with securities in accounting records Investments in shares listed on the stock exchange or at special auctions, the quotation of which is regularly published, are reflected in the financial statements at the lowest of the market or balance values. Balance indicators are formed according to the data of two accounts - account 58 "Financial investments" and account 59 "Provisions for depreciation of investments in securities". Investments in securities on account 58 are reflected in the actual costs of their acquisition or according to the assessment of investments recorded in the constituent documents when the enterprise is created. Adjustment of the value of securities in the formation of balance sheet indicators is carried out using the reserve for depreciation of securities.

In accordance with the provisions of Art. 270 of the Tax Code of the Russian Federation "the amounts of deductions to the reserve for depreciation of investments in securities created by organizations in accordance with the legislation of the Russian Federation, with the exception of the amounts of deductions to reserves for depreciation of securities made by professional participants in the securities market in accordance with Article 300 of this Code" in tax purposes are not taken into account.

58.2 "Debt securities"

Among the many differences between shares and shares on the one hand and other securities, the decisive factor is that the former are perpetual, while the latter is strictly limited to a specified time period. It follows that perpetual securities, such as shares, under the going concern assumption, should be accounted for at their purchase price, but subject to the requirement of prudence.

One of the important aspects of accounting for debt securities is the question of the moment of recognition of ownership of these securities and, consequently, the moment of reflection of these securities on account 58 "Financial investments". The grounds for reflecting the acquired securities on the financial investment account, depending on the type of securities and the procedure for accounting and storage, are given in Table No. 2.

table 2

The moment of transfer of ownership of debt securities and accounting as financial investments

| Type of security | Procedure for accounting and storage of securities | Time of transfer of ownership | |

|---|---|---|---|

Bond |

Bearer documentary |

Owner |

Obtaining a certificate |

In the depository |

|||

Nominal non-documentary |

In the depository |

Making a credit entry on the acquirer's depo account |

|

In the registry system |

Making a credit entry on the personal account of the acquirer |

||

Nominal documentary |

In the depository |

Making a credit entry on the acquirer's depo account |

|

In the registry system |

Obtaining a security certificate and making a credit entry on the personal account of the acquirer |

||

Treasury bills |

In the depository authorized by the Ministry of Finance of Russia |

Obtaining a statement from a depo account |

|

Owner |

Drawing up an act of acceptance and transfer |

||

The accounting and valuation procedure for debt securities is basically the same as for equity securities. This paragraph deals only with the specifics of accounting for debt securities.

In accordance with paragraph 44 of the regulation on accounting and financial reporting, "for debt securities, the difference between the amount of actual acquisition costs and the nominal value during the period of their circulation is allowed to be attributed to financial results evenly as the accrual of the income due on them ... ".

The excess of the actual acquisition costs over the face value is written off under the credit of account 58 "Financial investments". If the actual acquisition costs are below the face value, then the difference is additionally charged to the debit of account 58 "Financial investments". Adjustment of the valuation of securities is carried out in such a way that by the time the bonds are redeemed, their book value corresponds to the face value.

Professional participants in the securities market may revalue bonds purchased for the purpose of obtaining income from their sale as the quote on the stock exchange changes.

One-time write-off of the difference between acquisition costs and the face value of bonds (RS) is determined by the formula:

RS \u003d (N - ZP): Chm, where

H- face value of the bond;

RFP- the cost of purchasing a bond;

WCH- the number of months of the maturity of the bond.

Example

On December 30, 1999, 94,000 rubles were transferred from the current account. for bonds with an issue date of January 1, 2000 with a total par value of 100,000 rubles. The maturity of the bonds is one year. The yield on bonds is 18% per annum.

Calculation of the required indicators:

1. Income on bonds:

- annual - 18,000 rubles. (100,000 * 18:100);

- monthly - 1,500 rubles. (18,000:12)

2. Monthly write-off of the difference between the nominal value of bonds and the cost of their acquisition:

3. RS \u003d (100,000 - 94,000): 12 \u003d 500 rubles.

Debit 76 (broker) Credit 51 - 94,000 rubles. - money is transferred to the broker for bonds; Debit 58 Credit 76 (broker) - 94,000 rubles. - received bonds from a broker; Debit 76 (agent) Credit 91 - 18,000 rubles. - accrued income on the bond (every month - 1500 rubles, for the year - 18000 rubles); Debit 58 Credit 91 - 6,000 rubles. - the difference between the face value of the bonds and the cost of their purchase was additionally charged (each month - 500 rubles, for the year - 6000 rubles); Debit 51 Credit 76 (agent) - 18,000 rubles. - received income from bonds; Debit 76 (agent) Credit 58 - 100,000 rubles. - transferred for redemption of the bonds to the paying agent; Debit 51 Credit 76 (agent) - 100,000 rubles. - received money for redeemed bonds.

In this case, the final result of this transaction with bonds is an income in the amount of 24,000 rubles. It consists of the interest received (18,000 rubles) and the difference between the face value of the bonds and the cost of their purchase (6,000 rubles). This difference was gradually written off in equal parts (by 500 rubles per month) to the income of the organization during the period of circulation of the bonds.

Example

On December 30, 1999, 108,400 rubles were transferred from the current account. for bonds with an issue date of January 1, 2000 with a total par value of 100,000 rubles. The maturity of the bonds is one year. The yield on bonds is 18% per annum.

Monthly write-off of the difference between the cost of purchasing bonds and their face value:

PC = (108,400 - 100,000) : 12 = 700

The following entries will be made in the accounting of the organization:

Debit 76 (broker) Credit 51 - 108,400 rubles. - money is transferred to the broker for bonds; Debit 58 Credit 76 (broker) - 108,400 rubles. - received bonds from a broker; Debit 76 (agent) Credit 91 - 18,000 rubles. - accrued income on bonds; Debit 91 Credit 58 - 8,400 rubles. - the difference between the costs of purchasing bonds and their face value was written off (each month - 700 rubles, per year - 8400 rubles); Debit 51 Credit 76 (agent) - 18,000 rubles. - received income from bonds; Debit 76 (agent) Credit 58 - 100,000 rubles. - transferred for redemption of the bonds to the paying agent; Debit 51 Credit 76 (agent) - 100,000 rubles. - received money for redeemed bonds.

In this case, the amount of interest on bonds amounted, as in the previous example, to 18,000 rubles. However, this income was reduced by the difference between the actual costs of purchasing the bonds and their face value (8,400 rubles). Hence the final result of the transaction - a profit of 9,600 rubles. (18,000 - 8,400).

Such a procedure for writing off the difference between the amount of actual costs for the acquisition of debt securities and their nominal value makes it possible to attribute this difference to financial results more evenly (throughout the entire period of circulation of securities). At the same time, it can be written off to financial results and at a time (when redeeming or selling securities), since clause 44 of the accounting and financial reporting regulations says that even write-offs are "permitted". The disadvantage of a one-time write-off is the uneven reflection in the accounting of income or expenses of the enterprise. The difference received from the revaluation of securities, according to Art. 251 and 270 of the Tax Code of the Russian Federation are not taken into account when determining the tax base for income tax. The composition of non-operating income for tax purposes includes interest on debt securities (clause 6, article 250 of the Tax Code of the Russian Federation).

The choice of one of the two options for writing off this difference should be determined by the accounting policy of the organization.

When selling debt securities, the following entries are made:

Debit 62 "Settlements with buyers and customers" Credit 91.1 "Other income" - reflected the sale of securities; Debit 91.2 "Other expenses" Credit 58.2 "Debt securities" - securities written off; Debit 51 "Settlement accounts" Credit 62 "Settlements with buyers and customers" - money received from the buyer.

Enterprises whose main activity is the purchase and sale of securities, when recording such transactions, instead of account 91 "Other income and expenses", use account 90 "Sales".

58.3 Loans granted

This sub-account takes into account the settlements that arise under loan agreements, more precisely, on loans provided.

Entries in the accounting accounts of loan transactions should be made on the basis of payment orders for the transfer of funds (if the subject of the loan agreement is cash) or primary documents for the disposal of material assets (if the subject of the loan agreement are other things specified generic traits).

When funds are transferred to the borrower, the granted loans are reflected in the debit of account 58.3 "Granted loans" in correspondence with account 51 "Settlement accounts" or other cash accounts. When property is transferred to the borrower, account 58.3 "Granted loans" corresponds with property accounts, for example, 10 "Materials", 41 "Goods", 43 "Finished products".

The return of the loan is reflected in the debit of account 51 "Settlement accounts" or other accounts of cash and property and the credit of account 58.3 "Granted loans".

If one of the ways to ensure the fulfillment of obligations under a loan agreement is a pledge, and the transfer of the pledged property (thing) to the pledgee into possession (pawn) is provided for (Articles 329 and 338 of the Civil Code of the Russian Federation), the pledged property in the lender's accounting should be recorded on account 002 "Commodity material values accepted for safekeeping.

If one of the ways to secure the fulfillment of obligations under a loan agreement is a surety, then the receipt of guarantees to secure the fulfillment of obligations and payments under a loan agreement should be accounted for on account 008 "Securities for obligations and payments received". Write-offs of collateral should be carried out as the debt is repaid.

Correspondence of accounting accounts for accounting for the provision of loans to other organizations is presented in table 3.

Table 3

| No. p / p | Content of operations | Debit | Credit | primary document |

|---|---|---|---|---|

Loan issued in cash |

58.3 | 51 | ||

|

002 008 |

Pledge agreement, The act of acceptance and transfer of property |

||

At the end of the loan agreement |

||||

Reflected the receipt of borrowed funds from the borrower |

51 | 58.3 | Bank statement on current account |

|

|

002 008 |

The act of acceptance and transfer of property |

||

The provided loan can be interest-free and interest-bearing. In the latter case, the accrual of interest due may be reflected as follows:

1 option. The borrower's obligations are reflected on account 76 "Settlements with other debtors and creditors":

Debit 76 "Settlements with different debtors and creditors"

Loan 91.1 "Other income"

Upon receipt of interest from the borrower, the following entry is made:

Debit 51 "Settlement accounts" Credit 76 "Settlements with various debtors and creditors."

Option 2. In accordance with the provisions of the order of the Ministry of Finance of Russia dated June 28, 2000 No. 60n, the borrower's obligations are reflected together with the amount of the principal debt under the loan agreement on account 58.3 "Granted loans":

Debit 58.3 "Loans granted" Credit 91.1 "Other income"

Upon receipt of interest from the borrower:

Debit 51 "Settlement accounts" Credit 58.3 "Granted loans"

58.4 "Contributions under a simple partnership agreement"

The contribution of comrades in accordance with Art. 1042 of the Civil Code of the Russian Federation recognizes everything that they contribute to the common cause (money, other property, etc.). Monetary valuation of contributions is made by agreement between the comrades.

Accounting for transactions under this agreement is carried out in accordance with the instructions for recording in accounting transactions related to the implementation of a simple partnership agreement, approved by order of the Ministry of Finance of Russia dated December 24, 1998 No. 68n.

In accordance with clause 4 of these instructions, confirmation of receipt of a property contribution for a partner organization and, therefore, reflection on account 58.4 "Contributions under a simple partnership agreement" is an advice note on the receipt of property by a partner conducting common business, or a primary accounting document on receipt of property ( a copy of the invoice, a receipt for a credit note, etc.).

It should be noted that, according to the provisions of the instructions, the transfer of property under a simple partnership agreement should be reflected in the accounting records of the partner organization through sales accounts. For example, when transferring a fixed asset, the following accounting entries must be made:

Debit 91.2 "Other expenses" Credit 01 "Fixed assets" - the initial (replacement) cost of the fixed asset was written off; Debit 02 "Depreciation of fixed assets"

Loan 91.1 "Other income" - accrued depreciation was written off; Debit 58.4 "Contributions under a simple partnership agreement"

Credit 91.1 "Other income" - reflects the contribution under a simple partnership agreement.

If the contractual valuation of the contribution under the simple partnership agreement exceeds the balance sheet valuation of the transferred fixed assets, the difference will be reflected as income on account 99 "Profit and Loss":

Debit 91.9 "Balance of other income and expenses"

Loan 99 "Profit and Loss"

However, when property is transferred under a simple partnership agreement, there is no transfer of ownership, and therefore property transfer operations should not be reflected through sales accounts. The balance estimate of the transferred property is reflected directly on account 58.4 "Contributions under a simple partnership agreement" in correspondence with property accounts. In this case, the difference between the book value of the property and its valuation under the agreement is reflected in account 91 "Other income and expenses" (debit or credit). For example:

Debit 02 "Depreciation of fixed assets" Credit 01 "Fixed assets" - the accrued depreciation of fixed assets was written off; Debit 58.4 "Contributions under a simple partnership agreement"

Credit 01 "Fixed assets" - reflects the contribution under a simple partnership agreement. Debit 58.4 "Contributions under a simple partnership agreement"

Credit 91.1 "Other income". - reflects the excess of the assessment of the contribution under the simple partnership agreement over the book value of the fixed asset.

Upon termination of a simple partnership agreement, the return of property is reflected in the credit of account 58.4 "Contributions under a simple partnership agreement" in correspondence with the property accounts.

It is necessary to pay attention to the fact that the depreciable property is transferred by the enterprise that maintains the balance sheet of a simple partnership at the residual value, which should be reflected in the partner organization as the initial one:

Debit 01 "Fixed assets" Credit 58.4 "Contributions under a simple partnership agreement"

According to clause 20 PBU 6/01, the organization must determine the useful life of an object of fixed assets when accepting an object for accounting.

If, as a result of the division of property, a partner is entitled to a share in excess of the amount of his contribution, then account 91.1 "Other income" is credited for the difference.

Analytical accounting for account 58 "Financial investments"

Since, in essence, as we have already seen, this account should be assigned to a group of settlement accounts, then analytical accounting for each subaccount should be organized in the context of settlements with each entity that accepted the investments of our enterprise.

Investments within one financial group for subsequent data consolidation should be allocated to a separate accounting section.

Two general remarks on the nature of the maintenance of account 58 "Financial investments"

1. Connection of the balance of account 58 "Financial investments" with the balance sheet items.

The balance sheet asset is divided into articles of non-current and current assets. The criterion is one year. This means that expenses capitalized for a period of more than a year are recognized as non-current, and capitalized for a period of less than a year - as working capital. In this regard, the usual practice involved the existence of two accounts:

- "Long-term financial investments"

- "Short-term financial investments".

The compilers of this chart of accounts combined these two accounts. They could be guided by the following considerations:

1) when a security is purchased, even if it is urgent, then the administration, as a rule, does not know for how long this paper was bought, and even if the administration knows this, then at any moment circumstances may force it to sell this paper;

2) in order to reflect financial investments in the balance sheet and in the appendix to the balance sheet (form No. 5), it is necessary to keep their division into long-term and short-term, which obliges the administration of the enterprise, represented by the chief accountant, to decide when leaving the balance sheet what amounts should be attributed to the first, and which ones go to the second section of the balance, without changing the very value of the balance of account 58 "Financial investments". At the same time, only sub-account 58.3 "Granted loans" is not in doubt, since the loans are of an urgent nature and the likelihood that the loans will be repaid before the expiration date is insignificant. For all other sub-accounts, on the basis of analytical accounting data, it is necessary to distinguish between what amounts of investments and in which section of the balance sheet should be included. In this case, the accountant should be guided only by his professional judgment, which is based on the conscientiousness of his approaches and, as a result, leads to reliable indicators of financial statements.

This approach is fraught with great danger, as it can lead to subjectivism and arbitrariness, because the smaller the share attributed by the accountant to long-term assets, the higher its liquidity and solvency indicators.

Sometimes, instead of one account, accountants maintain two accounts 58.1 - "Long-term financial investments" and 58.2 "Short-term financial investments", i.e. keep the old order. This deprives accounting of the flexibility it needs and goes against the very idea of the charter of accounts.

2. Evaluation of financial investments

Financial investments accounted for on sub-accounts 58.1 "Shares and shares" and 58.2 "Debt securities" should be reflected in accordance with the requirement of prudence, i.e. if the market valuation of the securities is higher than what was paid for them, then their valuation does not change.

If the market valuation of securities is lower than what was paid for them, then they must be valued to their market value (see account 59 "Provisions for depreciation of investments in securities").

Please note that in the chart of accounts there are accounts associated with bill circulation. Moreover, if we proceed from the already established tradition, then we should note that the compiler assumes the division of all bills according to the function they perform. If a bill of exchange is issued under a loan of money, then this is a financial security, and it is accounted for on account 58 "Financial investments".

If a bill of exchange is issued for services, goods or any other tangible and intangible assets, then it is considered as a commodity, and in this case accounting is kept on the accounts:

- 60 "Settlements with suppliers and contractors";

- 62 "Settlements with buyers and customers";

- 76 "Settlements with different debtors and creditors".

There are other options, the meaning of which boils down to the account on which the debt arises, and bills of exchange are also taken into account on the same account.

Account No. 58 of accounting "Financial Investments" is used to systematize data on a company's investments in public and private securities, the authorized capital of firms. The same account records information on loans granted to other enterprises.

Analytical accounting on the 58th account is kept by types of assets and by objects in which these assets are invested.

What sub-accounts can be opened for the 58th account

The accounting rules provide for the opening of sub-accounts to account 58.

For example:

- "Shares and shares" - 58-1;

- "Debt securities" - 58-2;

- "Granted loans" - 58-3;

- “Contributions under a simple partnership agreement” - 58-4, etc.

Sub-account maintenance 58-1

Sub-account 58-1 is intended to systematize data on investments in shares of joint-stock companies (joint-stock companies), capitals of other firms, etc. The following sub-account is used to analyze investments in private and public debt assets (for example, bonds).

The investments made by the company must be displayed in the Debit of the 58th account and in the number of accounts on which the corresponding values are taken into account. For example, a company acquires the assets of other enterprises for money. This fact is displayed in two records: for the D-tu of account 58 and for the K-tu of one of the accounts 51 or 52 "Settlement accounts", "Currency accounts".

The investments made by the company must be displayed in the Debit of the 58th account and in the number of accounts on which the corresponding values are taken into account. For example, a company acquires the assets of other enterprises for money. This fact is displayed in two records: for the D-tu of account 58 and for the K-tu of one of the accounts 51 or 52 "Settlement accounts", "Currency accounts".

How to keep a sub-account 58-2

How to keep accounting for assets, for which the current market value is not determined?

In this case, the difference between the initial and nominal price of assets is evenly recorded on the financial results of the company.

If it is a non-profit organization, the amount should be attributed to a decrease or increase in expenses. If you need to write off the difference between two asset prices, the accountant makes 3 entries at the same time.

The entries are as follows:

- “Settlements with various debtors and creditors” - Dt 76 (here the amount of income on assets is indicated);

- “Financial investments - Kt 58 (only a part of the difference between the purchase and nominal value is indicated here);

- "Other income and expenses" - Kt 91 (the difference between the amounts charged to account 76 and 58).

If you need to accrue the difference between the real and nominal price of assets, you must also make three entries.

The accountant takes notes:

- Dt 76 (you must specify the amount of income received on securities);

- Dt 58 (this account takes into account only the share of the difference between the two prices);

- Kt 91 (the entire amount that was allocated to the 2 above accounts is recorded here).

The fact of redemption of securities is taken into account according to the D-tu of the 91st account and according to the K-tu of the account considered in this article. An exception to the rule are companies that record such transactions using the “Sales” account (No. 90).

The procedure for maintaining the sub-account "Granted loans"

Sub-account 58-3 takes into account loans that the company issues to legal entities and individuals.

The latter does not include employees of the organization itself. Loans secured by promissory notes must be accounted for separately. Granted loans are displayed in two records at once: by D-tu of the 58th account and by K-tu of the account corresponding to the resource provided. For example, if money is provided, you need to make an entry in the credit of the “Settlement Accounts” account (No. 51). The return of the debt corresponds to the reverse record - according to D-tu 51 and the credit of the 58th account.

Sub-account maintenance 58-4

Sub-account 58-4 is intended for the analysis of contributions to the partnership. For example, a cash investment is displayed by an entry in the debit of the 58th account and in the Kt of the 51st account or another account corresponding to the type of material values \u200b\u200bor assets provided. If the partnership agreement is terminated, the tangible assets are returned to the firm. The accountant makes entries that are reverse to the original.

These are financial investments, which include, in particular, state and municipal securities, securities of other organizations (including bonds, promissory notes), contributions to the authorized capital of other organizations, interest-bearing loans provided to other organizations, deposits, receivables debt acquired on the basis of the assignment of the right to claim (clause 3 PBU 19/02).

Account 58 “Financial Investments” () is intended as a chart of accounts for accounting and Instructions for its use to summarize information on the presence and movement of financial investments of an organization. 58 accounting account is an active synthetic account, the debit of which reflects the receipt (increase in value) of financial investments, and the credit - their disposal (decrease in value). Analytical accounting on account 58 is kept by types of financial investments and objects in which these investments are made (for example, by borrowing organizations).

In addition, in analytical accounting, financial investments should be divided into short-term and long-term.

Also, separately on account 58, financial investments should be taken into account within a group of interrelated organizations for which consolidated financial statements are prepared (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Sub-accounts to account 58

The organization can open, in particular, the following sub-accounts to account 58:

Typical postings on account 58

Let's present in the table some typical accounting entries for account 58 (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

| Operation | Account debit | Account credit |

|---|---|---|

| Shares purchased by transfer from a foreign currency account | 58-1 | 52 "Currency accounts" |

| Purchased ruble bonds | 58-2 | 51 "Settlement accounts" |

| Granted a loan of materials | 58-3 | 10 "Materials" |

| An object of fixed assets was transferred as a contribution under a simple partnership agreement | 58-4 | 01 "Fixed assets" |

| The difference between the initial and nominal value of the bond, which does not determine the current market value, is charged to financial results | 58-2 | 91 "Other income and expenses" |

| Reflected as of the reporting date is the revaluation of shares for which the current market value is determined | 91 | 58-1 |

| Reflected repayment of the bill | 51 | 58-2 |

| Returned a loan issued in a non-cash form | 51 | 58-3 |

| The object of intangible assets, transferred earlier as a contribution under a simple partnership agreement, was returned | 04 "Intangible assets" | 58-4 |