- Consider the role of the state in the country's economy

- Get to know the tax system

Analyze the types of resources using the table.

hired worker

Entrepreneurial ability

locomotive driver

Making decisions

mountain river

- 1. Functions of the state.

- 2. Why does the economy need a state

- 3. Why do we pay taxes

- 4.State budget

State functions

What economic functions of the state exist according to A. Smith?

Page 132 (1 paragraph) textbooks

- economic stabilization

- protection of property rights

- regulation of money circulation

- redistribution of income

- regulation of relations between employers and employees

- control over foreign economic activity

- creation of public goods

Direct and indirect impact of the state on the economy

direct

regulation

Includes predominantly administrative methods (laws, government orders, development of the public sector in the economy)

indirect

regulation

Uses methods of monetary and fiscal policy

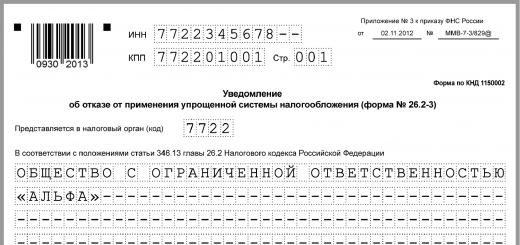

Compulsory payments levied by the state from individuals and legal entities to state and local budgets.

Tax functions:

- fiscal (the revenue part of the budget is formed)

- regulatory (stimulating or curbing the pace of production)

- distribution (distribution of production results between various areas and groups of the population)

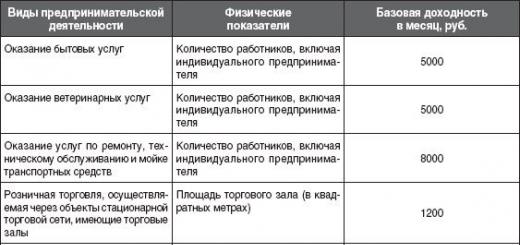

- taxes

Direct (imposed directly on consumers)

Indirect (taxes on the sale of goods and services)

Income tax

customs duty

Excise taxes (surcharges)

Property tax

income tax

sales tax

vocabulary work

Direct taxes - These are payments to the state, depending on the size of their income or the value of property. Indirect taxes - These are payments to the state, collected only when certain actions are carried out, for example, when buying certain goods.

excise tax - this is a tax paid on the purchase of certain goods, which is set as a percentage of the price of the goods.

duties- These are payments for the right to provide or use certain services.

TAXES

Provide distribution and

redistribution of national income in accordance with social and economic objectives.

REGIONAL

(taxes of subjects of the Russian Federation)

Federal

Homework:

Paragraph § 17, learn concepts, write out a definition state budget, list the income and expenses of the state.

Main types of economic systems Lines of comparison Traditional Centralized (command) Market What to produce? Products Agriculture, hunting, fishing. Few products and services are produced. What to produce is determined by customs and traditions that change slowly Determined by groups of professionals: engineers, economists, computer specialists, industry representatives - “planners” Determined by the consumers themselves. Producers produce what consumers want, i.e. what can be bought How to produce? They produce in the same way as what their ancestors produced. Determined by the state plan. Determined by the producers themselves.

Main types of economic systems Lines of comparison Traditional Centralized (command) Market For whom? Most people live on the edge of survival. The surplus product goes to the chiefs or landowners, the rest is distributed according to customs and traditions Planners, directed by political leaders, determine who and how much goods and services will receive Consumers get as much as they want, producers - profit - excess income from the sale of T and Y over the cost of their production DefinitionE.S. with a natural form of management, in which the production of material goods and services is carried out to meet the producer's own needs, and decisions on the production, distribution and consumption of eq. goods are accepted on the basis of the customs and traditions of E.S., in which eq. the activities of all subjects are strictly regulated from a single eq. center in accordance with the state plan E.S., in which decisions on production, distribution and consumption are made by independent eq. subjects on the basis of freedom of choice

A. “... In order to close any loophole through which products could escape state control, in March 1933 a decree was issued in the USSR according to which, until the district fulfills the plan for grain procurement, 90% of the milled grain was given to the state, and the remaining 10% were distributed among the collective farmers as an advance payment for work. The opening of collective farm markets ... depended on whether the collective farms of the region coped with the implementation of the plan ... The authorities announced the establishment of an exceptionally high monetary taxation of private peasants ... "

B. “In October 1922, a new Land Code was adopted in our country, according to which the peasants received the right to freely leave the rural community, to choose the forms of land use. Strict centralization in the supply of industrial enterprises with raw materials and in the distribution of finished products was abolished. The factories independently solved the issues of procurement of raw materials and the sale of finished products.

V. “In national history, the end of the 1920s is remarkable, when in June 1918 a decree was issued on the nationalization of large-scale industry, and in November 1920 of small industry. According to the decree of January 11, 1919, all surplus grain was confiscated from the peasants. Non-monetary settlements dominated everywhere. Payment for labor was carried out with food, basic necessities. In 1919, free food was introduced for children, and then for workers in industry and transport.”

Functions of the state: 1) Collection and dissemination of reliable economic information. 2) Usage control natural resources, environmental protection. 3) Helps the poor, solves social problems. 4) Protects the interests of consumers, controls the quality of goods and services. 5) Protects the property of citizens, firms. 6) Protect the mechanism of competition, prevent monopoly, save the market. 7) Supports public institutions. 8) Formation of legislation on economic issues, judicial protection of citizens, firms. 9) Regulates the country's monetary economy. 10) Prevention of economic crises.

TAXES (by territorial level) FEDERAL PIT - income tax individuals; corporate income tax; VAT - value added tax; excises; mineral extraction tax; water tax; fees for the use of wildlife and aquatic biological resources; state duty REGIONAL LOCAL corporate property tax; gambling business tax; transport tax land tax; personal property tax

TYPES OF TAXATION Progressive - a system in which there is a flexible scale of tax rates: more income is taken more interest rate tax, and from less - less (helps to equalize the difference in income between the rich and the poor); Regressive is a system that is the opposite of a progressive one (from a higher income - a lower tax rate, and vice versa); Proportional - regardless of the amount of income, the same tax is levied on all persons (in Russia 13%)

TYPES OF TAXATION Progressive - a system in which there is a flexible scale of tax rates: more income is taken more interest rate tax, and from less - less (helps to equalize the difference in income between the rich and the poor); Regressive is a system that is the opposite of a progressive one (from a higher income - a lower tax rate, and vice versa); Proportional - regardless of the amount of income, the same tax is levied on all persons (in Russia 13%)

1 slide

The role of the state in the economy. (Workshop). The objectives of the lesson: to consolidate the studied theoretical material on this topic through the solution of practical tasks.

2 slide

3 slide

1. Warm-up on terms: - Economy - Economic system - Taxes - Excise - Social politics

4 slide

Answers Economy is a rationally organized activity of large groups of people who enter into relations of production, consumption, distribution of the exchange of goods and services. An economic system is a form of organization of the economic life of a society, characterized by a certain type of ownership. Taxes are payments levied by the state from individuals and legal entities. An excise is a type of indirect tax paid on the purchase of certain goods, which is set as a percentage of the price of the goods.

5 slide

Social policy is a set of measures taken by the government in the social sphere.

6 slide

What type of economic system, in your opinion, is considered the most progressive? Question for students.

7 slide

2. Work with the source. Task: Analyze the following situations and explain what type of economic system they characterize

8 slide

A. “... In order to close any loophole through which products could escape state control, in March 1933, a decree was issued in the USSR according to which, until the district fulfills the grain procurement plan, 90% of the milled grain was given to the state, and the remaining 10% was distributed among the collective farmers as an advance payment for work. The opening of collective farm markets ... depended on whether the collective farms of the region coped with the implementation of the plan ... The authorities announced the establishment of an exceptionally high monetary taxation of private peasants ... "B. "In October 1922, a new Land Code was adopted in our country, according to which the peasants received the right to freely leave the rural community, to choose the forms of land use. Strict centralization in the supply of industrial enterprises with raw materials and in the distribution of finished products was abolished. The factories independently solved the issues of procurement of raw materials and the sale of finished products. V. “In national history, the end of the 1920s is noteworthy, when in June 1918 a decree was issued on the nationalization of large-scale industry, and in November 1920, small-scale industry. According to the decree of January 11, 1919, all surplus grain was confiscated from the peasants. Non-monetary settlements dominated everywhere. Payment for labor was carried out with food, basic necessities. In 1919, free meals were introduced for children, and later for industrial and transport workers.

9 slide

Ways of influence of the state on the economy. Tasks: explain which of the methods will be more successful in a particular situation and why? In connection with the increase in the price of bread, the inhabitants of the N-th region began to stock up on products "for the future." Such a boom in goods has led to a shortage of many products. Automotive companies in the country began to go bankrupt due to the fact that citizens buy only foreign cars, as they are cheaper and more practical to operate. In order to provide food and clothing to the low-income segments of the population, the disabled and pensioners, it is necessary to produce special goods for them, selling them at low prices. However, commodity producers are not interested in the production of such products. A certain pensioner Grigoriev took the land for farming, dug a pond on it and began to breed fish. The neighbor did not like this, and he came with a friend to someone else's pond and began to catch fish there with a rod. Grigoriev went home for a gun and threatened that he would kill him, that this pond was his property, to which the neighbor replied rudely. Then Grigoriev fired in desperation from two barrels and killed him ... ”(From the memoirs of A. Pristavkin.)

10 slide

Taxes. Levels A) federal B) regional C) local Types of taxes 1) housing maintenance tax 2) income tax 3) property tax Set the correspondence: A-2 B-3 C -1

11 slide

1. One of the functions of the state in the economy is: a) decides what and how to produce; b) not interfering in the economy; c) product exchange; d) solving social problems, helping the poor. . 2. Excise is a type of direct tax: a) yes; b) no 3. A sign of a command-administrative economic system is: a) strict state regulation of the economy; b) no exchange; c) the state interferes minimally in the economy; 4. To the main functions of the state in market economy include: a) establishing the required production volumes; b) regulating pricing; c) the distribution of profits by the enterprise; d) implementation of antimonopoly policy. 5. One of the ways the state influences the economy and population: a) persuasion b) punitive measures; c) no impact. 6. A sign of a market economic system is: a) the predominance of state ownership; b) central planning; c) centralized pricing; d) competition between producers. Taxed: a) pension b) scholarship c) unemployment benefit d) wage. 8. A sign of a traditional economy is the equalization of distribution: a) yes b) no

12 slide